Overview

Financing a commercial building successfully requires a comprehensive understanding of various loan types, a robust loan application, and an awareness of lenders' evaluation criteria. This article outlines essential steps for potential borrowers, such as:

- Gathering financial documents

- Creating a detailed business plan

Furthermore, it explores financing options, including:

- Traditional bank loans

- Private lenders

These collectively equip borrowers with the knowledge needed to secure appropriate funding. By following these guidelines, you can enhance your chances of obtaining the necessary financing for your commercial project.

Introduction

Understanding how to finance a commercial building can be a daunting task, particularly given the myriad options and requirements involved. Navigating through various loan types, terms, and lender expectations is crucial for securing the right funding that aligns with your business goals. But what happens when the complexities of financing threaten to derail a promising investment? This guide unveils essential steps and insights to empower you in making informed financing decisions, ultimately unlocking the potential of your commercial real estate ventures.

Understand the Basics of Commercial Building Financing

A comprehensive understanding of the landscape is crucial for success when learning how to finance a commercial building, which requires securing funds for properties intended for business use. Here are the key concepts:

- Types of Commercial Loans: Familiarize yourself with various loan options, including traditional mortgages, construction loans, and bridge loans. Each type serves distinct needs, whether you're purchasing an existing property, funding new construction, or seeking short-term financing. At Finance Story, we focus on developing refined and highly tailored business cases to present to banks, ensuring you obtain the appropriate funding for your situation.

- Loan Terms: Understanding common loan terms such as interest rates, repayment periods, and down payment requirements is essential. In 2025, average interest rates for commercial mortgages in Australia are projected to be around 6.5%, influenced by rising economic conditions. Staying informed about market trends is vital for making sound financial decisions, and our expertise can guide you through these complexities.

- Purpose of Financing: Financing can be utilized for multiple purposes, including acquiring property, renovating existing structures, or funding new construction projects. Recognizing the intended use of the funds can help tailor your financing strategy effectively. Whether you aim to acquire a warehouse, retail location, or hospitality project, we offer a complete variety of financial institutions to meet your requirements, including high street banks and creative private financing groups.

- Refinancing Choices: As your enterprise develops, refinancing your commercial credit may become essential to address evolving requirements. Understanding how to finance a commercial building can help you access better terms or additional funds for growth.

- Successful Loan Applications: For instance, a small enterprise owner who successfully obtained a construction loan for a new retail space illustrated the significance of presenting a robust plan and financial forecasts to financial institutions. With our access to a full suite of lenders, including high street banks and innovative private lending panels, we can help you craft a compelling proposal that meets the heightened expectations of lenders.

By grasping these fundamentals and leveraging the expertise of Finance Story, you will be better equipped to understand how to finance a commercial building and make informed decisions that align with your business goals.

