Overview

Small businesses must leverage business loan brokers to gain enhanced access to a diverse range of lenders, personalized guidance, and streamlined loan processes. This strategic move ultimately increases the chances of securing favorable financing. Brokers not only save time by managing the complexities of financing applications; they also utilize their expertise and established relationships to negotiate better terms. This capability is crucial for small enterprises as they navigate financial challenges in a competitive landscape.

Furthermore, by working with brokers, small business owners can focus on their core operations while experts handle the intricacies of loan acquisition. Are you ready to explore how a broker can transform your financing journey? With the right support, you can unlock opportunities that may have previously seemed out of reach.

In addition, the article highlights the importance of establishing relationships with brokers who understand your unique business needs. This personalized approach not only facilitates a smoother application process but also ensures that you receive tailored solutions that align with your financial goals. Don't underestimate the power of having a knowledgeable ally in your corner.

Ultimately, engaging a business loan broker can be a game-changer for small businesses. By navigating the financing landscape with a trusted partner, you can secure the funding necessary to thrive and grow. Take action today—consider partnering with a broker to enhance your chances of success.

Introduction

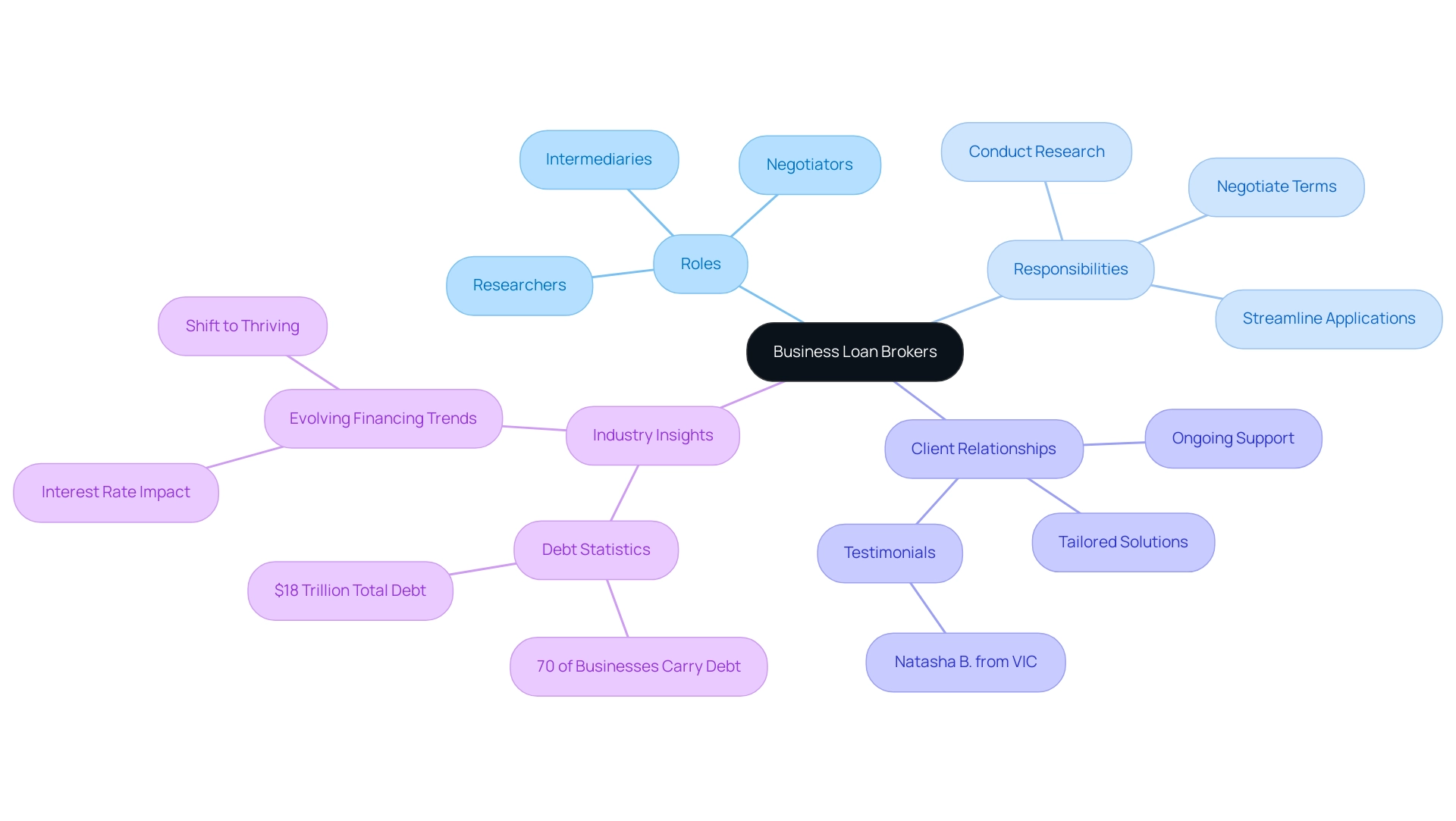

In the ever-evolving landscape of small business financing, the role of business loan brokers has become increasingly vital. Acting as intermediaries between entrepreneurs and a diverse array of lenders, these professionals simplify the daunting loan application process and provide tailored financial solutions that align with each business's unique needs. As many small enterprises grapple with limited access to capital and stringent lending criteria, brokers like Finance Story emerge as essential allies, offering personalized support and a wide range of financing options.

Statistics indicate that approximately 70% of small businesses carry some form of debt. This underscores the expertise and adaptability of brokers, which are crucial in navigating the complexities of obtaining necessary funding. This article delves into the multifaceted benefits of working with business loan brokers, highlighting their role in empowering small businesses to thrive in a competitive market.

Understanding Business Loan Brokers: Who They Are and What They Do

