Overview

An equity loan for business serves as a powerful financial tool, enabling companies to leverage the value of their assets. This approach provides the flexibility needed for funding without the immediate burden of regular repayments. Such loans empower businesses to allocate resources effectively for growth and operational needs, all while managing cash flow efficiently. Furthermore, they are gaining traction among Australian enterprises, particularly in the current economic climate, illustrating their rising popularity and strategic importance.

Introduction

In the dynamic landscape of business financing, equity loans stand out as a formidable tool for companies eager to leverage their existing assets for growth. Unlike traditional loans, which often impose stringent repayment schedules and credit requirements, equity loans offer a flexible alternative, enabling businesses to access capital without the immediate pressure of monthly payments. This innovative financing option proves particularly advantageous for entrepreneurs aiming to fund expansion projects, acquire new equipment, or navigate cash flow challenges.

As the trend of utilizing equity loans gains momentum in Australia, it is essential for business owners to grasp their key characteristics, advantages, and potential risks. By understanding these elements, they can make informed decisions.

With expert insights and tailored solutions available, businesses can strategically navigate the world of equity financing, unlocking new opportunities for success.

Understanding Equity Loans: A Business Perspective

An equity loan for business serves as a strategic financial instrument, empowering firms to borrow against the ownership value they hold in their assets, such as real estate or equipment. This funding option, particularly an equity loan for business, presents substantial advantages over conventional lenders, especially in terms of flexibility. Unlike traditional financing that necessitates regular repayments, an equity loan for business enables companies to allocate the funds for various purposes, including growth, operational expenses, or the acquisition of new equipment.

This flexibility is particularly advantageous for companies facing cash flow constraints, as an equity loan for business allows them to leverage their existing assets to secure essential funding.

At Finance Story, we specialize in crafting refined and highly tailored proposals to present to banks, ensuring you secure the appropriate funding for your commercial property investments. We connect you with a comprehensive range of lenders, including high street banks and innovative private lending panels, tailored to your specific circumstances. Current trends indicate an increasing reliance on equity loans for business among Australian enterprises.

In 2025, a significant number of enterprises have chosen equity loans for business as a viable funding method, reflecting a shift in how organizations pursue financial support. The rise in household obligations, which increased by 1.4% ($45.4 billion) primarily due to housing credits, underscores the strong demand for financial solutions that cater to both owner-occupiers and investors. This trend highlights the robustness of the housing market and the broader economic landscape, which continues to facilitate financing options, including equity loans for business.

Furthermore, the average borrowing amount for owner-occupier residences in Western Australia was $383,000, providing insight into the scale of asset financing compared to traditional borrowing. Additionally, household wealth rose by 0.9% in the December quarter, indicating a favorable economic environment for enterprises seeking financing.

Equity financing, such as an equity loan for business, diverges from conventional financing in several key ways. While conventional financing typically requires a fixed repayment plan and may impose stringent credit criteria, an equity loan for business offers more flexible terms, allowing enterprises to obtain funds without the immediate pressure of consistent repayments. This adaptability can be crucial for business owners looking to invest in growth opportunities through an equity loan for business without jeopardizing their cash flow.

Successful examples of financing in action can be observed across various sectors. For instance, companies that have utilized an equity loan for business to finance expansion initiatives or invest in new technology have reported significant growth and improved operational efficiency. These case studies illustrate how an equity loan for business can empower companies to make strategic decisions that foster long-term success.

In conclusion, an equity loan for business is increasingly emerging as a preferred funding option for enterprises in Australia, providing the necessary capital to address challenges and seize opportunities. With current economic conditions fostering a positive environment for such financial offerings, entrepreneurs are well-positioned to leverage an equity loan for business to enhance their operations and achieve their financial goals. If you're considering refinancing your commercial financing or exploring capital options, contact Finance Story today to discuss how we can assist you in securing the right funding for your needs.

Defining Equity Loans: Key Characteristics and Differences

Equity financing stands out due to its reliance on asset value as collateral, differentiating it from traditional financing, which primarily assesses creditworthiness and income. This asset-focused evaluation empowers companies to leverage their current assets, leading to several significant advantages. Notably, financing options often feature adaptable repayment frameworks, including choices for interest-only payments or deferred payments until the asset is sold or refinanced.

This flexibility alleviates short-term cash flow pressures, making capital advances particularly appealing for enterprises looking to fund substantial projects without the burden of monthly repayments.

