Overview

This article identifies the best commercial construction loan lenders for small businesses, emphasizing the critical need for tailored financing solutions that address specific project requirements. It highlights how companies like Finance Story effectively connect small enterprises with a diverse array of lenders, providing customized options that enhance project feasibility and support long-term growth. Successful case studies and expert insights illustrate the benefits of personalized financing, reinforcing the value of strategic financial partnerships in achieving business objectives.

Introduction

In the dynamic landscape of commercial construction, small businesses often find themselves at a crossroads, seeking the right financial solutions to fuel their growth and navigate complex projects. With the increasing demand for tailored financing options, companies like Finance Story are stepping up to provide personalized commercial construction loans that cater to the unique needs of each client.

By leveraging a vast network of lenders and offering expert guidance, Finance Story empowers small business owners to secure the necessary funding to expand or renovate their facilities. As the construction industry evolves, understanding the intricacies of financing becomes paramount. Therefore, it is essential for businesses to partner with knowledgeable brokers who can help them thrive in this competitive environment.

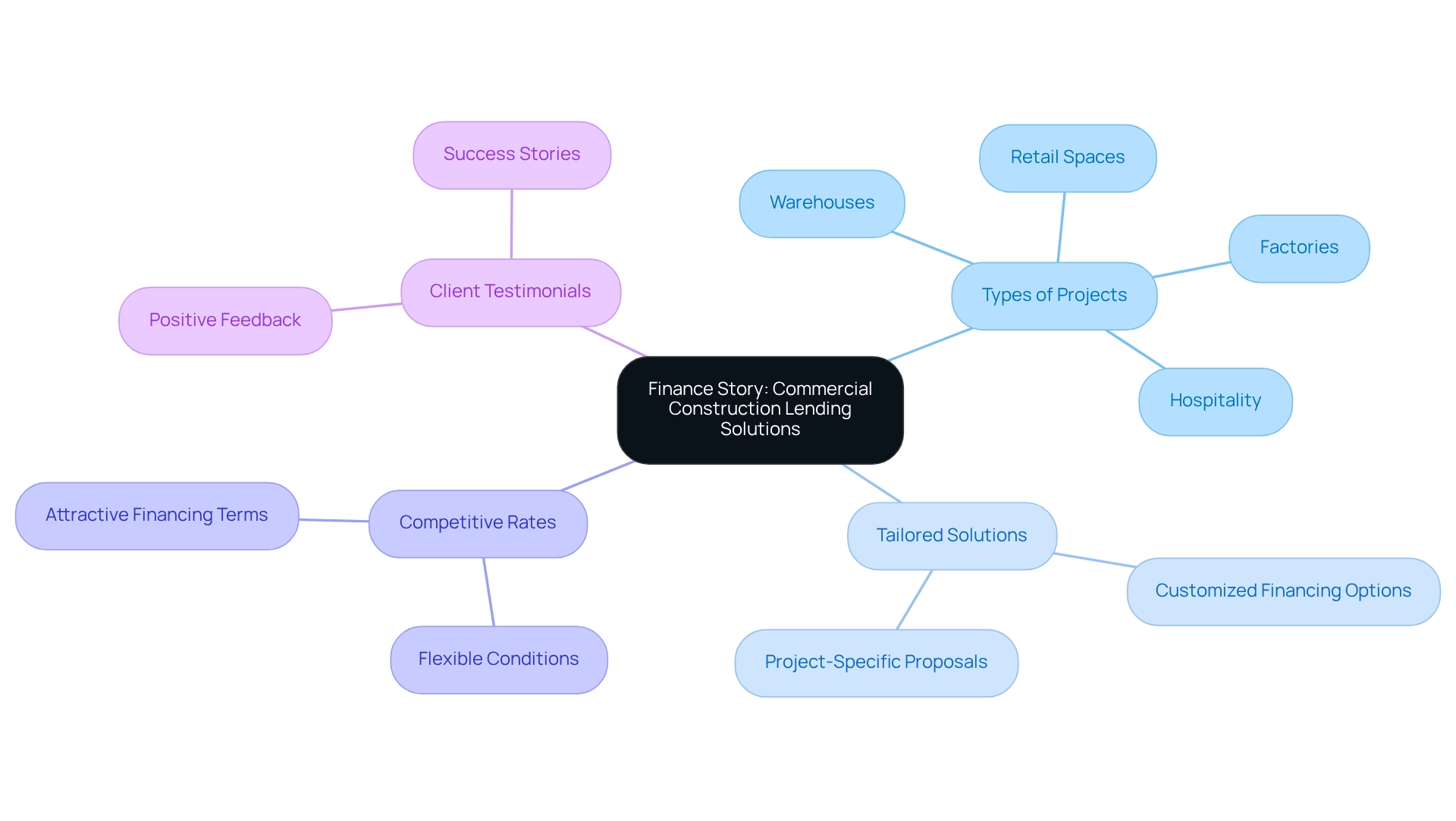

Finance Story: Tailored Commercial Construction Loans for Your Business Needs

Finance Story excels in providing customized commercial financing solutions from the best commercial construction loan lenders, tailored to the unique needs of small enterprises. By prioritizing a profound understanding of each client's requirements, the brokerage delivers personalized financing solutions adaptable to various project types. Their extensive network, which features the best commercial construction loan lenders alongside mainstream financial institutions, grants clients access to a diverse selection of financing options, facilitating the procurement of necessary capital for construction projects. This tailored service is particularly advantageous for small enterprises aiming to grow or renovate their facilities, as it connects them with the best commercial construction loan lenders who offer flexibility in terms and conditions that align with their operational goals.

In 2025, average interest rates for commercial construction loans in Australia are projected to remain competitive, with many lenders offering rates around 5% to 6%. This competitive environment presents a favorable opportunity for independent enterprises to explore funding alternatives. Moreover, current trends indicate a rising demand for personalized financing solutions, as the best commercial construction loan lenders recognize the importance of tailored approaches to meet the specific needs of local businesses.

