Overview

The article identifies the top commercial bridge loan lenders for 2025, underscoring their capability to deliver tailored financing solutions that address the distinct needs of borrowers.

In a landscape where personalized lending is increasingly sought after, these lenders emerge as essential partners.

The article highlights the growing demand for streamlined approval processes and emphasizes the necessity of understanding market trends.

Collectively, these factors position these lenders as indispensable allies for businesses in pursuit of effective financial solutions.

Introduction

In the fast-paced realm of commercial finance, businesses are increasingly seeking tailored solutions to address their specific financial needs. Finance Story stands out as a pivotal player in this landscape, delivering personalized bridge loan options that empower clients to capitalize on opportunities for property acquisition and business expansion.

By prioritizing a deep understanding of individual circumstances, the brokerage effectively connects clients with a diverse array of lenders, guaranteeing access to the most fitting funding solutions.

As the demand for commercial bridge loans escalates and the market continues to evolve, Finance Story's expertise and innovative strategies establish them as a trusted partner for businesses navigating the complexities of financing in 2025.

Finance Story: Tailored Commercial Bridge Loan Solutions

The organization sets itself apart as one of the best commercial bridge loan lenders in the financing market by delivering tailored solutions that address the unique financial requirements of each individual. By emphasizing a profound understanding of personal circumstances, the brokerage provides customized advice and access to the best commercial bridge loan lenders, along with a diverse array of other lending options, including mainstream banks and private lending panels. This personalized approach enables clients to secure the optimal bridge financing options from the best commercial bridge loan lenders, whether for property acquisition or business expansion. With over 25 years of expertise in the financial sector, Financial Narrative adeptly navigates complex economic landscapes, ensuring clients are connected with the best commercial bridge loan lenders for their funding solutions.

Recent trends reveal a growing demand for commercial bridge financing, with the best commercial bridge loan lenders showcasing average approval times in 2025 that reflect a more streamlined process, further enhancing the appeal of Finance Story's services. A recent case study highlights that term rental loans are sensitive to Treasury market fluctuations, resulting in variations in interest rates and loan amounts. Understanding this volatility is crucial for clients as they evaluate their financing options with the best commercial bridge loan lenders, especially given that interest rates started at 8% in early 2023 and escalated to 8.31% by September.

Raphael Benggio, Head of Lending – Bridging Funding at MT Lending, underscores the importance of personalized lending in the commercial sector, stating that the best commercial bridge loan lenders provide tailored solutions essential for customers to navigate the complexities of their financial needs effectively. Furthermore, with the UK expected to emerge from recession in Q1 2024, the economic landscape may significantly influence the strategies of the best commercial bridge loan lenders, presenting an opportune moment for clients to explore their funding alternatives. The commitment to innovation and adaptability positions them as a trustworthy partner for both business and personal clients seeking effective financial solutions.

Bridgit: Fast Approval and Flexible Terms for Commercial Loans

Financial Narrative stands out in the commercial lending sector due to its expertise in crafting refined and deeply personalized business cases, enabling clients to secure approvals efficiently. This tailored approach is essential for small business owners eager to seize timely property opportunities. In 2025, the typical timeframe for obtaining business financing in Australia shows a positive trend towards efficiency, with several providers, including Financial Narrative, prioritizing rapid approvals to meet market demands. Notably, the average approval time for upsizers is around 45 minutes, underscoring the company's commitment to prompt service.

A key advantage of the company's offerings is their flexible loan conditions, designed to accommodate diverse financial situations. This flexibility ensures that clients can find tailored solutions that align with their specific needs, whether they are expanding operations or navigating cash flow challenges. The company's dedication to exceptional customer service further cements its status as one of the best commercial bridge loan lenders, especially since recent data indicates a growing demand for bridging solutions driven by the evolving requirements of businesses in Australia.

The proactive approach of this organization towards broker education positions them as a leader in the field. By investing in education, the organization has improved the accessibility of customized funding solutions for their clients. As businesses increasingly seek swift and reliable funding options, Financial Narrative's ability to provide rapid approvals and adaptable terms positions it among the best commercial bridge loan lenders, making it a vital partner in managing the complexities of commercial real estate financing.

