Overview

Business loan equity is essential for entrepreneurs; it represents their ownership stake in the company and serves as a vital asset when seeking funding. Understanding how to leverage this equity can significantly enhance financing prospects. Typically, higher equity ownership leads to better loan terms. Furthermore, maintaining a strong credit profile is crucial to avoid loan refusals. By recognizing these factors, entrepreneurs can position themselves for success in securing the financing they need.

Introduction

In the dynamic realm of business financing, grasping the nuances of equity can be a pivotal factor for entrepreneurs pursuing growth and stability. Business loan equity, which signifies the ownership stake within a company, is a vital asset in securing funding.

As entrepreneurs navigate the intricate landscape of financing options—from angel investors to venture capital and crowdfunding—they must carefully evaluate the advantages and disadvantages of equity financing compared to traditional debt methods.

Statistics reveal that a substantial portion of small businesses leverage equity to propel their ambitions, making it essential to comprehend how to build and manage this equity effectively.

This article explores the intricacies of business loan equity, highlighting its significance, the various types of equity financing available, and strategies to attract investment while maintaining control and fostering long-term success.

What is Business Loan Equity?

Business loan equity represents the ownership stake a business owner holds in their company, serving as a critical asset when seeking funding. This equity is calculated by subtracting total liabilities from total assets. For instance, if a company possesses assets valued at $500,000 and has obligations totaling $300,000, the net worth would amount to $200,000.

This asset can be leveraged as collateral for business loans, making it essential for acquiring the financing necessary for growth or expansion.

Understanding the importance of loan collateral is vital for entrepreneurs, especially those operating within leasehold properties or businesses lacking a physical structure. In such scenarios, borrowing options against commercial real estate may be limited, compelling business owners to rely on cash reserves or the value of any owned property. For example, if a home is valued at $1.3 million with $300,000 owed, borrowing up to an 80% loan-to-value ratio (LVR) could yield $740,000 in equity to invest in a business, supplemented by any cash savings.

Moreover, the ability to utilize equity for funding is underscored by recent statistics indicating that approximately 70% of small enterprises in the United States carry outstanding debt, with 62% owing over $100,000. This situation exemplifies a common challenge faced by entrepreneurs: while new loans can aid in managing existing debt, consolidating multiple debts into a single payment can alleviate financial pressure and facilitate quicker repayment. It is crucial to grasp the various financing options available, such as term lending, lines of credit, and tailored loan solutions, to navigate these challenges effectively.

In addition, recent data reveals that households' net lending increased by $2.5 billion due to higher net savings from increased disposable income, suggesting a more favorable financial landscape for potential lenders. Experts emphasize that maintaining a strong credit profile is essential, as credit issues account for roughly 20% of loan refusals for small enterprises. Poor credit can lead to higher interest rates and stricter loan conditions, making it imperative for business owners to prioritize their creditworthiness.

By comprehensively understanding and effectively managing their business loan equity, entrepreneurs can improve their financing prospects and adeptly navigate the complexities of securing necessary funds for their ventures. At Finance Story, we offer a comprehensive portfolio of lenders and diverse financial options, including term lending, debtor finance, lines of credit, stock finance, asset finance, and invoice lending, to support small business owners in achieving their growth objectives.

How Does Equity Work in Business Loans?

Business loan equity serves a pivotal role in commercial loans, acting as collateral that lenders utilize to assess the risk associated with lending. When an enterprise seeks funding, lenders meticulously evaluate the business loan equity to determine the loan amount they are prepared to offer. Typically, more advantageous loan terms—such as lower interest rates and improved repayment conditions—are linked to higher business loan equity ownership value.

In the realm of freehold property enterprises, understanding the loan-to-value ratio (LVR) is essential. For example, if a commercial property is valued at $1 million, lenders may permit borrowing up to 70% of that value, translating to a loan of $700,000. This scenario indicates that a company owner must provide a deposit of $300,000, along with additional funds for the commercial aspect of the purchase, totaling $700,000.

This total does not encompass extra expenses like valuation, legal fees, and stamp duty, which must also be considered.

Moreover, lenders frequently stipulate a minimum ownership percentage that must be maintained. This requirement ensures that company owners have a significant stake in their firm's performance and the business loan equity involved. Such a condition not only protects the lender's investment but also motivates the owner to drive the venture toward success.

Statistics reveal that lenders typically demand an average ownership stake of approximately 20% to 30% for small enterprise business loan equity, underscoring the importance of ownership in securing funding. Furthermore, case studies indicate that companies with robust business loan equity positions are more likely to secure favorable terms, as lenders view them as lower-risk borrowers. For instance, data shows that between 65% and 70% of companies that faced insolvency employed fewer than five full-time staff members, highlighting the necessity for sufficient capital to weather financial challenges.