Finance Story specializes in crafting refined and highly tailored cases for banks, ensuring that emerging enterprises can secure appropriate funding from the best commercial construction loan lenders for their projects. Successful examples of customized financing solutions provided by the best commercial construction loan lenders highlight the positive impact of tailored funding on project outcomes. For instance, a recent case study illustrated how a small enterprise secured a tailored loan that enabled them to complete a significant renovation, resulting in a 30% increase in operational efficiency. Financial experts, including Warren Buffett, emphasize that such tailored solutions not only enhance project feasibility but also contribute to long-term organizational growth. Buffett famously stated, "You can't produce a baby in one month by getting nine women pregnant," underscoring the significance of patience and tailored strategies in achieving financial goals.

As small enterprises navigate the complexities of construction financing, the knowledge and flexibility offered by Finance Story, recognized as one of the best commercial construction loan lenders, position them as a trusted ally in achieving their development objectives. For small business owners seeking to obtain a customized commercial financing loan, it is advisable to develop a comprehensive plan and consult with a financial advisor to explore options from the best commercial construction loan lenders.

American Express: Comprehensive Financing Solutions for Commercial Construction

Finance Story delivers a comprehensive suite of financing options tailored specifically for commercial construction projects, showcasing the best commercial construction loan lenders to address the unique needs of small enterprises in the construction sector. Their expertise in crafting refined and highly customized cases enables clients to present their proposals effectively to banks, thereby increasing their chances of securing funds. With both short-term and long-term loans available, Finance Story empowers contractors to manage cash flow and control project costs efficiently.

Their adaptable conditions and access to a complete variety of lenders, including mainstream banks and innovative private financing groups, position them as a trustworthy ally for businesses undertaking substantial building projects. Notably, if the down payment is below 20%, Private Mortgage Insurance (PMI) becomes necessary. This is a crucial consideration for small enterprises evaluating their financing options. The company's established reputation in the financial industry instills confidence in borrowers, making it an attractive choice for those seeking funding.

As Finance Story continues to evolve its commercial building financing solutions in 2025, they ensure alignment with the changing requirements of small enterprises. Case studies reveal that numerous modest businesses have successfully utilized Finance Story's financing to complete building projects on time and within budget, underscoring their commitment to fostering client growth and success. Additionally, refinancing options are available for clients looking to improve their credit terms, providing further flexibility.

