Overview

Securing a business purchase loan requires a thorough understanding of various financing options, including both secured and unsecured loans. It is crucial to prepare essential documentation to support your application. A robust business plan, accurate financial records, and expert guidance can significantly enhance your chances of loan approval. These elements provide lenders with a clear picture of your business's viability and repayment capability, ultimately positioning you for success in obtaining the necessary financing.

Introduction

In the dynamic world of entrepreneurship, securing the right financing is crucial for growth and success. Business purchase loans, specifically designed to facilitate the acquisition of existing businesses or franchises, have gained traction among entrepreneurs seeking to expand their operations.

As the landscape evolves in 2025, understanding the various types of loans available—ranging from traditional bank loans to government-backed options—becomes essential for making informed decisions.

This article delves into the intricacies of business purchase loans, highlighting:

- The importance of tailored financial solutions

- The documentation required for successful applications

- The critical distinctions between secured and unsecured loans

By navigating these complexities, business owners can position themselves for a prosperous future while leveraging the right financing strategies to fuel their ambitions.

Understanding Business Purchase Loans: An Overview

Commercial acquisition financing options represent specialized financial products designed to facilitate business purchase loans for acquiring existing enterprises or franchises. These financial agreements encompass a variety of expenses tied to the purchase, including operational assets, inventory, and goodwill. As we look ahead to 2025, the landscape of commercial purchase credit is characterized by diverse choices, each tailored to meet the distinct needs of entrepreneurs. This emphasizes the importance of expertise in personalized credit proposals and funding solutions for commercial property investments and refinances.

Understanding the distinctions between secured and unsecured credit is crucial for making informed financial decisions. Secured borrowing typically requires collateral, which can significantly reduce interest rates, making it an appealing choice for many entrepreneurs. On the other hand, unsecured credit options allow for quicker access to funds, although they often come with higher interest rates due to the increased risk for lenders.

Recent statistics reveal a growing trend in the utilization of purchase financing. In the final quarter of 2024, financial commitments across various categories, including personal investments and commercial acquisitions, saw a notable increase of 3.9%. This rise indicates a heightened confidence among small and medium enterprises (SMEs) in leveraging financing to support growth. It is essential to highlight that the business purchase loan is gaining traction as entrepreneurs strive to expand their operations.

In 2025, the available categories of commercial acquisition financing include:

- Traditional bank funding

- Government-supported financing

- Alternative funding options

Each type presents unique benefits and considerations, enabling owners to select the most appropriate option based on their financial circumstances and goals. For instance, government-supported financing often features favorable terms and reduced interest rates, making it an attractive choice for both startups and established firms.

Refinancing commercial loans is also a critical aspect of funding strategies for growing enterprises. Finance Story specializes in guiding clients through the refinancing process, ensuring they can adapt their obligations to meet changing organizational needs. By partnering with a diverse array of lenders, including high street banks and entrepreneurial private lending groups, Finance Story connects clients with the right funding solutions tailored to their specific situations.

Case studies from Finance Story illustrate the effectiveness of customized financial solutions in securing business purchase loans. By concentrating on clients' unique needs, the brokerage has successfully assisted numerous entrepreneurs in navigating the complexities of financing, particularly in securing business purchase loans, leading to successful acquisitions and business growth. For example, one client obtained government-backed financial support that enabled the purchase of a franchise, resulting in a substantial increase in revenue.

Expert opinions underscore the significance of understanding the nuances between secured and unsecured financing. As Phil Collard, a financing specialist at Money.com.au, states, "This is still being approached with caution, but SMEs are increasingly seeking to expand their operations by utilizing credit to help stimulate growth." This insight highlights current trends in commercial acquisition borrowing, demonstrating the growing willingness of SMEs to leverage capital as a means of growth.

Overall, the trends in commercial acquisition financing for 2025 showcase a dynamic funding environment, where entrepreneurs are increasingly pursuing innovative solutions to support their growth ambitions. By staying informed about the various credit options and market conditions, entrepreneurs can make strategic decisions that align with their financial capabilities and long-term objectives.

