Overview

The article titled "Top 10 Best Business Loans Australia for 2025" serves to identify and analyze the most effective business loan options available in Australia for the upcoming year. It underscores the critical importance of understanding various loan types and their eligibility criteria. Furthermore, it outlines strategies for securing financing, emphasizing that businesses must adeptly navigate a growing lending landscape and evolving economic conditions. This navigation is essential for successfully obtaining the funding necessary for growth and operational needs.

Introduction

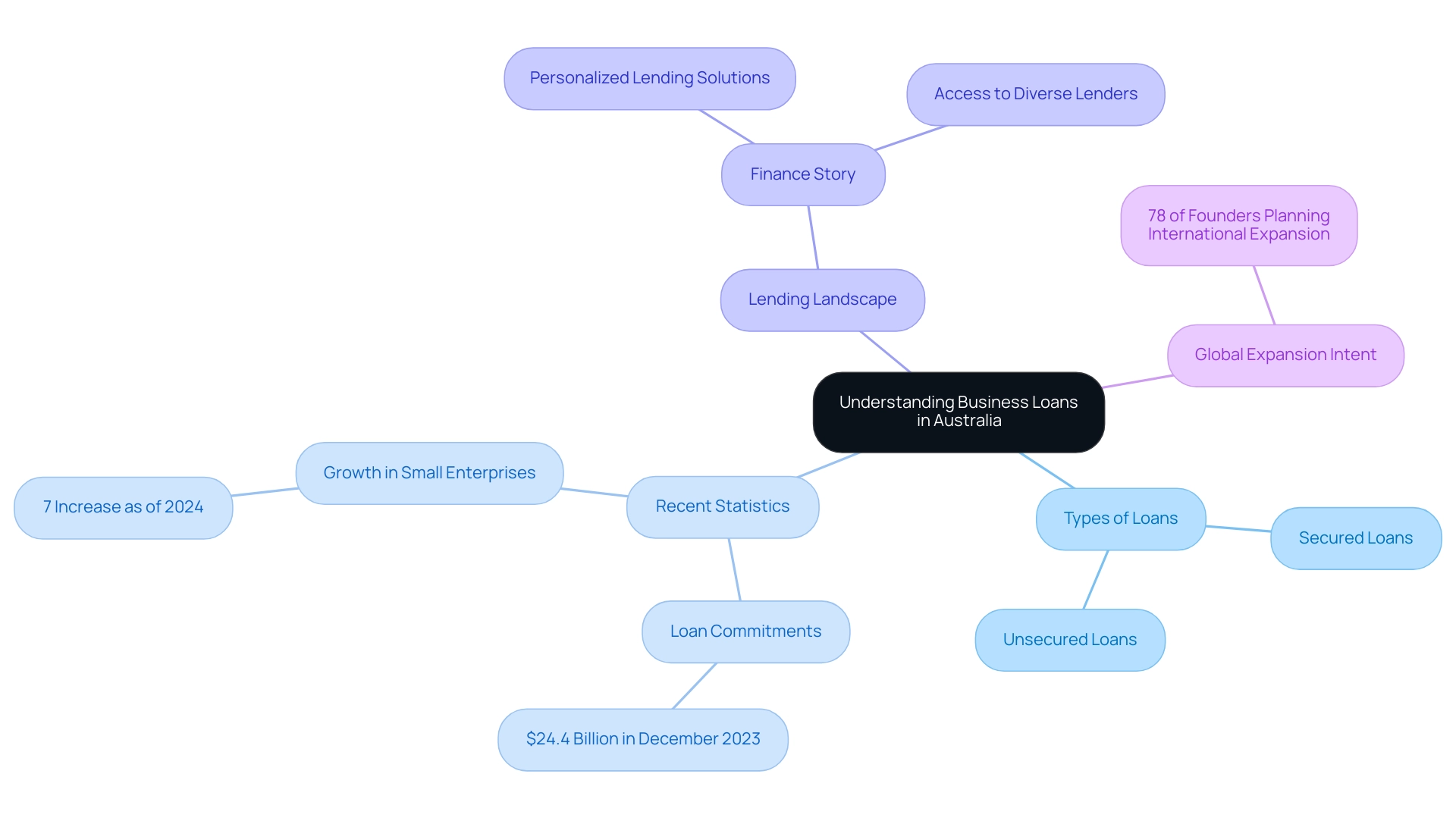

In the ever-evolving landscape of Australian business financing, understanding the intricacies of loans is paramount for entrepreneurs aiming to thrive. As we look toward 2025, business loans have emerged as essential tools, providing the necessary capital for everything from expansion to managing cash flow. With a diverse range of options—including secured and unsecured loans—business owners must navigate the lending landscape carefully to secure the best financing solutions for their unique needs. Recent statistics highlight a robust demand for such financial support, reflecting a vibrant entrepreneurial ecosystem that encourages innovation and growth. This article delves into the various types of business loans available, eligibility criteria, factors influencing loan approval, and valuable insights to empower small business owners on their journey to securing the funding they need for success.

1. Name: Understanding Business Loans in Australia

In 2025, the best business loans in Australia will serve as essential financial instruments designed to empower enterprises with the necessary funds for various operational needs, including growth, equipment acquisition, and cash flow management. These financial agreements can be categorized as either secured or unsecured, each tailored with distinct terms and conditions to suit specific organizational circumstances. Recent statistics reveal that new loan commitments for property purchases reached an impressive $24.4 billion in December 2023, underscoring the robust demand for financial support among Australian businesses.

The lending landscape is evolving, with a growing number of financial institutions in Australia offering the best business loans to address the diverse requirements of enterprises across multiple sectors.

At Finance Story, a Melbourne-based boutique mortgage brokerage, we recognize the unique challenges and opportunities facing small enterprises. Our dedication to personalized commercial and residential lending solutions is reflected in our expertise and relationship-driven support. With access to a comprehensive panel of lenders, including mainstream banks, private lenders, and angel investors, we ensure that our clients receive customized financing options designed for growth.

As one of our clients, Jane Conte from Victoria, stated, "Finance Story truly understands our needs and has been instrumental in helping us navigate the complexities of financing."

Moreover, the small enterprise sector has experienced a notable 7% increase as of 2024, particularly concentrated in New South Wales, Victoria, and Queensland. This growth is driven by a vibrant entrepreneurial ecosystem, as highlighted by an anonymous surveyed founder who remarked,

What excites me most about being an Australian startup is the vibrant and supportive entrepreneurial ecosystem that fosters innovation and growth.

Such an environment encourages businesses to explore various funding options and strategies for success.

Understanding the range of financing types available, including the best business loans for flexible, revolving options secured by property and long-term lending solutions for import-export financing, is crucial for making informed financial decisions. As the trend towards global expansion continues—78% of founders expressing intent to expand internationally within the next 12 months—businesses must adeptly navigate these financial resources to access broader markets and attract overseas investment. Finance Story, recognized as a reliable partner for customized financing solutions, plays a pivotal role in assisting enterprises in securing the right funding.

