Overview

This article outlines four essential steps to secure a commercial real estate investment loan:

- Preparing a strong financial profile

- Navigating the application process

- Addressing common challenges

- Selecting the right lender

It emphasizes the importance of thorough documentation and a solid understanding of financial metrics. Furthermore, the role of personalized guidance from Finance Story is highlighted as a key factor in enhancing the likelihood of approval. By following these steps, readers can position themselves for success in their investment endeavors.

Introduction

In the dynamic realm of commercial real estate, securing the right investment loan stands as a pivotal factor in achieving financial success. With a spectrum of loan types available—from traditional bank loans to innovative private financing options—understanding the nuances of each empowers investors to make informed decisions.

However, the complex application process often raises critical questions:

- What steps must be taken to enhance approval chances?

- How can potential obstacles be effectively managed?

This guide offers a comprehensive roadmap to mastering the commercial real estate investment loan process, ensuring that investors are well-equipped to seize lucrative opportunities.

Understand Commercial Real Estate Investment Loans

Real estate financing loans, specifically commercial real estate investment loans, are tailored for the acquisition, refinancing, or development of business properties. These loans differ significantly from residential loans in terms of conditions, interest rates, and qualification criteria. At Finance Story, we prioritize developing refined and highly personalized business cases to present to banks, ensuring you secure the appropriate funding for your property investments. We provide access to a comprehensive range of lenders, including high street banks and innovative private lending panels, tailored to your specific circumstances.

Key types of commercial loans include:

- Traditional Bank Loans: Offering lower interest rates, these loans require strong credit scores and extensive documentation, making them suitable for well-established businesses.

- SBA Financing: Supported by the Small Business Administration, this funding is particularly advantageous for small enterprises seeking to acquire real estate, providing favorable conditions and reduced down payments.

- Bridge Financing: These short-term arrangements deliver prompt funding, enabling investors to acquire properties while awaiting long-term financial solutions, making them ideal for swift transactions.

- Hard Money Financing: This asset-based funding is simpler to qualify for, although it comes with higher interest rates and is frequently utilized by investors needing quick access to capital.

In 2025, average interest rates for business real estate financing are anticipated to narrow, with mortgage spread averages near 183 basis points, indicating a careful lending atmosphere. Current patterns suggest a resurgence in business property financing, driven by heightened bank involvement and a supportive regulatory environment. Understanding these options and the present market dynamics is crucial for selecting the appropriate commercial real estate investment loan to meet your financial goals. With Finance Story's expertise, you can navigate these complexities efficiently.

