Overview

Engaging a finance broker for tailored financial solutions is crucial, as they act as intermediaries connecting clients with a diverse array of lenders. This connection is vital in securing the most appropriate financial products. Brokers possess the expertise necessary to navigate complex financial landscapes, negotiate favorable terms, and provide personalized service. These attributes collectively increase the likelihood of successful loan approvals and better financing options for clients. By leveraging their knowledge, clients can achieve optimal financial outcomes.

Introduction

In the complex realm of finance, the journey to secure the right funding can often seem daunting. Finance brokers stand out as essential allies in this process, effectively bridging the divide between clients and lenders, while providing customized solutions that meet distinct financial needs.

Leveraging a vast network of connections and a profound understanding of the financial landscape, these professionals empower both individuals and businesses to obtain the capital crucial for growth and success.

As the demand for tailored financial guidance continues to rise, the importance of brokers becomes ever more pronounced, transforming intricate challenges into achievable opportunities.

Through skillful negotiation and continuous support, finance brokers not only improve the loan application experience but also cultivate long-term financial health for their clients.

Define the Role of a Finance Broker in Your Financial Journey

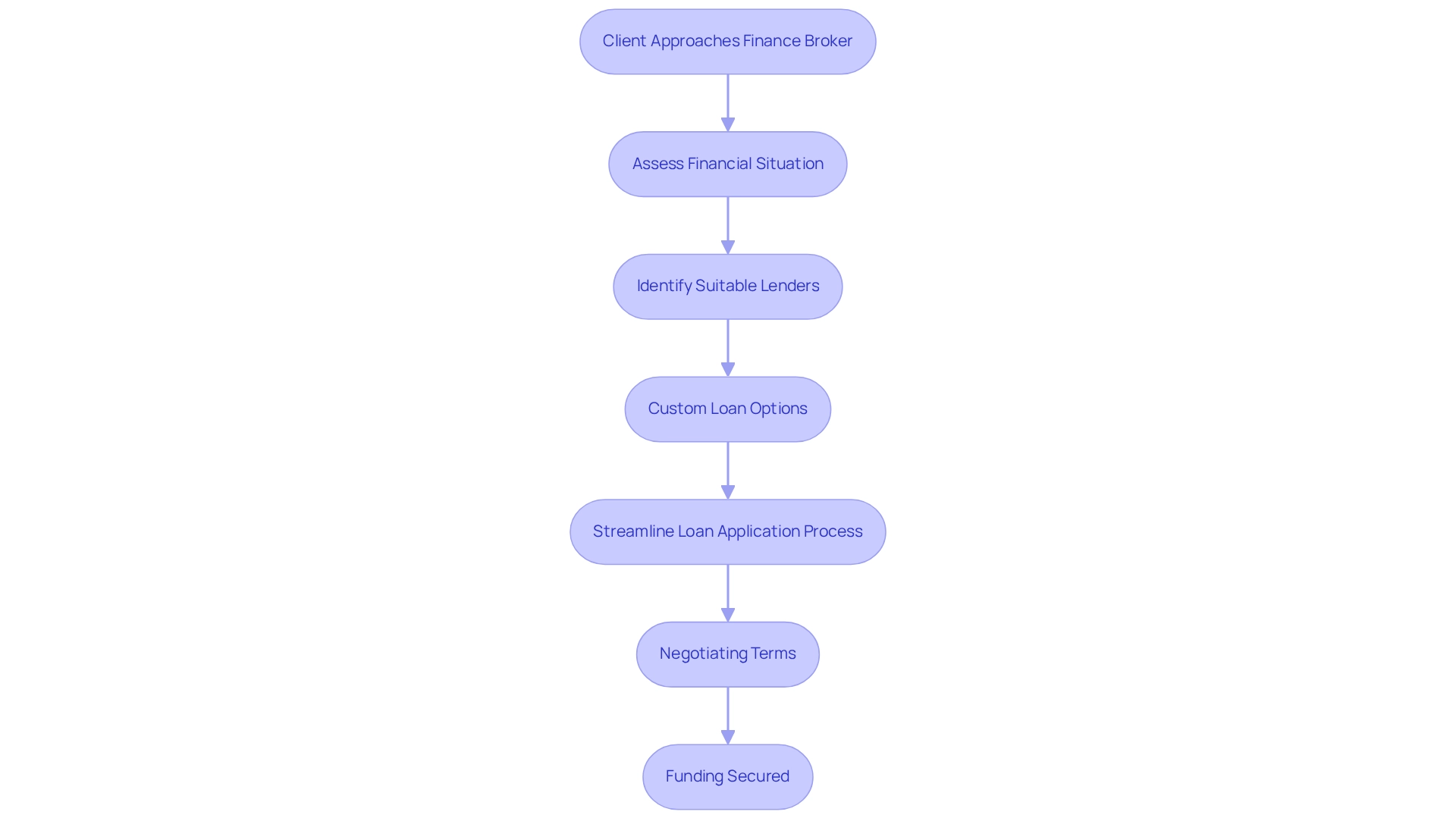

A finance broker serves as a crucial intermediary between customers and lenders, highlighting why use a finance broker is essential for helping individuals and businesses secure the most suitable financial products. At Finance Story, we understand business like no one else, working closely with our partners to develop robust business cases tailored to their specific needs. By thoroughly assessing customers' financial situations, we leverage our extensive connections with a diverse range of lenders—including traditional banks, private financiers, and angel investors—to pinpoint customized loan options. This expertise is particularly beneficial for those who may lack the time or knowledge to navigate the often complex financial landscape independently, highlighting why use a finance broker is important. Our commitment to fostering ongoing relationships allows us to streamline the loan application process, managing paperwork, negotiating favorable terms, and providing expert guidance throughout the journey. Recent statistics indicating that commercial and asset finance volumes have surged by over 20 percent underscore why use a finance broker, highlighting the increasing reliance on these professionals within the industry. This growth can be attributed to brokers' ability to connect individuals with appropriate financing options, highlighting why use a finance broker is crucial for facilitating access to essential capital for business growth and development.