By offering a comprehensive selection of tailored funding options, we ensure that small enterprises can leverage financial assistance to achieve their growth objectives.

2. Name: Exploring Different Types of Business Loans

In Australia, business loans are primarily categorized into several key types, each designed to meet specific financial needs:

- Secured Loans: These loans require collateral, such as property or equipment, which minimizes the lender's risk and often results in lower interest rates for borrowers. Finance Story can assist you in crafting a persuasive case to secure these funds, ideal for enterprises aiming to make substantial investments without the burden of increased expenses.

- Unsecured Loans: Unlike secured loans, these do not require collateral, making them accessible to a broader range of enterprises. However, they typically come with higher interest rates, reflecting the increased risk for lenders. This option is suitable for enterprises needing quick cash without tying up assets. At Finance Story, we can guide you through the application process to ensure you obtain the necessary funds promptly. As noted by Godrej Capital, "the introduction of unsecured financial products specifically for MSMEs showcases the changing environment of funding alternatives accessible in Australia."

- Line of Credit: A flexible financing option, a line of credit provides access to funds up to a predetermined limit. This type of loan is particularly beneficial for managing cash flow, allowing businesses to draw funds as needed, which can be critical for day-to-day operations. Finance Story can help you establish a line of credit that aligns with your operational needs.

- Equipment Financing: Specifically tailored for purchasing essential equipment, this financing option uses the equipment itself as collateral. This can lower the overall cost of borrowing, as financial institutions feel more secure knowing the equipment can be seized if payments are not met. Finance Story can assist you in presenting a strong case to lenders for equipment financing.

- Short-term Financing: Created for rapid access to capital, these options typically have shorter repayment periods, making them an appropriate selection for enterprises encountering urgent monetary requirements or unforeseen costs. Our team at Finance Story can guide you through the available short-term financing options.

Additionally, refinancing options are crucial for companies looking to adapt their financial strategies as they grow. For instance, if your company has improved its creditworthiness or if interest rates have dropped, refinancing your existing loans could lead to lower monthly payments or better terms. At Finance Story, we focus on helping small enterprise owners recognize when refinancing is advantageous and assist in developing customized proposals to present to creditors.

Understanding these options is vital for companies, as it allows them to align their financing strategies with operational requirements and growth ambitions. As a reference, an enterprise is classified as medium if the creditor has total exposure to the enterprise that is greater than or equal to $1 million and the enterprise has turnover of less than $50 million. Therefore, being knowledgeable about the various types of credit can empower small enterprise owners to make choices that best fit their economic circumstances.

3. Name: Eligibility Criteria for Securing Business Loans

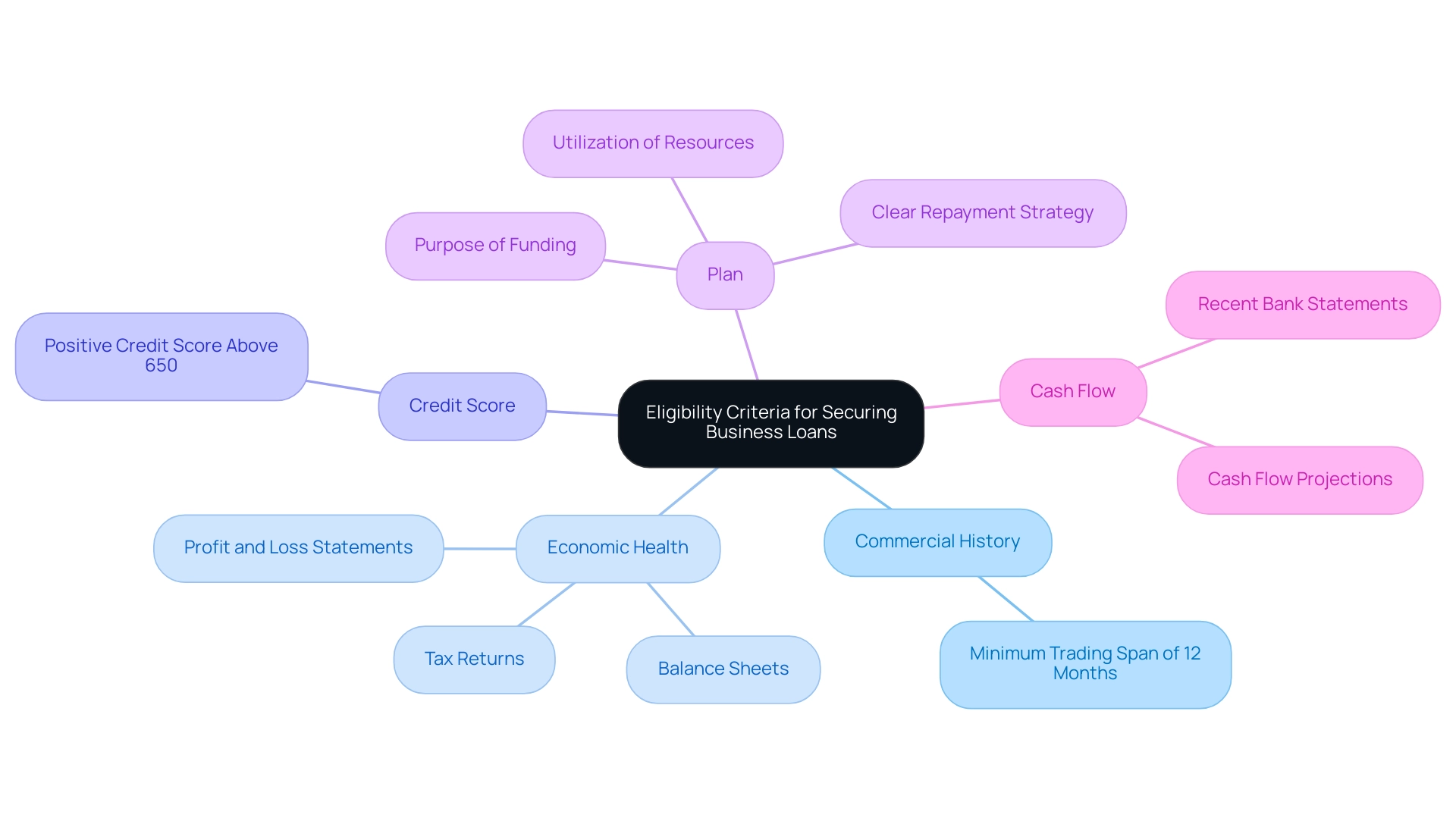

To secure the best business loans Australia offers, candidates must meet several essential eligibility standards that financial institutions evaluate to determine their suitability. These standards include:

- Commercial History: Creditors typically expect a minimum trading span of at least 12 months. This timeframe allows the enterprise to establish itself in the market adequately.

