Overview

The article "Mastering the Business Acquisition Loan: A Step-by-Step Guide for Small Business Owners" serves as an essential resource for small business owners seeking to secure financing for acquisitions. It provides comprehensive insights and strategies, emphasizing the critical nature of understanding various loan options.

By preparing a robust business plan and navigating the application process effectively, business owners can significantly enhance their chances of obtaining favorable loan terms. This approach is supported by evidence of market trends and expert recommendations, ensuring that readers are well-equipped to make informed decisions.

Introduction

In the competitive realm of small business ownership, the pursuit of growth often necessitates the strategic decision to acquire additional enterprises. Business acquisition loans are essential financial tools that empower established owners to expand their portfolios. However, navigating the landscape of these loans can be daunting. Small business owners must understand the various types of loans available, such as:

- Traditional bank loans

- SBA financing

and comprehend the intricate requirements for securing funding. Being well-informed is crucial for making sound financial choices. As market conditions evolve and the demand for business acquisitions rises, grasping the nuances of financing options becomes imperative for those looking to leverage new opportunities and ensure long-term success.

Understanding Business Acquisition Loans: An Overview

Commercial purchase funds serve as tailored instruments that empower seasoned entrepreneurs to acquire additional ventures. These financial agreements encompass a wide array of costs related to the purchase, including the acquisition price, operational expenses, and necessary renovations or enhancements for the new endeavor. In 2025, grasping the landscape of business funding is crucial for making informed financial decisions.

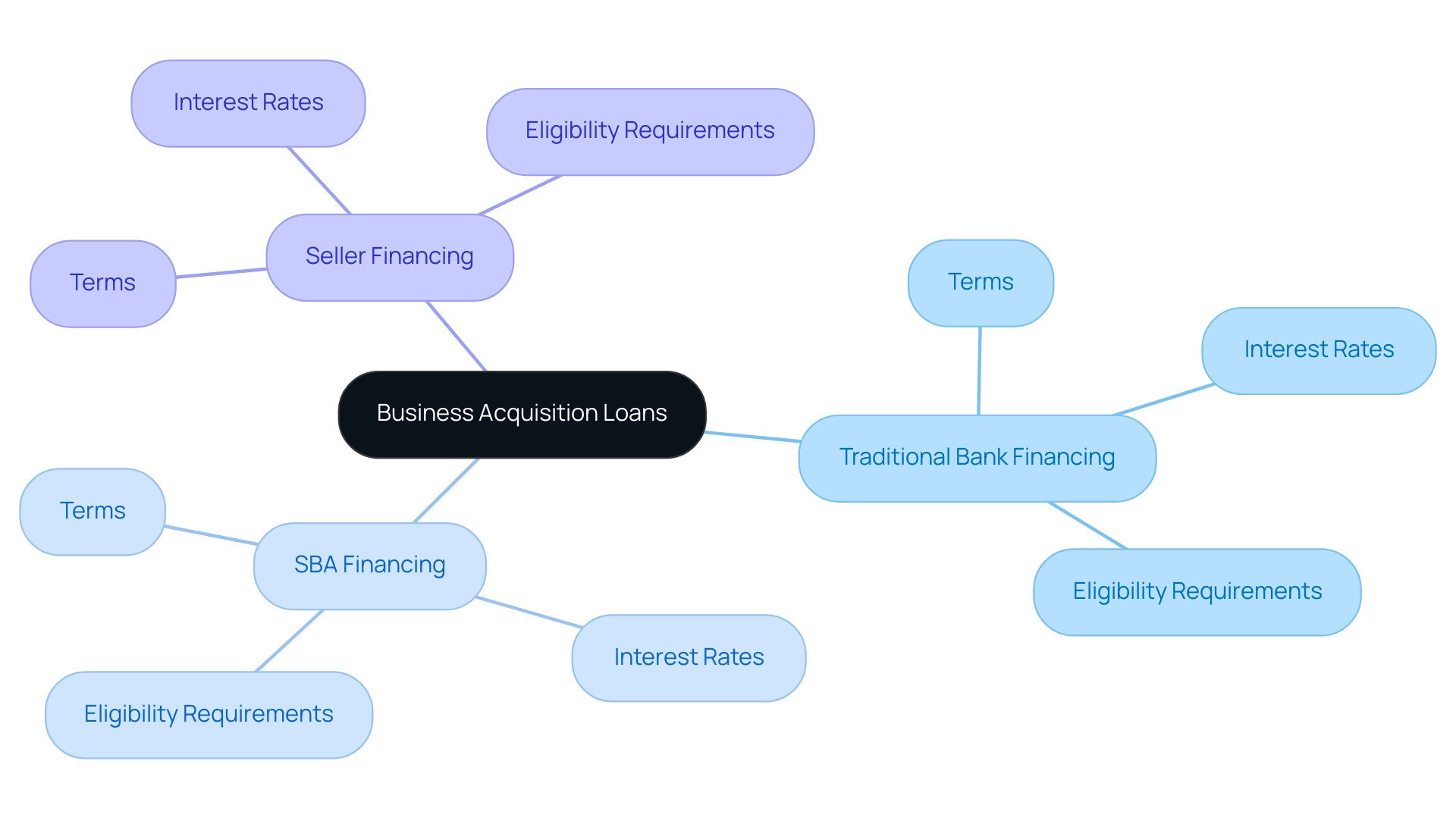

The primary categories of financing for acquisitions include:

- Traditional bank financing

- Small Business Administration (SBA) financing

- Seller financing

Each option offers distinct terms, interest rates, and eligibility requirements, which can significantly affect the overall cost and feasibility of the purchase.