Additionally, it is noteworthy that there were 48,876 investor loan commitments, illustrating the volume of loans available in the market and the critical role capital plays in obtaining funding. As Goldman Sachs emphasizes, 70% of small enterprise loans are provided by banks with under $250 billion in assets, accentuating the competitive lending landscape where business loan equity becomes a vital factor in the approval process.

In conclusion, comprehending how business loan equity functions in loans is crucial for entrepreneurs aiming to enhance their funding options. By sustaining a strong ownership position, owners can elevate their chances of obtaining loans with favorable conditions, ultimately fostering their growth and sustainability.

Types of Equity Financing for Businesses

Equity financing presents a range of alternatives for enterprises in search of capital, with business loan equity being one distinctive option that offers unique traits and advantages. The primary types include:

- Angel Investors: Affluent individuals who invest their personal funds into startups in exchange for ownership equity or convertible debt. They frequently provide not only funding but also guidance and networking opportunities, which are essential for developing enterprises. Furthermore, angel groups offer newer investors chances to enhance their knowledge and skills in evaluating startups, amplifying the support they provide.

- Venture Capital: This involves investment funds that aggregate capital from various investors to support startups and small enterprises with significant growth potential. Venture capitalists typically seek substantial returns on investment and may take an active role in the management of the companies they invest in.

- Crowdfunding: This method enables businesses to raise small amounts of money from a large number of people, usually through online platforms. In return for their contributions, supporters receive shares or rewards, making it a popular option for startups aiming to engage their community.

- Public Offerings: Companies can pursue an initial public offering (IPO) to sell shares to the public. This approach not only raises capital but also enhances the company's visibility and credibility in the market.

- Private Equity Firms: These investment companies provide funds to businesses in exchange for ownership stakes, often taking an active role in management to foster growth and improve profitability.

As we look ahead to 2025, the landscape of equity financing continues to evolve, with angel investors playing a pivotal role. Recent statistics reveal that female-led firms have experienced a notable increase in funding from angel groups, receiving 6.36% of total funding compared to 3.4% for male-led firms. This trend underscores the growing support for diverse entrepreneurial ventures and highlights the necessity of fostering an inclusive funding environment.

Understanding the distinctions between angel investors and venture capitalists is crucial for entrepreneurs. While angel investors typically invest their personal funds and may focus on early-stage firms, venture capitalists manage pooled resources and often target companies with established growth trajectories. This distinction can significantly influence the type of support and resources available to startups.

As the entrepreneurial ecosystem flourishes, the significance of flexible financial solutions cannot be overstated. Finance Story recognizes this necessity and collaborates closely with clients to develop customized financial strategies that align with their unique operational scenarios. With a comprehensive panel of lenders, including angel investors and private lenders, Finance Story ensures that clients have access to diverse funding options.

A case study titled "Importance of Flexibility in Financial Solutions" revealed that 37% of founders emphasized the necessity of adaptable banking options to manage cash flow and seize emerging opportunities. This adaptability is vital in an unpredictable market, enabling companies to pivot as needed.

In summary, business owners have a variety of business loan equity funding alternatives available to them, each offering distinct benefits. By understanding these options and current funding trends, entrepreneurs can make informed decisions that align with their growth strategies. As one anonymous surveyed founder noted, "What excites me most about being an Australian startup is the vibrant and supportive entrepreneurial ecosystem that fosters innovation and growth."

This collaborative community of fellow startups, incubators, and investors provides invaluable resources and networking opportunities, driving continuous improvement and pushing boundaries.

Moreover, client reviews highlight Finance Story's exceptional service and commitment, showcasing the ease of obtaining loans and the tailored assistance that can significantly influence the funding process for business owners. One client remarked, "Finance Story made the loan process effortless and customized to my company's needs, which was a game-changer for us.

