Overview

Securing a business loan using home equity is a strategic move that requires a clear understanding of your property's value and a careful calculation of your equity. It is essential to select the right financing option, such as:

- A home equity line of credit

- A cash-out refinance

By accurately assessing home equity and following a structured application process, entrepreneurs can effectively leverage their residential assets to access capital for business growth. However, it is crucial to remain mindful of the associated risks, including:

- Potential foreclosure

- Increased debt levels

Are you ready to explore how your home equity can fuel your business ambitions?

Introduction

In the evolving landscape of business financing, home equity has emerged as a pivotal resource for entrepreneurs seeking capital. As homeowners gain a deeper understanding of their property’s value, the potential to leverage home equity for business growth becomes increasingly appealing. With the average home equity percentage projected to reach 40% in Australia by 2025, many are exploring how this financial tool can unlock opportunities for expansion and innovation.

However, navigating the complexities of home equity financing requires a keen awareness of both the benefits and risks involved. From understanding the intricacies of various loan options to recognizing the disparities in equity ownership, this article delves into the essentials of leveraging home equity as a strategic advantage for business financing. With real-world examples and expert insights, it provides a comprehensive guide for entrepreneurs ready to harness their home’s value to fuel their ambitions.

Understanding Home Equity: The Foundation for Financing

The value of property ownership represents the portion of your residence that you fully own, calculated by subtracting the outstanding mortgage debt from your property’s current market value. For instance, if your home is valued at $500,000 and you owe $300,000, your property value stands at $200,000. This ownership can act as a significant financial resource, allowing homeowners to tap into funds for various needs, including securing a business loan through home equity.

Understanding how residential value functions is essential for business owners looking to leverage home equity for financing. In 2025, it is projected that the average property ownership rate among Australian residents will be around 40%, reflecting a growing trend of using property value as a financial tool. Recent statistics indicate that the average loan amount for owner-occupier homes in Tasmania reached $465,000 in December 2024, underscoring the potential for considerable asset appreciation.

Moreover, the financial landscape reveals disparities in property ownership. For example, while 69.2% of properties owned by women are houses, they encounter challenges with an average housing debt of $256,541, compared to $237,230 for men. This situation results in a less favorable property investment status for women, emphasizing the need for targeted solutions to address these inequalities.

As Ms. Owen notes, "Despite overall dwelling ownership equality, this year’s survey shows that affordability constraints and the property purchasing process pose significant challenges for a larger proportion of females, highlighting the necessity for targeted solutions to tackle gender disparities in Australian property ownership."

Real-world examples illustrate how entrepreneurs can effectively utilize residential assets for a business loan through home equity. By leveraging their property value, entrepreneurs can secure a business loan for growth, equipment purchases, or operational expenses. Finance Story's expertise in crafting tailored and compelling cases can assist you in presenting your funding proposal to lenders, ensuring you gain access to the necessary capital for your operational needs.

Financial advisors emphasize that understanding residential value not only aids in securing essential capital but also enhances overall financial strategy.

As the market evolves, recent trends in property value loans indicate a growing willingness among lenders to consider a business loan using home equity as a viable financing option. This shift highlights the importance of staying informed about property financing developments and grasping critical information that can empower small business owners in their financial decisions. Additionally, the case study titled "Property Values and Debt Levels" reveals that the average property value for females is reported at $1,046,547, slightly lower than the average for males at $1,071,912, further illustrating the financial disparities between genders concerning property values and debt levels.