Current trends reveal a rising interest in acquisition loans, fueled by the desire for expansion and diversification among small business owners. Notably, statistics indicate that a substantial portion of companies—approximately 11.8%—sought financing for reasons classified as 'other' in 2020, underscoring the varied motivations behind acquiring additional firms. Furthermore, as Janet Gershen-Siegel noted, "70% of small enterprises carry some degree of debt, with a total of $18 trillion owed by the end of 2022," highlighting the complex financial landscape that small business owners must navigate.

Understanding repayment criteria is vital, especially when leveraging property equity for financing. For example, when acquiring a freehold property, owners can typically borrow against the commercial asset, often at a maximum loan-to-value ratio (LVR) of 70%. This means that for a commercial property valued at $1 million, a buyer could secure a loan of $700,000, necessitating a deposit and additional funds to cover the acquisition.

This strategy underscores the importance of leveraging existing property equity, which can be instrumental in facilitating seamless purchases.

Moreover, refinancing options can play a critical role in enabling company acquisitions. By restructuring existing debts, small business owners can potentially unlock equity from their current properties, allowing them to access additional capital for new initiatives. This process involves assessing current financing conditions and exploring alternatives to modify them in alignment with evolving organizational needs.

It is imperative for business owners to comprehend how refinancing can influence their overall financial strategy and support their growth aspirations.

Expert opinions emphasize the importance of selecting the appropriate type of financing based on individual circumstances. For instance, traditional bank financing often provides competitive rates but may necessitate stringent credit evaluations. In contrast, SBA financing offers favorable terms for qualifying businesses, making it an attractive option for many entrepreneurs.

Seller financing, on the other hand, can facilitate smoother transactions by permitting the seller to finance part of the purchase, thereby alleviating the financial burden on the buyer.

Successful case studies illustrate the efficacy of these financial products in real-world applications. For instance, a small business owner who utilized SBA funding to acquire a competitor not only expanded their market share but also enhanced operational efficiencies, demonstrating the potential benefits of strategic mergers. This aligns with Finance Story's commitment to guiding clients through their financial journeys, ensuring they have access to the most suitable funding options tailored to their specific needs.

As the market evolves, it is essential for small business owners to remain informed about the types of business acquisition loan financing available and their respective advantages. Additionally, it is crucial to consider other costs associated with the purchase, such as valuation, legal fees, and lender fees, as these can significantly impact the overall financial picture. Finance Story is well-positioned to assist clients in understanding these options and securing optimal financing solutions tailored to their requirements.

