Overview

Securing business loans for new ventures in Australia requires a solid understanding of the various loan types available and a well-prepared application. To enhance your chances of approval, consider these essential steps:

- Start by crafting a comprehensive business plan that outlines your vision and strategy.

- Next, organize your financial statements to present a clear picture of your financial health.

- Finally, clearly define the purpose of the loan, as this demonstrates your preparedness and financial acumen to potential lenders.

By following these guidelines, you not only increase your chances of securing funding but also position yourself as a credible candidate in the eyes of lenders.

Introduction

In the dynamic realm of Australian entrepreneurship, comprehending business loans is crucial for overcoming financial obstacles and capitalizing on growth opportunities. As small businesses increasingly depend on various loan types to realize their ambitions, it is vital to understand the differences between:

- Secured and unsecured loans

- Short-term versus long-term financing

- The intricacies of low doc options

This article explores the complexities of business loans in Australia, providing insights on:

- Preparing for loan applications

- Examining diverse financing options

- Adeptly navigating the application process

By equipping business owners with the essential knowledge to confront common challenges, it seeks to empower them to make informed decisions that align with their distinct financial goals.

Understand the Basics of Business Loans in Australia

In Australia, business loans for new enterprises serve as essential financial tools for addressing a variety of funding needs. A solid understanding of the different loan types is crucial for making informed decisions:

- Secured Loans: These loans require collateral, which can lead to lower interest rates. However, they also pose a risk to the assets pledged.

- Unsecured Financing: Unlike secured options, these do not require collateral, making them accessible but often accompanied by higher interest rates due to the increased risk for lenders.

- Short-term Financing: Ideal for prompt cash flow needs, these options are usually settled within a year, offering quick access to funds.

- Long-term Financing: Designed for significant investments, these funds are repaid over multiple years, enabling companies to support growth initiatives.

Understanding these borrowing categories is vital for aligning funding alternatives with your objectives and financial situation. By 2025, small enterprises, which employ over 5 million individuals in Australia, are increasingly utilizing these funds to navigate economic challenges and seize growth opportunities. For instance, low doc loans have emerged as a popular choice for businesses lacking detailed financial records, focusing instead on cash flow, providing quick processing despite higher interest rates and limited borrowing amounts.

At Finance Story, we specialize in developing refined and highly personalized case studies to present to banks, ensuring you secure the appropriate funding for your commercial property investments or refinances. We provide access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, tailored to meet your specific circumstances. Interest rates fluctuate based on your unique situation, as no two enterprises are the same.

There are no hidden costs or fees; all details will be clearly outlined before any commitment. This transparency is essential for small business owners to fully understand the terms of their financing. Familiarizing yourself with these options will enable you to select the most suitable business loans for new enterprises in Australia that cater to your specific needs.

Navigating financing options can be complex, but understanding the types of credit, their benefits, and the application process empowers entrepreneurs to make informed decisions.