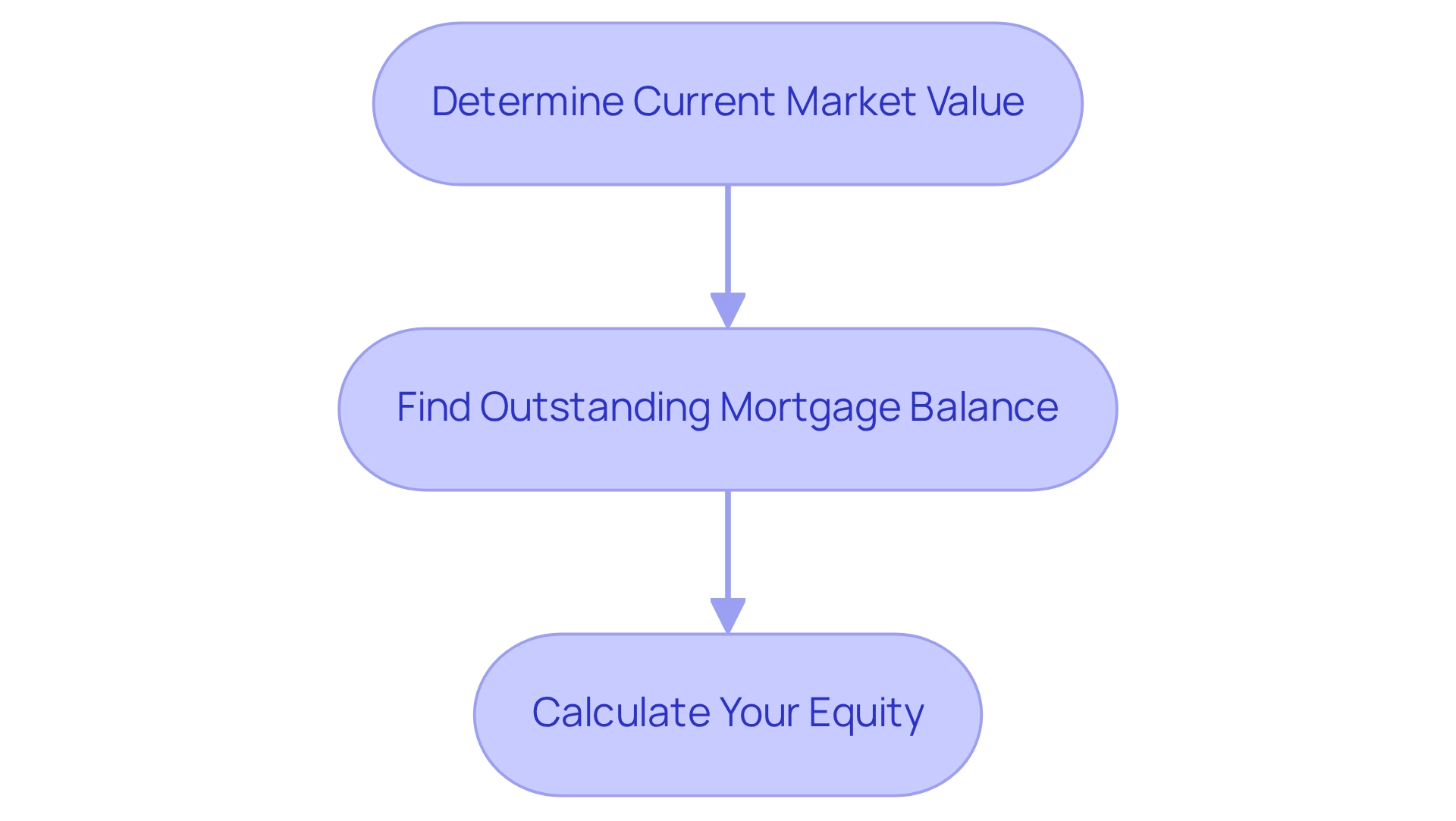

Calculating Your Home Equity: Assessing Your Financial Position

To effectively calculate your property equity and explore financing options for your business, follow these essential steps:

-

Determine Your Residence's Current Market Value: Utilize online property valuation tools or consult a local real estate agent to obtain an accurate estimate of your property's worth. As of 2025, the average property value in Melbourne is approximately $800,000, reflecting the current market dynamics. Significantly, property values increased by 2.9% during the previous year, which may affect your residence's market worth and, as a result, your ownership calculations.

-

Find Your Outstanding Mortgage Balance: Review your latest mortgage statement to ascertain the remaining amount owed on your mortgage. This figure is crucial for understanding how much ownership you have available.

-

Calculate Your Equity: Subtract your outstanding mortgage balance from your property's market value. For instance, if your residence is valued at $800,000 and your mortgage balance is $500,000, your ownership stake would be $300,000. This sum indicates the highest possible borrowing ability based on your property.

Grasping these computations is crucial for small entrepreneurs seeking to utilize property value for a business loan using home equity as funding. Financial specialists stress that precisely evaluating home equity can create opportunities for diverse funding alternatives, such as a business loan using home equity, allowing entrepreneurs to invest in their ventures efficiently.

Furthermore, Finance Story specializes in creating polished and highly personalized cases to present to banks, ensuring you secure the right financing for your commercial property investments or refinances.

We offer a full range of lenders, including high street banks and innovative private lending panels, to suit your specific circumstances, whether you are purchasing a warehouse, retail premise, factory, or hospitality venture. As Dr. Nalini Prasad observes, sectors of the market with a significant portion of cash buyers are likely to excel compared to the overall market, which can be a crucial factor for small enterprises evaluating their financial strategies.

By adhering to these steps and utilizing the expertise of Finance Story, you can gain a clearer understanding of your financial position and make informed choices regarding your financing requirements.

Reach out to us today to discover how we can help you in developing a customized proposal that addresses your specific needs.

