Overview

This article delves into essential government loan programs for small and medium enterprises (SMEs), which are vital for their success. It outlines various funding options, such as the SME Recovery Loan Scheme, alongside the eligibility criteria.

How can tailored financing solutions significantly enhance SMEs' access to capital? By fostering growth and stability in a competitive environment, these programs play a crucial role. Understanding these options empowers SMEs to navigate financial challenges effectively.

Introduction

In the ever-evolving landscape of small and medium enterprises (SMEs), securing the right financing can be a defining factor between survival and success. As businesses navigate the complexities of economic challenges, tailored financing solutions have emerged as a beacon of hope, offering customized support that aligns with unique operational needs.

From government-backed loan schemes to innovative private lending options, SMEs now have access to a diverse array of financial resources designed to empower their growth. This article delves into the various financing avenues available, highlights recent changes in loan programs, and showcases inspiring success stories that underscore the transformative power of strategic financial support.

Whether a business is looking to stabilize operations or expand into new markets, understanding these options is crucial for building a resilient future.

Finance Story: Tailored Financing Solutions for SMEs

Finance Story excels in providing tailored financing solutions specifically designed to meet the unique needs of small and medium-sized businesses through SME loans government. By prioritizing a deep understanding of each client's individual circumstances, the brokerage offers a diverse array of services, including commercial property financing, business finance, SMSF funding, and residential home financing. This customized strategy not only enhances access to the most suitable funding alternatives but also significantly increases SMEs' opportunities for success in a competitive environment.

Recent data indicates that the average amount borrowed for needs beyond immediate operational requirements is $112,047. This figure underscores the considerable financial pressures faced by SMEs in securing essential funding, highlighting the critical need for SME loans government that can effectively address these challenges. Furthermore, sectors such as healthcare, social support, and retail together represent nearly 24% of Australia's workforce, illustrating the distinct funding requirements within these industries that Finance Story is well-equipped to address.

Expert insights emphasize that the right loan can stimulate growth. Phil Collard, a lending specialist, stresses the importance of having clear plans in place, including anticipated return on investment (ROI). Finance Story embodies this principle by collaborating closely with small and medium enterprises to develop tailored funding strategies that align with their growth objectives, thereby reinforcing the brokerage's role in facilitating sustainable expansion. Moreover, the alarming statistic of 362,893 small company exits reported in the last financial year illustrates the urgent need for enhanced support systems. Tailored financing strategies, particularly SME loans government, can play a pivotal role in reversing this trend, ensuring that SMEs not only survive but also thrive in their respective markets. By leveraging their expertise and a comprehensive panel of lenders, including mainstream banks and private investors, Finance Story is committed to empowering small businesses with the financial tools they need to succeed. This includes tailored funding solutions for building homes and residential property investments.

SME Recovery Loan Scheme: Key Features and Benefits

The SME Recovery Financing Scheme acts as a vital support mechanism for small and medium enterprises by facilitating access to SME loans government under advantageous conditions. With SME loans government guarantees covering up to 80% of the loan amount, lenders can offer lower interest rates and more flexible repayment options, significantly easing the financial strain on these enterprises. This initiative proves especially crucial as businesses navigate the aftermath of economic disruptions, empowering them to secure essential funding for growth and operational stability through SME loans government.

As we move into 2025, the scheme continues to play a pivotal role, boasting approximately $7.4 billion in credit outstanding, a testament to its widespread adoption among small and medium-sized enterprises. The recent extension of the SME loans government scheme by the Federal government for an additional six months underscores its importance in aiding businesses affected by pandemic-related challenges. Qualified small and medium enterprises can access SME loans government of up to $5 million, which not only aids in refinancing existing debts but also improves cash flow management and supports potential expansion.