Prepare Your Loan Application: Key Steps

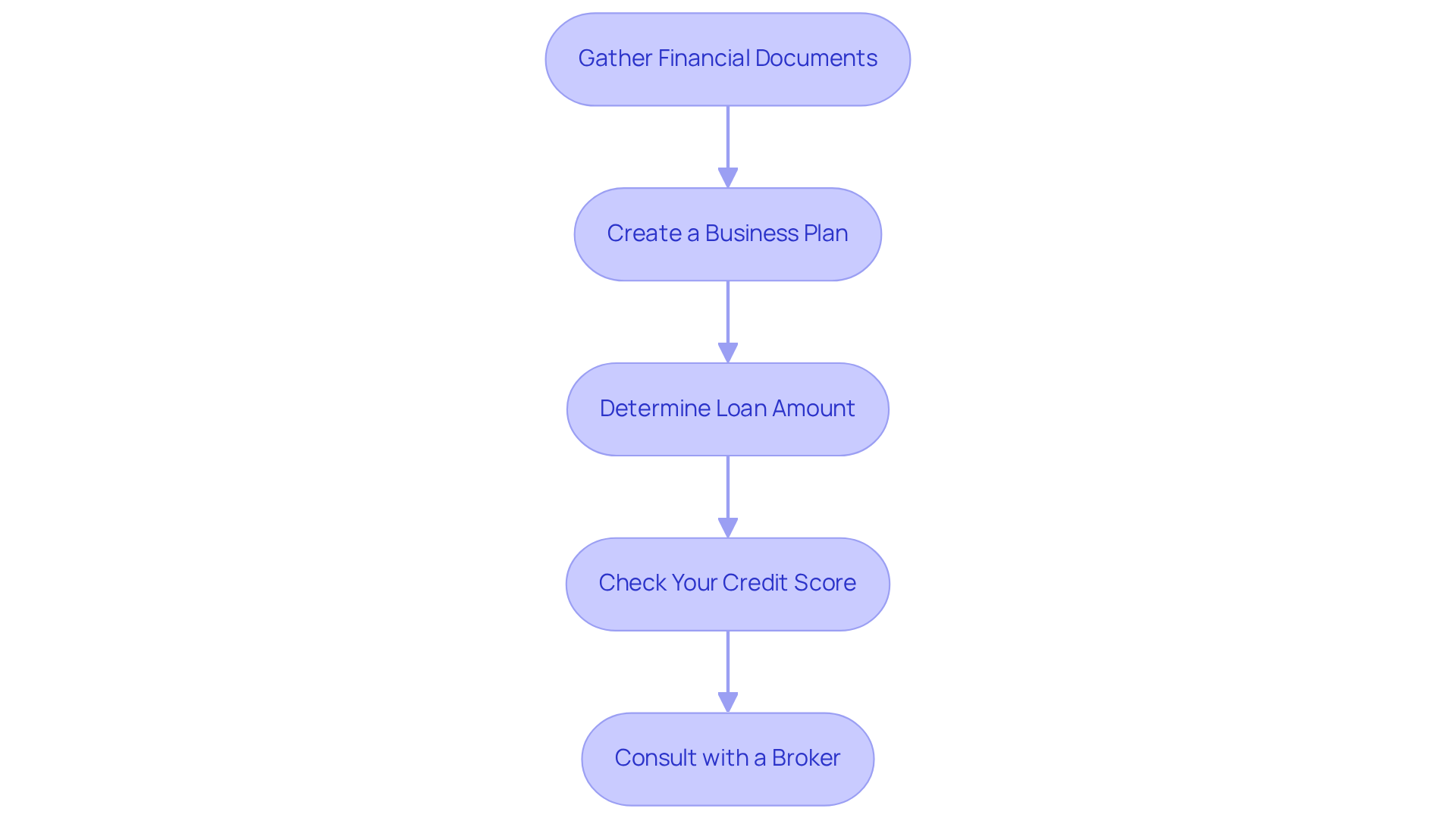

To effectively prepare your loan application, adhere to these crucial steps:

- Gather Financial Documents: Compile essential documents, including tax returns, profit and loss statements, and bank statements from the past two years. These documents offer creditors a clear view of your financial well-being.

- Create a Business Plan: Formulate a detailed business plan that outlines your business model, market analysis, and financial projections. A well-structured plan demonstrates your understanding of the market and your strategy for success.

- Determine Loan Amount: Clearly specify the amount of funding you require and articulate how it will be utilized. This clarity helps lenders assess your needs and the viability of your project.

- Check Your Credit Score: Review your credit report for any discrepancies and address them promptly. A robust credit profile is crucial for obtaining advantageous financing conditions.

- Consult with a Broker: Engage with a mortgage broker who specializes in commercial financing. Their expertise can provide valuable insights and streamline the application process.

By meticulously preparing your application, you significantly enhance your chances of obtaining the financing necessary for understanding how to finance a commercial building.