Case studies, such as the recognition of mortgage and asset brokers by industry leaders, underscore the critical roles brokers play in enhancing experiences for consumers and entrepreneurs alike. For example, at Finance Story, we have successfully assisted small business owners in securing funding for expansion projects, demonstrating our effectiveness in navigating complex financial scenarios. One satisfied client, Natasha B. from VIC, remarked, 'I will certainly be suggesting your services to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey.' This acknowledgment of the intermediary sector's evolution further illustrates our role in helping individuals achieve their financial goals efficiently and effectively.

In addition to securing loans for growth, we specialize in refinancing commercial properties to meet the evolving needs of businesses. Our expertise in crafting refined and highly customized case studies ensures that clients can access the best refinancing options available. In summary, understanding why use a finance broker is crucial, as these specialists are indispensable allies in the economic journey, providing personalized solutions and expert advice that empower clients to make informed decisions and secure the funding they require.

Explore the Unique Benefits of Using a Finance Broker

There are distinct advantages to engaging a finance broker, which is why using a finance broker is particularly beneficial for small business owners seeking tailored financial solutions. Brokers provide access to a wider array of financial products and lenders than individuals typically encounter independently. Their established relationships with various financial institutions empower them to negotiate more favorable rates and terms on behalf of their clients.

Statistics from 2025 indicate that the conversion rate of home loan applications to settlements has fallen below 80%, marking a 9.2 percentage point decline year on year. This highlights the critical need for expert guidance in navigating the complexities of the lending landscape. At Finance Story, we specialize in delivering seamless and personalized financing solutions for home buyers, ensuring that our offerings are specifically designed to meet individual financial requirements. This tailored approach frequently results in improved loan terms and conditions.

Moreover, agents provide ongoing support throughout the loan process, assisting clients in overcoming any challenges that may arise. Case studies demonstrate that individuals utilizing financial intermediaries often achieve significant savings and more favorable loan conditions compared to those who handle the process alone. As Anja Pannek, CEO of MFAA, states, "We believe this campaign will enhance the visibility and promote the strong reputation of our member agents, providing a significant boost in connecting them with clients actively seeking reliable and skilled professionals." Additionally, the MFAA campaign aims to connect potential homebuyers with certified agents, emphasizing the credentials and continuous professional development essential for agents.

The role of brokers is crucial in enhancing the decision-making process for consumers, which highlights why using a finance broker is invaluable for small business owners looking to optimize their financing options through customized mortgage brokerage solutions from Finance Story. Furthermore, Finance Story offers specialized refinancing options that help clients access equity and lower rates, ensuring that both self-employed and salaried individuals can take advantage of our comprehensive services.