- Economic Health: Demonstrating a robust monetary track record is critical. This includes supplying profit and loss statements, balance sheets, and tax returns to showcase the company's profitability and economic stability.

- Credit Score: A positive credit score is essential, with most creditors seeking scores above 650. A solid credit history reflects the company's reliability and ability to meet financial obligations.

- Plan: A comprehensive plan is vital, detailing the purpose of the funding, how the resources will be utilized, and a clear repayment strategy. This approach helps financiers understand the operational model and the potential for success.

- Cash Flow: Evidence of adequate cash flow is crucial, as it indicates the entity's capacity to manage repayments comfortably. Lenders generally require recent bank statements and cash flow projections to assess this.

Meeting these criteria can significantly enhance the likelihood of approval for the best business loans in Australia. Notably, a substantial 45% of SMEs are currently considering financing to manage high inflation and navigate challenges such as late customer payments and rising costs. Furthermore, with the SME procurement goal set to rise to 25% for agreements up to $1 billion and 40% for those valued up to $20 million from 1 July 2024, small enterprises may discover increased opportunities for growth, positively impacting their financing requests.

Recent trends also indicate a decrease in investor financing, reflecting shifts in market dynamics that could affect eligibility standards and strategies for obtaining capital. By understanding these prerequisites and collaborating with specialists like Finance Story—who focus on developing refined case presentations and providing customized refinancing solutions—applicants can tailor their funding proposals to secure the best business loans Australia offers, meeting evolving organizational needs. Finance Story also provides access to a comprehensive range of financial institutions, including mainstream banks and innovative private financing panels. This support enables applicants to navigate the funding process more effectively and position themselves advantageously in a competitive borrowing landscape.

4. Name: Factors Affecting Business Loan Approval

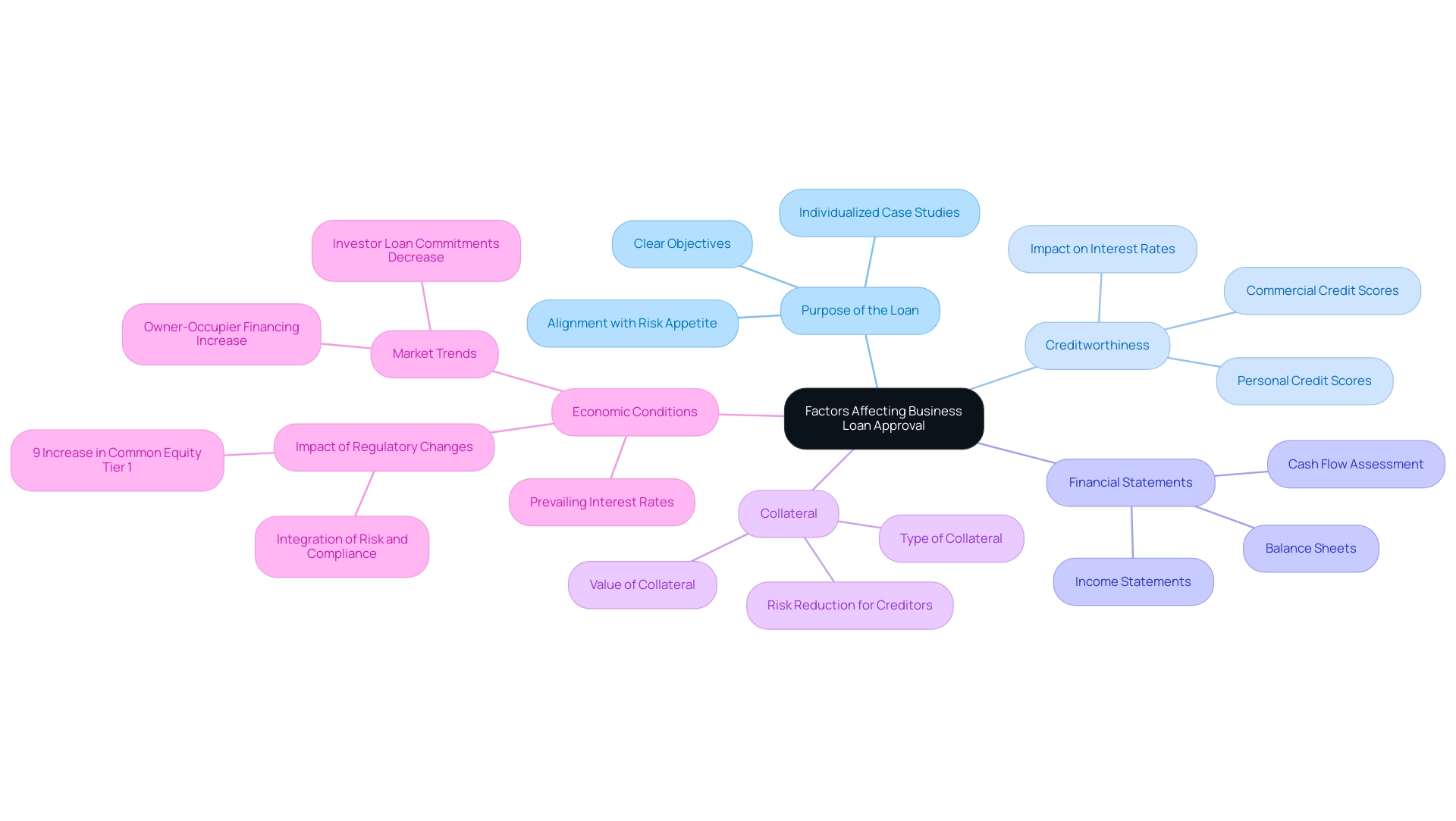

Several critical factors influence the approval of business loans in Australia as of 2025, each carrying significant weight in the decision-making process of lenders.

- Purpose of the Loan: Lenders meticulously evaluate whether the intended use of the loan aligns with their risk appetite. Projects with clear, pragmatic objectives typically receive more favorable assessments, especially when backed by polished and highly individualized case studies.

- Creditworthiness: Personal and commercial credit scores are pivotal in determining financing eligibility. A robust credit profile not only improves the likelihood of approval but can also result in more appealing interest rates, particularly when refinancing current commercial financing to address changing enterprise requirements.

- Financial Statements: Lenders scrutinize financial documents, including income statements and balance sheets, to assess a business's profitability and cash flow. Steady income and favorable cash flow frequently indicate stability, which can enhance approval prospects and enable easier access to customized financial arrangements.

- Collateral: The value and type of collateral are essential for secured financing. Assets pledged as collateral can reduce risk for creditors and play a decisive role in the approval process, particularly for small business owners seeking financing for commercial property investments.