As highlighted in Finance Story's detailed FAQs, understanding the building financing application process can enhance preparedness for small enterprises exploring their funding options. Finance Story is equipped to assist with various commercial properties, including warehouses, retail spaces, factories, and hospitality ventures, ensuring tailored solutions for each client's specific needs.

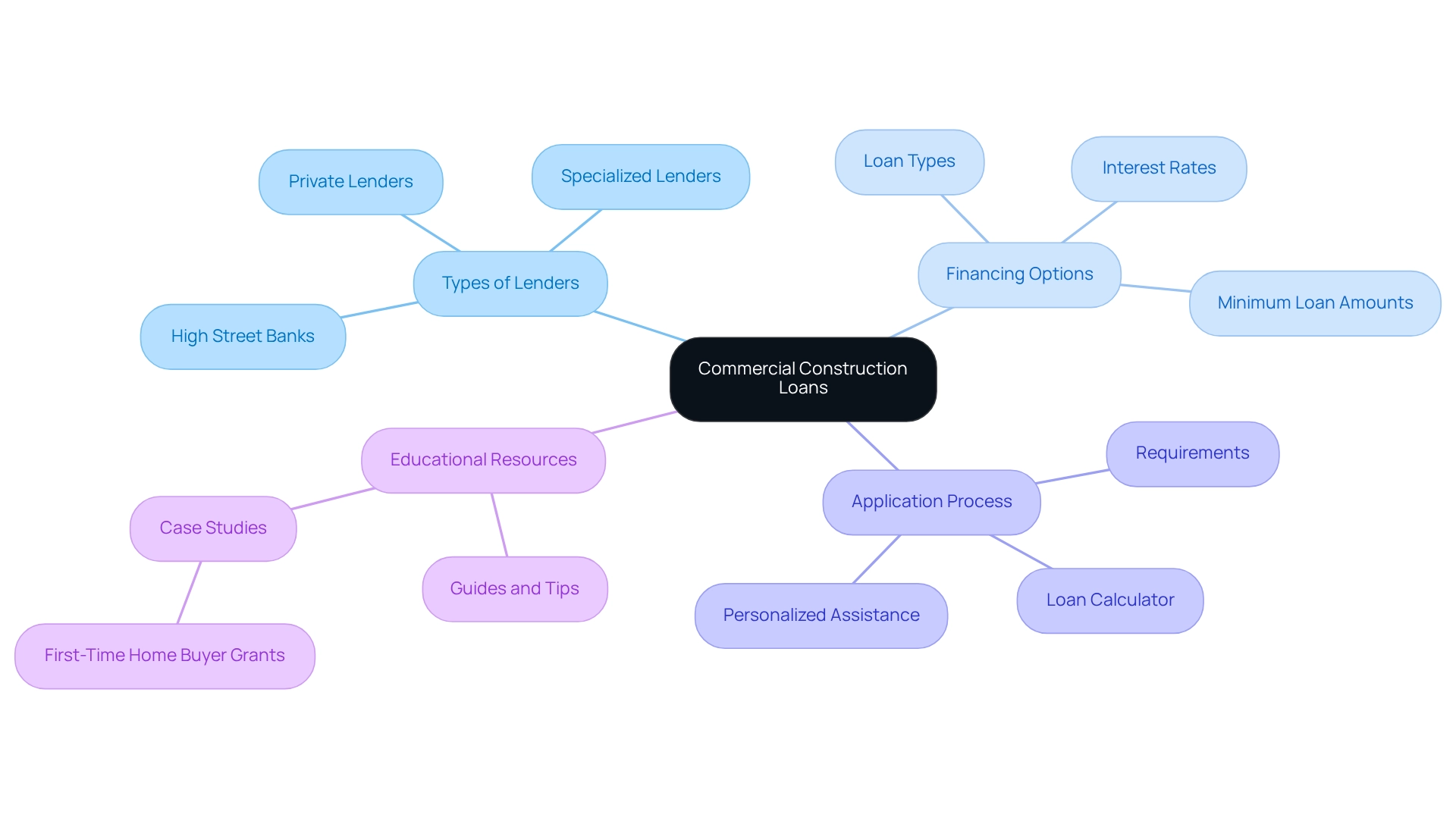

NerdWallet: Expert Guidance on Commercial Construction Loans

Finance Story serves as an essential resource for small enterprise owners navigating the complexities of commercial construction financing through the best commercial construction loan lenders. Our expertise lies in crafting refined and highly personalized case studies to present to banks, ensuring you secure the right financing for your development projects. We provide a comprehensive range of lenders, including the best commercial construction loan lenders, high street banks, and innovative private lending panels, tailored to your specific needs—whether you are financing a warehouse, retail premise, factory, or hospitality venture. Our thorough evaluations of various lenders, financing types, and interest rates empower borrowers to make informed choices. By offering educational materials that elucidate the application process, Finance Story guarantees that entrepreneurs fully comprehend the requirements and options available to them. This expert guidance is particularly vital for those unfamiliar with commercial financing, as it clarifies the often intricate landscape of securing funding for construction projects.

In 2025, a significant number of independent enterprise proprietors are actively seeking advice on commercial funding options, underscoring the importance of customized financial solutions in facilitating informed monetary decisions. Furthermore, it is crucial to recognize that the minimum borrowing amount can fluctuate based on market conditions and project demands. By leveraging Finance Story's resources, entrepreneurs can effectively compare the best commercial construction loan lenders and various financing types, ensuring they choose the optimal funding solutions for their development projects.

Elevations Credit Union: Local Lending for Commercial Construction Projects

Finance Story is dedicated to empowering local businesses with their commercial funding needs. By offering tailored services and a deep understanding of the market, Finance Story delivers personalized loan options that specifically meet the requirements of small enterprises. Their expertise in crafting refined and highly personalized project cases ensures that clients can secure the appropriate funding for their development initiatives, even in challenging circumstances.

Furthermore, with access to a diverse portfolio of the best commercial construction loan lenders, including private and boutique commercial investors, Finance Story provides competitive rates and flexible terms. This makes them an attractive choice for contractors and developers looking to finance construction projects.

This emphasis on customized solutions not only strengthens relationships but also plays a vital role in fostering the economic growth of the community.