Moreover, this entity offers a comprehensive selection of lenders, ensuring clients have access to various funding options tailored to their unique circumstances. Testimonials from satisfied clients, such as Natasha B from VIC, highlight the effectiveness of the services, stating, 'I will certainly be suggesting your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey.'

Furthermore, Financial Narrative provides refinancing options that address the evolving needs of businesses, making them a complete solution for commercial property investments.

eFunder Capital: Seize Opportunities with Commercial Bridge Loans

Finance Story specializes in empowering individuals to capitalize on immediate opportunities through tailored commercial financing solutions. We are dedicated to offering personalized business cases that clarify the intricacies of obtaining commercial financing. This ensures that individuals have access to a comprehensive range of the best commercial bridge loan lenders tailored to their unique situations. Our expertise in refinancing and securing business loans for commercial property investments assists individuals in diversifying their portfolios and seizing lucrative investment opportunities as they arise.

As one satisfied customer remarked, Finance Narrative was essential in assisting us with [our financing journey](https://fluxxlevelfinancing.com), offering us the appropriate choices and assistance.

This commitment to customer success establishes Finance Story as an invaluable ally in the real estate sector.

JVM Lending: Innovative Bridge Loan Products for Diverse Needs

JVM Lending stands out as one of the best commercial bridge loan lenders in the market with a range of innovative offerings tailored to meet the diverse needs of its customers. These offerings from the best commercial bridge loan lenders encompass both residential and commercial properties, empowering borrowers to leverage existing equity for new acquisitions. In 2025, the demand for bridge loans has surged, primarily due to borrowers facing challenges in qualifying for both current and new mortgage payments—this is the most prevalent issue encountered by borrowers. JVM Lending's solutions are meticulously crafted to address these challenges, providing customers with the necessary flexibility to navigate the evolving financial landscape.

In conjunction with JVM Lending, Finance Story offers customized refinancing options that enable customers to access equity and benefit from reduced rates, catering to both self-employed and salaried individuals. Their expertise in developing refined funding proposals ensures that customers can secure options from the best commercial bridge loan lenders, whether for residential real estate investments or business ventures. This is especially advantageous for small business owners striving to navigate the complexities of securing funds for development projects.

The commitment to exceptional customer service is evident in the numerous positive reviews for both companies, underscoring their responsiveness and efficiency. This dedication to customer satisfaction is further emphasized by Harrison Astbury, who notes that "some lenders may only provide bridging financing to existing patrons," highlighting the critical importance of flexibility in the current market. JVM Lending's ability to adapt to market conditions positions them as a formidable player in the bridge financing sector. For instance, their collaboration with Connective Home Loans to streamline bridge financing applications exemplifies their proactive approach to addressing market demands, ensuring brokers can capitalize on commission opportunities while providing customers with easier access to funding.

As the market for innovative bridge funding products continues to grow, driven by the increasing demand for adaptable financing solutions, both JVM Lending and Lending Narrative are considered among the best commercial bridge loan lenders, committed to delivering customized options that cater to the unique circumstances of each individual. Their combined expertise in both residential and commercial financing equips them to effectively support a wide array of borrowers, establishing them as trusted partners in achieving financial goals.