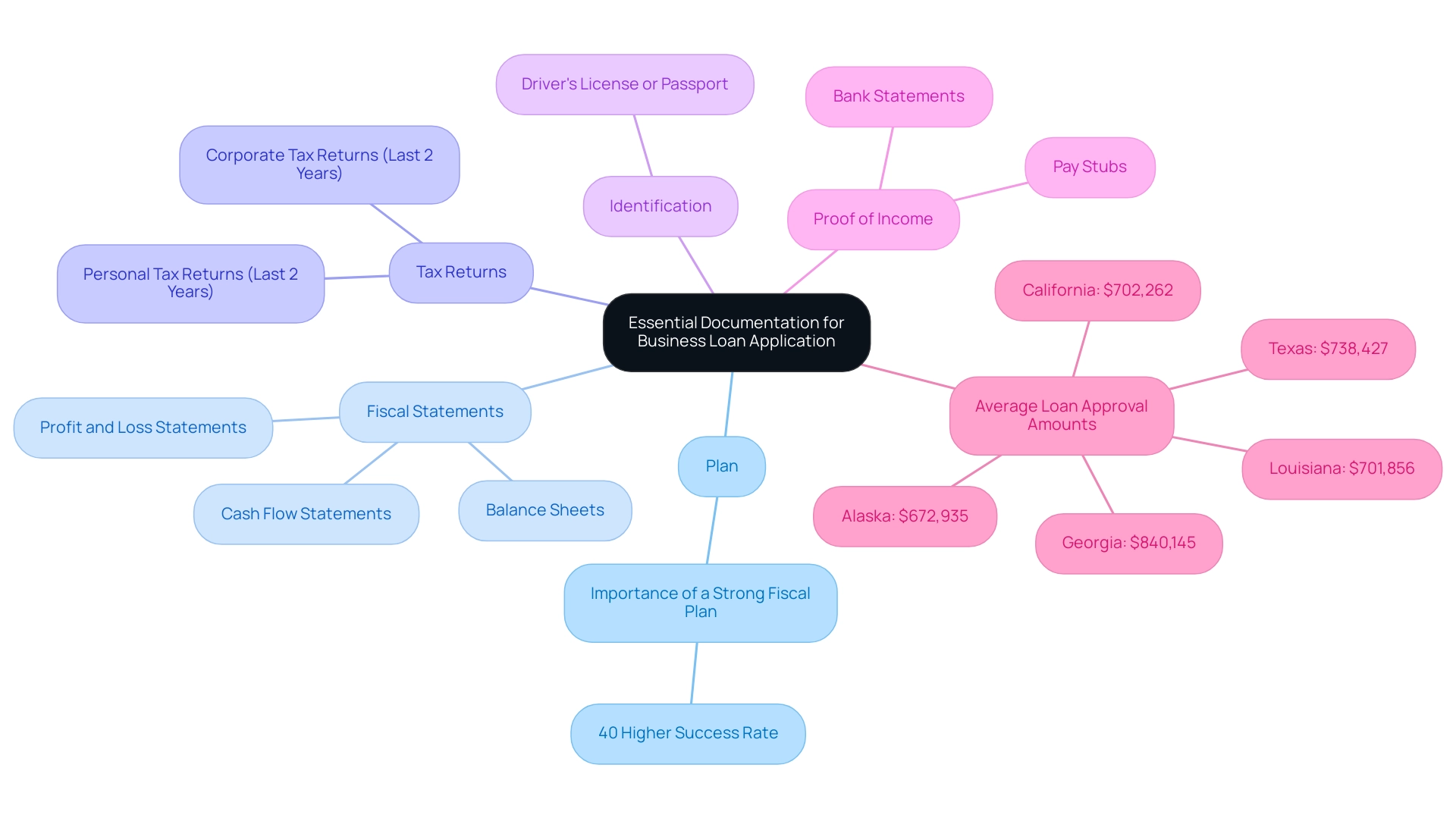

Essential Documentation for Your Business Loan Application

When applying for a business purchase loan, assembling a comprehensive set of essential documents is crucial to effectively support your application. The following documents are generally necessary:

- Plan: A well-structured plan is essential, outlining your model, market analysis, and economic projections. A Deloitte report indicates that companies with a strong fiscal plan are 40% more likely to thrive in the long term, underscoring the significance of this document in securing funding.