Leveraging Home Equity: Options for Business Financing

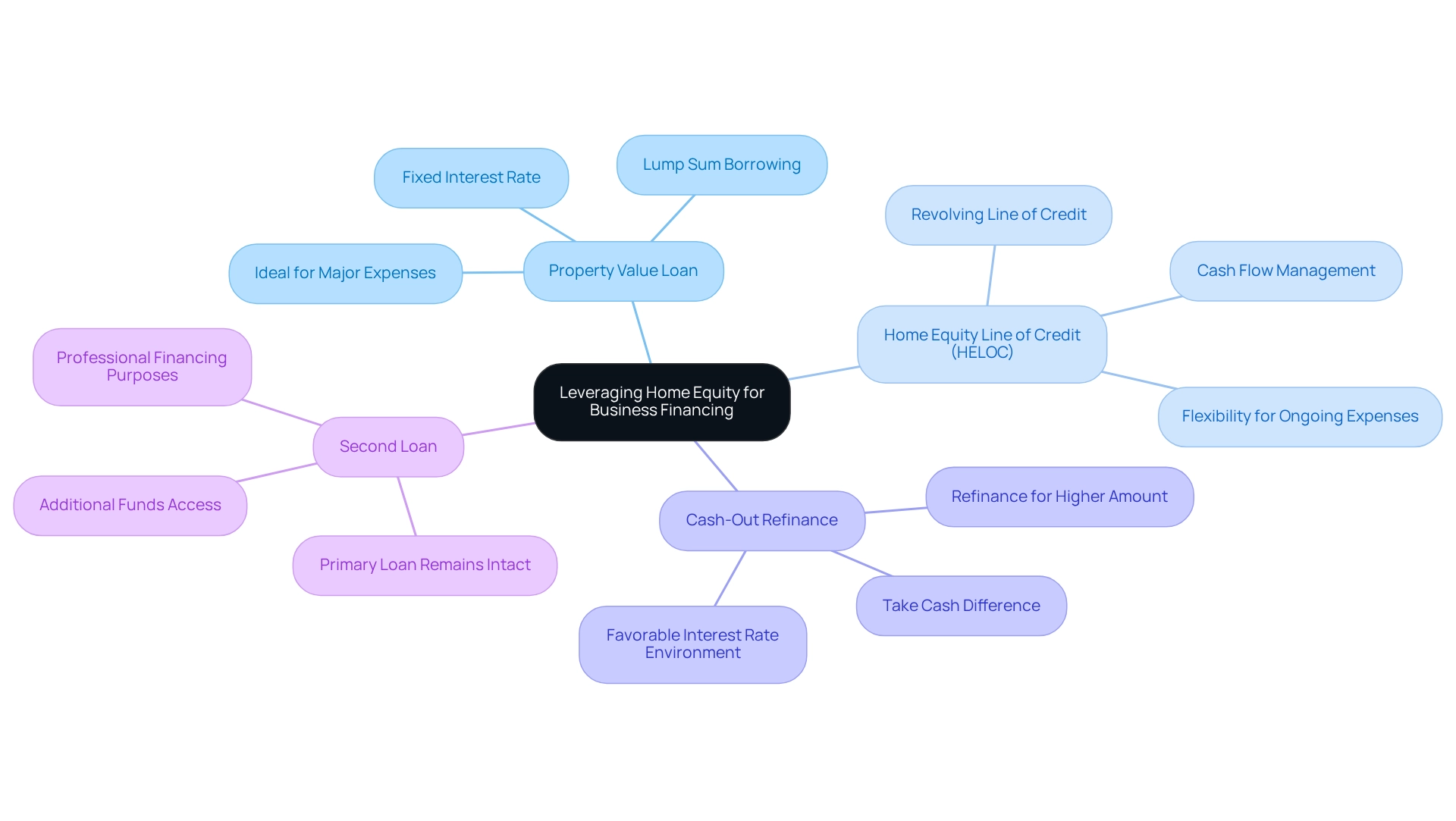

Leveraging residential value for a business loan through home equity can be a strategic move for entrepreneurs aiming to secure capital. Consider these effective options:

- Property Value Loan: This loan type allows you to borrow a lump sum based on your property's value, typically at a fixed interest rate. It is particularly suited for significant, one-time expenses, such as acquiring equipment or funding a major project.

- Home Equity Line of Credit (HELOC): A HELOC provides a revolving line of credit based on your home equity, allowing you to borrow as needed. This flexibility makes it ideal for ongoing operational expenses, such as managing cash flow or covering costs.

- Cash-Out Refinance: This option entails refinancing your existing mortgage for an amount greater than what you owe, enabling you to take the difference in cash. This can yield substantial capital for commercial use, especially in a favorable interest rate environment. Finance Story specializes in developing customized refinancing options that assist you in obtaining funds and reducing rates with ease, whether you are self-employed or earn a salary.

- Second Loan: By securing a second loan against your property's value, you can access additional funds for professional purposes while keeping your primary loan intact. This option is viable for those needing extra financing without altering their existing mortgage terms.

Current trends indicate a growing interest among Australian business owners in property-backed financing and HELOCs, especially for securing business loans using home equity. Recent statistics reveal that investor borrowing commitments reached 48,876, reflecting a cautious yet optimistic approach to utilizing residential value. Many borrowers have been refinancing larger debts during the economic recovery following COVID-19.

Expert insights underscore the importance of understanding the distinctions among these financing options. Home value loans provide a fixed amount, while HELOCs offer flexibility. Cash-out refinancing can be advantageous for those seeking larger sums, but it necessitates careful consideration of existing mortgage terms.

As Peter Marshall, a Financial Services Specialist, notes, "Understanding the nuances of these options is crucial for making informed financial decisions."

As recommended by InfoChoice.com.au, obtaining impartial financial guidance before making property financing choices is essential. Reviewing relevant product documents can also help ensure you select the optimal option suited to your needs. With the right strategy, a business loan using home equity can serve as a powerful resource for entrepreneurs looking to expand their ventures.

Finance Story's reputation for professionalism and deep understanding of the finance sector further supports clients in achieving their financial goals efficiently.