- Economic Conditions: Broader economic factors, including market trends and prevailing interest rates, significantly impact lending decisions. For instance, the recent statistics from the December quarter of 2024 showed a mixed trend in borrowing commitments, with a notable increase in owner-occupier financing, suggesting shifting buyer behavior amidst fluctuating economic conditions. This trend emphasizes how macroeconomic factors can affect creditors' risk evaluations and credit approvals. In fact, the total number of new owner-occupier financing commitments rose by 2.2% in number and 4.2% in value, indicating a potential shift in market dynamics.

As Federal Reserve Vice Chair Michael Barr noted, there are "key broad and material changes to the original proposal" that could affect lending environments. Incorporating risk and compliance into transformation initiatives enables financial institutions to attain sustainable cost savings and manage regulatory challenges, thus affecting their approval criteria. Additionally, the proposed changes to capital requirements are estimated to result in a 9% increase in common equity tier 1 for global systemically important banks, which may further shape the lending landscape.

Grasping these dynamics can assist small enterprise owners in better preparing for their funding requests and obtaining the best business loans in Australia for their commercial ventures. Furthermore, we offer access to a complete selection of financial institutions, including high street banks and innovative private lending panels, ensuring that you can find the suitable financing option for different types of commercial properties, such as warehouses, retail premises, factories, and hospitality ventures.

5. Name: Understanding Interest Rates and Repayment Terms

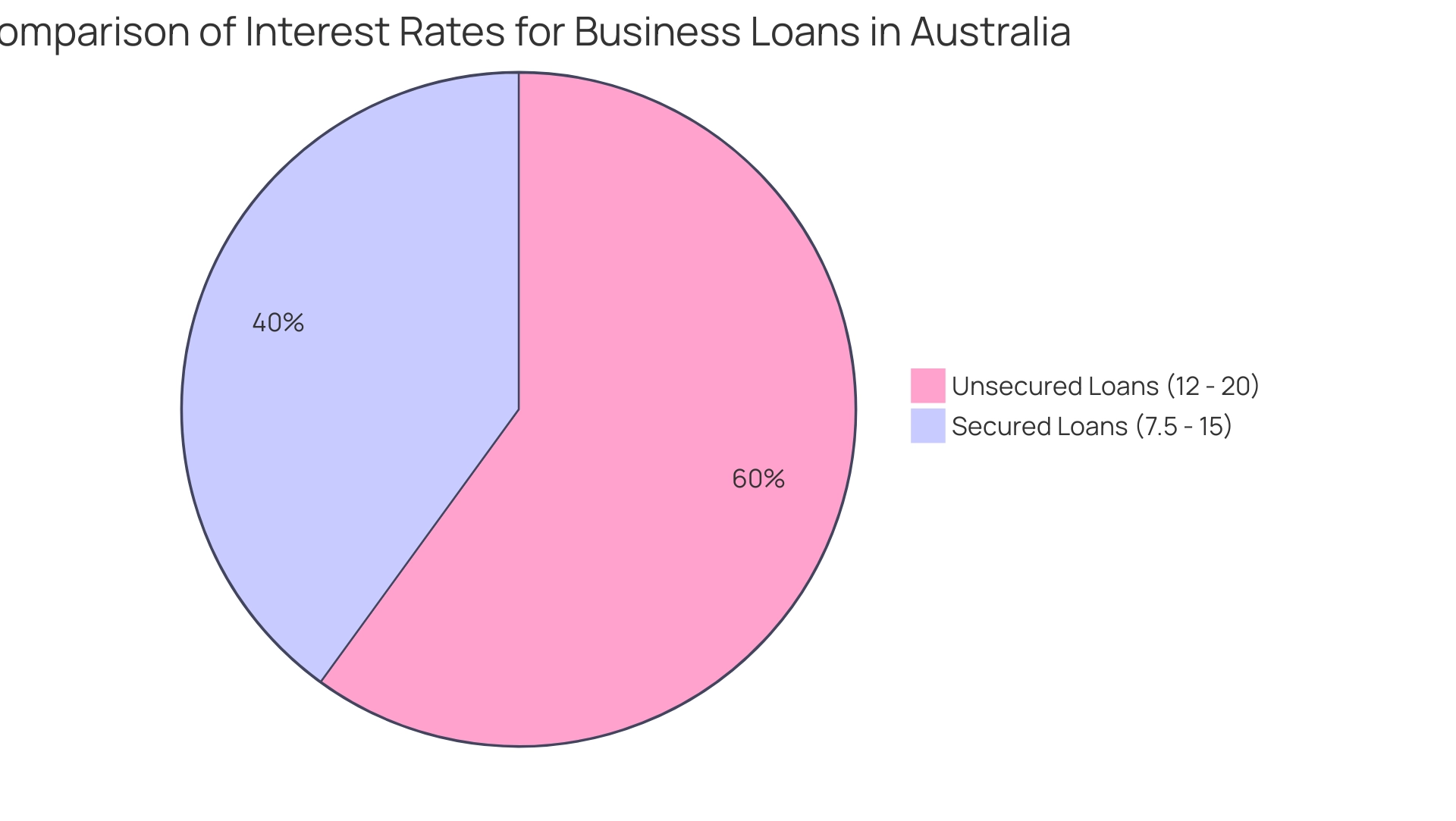

In Australia, the landscape of business loans is shaped by various factors, including financing type, lender policies, and the borrower's credit profile, leading to significant variations in interest rates for commercial financing. Secured loans typically offer lower rates, generally ranging from 7.5% to 15% per annum, while unsecured options are higher, typically falling between 12% and 20%. Moreover, the variability in repayment terms is crucial, with options available from just a few months to several years.

For small enterprise owners, grasping these rates and terms is vital for assessing financial commitments and ensuring that repayment obligations do not negatively impact cash flow. Consider this: a mere 1% increase in interest rates can result in an additional $8.33 in monthly repayments, which accumulates to approximately $300 over the life of the loan. This highlights the necessity of selecting the right financing option, particularly the best business loans in Australia, and understanding the long-term implications of interest rates on organizational decisions.

In the current environment, where the lowest advertised variable rates from banks hover between 5.64% and 6.03% per annum, it is essential for organizations to remain informed and strategically plan their borrowing to secure the best business loans in Australia and optimize financial outcomes. Finance Story specializes in crafting polished and highly individualized cases to assist in securing the right funding tailored to each entity's unique needs. Their innovative lending process provides access to a diverse portfolio of lenders, encompassing high street banks and private lending panels, ensuring that small enterprises can effectively navigate their options for various commercial properties, including warehouses, retail premises, factories, and hospitality ventures.

As Shaun McGowan, Founder of Money.com.au, emphasizes, 'He's determined to assist individuals and enterprises in paying as little as possible for monetary products, through education and developing world-class technology.' This perspective is particularly significant as companies evaluate their funding alternatives, illustrating the potential benefits of customized proposals in securing favorable credit terms.