Key Requirements for Securing a Business Acquisition Loan

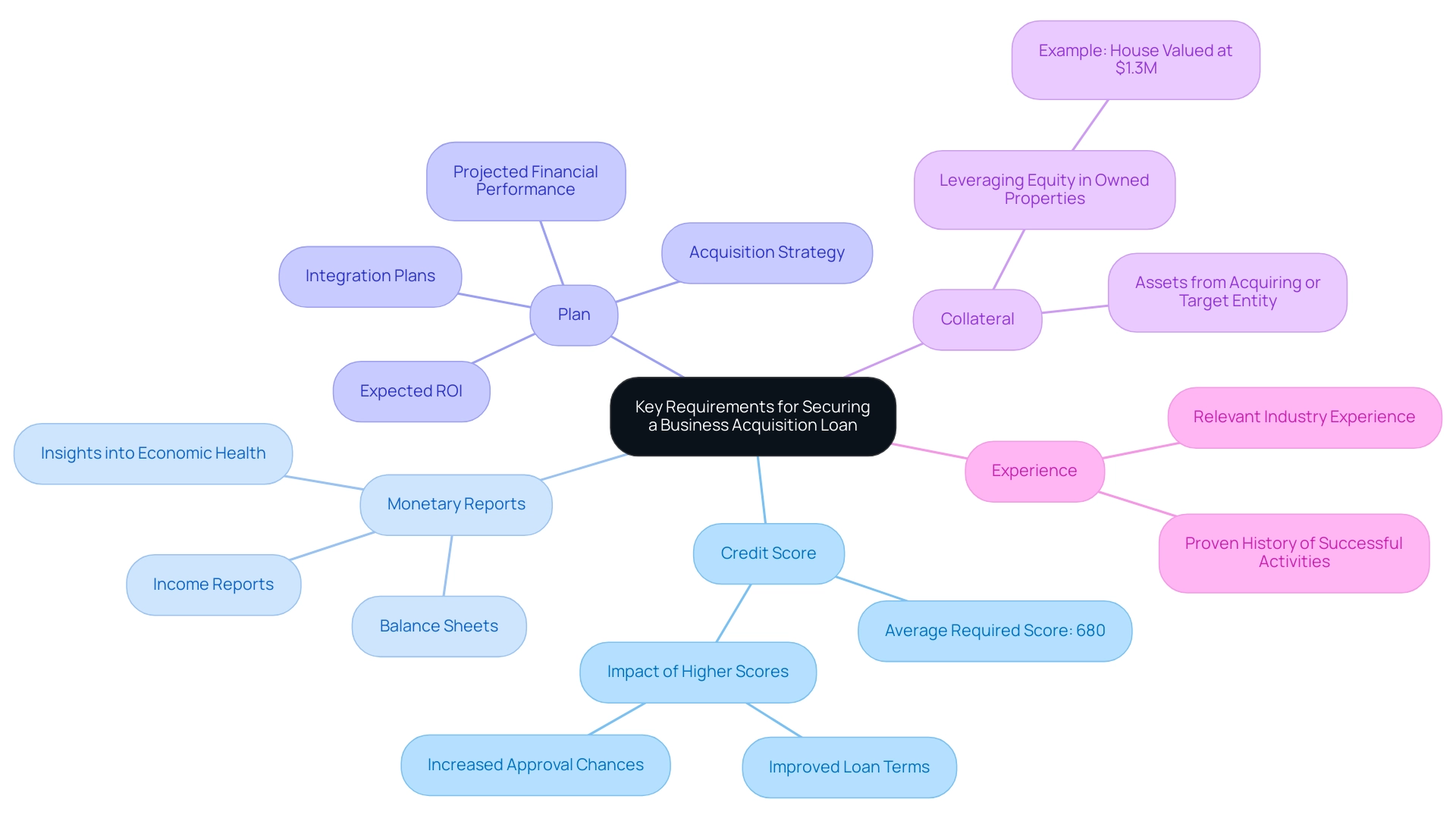

Securing corporate purchase financing requires meeting several critical criteria that lenders assess to evaluate creditworthiness and the viability of the purchase. Understanding these factors is essential for small business owners aiming to navigate the complexities of obtaining a business acquisition loan in 2025.

-

Credit Score: A strong personal and business credit score is vital, serving as a primary indicator of the borrower's financial reliability. In 2025, the average credit score required for acquisition loans hovers around 680; however, higher scores can significantly improve loan terms and increase approval chances.

-

Monetary Reports: Lenders will demand comprehensive monetary statements, including balance sheets and income reports, to assess the economic health of both the acquiring and target entities. This documentation provides insights into cash flow, profitability, and overall economic stability.

-

Plan: A well-structured plan is crucial. It should articulate the acquisition strategy, projected financial performance, and integration plans, effectively demonstrating to lenders the potential for success and return on investment (ROI). As Phil Collard, a lending expert at Money.com.au, states, "The right loan facility can be a very powerful tool to accelerate growth, so be sure to have your plans clearly mapped out, including expected ROI."

-

Collateral: Some lenders may require collateral to mitigate risk. This could involve assets from either the acquiring or target entity, providing lenders with additional security in case of default. For enterprises operating under leasehold agreements, which typically lack commercial property to borrow against, leveraging equity in owned properties can be a viable option. For instance, if you own a house valued at $1.3M with $300k owed, you could potentially access up to $740k in equity for your venture by borrowing against it, thereby enhancing any cash reserves you possess. This highlights the importance of understanding the limitations of financing options available to leasehold enterprises.

-

Experience: Demonstrating relevant industry experience can significantly bolster credibility. Lenders are more likely to endorse financing for candidates with a proven history of successful commercial activities and purchases.

By preparing the necessary documentation and presenting a compelling case, applicants can improve their chances of securing favorable terms for a business acquisition loan. Additionally, as banks are encouraged to adopt automation and machine learning tools to streamline processes, comprehending the current lending environment is crucial.

This competitive landscape, as emphasized in the case study 'Growth Opportunities in Wealth Management,' reveals that lenders face challenges from rivalry and customer dissatisfaction, which can impact approval rates.