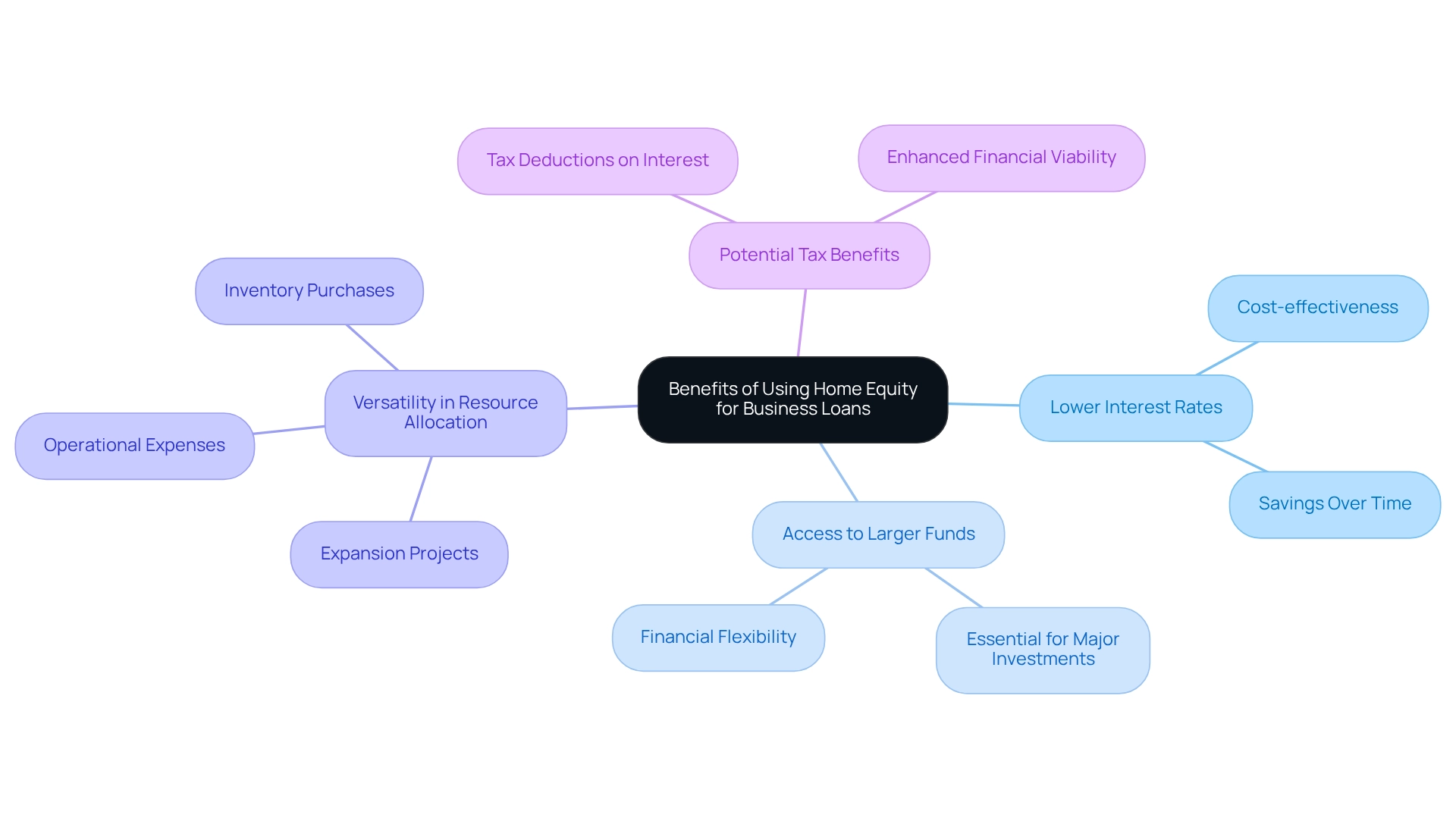

Benefits of Using Home Equity for Business Loans

Utilizing home value for funding opportunities, such as a business loan through home equity, presents numerous advantages that can significantly benefit entrepreneurs. A business loan leveraging home equity typically offers lower interest rates compared to unsecured commercial financing. This cost-effectiveness can lead to substantial savings over the financing period, making it an attractive option for commercial funding.

Access to larger funds is attainable through a business loan using home equity, enabling entrepreneurs to secure more capital—essential for major investments like acquiring equipment, expanding operations, or launching new projects. This financial flexibility can be transformative for growing businesses.

The resources obtained via a business loan using home equity can be allocated for various business objectives. Whether for expansion, inventory purchases, or covering operational expenses, the versatility of these financial products allows entrepreneurs to direct resources to where they are most needed. A notable financial advantage of a business loan using home equity is the potential tax benefits, including possible tax deductions on the interest paid. This can yield additional savings for business owners, enhancing the overall financial viability of utilizing property value as a funding source.

Case Study Insight: Consider Doug, who accessed $526,500 under the Home Equity Access Scheme. By opting for a repayment of $1,350 every two weeks, he effectively addressed his financial needs. After 15 years, his debt balance reached $718,810.81, illustrating how the strategic use of property value can support long-term financial planning, even with the accumulation of compound interest.

Expert Perspectives: Financial analysts emphasize the affordability of a business loan using home equity compared to unsecured alternatives. For instance, the average refinancing amount for owner-occupiers is approximately $585,000, while investors average $654,000, highlighting the significant financial leverage available through home ownership. Additionally, the total value of refinanced financial commitments in Australia has varied widely, ranging from $6.936 billion to $41.193 billion, indicating a robust market for refinancing options.