In terms of financial access, capital advances can unlock larger sums of money, as they are typically based on the total value of the asset. This characteristic is especially advantageous for entrepreneurs aiming to invest in growth opportunities or tackle significant expenses. For instance, companies utilizing capital loans have successfully financed expansions and renovations without the weight of regular loan payments, allowing them to allocate resources more effectively.

Finance Story specializes in offering customized refinancing solutions that assist both self-employed and salaried individuals in accessing capital at reduced rates, ensuring that support aligns with their unique circumstances. Furthermore, Finance Story has access to a wide range of lenders, providing diverse options for clients.

Recent trends indicate a shift in the capital funding landscape. For example, the Help to Buy: Equity Loan program has shown that first-time purchasers accounted for 82% of all acquisitions under its previous version, highlighting the growing acceptance and utilization of equity-based funding options. Additionally, case studies reveal that in the third quarter of 2022, the average deposit percentage required for capital financing decreased across various regions, suggesting a more accessible environment for borrowers.

This trend is significant, particularly considering that the number of underwater U.S. homes fell by 30,000 from the previous year, indicating an overall improvement in the housing market that could positively influence access to credit options. Mia Taylor, a prominent journalist, underscores the importance of understanding these financial alternatives in her contributions to economic discussions. Her insights lend credibility to the conversation surrounding financial agreements and their strategic benefits for enterprises.

Moreover, Finance Story's expertise in crafting tailored funding proposals ensures that clients can effectively present their situations to banks, facilitating the acquisition of essential resources for both residential and commercial real estate investments, including warehouses, retail spaces, factories, and hospitality projects.

In conclusion, an equity loan for business presents an appealing alternative to conventional funding methods, particularly for enterprises seeking to strategically leverage their assets while maintaining financial flexibility. The recent transition of lending indicators from monthly to quarterly releases further underscores the evolving financing landscape, providing businesses with updated insights into their funding options.

How Businesses Can Leverage Equity Loans for Growth

Companies can utilize an equity loan for business to support a diverse range of growth initiatives, including financing new projects, expanding operations, or acquiring essential assets. For instance, a company might utilize an equity loan for business to acquire more commercial property, thus improving its operational capacity and preparing for future expansion. In 2025, numerous companies are progressively opting for an equity loan for business to fund marketing initiatives or product advancement, which can greatly enhance revenue sources.

At Finance Story, we focus on crafting refined and highly customized financing proposals that align with the elevated expectations of lenders. Our knowledge guarantees that small enterprise owners can obtain the appropriate funding solutions customized to their particular requirements, whether they are acquiring a large warehouse, retail location, factory, or hospitality project. The adaptability inherent in an equity loan for business enables companies to distribute resources exactly where they are most necessary, promoting innovation and growth without the immediate pressure of repayment.

While statistics show that personal savings and family support remain primary sources of startup funding, an equity loan for business is becoming a crucial alternative, especially as the value of new personal fixed-term financial commitments in Australia reached $8.35 billion in the December quarter of 2024. Grasping repayment criteria is crucial for business financing, and our team at Finance Story offers insights that assist entrepreneurs in navigating these complexities.

Mark E. Schweitzer highlights that homes serve as an important source of capital for small business owners, and the recent drop in housing prices presents a significant limitation on small business finances. This makes access to an equity loan for business even more essential for sustainable growth.

Successful projects financed by capital illustrate their effectiveness. For example, crowdfunding platforms such as Wefunder and Crowdcube have allowed startups to gather significant funds by providing shares to the public, democratizing the investment process and enabling numerous small investors to participate without any individual investor obtaining a majority ownership. This approach not only offers essential financing but also cultivates a network of supporters committed to the company's success, enhancing conventional funding alternatives.

Furthermore, enterprises employing financing for growth have reported significant success rates. By strategically investing in growth initiatives, these companies can enhance their market presence and operational efficiency. Expert insights indicate that the connection between a company's financial performance and its capacity to obtain an equity loan for business is significant, with research revealing that homes serve as a crucial source of capital for small enterprise owners.

Benefits of Equity Loans for Business Financing

An equity loan for business presents numerous advantages for enterprises, establishing itself as a strategic option for entrepreneurs seeking to improve their financial standing. A primary benefit lies in the flexibility of repayment terms, allowing businesses to access substantial capital while effectively managing their cash flow. Unlike traditional lending options, this financing typically does not necessitate monthly payments, enabling enterprises to allocate resources toward operational expenses without the immediate pressure of debt repayment.

Despite these advantages, many companies harbor concerns that new loans, such as an equity loan for business, could further entrap them in debt. This apprehension may deter them from pursuing investment loans, even when such options could be beneficial. This concern is particularly pronounced in the current economic climate, where small enterprises face challenges stemming from rising input costs and cash flow pressures. For leasehold businesses, the absence of a commercial property to secure loans limits their options to cash reserves or the value of any owned property.