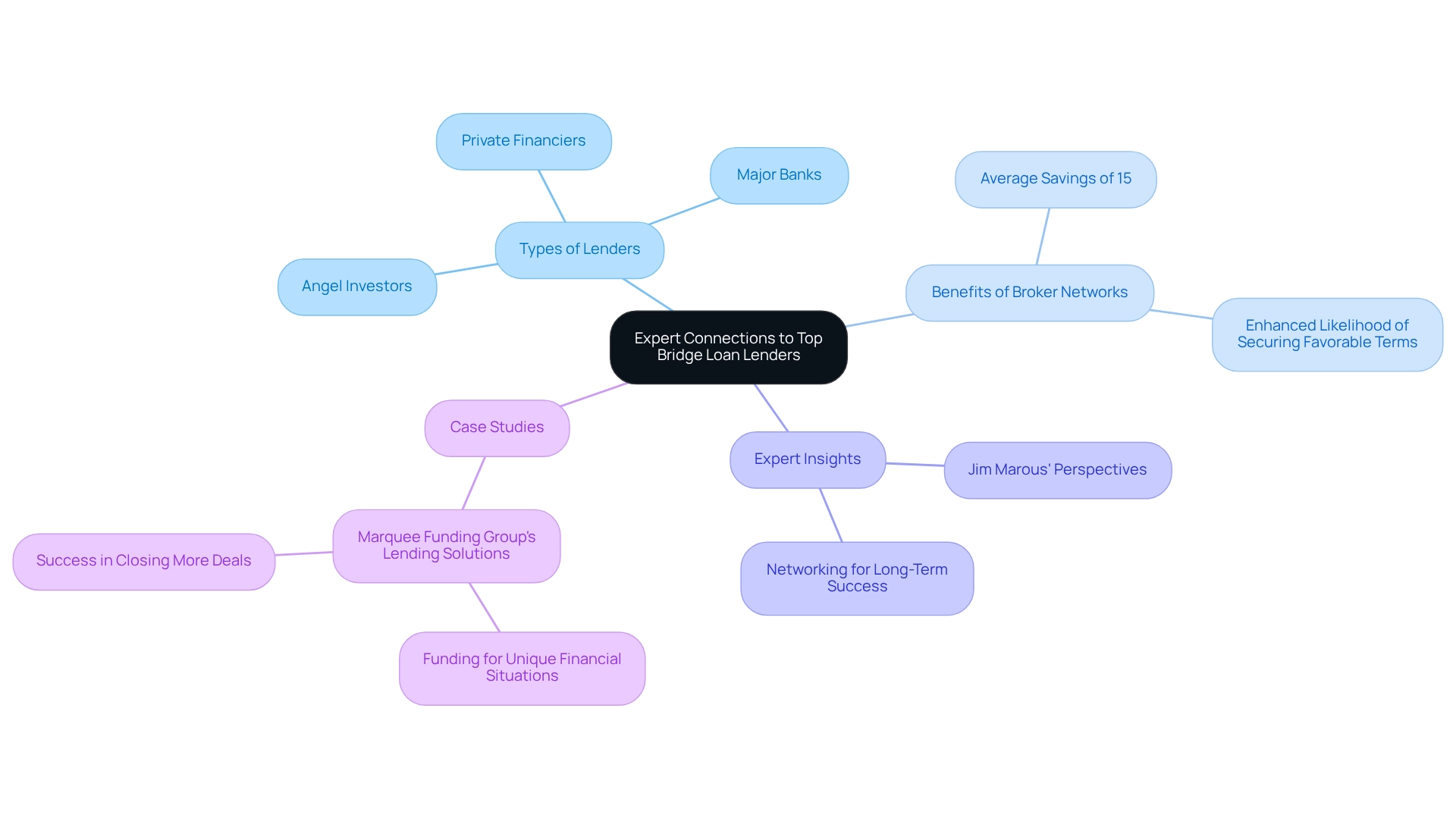

Marquee Funding Group: Expert Connections to Top Bridge Loan Lenders

Finance Story stands out in the competitive landscape of commercial financing by expertly connecting individuals with a wide range of lenders, including major banks, private financiers, and angel investors. This strategic advantage allows them to provide customized financing options that cater to the unique needs of small business owners seeking the best commercial bridge loan lenders to invest in commercial properties or refinance existing debts. Their extensive knowledge of the lending environment ensures that clients receive tailored support throughout the loan process, streamlining the journey to secure essential funding for various projects.

In 2025, data from the State of Marketing Trends Report reveals that utilizing broker networks significantly enhances the likelihood of securing favorable loan terms, with average savings reported at 15% compared to direct lender approaches. This is particularly evident in case studies related to financial narratives, which have effectively assisted numerous individuals in navigating the complexities of commercial funding, even in challenging circumstances. By fostering robust relationships with a diverse array of the best commercial bridge loan lenders, they have empowered clients to close more deals and boost profitability, solidifying their reputation as a trustworthy alternative to traditional lending.