However, it is essential to acknowledge that borrowing against leasehold properties may present limitations, as these properties do not offer the same value support as owned commercial properties. This can restrict the amount available for borrowing and may require alternative financial strategies.

In the December quarter of 2024, investor commitments for borrowing totaled 48,876, reflecting a 4.5% decrease from the previous quarter but a 13.2% increase compared to the same quarter in 2023. This context underscores the ongoing significance of residential asset financing, particularly through a business loan using home equity, as a viable funding strategy for enterprises. In 2025, as interest rates fluctuate, the benefits of a business loan using home equity for companies remain appealing, especially for those looking to enhance their financing strategies.

With the right approach, leveraging property value can yield considerable financial advantages and promote sustainable growth. Furthermore, for leasehold businesses, utilizing property value and cash reserves becomes vital, as these options can enable business acquisitions without necessitating a physical commercial property.

Risks and Considerations: What to Watch Out For

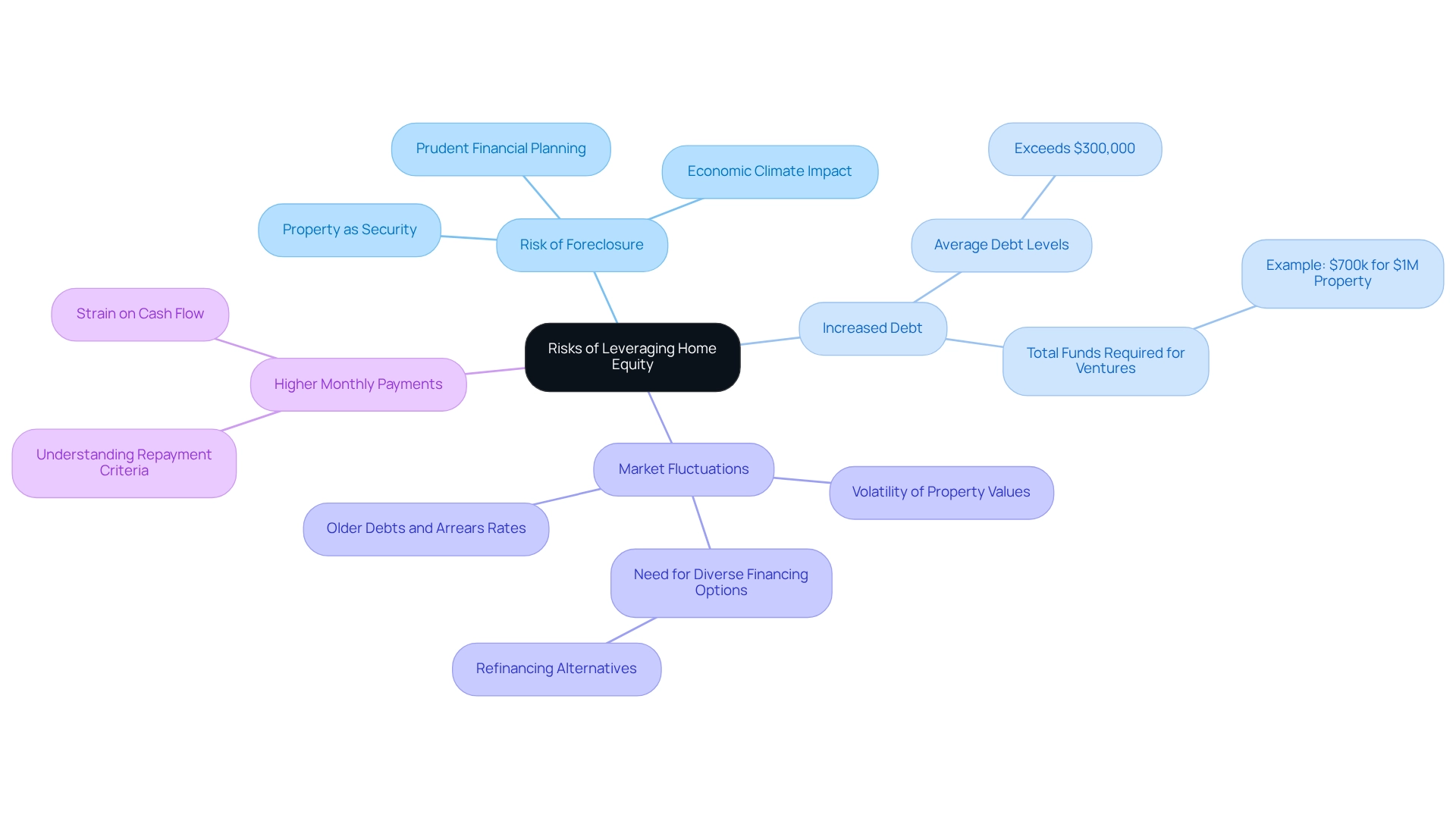

While leveraging home equity can provide significant financial advantages, it is essential to be aware of the associated risks:

- Risk of Foreclosure: Using your residence as security means that inability to repay the debt could lead to losing your property. This risk is particularly pronounced in the current economic climate, where fluctuations in interest rates and market conditions can lead to increased financial strain on borrowers. Recent statistics suggest that foreclosure rates associated with property loans in Australia have been increasing, highlighting the significance of prudent financial planning. Furthermore, when contemplating a commercial property acquisition, lenders generally permit borrowing against the commercial property instead of the enterprise itself, which can complicate financing if significant assets are not accessible.