Prepare Your Financial Profile and Documentation

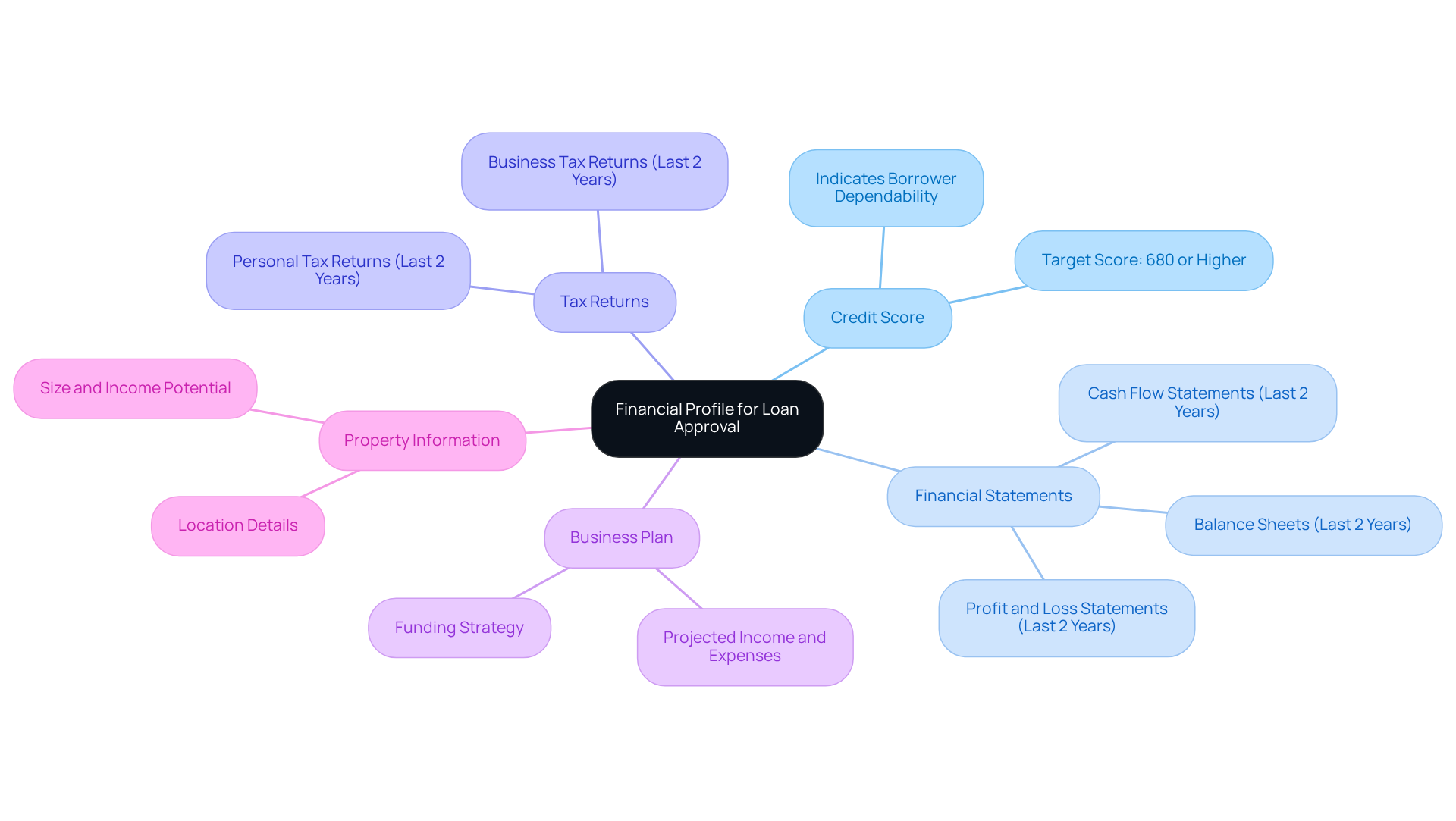

Preparing a comprehensive financial profile is essential to enhance your chances of securing a commercial real estate investment loan. Key components include:

- Credit Score: A healthy credit score is crucial, with a target of 680 or higher significantly improving your chances of approval. A solid credit score indicates your dependability as a borrower, which financial institutions prioritize.

- Financial Statements: Compile your business's profit and loss statements, balance sheets, and cash flow statements for the past two years. These documents provide lenders with a clear picture of your financial health and operational performance.

- Tax Returns: Submit personal and business tax returns for the last two years. This information helps verify your income and financial stability, which are critical for loan assessment.

- Business Plan: A well-organized business plan outlining your funding strategy, projected income, and expenses can greatly enhance your application. It showcases your foresight and readiness to handle the funds effectively.

- Property Information: Include comprehensive details about the property you intend to purchase, such as its location, size, and potential for income generation. This information is essential for financiers to evaluate the project's feasibility.

Arranging these documents beforehand will simplify the application process and demonstrate your readiness to financial institutions, ultimately enhancing your chances of obtaining a commercial real estate investment loan.