Business loan brokers are essential intermediaries between small enterprise owners seeking financing and lenders ready to provide the necessary funds. Finance Story exemplifies this role, demonstrating a deep commitment to understanding your unique operational needs. With access to a comprehensive panel of lenders—including boutique lenders, private investors, and mainstream banks—we work collaboratively with you to develop strong proposals tailored to your specific financial requirements.

This ongoing relationship ensures that you receive the best possible solutions for expansion, operational costs, or inventory management, reflecting our dedication to your success.

The responsibilities of loan brokers extend beyond mere facilitation; they conduct thorough research on potential lenders, negotiate favorable terms, and streamline the application process. This comprehensive approach not only saves time and effort for entrepreneurs but also enhances the likelihood of securing the most advantageous financing solutions available. In fact, as of 2025, statistics indicate that a considerable portion of businesses—approximately 70%—carry some degree of debt, totaling around $18 trillion.

This underscores the essential role that business loan brokers play in assisting enterprises to navigate their financial obligations and opportunities.

Furthermore, specialist views emphasize the evolving characteristics of minor enterprise funding. Janet Gershen-Siegel, a finance writer, observes, "But as times change and the Fed continues to raise interest rates, financing for lesser enterprises will evolve accordingly, and entrepreneurs may be more inclined to borrow to move beyond surviving and begin thriving." This insight reinforces the argument about the evolving role of intermediaries in guiding entrepreneurs through the complexities of borrowing.

By leveraging their expertise, small enterprises can access tailored financial solutions that not only meet immediate needs but also support long-term growth.

In summary, the role of business loan brokers as financing intermediaries is multifaceted, encompassing research, negotiation, and personalized support. At Finance Story, we exemplify how business loan brokers can provide customized financial solutions, assisting clients in navigating the complexities of securing loans, including lines of credit often used for working capital or inventory. Our adaptability and focus on your needs further highlight the significance of intermediaries in the financing landscape, ensuring that you can thrive in an ever-changing environment.

As a pleased client, Natasha B. from VIC stated, "I will definitely be recommending your service to anyone." We are finished with the constant worry. Once again, thank you so much for being a part of our journey.

This testimonial underscores our commitment to fostering strong relationships and delivering effective financial solutions.

