Overview

This article serves as a comprehensive step-by-step guide on financing commercial real estate, addressing crucial concepts such as Loan-to-Value Ratio (LTV) and Debt Service Coverage Ratio (DSCR). It explores various types of loans available, providing a clear outline of the application process and necessary documentation. Furthermore, it presents strategies to overcome common financing challenges, emphasizing the importance of preparation and understanding lender requirements to enhance the chances of securing funding.

Introduction

Navigating the world of commercial real estate financing can indeed be daunting, particularly for those unfamiliar with the intricacies of the process. The potential to unlock lucrative income-generating properties—from bustling retail spaces to expansive office buildings—makes it essential to understand how to effectively finance these investments.

But what are the critical steps and strategies that can empower investors to secure the necessary funding? This guide delves into the core principles of commercial real estate financing, offering a comprehensive roadmap designed to help you overcome common challenges and make informed decisions in an ever-evolving market.

Understand Commercial Real Estate Financing Basics

It is essential to know how to finance commercial real estate in order to acquire or develop income-generating properties, such as office buildings, retail spaces, and warehouses. Understanding key concepts is essential:

- Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the property's appraised value, significantly impacting the financing amount a lender is willing to provide. Typically, a common LTV ratio for commercial properties ranges between 70% and 80%, indicating that financial institutions generally require borrowers to contribute 20% to 30% of the property's worth as equity.

- Debt Service Coverage Ratio (DSCR): This vital metric evaluates a property's ability to meet its debt obligations. It is calculated by dividing the net operating income (NOI) by the total debt service. A DSCR of 1.25 or higher is typically preferred, signifying that the property generates sufficient income to comfortably cover its debt payments.

- Types of Funding: Understanding how to finance commercial real estate through various funding options is imperative. Conventional banking credit, private financiers, and alternative funding sources each offer unique benefits and criteria. For instance, private lenders may provide more flexible terms but often at higher interest rates compared to conventional banks.

Grasping these essential concepts equips you with the knowledge necessary to explore specific types of credit and application procedures in subsequent sections.