Pros and Cons of Equity Financing

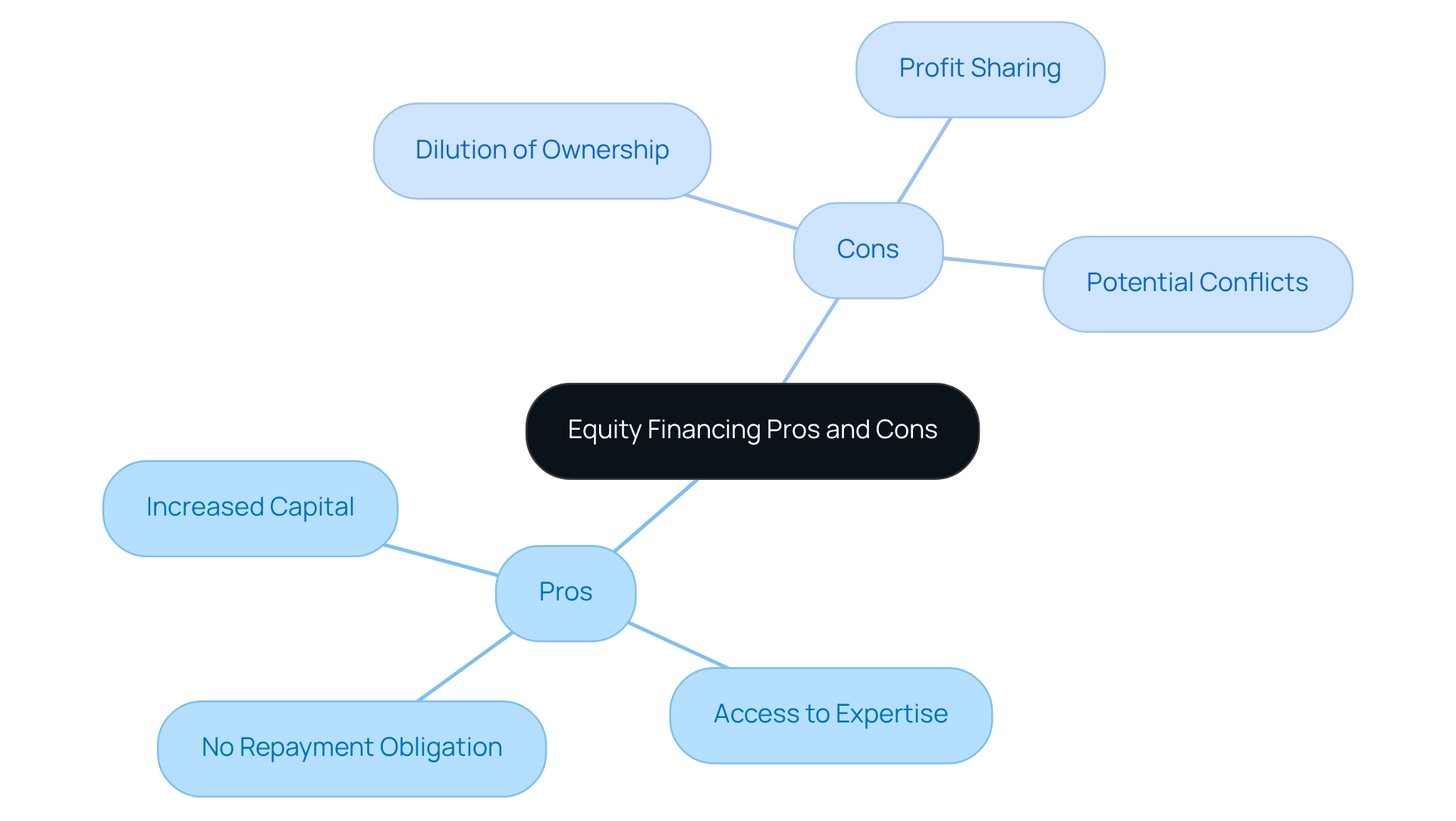

Equity financing presents a unique set of advantages and disadvantages that entrepreneurs must carefully consider:

Pros:

- No Repayment Obligation: Unlike traditional loans, equity financing does not impose a repayment requirement, alleviating financial strain on the business. This feature is especially advantageous for startups and small enterprises that may encounter cash flow challenges.

- Access to Expertise: Investors often contribute not just capital but also valuable industry experience and networks. This can be instrumental in guiding the enterprise through growth phases and navigating market challenges.

- Increased Capital: Equity financing can unlock substantial capital, enabling enterprises to invest in expansion, enhance operational capabilities, or innovate new products and services.

Cons:

- Dilution of Ownership: One of the most significant drawbacks is the dilution of ownership. Entrepreneurs must surrender a portion of their equity, which can result in a loss of control over decisions and direction.

- Profit Sharing: Investors typically expect a return on their investment, which necessitates sharing profits. This can reduce the financial rewards for original owners, especially in profitable ventures.

- Potential Conflicts: Divergent visions between entrepreneurs and investors can lead to conflicts. Disagreements over strategic direction or operational decisions may arise, complicating the professional relationship.

In 2025, statistics reveal that roughly 30% of small enterprises are using ownership capital, in contrast to 70% depending on debt alternatives. This shift highlights a growing trend among entrepreneurs seeking alternative funding sources to fuel their growth. Significantly, 98% of investment experts acknowledge the vital role of alternative data in generating alpha, emphasizing the necessity of informed decision-making in stock investment.

Expert views highlight the effect of capital raising on company control and expansion. Doug Dannemiller, a senior research leader in investment management, emphasizes that while stock funding can provide essential capital, it is crucial for business owners to maintain a clear vision and establish strong communication with investors to mitigate potential conflicts.