Key Advantages of Using Business Loan Brokers for Small Enterprises

Utilizing business loan brokers as financial intermediaries presents numerous advantages for small enterprises, particularly in the competitive economic landscape of 2025. One of the most significant benefits is the enhanced access to a diverse range of lenders, including both traditional banks and alternative financing sources. This broader scope markedly increases the likelihood of securing favorable financing conditions tailored to the unique requirements of each enterprise.

Furthermore, business loan brokers are instrumental in saving time for business owners. By managing the intricate task of researching and comparing various financing options, brokers empower entrepreneurs to concentrate on their core activities rather than becoming bogged down by paperwork. Their established relationships with lenders can also facilitate more advantageous negotiation outcomes, as these brokers often possess valuable insights into lender preferences and requirements.

Personalized guidance constitutes another key advantage that business loan brokers offer throughout the loan application process. They ensure that companies effectively articulate their financial narratives to potential lenders, with brokers playing a pivotal role in securing approvals. For instance, Finance Story's expertise in crafting refined and highly customized financial cases exemplifies how intermediaries can enable access to funding tailored to the specific needs of commercial property investments, including refinancing options for warehouses, retail spaces, factories, and hospitality projects, all without burdensome presales or serviceability evaluations.

Statistics underscore the importance of employing intermediaries: approximately 70% of small enterprises carry some level of debt, with total liabilities reaching $18 trillion by the end of 2022. As finance author Janet Gershen-Siegel noted, "70% of small enterprises hold some level of debt with a total of $18 trillion owed by the end of 2022." This statistic highlights the critical need for effective financing solutions.

Moreover, as integrated financing continues to grow—projected to reach a value of $23.31 billion by 2031—business financing specialists are increasingly positioned as vital allies in navigating this evolving landscape.

In summary, the advantages of utilizing business loan brokers for small enterprises are clear. They not only enhance access to a broader array of lenders but also streamline the loan process and provide tailored support, ultimately increasing the chances of securing the necessary financing to thrive in today's market. Finance Story's specialized expertise in navigating challenging financial situations, including refinancing for various commercial properties, further distinguishes it as a valuable ally for enterprises striving to overcome financial obstacles.

Navigating Financial Challenges: Why Small Businesses Need Support

Small enterprises frequently grapple with a myriad of financial challenges that can impede their growth and long-term viability. Among these hurdles are:

- Limited access to capital

- Inconsistent cash flow

- Stringent lending criteria set by financial institutions

In fact, as of 2025, a significant percentage of small enterprises report struggling to secure the necessary funding, underscoring the urgency of this issue.

Many small enterprise owners find themselves overwhelmed by the complexities of the financing application process, often lacking the time and expertise to navigate it effectively. This can result in missed opportunities for essential funding, particularly detrimental in an economic landscape marked by fluctuations and unforeseen expenses. The construction sector, for instance, has seen a staggering 25% failure rate among new businesses within their first year, highlighting the precarious nature of financial stability in this industry.

In this challenging environment, business loan brokers, such as those at Finance Story, emerge as invaluable allies. They specialize in creating polished and highly individualized loan proposals for various commercial properties, including:

- Warehouses

- Retail premises

- Factories

- Hospitality ventures

This expertise offers the support essential for enterprises to secure the funding they require to flourish.

Business loan brokers simplify the application process and provide access to a diverse range of financing options that are tailored to the unique circumstances of each enterprise, including both high street banks and innovative private lending panels. This flexibility is essential, particularly as minor enterprises encounter rising pressure to innovate and expand.

Expert views highlight the significance of intermediary support for lesser ventures, especially in 2025, as they navigate the changing financial environment. Shaun McGowan, Founder of Money.com.au, emphasizes the necessity for education and technology in obtaining financing, asserting that he is committed to assisting enterprises in minimizing costs for financial products. By utilizing the expertise and assets of entities like Finance Story, little enterprises can navigate financial challenges, acquire understanding of repayment standards, and set themselves up for achievement.