Know the Lender's Evaluation Criteria

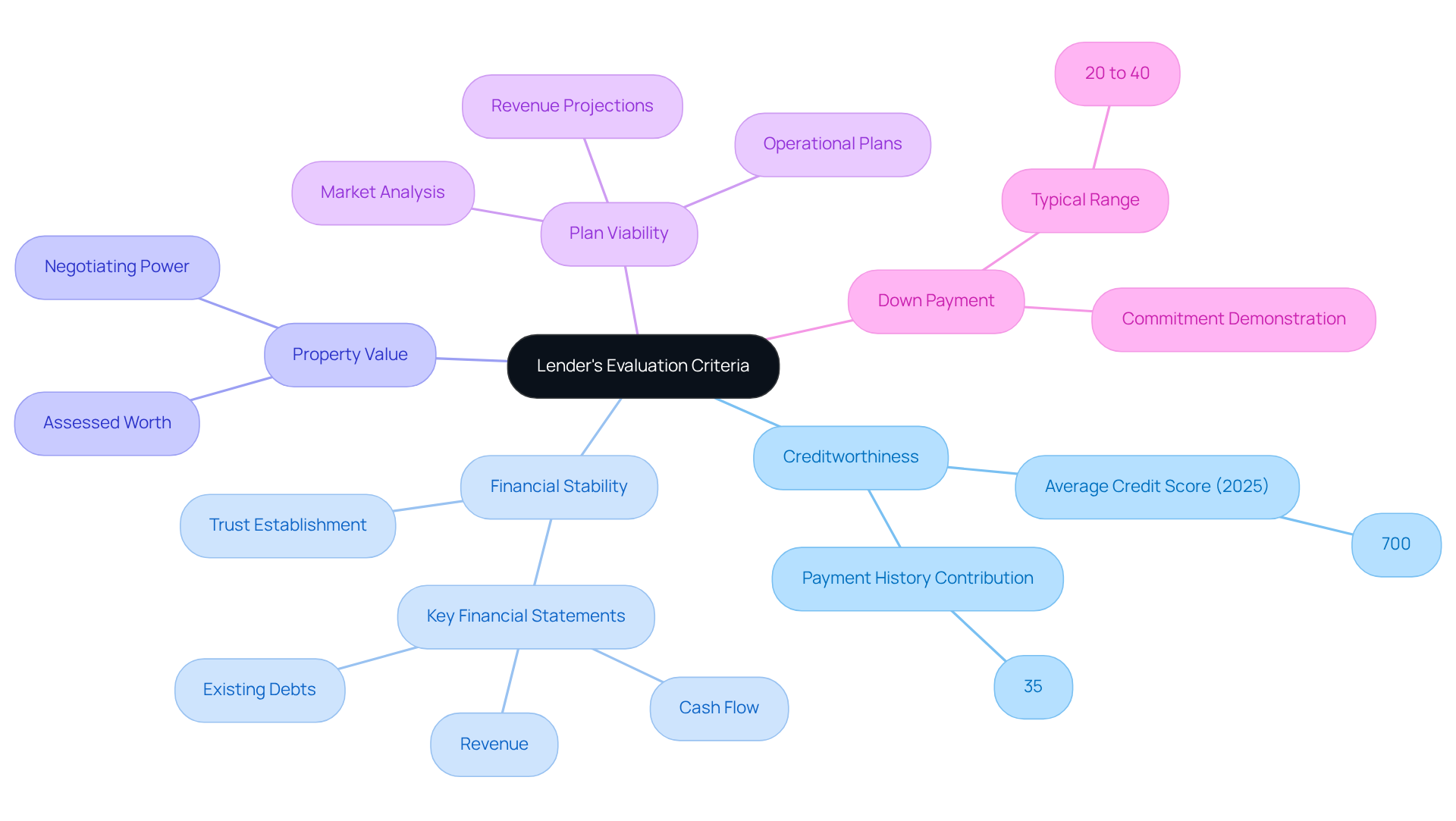

When applying for a commercial loan, lenders assess several critical criteria that can significantly impact your chances of approval.

- Creditworthiness: Your credit score is a pivotal factor in the lender's decision-making process. In 2025, the average credit score of successful commercial financing applicants in Australia is anticipated to be around 700, highlighting the significance of upholding a robust credit history. Notably, payment history contributes 35% to your credit score, underscoring the importance of timely payments in securing favorable loan terms.

- Financial Stability: Lenders will examine your company's financial statements, including cash flow, revenue, and existing debts. Demonstrating stable financial well-being is crucial for establishing trust with prospective creditors. At Finance Story, we specialize in creating polished and highly individualized business cases that effectively showcase your financial stability to lenders.