- Fiscal Statements: Recent profit and loss statements, balance sheets, and cash flow statements are vital to illustrate the economic health of your enterprise. These documents provide lenders with insight into your operational performance and profitability.

- Tax Returns: Personal and corporate tax returns for the last two years are essential to present a clear picture of your income and expenses. This information aids lenders in evaluating your financial stability and repayment ability.

- Identification: Personal identification documents, such as a driver's license or passport, are required to verify your identity and ensure compliance with lending regulations.

- Proof of Income: Documentation demonstrating your income, which may include pay stubs or bank statements, is crucial for lenders to assess your financial situation.

Additionally, our expertise in creating polished and tailored business cases can significantly enhance your application, positioning you favorably with lenders. Understanding the average funding approval amounts can provide valuable context for your financing needs. For instance, recent data shows that Georgia boasts the highest 5-year average approval amount at $840,145, followed by Texas at $738,427, California at $702,262, Louisiana at $701,856, and Alaska at $672,935.

Having these documents prepared not only streamlines the application process for a business purchase loan but also strengthens your case with potential financiers. Recent data highlights that businesses that approach the financing process with confidence and a clear understanding of the required documentation are more likely to make informed decisions regarding amounts, interest rates, and deposit requirements, setting them on a path to growth. As noted in the case study 'Empowering Your Business's Financial Journey,' comprehending the financing landscape is essential for success.

Furthermore, investigating customized funding options, including a business purchase loan, can greatly improve your capacity to obtain the suitable resources for your situation, whether you're refinancing or acquiring a new property. It’s important to recognize that various funding options, such as unsecured credit and merchant cash advances, require specific documentation. By ensuring that all necessary documentation is in order, you position your enterprise favorably in the competitive landscape of funding alternatives.

As Goldman Sachs mentions, 70% of small enterprise financing is offered by banks with under $250 billion in assets, emphasizing the importance of being well-prepared when approaching creditors. Additionally, we offer a full range of lenders to meet diverse financing needs, whether you are looking to purchase a warehouse, retail premise, factory, or hospitality venture.

Exploring Types of Business Loans: Secured vs. Unsecured

When assessing a business purchase loan option, understanding the distinctions between secured and unsecured types is crucial for making an informed decision, particularly in 2025.

- Secured Financing: These financial products are backed by collateral, such as real estate or equipment, which the lender can seize if the borrower defaults. This security enables lenders to offer lower interest rates and higher borrowing limits, making secured financing an appealing choice for many entrepreneurs. In today’s market, small business owners are increasingly favoring secured financing options like a business purchase loan, recognizing their financial advantages in terms of cost-effectiveness and stability. Recent statistics reveal that in the December quarter of 2024, there were 46,166 internal owner occupier credits and 61,749 external owner occupier credits refinanced in Australia, indicating a robust lending environment that favors secured financing options. Finance Story specializes in crafting polished and highly individualized business cases that showcase the strengths of secured financing, assisting clients in presenting compelling proposals to a diverse range of lenders.

- Unsecured Financing: Conversely, unsecured financing does not require collateral, making it more accessible and quicker to obtain. However, this convenience comes at a price; unsecured credit typically carries higher interest rates and lower borrowing limits due to the increased risk for lenders. Recent statistics indicate that the average interest rate for unsecured corporate financing can be significantly higher than that of secured credit, underscoring the lender’s need to mitigate risk. Finance Story provides expert guidance in navigating the complexities of unsecured financing, ensuring clients understand the implications of their choices.

The decision between secured and unsecured credit options hinges on several factors, including your business’s financial condition, the availability of assets for collateral, and your overall risk tolerance. For instance, a Melbourne cafe that secured a $50,000 unsecured loan at a 20% interest rate to fund expansion encountered difficulties when projected revenue did not materialize, ultimately leading to its closure within two years. This example highlights the potential pitfalls of unsecured lending and the importance of responsible financial planning.

As Labor Senator Katy Gallagher stated, "We need to move beyond short-term fixes and establish frameworks that protect small enterprises from exploitative lending."

