Overview

This article identifies the leading loan providers for small and medium enterprises (SMEs) that offer tailored business financing solutions. It highlights various lenders, including:

- Finance Story

- Commonwealth Bank

- Prospa

These providers are committed to delivering customized solutions, significantly enhancing SMEs' chances of securing funding in a competitive market. By focusing on the specific requirements of businesses, these lenders stand out as valuable partners in navigating the financing landscape.

Introduction

In a rapidly evolving financial landscape, small and medium enterprises (SMEs) are increasingly seeking tailored solutions to meet their unique funding needs. With a diverse range of options available—from bespoke mortgage brokerage services to innovative lending platforms—businesses now have more resources than ever to navigate financial complexities.

As SMEs contribute significantly to the economy, understanding various financing solutions, including bank loans, alternative funding, and industry-specific options, is crucial for their growth and sustainability.

This article delves into the myriad of financial services designed specifically for SMEs, highlighting key providers and emphasizing the importance of personalized approaches in securing the right funding for success.

Finance Story: Tailored Solutions for SMEs

In the competitive finance sector, Finance Story sets itself apart by delivering bespoke mortgage brokerage services tailored specifically for SMEs and their unique needs, catering to SME loan providers. With SMEs contributing approximately two-thirds of Australia’s workforce, the firm prioritizes understanding the distinct financial requirements of each client. This commitment is reflected in its extensive panel of lenders, which includes mainstream banks, private lenders, and angel investors, facilitating a diverse range of financing solutions such as:

- Commercial property loans

- Enterprise finance

- SMSF loans

- Residential home loans

- Expat mortgages

By adopting a personalized approach, Finance Story significantly enhances the likelihood of SMEs securing the most suitable funding options from SME loan providers, thus improving their chances of success in a challenging economic landscape. The company takes pride in fostering long-lasting relationships with clients, collaborating to craft robust proposals that resonate with lenders. This ongoing collaboration ensures that clients receive customized financial solutions that align with their specific situations and objectives.

Recent trends indicate that personalized financial solutions provided by SME loan providers play a crucial role in influencing SME success rates, enabling enterprises to navigate financial complexities more effectively. The SME Finance Forum supports industry innovations and underscores the importance of tailored solutions in the SME sector, particularly those offered by SME loan providers, further highlighting the relevance of Finance Story's offerings. For example, the integration of digital tools in corporate banking, as noted by Rajeev Chalisgaonkar from Mashreq Bank, has streamlined processes and improved customer experiences for SMEs. This trend underscores the significance of innovative funding solutions in today’s market and aligns with Finance Story's commitment to leveraging such advancements.

Expert insights, such as those from Malcolm Roberts, the Productivity Commissioner, emphasize that while identifying the right product can be challenging, the advantages of tailored solutions are considerable. By incorporating this perspective, Finance Story’s dedication to understanding and addressing the unique challenges faced by SMEs positions it as a trusted partner in achieving financial goals efficiently and effectively.

Commonwealth Bank: Comprehensive Business Loan Options

Commonwealth Bank provides a robust array of financing options tailored to meet the diverse needs of SME loan providers for small and medium enterprises (SMEs). Their offerings encompass organized term credits, commercial overdrafts, and customized funding solutions, all designed to address the unique requirements of each enterprise. With competitive interest rates and flexible repayment terms, Commonwealth Bank establishes itself as a premier choice among SME loan providers for those seeking capital for growth and expansion.

In 2025, the average interest rates for commercial loans in Australia are anticipated to remain favorable, presenting an opportune moment for SMEs to explore SME loan providers as viable funding alternatives. Notably, Commonwealth Bank has reported a significant increase in the number of successful SMEs utilizing their funding solutions, underscoring the bank's commitment to fostering growth. The average renovation amount stands at $55,250, exemplifying the types of financing SME loan providers extend to SMEs.

However, it is crucial to acknowledge the controversies that have affected Commonwealth Bank's reputation, including a historic $10 million fine for wage theft in 2024 and a $700 million payout related to misleading consumers in 2018. These incidents underscore the critical importance of compliance and transparency within the financial sector. Financial analysts have recognized the effectiveness of structured term financing for small enterprises, particularly in providing predictable repayment plans that facilitate cash flow management. This organized approach, combined with the bank's reputation for reliability, positions Commonwealth Bank as a trusted partner for SMEs and SME loan providers navigating their financial journeys.