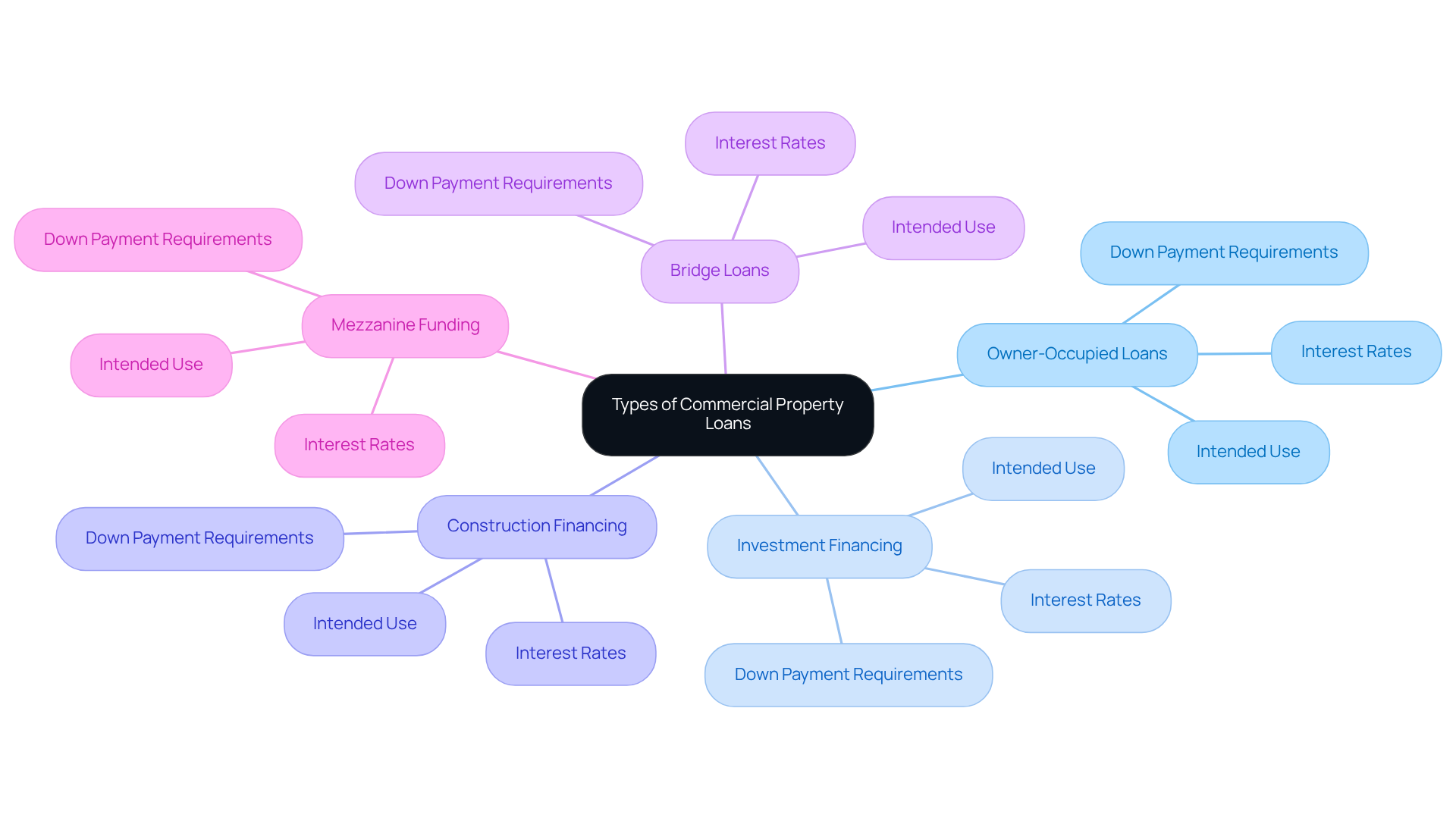

Explore Types of Commercial Property Loans

When considering how to finance commercial real estate, understanding the various types of loans available is crucial, as each is tailored to specific needs.

- Owner-Occupied Loans cater to businesses purchasing properties they will occupy. These loans typically feature lower interest rates and down payment requirements, making them an attractive option for small businesses aiming to establish a physical presence.

- Investment Financing is designed for acquiring properties intended for rental revenue. These financing options usually require a larger down payment and may impose more stringent qualification standards, reflecting the increased risk associated with investment properties, which are often subject to market fluctuations.

- Construction Financing provides short-term funds to support the building of new properties or significant renovations. Upon project completion, these loans typically transition to permanent funding, facilitating a smoother shift into long-term debt.

- Bridge Loans serve as short-term funding solutions, helping address urgent monetary needs while awaiting long-term financing options. They are particularly beneficial in competitive real estate markets where quick access to capital is essential.

- Mezzanine Funding is a hybrid option that merges debt and equity, bridging the gap between senior debt and equity. It often comes with higher interest rates, indicating the increased risk taken on by financial institutions.

Understanding these loan categories is essential for learning how to finance commercial real estate when seeking funding. Furthermore, refinancing alternatives are available to adapt to changing organizational needs, and Finance Story offers a comprehensive selection of lenders to assist with these funding methods.

Follow Steps to Apply for Commercial Financing

Applying for commercial financing involves several key steps that can significantly impact your success:

- Evaluate Your Financial Status: Start by checking your credit score, financial statements, and strategic plan. Comprehending your borrowing potential is vital, as the majority of financial institutions favor scores of at least 690 for the best rates. In 2025, the average credit rating for small enterprises seeking funding in Australia remains a crucial element in obtaining advantageous conditions. Significantly, online lenders may approve applications with scores as low as 600, offering additional choices for enterprises with varying credit profiles.

- Choose the Right Loan Type: Depending on your particular requirements, pick the most appropriate loan type from options like term loans, lines of credit, or equipment funding. Each type has unique requirements and benefits that can align with your organizational goals. Finance Story specializes in crafting refined and highly personalized proposals to present to lenders, showcasing how to finance commercial real estate and ensuring you obtain the appropriate funding for your investment.

- Gather Necessary Documentation: Prepare essential documents, including tax returns, financial statements, and a comprehensive plan for the enterprise. Comprehensive documentation enhances your credibility and ensures compliance, which can lead to smoother processing and higher approval rates. Additionally, consider including business overview materials, such as an executive summary, especially if you are a startup or seeking significant funding.

