Overview

This article identifies the best commercial loan providers by comparing their essential features and selection criteria. It outlines various loan types and highlights the significance of interest rates, fees, and lender reputation. Furthermore, it provides a comparative analysis of leading providers, ultimately guiding businesses in making informed financing decisions that align with their operational needs.

Introduction

Navigating the world of commercial loans presents a significant challenge for business owners aiming to secure the right financing. With a diverse array of loan types available, each crafted to address specific business needs, comprehending the nuances of these financial tools is vital for making informed decisions.

From traditional term loans that facilitate major purchases to flexible lines of credit designed for managing cash flow, the options can indeed feel overwhelming. Furthermore, disparities in loan approval rates, particularly for women entrepreneurs, underscore the necessity of awareness and strategy within the lending landscape.

As businesses confront ever-evolving market conditions, a comprehensive understanding of commercial loan options and provider criteria becomes essential for fostering growth and achieving financial stability.

Understanding Commercial Loans: Types and Features

Understanding Commercial Loans: Types and Features

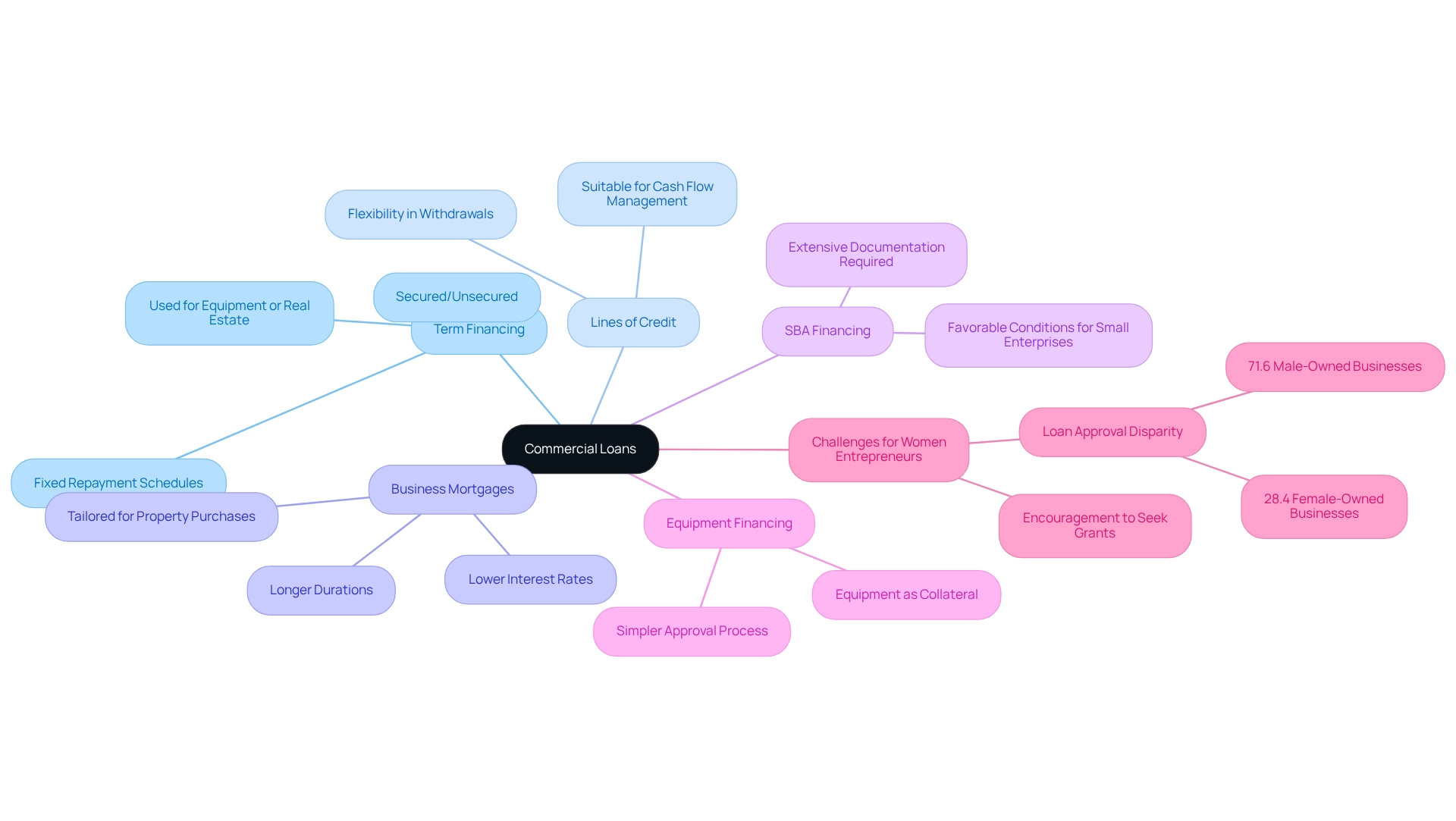

Commercial loans are essential financial tools catering to various business needs, categorized into several distinct types, each with unique features:

- Term Financing: These conventional arrangements come with fixed repayment schedules, generally used for substantial acquisitions like equipment or real estate. They can be either secured or unsecured, depending on the borrower's credit profile.