Real-world examples illustrate the scheme's impact: numerous small and medium-sized enterprises have successfully leveraged these financial resources to stabilize their operations and invest in growth opportunities. However, it is critical to recognize that while SME loans government guarantees enhance funding access, banks still retain the responsibility for assessing creditworthiness, potentially complicating the approval process. As industry specialists emphasize, understanding the intricacies of the SME loans government scheme is essential for SMEs to align it with their funding needs and organizational frameworks.

At Finance Story, we are dedicated to crafting customized loan proposals that meet the unique requirements of your organization. Our expertise in financing solutions for commercial property investments ensures that you can navigate the complexities of securing funding effectively. As Marie Ryan, Director and Accredited Finance Broker, advises, "It is important to seek advice to determine whether the scheme meets your funding needs and business structure." Additionally, the liability limitation provided by a scheme approved under Professional Standards Legislation offers further reassurance to SMEs navigating this financial landscape.

To discover how we can assist you in securing the right financing solutions, schedule your free personalized consultation with Shane Duffy, our Head of Funding Solutions, and let us help you create your next chapter.

Eligibility Criteria for Government SME Loan Programs

Qualifying for SME loans government funding programs in Australia necessitates adherence to specific eligibility criteria. Typically, this involves maintaining an annual turnover below a designated threshold, often set at $250 million, and being registered and actively operating within the country. Furthermore, companies must demonstrate a feasible operational model and provide proof of negative impacts from economic circumstances, such as those encountered during the COVID-19 pandemic, to qualify for recovery funding.

In 2025, it is estimated that approximately 70% of SMEs will meet these government loan eligibility requirements, indicating a substantial opportunity for enterprises to secure essential funding. Financial analysts emphasize the importance of understanding these criteria, as they significantly influence an organization's ability to access vital financial assistance. As Peter King, CEO of Westpac, stated, "The SME Recovery Loans assist small enterprises in obtaining funding to sustain their operations until lockdowns are lifted and the economy returns to normal."

When assessing your capacity to repay a loan, lenders will evaluate the strength of your company's profits, ensuring it can comfortably manage repayments for all loans, including those against new commercial property. This is where the expertise of Finance Story becomes invaluable; they specialize in crafting polished and highly individualized cases that effectively present your financial situation to lenders. A clear strategy and cash flow forecasts for at least the next 12 months are crucial to demonstrate your understanding of the enterprise and its growth potential.

For instance, a case study involving a small retail venture that successfully navigated these requirements illustrates how a clear strategic plan and documentation of economic impact can facilitate financing. This example underscores the broader context of government support and its significance for small and medium-sized enterprises, particularly in challenging times.

Overall, understanding the eligibility requirements for SME loans government programs is essential for small enterprises aiming to leverage available funding opportunities effectively.

Types of Government-Backed Loans for SMEs

The financing options available through SME loans government in Australia encompass a variety of programs designed to assist small enterprises with their development and operational needs. Among the key offerings is the SME loans government Recovery Loan Scheme, which offers essential financial support to companies recovering from the pandemic's impacts. Additionally, the SME loans government guarantee scheme enhances access to finance for small enterprises. Specific grants for innovation and technology upgrades further diversify the funding landscape available to these businesses.

Each type of credit presents distinct characteristics, including interest rates, repayment terms, and eligibility criteria. For instance, the SME Recovery Loan Scheme offers competitive interest rates and flexible repayment options, making it an attractive choice for enterprises aiming to stabilize and expand. Conversely, the SME Guarantee Scheme facilitates access to credit by providing lenders with a government-backed assurance, thereby mitigating the risks associated with lending to smaller enterprises.

Statistics indicate that SME loans government-supported financing has been pivotal in helping SMEs, with a significant portion of small enterprises utilizing these loans to enhance their financial stability. Real-world examples underscore the effectiveness of these financing options; for example, a local manufacturing SME successfully utilized the SME Recovery Funding Scheme to invest in new equipment, resulting in increased production capacity and job creation.