- Property Value: The assessed worth of the property you intend to acquire or develop acts as security for the financing. A higher property value can enhance your negotiating power and improve loan terms. Our expertise in refinancing can help you leverage your property’s value to secure better financing options.

- Plan Viability: A well-organized plan detailing your approach for profitability can greatly affect a creditor's decision. Highlighting your market analysis, revenue projections, and operational plans is crucial. Our team can help you create a persuasive business plan that meets the expectations of financial institutions.

- Down Payment: Be prepared to provide a substantial down payment, typically ranging from 20% to 40% of the property's value. A larger down payment not only reduces the loan amount but also demonstrates your commitment to the investment. Understanding the subtleties of down payments can assist you in negotiating improved conditions with financial institutions.

Comprehending these standards enables you to customize your application efficiently, enhancing your likelihood of obtaining the funds required for your commercial property investment. Furthermore, at Finance Story, we provide access to a varied selection of lenders, including high street banks and private lending panels, to guarantee you discover the optimal funding solution for your needs.

Explore Financing Options for Your Commercial Building

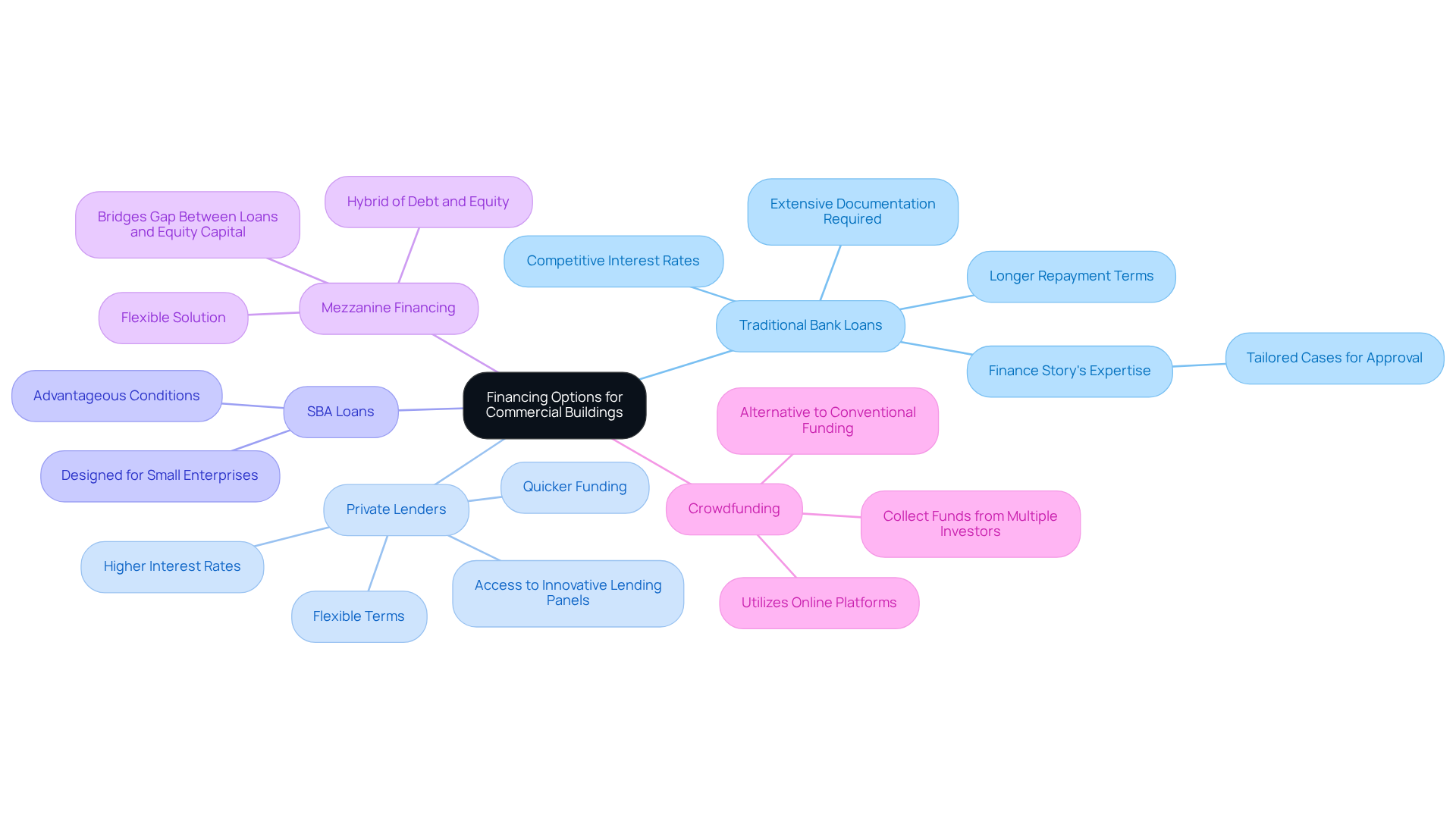

When considering how to finance a commercial building, it's essential to evaluate several options that can meet your needs effectively.

- Traditional Bank Loans: These loans typically offer competitive interest rates and longer repayment terms. However, they may require extensive documentation. Finance Story specializes in creating refined and highly tailored cases to present to banks, significantly enhancing your likelihood of approval.

- Private Lenders: Often more flexible than banks, private lenders can provide quicker funding, though they may charge higher interest rates. With access to innovative and entrepreneurial private lending panels, Finance Story can help you navigate these options effectively.

- SBA Loans: The Small Business Administration provides funding programs designed to assist small enterprises in obtaining capital under advantageous conditions, making them a feasible choice for many.

- Mezzanine Financing: This hybrid of debt and equity funding is particularly useful for companies seeking to bridge the gap between traditional loans and equity capital, offering a flexible solution.

- Crowdfunding: An emerging choice, crowdfunding enables enterprises to collect funds from numerous investors, often via online platforms. This can be an excellent method to accumulate capital without relying on conventional funding sources.

By examining these alternatives and leveraging the expertise of Finance Story, you can discover how to finance a commercial building in a way that aligns with your business objectives.