Case studies demonstrate the benefits of ownership financing. For example, a tech startup that obtained capital funding was able to scale operations quickly, utilizing investor knowledge to enhance its product and broaden its market reach. Conversely, another case revealed a retail operation that faced challenges due to investor disagreements over strategic direction, ultimately leading to a restructuring of ownership.

Furthermore, the investment management sector is undergoing significant regulatory changes and product advancements, which may influence funding strategies for small enterprises.

In summary, while ownership financing offers significant advantages for small enterprises, such as access to capital and expertise, it also comes with challenges that require careful consideration and management.

How to Build Equity in Your Business

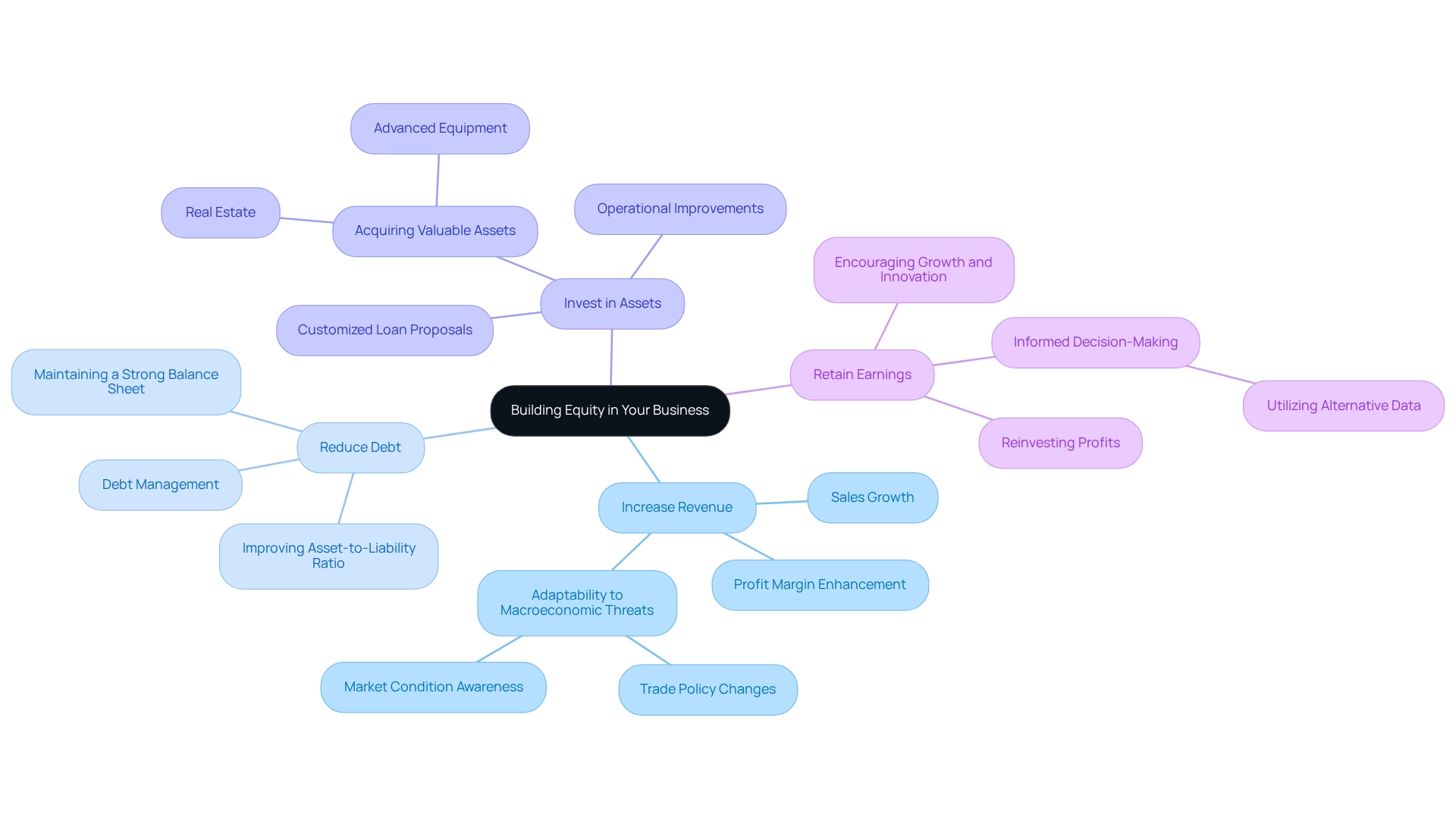

Building equity in your business is essential for long-term success and can be achieved through several effective strategies:

- Increase Revenue: Prioritizing sales growth and enhancing profit margins are critical steps in boosting your company's overall value. In 2025, companies that successfully increased their revenue reported average growth rates of over 15%, demonstrating the significant impact of effective sales strategies on equity. However, entrepreneurs should also be aware of macroeconomic threats, such as trade policy changes, which can influence market conditions and affect revenue streams. For example, the case study titled "Macro Strength Meets Trade Policy Uncertainty" highlights how aggressive tariff implementations can pose risks to commercial activities, emphasizing the need for adaptability in revenue strategies.