Expert insights highlight the critical role of networking with the best commercial bridge loan lenders in the lending sector, with perspectives from Jim Marous, co-publisher of The Financial Brand, underscoring that prioritizing these relationships can pave the way for long-term success for both lenders and borrowers. The organization’s commitment to cultivating these connections not only benefits their clients but also propels the overall growth and advancement of the lending industry.

For example, a small business owner recently secured a tailored financial arrangement through a financial service, enabling them to capitalize on a timely investment opportunity that would have otherwise been inaccessible through conventional lending channels. Moreover, clients have expressed their satisfaction, with one stating, 'Finance Narrative made the financing process smooth and customized to my requirements, which was vital for my business.

Mortgage Choice: Comprehensive Loan Options Including Commercial Bridge Loans

The service distinguishes itself with an extensive selection of credit alternatives, prominently featuring commercial property financing, SMSF funding, and offerings from the best commercial bridge loan lenders tailored for various property types, including warehouses, retail spaces, factories, and hospitality projects. This diverse portfolio empowers clients to explore customized financing solutions that meet their specific needs. With a strong commitment to customer service, Financial Narrative offers expert guidance and support throughout the financing application process, ensuring clients feel informed and confident in their decisions.

Specializing in crafting refined and highly tailored business cases, the organization aids clients in securing the appropriate business loans from a wide array of lenders, encompassing high street banks and private lending panels. This dedication to personalized service, coupled with their extensive offerings, positions the firm as one of the best commercial bridge loan lenders for companies seeking effective bridge financing solutions in 2025. As Natasha B. from VIC remarked, 'I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey.'

Furthermore, with the anticipated rise in mergers and equity issuance driven by nearshoring and foreign investments, the organization is well-equipped to assist individuals in navigating these evolving financial landscapes.