Exploring Different Financing Options for Business Acquisitions

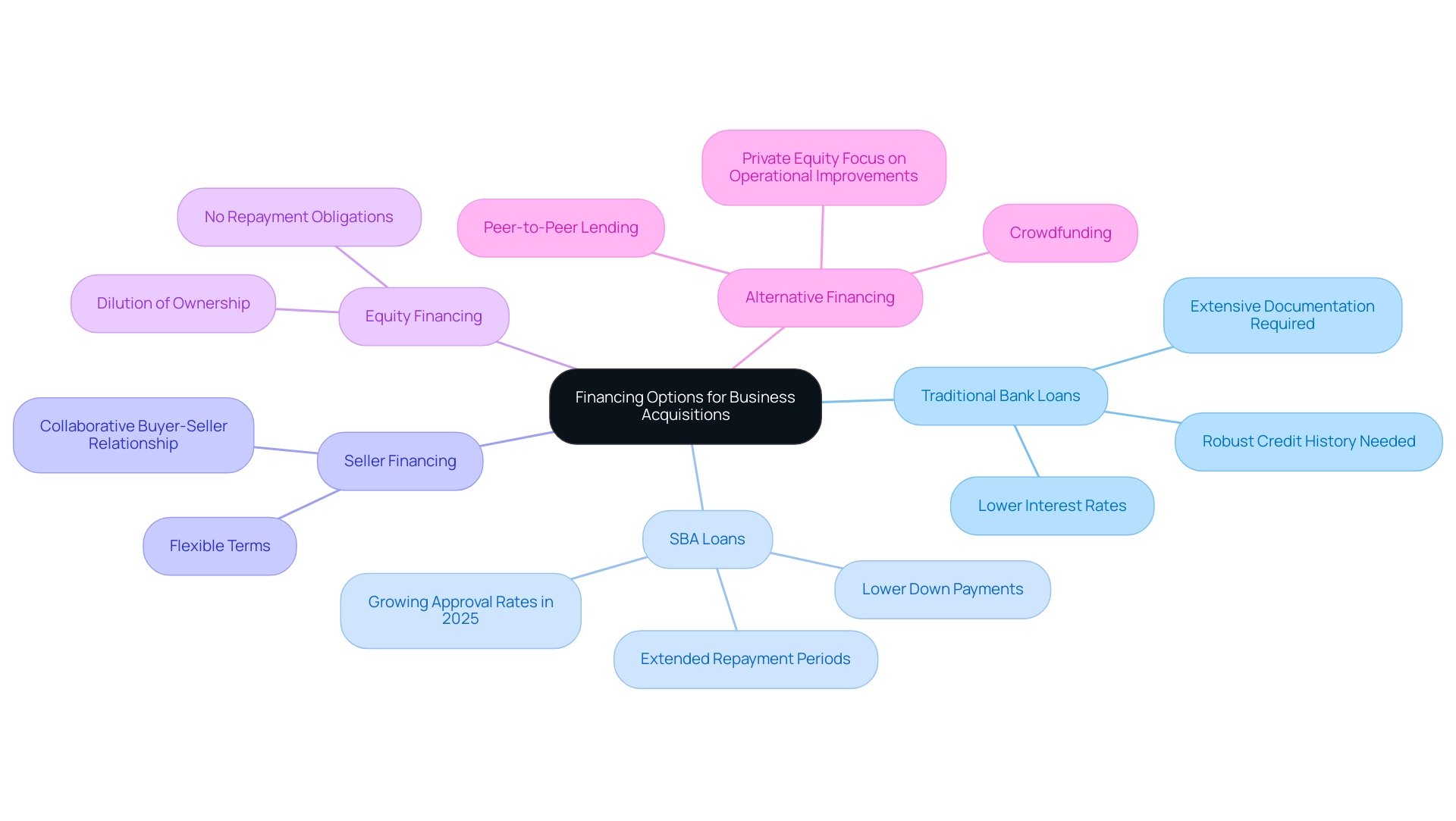

When exploring financing options for business acquisitions, small business owners have a wealth of avenues to consider, each presenting its own advantages and considerations:

- Traditional Bank Loans: Often characterized by lower interest rates, these loans are attractive for many. However, they typically require extensive documentation and a robust credit history, which can pose challenges for some small enterprises.

- SBA Loans: The Small Business Administration (SBA) plays a crucial role in facilitating access to capital for small enterprises. By providing guarantees, the SBA enables lenders to offer favorable terms, including lower down payments and extended repayment periods. In 2025, SBA loan approval rates have shown a positive trend, reflecting growing support for small enterprise acquisitions.

- Seller Financing: This option allows the seller of the enterprise to finance a portion of the purchase price. It can lead to more flexible terms and is particularly beneficial when traditional financing is challenging to secure. This arrangement fosters a collaborative relationship between the buyer and seller, often resulting in smoother transitions.

- Equity Financing: Raising capital through equity financing involves selling shares in the company. While this method can provide necessary funds without repayment obligations, it does dilute ownership. This choice is especially appealing for companies seeking rapid growth without incurring debt.

- Alternative Financing: In today's dynamic financial landscape, alternative financing options such as peer-to-peer lending, crowdfunding, and private equity have gained traction. These resources can be particularly beneficial for enterprises that may not meet the stringent requirements of conventional financing. The private equity sector is emerging more resilient and innovative, focusing on operational improvements and sustainable growth within portfolio companies. As stated in the Global Private Markets Report 2025, "The exit backlog of sponsor-owned companies is larger in value, count, and as a share of total portfolio companies than at any point in the past two decades," underscoring current market conditions impacting acquisitions.

Understanding the complexities of repayment criteria is crucial, especially when evaluating options for freehold property ventures, where lenders frequently stipulate a maximum loan-to-value ratio (LVR) of 70% against commercial properties. For instance, if a commercial property is valued at $1M, the maximum loan would be $700k, necessitating a deposit of $300k. Small enterprise owners may also need to utilize property equity and cash savings, particularly in leasehold scenarios where traditional collateral isn't available.

In such situations, if a residential property is appraised at $1.3M with a mortgage of $300k, the available equity for buying a venture would be $740k, which could be combined with cash savings to cover the total funds needed for the purchase.

Moreover, it's essential to consider other expenses related to corporate purchases, such as valuation, legal fees, and stamp duty, which can significantly influence the overall amount required.