In 2025, market analysis indicates a clear preference among small businesses for secured financing options like a business purchase loan, driven by the desire for lower interest rates and the ability to secure larger sums of funding. As the landscape evolves, understanding the current trends in secured financing will be essential for making strategic financial decisions. By weighing the benefits of secured borrowing against the risks associated with unsecured alternatives, entrepreneurs can more effectively manage their funding choices and align them with their long-term goals.

With Finance Story's expertise in refinancing and securing tailored financial solutions, clients can confidently address their financing needs.

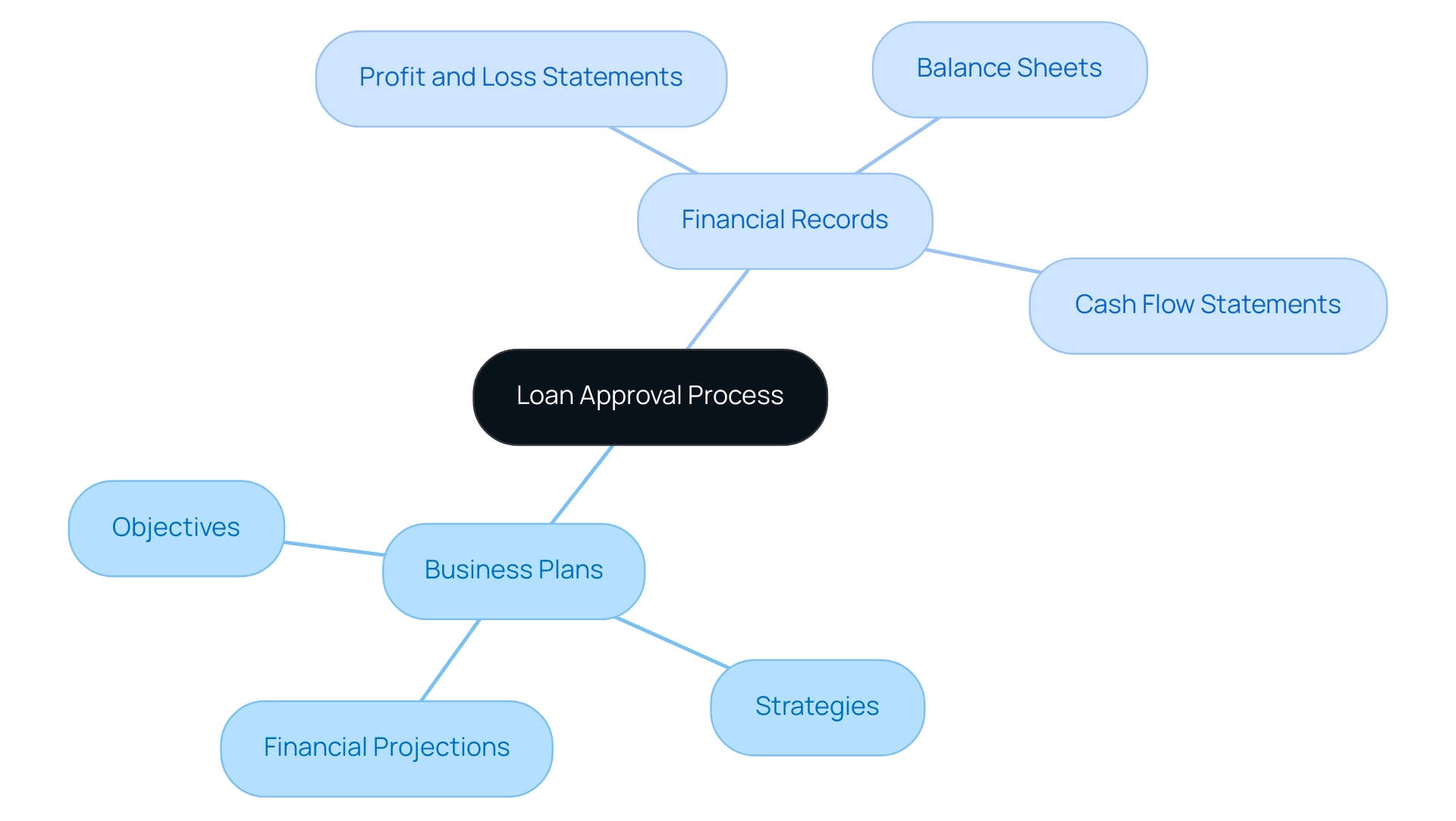

The Role of Business Plans and Financial Records in Loan Approval

A robust plan is essential for securing a purchase loan, serving as a roadmap that outlines your objectives, strategies for achieving them, and detailed financial projections. Collaborating with Finance Story empowers you to craft solid cases tailored to your specific lending needs. Our experienced team understands the intricacies of your organization and values the long-term relationships we build with our clients. Lenders rely heavily on this information to evaluate the viability of your enterprise and assess the likelihood of repayment.

In fact, studies show that entrepreneurs who finalize their project plans are twice as likely to succeed in obtaining funding. Val Srinivas, a senior research leader in banking and capital markets, emphasizes that 'a well-structured plan not only aids in securing financing but also serves as a strategic tool for guiding your organization's growth and sustainability.'

Equally important is the maintenance of precise monetary records, which play a pivotal role in the loan approval process. Key documents include:

- Profit and Loss Statements: These illustrate your revenue and expenses over time, providing insight into your business's operational efficiency.

- Balance Sheets: Providing an overview of your company's assets, liabilities, and equity, balance sheets assist lenders in assessing your stability.

- Cash Flow Statements: Detailing the inflow and outflow of cash, these statements enable lenders to understand your enterprise's liquidity and ability to meet monetary obligations.

When merged, these documents form a thorough overview of your company's economic status, greatly improving your likelihood of loan approval. Furthermore, the significance of a strong plan cannot be overstated; it not only aids in securing a business purchase loan but also acts as a strategic tool for guiding your enterprise's growth and sustainability in a competitive market. Tackling challenges like employee recruitment and inflation through careful record-keeping can assist your enterprise in navigating the intricacies of the present economic climate.

For example, one of our clients effectively utilized their strategy and financial documents to obtain a $500,000 funding, allowing them to grow their operations and employ more personnel. Additionally, for leasehold enterprises, leveraging property equity and cash savings can provide viable financing options, ensuring you are well-prepared for acquisition.