For instance, an entrepreneur possessing a residence valued at $1.3M with $300k owed could potentially access $740k in assets to support their business acquisition, supplementing this with any available cash savings.

Financial expert Mark E. Schweitzer emphasizes the importance of homes as a vital source of capital for small business owners, stating, "We analyze information from a variety of sources and find that homes do constitute an important source of capital for small enterprise owners and that the impact of the recent decline in housing prices is significant enough to be a real constraint on small enterprise finances." This underscores the necessity of maintaining access to funding sources, particularly an equity loan for business, to sustain operational activities, especially for individuals lacking tangible assets.

Data indicates that non-bank credits, often including capital advances, boast an approval rate of nearly 25%, reflecting a growing acceptance of alternative funding avenues. This statistic highlights the challenges leasehold enterprises encounter in securing conventional financing, making an equity loan for business an increasingly vital option. Case studies illustrate the practical benefits of ownership financing.

For example, businesses facing cash flow issues due to delayed payments and increased tax obligations have successfully utilized capital borrowing to stabilize their finances. By preserving liquidity rather than succumbing to insolvency, these enterprises have navigated difficult circumstances while positioning themselves for future growth.

As we look toward 2025, the benefits of shared capital financing for enterprises remain significant. They not only provide swift access to funds but also empower businesses to invest in growth initiatives that can yield substantial returns over time. As entrepreneurs continue to seek innovative solutions to manage cash flow, an equity loan for business emerges as a pragmatic choice for ensuring financial stability and fostering long-term success.

At Finance Story, we recognize the critical importance of these funding alternatives for small business owners.

Risks and Considerations When Using Equity Loans

An equity loan for business can offer substantial benefits for funding; however, it also carries inherent risks that entrepreneurs must thoughtfully assess. One of the primary concerns is the potential loss of ownership or control over the asset pledged as security if financial obligations are not met. This risk becomes particularly pronounced in unstable markets, where asset values can fluctuate significantly, impacting the capital available for borrowing.

Indeed, recent statistics reveal that a considerable portion of enterprises experience asset loss due to equity financing, underscoring the necessity for careful financial management.

Furthermore, excessive reliance on equity financing can lead to financial instability, especially if an enterprise struggles to generate sufficient revenue to cover operational costs. According to Zippia, 62% of all small enterprises owe over $100,000, illustrating the financial pressure that can arise from excessive borrowing. This situation can be exacerbated by the variability in interest rates for commercial financing, which, as reported by the SBA, can range from 2.54% to 7.01%, with typical rates falling between 5.50% and 8%. Such variations necessitate meticulous repayment strategies to avoid prolonged debt.

To mitigate these risks, business proprietors should engage in comprehensive financial planning and risk evaluation before applying for an equity loan. This process includes assessing their long-term goals and ensuring that any borrowing aligns with their overall financial strategy. Consulting with financial experts, such as those at Finance Story—recognized for their professionalism and extensive knowledge of the finance sector—can provide valuable insights into tailored funding proposals and financing solutions for commercial property investments.

Finance Story grants access to a comprehensive array of lenders, including high street banks and innovative private lending panels, ensuring that entrepreneurs have access to the best options available. Their expertise enables business owners to navigate the complexities of capital borrowing and refinancing, leading to informed choices that safeguard their financial stability. As one satisfied customer, Natasha B. from VIC, stated, 'I will certainly be recommending your services to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey.

Qualifying for an Equity Loan: Requirements and Process

Qualifying for a financial loan requires owners to demonstrate possession of an asset that retains adequate value, such as property or machinery. Lenders typically assess the asset's market value alongside the available financing for borrowing. To streamline this process, business owners must prepare comprehensive documentation, often including financial statements, tax returns, and a detailed business plan outlining the intended use of the funds.

At Finance Story, we excel in crafting polished and tailored business cases for presentation to lenders, ensuring our clients meet the increasingly stringent expectations for securing funds.

The application procedure can vary among lenders, but it generally involves a professional assessment of the asset to establish its market worth—an essential step for calculating the available value. Understanding the appraisal criteria can significantly aid borrowers in preparing for the application process, as it directly impacts their ability to secure financing.

In 2025, lenders will also consider the debt-to-income ratio when qualifying applicants for home financing, underscoring the importance of maintaining a sound financial profile. This assessment is crucial as it enables lenders to evaluate the borrower's capacity to manage additional debt. Recent statistics reveal that financial commitments categorized as 'Other' saw a notable 3.9% increase from the September quarter to the December quarter of 2024, with an impressive year-on-year rise of 25.9%.