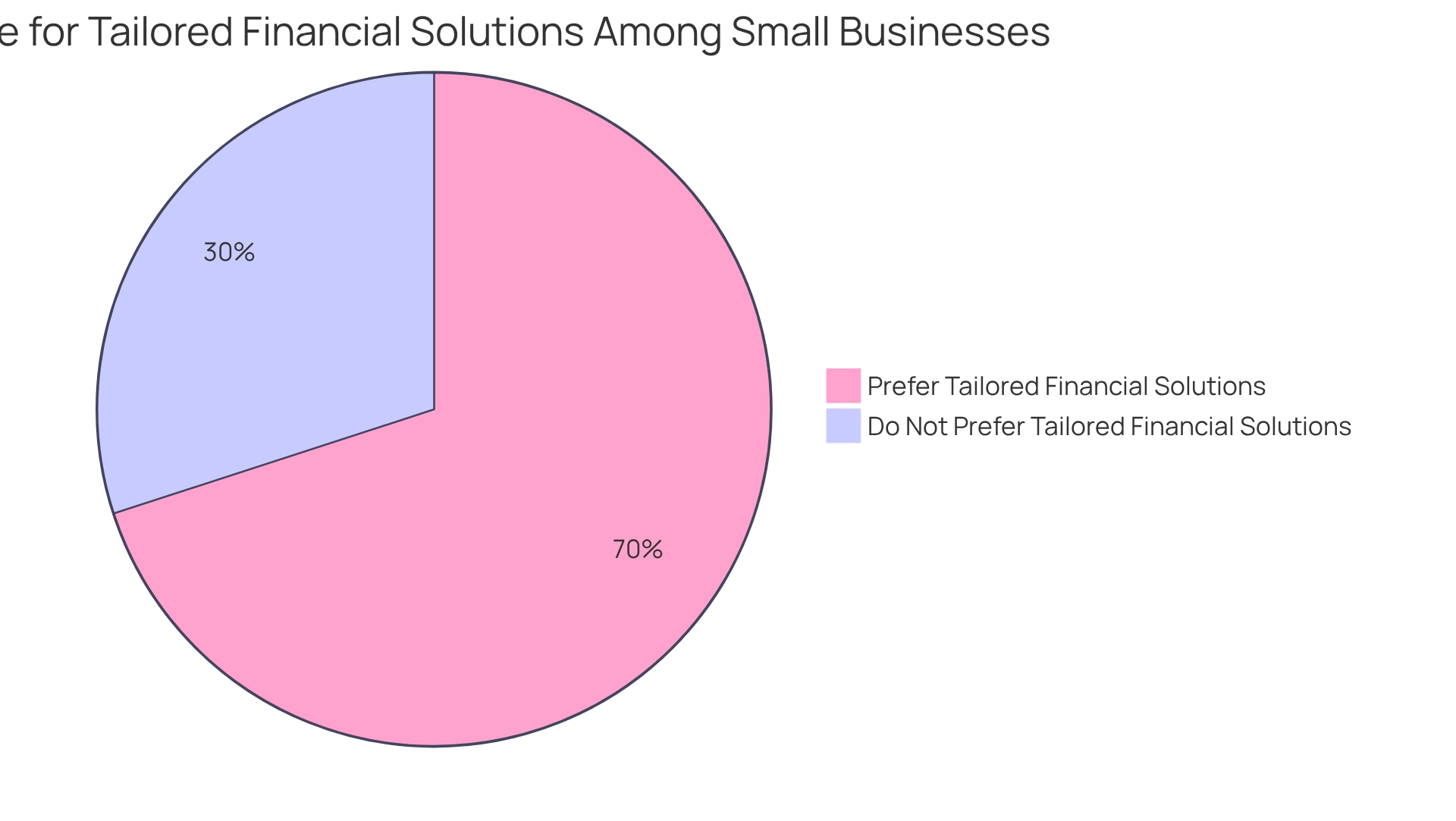

Simplicity: Boutique Commercial Finance Solutions for Tailored Needs

This narrative presents a distinguished boutique financial provider committed to delivering tailored commercial funding solutions. By concentrating on the unique requirements of each customer, Financial Narrative ensures that individuals and enterprises secure the most suitable funding options available. Their commitment to exceptional service, combined with a profound understanding of the commercial lending landscape and access to a comprehensive array of lenders, positions this organization as a preferred choice for those seeking customized financial solutions.

In 2025, the emphasis on personalized financing is more critical than ever, as businesses navigate a complex financial environment. Statistics reveal that boutique finance providers in Australia are increasingly favored, with a reported 70% of small businesses opting for customized solutions that align with their specific needs.

Client testimonials reflect high satisfaction levels, with many praising the tailored financing options that have empowered them to achieve their business objectives. For instance, one customer stated, "The financial service assisted us in obtaining the funding we required for our growth, making the process smooth and hassle-free." Furthermore, a recent case study highlighted how a client leveraged the company’s tailored services to launch a new website without initial expenses, allowing them to continue providing essential services during challenging times. This initiative exemplifies the tangible benefits of personalized financial support in difficult circumstances.

Overall, the approach adopted not only enhances customer satisfaction but also underscores the significance of adaptability and innovation in the commercial financing sector.

Xero: Informative Resources and Guides on Bridge Loans

Financial Narrative possesses extensive expertise in developing tailored funding proposals that cater specifically to the unique needs of small business owners aiming to secure financing for commercial property investments and refinances. Our specialized approach guarantees that each business case is meticulously polished and individualized, effectively addressing the elevated expectations of lenders. By collaborating with a diverse array of lenders, including high street banks and innovative private funding groups, we empower our clients to navigate the complexities of obtaining appropriate business financing for their specific situations—be it acquiring a warehouse, retail outlet, factory, hospitality enterprise, or office space.

Understanding the intricacies of repayment criteria is essential for effective business financing. At our organization, we provide insights that help clients grasp the critical components of repayment frameworks, ensuring they are well-prepared to engage with lenders. This knowledge is particularly valuable in a competitive lending landscape, where being informed can significantly impact the ability to secure favorable terms.

As the market evolves, especially with recent indications of declining interest rates from the Federal Reserve, small business owners must remain vigilant about how these changes influence their financing options. By leveraging our expertise in refinancing and customized business financing, clients can confidently navigate the lending environment and seize opportunities that align with their business objectives. Finance Story is dedicated to empowering small business owners with the knowledge and resources necessary to achieve successful financing outcomes in 2025.