- Reduce Debt: Actively managing and paying down existing debts can substantially improve your asset-to-liability ratio, thereby increasing equity. A reduced debt load not only improves financial stability but also places your enterprise advantageously for future opportunities involving business loan equity. In the current landscape, where private equity-backed IPOs have declined in both value and count, maintaining a strong balance sheet is crucial for navigating potential liquidity challenges.

- Invest in Assets: Acquiring valuable assets, such as real estate or advanced equipment, contributes to the overall valuation of your business. Investments in tangible assets can offer both immediate operational advantages and long-term growth, further strengthening your financial foundation. As private equity operators increasingly focus on value creation, entrepreneurs can leverage operational improvements to enhance their asset base and increase their business loan equity. Furthermore, obtaining the appropriate loan through customized proposals can promote these investments, guaranteeing that you have access to the essential funds to expand your enterprise. Finance Story offers a full range of lenders to suit various circumstances, whether you are purchasing a warehouse, retail premise, factory, or hospitality venture.

- Retain Earnings: Instead of distributing profits among stakeholders, consider reinvesting them back into the enterprise. This strategy encourages growth and improves fairness, as retained earnings can be utilized for expansion, innovation, or enhancing operational efficiencies. As Jeff Shen, PhD, notes, "As systematic investors, alternative data provides a real-time view of how tariffs are impacting companies across the breadth of the market—allowing us to dynamically navigate a range of possible scenarios." This highlights the importance of informed decision-making in retaining earnings effectively.

By applying these tactics, entrepreneurs can successfully establish value in their ventures, assuring a strong financial base for future expansion. Successful case studies demonstrate that companies concentrating on these areas not only boost their capital but also strengthen their resilience against market fluctuations and economic uncertainties. Moreover, comprehending funding alternatives for leasehold enterprises, such as leveraging property equity and cash savings, can offer extra avenues for obtaining new ventures and broadening your portfolio.

For those looking to refinance their commercial loans, Finance Story can assist in navigating the options available through our diverse lending partners.