Understand the Importance of Personalized Financial Solutions

In today’s intricate economic environment, it is crucial to understand why use a finance broker, as tailored solutions are essential and standard methods often fail to meet diverse customer requirements. A finance specialist, such as Finance Story, invests time to thoroughly understand each client's unique financial circumstances, aspirations, and challenges. This customized understanding empowers agents to recommend financing products specifically optimized for individual situations, particularly in commercial property investments and refinances.

For instance, a small business owner seeking expansion may require distinct financing options compared to an individual purchasing their first home. By offering tailored solutions, agents not only enhance customer satisfaction but also significantly increase the likelihood of successful loan approvals. Research shows that 78% of consumers would continue using their bank if they received personalized support, emphasizing the vital role of tailored services in promoting long-term financial health.

Moreover, a report highlights that despite advancements in digital banking, customers still value personal interactions for their banking needs, which raises the question of why use a finance broker to ensure personalized service. Additionally, understanding why use a finance broker is important, as their ability to customize solutions to customer needs can lead to higher approval rates, making customers feel more understood and supported throughout the financing process.

Finance Story excels in crafting refined and highly tailored cases to present to banks, ensuring that customers secure the appropriate loans for their commercial investments. With access to a comprehensive range of lenders, including high street banks and innovative private lending panels, Finance Story is well-equipped to assist clients in financing various commercial properties, such as warehouses, retail premises, factories, and hospitality ventures. This expertise in refinancing and securing customized business loans further illustrates the value of personalized monetary solutions.

Address Common Financial Challenges with Broker Support

Clients frequently encounter substantial financial obstacles, such as challenges in securing loans due to poor credit histories, insufficient documentation, or complex financial situations. In these circumstances, understanding why use a finance broker becomes essential, as they leverage their expertise and industry connections to effectively navigate these hurdles. Finance Story specializes in crafting refined and highly personalized business cases for lenders, significantly boosting loan approval rates for clients, even those with poor credit histories.

Brokers assist individuals in enhancing their credit profiles and gathering the necessary documentation, ensuring that their financial situations are presented favorably to lenders. Furthermore, they can uncover alternative financing options that clients might overlook, including private lenders or specialized loan products tailored to unique circumstances. Finance Story offers a comprehensive array of lenders, encompassing high street banks and innovative private lending panels, to meet diverse customer needs.

As finance professional Balki Bartokomous remarked, "I’m in debt. I am a true American," emphasizing the shared nature of economic struggles. By addressing these common challenges, intermediaries demonstrate why use a finance broker to empower individuals to overcome obstacles and achieve their financial goals, transforming hindrances into opportunities for success. A relevant case study titled 'Aligning Budget with Priorities' illustrates how intermediaries have effectively aided individuals in reassessing their expenditures to meet their objectives, showcasing the tangible benefits of intermediary support in confronting economic challenges.

Additionally, brokers provide guidance that helps clients remain focused amidst market noise and the fear of loss, further highlighting their significance in the financial landscape.

Conclusion

Navigating the financial landscape can indeed be a formidable challenge. Finance brokers emerge as invaluable partners in this journey. Acting as intermediaries between clients and lenders, they provide tailored solutions that cater to the unique financial needs of individuals and businesses alike. Their extensive networks and expertise empower them to match clients with the most suitable funding options, ultimately facilitating access to essential capital for growth and development.

The increasing reliance on finance brokers is evident, highlighted by a significant surge in commercial and asset finance volumes. This trend underscores the crucial role brokers play in simplifying the loan application process, negotiating favorable terms, and providing continuous support throughout the financing journey. Positive testimonials from satisfied clients further emphasize the effectiveness of brokers in transforming complex financial scenarios into achievable opportunities.

Furthermore, personalized financial solutions are essential in today's diverse economic landscape. Brokers excel in understanding the distinct circumstances and aspirations of their clients, leading to improved loan approval rates and overall satisfaction. By addressing common financial challenges and offering ongoing support, finance brokers empower clients to overcome obstacles and achieve their financial goals.

In conclusion, the role of finance brokers transcends mere facilitation; they are essential allies in fostering long-term financial health. By leveraging their expertise and resources, brokers not only enhance the loan application experience but also contribute significantly to the success and stability of their clients' financial futures. Engaging a finance broker is not just a smart choice; it is a strategic move towards securing the funding necessary for growth and prosperity.