Prepare Your Business for Loan Application

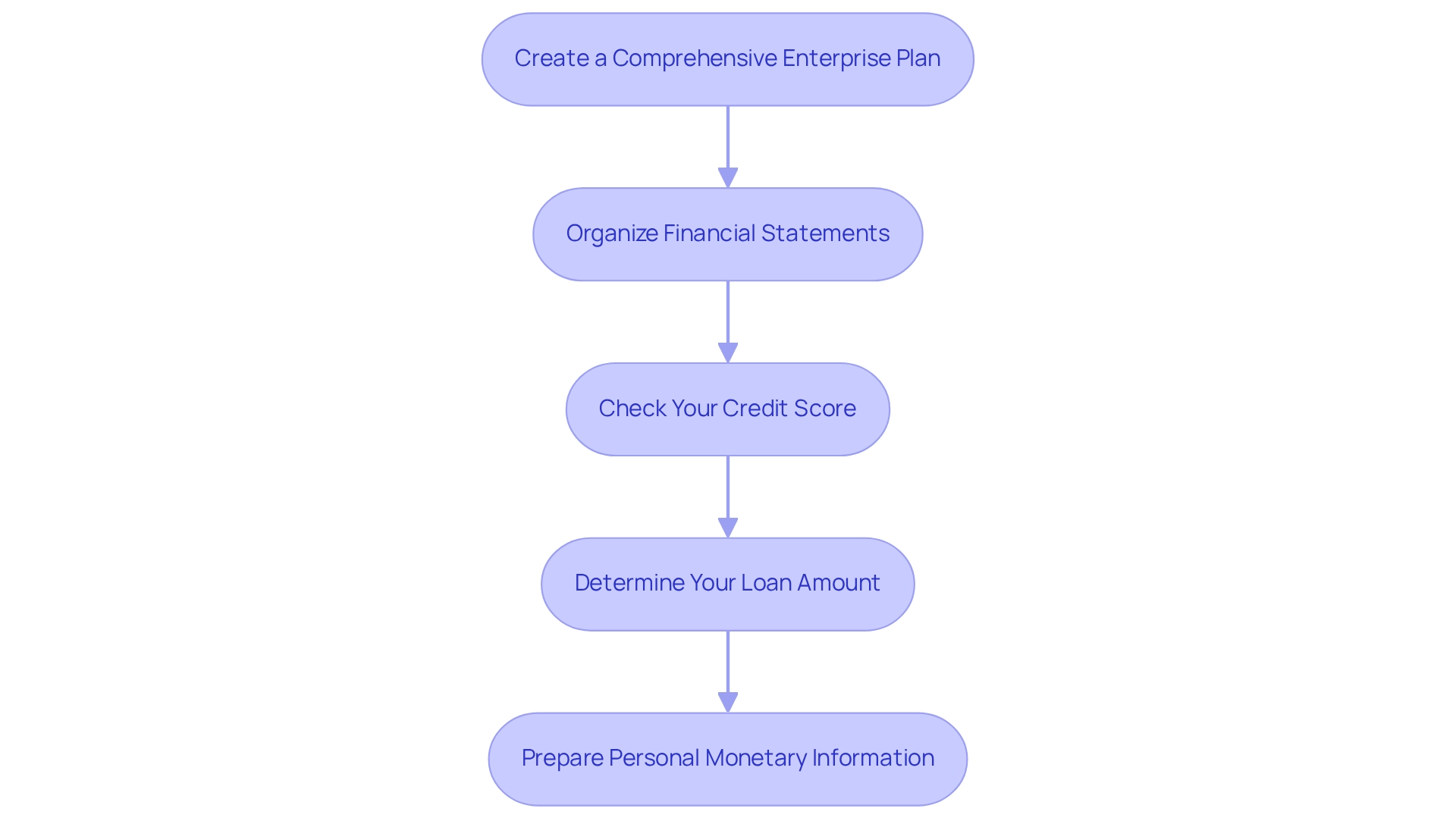

To effectively prepare your enterprise for a loan application, consider the following essential steps:

- Create a Comprehensive Enterprise Plan: Your plan should outline your model, market analysis, and financial forecasts. A well-organized plan not only highlights your vision but also assures financiers that you have a strategic method for achieving success. At Finance Story, we focus on developing refined and highly personalized proposals to present to banks, boosting your likelihood of approval.

- Organize Financial Statements: Compile your profit and loss statements, balance sheets, and cash flow statements for at least the past two years. These documents are essential as lenders will assess your monetary well-being based on this information. Grasping the financial consequences of business financing on your capital is crucial, as it can greatly influence your company's future.

- Check Your Credit Score: A strong credit score is essential for obtaining approval. Obtain your credit report and rectify any discrepancies prior to your application. For instance, the minimum credit score needed for an SBA financing option is typically around 680 or higher, underscoring the importance of maintaining good credit. Keep in mind, personal credit can also influence your financing choices, as personal borrowing can assist in speeding up growth.