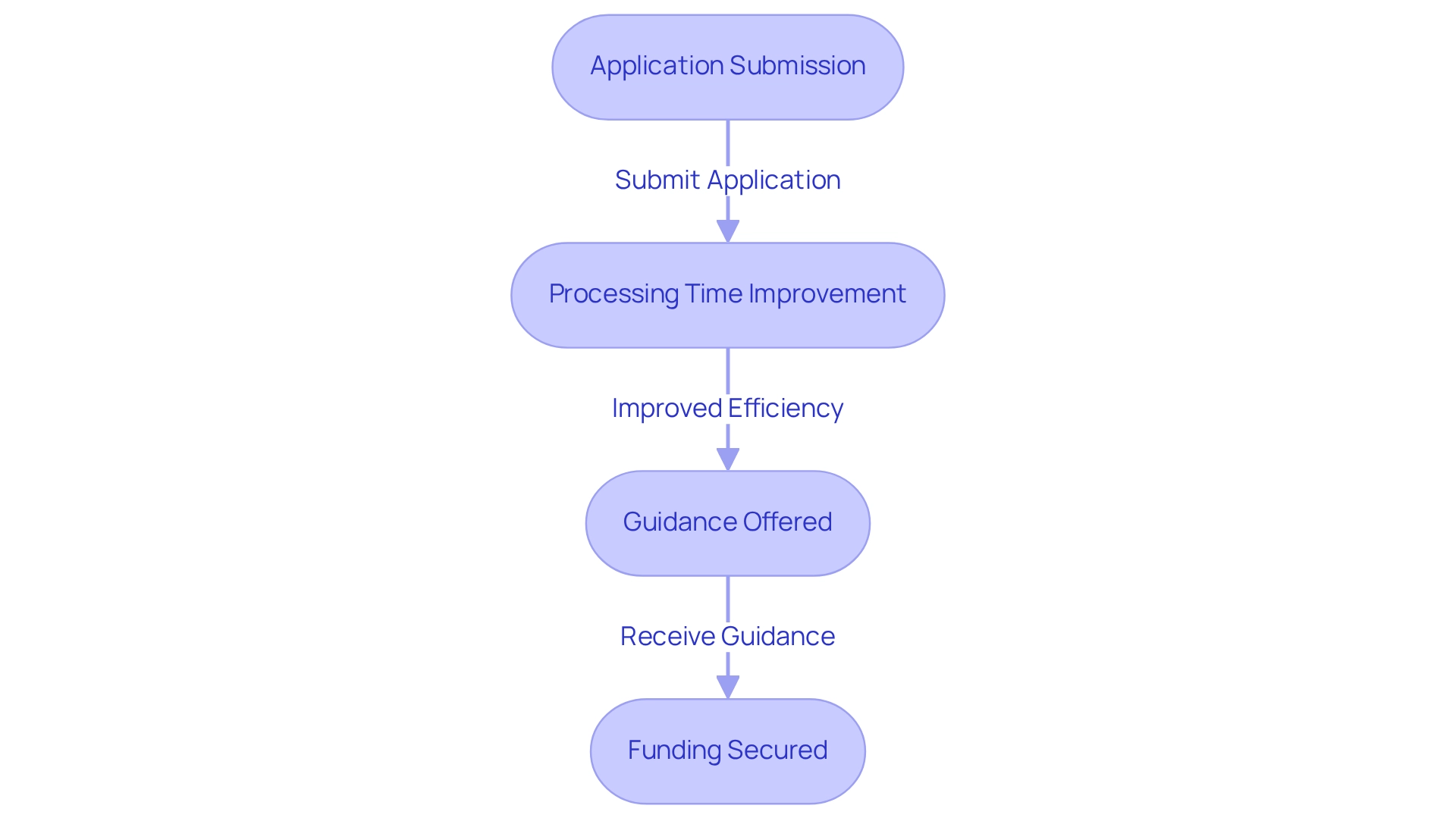

FC Banking: Simple Application Process for Commercial Construction Loans

FC Banking is recognized among the best commercial construction loan lenders for its efficient application process for commercial development financing, specifically catering to the needs of small business owners who often face time constraints. Their intuitive online platform enables borrowers to submit applications swiftly, significantly minimizing the delays typically associated with approvals. In 2025, the average application processing time for commercial construction financing has improved, reflecting a growing trend toward efficiency in the lending sector. Notably, the Australian Capital Territory reported an average borrowing amount of $377,000 for owner-occupier residences in the December quarter of 2024, underscoring the critical funding opportunities available for small enterprises.

Finance Story excels in crafting tailored and highly personalized proposals for banks, ensuring that small business owners can secure the right financing for their commercial investments. This expertise in customized financial proposals is vital for navigating the complexities of repayment criteria and obtaining favorable terms. Furthermore, Finance Story provides access to a comprehensive range of lenders, including the best commercial construction loan lenders, high street banks, and innovative private lending panels, thereby enhancing the financing options available for small businesses.

FC Banking not only streamlines the application experience but also offers extensive guidance throughout the process, ensuring clients are well-informed at every stage. This approach not only boosts user satisfaction but also increases the likelihood of securing essential funding promptly. Small enterprises have reported significant benefits from FC Banking's straightforward application processes, reinforcing the importance of an efficient approval method in today’s competitive market. Financial experts emphasize that an easy-to-navigate application system is crucial for fostering positive borrower experiences, ultimately leading to improved financial outcomes for businesses. Additionally, a strong execution discipline in credit processing can yield better financial results for small enterprises, further highlighting the importance of efficiency in the lending process.