As the Australian economy shows signs of recovery in early 2025, SMEs are encouraged to leverage these favorable conditions and investigate financing options offered by SME loan providers like Commonwealth Bank to bolster their growth strategies. Furthermore, collaborating with specialists such as Finance Story can enhance the funding proposal process, ensuring that businesses present refined and tailored cases to lenders, ultimately increasing their chances of securing the necessary capital.

Prospa: Fast and Flexible Business Loans

Prospa distinguishes itself as a leading provider of rapid and adaptable financial solutions, specifically catering to SMEs in need of swift access to funds. With loan amounts ranging from $5,000 to $500,000 and terms from 3 to 36 months, Prospa's efficient application process enables businesses to secure financing in as little as 24 hours. This rapid turnaround is critical for SMEs, particularly when seeking to capitalize on growth opportunities or address unforeseen expenses.

In 2025, the average credit amount for SMEs in Australia indicates a growing demand for financing options, with many businesses acknowledging the importance of quick capital access. Notably, companies must be operational for either 1 year or 6 months to qualify for a small enterprise loan. Financial experts highlight that timely funding can significantly impact an organization's ability to thrive in competitive markets. As one expert noted, "However, there are other types of funding options that can be considered for supporting your enterprise including: Peer to Peer Lending, Merchant Cash Lending, Crowdfunding, Borrowing from family and friends." Prospa's innovative approach is transforming the financing landscape, empowering enterprises to navigate financial challenges effectively.

Recent case studies underscore how Prospa's rapid financial solutions have enabled SMEs to overcome obstacles and achieve their goals. One notable case study, 'Common Mistakes in Credit Requests,' identifies frequent errors made by small enterprises when preparing credit applications, which can lead to delays and complications. By avoiding these pitfalls and being equipped with essential documents, organizations can enhance their chances of securing necessary funding. Prospa's commitment to streamlining the financing process ensures that SME loan providers allow businesses to focus on growth rather than becoming bogged down by paperwork.

As the financing landscape evolves, Finance Story's expertise in crafting customized funding proposals complements Prospa's offerings, highlighting the importance of understanding repayment criteria and providing a comprehensive range of lenders to meet the unique needs of businesses. This collaboration strengthens the reputation of both entities as trusted partners in the journey toward financial success.

OnDeck: Dedicated Funding for Small Enterprises

OnDeck stands as a leader in providing specialized funding options tailored specifically for minor businesses, with amounts available for selection starting at $50,000. Their innovative Lightning Loans deserve special mention, offering rapid access to capital with approval times averaging just a few hours. This swift turnaround is essential for SMEs grappling with cash flow challenges or looking to invest in growth initiatives through sme loan providers. Financial analysts emphasize that quick access to capital significantly enhances a small enterprise's ability to seize opportunities and tackle operational challenges effectively.

At Finance Story, we understand that crafting a loan proposal for your upcoming project requires expertise, knowledge, and skill to meet the increasing expectations surrounding fund acquisition. We prioritize the creation of refined and highly customized proposals to present to banks, ensuring you secure the funding you need. Our extensive network encompasses a comprehensive range of lenders, from high street banks to innovative private lending panels, catering to various commercial property types such as warehouses, retail premises, factories, and hospitality ventures. Understanding business credit scores is crucial for obtaining financing and enhancing creditworthiness, particularly for SMEs that may face difficulties due to poor credit ratings. Numerous success stories illustrate how SMEs have effectively leveraged sme loan providers like OnDeck's Lightning Loans to navigate financial obstacles and achieve their growth objectives. For those confronting challenges stemming from bad credit, various lenders, including those from Finance Story, are prepared to offer loans, underscoring the importance of comprehending loan terms and exploring alternative lending options. With a steadfast commitment to understanding the unique needs of minor enterprises, Finance Story remains an indispensable partner among sme loan providers on the journey toward achieving financial stability and success. As author Jeffrey Gitomer aptly states, 'Failure is not about insecurity, it’s about lack of execution.