As small enterprise owners navigate these financing options, grasping the landscape is crucial. Over the last ten years, yearly corporate mergers and acquisitions have averaged between 800 and 1,000 transactions, indicating a robust market for corporate takeovers. Furthermore, financial advisors emphasize the advantages of business acquisition loans, particularly SBA loans, over traditional bank loans, especially for those seeking to minimize upfront costs and secure favorable terms.

In summary, the funding environment for enterprise purchases in 2025 is varied and evolving. By strategically utilizing the appropriate mix of these options, small enterprise owners can position themselves for successful purchases and long-term growth. Additionally, as private equity firms contend with rising purchase prices and extended holding periods, there is a heightened focus on operational improvements and value creation initiatives within portfolio companies, further informing financing strategies.

Crafting a Winning Business Plan for Your Loan Application

A robust financial strategy is essential for securing a business acquisition loan, especially concerning freehold property purchases. Here are the key elements to incorporate:

-

Executive Summary: This section provides a concise overview of the entity being purchased, detailing its current condition and the strategic rationale behind the acquisition. A well-crafted executive summary not only sets the tone for the entire plan but also captures the lender's interest.

-

Market Analysis: Conduct a comprehensive analysis of the industry, target market, and competitive landscape. This demonstrates your grasp of market dynamics and underscores the potential for growth. In 2024, 18% of small businesses are anticipated to invest in digital marketing, signifying a shift towards enhancing customer engagement, a critical factor in your market analysis.

-

Financial Projections: Present detailed forecasts of revenue, expenses, and profitability for the next three to five years. These projections should reflect realistic expectations based on market conditions and historical performance, showcasing the economic viability of the acquisition. With deposit costs projected to rise to 2.03% in 2025, lenders will be particularly interested in your ability to manage financial obligations. If you are acquiring a freehold property venture, lenders typically permit you to utilize a business acquisition loan to borrow against the property, with a maximum loan-to-value ratio (LVR) often capped at 70% for commercial properties, influencing your funding strategy.

-

Operational Plan: Outline how the acquired entity will be integrated and managed post-acquisition. This should encompass plans for staffing, operational adjustments, and any necessary modifications to align with your organizational strategy. A clear operational plan reassures lenders of your capability to manage the transition effectively when applying for a business acquisition loan.

-

Funding Requirements: Clearly articulate the amount of funding needed for the business acquisition loan, its intended use, and the anticipated return on investment. This section should provide a transparent perspective on your financial requirements and the expected benefits of the acquisition, reinforcing the justification for the funding request. For example, if considering a total asking price of $1.4M for a freehold property, detail how the required deposit and any additional funds will be sourced, potentially from equity in other properties. Additionally, account for other costs such as valuation, legal fees, and stamp duty, which can significantly impact your total funding needs for a business acquisition loan. To calculate available equity from a residential property, consider the maximum LVR that the lender will allow, typically 80%. For instance, if you have a property valued at $1.3M, the maximum a lender will provide against the property is $1.3M x 80% = $1,040,000. If you owe $300k on your mortgage, you thus have $1,040,000 - $300k = $740k of available equity to utilize. This amount suffices for the $700k required, but be mindful of covering the other costs mentioned earlier. Moreover, lenders usually do not allow borrowing against the company unless it possesses substantial assets, a critical consideration in your financing strategy.

In 2024, 78% of small enterprises are expected to adopt sustainability practices, reflecting a growing consumer preference for ethical brands. Integrating such trends into your strategy can enhance its appeal and competitiveness, rendering it more attractive to lenders. As noted by Zippia, the likelihood of failure diminishes with a strong plan.

A solid plan not only boosts your chances of securing funding but also serves as a roadmap for your venture's future success.