Expert opinions further emphasize the importance of understanding the nuances of these financing options. Industry leaders advocate for targeted financial measures to bolster SME success, asserting that tailored support can greatly influence economic development. Shane, the Founder and Funding Specialist Director at Finance Story, highlights the necessity of crafting tailored financing proposals that align with specific organizational needs, ensuring that small and medium enterprises can effectively navigate the complexities of funding. As Anna Bligh, CEO of the Australian Banking Association, remarked, "Customers don’t have to tough it out on their own; banks have a range of practical measures to assist those facing financial stress."

By thoroughly exploring the various financing options available, including SME loans government, SMEs can make informed decisions that align with their specific needs and growth objectives.

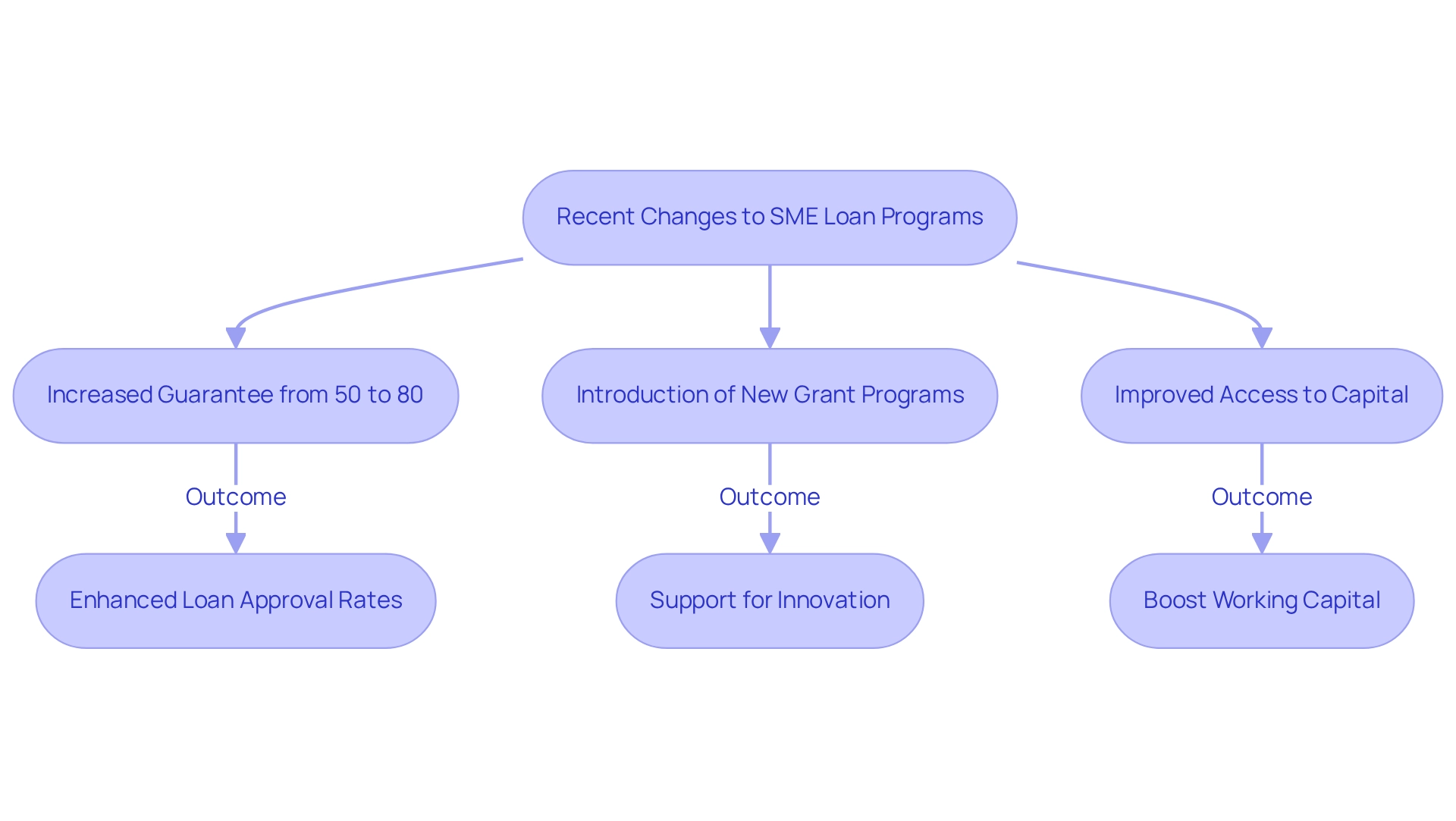

Recent Changes to SME Loan Programs: What You Need to Know

Recent modifications to the SME loans government programs have significantly enhanced access to capital for small enterprises across Australia. Notably, the government has increased the guarantee percentage from 50% to 80% for select financial products, which enhances the availability of SME loans government and enables lenders to extend credit to a broader range of businesses. This adjustment is crucial in the current economic climate, as it empowers small and medium enterprises to secure SME loans government funding to address challenges and seize growth opportunities.

In addition to the heightened guarantees, the introduction of new grant programs aimed at sectors like technology and sustainability highlights the government's dedication to fostering innovation and resilience through SME loans government initiatives. These initiatives not only offer immediate financial relief but also promote long-term investment in vital industries.

The impact of these changes is already evident, with numerous small and medium enterprises reporting improved access to capital through SME loans government and better loan approval rates. For example, the Australian Banking Association has observed a positive reception to the 2025-26 Federal Budget, which seeks to bolster confidence in the financial system while addressing the urgent needs of businesses confronting economic challenges. As Anna Bligh, CEO of the ABA, remarked, "Customers don’t have to tough it out on their own and banks have a range of practical measures to assist those facing financial stress." This proactive approach is essential for ensuring that SMEs can thrive in a post-COVID-19 environment.