- Determine Your Loan Amount: Clearly articulate the amount of funding you require and specify how it will be utilized. This clarity assists creditors in comprehending your financial requirements and intentions. Significantly, 9% of loans are requested for reasons other than expansion, emphasizing the varied needs of small enterprise owners. Collaborating with Finance Story will provide you access to a comprehensive range of financial institutions, helping you discover the right business loans for new business Australia for your specific situation, whether you are acquiring a warehouse, retail space, factory, or hospitality project.

- Prepare Personal Monetary Information: If you operate as a sole trader or small enterprise owner, be ready to supply personal monetary details, including income statements and tax returns. This information is often necessary for lenders to evaluate your overall monetary situation. Furthermore, bear in mind that numerous small enterprise finances are offered by banks with fewer than $250 billion in assets, highlighting the significance of small banks in the economy.

By adhering to these steps, you can improve your odds of obtaining the capital required to expand your enterprise. Remember, a well-prepared application demonstrates your commitment and readiness to handle the financial obligations that accompany borrowing.

Explore Different Types of Business Loans

When investigating financial options, it is crucial to comprehend the various categories available to meet your specific requirements:

- Term Financing: This type of funding provides a lump sum that is repaid over a fixed duration, making it suitable for significant investments such as acquiring real estate or expanding operations. Notably, in December 2024, the value of new credit commitments for property acquisitions reached $20.53 billion, underscoring the demand for these financing alternatives and reflecting a broader trend in enterprise financing.

- Credit Lines: This flexible financing option allows businesses to access funds as needed, making it ideal for managing cash flow fluctuations. Many Australian enterprises utilize business loans for new business Australia to ensure liquidity, particularly during unforeseen expenses or slow revenue periods.

- Equipment Financing: Specifically tailored for acquiring equipment, this loan type uses the equipment itself as collateral. This can be a strategic choice for companies looking to invest in essential tools without depleting cash reserves.

- Invoice Financing: This option enables businesses to borrow against their unpaid invoices, providing quick access to cash. It is especially beneficial for companies with lengthy payment cycles, allowing them to sustain operations without interruption.

- Government Grants and Loans: Numerous government initiatives offer financial support to new enterprises, often with favorable conditions. These can be a valuable resource for startups in Australia seeking to alleviate their financial burden while establishing their operations through business loans for new business Australia.

- Financing Options: Businesses can pursue business loans for new business Australia from both banks and alternative sources, each presenting various terms and conditions. At Finance Story, we focus on crafting refined and highly personalized proposals to present to financial institutions, ensuring you secure the appropriate funding for your commercial property investments or refinances. We offer a comprehensive selection of financial institutions tailored to your situation, whether you are purchasing a warehouse, retail space, factory, or hospitality business. Exploring different lender options enables companies to discover the most advantageous financing conditions to meet their monetary needs. Each funding category has distinct characteristics and advantages, making it essential to thoroughly evaluate your company's requirements to select the most suitable alternative. Understanding the current trends in financing types for 2025, including the cautious approach to capital investment, can further inform your decision-making process.