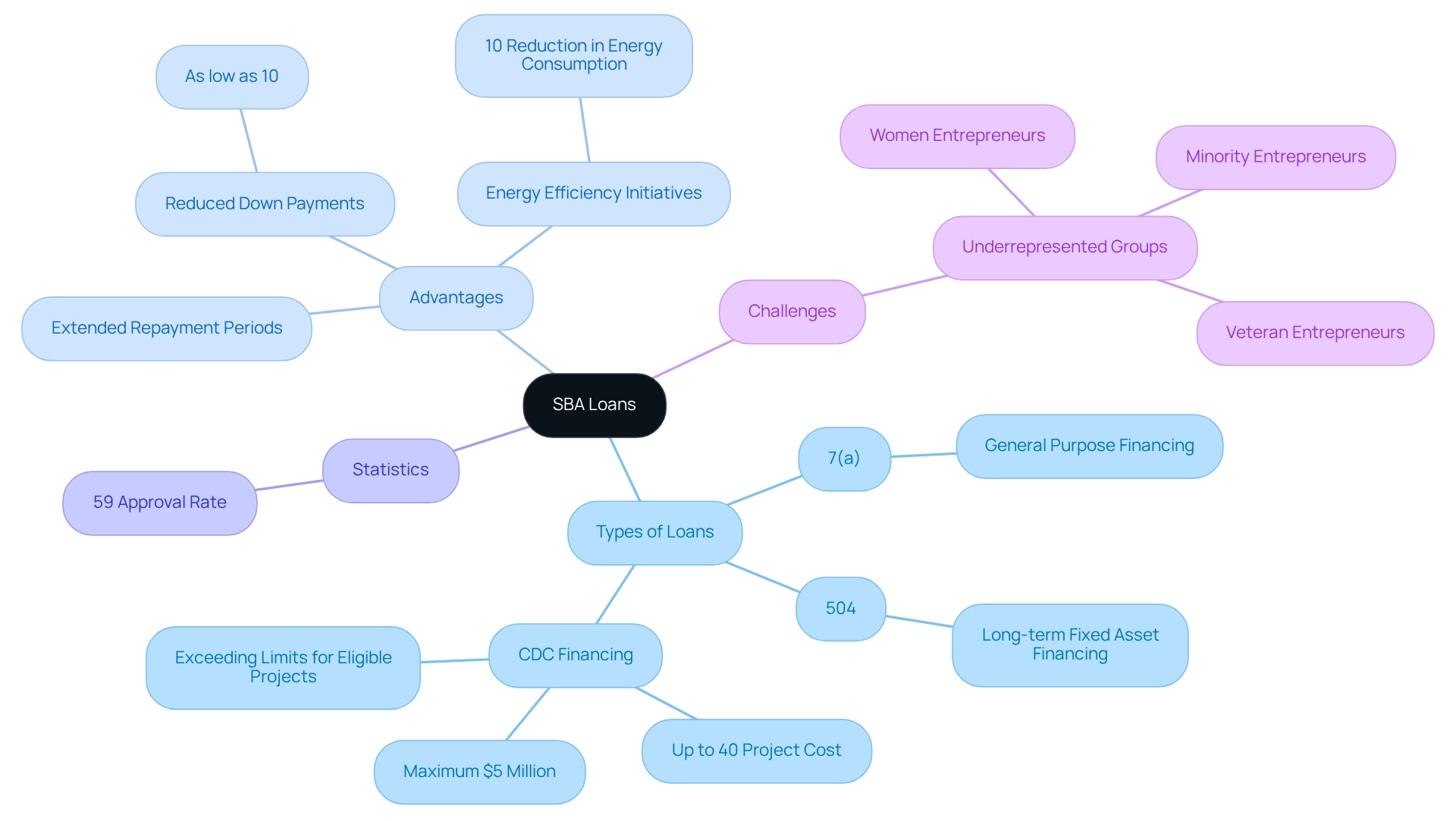

SBA Loans: Government-Backed Financing for Small Business Construction

SBA funding stands as a vital financial avenue for small enterprises looking to the best commercial construction loan lenders when embarking on building projects. These financial products, offered by the best commercial construction loan lenders and supported by the U.S. Small Business Administration, provide appealing terms such as reduced down payment conditions—often as low as 10%—and extended repayment periods, making them more accessible than traditional financing options. The SBA presents various financing programs, including the 7(a) and 504 options, tailored to meet diverse business needs, empowering owners to choose from the best commercial construction loan lenders for their construction financing. In 2025, around 59% of SBA loan applications received approval, underscoring their effectiveness as a funding source.