- Lines of Credit: Offering flexibility, lines of credit enable organizations to withdraw funds as required, making them suitable for managing cash flow variations and unforeseen costs.

- Business Mortgages: Tailored specifically for purchasing business properties, these loans typically provide longer durations and lower interest rates compared to other financing alternatives, making them appealing for property investments. Finance Story focuses on developing refined and highly customized proposals to present to the best commercial loan providers, ensuring clients secure the most favorable conditions for their commercial loans. Furthermore, we provide access to a complete range of financial institutions, including the best commercial loan providers, high street banks, and innovative private lending groups, to address varied financing requirements.

- SBA Financing: Supported by the Small Business Administration, these funds offer favorable conditions for small enterprises, although they necessitate extensive documentation and a detailed application process.

- Equipment Financing: This form of credit is specifically designed for acquiring equipment, utilizing the equipment itself as collateral, which reduces risk for lenders and can enable simpler approval.

Recent trends indicate an increasing reliance on these funding alternatives, with a notable proportion of enterprises utilizing term financing and lines of credit for working capital and inventory management. Significantly, in 2022, male-operated enterprises obtained 71.6% of funding approval amounts, whereas female-operated enterprises received merely 28.4%. This disparity emphasizes the challenges women entrepreneurs face in securing funding and highlights the importance of recognizing the different types of financial options available, along with the characteristics that can most effectively support a company's growth and operational needs.

Specialist views underscore the necessity for entrepreneurs to have a comprehensive understanding of financing types. As Jim Pendergast observes, "Factoring happens when companies sell their outstanding accounts receivable to a third-party factoring firm in return for an immediate cash advance." This illustrates a varied approach for managing cash flow that can enhance traditional business financing. By selecting the appropriate type of financing, enterprises can effectively navigate financial challenges and capitalize on growth opportunities.

Additionally, the case study titled "Women Are at a Disadvantage as Male-Owned Businesses Have a Higher Chance of Approval" serves as a poignant reminder of the systemic barriers that women entrepreneurs encounter in the lending landscape. By understanding these dynamics and exploring various financing alternatives, including refinancing opportunities, owners can better position themselves to secure the funding they require.

Key Criteria for Choosing a Commercial Loan Provider

When selecting a commercial loan provider, businesses must meticulously evaluate several key criteria:

- Interest Rates: Comparing rates among different lenders is crucial, as even minor variations can lead to substantial savings over the financing term. As of March 11, 2025, average interest rates for commercial financing in Australia are competitive, underscoring the importance of thorough research.

- Financing Conditions: Assess the duration of the financing and its repayment conditions. While longer terms may lower monthly payments, they can also result in higher overall interest costs, impacting your total financial outlay.

- Fees and Charges: Remain vigilant about potential hidden fees, such as origination fees, prepayment penalties, and closing costs. Studies indicate that many borrowers overlook these expenses, which can significantly affect the total cost of the loan.

- Creditor Reputation: Investigate the creditor's standing through customer reviews and testimonials. A provider known for exceptional customer service can facilitate a smoother borrowing experience, which is vital for sustaining operations.

- Adaptability: Determine if the provider offers flexible repayment options or the ability to adjust terms in response to changing operational conditions. This adaptability can be instrumental in effectively managing cash flow.

- Specialization: Some financial institutions focus on specific sectors or loan categories, which can be advantageous if your business has unique funding needs. Choosing a financial institution with relevant expertise can improve your chances of securing favorable terms.

- Types of Lenders: Explore the variety of lenders available, including high street banks and private lending panels. This diversity can provide more options tailored to your specific requirements.

- Asset Backing: Understand the importance of asset backing in obtaining favorable credit terms. Lenders often prefer financing supported by tangible assets, which can enhance your chances of approval.

Incorporating these criteria into your decision-making process will empower you to select the best commercial loan providers that align with your objectives and financial needs. Finance Story specializes in crafting refined and highly customized cases to present to banks, ensuring you have the best opportunity to secure the appropriate funding. As Phil Collard, a financing specialist at Money.com.au, states, "The appropriate credit facility can be a very powerful tool to accelerate growth, so be sure to have your plans clearly mapped out, including anticipated ROI." Furthermore, corporate financing provides numerous benefits for enterprises aiming to fund expansion, including a variety of options for diverse funding needs, affordability due to asset support, and flexible repayment strategies tailored to organizational cash flow.

Comparative Analysis of Leading Commercial Loan Providers

A comparative analysis of several leading commercial loan providers reveals distinct features that can significantly impact financing decisions for businesses:

- Provider: NAB

Interest Rates: 5.5% - 7.0%

Loan Terms: 1-15 years

Fees: Moderate

Specialization: General commercial loans - Provider: Liberty Financial

Interest Rates: 6.0% - 8.0%

Loan Terms: 1-30 years

Fees: Low

Specialization: Flexible lending options - Provider: BOQ Specialist

Interest Rates: 5.0% - 6.5%

Loan Terms: 1-20 years

Fees: High

Specialization: Medical and professional practices - Provider: Hunter Galloway

Interest Rates: 5.5% - 7.5%

Loan Terms: 1-10 years

Fees: Moderate

Specialization: Commercial property loans - Provider: ING

Interest Rates: 5.0% - 6.8%

Loan Terms: 1-15 years

Fees: Low

Specialization: Experienced owner-occupiers

This summary assists businesses in identifying which lender aligns best with their financial goals and needs.