Review Terms and Conditions of Financing Agreements

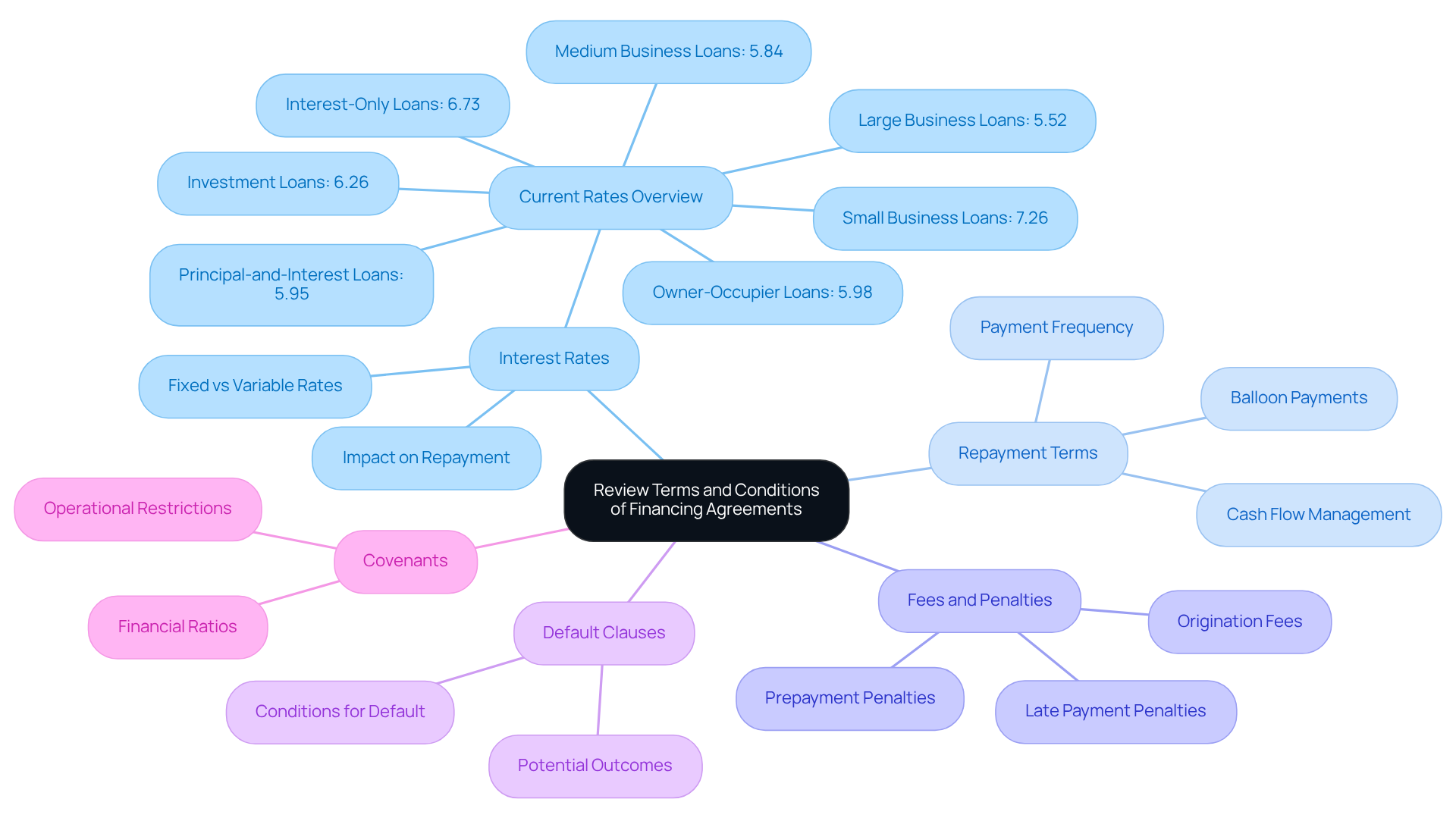

Before entering into any financing agreement, it is crucial to meticulously review the following terms and conditions:

- Interest Rates: Are you aware of whether the interest rate is fixed or variable? As we look toward 2025, commercial financing typically features interest rates that may fluctuate, impacting your overall repayment expenses.

- Repayment Terms: Familiarize yourself with the repayment schedule, including the frequency of payments and any balloon payments required at the end of the term. Understanding these details can significantly enhance your cash flow management.

- Fees and Penalties: Be vigilant about additional fees associated with borrowing, such as origination fees, late payment penalties, or prepayment penalties. These costs can profoundly affect the total amount you pay over the life of the loan.

- Default Clauses: Do you grasp the conditions under which the lender can declare a default? Understanding the possible outcomes can assist you in avoiding situations that might jeopardize your enterprise.

- Covenants: Review any covenants that may impose restrictions on your business operations or require you to maintain specific financial ratios. These stipulations can significantly influence your operational flexibility.

By thoroughly examining these terms, you empower yourself to make informed decisions and mitigate potential pitfalls in your financing journey.

Conclusion

Understanding how to finance a commercial building is essential for any business looking to invest in real estate. The intricacies involved in securing the right funding can seem overwhelming, but with the right knowledge and preparation, it is possible to navigate this complex landscape successfully. By grasping the various loan types, terms, and lender expectations, businesses can align their financing strategies with their goals, ensuring a solid foundation for their investments.

Key insights from this guide emphasize the importance of:

- Familiarizing oneself with different types of commercial loans

- Thoroughly preparing loan applications

- Understanding lender evaluation criteria

Furthermore, exploring various financing options—from traditional bank loans to innovative crowdfunding solutions—can provide the necessary flexibility to meet specific business needs. A careful review of terms and conditions associated with financing agreements is crucial to avoid potential pitfalls that could hinder business growth.

Ultimately, the journey to financing a commercial building is not just about securing funds; it is about empowering businesses to make informed decisions that pave the way for future success. By leveraging available resources and insights, businesses can confidently embark on their commercial real estate ventures, transforming challenges into opportunities and ensuring their investments yield fruitful returns.