Westpac: Competitive Financing for Small Businesses

Westpac presents a diverse array of competitive financing options meticulously designed for enterprises, encompassing both secured and unsecured loans, overdrafts, and bespoke funding solutions. Their unwavering commitment to supporting SMEs is evident through flexible repayment terms and personalized service—critical elements for businesses navigating financial challenges. As we look to 2025, Westpac is dedicated to enhancing its offerings, ensuring small enterprises have the necessary capital to thrive.

Secured financing, backed by collateral, often provides lower interest rates, rendering it an attractive option for SMEs and their loan providers aiming to minimize costs. Conversely, unsecured financing allows for quicker access to capital without the need for collateral, appealing to enterprises that may not possess substantial assets. Financial experts assert that the choice between secured and unsecured loans should align with an organization's financial strategy and risk appetite.

Successful SMEs have leveraged funding solutions from loan providers like Westpac to spur growth. For example, companies utilizing Westpac's tailored lending solutions have reported notable enhancements in cash flow and operational capacity. A case study titled "Tailored Lending Solutions" illustrates how Finance Story specializes in crafting polished and highly customized cases for banks, increasing the chances of clients securing favorable financing terms for their commercial property investments and refinances. This service significantly contributes to their overall financial success.

As of 2025, Westpac remains a premier choice for small enterprises, with data indicating that the vehicle or equipment financed must be five years old or less—an important consideration for SMEs and their loan providers regarding equipment acquisitions. Moreover, Canstar's 2024 award for Most Satisfied Customers – Business Bank underscores Westpac's dedication to exceptional service. Their commitment to innovation and adaptability in the lending process positions them as a reliable partner for businesses striving to achieve their financial objectives.

Zip Business: Quick Access to SME Financing

Zip Business distinguishes itself through rapid access to SME loan providers, enabling loan approvals to be finalized often within hours. This speed is essential for small enterprises that require immediate financial assistance to manage cash flow, purchase inventory, or capitalize on growth opportunities. The application process is designed to be straightforward, allowing businesses to navigate it seamlessly without the cumbersome delays associated with traditional lenders. Notably, all applications can be completed entirely online, further enhancing convenience for entrepreneurs.