Furthermore, the agriculture, forestry, and fishing support services sector boasts a profit margin of 20.2%, illustrating the varying financial landscapes minor enterprises operate within. The function of financial advisors is not solely focused on obtaining funding; it’s about enabling local enterprises to flourish in a competitive marketplace. Moreover, with 72% of minor enterprises intending to enhance their video marketing initiatives in 2024, it is clear that they are adjusting and pursuing creative solutions, further highlighting the necessity for financial assistance.

Tailored Financial Solutions: The Personalized Approach of Brokers

A key benefit of partnering with business loan brokers like Finance Story lies in their capacity to provide personalized financial solutions specifically tailored for entrepreneurs. These brokers dedicate time to understanding the unique needs and aspirations of each enterprise, whether self-employed or salaried. This enables them to recommend financing options that align closely with those objectives. Such a tailored approach guarantees that small enterprise owners receive more than just generic financing options; they are presented with solutions crafted for their specific circumstances, such as refinancing to access equity or benefit from lower rates.

For instance, whether an organization seeks funding for expansion, equipment purchases, or working capital, business loan brokers excel at identifying the most suitable options from a comprehensive range of lenders, including high street banks and private lending panels. This personalized guidance not only streamlines the application process but also significantly enhances the likelihood of approval.

In 2025, the focus on personalized financial solutions has become increasingly vital. Statistics reveal that companies utilizing tailored financing options experience higher success rates. The value of refinanced financial commitments reached $37.617 billion in June 2023, underscoring the growing demand for customized financial solutions in the current market.

Business loan brokers leverage their extensive networks and expertise, including the methodologies developed by Finance Story, to navigate the complexities of the lending landscape. This ensures that enterprises can efficiently access the funding they require. The importance of this personalized approach cannot be overstated; it fosters a deeper understanding of each client's financial journey, ultimately leading to more effective and satisfactory outcomes. As Tiffany Johnson, chief product officer, noted, 'Beyond marketing, I’d love to see greater personalization in product design within the financial space to help streamline workflows and support users’ decision-making processes.'

Moreover, case studies illustrate the effectiveness of tailored financial solutions. For instance, companies that engaged with intermediaries, like those at Finance Story, reported enhanced satisfaction and success in securing loans that met their specific needs. The case study titled 'Opportunities in Wealth Management' highlights that top banks hold only a 32% market share in wealth management, indicating potential for growth in personalized services.

As the financial landscape evolves, the role of business loan brokers in offering tailored financing alternatives remains an essential resource for enterprises striving to succeed in a competitive environment. Shane, the founder and Funding Specialist Director at Finance Story, brings expertise in growth and customized financial solutions, further enhancing the company's credibility and establishing them as a reliable partner for entrepreneurs.

Access to Diverse Financing Options: How Brokers Expand Opportunities

Business loan brokers are pivotal in providing enterprises with access to a diverse range of funding options that often surpass conventional lending avenues. With established relationships across a wide network of lenders—including banks, credit unions, and alternative financing sources—business loan brokers are uniquely positioned to offer clients an array of loan products tailored to their specific needs. At Finance Story, we prioritize developing refined and tailored cases that not only meet lender criteria but also align with the evolving needs of entrepreneurs pursuing commercial property investments and refinancing options.

In 2025, statistics reveal that a significant percentage of small enterprises are seeking intermediaries for alternative financing, accessing options that were previously out of reach. This trend underscores the growing reliance on intermediaries, such as business loan brokers, who have adapted to the changing financial landscape by tripling their digital communication since 2018. As James Hickey, a Deloitte partner, notes, "Brokers now conduct three times more communication on a digital platform during the booking process since the 2018 report, enabling them to reach a wider customer base."

This shift not only enhances their ability to connect with a broader customer base but also streamlines the loan application process, making it more efficient for clients.

Expert insights indicate that leveraging network connections can significantly benefit smaller enterprises. Business loan brokers excel at navigating complex financial situations, ensuring clients receive personalized support throughout their financing journey. For instance, small enterprises seeking specialized funding for unique projects can uncover customized solutions through business loan brokers, who understand the nuances of various financing options.

With over 25 years of experience in organizational enhancement and technology implementation, Finance Story exemplifies the expertise that agents bring to the table, amplifying the advantages of utilizing their services.