- Research Providers: Compare various providers and their offerings, considering interest rates, terms, and fees. Grasping the preferences of financial institutions can assist you in customizing your application to satisfy their specific criteria, enhancing your likelihood of approval. It's important to note that the percentage of small businesses applying for traditional financing has declined from 43% in 2019 to 34% in 2021, highlighting the need to adapt to changing dynamics in the financing landscape. With access to a full suite of lenders, including high street banks and innovative private lending panels, Finance Story can help you navigate these options effectively.

- Submit Your Application: Complete the application form and submit it along with your documentation. Ensure that all information is accurate and complete to avoid unnecessary delays.

- Negotiate Terms: Once approved, carefully review the agreement terms and negotiate if necessary. Effective negotiation can lead to more favorable conditions, such as lower interest rates or flexible repayment schedules, which are essential for managing cash flow. As Matthew Board highlights, 'This is why we urge companies to seek funding when their operations are strong, as they can frequently secure very favorable conditions from banks/lenders.'

- Complete the Financing: After agreeing on terms, finalize the financing by signing the necessary documents and receiving the funds. This step is crucial for accessing the capital needed to support your business initiatives.

By adhering to these steps and utilizing the knowledge of Finance Story in customized loan proposals and refinancing solutions, including options for how to finance commercial real estate such as warehouses, retail spaces, factories, and hospitality projects, you can simplify your application process and greatly enhance your chances of obtaining the capital you require for your commercial real estate endeavors.