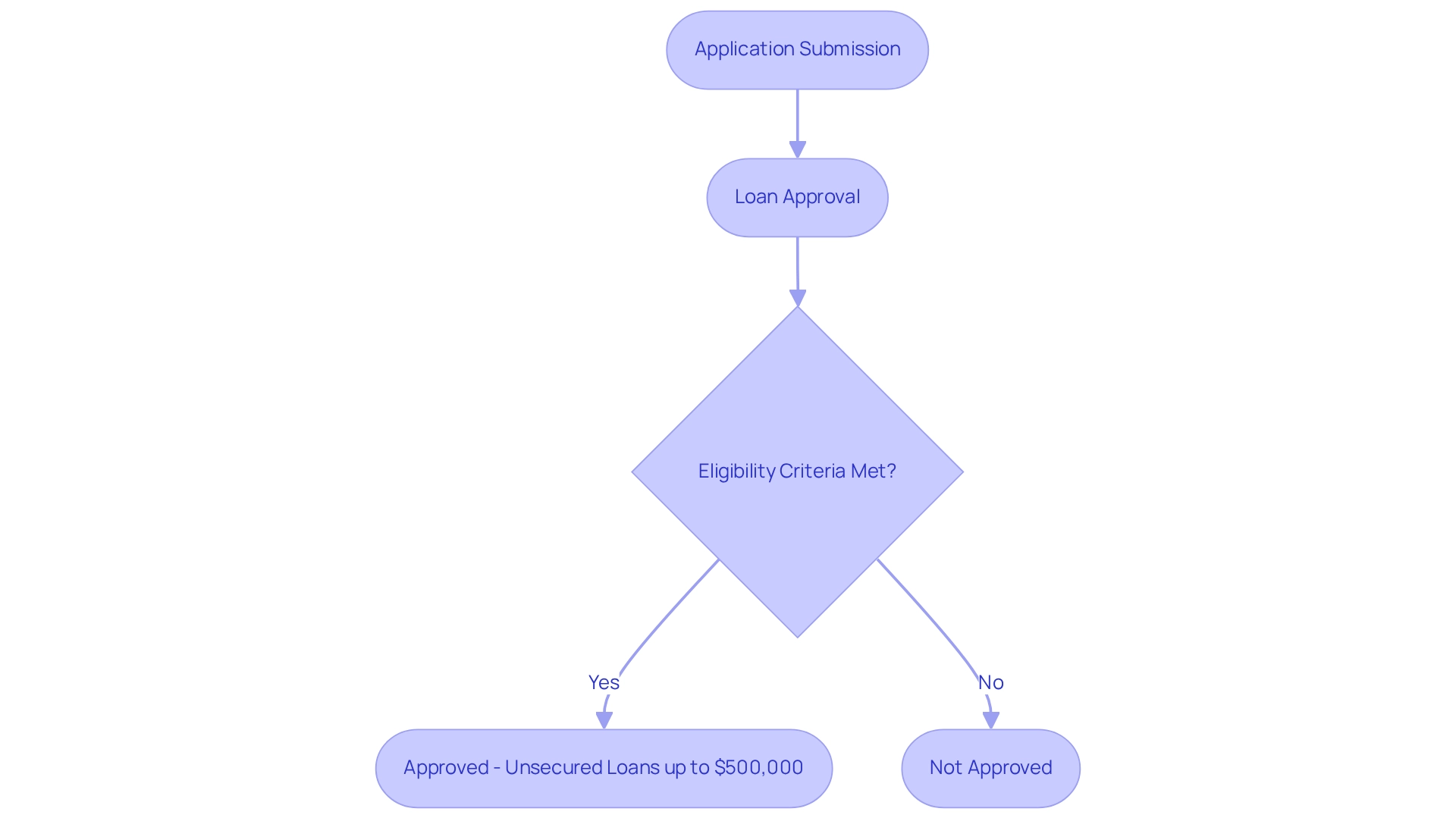

In 2025, Zip Business continues to showcase its dedication to offering flexible terms tailored to the unique needs of SME loan providers. For instance, businesses can qualify for unsecured loans up to $500,000, contingent upon meeting specific eligibility criteria, including an annual turnover exceeding $200,000. This approach not only facilitates rapid access to funds but also alleviates the financial strain that many small enterprises face, particularly in low-margin or seasonal sectors.

Case studies indicate that the demand for swift financing solutions is propelling the growth of alternative lending options like Zip Business. For example, companies in need of prompt capital benefit from the efficient approval process, which significantly reduces the waiting time compared to traditional banks, where financing processing can extend to 90 days. Financial analysts emphasize that rapid loan approvals are vital for small enterprises, as they enable timely investments and operational continuity. The importance of quick access to funds is underscored by the challenges faced by modest enterprises, especially in low-margin or seasonal sectors.

Furthermore, Canopy's role in assisting non-traditional lenders in developing innovative lending programs that leverage digital and API-first solutions positions Zip Business advantageously within the evolving landscape of alternative lending.

Overall, Zip Business effectively addresses the urgent financial needs of SMEs by collaborating with SME loan providers, ensuring they possess the resources necessary to thrive in a competitive environment. The emphasis on swift access to funds not only supports cash flow management but also empowers enterprises to seize opportunities as they arise. As Jess Rise aptly states, "Thriday feels like a product built in the future," reflecting the innovative spirit that Zip Business embodies.

Spotcap: Innovative Financing for Startups

Finance Story stands out in the financial sector by offering innovative funding solutions tailored specifically for local enterprises and commercial real estate investments. Recognizing the unique challenges that businesses encounter, Finance Story is dedicated to crafting refined and highly customized proposals for banks, ensuring that clients secure the necessary capital to build or refinance their projects.

The funding options provided by Finance Story have proven to be a vital resource for many smaller enterprises, with SME loan providers presenting a diverse array of lenders ready to cater to various situations—whether for acquiring a warehouse, retail space, factory, or hospitality venture. This trend underscores an increasing reliance on flexible financing solutions as businesses navigate the complexities of the market.