Present interest rates for business financing in Australia differ, with NAB providing competitive rates between 5.5% and 7.0%, while Liberty Financial offers flexible choices with rates ranging from 6.0% to 8.0%. The overall costs associated with commercial loans can fluctuate based on various factors, including origination/application fees, annual fees, brokerage fees, and late or default fees, which are crucial for companies to consider when evaluating their financing options.

For instance, Liberty Financial is noted for its flexible lending solutions, catering to businesses with unique financial needs. This adaptability is crucial in the current economic climate, where the real estate market is evolving in response to market demands. A case study featuring Thinktank demonstrates this trend; they have increased their highest credit amounts for business and SMSF transactions, introducing innovative lending solutions to assist brokers and clients in obtaining financing amid evolving market conditions.

Expert insights emphasize the importance of understanding interest rates and fees when selecting the best commercial loan providers. As Belinda Wright, head of partnerships and distribution at a non-bank lender, states, "We’re committed to supporting brokers in navigating market shifts effectively." This highlights the necessity for businesses to stay informed about the lending landscape to make educated financial decisions.

In summary, while NAB provides a moderate fee structure and general business financing, Liberty Financial distinguishes itself with its low fees and adaptable lending choices. BOQ Specialist caters specifically to medical and professional practices but comes with higher fees. Hunter Galloway offers reasonable charges for business property financing, while ING is advantageous for seasoned owner-occupants with attractive rates and minimal fees. Comprehending these strengths and limitations is essential for small enterprise owners as they navigate their financing options.

Making an Informed Choice: Selecting the Right Provider for Your Business

To select the right commercial loan provider, businesses should follow these essential steps:

- Assess Your Needs: Clearly define your financing requirements, including the amount needed, the purpose of the loan, and your repayment capacity. Understanding these factors is crucial, as nearly 9% growth in business lending in Australia from 2022 to 2023 indicates increasing financial support for SMEs.

- Research Providers: Utilize online resources and reviews to gather information about potential financial institutions. Pay attention to their reputation and customer service, as these elements can significantly impact your borrowing experience. Finance Story provides a complete variety of financial institutions, guaranteeing you discover the suitable match for your particular situation.

- Compare Offers: Request quotes from multiple lenders and compare their interest rates, terms, and fees. A comparative analysis table can be a useful tool in this process, helping you visualize the differences and make informed decisions. Finance Story focuses on crafting refined and highly personalized cases to present to banks, improving your chances of obtaining favorable terms.

- Consult with Experts: Consider seeking advice from financial consultants or brokers who can provide personalized recommendations based on your enterprise situation. As Phil Collard, a business lending specialist, observes, "The appropriate financing option can be a very powerful tool to accelerate growth, so be sure to have your plans clearly outlined, including anticipated ROI." At Finance Story, our Head of Funding Solutions, Shane Duffy, is available for a free personalized consultation to help you navigate the complexities of commercial financing.

- Read the Fine Print: Before signing any agreements, carefully review the terms and conditions to ensure you understand your obligations and any potential penalties. This diligence can prevent costly surprises down the line.

- Make a Decision: Choose the lender that best meets your needs, balancing cost, flexibility, and service quality. Ensure that the selected provider aligns with your long-term objectives, as the appropriate financing option can be a powerful tool for growth. Additionally, it's worth noting that industries such as healthcare, retail trade, professional services, and construction employ the greatest number of people, which may influence your financing needs and options.

By following these steps and considering the broader economic context, small business owners can make informed decisions when selecting the best commercial loan providers. Don't hesitate to book your free personalized consultation with Finance Story to start crafting your tailored financial strategy.

Conclusion

Navigating the landscape of commercial loans is an essential undertaking for business owners aiming to secure the appropriate financing for growth and stability. This article underscores the diverse types of commercial loans available—term loans, lines of credit, commercial mortgages, SBA loans, and equipment financing—each tailored to meet distinct business needs. Understanding these options is crucial, especially given the disparities in loan approval rates between male and female entrepreneurs, which highlights the necessity for awareness and strategic planning in the lending process.

Selecting the right loan provider requires careful evaluation of several key criteria, including interest rates, loan terms, fees, and the lender's reputation. By meticulously assessing these factors and comparing offers from various providers, businesses can empower themselves to make informed decisions that align with their financial objectives. The comparative analysis of leading commercial loan providers presented in this article further emphasizes the importance of vigilance and awareness regarding financing options available to business owners.

Ultimately, the pursuit of a commercial loan should be approached with a strategic mindset. By evaluating specific financing needs, conducting thorough research, and consulting with experts, businesses can significantly improve their chances of securing favorable terms. With the right commercial loan in place, entrepreneurs can adeptly navigate financial challenges and seize growth opportunities, ensuring long-term success in an ever-evolving market landscape.