Moreover, the transition towards smaller-scale, short-term funding carries implications for investment, productivity, competitiveness, and resilience, further underscoring the significance of these loan programs. As the SME financing landscape evolves, the increased guarantees from the SME loans government are expected to play a pivotal role in enhancing the competitiveness and resilience of small enterprises, ultimately contributing to a more robust economy.

Additionally, companies like Earlypay are actively engaging in the SME loans government initiative, providing services such as Invoice Finance and Equipment Finance to bolster working capital for SMEs. This illustrates how certain organizations are leveraging these programs to support small enterprises in their financial journeys.

To explore how these changes can benefit your company, we invite you to schedule a free personalized 30-minute consultation with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your needs and objectives, and let us assist you in crafting your next chapter. Please select a suitable time from our live calendar.

Cash Flow Management: A Critical Factor in SME Loan Success

Effective cash flow management is essential for small and medium-sized enterprises (SMEs) seeking sme loans government, particularly when crafting tailored proposals for commercial property investments. Did you know that approximately 37% of small enterprise owners have considered closing their businesses due to late payment issues? This statistic underscores the critical need for robust cash flow practices.

Maintaining accurate financial records, forecasting cash flow needs, and optimizing receivables and payables are not just strategies; they are vital components of financial health. By demonstrating strong cash flow management, SMEs can significantly enhance their credibility with lenders, which facilitates easier access to sme loans government. This credibility becomes even more crucial when presenting refined and personalized proposals to banks, as it showcases financial stability and preparedness.

Furthermore, integrating cash flow forecasting software can streamline the tracking and management of cash flow, ensuring businesses remain financially agile. Financial advisors consistently emphasize that effective cash flow is a cornerstone of success when applying for sme loans government. Thus, it is imperative for small and medium enterprises to prioritize these practices.

To improve their chances of obtaining financing, SMEs should actively implement cash flow management techniques, especially when seeking to refinance or acquire commercial properties.