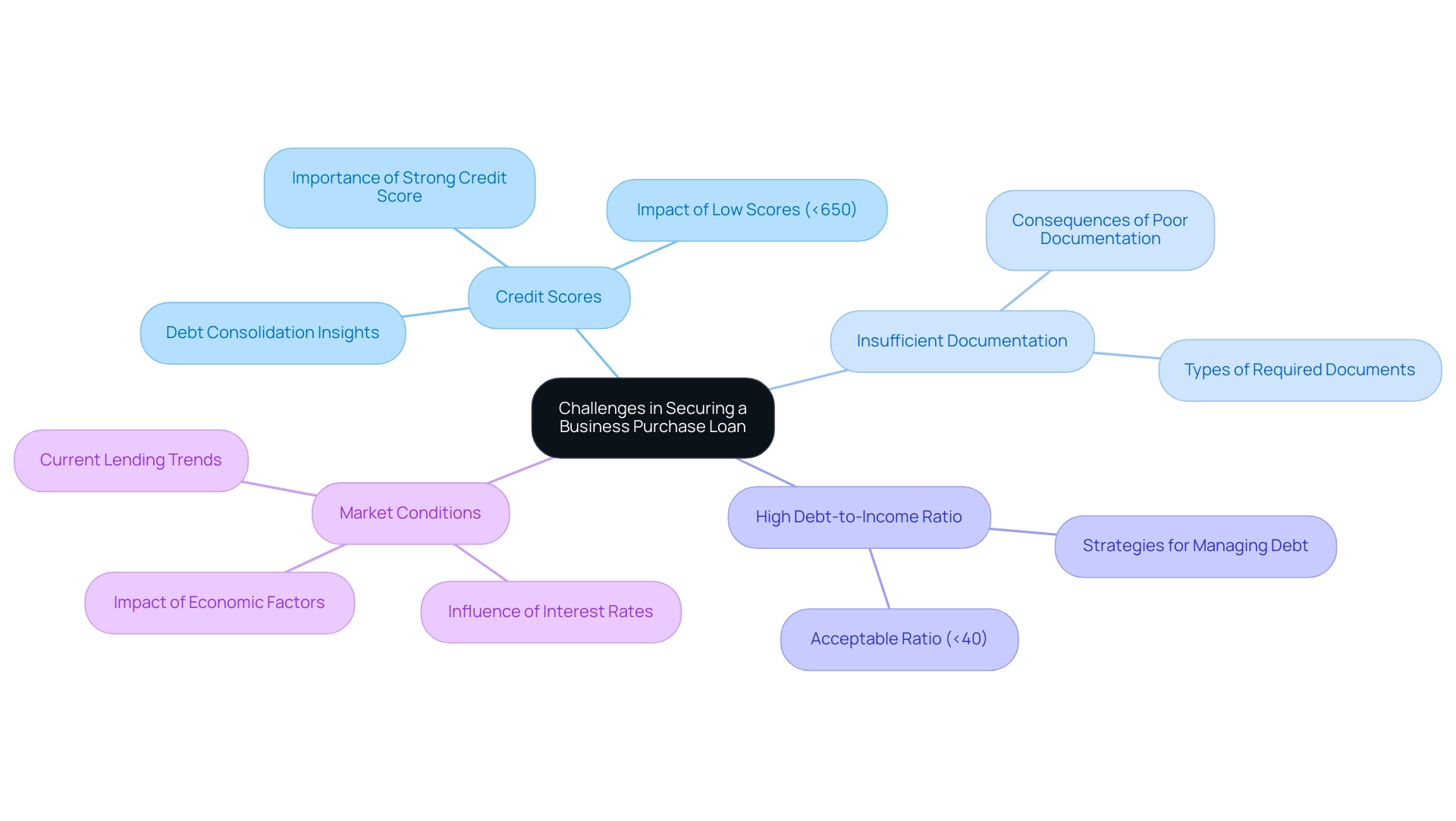

Navigating Challenges in Securing a Business Purchase Loan

Obtaining a business purchase loan can pose various obstacles that prospective borrowers must manage efficiently. Key issues include:

- Credit Scores: A strong credit score is often a prerequisite for loan approval. In 2025, lenders are increasingly stringent about credit requirements, making it essential for entrepreneurs to assess and improve their scores prior to applying. For instance, a significant number of applicants with scores below 650 may face difficulties in securing favorable terms. According to industry insights, the highest average financial value is often associated with debt consolidation among online business financing, highlighting the importance of maintaining a healthy credit profile.

- Insufficient Documentation: The completeness and organization of your documentation play a crucial role in the approval process. Inadequate or poorly structured paperwork can lead to delays or outright denials. It is vital to ensure that all necessary documents, such as financial statements and tax returns, are meticulously prepared and accurate.

- High Debt-to-Income Ratio: Lenders assess your ability to repay the amount by analyzing your income compared to existing debt. A high debt-to-income ratio can significantly hinder your chances of approval. As of 2025, many lenders prefer a ratio below 40%, so it’s advisable to manage your debts proactively.

- Market Conditions: Economic factors, including interest rates and lending trends, can greatly influence lending criteria. Staying informed about current market conditions is essential, as fluctuations can affect the success of your application. Notably, 31% of small enterprise owners identify driving sales as their top marketing goal, which can impact their financial strategies and loan applications.

Addressing these challenges proactively can significantly enhance your chances of securing the necessary financing for your enterprise acquisition through a business purchase loan. For example, during the COVID-19 pandemic, many small to medium-sized enterprises (SMEs) faced severe revenue losses, with estimates suggesting that up to 80% of SMEs lost up to 50% of their revenues. This disruption highlighted the vulnerabilities of small enterprises and the need for resilience and adaptability in the face of unforeseen challenges, prompting many to rethink their operational strategies.