Moreover, a Community Development Corporation (CDC) can finance up to 40% of the project cost, with a maximum limit of $5 million, which may be exceeded for qualifying manufacturing and energy-efficient technology projects. This government-backed financing not only facilitates the acquisition, construction, or retrofitting of facilities but also promotes energy-efficient initiatives, offering potential funding for projects that achieve a 10% reduction in energy consumption. As highlighted by Finance Story, crafting well-defined and personalized cases is essential for securing the right financing solutions.

Understanding the lending landscape, including repayment standards, is crucial for businesses aiming to navigate their growth and success. Successful case studies illustrate how enterprises have leveraged SBA financing to overcome funding challenges, particularly among underrepresented groups, as demonstrated in the case study titled 'Optimism vs. Reality in Small Business Financing.' This emphasizes the importance of these loans in fostering growth and sustainability within the local business ecosystem.

PNFP: Real Estate Lending Solutions for Commercial Construction

Finance Story is among the best commercial construction loan lenders, offering specialized real estate lending solutions specifically designed for commercial development projects. As one of Australia’s leading expert brokerages in commercial and personal funding, they understand the distinct challenges faced by small enterprises in the building sector. This insight enables them to deliver tailored financing options that align with the precise goals of each project. Their proficiency in crafting refined and highly customized proposals ensures clients can secure the necessary funds to undertake developments of any size.

With access to a comprehensive portfolio of private, boutique commercial investors alongside standard financing providers, Finance Story offers the best commercial construction loan lenders to accommodate various needs—whether for large warehouses, retail spaces, factories, or hospitality ventures. Their competitive rates and flexible conditions make them one of the best commercial construction loan lenders for enterprises seeking to finance new developments or renovations.

In 2025, their customized solutions have proven advantageous for numerous small enterprises, empowering them to effectively achieve their building objectives. As Natasha B. from VIC states, 'I will certainly be suggesting your company to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey.'

This unwavering commitment to service and support is evidenced in various successful projects, underscoring Finance Story's significant impact on the financing landscape.

SMB Compass: Diverse Financing Options for Construction Businesses

Finance Story provides a comprehensive selection of financing options tailored specifically for building enterprises, featuring the best commercial construction loan lenders. This includes access to a wide array of lenders, from high street banks to innovative private lending panels. Their expertise in developing refined and highly personalized financial proposals empowers companies to secure the appropriate business funding necessary for their operational needs. This flexibility is particularly vital for construction firms, which often face fluctuating cash flow due to the nature of project timelines.

As the building sector anticipates moderate growth driven by slowing inflation and supportive monetary policies, access to diverse financing options—including loans from the best commercial construction loan lenders for warehouses, retail spaces, factories, and hospitality ventures—can significantly enhance a company's ability to manage cash flow effectively and navigate potential financial challenges.

Kruttika Dwivedi, a research manager in industrial products and development, highlights that the engineering and building sector is no stranger to disruption and volatility, underscoring the necessity for adaptable financing solutions provided by the best commercial construction loan lenders. Moreover, emerging startups in the building industry are exhibiting increased growth and optimism, showcasing the potential for new enterprises to thrive with adequate financial backing.

By emphasizing a thorough understanding of client needs, Finance Story provides customized financing solutions that not only foster growth but also enhance operational efficiency. This includes options for refinancing existing debts to meet the evolving demands of businesses.

TD Bank: Flexible Construction Loans for Various Project Types

TD Bank sets itself apart with its adaptable financing options tailored for a variety of project categories, encompassing both residential and commercial developments. Their adjustable loans, including building-to-permanent financing, streamline the funding process, facilitating easier management of development projects for small enterprises. With competitive interest rates and a robust commitment to customer service, TD Bank emerges as a dependable ally for businesses in need of funding for construction projects. The bank's knowledgeable personnel are dedicated to guiding borrowers through the application process, ensuring a seamless experience.