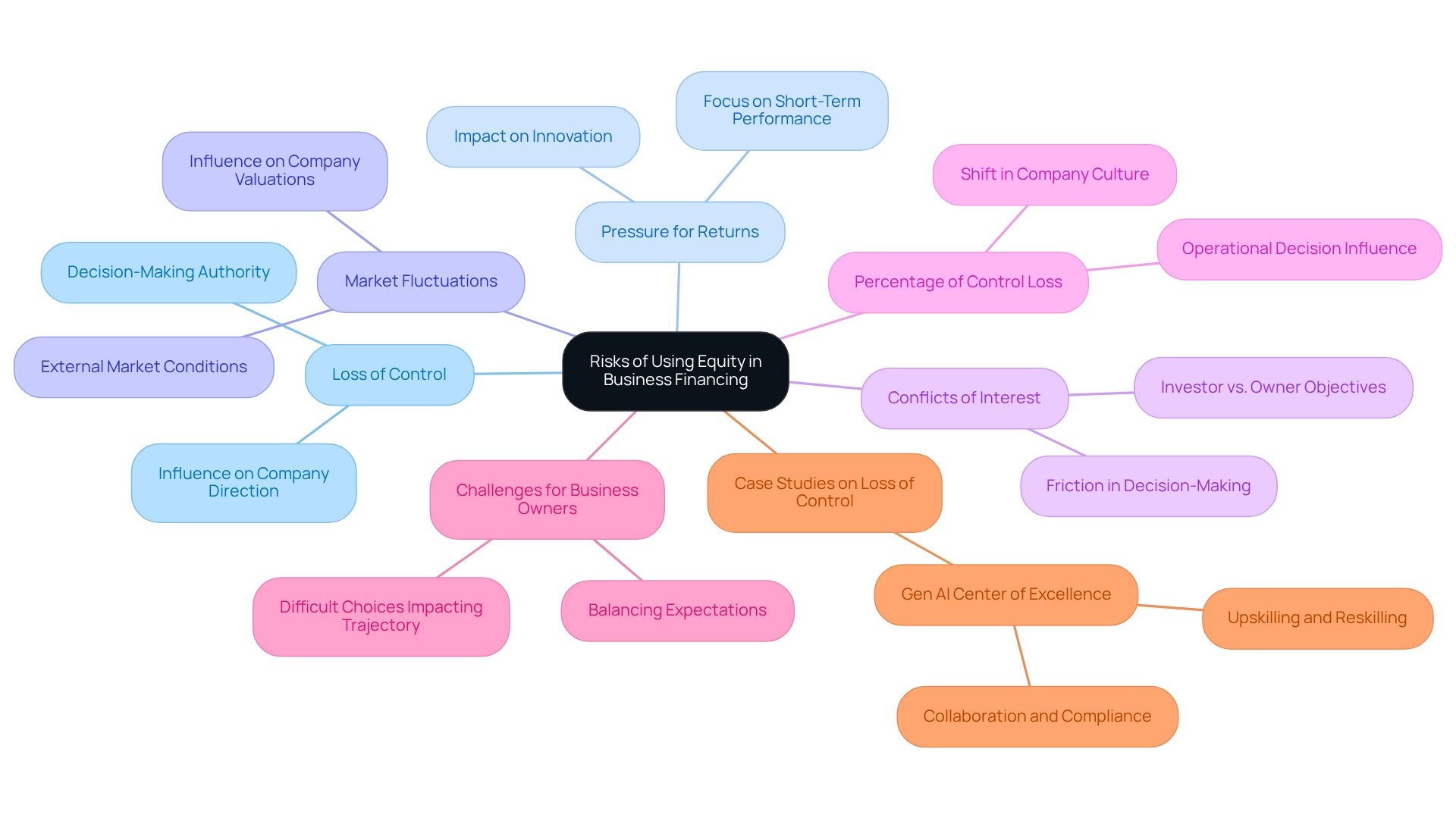

Risks of Using Equity in Business Financing

Equity financing can offer substantial benefits for companies, but it is crucial to acknowledge the inherent risks involved.

-

Loss of Control: One of the most pressing concerns for entrepreneurs is the potential loss of decision-making authority when bringing in investors. As equity partners acquire a stake in the enterprise, they frequently anticipate a voice in strategic decisions, which can undermine the original owners' control over the company's direction.

-

Pressure for Returns: Investors typically seek a return on their investment, creating a challenging dynamic for business owners. This pressure may lead to a focus on short-term financial performance at the expense of long-term growth strategies and business loan equity, potentially stifling innovation and sustainable development. Doug Dannemiller, a senior research leader at the Deloitte Center for Financial Services, emphasizes that this pressure can significantly impact how entrepreneurs manage their businesses.

-

Market Fluctuations: The worth of shares is not static; it can be significantly influenced by external market conditions. For example, in 2025, the unemployment rate in Canada is expected to stay near 6.6%, which could affect consumer spending and, as a result, the worth of companies dependent on equity support. Economic circumstances like these can shape investor expectations and influence perceptions of business loan equity, thereby affecting company valuations.

-

Conflicts of Interest: Equity funding can create potential conflicts between the objectives of investors and those of the owners. While investors may prioritize immediate returns, business owners might focus on long-term vision and stability, leading to friction in decision-making processes.

-

Percentage of Control Loss: Recent studies suggest that a substantial proportion of companies encounter a loss of control after obtaining capital investment. This can manifest in various ways, from diminished influence over operational decisions to a shift in company culture, as new stakeholders bring their own perspectives and priorities.

-

Challenges for Business Owners: Managing the intricacies of business loan equity can be overwhelming. The need to balance investor expectations with personal objectives often leads to difficult choices that can affect the company's trajectory.

-

Case Studies on Loss of Control: Numerous case studies demonstrate the challenges faced by business owners who have involved capital investors. Companies that initially flourished may find themselves battling to uphold their original vision as they adjust to the requirements of their new associates. A pertinent example is the creation of a Gen AI Center of Excellence, which highlights how companies can promote collaboration and adjust to investor expectations while ensuring adherence to regulatory requirements.

Understanding these risks is essential for entrepreneurs contemplating capital investment. By being aware of the potential pitfalls, business owners can make informed decisions that align with their long-term objectives while effectively managing the expectations of their investors. Furthermore, exploring various funding alternatives, such as those provided by Finance Story's specialized lending partner in the UK for expat loans, can assist in mitigating some of the risks linked to capital financing.