As Vikram Bhat, Vice Chair and US Services Industry Leader at Deloitte, notes, "With more than 25 years of experience in the services sector, understanding these dynamics is crucial for navigating the lending landscape."

By understanding these common challenges and taking strategic steps to mitigate them, you can improve your prospects for obtaining a business purchase loan that aligns with your financial goals. At Finance Story, we specialize in creating polished and highly individualized cases to present to banks, ensuring you have access to a full suite of lenders, including high street banks and innovative private lending panels. We can help with funding options for a variety of commercial properties, such as warehouses, retail premises, factories, and hospitality ventures.

Additionally, we offer refinancing solutions customized to your changing organizational needs. Schedule your free personalized consultation with our Head of Funding Solutions, Shane Duffy, today to discuss your needs and goals, and let us help you secure the financing you need.

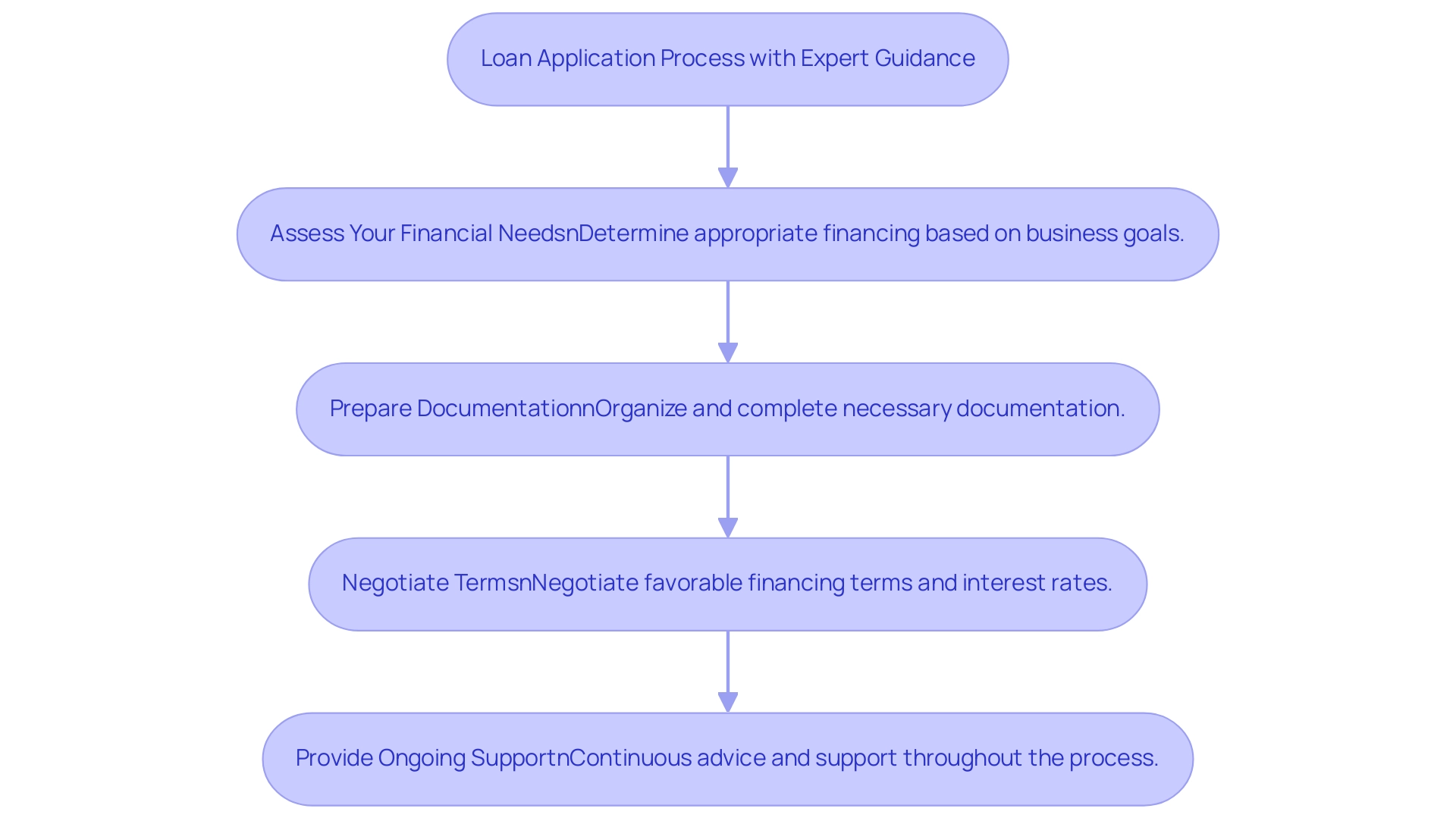

The Value of Expert Guidance in Your Loan Journey

Navigating the complexities of obtaining a business purchase loan can be daunting, making expert guidance essential for success. At Finance Story, we take pride in our dedication to understanding your unique needs and offering comprehensive lending solutions through ongoing relationships. Our finance consultants can significantly enhance your loan application process by offering the following key services:

- Assess Your Financial Needs: Our consultants help determine the appropriate amount of financing based on your specific business goals and financial situation, ensuring you are not under or over-leveraged.

- Prepare Documentation: We assist in organizing and completing all necessary documentation, minimizing the risk of delays that can arise from incomplete submissions.

- Negotiate Terms: With extensive industry knowledge and access to a full range of lenders—including mainstream banks, boutique lenders, and private investors—our consultants can negotiate more favorable financing terms and interest rates, potentially saving you thousands over the duration of the agreement.

- Provide Ongoing Support: From application to approval and beyond, we offer continuous advice and support, helping you navigate any challenges that may arise during the process.

A key aspect of our service is creating polished and highly individualized cases tailored to your specific business purchase loan needs. This method greatly improves your odds of obtaining the appropriate funding for your next commercial investment property, whether it be a warehouse, retail site, factory, hospitality venture, or office space.