Navigate the Business Loan Application Process

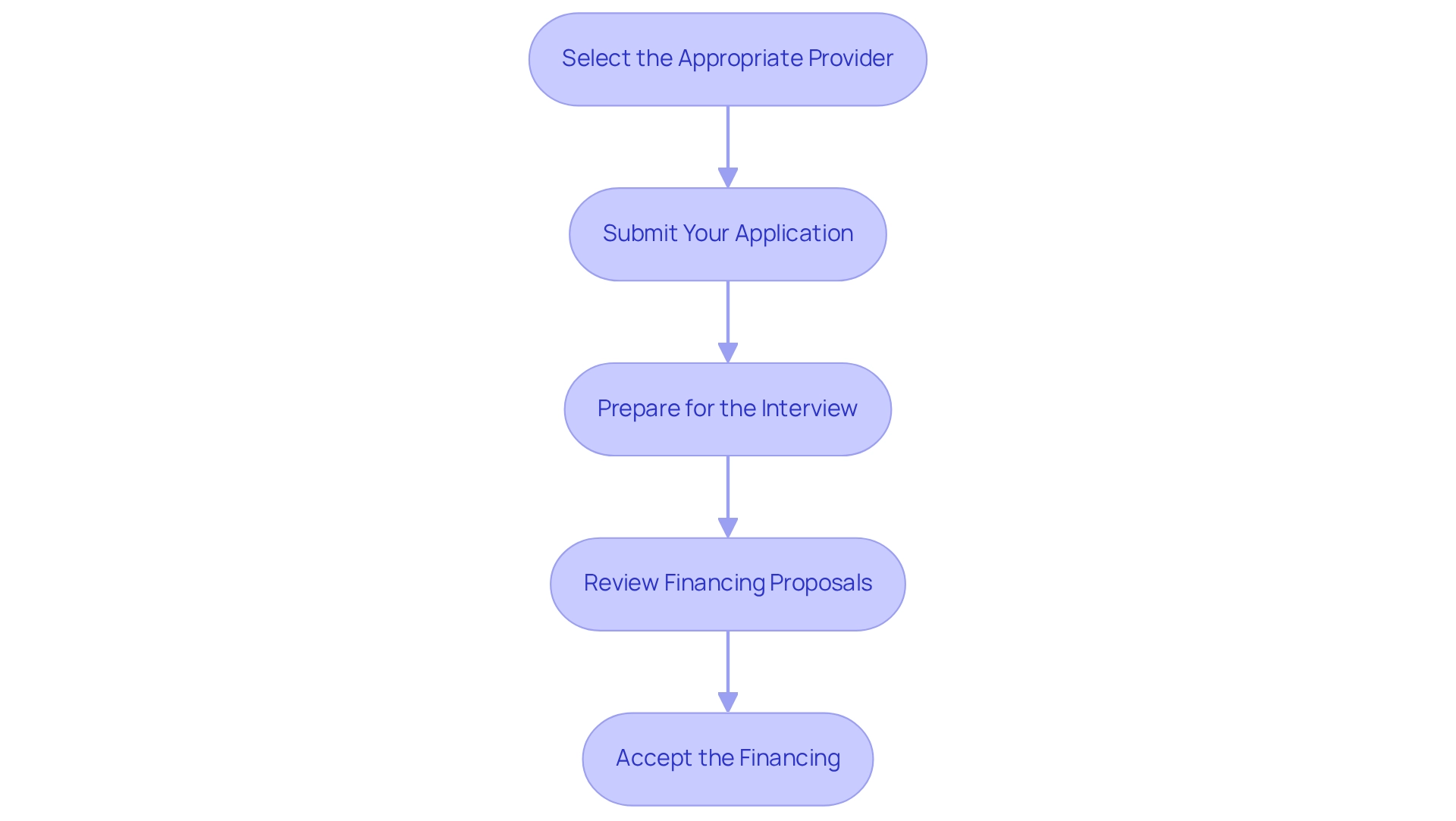

To successfully navigate the business loan application process, consider these essential steps:

- Select the Appropriate Provider: Conduct thorough research on various financial institutions to identify those that offer terms best suited to your enterprise type and financial needs. It is crucial to compare offers based on interest rates, repayment terms, and fees to make an informed decision. In June 2024, loan commitments for property purchases reached $22.22 billion, underscoring the potential availability of funds for small enterprises. At Finance Story, we specialize in connecting you with a comprehensive range of financial institutions, including high street banks and innovative private lending options, ensuring you discover the ideal business loan solutions for new businesses in Australia.

- Submit Your Application: Complete the application form with meticulous attention to detail, ensuring that all requested information and documentation are accurate and complete. This diligence can significantly influence the approval process. Our expertise in crafting refined and highly tailored applications can assist you in presenting a compelling case to potential financiers.

- Prepare for the Interview: Be ready for a potential interview with the lender. This is your opportunity to delve into your business plan and financial projections, demonstrating your preparedness and comprehensive understanding of your business. Showcasing your knowledge can enhance your credibility and improve your chances of securing approval.