Navigate the Application Process Step-by-Step

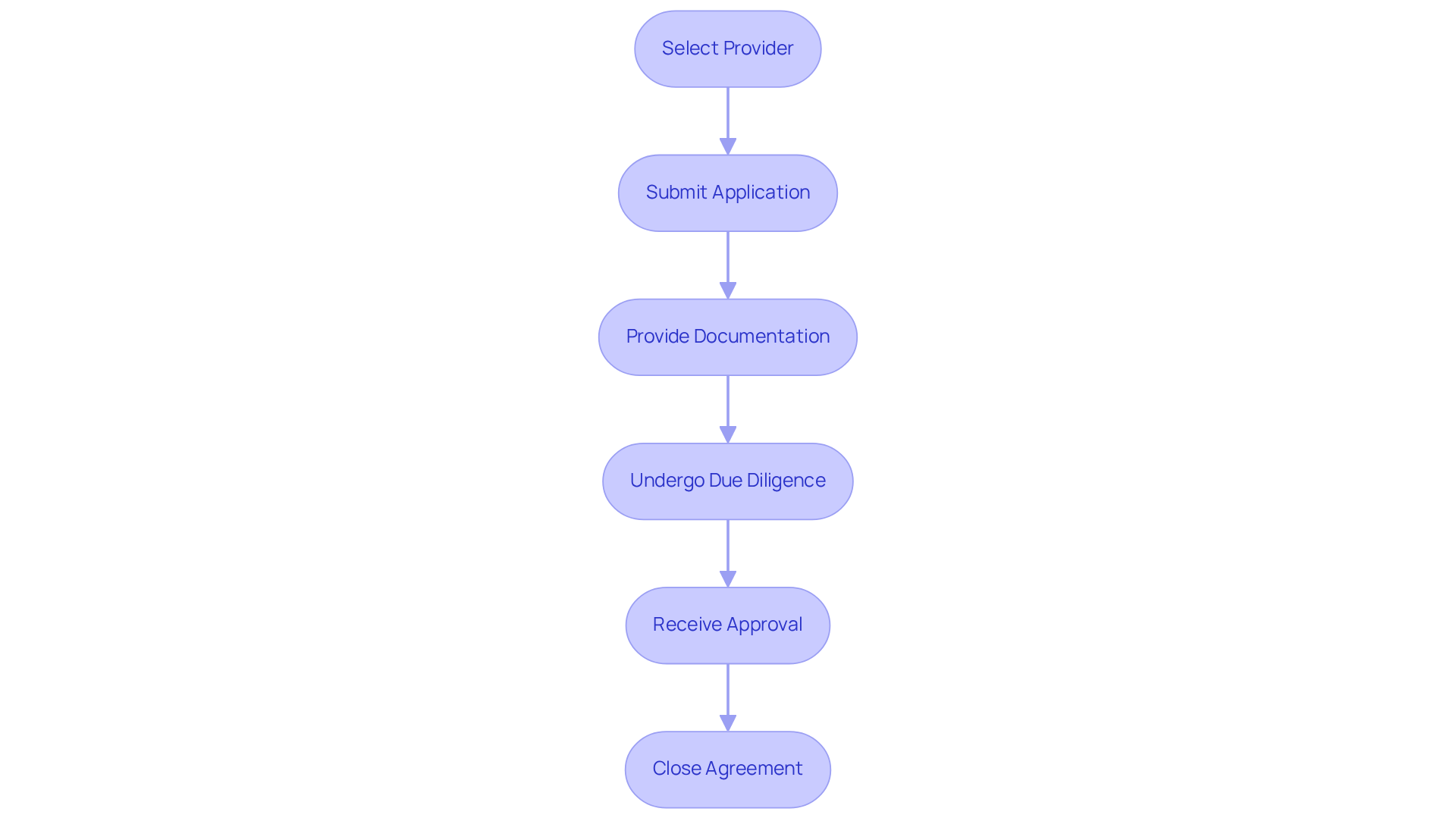

To successfully navigate the application process for your commercial real estate investment loan, follow these essential steps:

-

Select the Appropriate Provider: Identify institutions focusing on business financing. Compare their terms, interest rates, and customer reviews to find the best fit for your needs. In 2025, average approval rates for a commercial real estate investment loan are expected to be competitive, making it essential to choose a financial institution that aligns with your financial goals.