For example, case studies illustrate how TD Bank has effectively financed numerous projects, underscoring their capacity to cater to the distinct needs of each client. Furthermore, expert opinions emphasize the significance of customizable financing solutions for various project types. Joshua Holt, Creator of Biglaw Investor, asserts that tailored funding alternatives are vital for small enterprises navigating complex construction endeavors. This flexibility not only enhances the borrowing experience but also positions TD Bank as a frontrunner in providing flexible financing solutions for small businesses in 2025.

Additionally, the best commercial construction loan lenders compensate builders incrementally as work progresses, ensuring that funds are available when needed—an invaluable advantage for small business owners managing project timelines. At Finance Story, we specialize in crafting refined and highly customized business cases for presentation to the best commercial construction loan lenders, ensuring that small business owners secure the appropriate financing for their commercial property investments. Our expertise in loan repayment criteria and the evolving needs of businesses enables us to effectively guide clients through the refinancing process. We also provide access to the best commercial construction loan lenders, making us a valuable resource in the commercial lending landscape.

Hard Money Lenders: Quick Financing Solutions for Commercial Construction Needs

Hard money lenders, recognized as some of the best commercial construction loan lenders, provide rapid funding options tailored for commercial construction projects, positioning themselves as a compelling choice for small enterprises in need of immediate capital. Unlike traditional lenders, these financiers prioritize the property's value over the borrower's credit history, facilitating quicker approvals and funding—an essential factor for businesses facing tight deadlines. However, it is important for borrowers to recognize that hard money financing typically carries higher interest rates, ranging from 7.00% to 12.00%, along with shorter repayment terms. Understanding these elements is vital to ascertain whether their financial strategy aligns with the offerings of the best commercial construction loan lenders.

Engaging expert assistance, such as that offered by Finance Story, can significantly enhance the chances of a successful investment, particularly for those navigating the complexities of hard money financing. Finance Story excels in crafting refined and highly tailored cases to present to lenders, which is crucial for securing favorable outcomes. They provide access to a comprehensive range of the best commercial construction loan lenders, including high street banks and innovative private lending panels, ensuring that clients can identify the right financing solution for their specific needs. Numerous small enterprises have successfully leveraged these funds to expedite construction projects and capitalize on market opportunities, especially when supported by the right expertise.

It is essential to note that borrowers may require prior experience with successful projects or the collaboration of licensed contractors to secure hard money financing, particularly if they are less experienced. This prerequisite can pose a barrier for some, underscoring the importance of professional guidance from experts like Finance Story.

While the expedited nature of hard money loans can be beneficial, it often comes at a premium. As one specialist aptly noted, "Yes, you will pay more for the speed, but it's a minor cost to bear if your deal depends on a quick close." This statement underscores the trade-off between speed and expense that small business owners must consider.

When evaluating interest rates, it is crucial to acknowledge that hard money options generally feature higher rates than traditional financing alternatives, which can influence overall project costs. Therefore, small business owners should thoroughly assess their readiness for challenging financial options and contemplate seeking professional assistance to navigate this process effectively. Additionally, refinancing options are available for those looking to adjust their existing loans to better accommodate their evolving business needs.

Conclusion

In the fast-paced world of commercial construction, securing the right financial support is crucial for small businesses aiming to thrive and expand. Finance Story emerges as a vital partner, offering tailored commercial construction loans that cater specifically to the unique needs of each client. By understanding the intricacies of financing and leveraging a broad network of lenders, Finance Story ensures that small business owners can access the most suitable funding options for their projects.

The growing demand for personalized financing solutions highlights the importance of customized approaches in today’s competitive market. With competitive interest rates and a variety of loan products available, small businesses are well-positioned to explore the financing landscape. The success stories and case studies presented throughout the article illustrate how tailored loans can lead to significant improvements in operational efficiency and project outcomes, empowering businesses to navigate their construction goals effectively.

Ultimately, partnering with experienced brokers like Finance Story is essential for small business owners to secure the financing they need. By preparing comprehensive business plans and seeking expert guidance, businesses can enhance their chances of obtaining the right funding to fuel growth and achieve their construction ambitions. As the construction industry evolves, the importance of adaptable and informed financial strategies cannot be overstated, making it imperative for small businesses to prioritize tailored financing solutions for a successful future.