- Review Financing Proposals: After submitting your application, you will receive financing offers. Take the time to compare these offers carefully, focusing on interest rates, repayment terms, and any associated fees. The typical borrowing amounts for owner-occupier residences in Australia vary significantly by state, with the highest average in New South Wales at $449,000 and the lowest in Tasmania at $243,000. Understanding these regional differences can greatly influence your decision.

- Accept the Financing: Once you have identified the most advantageous offer, scrutinize the agreement carefully before signing. Ensure that you fully comprehend all terms and conditions to avoid any unforeseen surprises.

By adhering to these steps, you can streamline your loan application process and enhance your chances of obtaining business loans for new businesses in Australia. Additionally, it is vital to recognize that minority-owned enterprises often face unique economic challenges, as highlighted in the 2017 Reports from the 2016 Small Business Credit Survey. This underscores the importance of seeking customized financial solutions.

As Bankrate states, "While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service," emphasizing the necessity of comparing offers from various lenders.

Troubleshoot Common Loan Application Issues

Troubleshoot Common Loan Application Issues

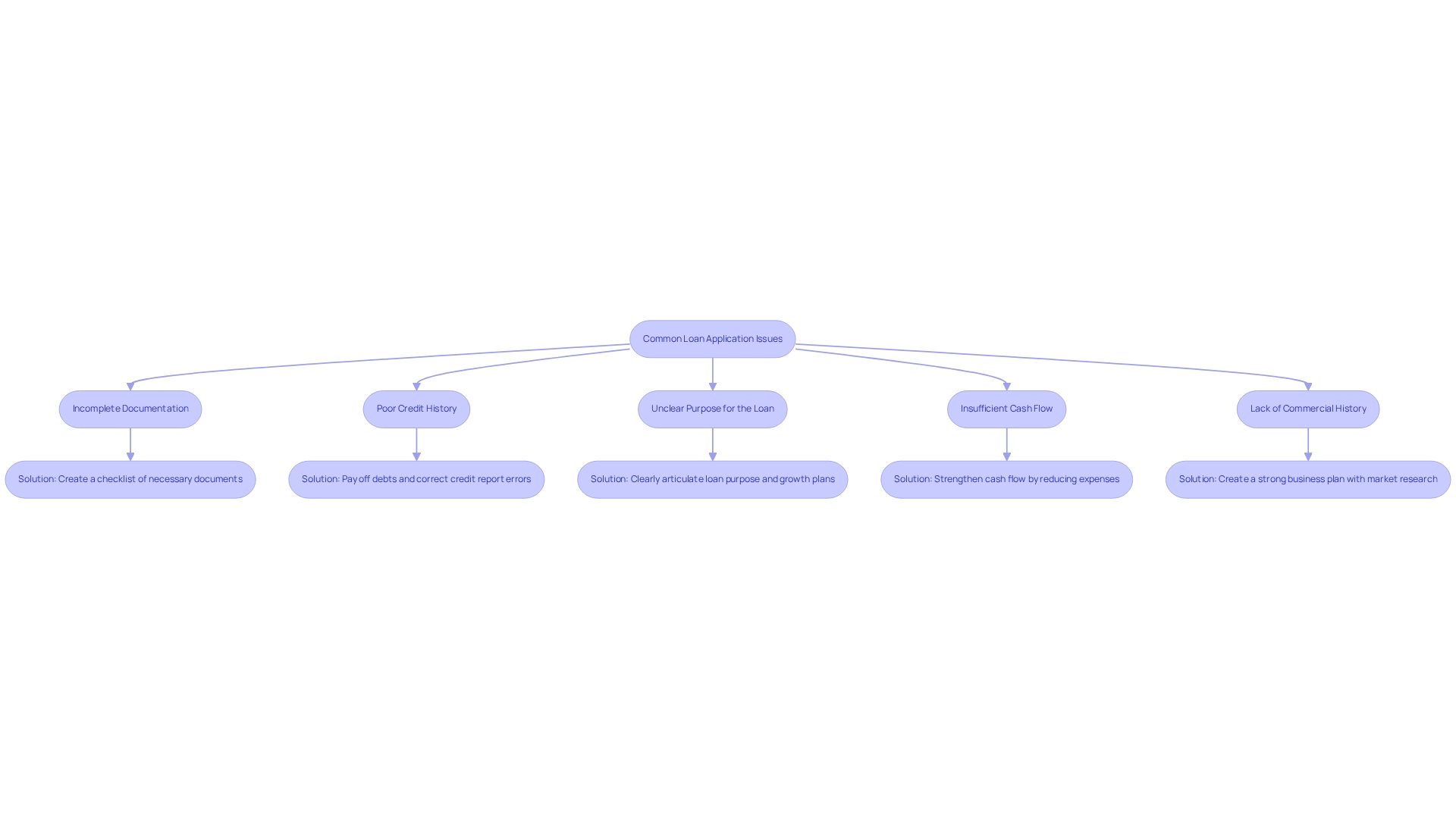

Navigating the loan application process can be challenging for small business owners. Understanding common issues that may arise, along with effective strategies to address them, is crucial for success.

- Incomplete Documentation: One of the most frequent pitfalls is failing to submit all required documents. Missing information can significantly delay or even derail your application. To avoid this, create a checklist of necessary documents and ensure everything is in order before submission.

- Poor Credit History: A low credit score can obstruct your opportunities for obtaining financing. To improve your credit score, consider paying off outstanding debts and correcting any errors on your credit report. Regularly reviewing your credit report can help you identify and address discrepancies that may negatively impact your score. For example, before seeking a mortgage, it is essential to review your credit report for mistakes or inconsistencies that could adversely affect your credit score. Correcting any errors can help prevent possible problems during the mortgage application process, thereby enhancing your chances of approval.

- Unclear Purpose for the Loan: Lenders prefer applicants who can clearly articulate how they intend to use the funds. Be specific about your plans and show a direct connection between the loan and your growth. This clarity can enhance your credibility and increase your chances of approval.