This trend underscores the growing interest in utilizing equity loans for business among entrepreneurs, indicating a shift towards leveraging existing assets for funding.

Successful case studies illustrate how various companies have effectively secured capital financing. For instance, a small startup leveraged its commercial property to obtain an equity loan for business expansion, resulting in a 30% increase in operational capacity within a year. This exemplifies the potential of shared financing as a viable funding option.

Financial specialists emphasize that understanding the funding application process can significantly enhance a company's chances of approval, particularly when all necessary documentation is meticulously organized.

On average, the time required to secure financing in Australia can vary, but many borrowers report a smooth process when adequately prepared. Furthermore, current trends in the lending market, including Finance Story's access to a comprehensive range of lenders, highlight the incentives available to borrowers. By staying informed about evolving demands and leveraging expert insights from Finance Story, owners can navigate the complexities of financing and position themselves for success in their financial endeavors.

Key Takeaways: Navigating Equity Loans for Your Business

An equity loan for business serves as a powerful financial tool for enterprises looking to leverage their assets to drive growth. By understanding the key traits, benefits, and inherent dangers of ownership financing, entrepreneurs can make informed funding choices. Key factors involve comprehending the qualification procedure, identifying possible risks, and strategically allocating resources to encourage company growth.

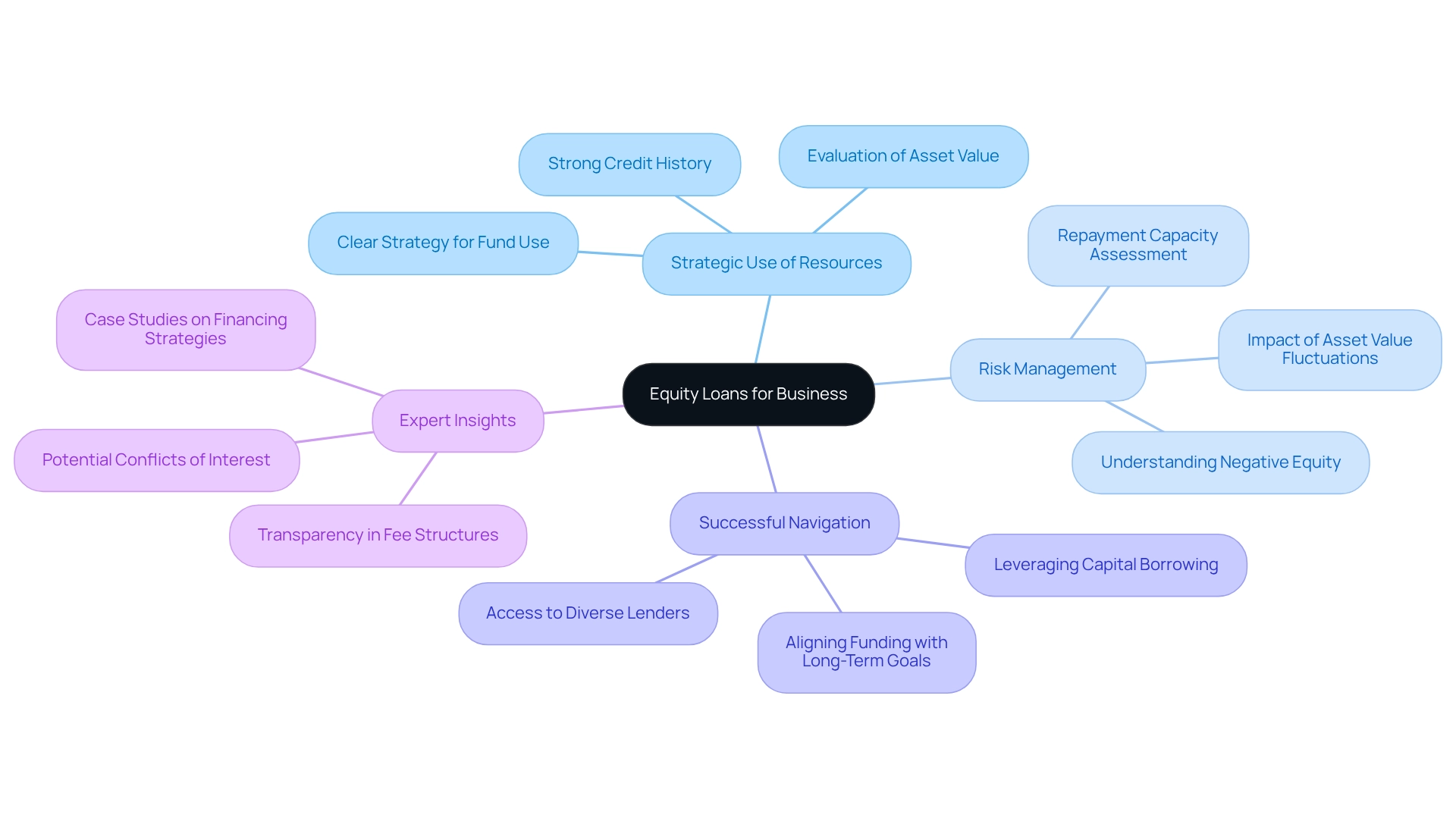

In 2025, companies contemplating capital loans should concentrate on several essential insights:

- Strategic Use of Resources: Capital loans can be employed for diverse aims, such as financing new initiatives, broadening operations, or improving cash flow. A clear strategy for how the funds will be used is crucial for maximizing the benefits of the equity loan for business, and understanding the criteria for obtaining this equity loan for business is essential. This frequently entails evaluating the worth of the company's assets and confirming that the enterprise possesses a strong credit history. At Finance Story, we specialize in creating refined and highly tailored cases to present to lenders, ensuring that your proposal meets the elevated standards of obtaining funds. We additionally provide refinancing alternatives to assist companies in adjusting to their changing requirements.

- Risk Management: Although ownership-based financing can offer substantial capital, it also carries risks, including the possibility of negative equity. Negative net worth occurs when homeowners owe more on their mortgage than their home is valued, making it challenging to sell or refinance. As of Q3 2024, the quantity of submerged U.S. residences has diminished, but entrepreneurs must still assess their capacity to repay the financing and the consequences of varying asset values.

- Successful Navigation: Statistics indicate that a significant percentage of enterprises successfully navigate the funding landscape, leveraging these resources to achieve their growth objectives. For example, firms that strategically leverage capital borrowing often report better financial stability and enhanced operational capabilities. With access to a complete range of lenders, including high street banks and creative private lending panels, Finance Story can assist you in obtaining the appropriate financing tailored to your needs, whether you are acquiring a warehouse, retail space, factory, or hospitality project.