Navigating the Loan Application Process: Step-by-Step

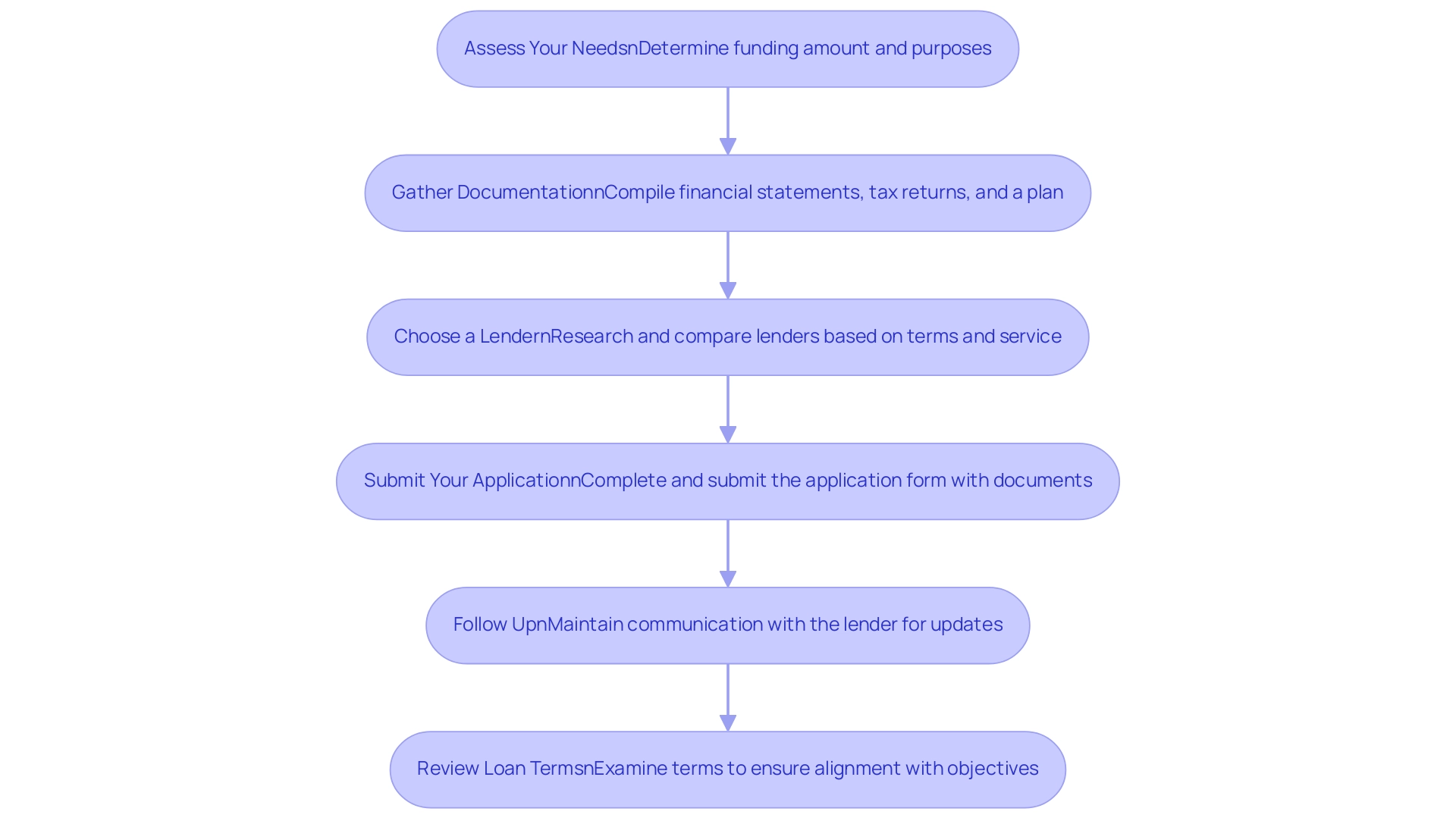

Navigating the application process can be straightforward if you follow these essential steps:

-

Assess Your Needs: Begin by determining the exact amount of funding required and the specific purposes for which it will be utilized. This clarity will guide your entire application process.

-

Gather Documentation: Compile all necessary documents, including financial statements, tax returns, and a comprehensive plan for the venture. Having these ready will streamline your application and demonstrate your preparedness to lenders.

-

Choose a Lender: Conduct thorough research to compare various lenders. Look for those that align with your requirements, focusing on interest rates, loan terms, and the quality of customer service. In 2025, small enterprise owners should prioritize lenders who offer flexibility and a strong understanding of the market. Finance Story specializes in creating refined and highly personalized cases, ensuring you have access to a full range of lenders, including high street banks and innovative private lending panels, for your commercial property investments, whether for warehouses, retail premises, or hospitality ventures. It's also crucial to align your practices with consumer expectations, as 74% of Gen Z consumers would boycott brands that go against their values.

-

Submit Your Application: Complete the application form with precision, ensuring all information is accurate. Submit this form along with your gathered documentation to the chosen lender.

-

Follow Up: Maintain open lines of communication with the lender. Regularly check in to address any questions they may have or to provide additional information, which can expedite the approval process.

-

Review Loan Terms: Upon receiving approval, meticulously review the loan terms. Ensure they correspond with your organizational objectives and monetary strategy before signing any agreements. Grasping the implications of the terms is essential for long-term success.

Incorporating insights from economic experts can also be advantageous. As Mike Berner, Senior Analyst, observes, companies can utilize the latest financial solutions and artificial intelligence tools to improve their credit applications. Moreover, refinancing alternatives for your commercial financing can be examined to better satisfy the changing requirements of your enterprise.

By following these steps, small business owners can enhance their chances of obtaining a business acquisition loan efficiently. Furthermore, to create a successful funding proposal, consider booking a free personalized 30-minute consultation with Finance Story's Head of Funding Solutions, Shane Duffy. This meeting will allow you to discuss your needs and goals, setting the stage for your next chapter.

In 2025, the average time to obtain such financing is approximately 30 to 45 days, depending on the lender and the complexity of the application. Statistics suggest that enterprises that prepare thoroughly and engage proactively with lenders are more likely to achieve favorable results in their financing applications. Moreover, understanding market trends, as highlighted by recent statistics, can help refine your approach and demonstrate growth potential to lenders.

Common Challenges in Securing Business Acquisition Loans and How to Overcome Them

Obtaining a commercial funding option can present several significant challenges that small enterprise owners must navigate:

- Credit Issues: A poor credit history can severely hinder funding approval. To improve your chances, focus on enhancing your credit score prior to applying. This may involve paying down outstanding debts, ensuring timely payments, and correcting any inaccuracies on your credit report. In 2025, the impact of credit scores on loan approval rates remains substantial, with lenders increasingly relying on these metrics to assess risk.