- Increased Debt: Borrowing against property value raises your overall debt levels, which can jeopardize your financial stability. Statistics show that numerous Australian homeowners who take a business loan using home equity for entrepreneurial purposes face average debt levels that can exceed $300,000, significantly affecting their financial well-being. When financing a freehold property venture, it’s crucial to account for the total funds needed, including deposits and additional costs like valuation and legal fees, which can further increase debt obligations. For instance, if you are purchasing a commercial property priced at $1M with a business price of $400k, the total funds required would be $700k, including a deposit of $300k.

- Market Fluctuations: The real estate market is inherently volatile. Fluctuations in property values can decrease your residence's worth, thereby limiting your borrowing potential. Recent analyses indicate that older debts tend to have higher arrears rates, suggesting that as market conditions change, so too do the risks associated with utilizing home equity. As Kevin James, General Manager of Advisory Solutions at Equifax, observed, 'There are additional options to develop and solutions, and I believe those have expanded significantly in the past 18 months,' emphasizing the necessity for owners to investigate various financing paths, including refinancing alternatives that may better accommodate their changing requirements.

- Higher Monthly Payments: Depending on the configuration of the financing, monthly payments may rise, which can strain your cash flow. Business owners must carefully assess their ability to manage these payments, especially in light of potential economic downturns. When obtaining financing for a commercial property, grasping the repayment criteria and ensuring that the payment structure corresponds with your cash flow is crucial.

Alongside these risks, it is essential for entrepreneurs to evaluate professional insights regarding the consequences of a business loan using home equity. Financial advisors often caution against overextending oneself, emphasizing the importance of maintaining a balanced debt-to-income ratio to avoid foreclosure risks and ensure sustainable debt management.

Case studies show that enterprises confronting foreclosure due to residential financing often experience this due to insufficient financial planning and a misjudgment of market risks. The findings from the financial stability assessment indicate that risks to financial stability from housing lending are evolving, with sound lending standards and rising housing prices supporting overall financial system resilience. Therefore, it is essential to perform comprehensive financial evaluations and obtain expert advice from Finance Story when contemplating property value as a funding alternative for entrepreneurial endeavors.