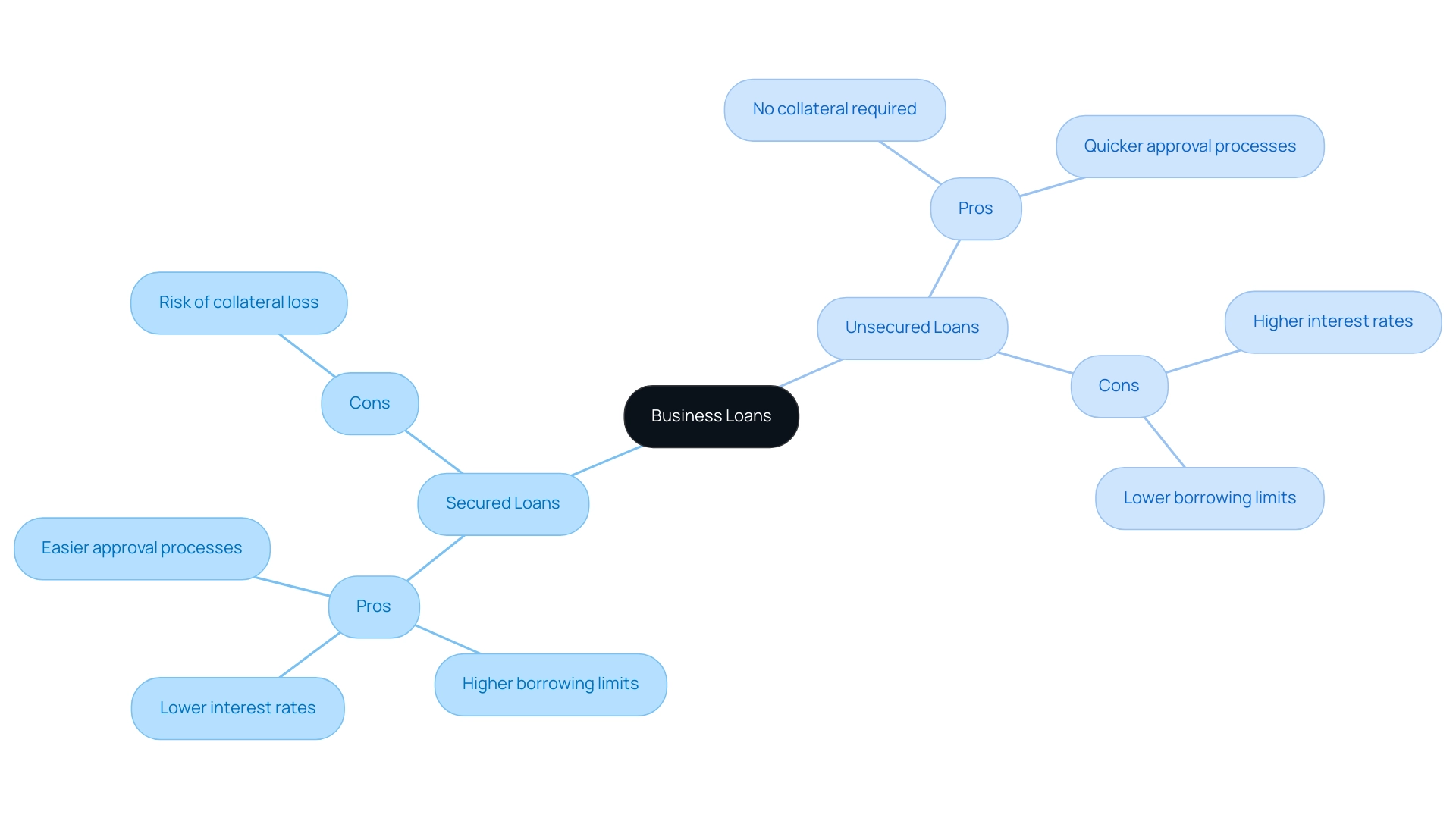

6. Name: Secured vs. Unsecured Business Loans: Pros and Cons

When assessing the best business loans Australia has to offer for 2025, understanding the distinctions between secured and unsecured options is crucial for making informed financial decisions.

Secured Loans:

- Pros: Secured loans typically present lower interest rates, higher borrowing limits, and can facilitate easier approval processes, making them a compelling choice for many businesses.

- Cons: However, there is an inherent risk; missed repayments could result in the loss of the collateral pledged against the loan.

Unsecured Loans:

- Pros: Conversely, unsecured loans eliminate the requirement for collateral, allowing for quicker approval processes and minimizing the risk to personal assets.

- Cons: The trade-off often involves higher interest rates and lower borrowing limits compared to secured options. As organizations navigate their financing needs, evaluating their financial situations and risk appetites is essential to identify the best business loans in Australia.

According to experts at Finance Story, 'Creating a polished and highly individualized case is vital for securing the right funding for your commercial investments.' This underscores the importance of aligning financing options, such as the best business loans Australia, with broader organizational objectives. Statistics reveal that approval rates for secured credit generally exceed those for unsecured credit, reflecting the diminished risk for lenders.

Furthermore, a case study on OnDeck illustrates a straightforward online application process for small enterprise loans up to $250,000, aiming to simplify the borrowing experience for entrepreneurs. This real-world example emphasizes how companies can efficiently access capital, enhancing their financial flexibility. In addition, Finance Story provides access to a comprehensive range of lenders, including high street banks and innovative private lending panels, ensuring that businesses can discover the best business loans Australia tailored to their specific needs.

Refinancing options are also available, enabling enterprises to adjust their financial agreements as their circumstances evolve. Ultimately, each company must meticulously evaluate these factors to select the most suitable financing option for their unique situation, and collaborating with Finance Story can provide the expertise needed to develop customized funding proposals and refinancing solutions.

7. Name: Alternative Financing Options for Small Businesses

In 2025, small enterprises in Australia have access to an array of alternative financing options that extend beyond traditional loans, including the best business loans Australia. This is largely due to Finance Story's extensive connections with boutique lenders, private investors, and mainstream banks. Our expertise in linking enterprises with these diverse lending sources is particularly beneficial for startups and organizations that encounter difficulties in securing conventional funding. As capital requirements evolve, with an anticipated 9% increase in common equity tier 1 for globally significant banks, the financial landscape is shifting, making these alternatives increasingly vital.

Here are some noteworthy options:

- Government Grants and Loans: The Australian government provides various programs designed to support small businesses, particularly startups. These grants offer essential capital without the burden of repayment, empowering enterprises to invest in growth and innovation.