-

Submit Your Application: Complete the financial institution's application form meticulously, ensuring all information is accurate and comprehensive. A well-prepared application can significantly enhance your chances of approval.

-

Provide Documentation: Prepare to submit your financial profile along with any additional paperwork requested by the financial institution. This may include tax returns, financial statements, and business plans, which are vital for the lender's assessment.

-

Undergo Due Diligence: Be ready for a thorough review of your financials and the property. Lenders typically conduct property appraisals and background checks to evaluate the investment's viability.

-

Receive Financing Approval: Upon approval, carefully review the terms of the financing. Understand the repayment schedule, interest rates, and any associated fees to ensure they meet your expectations.

-

Close the Agreement: Once you agree to the terms, the lender will arrange a closing meeting to finalize the financing. Bring all required documents and be ready to sign, indicating the conclusion of your application process.

By following these steps, you can simplify the application procedure and increase your chances of securing a favorable commercial real estate investment loan.

Troubleshoot Common Application Challenges

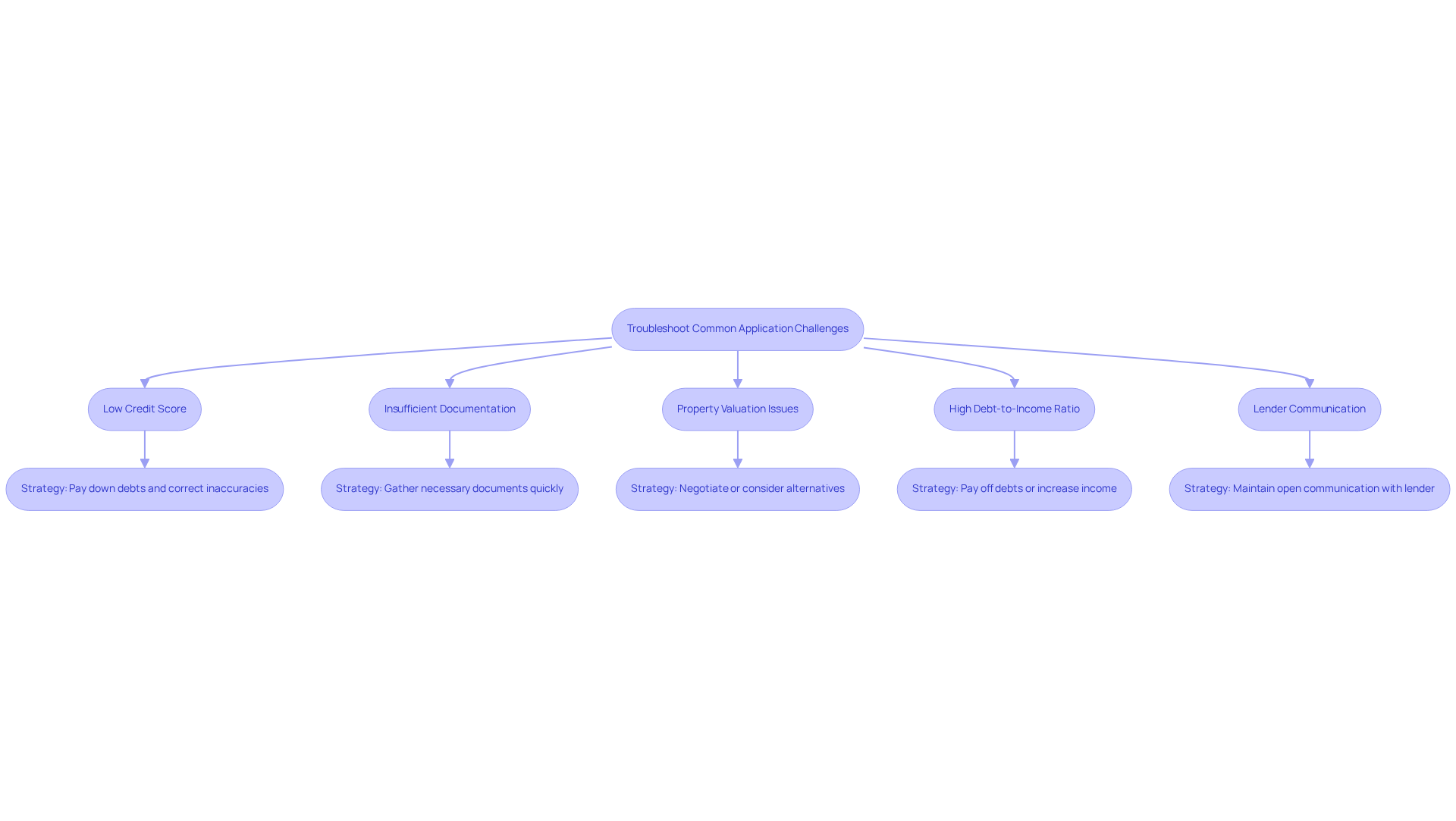

Navigating the challenges of the application process for a commercial real estate investment loan can be quite complex. Common issues and strategies to address them are outlined below, with support from Finance Story:

- Low Credit Score: A credit score below the desired threshold can hinder your application. To improve your score, focus on paying down existing debts and correcting any inaccuracies on your credit report. Finance Story can provide personalized guidance to help you understand your credit profile and suggest steps to enhance it.

- Insufficient Documentation: Having all required documents ready is crucial. Common documentation issues can lead to delays in processing. If a creditor asks for extra information, reply quickly to prevent delays. Finance Story can assist you in gathering the necessary documentation efficiently, ensuring accuracy and completeness.