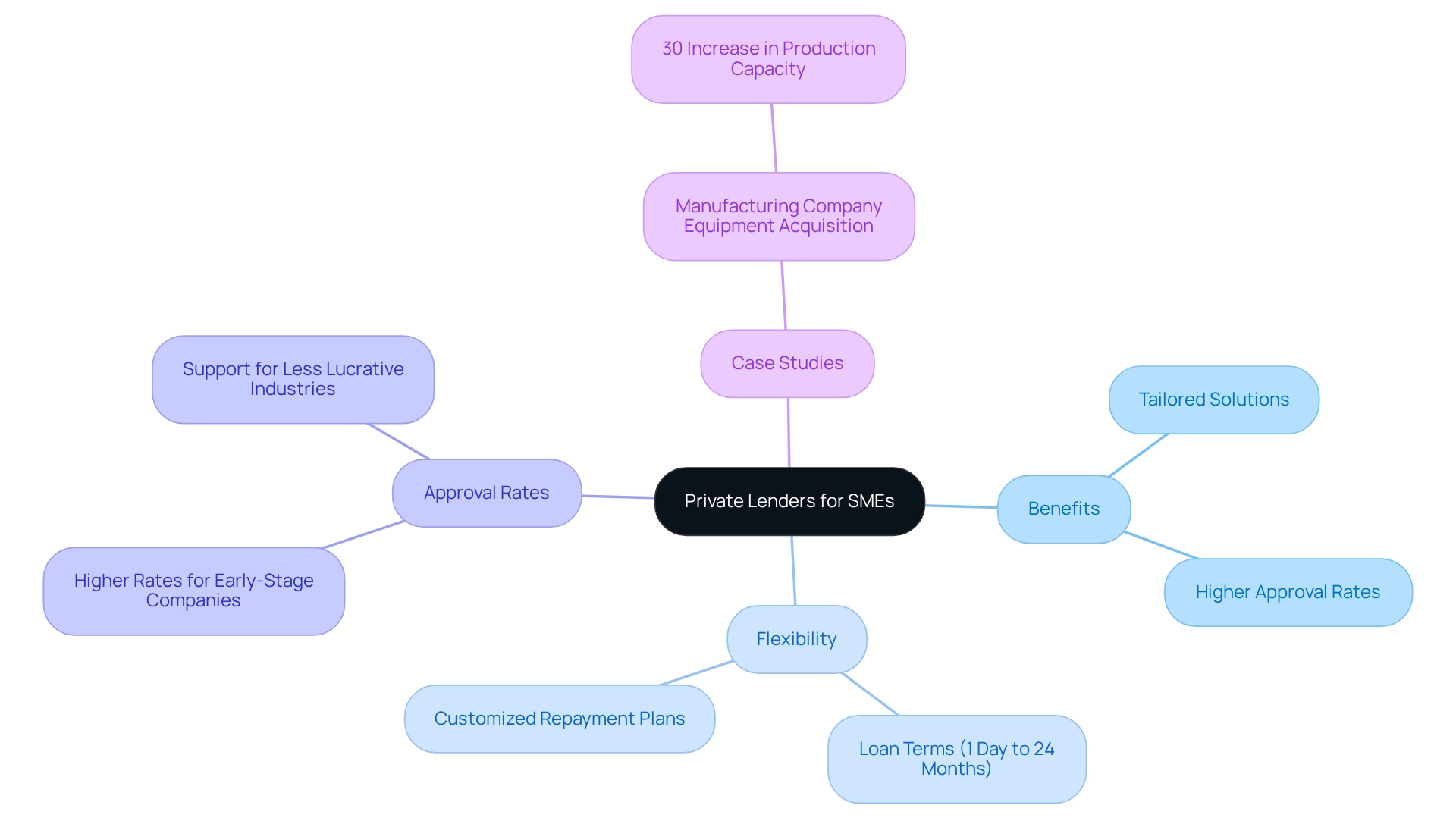

Private Lenders: Alternative Financing Options for SMEs

Private lenders present a viable alternative to conventional bank funding, often offering more flexible terms and expedited approval processes. These lenders typically cater to specific sectors or funding needs, such as short-term loans or equipment financing, making them particularly appealing for small and medium enterprises (SMEs) facing challenges with traditional loans, especially when considering SME loans government. As of 2025, the private lending landscape has transformed, with numerous SMEs successfully utilizing these options to overcome financial obstacles. For instance, Finance Story specializes in crafting refined and highly tailored business cases for banks, aiding clients in securing appropriate funding for their commercial property investments. A recent case study highlighted how a small manufacturing company accessed private funding to acquire vital equipment, resulting in a remarkable 30% increase in production capacity within six months.