How to Attract Equity Investment for Your Business

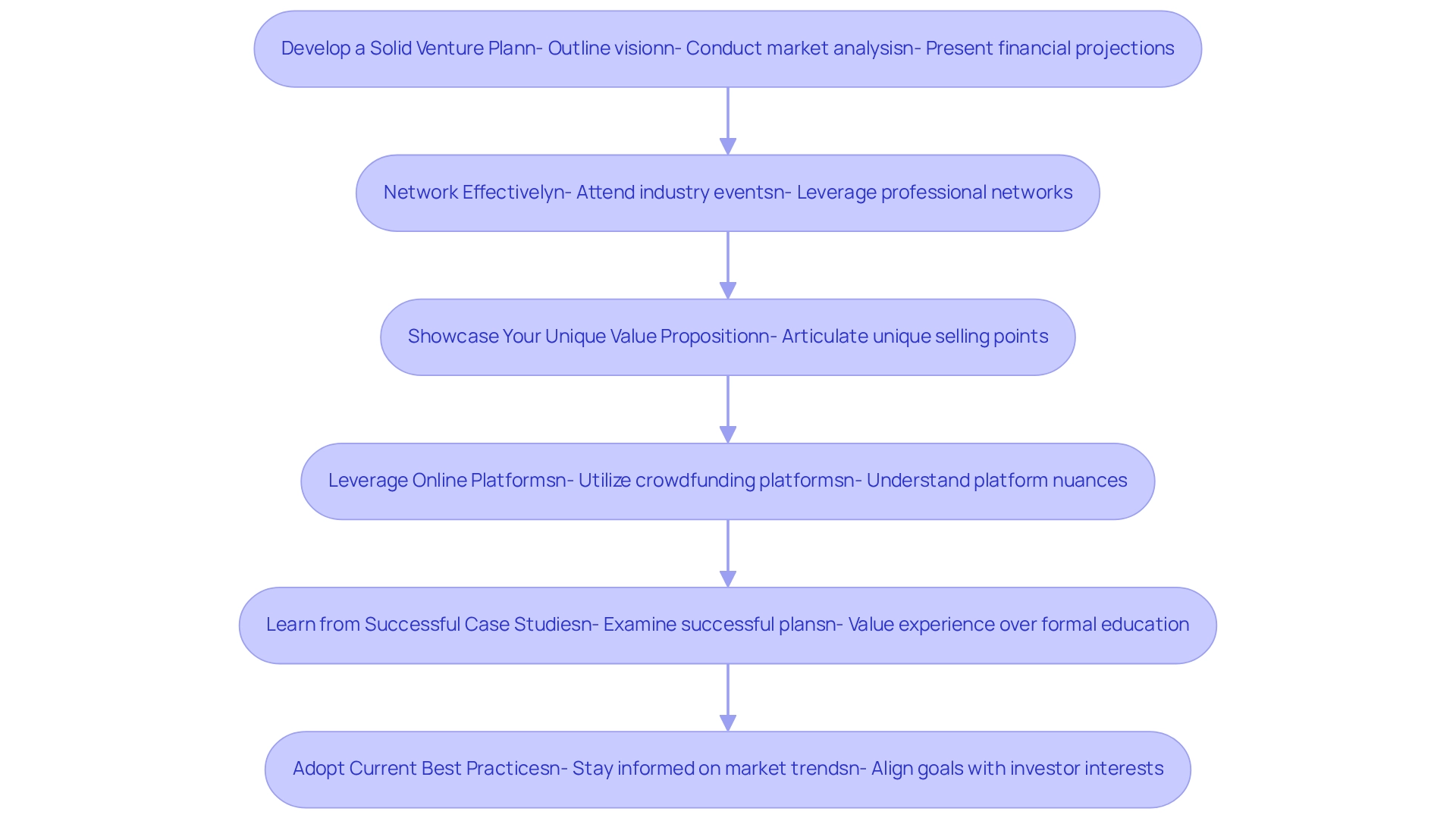

To successfully attract equity investment, entrepreneurs should implement the following strategies:

- Develop a Solid Venture Plan: Crafting a comprehensive venture plan is crucial. This document should clearly outline your vision, conduct thorough market analysis, and present realistic financial projections. A well-structured plan not only demonstrates your preparedness but also significantly increases your chances of attracting potential investors. Considering that approximately 50% of enterprises in the US are home-based, customizing your plan to highlight the unique elements of your venture is essential.

- Network Effectively: Building relationships is key in the entrepreneurial ecosystem. Attend industry events, workshops, and networking functions to connect with potential investors. Recent trends indicate that 40% of founders are turning to their professional networks for financial advice, underscoring the importance of leveraging connections to secure funding. This aligns with Finance Story's commitment to guiding clients through their financial journeys, showcasing the value of professional relationships in attracting investment.

- Showcase Your Unique Value Proposition: Clearly articulate what sets your enterprise apart from competitors. Investors are looking for unique selling points that indicate potential for growth and profitability. A compelling value proposition can make your venture more appealing to investors.

- Leverage Online Platforms: In today's digital age, utilizing crowdfunding platforms can broaden your reach to potential investors. Despite only 1% of entrepreneurs using crowdfunding for initial startup capital, it remains a viable option for those looking to diversify their funding sources. Understanding the nuances of these platforms can enhance your chances of success.