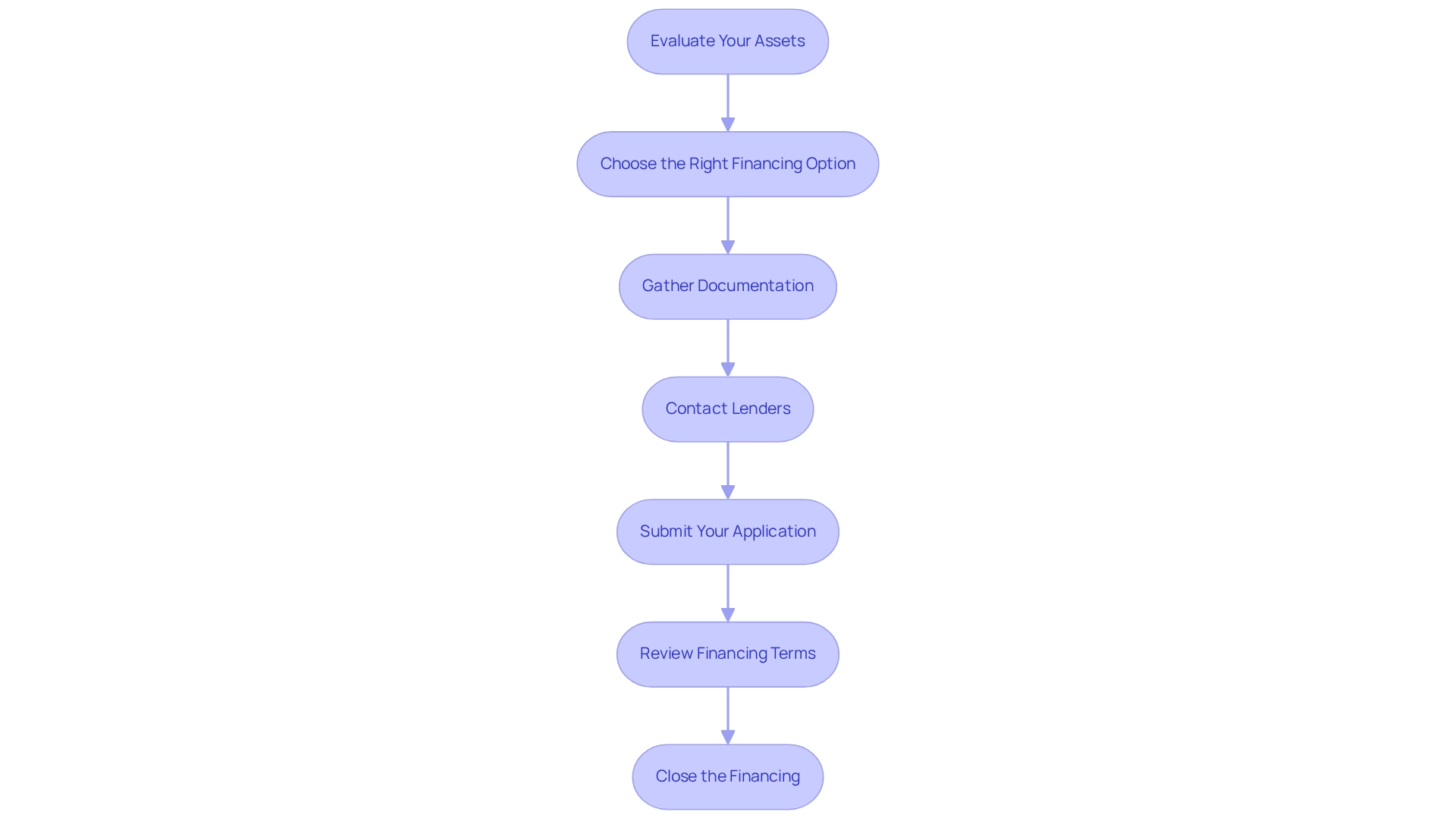

Step-by-Step Guide: Applying for a Business Loan with Home Equity

To successfully apply for a business loan utilizing residential assets, follow this structured approach:

-

Evaluate Your Assets: Begin by determining your property value. This is calculated as the difference between your property's current market value and the outstanding mortgage balance. Understanding your ownership stake is crucial, as it dictates how much you can borrow.

-

Choose the Right Financing Option: Assess your options to identify whether a home equity product, a home equity line of credit (HELOC), or a cash-out refinance best aligns with your financial needs. Each option presents distinct features and implications for repayment.

-

Gather Documentation: Compile all necessary documentation, typically including proof of income, credit history, and detailed information about your operations. Having these documents ready will streamline the application process.

-

Contact Lenders: Reach out to various lenders, including Finance Story, to discuss your financing options. With our expertise, we can assist you in navigating the complexities of obtaining customized financing for commercial property investments. It is advisable to secure pre-approval, as this will provide a clearer picture of how much you can borrow and the terms you can expect.

-

Submit Your Application: Complete the application process with your chosen lender. Ensure that you provide all required information accurately to avoid processing delays.

-

Review Financing Terms: Before signing any agreements, carefully examine the financing terms and conditions. Pay close attention to interest rates, repayment schedules, and any fees involved to ensure they align with your financial goals.

-

Close the Financing: Once your application is approved, finalize the agreement. After concluding, you will obtain the funds, which you can subsequently invest in your business.

In 2025, the approval rates for property-backed loans in Australia are displaying encouraging trends, indicating an increasing confidence in the market. Financial experts highlight that comprehending the intricacies of the financing application process can greatly enhance your prospects of securing advantageous terms. With an average of 10,000 new first-time home purchasers entering the market each month, borrowing an average of $543,000, the demand for home financing is on the rise, creating a favorable moment for entrepreneurs to leverage their home value for business funding.

Successful case studies emphasize that borrowers with a minimum of 20% ownership are better positioned to refinance and secure financing without incurring additional costs such as lenders mortgage insurance. This trend underscores the importance of fairness in refinancing choices, particularly as rental trends are expected to remain muted in 2025, according to Tim Lawless, CoreLogic Research Director. By adhering to these procedures and preparing thoroughly, you can effectively manage the intricacies of securing a business loan using home equity.