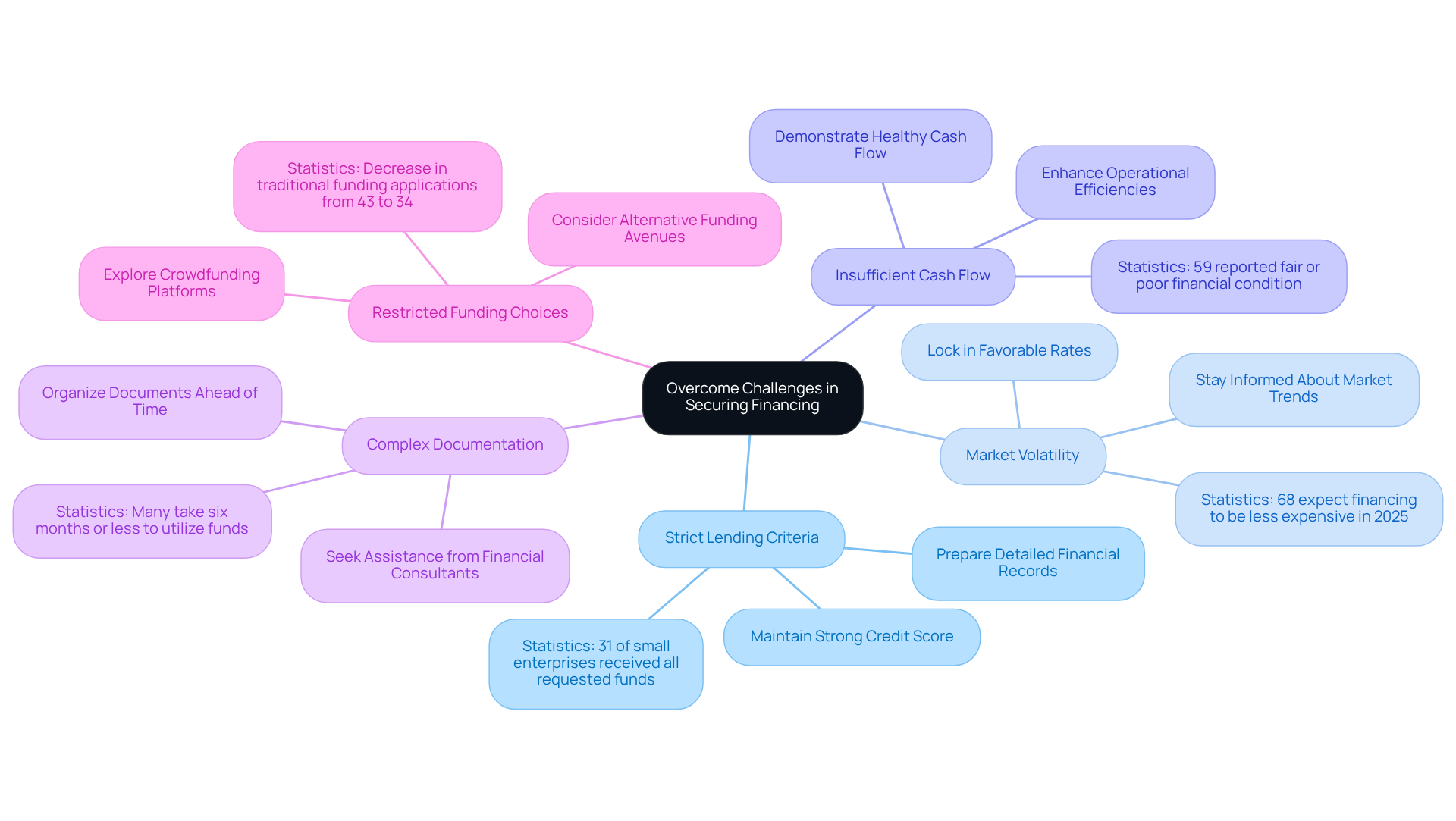

Overcome Challenges in Securing Financing

Securing financing for commercial real estate can be challenging, especially when considering how to finance commercial real estate in the current economic climate. Understanding these obstacles and employing effective strategies can significantly enhance your chances of success.

- Strict Lending Criteria: Lenders often impose stringent requirements, including a robust credit history and extensive documentation. To bolster your chances of approval, maintain a strong credit score and prepare detailed financial records. In 2021, only 31% of small enterprises obtained all the funds they requested, emphasizing the significance of being well-prepared. Finance Story specializes in creating polished and individualized business cases that can help you meet these stringent requirements.

- Market Volatility: Economic fluctuations can significantly affect interest rates and the availability of loans. Staying informed about market trends is crucial; consider locking in rates when they are favorable. A recent survey indicated that 68% of respondents expect financing to be less expensive in 2025, suggesting potential opportunities for borrowers. With access to a comprehensive panel of lenders, including boutique lenders and private investors, Finance Story can help you navigate these fluctuations effectively.

- Insufficient Cash Flow: Lenders closely evaluate your enterprise's cash flow to assess repayment capacity. Ensure your financial statements demonstrate healthy cash flow, and explore ways to enhance operational efficiencies. According to the Federal Reserve, 59% of small enterprises reported being in fair or poor financial condition, underscoring the need for strong financial management. Comprehending your repayment criteria is essential, and Finance Story can offer insights customized to your particular situation.

- Complex Documentation: The application process can be daunting due to the extensive paperwork involved. Organize your documents ahead of time and consider seeking assistance from a financial consultant to streamline the process. Many business owners take six months or less to utilize funds from their loans, indicating the importance of timely preparation. Finance Story's expertise in handling complex documentation can streamline this process for you.

- Restricted Funding Choices: If conventional sources are not feasible, consider alternative funding avenues such as private investors or crowdfunding platforms. The decrease in traditional funding applications—from 43% in 2019 to 34% in 2021—highlights a growing trend towards alternative options. Finance Story provides access to a comprehensive selection of lenders, ensuring you have varied choices to obtain the appropriate funding for your commercial property investments.

By anticipating these challenges and preparing strategically, you can significantly enhance your chances of understanding how to finance commercial real estate ventures successfully. As one satisfied client, Natasha B. from VIC, stated, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey.

Conclusion

Understanding how to finance commercial real estate is crucial for investors eager to capitalize on lucrative opportunities in the market. By grasping foundational concepts such as loan-to-value ratios and debt service coverage ratios, individuals can make informed decisions that significantly enhance their chances of securing the necessary financing for their ventures.

This guide outlines the various types of commercial property loans available—from owner-occupied loans to mezzanine funding—each tailored to meet specific needs. Furthermore, the step-by-step application process has been detailed, emphasizing the importance of:

- Evaluating financial status

- Choosing the right loan type

- Gathering necessary documentation

- Negotiating terms effectively

Recognizing the challenges in securing financing, including strict lending criteria and market volatility, is essential for navigating the complexities of commercial real estate financing.

In a rapidly changing economic landscape, staying informed and prepared is paramount. By leveraging the insights provided in this guide, investors can deepen their understanding of commercial real estate financing and adopt strategies that position them for success. The journey toward acquiring income-generating properties is filled with opportunities; with the right knowledge and preparation, it is indeed possible to overcome obstacles and secure the funding necessary for growth and profitability.