- Learn from Successful Case Studies: Examine successful plans that have drawn investors. For instance, a significant portion of entrepreneurs—30%—have only a high school education, yet they have succeeded by leveraging experience and commitment over formal qualifications. This demonstrates that a solid plan can frequently surpass educational qualifications in obtaining investment, emphasizing the notion that practical experience is essential.

- Adopt Current Best Practices: Stay informed about best practices for developing plans that attract investors. This includes incorporating current market trends and aligning your organization's goals with investor interests. By concentrating on these strategies, entrepreneurs can improve their chances of attracting business loan equity and achieving their goals.

Partnering with Finance Story can offer customized financial solutions and insights into managing the intricacies of funding, ensuring that your proposal aligns with various lending requirements. Furthermore, Finance Story collaborates with an extensive group of lenders, such as traditional banks, private financiers, and angel investors, to provide a broad array of funding alternatives that can assist your enterprise expansion.

Equity vs. Debt Financing: Making the Right Choice

When evaluating the choice between equity and debt financing, entrepreneurs must carefully consider several critical factors:

- Control: For numerous company owners, maintaining authority over their enterprise is crucial. Debt financing allows entrepreneurs to secure business loan equity while preserving ownership stakes, thereby maintaining their decision-making authority and strategic direction.

- Repayment Ability: A thorough evaluation of your company's cash flow is essential. Understanding your capacity to manage regular loan repayments can prevent financial strain. In 2025, statistics indicate that enterprises prioritizing cash flow management are more likely to sustain operations during economic fluctuations. According to the Private Credit Default Index as of June 30, 2024, the rising default rates in private credit underscore the importance of evaluating repayment capabilities. Shane, the Founder and Funding Specialist Director at Finance Story, leverages his extensive experience in organizational improvement and financial consultancy to provide insights into effective loan repayment strategies tailored to your enterprise's unique circumstances. His track record of saving companies millions of dollars over his thirty-year career further underscores his capability in this area.

- Growth Potential: If your enterprise is poised for rapid expansion, business loan equity might be the more suitable option. This approach can provide substantial business loan equity without the immediate pressure of repayment, enabling reinvestment into the business to capitalize on growth opportunities. Shane's experience in overseeing multi-million dollar initiatives, combined with his proficiency in automation and technology solutions, equips him to assist entrepreneurs in selecting the appropriate funding that aligns with their growth aspirations.

- Risk Tolerance: Each funding option carries inherent risks. Equity funding, which may involve business loan equity, can dilute ownership and control, while debt includes the obligation of repayment regardless of business performance. Entrepreneurs should evaluate their comfort level with these risks to make an informed decision. Shane's expertise in grasping the subtleties of financial responsibilities can assist business owners in managing these risks effectively.

Current trends indicate that many business owners are leaning towards debt support, particularly in the middle-market sector, where the significance of robust financial agreements is becoming more apparent. This shift is partly driven by a desire to maintain control and navigate the complexities of repayment obligations effectively. As highlighted in the case study "Future Challenges for Debt Markets," corporates must prioritize productive investment over financial operations to ensure long-term sustainability.

Grasping these dynamics is essential for making the correct funding decision that aligns with your business objectives. As Prof Damodaran aptly states, addressing mistakes or gaps in financial decision-making is essential for business owners to navigate their financing options successfully.

With Finance Story's reputation for professionalism and Shane's deep understanding of the finance sector, entrepreneurs can find reliable guidance in achieving their financial goals.

Conclusion

Navigating the complex landscape of business financing demands a keen understanding of equity, a paramount consideration for entrepreneurs. Business loan equity emerges as a critical asset, representing ownership stakes that can be strategically leveraged for funding and growth. Entrepreneurs can explore various equity financing options—from angel investors to venture capital and crowdfunding—each presenting distinct benefits and challenges. It is essential to weigh the advantages of increased capital and expertise against the potential dilution of ownership and profit-sharing obligations.

Building equity through strategies such as increasing revenue, reducing debt, and retaining earnings is vital for long-term success. Furthermore, recognizing the risks associated with equity financing—such as loss of control and pressure for returns—empowers business owners to make informed decisions that align with their overall vision. Attracting equity investment necessitates a solid business plan, effective networking, and a unique value proposition, all of which can significantly enhance funding prospects.

Ultimately, the choice between equity and debt financing hinges on factors such as control, repayment ability, growth potential, and risk tolerance. Entrepreneurs must carefully evaluate their circumstances and objectives to select the financing option that best supports their business goals. By effectively understanding and managing business loan equity, entrepreneurs can position themselves for sustainable growth and success in an ever-evolving market landscape.