The benefits of private lenders for SMEs in Australia are significant. They frequently boast higher approval rates compared to traditional banks, especially for early-stage companies or those in less lucrative industries, where obtaining financing can be particularly difficult. Statistics indicate that loan terms from private lenders can range from as short as one day to 24 months, providing businesses with the flexibility to choose a repayment plan that aligns with their cash flow. This adaptability is crucial, especially in light of the Reserve Bank Board's interest rate decision on April 1, 2025, which affects borrowing costs.

Furthermore, financial experts underscore the advantages of private lending for small businesses. Private lenders can offer customized solutions tailored to the unique needs of SMEs, facilitating a more personalized approach to funding. This flexibility is vital in a fluctuating economic climate, where traditional banks may enforce stricter lending criteria. In summary, while SMEs should meticulously evaluate the terms of loans, including SME loans government options, to ensure alignment with their financial strategies, the prospect of quicker access to funds and tailored solutions renders private lenders an attractive option in the current funding landscape. The resilience and growth potential of SMEs emphasize the importance of exploring diverse funding avenues, including SME loans government and private lending, to bolster their success. Finance Story provides access to a comprehensive array of lenders, ensuring that businesses can find the right funding solution for their specific requirements.

Navigating the Application Process for SME Loans

Navigating the application process for SME loans government can indeed pose challenges; however, a systematic approach can make it more manageable. SMEs should initiate this journey by gathering essential documentation, typically comprising financial statements, detailed plans, and recent tax returns. Understanding the specific requirements of potential lenders is crucial; this research enables the tailoring of applications to meet their expectations. A well-prepared application that articulates the organization's needs and demonstrates repayment capacity can significantly enhance the chances of approval.

At Finance Story, we specialize in crafting refined and highly personalized cases to present to banks, ensuring that your application stands out. Our expertise in customized funding proposals for commercial property investments empowers us to assist you in navigating the complexities of obtaining the right support. We provide access to a comprehensive range of lenders, including high street banks and innovative private lending panels, tailored to your unique circumstances. Whether you are looking to finance a warehouse, retail premise, factory, or hospitality venture, we have the right solutions for you.

Statistics reveal that nearly half of black business owners face loan denials, underscoring the importance of presenting a strong case. This statistic is vital for all small and medium-sized enterprises, as it highlights the broader difficulties many encounter in securing SME loans government. Furthermore, a recent study indicates that while 58% of SMEs feel confident in seeking external finance, including SME loans government options, this confidence has waned, emphasizing the need for thorough preparation and support.

As Sheila Johnson, co-founder of BET, reflects, "When I was younger, there was something in me. I had passion... it’s this little engine that roars inside of me, and I just want to keep going and going." This passion is crucial for small enterprise owners as they pursue funding.

To further enhance the application process for SME loans government, small business owners should seek expert advice on best practices. Financial consultants often recommend focusing on clarity and detail in applications, proactively addressing potential concerns lenders may have, and understanding common challenges such as insufficient credit history or lack of collateral. By implementing these strategies and leveraging the knowledge of Finance Story, small to medium-sized enterprises can navigate the intricacies of financing requests more efficiently and enhance their likelihood of obtaining the funding they require. Reach out to us today to discover how we can support you in your funding journey.