Client testimonials further illustrate the effectiveness of our offerings. Natasha B. from VIC shares, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." This feedback highlights our commitment to providing tailored mortgage brokerage solutions that address the unique needs of our clients.

Case studies demonstrate how minor businesses have successfully utilized intermediaries to access diverse financing opportunities. For example, a small startup secured funding for an innovative project through connections to alternative lenders, a feat that would have been challenging via traditional channels. Additionally, Finance Story collaborates with a comprehensive portfolio of lenders, including business loan brokers, high street banks, and innovative private lending panels, ensuring enterprises find the right fit for their financing needs.

These examples emphasize the vital role of business loan brokers as intermediaries in broadening access to alternative funding sources, enabling enterprises to secure the resources essential for expansion and innovation. As the landscape of commercial financing continues to evolve, the knowledge and adaptability of intermediaries, like those at Finance Story, remain crucial assets for entrepreneurs striving for success in a competitive market.

Building Lasting Relationships: The Long-Term Benefits of Working with Brokers

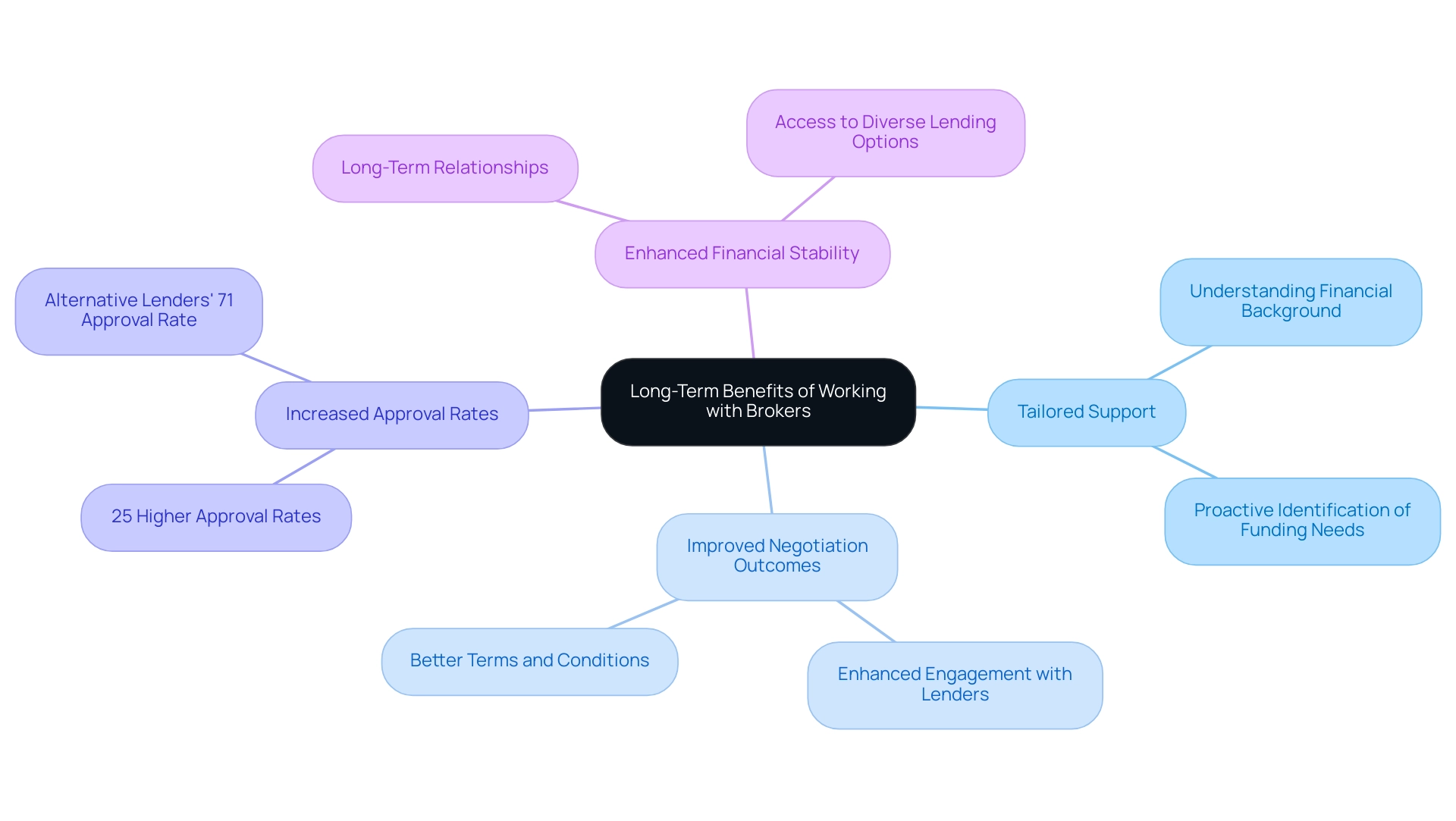

Establishing a long-term partnership with business loan brokers offers substantial advantages for small companies. As agents deepen their understanding of a business's financial background, goals, and challenges, they become equipped to deliver increasingly effective and tailored support. This is particularly crucial when developing customized financing proposals for commercial property investments and refinances. Such ongoing collaboration enables agents to anticipate their clients' funding needs and proactively identify suitable financing options as opportunities arise, leveraging their expertise in navigating the financial landscape.

Moreover, a robust relationship with an intermediary can significantly improve negotiation outcomes. Lenders are often more willing to engage with entities like Finance Story, which have demonstrated a successful track record of partnerships. Research indicates that small enterprises maintaining long-term relationships with business loan brokers experience a 25% increase in approval rates compared to those that do not. Furthermore, alternative lenders boast an approval rate of 71% for loan applications from businesses, in contrast to 58% for traditional banks, underscoring the importance of exploring diverse lending options.