- Insufficient Documentation: Lenders require comprehensive documentation to evaluate your application effectively. Prepare all essential statements, tax returns, and a strong plan that outlines your acquisition strategy and projected economic performance. A well-prepared application can significantly streamline the approval process.

- High Debt-to-Income Ratio: If your existing debt is too high relative to your income, lenders may be hesitant to extend additional credit. Consider strategies to reduce your current debt load or explore ways to increase your income before applying. This proactive approach can enhance your financial profile and improve your chances of securing a loan.

- Lack of Experience: New entrepreneurs may be perceived as higher risk by lenders. To counter this, emphasize any relevant experience you possess or consider partnering with someone who has a strong background in management. Demonstrating a solid understanding of the industry can help alleviate lender concerns.

- Market Conditions: Economic fluctuations can significantly impact lending conditions. In 2025, European banks are expected to face cost growth that surpasses revenue growth, prompting a more cautious lending environment. This context is vital as it may influence small enterprise funding approvals. Furthermore, the statistic from Standard Chartered shows a commitment of US$1.5 billion over the next three years for its 'Fit for Growth' program, which could offer some assistance for small enterprises seeking loans. Additionally, McKinsey emphasizes that the expense of securing a qualified SMB lending lead is 15 to 20 times greater than an embedded finance lead, highlighting the difficulties small enterprises encounter in obtaining financing. Understanding the broader economic landscape can help you anticipate challenges and position your application favorably.

- Financing Options for Leasehold Enterprises: If your venture operates within a lease and does not have a physical property to leverage, you may need to rely on cash savings or any equity in properties you do own. For example, if your residence is appraised at $1.3 million with $300,000 owed, you can access up to $740,000 in equity to assist with your venture purchase, supplemented by any cash savings you possess. By collaborating with Finance Story, you gain access to customized loan proposals that address specifically to your financing requirements, enhancing your chances of approval and ensuring that you secure the appropriate loan for your goals.

- Refinancing Options: Furthermore, refinancing your current commercial loans can provide you with the necessary capital to support your purchase. Our expertise at Finance Story enables us to create polished and tailored cases that highlight your strengths and address lender concerns effectively. This customized approach not only improves your application but also places you advantageously in a competitive lending environment.

By tackling these challenges directly and implementing strategic enhancements, small enterprise owners can boost their prospects for securing the necessary funding, including a business acquisition loan, to enable successful acquisitions.