Success Stories: SMEs Thriving with Government Loan Support

Many small and medium enterprises (SMEs) have effectively harnessed SME loans government funding initiatives to drive their growth and success. For example, a small manufacturing firm utilized the SME loans government Recovery Loan Scheme, which enabled not only an expansion of operations but also an increase in production capacity and the creation of new jobs. In a similar vein, a tech startup accessed government-backed funding to innovate and develop cutting-edge products, resulting in substantial market growth. These compelling success stories highlight the tangible benefits of government support, demonstrating how SME loans government can strategically finance and empower SMEs to thrive.

Significantly, companies that have engaged with these programs have reported a remarkable 78% rise in net sales, underscoring the profound impact of SME loans government funding on promoting SME growth. With the percentage of profitable companies climbing to 4.8%, it is evident that many enterprises exhibit resilience to financial shocks, further motivating others to explore these invaluable funding opportunities. As Akos Horvath remarked, "We are thankful to Missaka Warusawitharana at the Board of Governors of the Federal Reserve System," which emphasizes the critical role of supportive financial structures.

Testimonials from enterprise owners reinforce the transformative effect of these funds, illustrating that SME loans government assistance can indeed serve as a catalyst for sustainable growth and innovation. Moreover, understanding the challenges involved in the empirical analysis of subsidized financing can provide a more nuanced perspective on their impact, as outlined in recent research. Collaborating with specialists such as Finance Story can enhance these initiatives, focusing on developing refined and customized proposals that meet the evolving needs of SMEs seeking to refinance or secure personalized financing for commercial property investments.

Finance Story offers access to a diverse range of lenders, including high street banks and innovative private lending panels, ensuring that SMEs can identify the optimal financing solutions for various property types, whether they be warehouses, retail premises, factories, or hospitality ventures.