- Crowdfunding: Platforms like Kickstarter and Indiegogo have revolutionized how organizations can raise funds. By showcasing their ideas to the public, companies can garner financial support directly from interested consumers, often leading to successful fundraising campaigns that also foster a loyal customer base. As Kate Bravery, Senior Partner at Mercer, notes, "In an era where people risk is corporate risk, getting this balance wrong can bring a company to its knees." This underscores the importance of navigating crowdfunding effectively.

- Peer-to-Peer Lending: This option connects borrowers directly with investors, eliminating the middleman and frequently resulting in more competitive interest rates. For small enterprises seeking flexible financing, peer-to-peer lending can be a viable and efficient solution, especially when informed by Finance Story's insights into diverse lending sources.

- Invoice Financing: This method allows companies to borrow against their outstanding invoices, providing a rapid influx of cash to enhance cash flow. By leveraging unpaid invoices, companies can access funds without incurring additional debt.

The competitive landscape for small enterprises is further influenced by the challenges highlighted in the wealth management case study. Despite leading banks holding only a 32% market share, growth opportunities remain. Small enterprises must navigate these challenges while leveraging alternative financing options, including the best business loans Australia, tailored to their unique circumstances and funding needs. With the comprehensive lending solutions offered by Finance Story, our commitment lies in assisting you in discovering the most suitable pathway by connecting you with the right lenders and investors to support your growth.

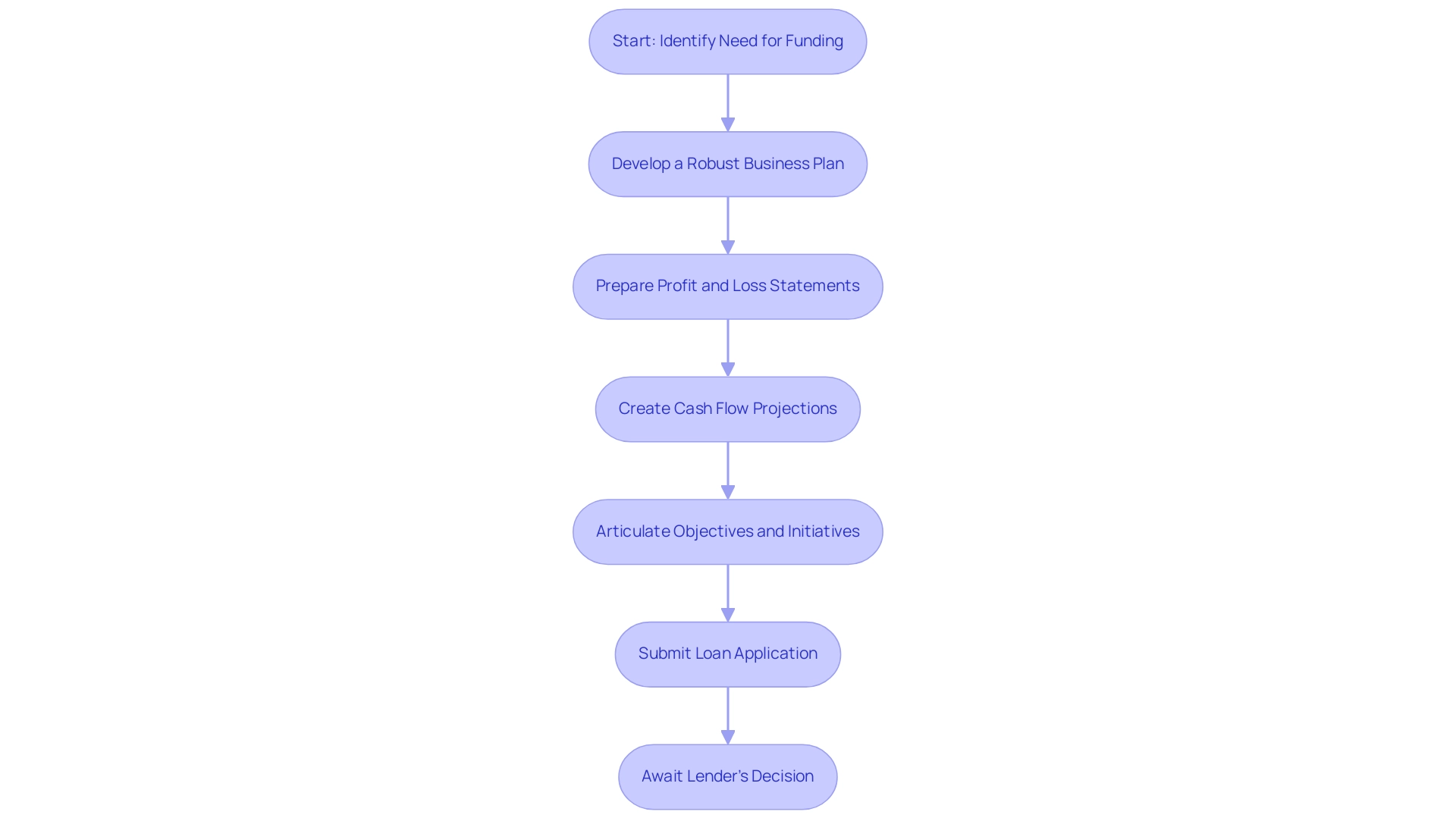

8. Name: The Importance of a Strong Business Plan and Financial Statements

For small enterprise proprietors seeking the best business loans in Australia, having a robust plan coupled with precise fiscal statements is paramount. A well-crafted plan should clearly articulate the organization’s objectives, outline strategic initiatives, and detail how the funding will be utilized to drive growth. Essential financial records, including profit and loss statements and cash flow projections, provide creditors with a clear perspective on the entity's financial health.

These documents work in tandem to establish the applicant's credibility, significantly enhancing the likelihood of securing the best business loans in Australia. In 2025, lenders are increasingly prioritizing these elements during the approval process, as they offer valuable insights into the viability and sustainability of the venture, making them essential components of any successful loan application. Notably, nearly half of the 25 global banking and capital markets respondents plan to conduct an enterprise-wide analysis of cost structure before deploying an expense management program to realize savings by 2026, underscoring the growing emphasis on financial planning.

Vikram, Vice Chair and US Financial Services Industry Leader at Deloitte, emphasizes, 'A comprehensive plan is critical in demonstrating an enterprise's potential and securing the necessary funding.' Furthermore, with Finance Story's expertise in crafting refined and customized financing proposals, small enterprise owners can navigate the complexities of applying for the best business loans in Australia more effectively. Their deep understanding of the finance sector and access to a full suite of lenders, including high street banks and innovative private lending options, ensure that clients are well-prepared to meet lenders' expectations and secure the funding necessary for growth and development.

Significantly, small enterprise owners should also be cognizant of specific repayment criteria, such as the ability to demonstrate consistent cash flow and a solid repayment strategy. Finance Story specializes in financing various commercial properties, including warehouses, retail spaces, factories, and hospitality enterprises, ensuring that clients can find the appropriate funding solution tailored to their needs.