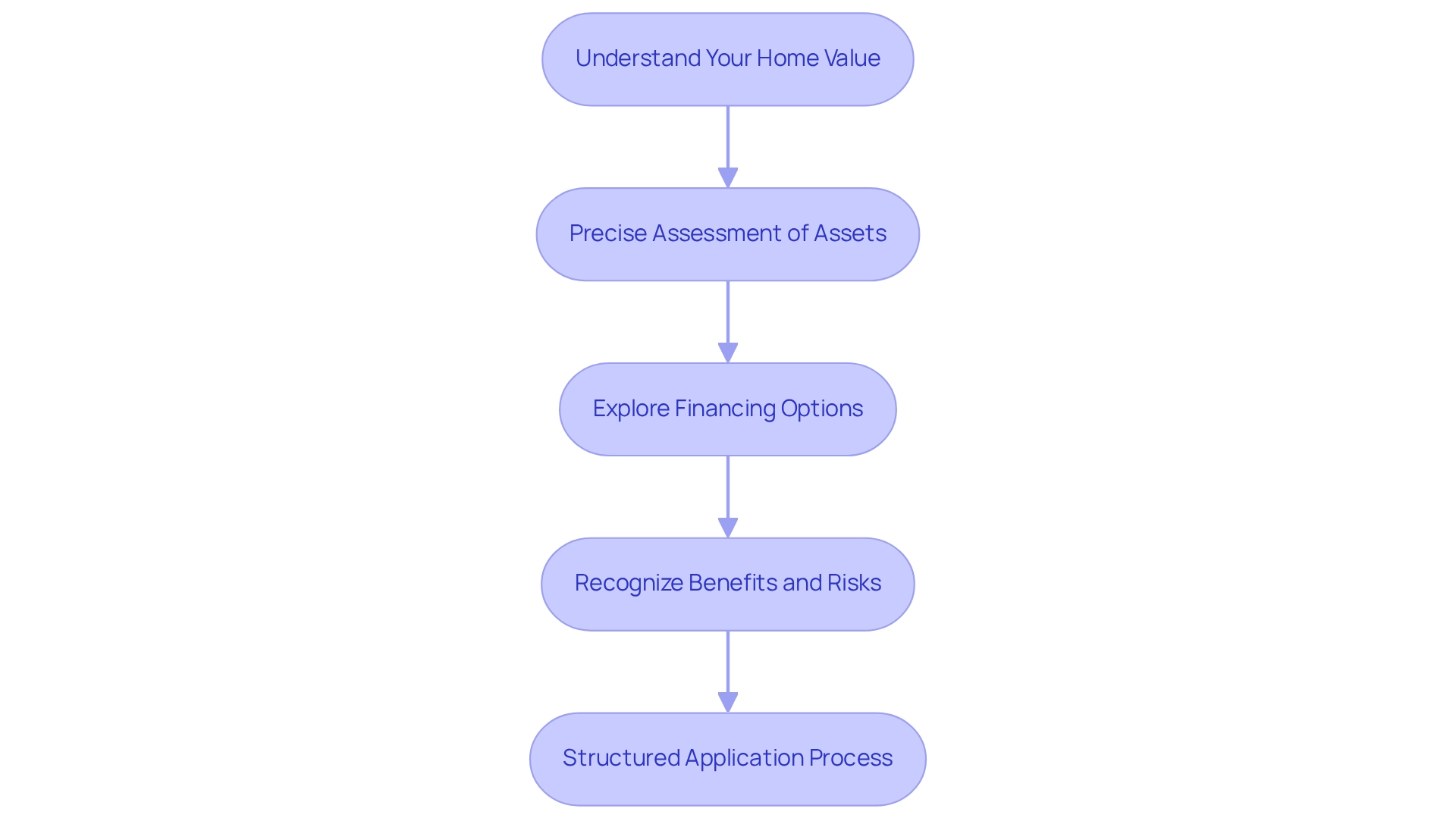

Key Takeaways: Making Informed Financial Decisions

Utilizing residential assets for a business loan through home equity offers significant advantages for entrepreneurs. Here are the key takeaways to consider:

-

Understand Your Home Value: Begin by assessing your home value, which is the difference between your property's market worth and the outstanding mortgage balance. This comprehension is essential as it determines how much you can potentially borrow.

-

Precise Assessment of Assets: Accurately calculate your assets to ascertain your borrowing capacity. For instance, if you possess a property worth $1.3M with a $300k mortgage, you could potentially access $740k in value, crucial for funding a company acquisition. New entrepreneurs typically face approximately $5,000 more in housing obligations compared to others, underscoring the importance of accurate assessments in understanding your financial position and the potential impact on your funding options.

-

Explore Financing Options: Investigate various avenues for leveraging property equity, such as equity financing and lines of credit. These options, including a business loan using home equity, can provide the necessary capital to fuel company growth. In a landscape where housing price growth positively correlates with entrepreneurship, understanding the value-to-equity ratio (LVR) is vital; lenders generally permit a maximum LVR of 80% when borrowing against residential properties for commercial acquisitions.

-

Recognize Benefits and Risks: Be aware of the advantages, such as reduced interest rates compared to unsecured credits, and the risks involved, including the possibility of losing your home if you fail to repay. Indebted small enterprises are particularly vulnerable to rising interest rates, which can strain cash flow and heighten financial pressure. As highlighted in the case analysis on small enterprises and interest rate exposure, many credits backed by residential mortgages are subject to variable rates, making it crucial for entrepreneurs to recognize their financial vulnerabilities.

-

Structured Application Process: Follow a structured application process to secure the financing you need. This involves gathering required documentation, understanding loan terms, and developing a solid plan to present to lenders. Finance Story, known for its tailored mortgage services, can assist you in navigating these complexities and obtaining the best financing options available.

By making informed financial choices, entrepreneurs can effectively leverage their property value through a business loan using home equity to support their entrepreneurial goals. Numerous successful instances exist, with many business owners utilizing their property value to enhance operations and achieve significant growth. As Frances Rickard-Bell, a Business Development Manager, notes, the opportunity cost of not fully utilizing available funding can hinder organizational potential.

Thus, understanding loan terms and making strategic decisions is essential for maximizing the benefits of a business loan using home equity in business financing.

Conclusion

Leveraging home equity for business financing offers a significant opportunity for entrepreneurs aiming to expand operations and secure necessary capital. By grasping the fundamentals of home equity—how to calculate it and the various financing options available—business owners can effectively access this valuable resource. The benefits, including lower interest rates, larger borrowing amounts, and flexible fund usage, render home equity loans an appealing choice for those in need of financial support.

However, it is essential to remain vigilant regarding the associated risks, such as the potential for foreclosure and increased debt levels. Careful financial planning and a thorough assessment of market conditions are critical to mitigating these risks. Entrepreneurs must diligently navigate the complexities of the loan application process, ensuring that all documentation is prepared and loan terms are clearly understood.

In conclusion, strategically utilizing home equity can serve as a powerful tool for business growth. Yet, it necessitates informed decision-making and a solid understanding of both the advantages and potential pitfalls. By leveraging expert insights and resources, such as those provided by Finance Story, entrepreneurs can effectively position themselves to maximize their home equity, paving the way for sustainable business success.