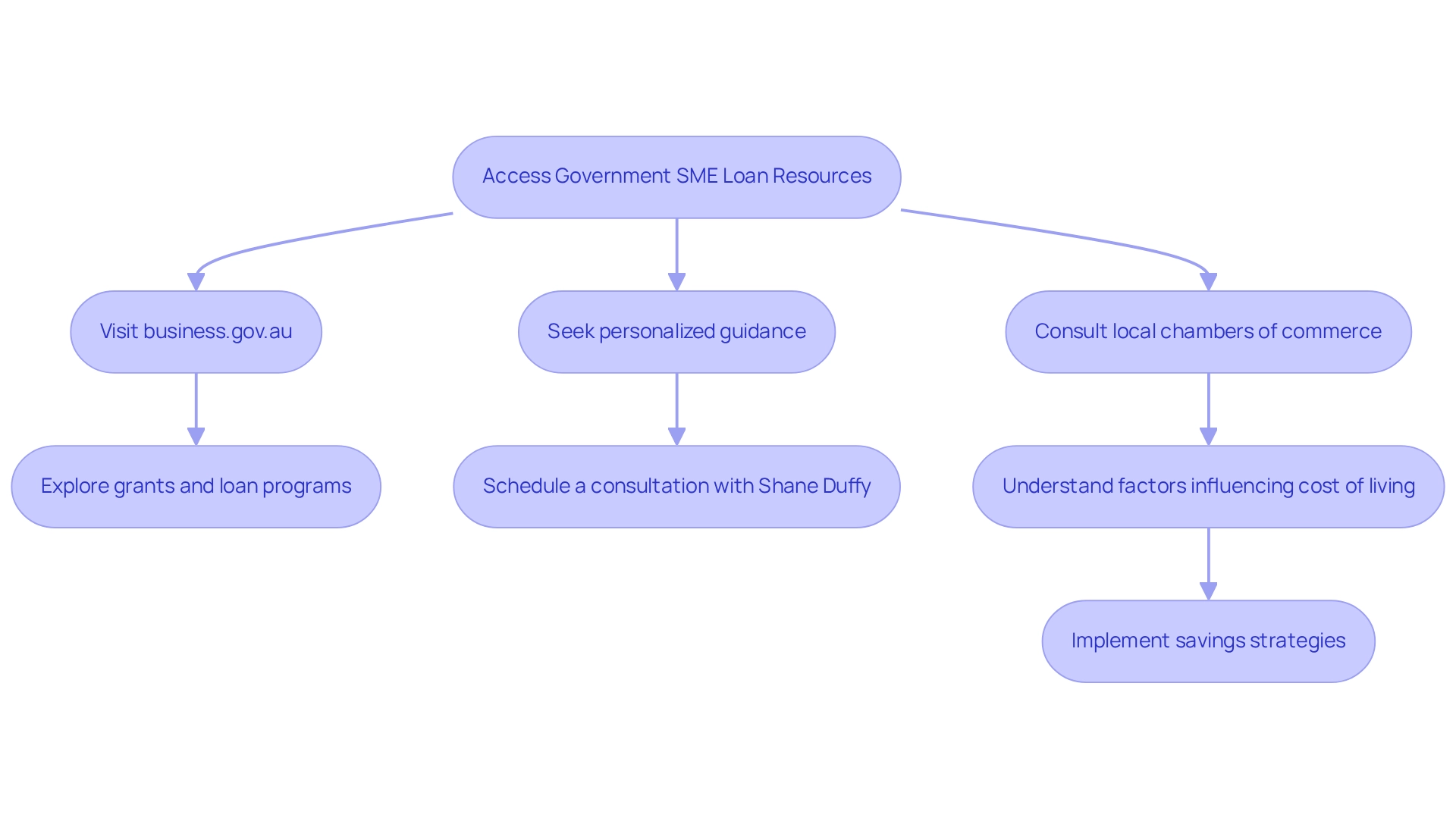

Get Started: Accessing Government SME Loan Resources

To effectively access SME loans government resources, enterprises should start by exploring official platforms such as business.gov.au. This site offers a wealth of information on available grants and loan programs specifically designed for small companies. Additionally, local chambers of commerce and advisory services play a crucial role, providing personalized guidance to navigate the often complex application processes.

Recent statistics reveal that Aussie households are grappling with approximately $2.7 billion in collective Christmas debt, underscoring the financial pressures faced by small and medium enterprises. This situation highlights the importance of tapping into government resources, including SME loans government, for support. Furthermore, case studies demonstrate that businesses adapting to rising living costs have successfully utilized these programs to secure essential funding. For instance, understanding the factors influencing the cost of living and applying straightforward savings strategies can significantly assist small and medium-sized enterprises in extending their budgets.

As legendary investor Philip Fisher noted, "The stock market is filled with individuals who know the price of everything, but the value of nothing," emphasizing the importance of recognizing the value of government resources. By leveraging these valuable tools, SMEs can enhance their chances of obtaining SME loans government assistance, which is crucial for their development and success.

To further assist you, we invite you to schedule your free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your specific needs and goals, whether for business or home, and let us help you create your next chapter. Select a convenient time from our live calendar to get started.

Conclusion

The landscape of financing for small and medium enterprises (SMEs) has evolved significantly, offering a plethora of tailored solutions to meet diverse business needs. With options ranging from government-backed loan schemes to innovative private lending, SMEs can now access the financial support necessary to navigate challenges and seize growth opportunities. Understanding eligibility criteria and the application process is crucial, as these factors play a vital role in securing funding.

Recent changes to loan programs, such as increased government guarantees and the introduction of new grant initiatives, further enhance access to capital for SMEs. These developments underscore the government's commitment to supporting small businesses in their recovery and growth, particularly in the wake of economic disruptions. Success stories of SMEs thriving with government loan support serve as powerful reminders of the transformative impact that strategic financing can have on business outcomes.

In conclusion, the right financing solutions can be a game-changer for SMEs striving to build resilience and drive growth. By leveraging tailored financial resources and expert guidance, businesses can position themselves for success in a competitive landscape. As the financing environment continues to evolve, exploring diverse funding options remains essential for SMEs looking to achieve their operational and expansion goals. Embracing these opportunities can pave the way for a brighter, more sustainable future.