Expert insights reveal that one of the primary hurdles for smaller enterprises is securing adequate capital, often exacerbated by stringent lending criteria from SME loan providers. Finance Story directly addresses these challenges by streamlining the lending process and providing a more accessible pathway to capital for SME loan providers, including refinancing options for existing loans.

Successful enterprises have leveraged Finance Story's customized loan proposals to fuel their growth, exemplifying the effectiveness of these innovative financial solutions. By focusing on the long-term potential of businesses rather than short-term metrics, Finance Story empowers entrepreneurs to invest in their visions with confidence.

As the market continues to evolve, Finance Story remains committed to adapting its offerings, ensuring that smaller enterprises receive the support they need to thrive in a competitive landscape. This commitment to understanding and addressing the specific needs of commercial property investments positions Finance Story as a pivotal player in the funding ecosystem for local enterprises, aligning with the necessity for a balanced approach to economic growth and social responsibility.

SBA Loans: Industry-Specific Financing Solutions

SBA funding provides sector-specific financial solutions meticulously designed to meet the diverse needs of enterprises across various industries, including offerings from SME loan providers. Backed by the U.S. Small Business Administration, these providers deliver financial products that present significant advantages, such as lower down payments and flexible repayment terms, making them particularly appealing to SMEs. As we approach 2025, the financing landscape for small enterprises continues to evolve, with SBA funding remaining a cornerstone for many entrepreneurs looking to enhance their operations and foster growth.

The benefits of SBA funding extend well beyond mere financial support; they serve as a safety net for businesses confronting challenging economic conditions. For instance, small enterprises leveraging SBA funding have reported increased stability and growth, with numerous businesses successfully expanding their operations despite market volatility. Data reveals that 36.0% of businesses that began with 20−99 employees remained operational after 19 years, underscoring the potential for longevity when utilizing effective funding solutions like SBA assistance, which can provide the necessary capital for sustained growth.

Industry-specific funding solutions are particularly vital for sectors such as leisure and hospitality, which, as of February 2020, were still 223,000 jobs short of pre-pandemic levels. SBA financing can directly support businesses within this sector by supplying the essential resources to adapt and recover, highlighting the importance of tailored financial solutions from SME loan providers that address the unique challenges faced by different industries.

At Finance Story, we are dedicated to crafting refined and highly customized cases for lenders, ensuring that entrepreneurs secure the appropriate funding for their needs. Our expertise in understanding loan repayment criteria enables us to guide clients through the complexities of obtaining funds, whether for purchasing commercial properties or refinancing existing loans.

Moreover, a case study emphasizing the necessity of a robust online presence illustrates the significance of digital engagement for small enterprises. Despite living in a digital age, only 71% of small businesses have a website, with many relying solely on social media. However, 76% of online consumers investigate a company's website before visiting in person, highlighting the critical need for businesses to invest in their digital footprint. SBA financing from SME loan providers can facilitate these investments, enabling enterprises to enhance their online presence and attract customers.

Financial analysts emphasize that SME loan providers, including SBA financing, not only deliver essential capital but also foster a supportive environment for small businesses to thrive. As noted, "Small enterprises continue to encounter significant challenges amid the COVID-19 pandemic, including weak demand, heightened expenses, and limited credit availability." By understanding the specific needs and benefits of these financial options, entrepreneurs can effectively leverage these resources to bolster their growth and operational capabilities. Therefore, entrepreneurs should consider SBA options as a practical solution for their funding needs.