- Insufficient Cash Flow: Weak cash flow can be a red flag for lenders. Before applying, explore ways to strengthen your cash flow, such as reducing unnecessary expenses or implementing strategies to boost sales. A healthy cash flow not only enhances your application but also bolsters the sustainability of your enterprise.

- Lack of Commercial History: New enterprises often encounter difficulties in obtaining loans due to restricted operational history. To counter this, create a strong plan that outlines your goals, strategies, and potential for growth. Highlighting your market research and financial projections can instill confidence in lenders.

Addressing these common issues proactively can significantly enhance your chances of securing business loans in Australia. As Phil Collard, a lending expert, observes, "The appropriate loan facility can be a highly effective tool to boost growth, so ensure you have your plans clearly outlined, including anticipated ROI." Additionally, with 60% of SMEs expecting their business to grow in the next year, securing the right financing is more crucial than ever.

By preparing thoroughly and understanding the lending landscape, you can navigate the application process more effectively.

Conclusion

Understanding the intricacies of business loans in Australia is essential for entrepreneurs aiming to navigate financial challenges and seize growth opportunities. This article has outlined the various types of loans available, including secured and unsecured loans, as well as short-term and long-term options. Each type serves distinct purposes and aligns differently with business needs, emphasizing the importance of selecting the right financial product for specific situations.

Preparation is key when applying for a loan. Developing a comprehensive business plan, organizing financial statements, and maintaining a solid credit score are critical steps that can significantly enhance the likelihood of approval. By clearly articulating funding needs and demonstrating financial health, business owners can present a compelling case to lenders that showcases their commitment and readiness to manage financial responsibilities.

Navigating the application process requires diligence and strategic planning. From choosing the right lender to submitting a meticulous application and preparing for potential interviews, every step contributes to a smoother experience. Furthermore, addressing common issues such as incomplete documentation and unclear loan purposes can further bolster an application, ensuring that businesses are well-positioned to secure the funding they need.

Ultimately, equipping oneself with knowledge about business loans and the application process empowers entrepreneurs to make informed decisions that align with their financial goals. As the landscape of Australian small business financing continues to evolve, staying informed and prepared will remain critical for achieving sustainable growth and success in the competitive marketplace.