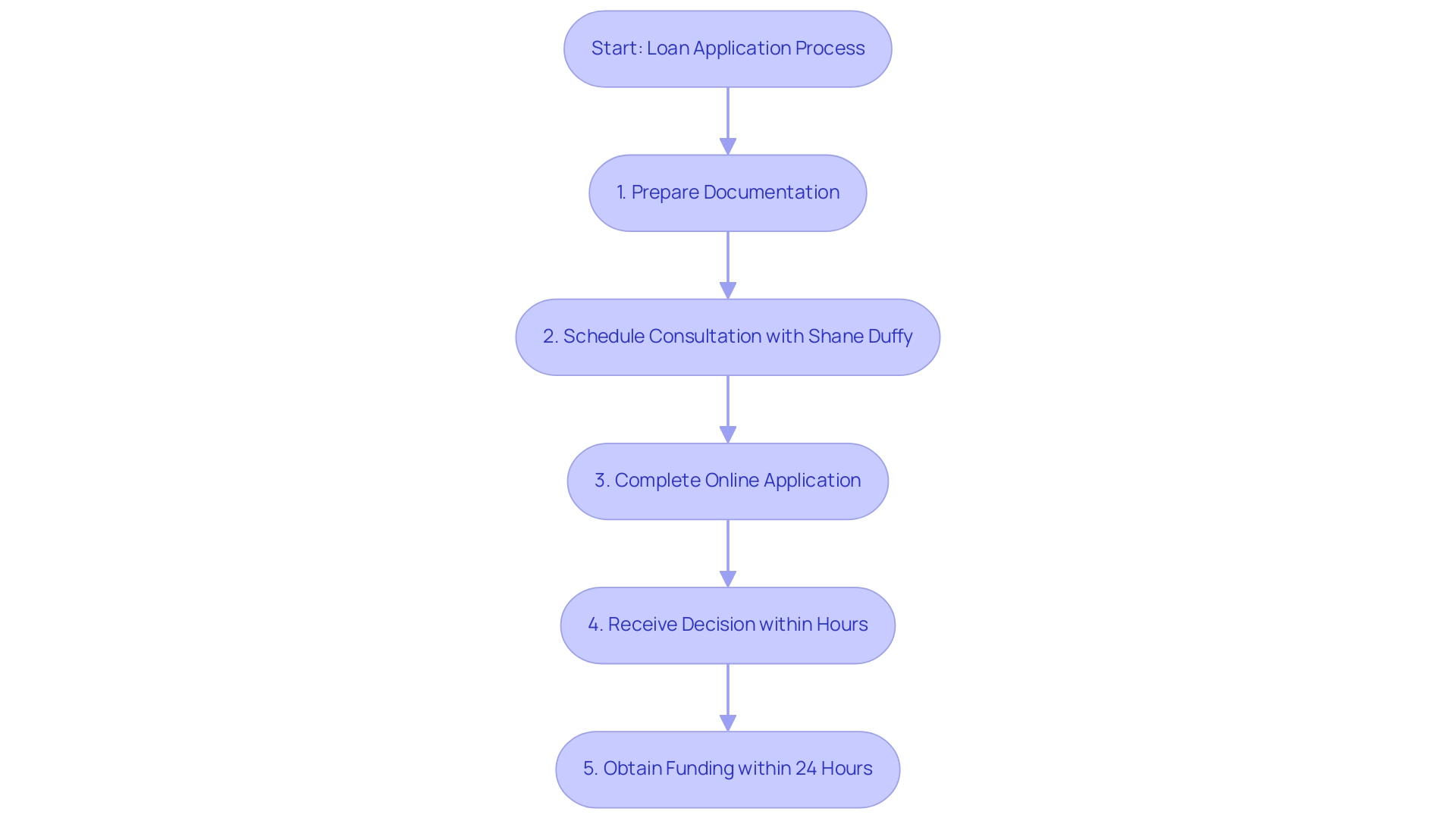

9. Name: The Speed and Convenience of Business Loan Applications

As of 2025, the loan application process in Australia has undergone significant improvements, largely due to the rise of digital technologies. Many lenders now facilitate online applications that can be completed in just minutes, with some capable of providing decisions within hours and funding often available within a mere 24 hours. This rapid turnaround is vital for small enterprise owners seeking the best business loans in Australia for swift access to capital, whether for operational needs or unexpected expenses.

To navigate this process effectively, we invite you to schedule your free personalized consultation with Shane Duffy, our Head of Funding Solutions. In this 30-minute meeting, you'll discuss your unique needs and goals, allowing us to create tailored financial strategies that fit your organization. Considering the typical borrowing amount for owner-occupier residences in New South Wales, which was $449,000 in December 2024, small enterprise owners can evaluate their financing options on a similar scale.

With pressures on small enterprises projected to ease as real household disposable incomes grow and inflation decreases, the environment for securing the best business loans in Australia is becoming increasingly favorable. However, to maximize efficiency, borrowers should ensure they have all necessary documentation prepared ahead of time. According to Dominic Beattie, Editor at Savings.com.au, 'We pride ourselves on maintaining a strict separation between our editorial and commercial teams, ensuring that the content you read is based purely on merit and not influenced by commercial interests.'

This commitment to quality information is essential for entrepreneurs navigating the complexities of securing funding in a fast-paced environment. Furthermore, we specialize in creating polished business cases to present to financial institutions, ensuring that your refinancing needs are met effectively. Our extensive network includes a diverse range of lenders, from high street banks to innovative private lending panels, providing you with various options tailored to your circumstances.

Understanding the repayment criteria is crucial when considering the best business loans in Australia, and we are here to guide you through this process. Recent trends in home refinancing, which have experienced significant increases since the last RBA rate cut, illustrate the dynamic nature of the mortgage market and its implications for commercial financing, particularly regarding consumer behavior and interest rate changes.