ANZ: Supportive Financing for Small Business Growth

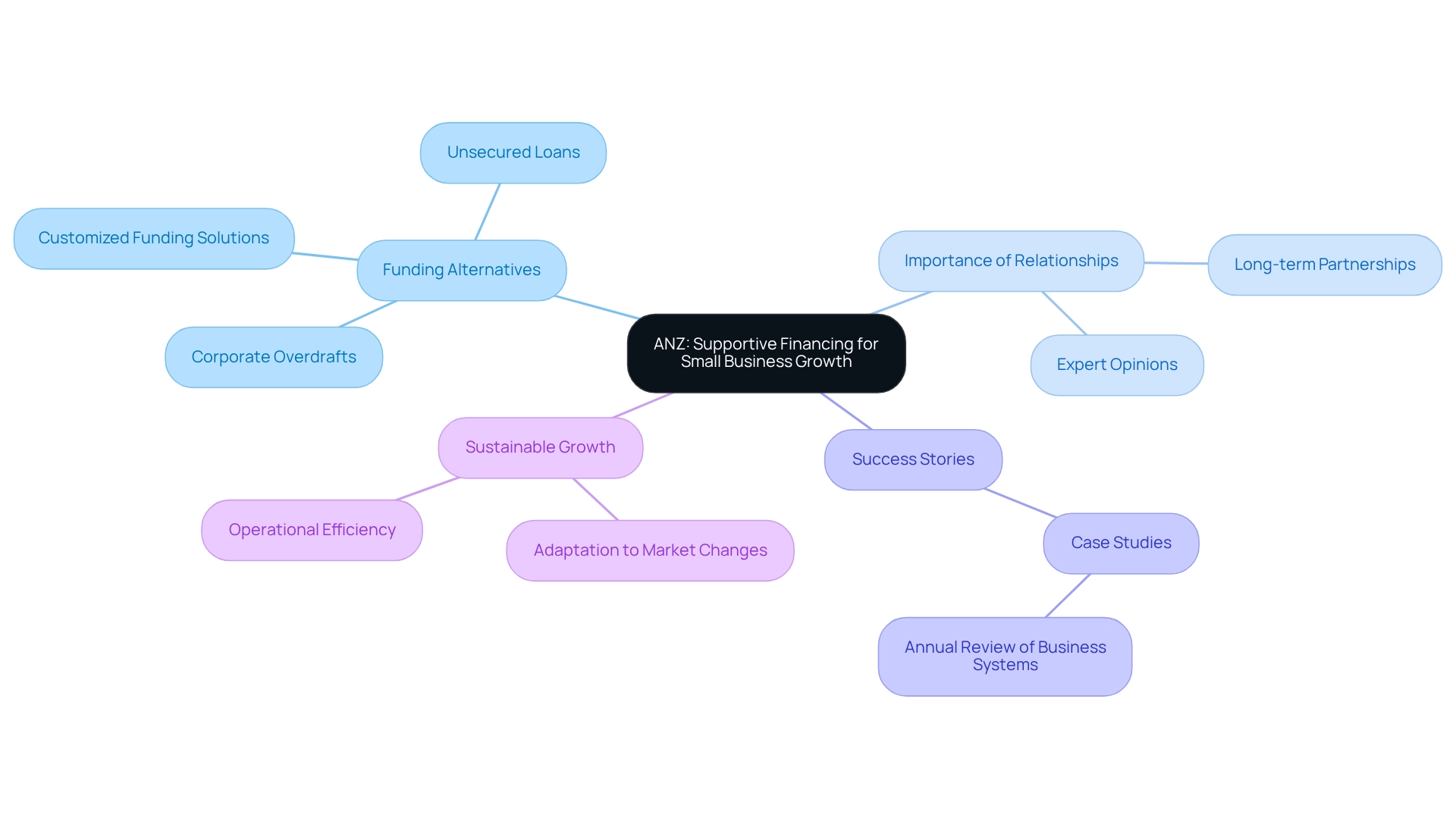

ANZ presents a robust array of funding alternatives specifically crafted to support the growth of minor enterprises, including options from SME loan providers. Their product range encompasses unsecured loans, corporate overdrafts, and customized funding solutions that cater to the unique needs of these providers. By prioritizing the establishment of enduring partnerships, ANZ empowers minor enterprises to navigate the complexities of the lending environment with efficiency.

Statistics reveal that only 25% of minor enterprises endure for 15 years or longer, underscoring the critical need for reliable financial support. ANZ's tailored funding solutions not only address immediate capital needs but also foster sustainable growth, enabling enterprises to adapt and thrive in a competitive market. In this landscape, Finance Story, led by Shane, offers customized financial solutions that complement ANZ's offerings. Shane's extensive experience in operational enhancement and insight into loan repayment criteria ensures that small enterprises have access to a diverse range of funding options that align with their specific circumstances.