- Property Valuation Issues: If the property appraisal is lower than anticipated, be prepared to negotiate with the financial institution or consider alternative financing options. Understanding the market value and having comparable sales data can strengthen your position during negotiations. Finance Story's expertise can help you navigate these discussions effectively.

- High Debt-to-Income Ratio: A high debt-to-income ratio can negatively impact your application. To improve this ratio, consider paying off existing debts or increasing your income before applying. Finance Story can provide personalized guidance on handling your finances to satisfy borrowing requirements.

- Lender Communication: Maintaining open lines of communication with your lender is essential. If you encounter issues, don’t hesitate to ask for clarification or assistance. Finance Story emphasizes proactive communication, which can significantly enhance your chances of a successful application.

By addressing these challenges head-on with the support of Finance Story, you can enhance your chances of obtaining a commercial real estate investment loan.

Conclusion

Securing a commercial real estate investment loan is a pivotal step for investors looking to capitalize on lucrative market opportunities. Understanding the various types of loans available—including traditional bank loans, SBA financing, bridge financing, and hard money loans—is essential for making informed decisions that align with financial goals. By preparing a robust financial profile and navigating the application process diligently, investors can significantly enhance their chances of approval.

Key components for success involve:

- Maintaining a healthy credit score

- Compiling detailed financial documentation

- Selecting the right lender

Furthermore, proactively addressing common challenges—such as low credit scores or insufficient documentation—can streamline the application process. With the right strategies and support from experts like Finance Story, potential obstacles can be effectively managed, leading to successful loan acquisition.

Ultimately, the ability to secure a commercial real estate investment loan not only provides the necessary funding for property acquisitions but also empowers investors to thrive in a competitive landscape. By following the outlined steps and leveraging available resources, stakeholders can position themselves for long-term success in the commercial real estate market. Embrace the opportunity to take informed action and unlock the potential of your investment journey today.