The significance of expert guidance in obtaining loans is emphasized by recent findings, which indicate that companies in 2025 will increasingly demand instant transfers to enhance cash flow across the credit-to-cash cycle. This shift emphasizes the necessity for companies to establish a robust monetary strategy, which our consultants can assist in creating. As Viren Patel, a Services Industry Strategist, notes, "Businesses in the services sector need to tackle siloed data if they are to drive performance in 2025," emphasizing the critical role of comprehensive planning.

Furthermore, case studies show that lenders assess various elements when determining approval, including credit scores, revenue, statements, and industry risk levels. By enhancing these factors with the assistance of a finance advisor, owners can significantly boost their chances of obtaining a business purchase loan under favorable conditions. Indeed, companies that involve monetary advisors frequently experience greater success rates in their funding requests, illustrating the concrete advantages of professional counsel in the financing procedure.

In summary, collaborating with a finance consultant not only simplifies the loan application process but also positions your business for long-term economic success. Finance Story, with its professionalism and deep understanding of the finance sector, is well-equipped to assist you in achieving your financial goals efficiently.

Conclusion

Understanding and navigating the landscape of business purchase loans is vital for entrepreneurs aiming to expand their operations in 2025. This article highlights the importance of tailored financial solutions, emphasizing the need for a comprehensive understanding of the various types of loans available, including secured and unsecured options. Secured loans often provide lower interest rates and higher borrowing limits, while unsecured loans offer quicker access to funds at a higher cost.

Furthermore, the significance of meticulous documentation cannot be overstated. A well-prepared business plan, alongside accurate financial statements and tax returns, plays a crucial role in enhancing loan approval chances. Entrepreneurs must also be aware of potential challenges, such as credit score requirements and market conditions, which can significantly impact their financing journey.

Expert guidance is essential in this complex process. Engaging with knowledgeable finance consultants can streamline the application process, ensure that all documentation is in order, and help negotiate favorable loan terms. By leveraging such expertise, business owners can position themselves strategically to secure the financing necessary for growth and success.

In conclusion, as the entrepreneurial landscape continues to evolve, being informed and prepared is key. Understanding the intricacies of business purchase loans, maintaining robust financial records, and seeking expert advice will empower entrepreneurs to make informed decisions. This proactive approach not only facilitates successful acquisitions but also lays the foundation for long-term business prosperity.