Case studies highlight the success of SMEs that have leveraged ANZ's funding options to enhance their operational efficiency and productivity. Regular evaluations of organizational systems, as noted in the Annual Review of Organizational Systems, are vital for adapting to changing conditions and boosting competitiveness. ANZ's funding solutions can facilitate these evaluations, providing the necessary capital to implement improvements and innovations.

Expert opinions consistently emphasize the importance of nurturing long-term relationships with SME loan providers in the realm of SME funding. A Joint Credit Survey conducted by various Reserve Banks in 2014 highlighted that strong partnerships with SME loan providers are essential for local enterprises seeking financial assistance. This reinforces ANZ's commitment to building partnerships that extend beyond mere transactions. By offering supportive funding alternatives, ANZ, in conjunction with Finance Story's expertise, plays a pivotal role in the success of local enterprises across Australia.

NAB: Cash Flow Management Solutions for SMEs

NAB offers a comprehensive suite of cash flow management solutions meticulously crafted for SME loan providers and small and medium enterprises (SMEs). These offerings include adaptable financial credit and overdrafts, crucial for maintaining positive cash flow. Financial analysts underscore that such flexibility is essential for SMEs loan providers, enabling them to respond effectively to fluctuating cash flow needs and unforeseen expenses, thereby supporting their operational objectives and growth.

In 2025, statistics from NAB's cash flow management solutions indicate that SMEs utilizing these products have reported an average loan amount of $150,000 from SME loan providers, highlighting the substantial financial support available to enterprises grappling with cash flow challenges. Moreover, NAB's recent initiatives, such as the launch of their AI-enabled cash management platform, NAB Liquidity+, significantly enhance corporate clients' capacity to obtain real-time insights into their cash positions, streamlining treasury operations and minimizing manual data reconciliation.

Successful SMEs have harnessed solutions from SME loan providers like NAB to achieve stability and encourage growth. For example, companies that have adopted these flexible financing options from SME loan providers report improved financial agility, enabling them to focus on strategic initiatives rather than being constrained by cash flow limitations. As Colin Moore, a small enterprise owner in NSW, articulates, "Instead of merely offering funding, policies should concentrate on training individuals and guiding the unemployed to sectors that require them the most," emphasizing the broader impact of effective cash flow management on sustainability and community development.

Furthermore, with nearly half (47%) of secondary school students expressing interest in launching their own ventures, the importance of cash flow management solutions becomes increasingly clear as these future entrepreneurs prepare to enter the market. Additionally, understanding the associated costs of utilizing NAB's services, as detailed in their fees guide, enhances transparency and empowers SMEs to make informed financial decisions.

Overall, NAB's dedication to supporting SMEs loan providers through tailored cash flow management solutions positions them as a pivotal player in fostering business success within a competitive landscape, particularly as they navigate the complexities of today’s economy.

Conclusion

The diverse financing solutions available for small and medium enterprises (SMEs) are essential for fostering their growth and sustainability. With tailored mortgage brokerage services from Finance Story and comprehensive business loan options from Commonwealth Bank, SMEs now have a wealth of resources designed to meet their unique funding needs. The emphasis on personalized approaches and understanding individual circumstances is a recurring theme, underscoring the importance of bespoke financial strategies in navigating the complexities of the current economic landscape.

Innovative lenders such as Prospa and OnDeck offer rapid access to capital, enabling SMEs to seize growth opportunities and effectively address immediate financial challenges. Furthermore, institutions like NAB and ANZ prioritize cash flow management, providing flexible solutions that help businesses maintain stability and operational efficiency. The ability to adapt financing strategies to specific industry requirements, as seen with SBA loans and other specialized offerings, further highlights the necessity of tailored financial products in supporting diverse sectors.

Ultimately, the commitment of financial providers to understand the unique challenges faced by SMEs is vital for their long-term success. By leveraging innovative solutions and fostering strong partnerships, these institutions empower small businesses to thrive amid economic fluctuations. As the landscape continues to evolve, it is essential for SMEs to explore these tailored options, ensuring they secure the right funding that aligns with their aspirations and operational goals. The path to sustainable growth is paved with strategic financial decisions, and the right support can make all the difference in achieving business objectives.