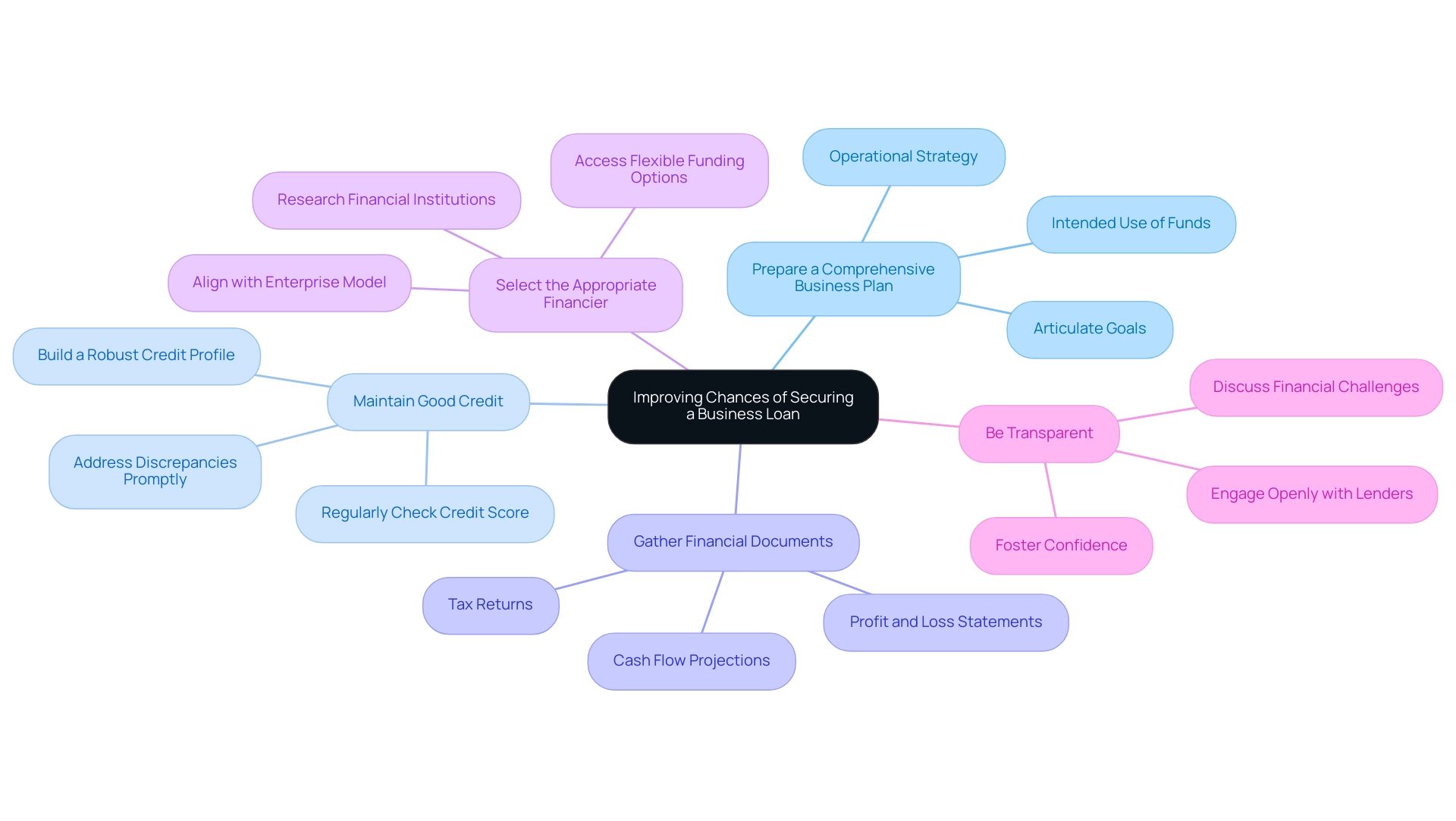

10. Name: Tips for Improving Your Chances of Securing a Business Loan

Securing a financial advance is a pivotal step for any small enterprise owner, and there are several strategies to enhance your chances of approval in 2025:

- Prepare a Comprehensive Business Plan: Create a thorough business plan that articulates your goals, operational strategy, and the intended use of the funds. A well-organized plan not only underscores your vision but also demonstrates to investors your commitment to prudent financial management.

- Maintain Good Credit: Regularly check your credit score, as it is a critical factor in loan approvals. Address any discrepancies or issues without delay. Financial experts assert that a robust credit profile can significantly bolster lender confidence, thereby improving your chances of obtaining favorable terms.

- Gather Financial Documents: Ensure your financial statements are current and accurately reflect your organization's performance. This includes profit and loss statements, cash flow projections, and tax returns. Lenders require this information to assess the viability of your enterprise and the associated risks of lending to you.

- Select the Appropriate Financier: Take the time to research various financial institutions that align with your specific needs and offer terms that suit your enterprise model. Access to flexible funding options is increasingly vital; indeed, 37% of founders emphasize that flexible banking solutions are essential for managing cash flow and scaling operations in a volatile market. Finance Story, with its extensive expertise in crafting polished and tailored funding proposals for diverse commercial properties—such as warehouses, retail spaces, factories, and hospitality ventures—can assist you in identifying options that meet your unique financing needs.

- Be Transparent: Engage openly with potential lenders about your enterprise's financial situation, including any challenges you've encountered. Transparency can foster confidence and may lead to more favorable credit terms.

By implementing these strategies, small enterprise owners can significantly enhance their chances of securing the best business loans Australia has to offer, thereby achieving their objectives. Finance Story's highly professional and bespoke mortgage services have supported businesses of all sizes, even in challenging circumstances. Staying informed about market trends and lender preferences will empower you to make strategic decisions throughout your financing application process.

As Val Srinivas, a senior research leader in banking and capital markets, notes,

The ability to differentiate one’s financial strategies amidst changing market conditions is essential for success.

Furthermore, as the lending landscape evolves, understanding these trends can further enhance your approach to securing a loan. For instance, a small enterprise that utilized flexible funding options successfully navigated a cash flow crunch, enabling them to seize growth opportunities despite market volatility.

Testimonials from clients like Natasha B. reflect this, as she stated, 'We are finished with the constant worry. Thank you so much for being a part of our journey,' illustrating how Finance Story's tailored solutions can alleviate financial stress and support business growth.

Conclusion

In the dynamic realm of Australian business financing, grasping the diverse offerings of business loans is paramount for entrepreneurs striving for success. As outlined, loans can be classified into secured and unsecured options, each presenting distinct benefits and risks. Secured loans typically feature lower interest rates but necessitate collateral, while unsecured loans afford quicker access to funds without requiring assets, albeit at higher rates.

Navigating eligibility criteria is crucial for securing financing, with key factors such as business history, financial health, and credit scores playing essential roles in the approval process. Moreover, a meticulously structured business plan and precise financial statements are vital for establishing credibility with lenders.

The landscape of business loans is ever-changing; it is shaped by broader economic conditions and evolving market dynamics. Entrepreneurs must remain vigilant regarding interest rates, repayment terms, and emerging alternative financing options, such as government grants, crowdfunding, and peer-to-peer lending. These alternatives can provide critical capital without the constraints of traditional loans, particularly for startups or those encountering difficulties in securing conventional funding.

Ultimately, the journey to securing a business loan is intricate yet attainable with the right preparation and knowledge. By leveraging expert guidance and crafting tailored proposals, small business owners can significantly enhance their chances of securing the necessary funding to propel their growth ambitions. As the entrepreneurial ecosystem in Australia continues to flourish, comprehending these financial tools will empower businesses to navigate challenges and seize opportunities in an ever-evolving landscape.