Post-Acquisition Strategies: Ensuring Financial Success After Your Purchase

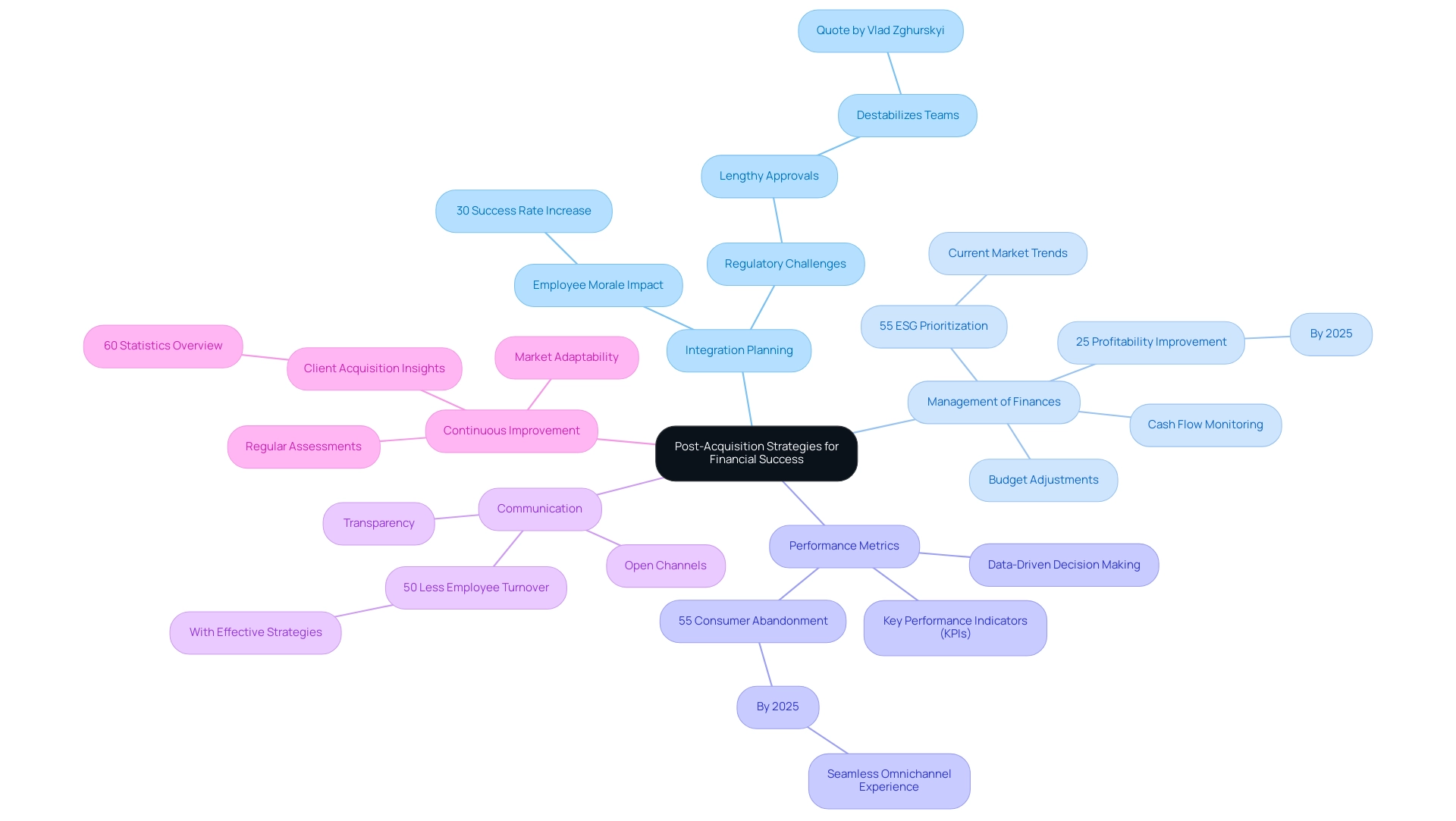

Implementing effective post-acquisition strategies is crucial for ensuring the long-term success of your newly acquired entity financed by a business acquisition loan. Here are key components to consider:

- Integration Planning: Craft a comprehensive integration plan that aligns the cultures and processes of both businesses. This step is vital, as successful integration can significantly impact employee morale and operational efficiency.

According to industry experts, a well-structured integration plan can enhance success rates by up to 30% in the first year post-acquisition. However, lengthy regulatory approvals can destabilize teams, as noted by Vlad Zghurskyi, highlighting the importance of addressing these challenges early in the process.

-

Management of Finances: Vigilantly monitor cash flow and adjust budgets to meet the economic demands of the acquired entity. This proactive approach aids in identifying potential monetary pitfalls early on, which is crucial for managing a business acquisition loan and allowing for timely interventions. In 2025, businesses that prioritize fiscal oversight during integration are expected to see a 25% improvement in overall profitability. Moreover, with just 55% currently emphasizing ESG in dealmaking, aligning your monetary strategies with present market trends is crucial.

-

Performance Metrics: Establish key performance indicators (KPIs) to assess the success of the purchase. These metrics should encompass financial performance, employee engagement, and customer satisfaction. Utilizing data-driven decision-making can lead to more informed strategies and adjustments, ultimately fostering a culture of accountability. Notably, 55% of consumers will abandon brands that do not offer seamless omnichannel experiences by 2025, emphasizing the need for effective communication and integration strategies post-acquisition.

-

Communication: Foster open communication channels with employees, stakeholders, and customers. Transparency during the transition phase can alleviate concerns and build trust, which is essential for maintaining morale and productivity. Research suggests that companies with effective communication strategies during mergers experience 50% less employee turnover. This is particularly relevant in the context of the M&A landscape in 2025, where private equity is projected to be a major driver of growth, with firms ready to deploy $2.5 trillion in capital.

-

Continuous Improvement: Regularly assess and refine your strategies based on performance data and evolving market conditions. This iterative process ensures that your organization remains agile and responsive to changes, which is particularly important in the dynamic landscape of 2025, where adaptability is key to sustaining competitive advantage. Insights from client acquisition statistics will shape marketing and sales efforts, further enhancing the relevance of your strategies, particularly in the context of securing a business acquisition loan. By focusing on these areas, small business owners can navigate the complexities of post-acquisition integration and position their companies for financial success in the years to come.

Conclusion

Navigating the complexities of business acquisition loans is essential for small business owners aiming for growth and diversification. Understanding the various types of financing options—such as traditional bank loans, SBA loans, and seller financing—enables entrepreneurs to make informed decisions that align with their strategic goals. Each option presents unique advantages and requirements, emphasizing the importance of thorough preparation and research.

Securing a business acquisition loan involves meeting critical criteria, including:

- Maintaining a strong credit score

- Providing comprehensive financial statements

- Presenting a solid business plan

Addressing potential challenges, such as credit issues and insufficient documentation, is vital for enhancing the likelihood of approval. By proactively managing these factors, small business owners can position themselves favorably in a competitive lending landscape.

Once the acquisition is complete, implementing effective post-acquisition strategies becomes crucial for ensuring long-term success. Key components include:

- Integration planning

- Diligent financial management

- Clear communication

These elements can significantly impact the success of the newly acquired business. By continually assessing performance metrics and adapting strategies to evolving market conditions, small business owners can foster resilience and drive sustainable growth.

In conclusion, understanding the intricacies of business acquisition loans and developing robust strategies for both the acquisition process and post-acquisition phase are paramount for small business owners. With the right preparation and insights, entrepreneurs can leverage these financial tools to unlock new opportunities and secure a prosperous future for their ventures.