Finance Story, recognized for its professionalism and deep understanding of the finance sector, plays a pivotal role in assisting small enterprises as they navigate these complexities. With access to a comprehensive array of lenders, including high street banks and innovative private lending panels, Finance Story ensures that businesses secure the most appropriate financing for their needs, whether they are acquiring a warehouse, retail space, factory, or hospitality venture. Financial experts emphasize that ongoing collaborations with agents not only enhance loan accessibility but also aid companies in scrutinizing potential hidden charges and interest rates when evaluating loan options.

Additionally, numerous small enterprises have reaped the benefits of forging long-term relationships with business loan brokers, resulting in enhanced financial stability and growth. Ultimately, these enduring relationships play a crucial role in empowering small businesses to navigate the intricacies of the financial landscape with greater confidence and success.

Conclusion

The significance of business loan brokers in the realm of small business financing is paramount. As intermediaries, brokers such as Finance Story play a critical role by connecting entrepreneurs with a wide array of lenders and customizing financial solutions to address specific business needs. Their expertise not only simplifies the often overwhelming loan application process but also increases the likelihood of obtaining favorable terms, which is essential as many small businesses navigate the intricacies of debt.

The benefits of collaborating with brokers extend beyond simple access to capital; they provide personalized guidance that empowers small business owners to effectively articulate their financial narratives. This tailored approach is crucial in a competitive environment where approximately 70% of small businesses are managing some form of debt. By leveraging their extensive networks and insights into lending landscapes, brokers enable access to innovative financing options that traditional banks may overlook.

Moreover, the enduring relationships forged between brokers and small businesses yield substantial advantages. This ongoing partnership allows brokers to anticipate financial needs and proactively identify appropriate loan options, ultimately resulting in higher approval rates. As the financial landscape continues to evolve, the role of business loan brokers remains vital in helping small enterprises navigate challenges and seize opportunities for growth.

In conclusion, engaging a business loan broker transcends merely securing funding; it fosters a strategic partnership that underpins long-term success. By opting to collaborate with professionals who grasp the intricacies of small business financing, entrepreneurs can navigate their financial journeys with assurance, ensuring they are well-prepared to confront the future and realize their aspirations.