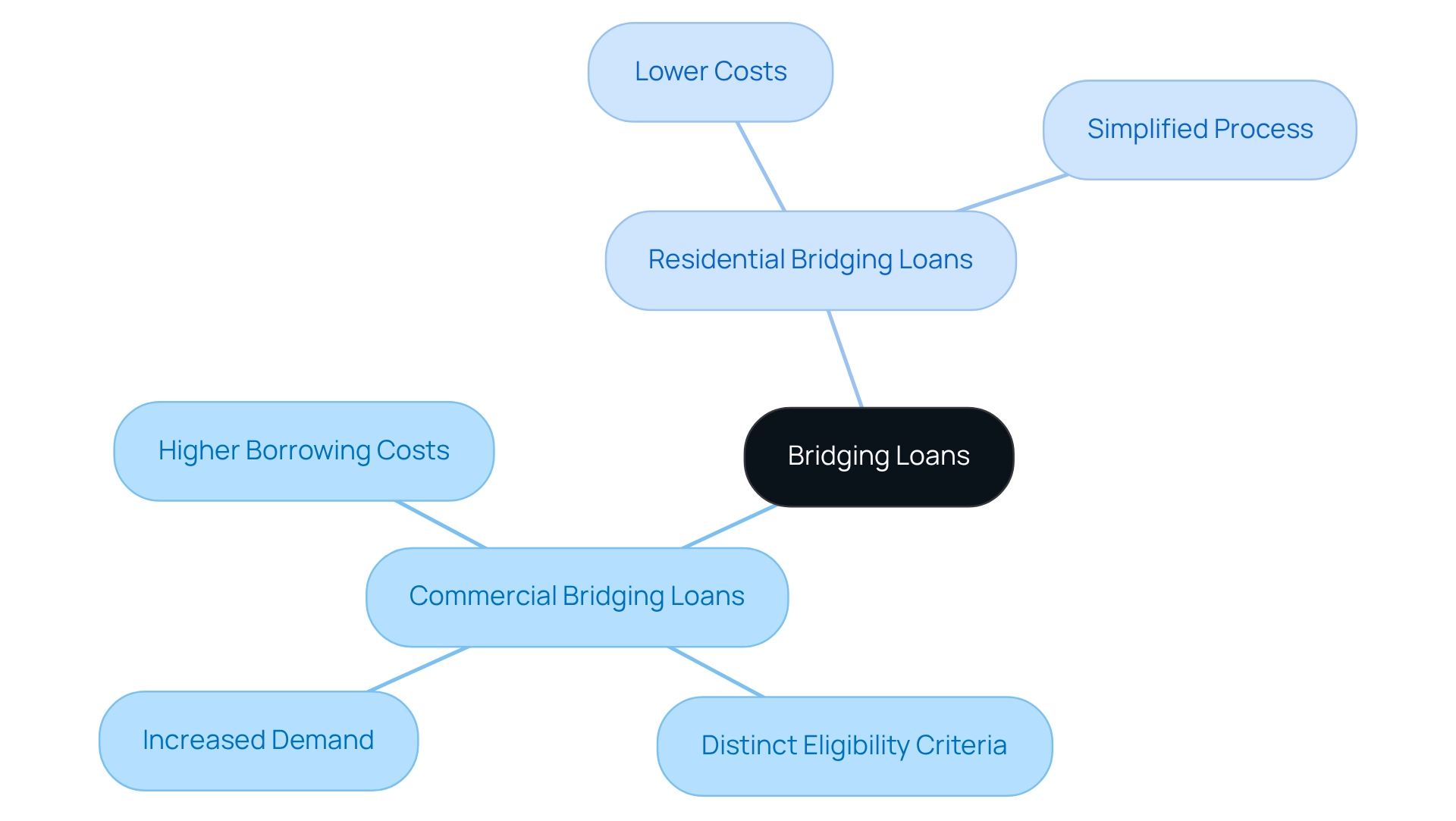

Brickflow: Insights on Commercial vs. Residential Bridging Loans

Understanding the essential distinctions between commercial and residential bridging finances is crucial for borrowers looking to choose the best commercial bridge loan lenders for informed funding decisions. Typically, the best commercial bridge loan lenders provide financing that incurs higher borrowing costs and distinct eligibility criteria compared to residential options. For instance, the average borrowing expenses for commercial bridging financing in 2025 are projected to be significantly higher than those for residential financing, reflecting the heightened risk and complexity associated with commercial transactions.