Expert insights indicate that companies should approach ownership financing with a thorough understanding of their financial situation. Financial professionals emphasize the importance of transparency in fee structures and the potential conflicts of interest that can arise from undisclosed fees in private capital funds. As Weinman observed, Australian private investment firms are retaining assets for an extended period, anticipating improved market conditions to divest, which highlights the necessity for companies to be strategic in their methods regarding financial borrowing.

Case studies demonstrate the effective application of financial borrowing in corporate strategy. For instance, firms that have effectively executed financing agreements often emphasize the significance of aligning their funding strategies with long-term objectives. By doing so, they not only secure necessary funding but also position themselves for sustainable growth.

Furthermore, the case study on elevated fees and leakage in private capital funds shows that considerable fees can signify important leakage from investor returns, prompting inquiries about the total value contributed by private equity firms.

In conclusion, companies seeking to utilize capital financing for expansion must take into account these critical elements: strategic fund application, comprehending the qualification procedure, managing risks, and gaining insights from successful case studies. With careful planning and a proactive approach, an equity loan for business can be a valuable asset in a business's financial toolkit, especially when supported by the expertise of Finance Story.

Conclusion

Equity loans have emerged as a pivotal financing option for businesses eager to leverage their existing assets for growth. By grasping the fundamental characteristics and benefits of equity loans, entrepreneurs can make informed decisions that align with their financial objectives. These loans provide flexibility in repayment terms, allowing businesses to access substantial capital without the burden of immediate repayments. This flexibility facilitates investment in expansion, new projects, or operational improvements.

However, while equity loans present numerous advantages, they also carry inherent risks that must be carefully evaluated. The potential for asset loss and the impact of fluctuating market values underscore the importance of prudent financial management. A strategic approach to utilizing equity loans, paired with a thorough understanding of the qualification process and risk factors, can empower businesses to harness this financing tool effectively.

In the evolving landscape of business financing, equity loans stand out as a viable solution for entrepreneurs aiming to foster growth and navigate financial challenges. By leveraging the expertise of financial professionals, such as those at Finance Story, businesses can secure the right financing tailored to their needs, ensuring they are well-equipped to thrive in a competitive market. Ultimately, with careful planning and strategic deployment of funds, equity loans can become a cornerstone of a successful business strategy, driving long-term financial stability and growth.