At Finance Story, we excel in crafting polished and highly individualized business cases for presentation to banks, ensuring that small business owners can effectively navigate their financing options. Our expertise in refinancing and securing customized business financing for commercial property investments equips us to meet the evolving demands of our clients. We collaborate with a diverse range of lenders, including high street banks and innovative private lending panels, to deliver the best financing solutions tailored to your needs. Recognizing these differences empowers borrowers to make informed decisions that align with their financial objectives.

This understanding is particularly vital in a competitive market where brokers are encouraged to differentiate themselves, as evidenced by recent trends in the lending landscape. Notably, over 5,000 additional Australian brokers now have access to a comprehensive array of non-bank lending solutions, providing customers with a broader selection of options.

Moreover, the increasing demand for bridge financing has fostered a favorable environment for both brokers and the best commercial bridge loan lenders, allowing them to provide more customized solutions to their clients. As Arthur Kavelas, State Manager for VIC, notes, "Credit analysts, property risk analysts, BDMs, and brokers all collaborate to deliver results on application requests swiftly and efficiently." This collaboration is essential in ensuring that borrowers receive the necessary support throughout the financing process. Brokers can earn commissions on initial funding amounts without the risk of clawbacks, enhancing their income potential while providing valuable assistance to borrowers navigating the complexities of financing.

In summary, insights from financial narratives not only clarify the key differences between commercial and residential bridging options but also illustrate how informed decision-making can lead to improved financial outcomes for individuals. For small business owners seeking financing, understanding these nuances is essential—contact us today to explore your options and discover the best lending solutions tailored to your needs.

efundercapital.com: Detailed Insights on Commercial Bridge Loan Rates and Terms

Finance Story offers comprehensive insights into commercial bridge financing rates and terms, equipping customers with essential tools to identify the best commercial bridge loan lenders and effectively compare diverse funding options. Their thorough analysis includes current average rates, repayment terms, and eligibility criteria, which are crucial for borrowers navigating the lending landscape in 2025. Notably, 2024 saw an increase in regulated bridging, evolving from a niche role to a mainstream financing method. This shift underscores the growing importance of bridge financing in today's market. Such transparency not only aids clients in understanding the intricacies of various financial products but also empowers them to select the most suitable bridge financing options tailored to their unique financial situations.

As the demand for bridge loans from the best commercial bridge loan lenders continues to rise, influenced by fluctuating market conditions, this publication serves as a valuable resource for informed decision-making in commercial lending. Furthermore, as Erika Giovanetti observes, "Buy now, pay later typically doesn't require a hard credit inquiry, and you can use it to borrow exactly as much as you need to cover your expense," which highlights the evolving landscape of borrowing methods.

For small business owners seeking financing options, visiting Finance Story to compare current rates and terms is a recommended next step.

Conclusion

The landscape of commercial finance is undergoing a rapid transformation, with Finance Story leading the charge by providing tailored bridge loan solutions that address the unique needs of clients. By leveraging a profound understanding of individual circumstances alongside a diverse array of lenders, Finance Story empowers businesses to secure optimal funding for property acquisitions and expansions. Their emphasis on personalized service, swift approval times, and flexible terms positions Finance Story as a trusted partner in navigating the complexities of commercial financing.

As the demand for bridge loans continues to surge, propelled by evolving market dynamics and economic recovery, the significance of expert guidance becomes increasingly clear. Finance Story's unwavering commitment to innovation and a comprehensive approach ensures that clients are well-equipped to seize opportunities as they arise, whether through refinancing or new investments. Testimonials from satisfied clients further underscore the effectiveness of their services, highlighting the positive impact of tailored financial solutions.

Ultimately, as businesses prepare to confront the challenges and opportunities of 2025, collaborating with a knowledgeable broker like Finance Story can prove pivotal. With a focus on adaptability and a client-centric approach, Finance Story stands ready to support businesses in achieving their financial goals, solidifying their role as an invaluable resource in the commercial finance sector.