Overview

Business finance brokers play a vital role for small business owners, facilitating access to financing by identifying suitable options, negotiating favorable terms, and providing tailored advice to navigate the complex lending landscape. Their expertise is crucial in overcoming financing challenges, enhancing credit profiles, and fostering strong client relationships. This ultimately empowers small enterprises to secure the necessary capital for growth and success.

Have you considered how a finance broker could transform your funding journey? By leveraging their knowledge, business owners can unlock opportunities that may otherwise remain out of reach. Furthermore, brokers can demystify the lending process, making it more approachable and less intimidating.

In addition to their negotiation skills, finance brokers offer personalized strategies that align with the unique needs of each business. This level of customization not only builds trust but also enhances the likelihood of securing the best possible financing options.

As you reflect on your financial situation, think about the potential benefits of partnering with a finance broker. Their insights can be invaluable in navigating the intricacies of business financing, providing you with the confidence to take the next steps toward achieving your goals.

Introduction

In the dynamic landscape of small business financing, the significance of finance brokers has reached unprecedented heights. Acting as intermediaries between business owners and lenders, these experts adeptly navigate the complex array of financial options, delivering tailored solutions that empower entrepreneurs to secure the necessary capital for growth. Given the challenges posed by limited credit history, fluctuating cash flow, and the intricacies of diverse lending products, brokers offer invaluable support by streamlining the financing process and championing their clients' best interests.

As we approach 2025, with small businesses increasingly pursuing innovative funding strategies, it is essential to understand the unique advantages that finance brokers bring to the table for achieving financial success.

Understanding the Role of Business Finance Brokers

Business finance brokers serve as critical intermediaries between small business proprietors and lenders, playing an essential role in the funding process. They assist clients in identifying suitable financing options, negotiating favorable terms, and navigating the often complex lending landscape. With a comprehensive understanding of various financial products, agents adeptly match clients with a diverse range of lenders, including high street banks and private lending panels, tailored to their specific needs and circumstances.

This includes customized refinancing solutions that help access equity and secure lower rates for both self-employed and salaried individuals.

In 2025, the significance of finance brokers is underscored by their ability to provide tailored advice that directly addresses the unique challenges faced by small businesses. This is particularly crucial in a competitive market where access to capital can present significant barriers to growth. For instance, the typical loan amounts for owner-occupier homes vary by state, with New South Wales leading at an average of $449,000, highlighting the diverse monetary requirements across regions.

Moreover, the mortgage and finance broking industry has witnessed a substantial rise in refinancing options, with the value of investor and internal refinancing loans reaching $6.936 billion in December 2022, illustrating the extensive resources available in the market for residential property investment.

Furthermore, finance professionals excel in crafting polished loan proposals that meet the heightened expectations of lenders, particularly in commercial property investments. They understand the nuances of funding alternatives for leasehold enterprises, ensuring that clients can effectively utilize property equity and cash savings for acquisitions. For example, agents have successfully assisted clients in securing funding for various commercial properties, demonstrating their ability to navigate complex financing scenarios.

The mortgage and finance broking industry increasingly acknowledges the importance of building strong relationships with clients. Repeat clients and referrals are vital for generating business, reinforcing the individual's role in fostering long-term partnerships. As Anja Pannek, CEO of the Mortgage and Finance Association of Australia, states, 'Your intermediary is working very specifically with you and what is in your best interest.' This highlights the essential advocacy function intermediaries fulfill in ensuring enterprises obtain the most favorable terms and services.

Case studies illustrate the impact of finance agents on small business funding. For example, independent agents who cultivate referral networks can navigate the competitive landscape more effectively, leveraging strategic connections to enhance their service offerings. One case study titled 'Competitive Forces in Mortgage Intermediation' emphasizes how independent agents increased their client base by 30% through effective networking and personalized service, showcasing the tangible benefits of their expertise.

This flexibility is crucial for entrepreneurs aiming to secure funding in a challenging economic environment.

In summary, the role of business finance brokers is indispensable for modest enterprise owners in 2025. Their expertise not only simplifies the financing process but also empowers organizations to achieve their financial goals, positioning them as trusted allies in the journey toward growth and success.

Tailored Financial Solutions for Small Businesses

Business finance brokers are essential in delivering a range of tailored financial solutions that address the unique needs of small enterprises. At Finance Story, we possess an unparalleled understanding of commerce, providing services such as commercial property loans, finance solutions, SMSF loans, and residential home loans. By meticulously evaluating the specific requirements of each organization, we work closely with you to build robust cases for diverse lending needs.

Consider a startup that may find a line of credit particularly advantageous for managing cash flow, while an established company might seek a commercial property loan to facilitate expansion.

In 2025, minor enterprises are increasingly turning to business finance brokers to navigate the complexities of financing. Statistics indicate that the average loan amount requested by minor enterprises is approximately $94,845, with many seeking capital for expansion initiatives, such as acquiring existing companies or investing in essential machinery. This trend emphasizes the necessity of strategic planning to utilize loan facilities effectively.

Moreover, minor enterprise credit card balances have surged by 18% since 2019, reflecting a growing reliance on credit as companies manage their finances.

Additionally, business finance brokers like Finance Story leverage extensive relationships with a variety of lenders, including mainstream banks and private investors, to negotiate favorable terms and rates. Our comprehensive panel of lenders ensures that small enterprises can access a broad spectrum of financing options tailored to their specific needs. Our customized mortgage brokerage solutions are particularly advantageous in challenging circumstances, delivering expert funding solutions that align with your financial landscape.

As one satisfied client, Natasha B. from VIC, remarked, "I will definitely be recommending your services to anyone." We have alleviated the constant worry. Once again, thank you so much for being a part of our journey.

Expert opinions underscore that engaging business finance brokers can significantly improve the chances of securing tailored financial solutions, particularly in economic climates where discretionary spending is limited. Dr. Pratiti Chatterjee notes that sectors such as hospitality are facing tighter profit margins alongside household budget constraints, making it crucial for enterprises to pursue innovative financing strategies.

Furthermore, the recent 0.7% decline in earnings within rental, hiring, and real estate services adds another layer of complexity to the financial landscape that lesser enterprises must navigate. Ultimately, the expertise of agents at Finance Story in understanding the financial environment, coupled with our commitment to exceptional customer service and personalized interactions, are invaluable assets for small enterprises striving to thrive in a competitive market.

Overcoming Common Financing Challenges for Small Businesses

Small enterprise owners often face a multitude of financing challenges, including limited credit history, insufficient collateral, and unpredictable cash flow. These obstacles can impede their ability to secure essential funding. Business finance brokers, like Shane, the Founder and Funding Specialist Director at Finance Story, play a pivotal role in navigating these complexities. With a BEng Hons in Manufacturing Engineering and a Diploma in Finance & Mortgage Broking, Shane's extensive experience in improvement consulting provides him with unique insights into the significant impact that strategically chosen financial solutions—such as property, automation, and robotics—can have on an organization's long-term growth.

Business finance brokers offer tailored guidance on enhancing credit scores, which is crucial since a robust credit history greatly influences loan approval rates. Many lenders regard credit scores as a primary factor in their decision-making processes. To address the issue of restricted credit history, brokers can recommend strategies such as establishing a company credit profile or utilizing secured credit cards to gradually build a favorable credit history.

Additionally, they assist in preparing comprehensive loan applications, ensuring that all necessary documentation is organized and the business plan is robust and well-articulated. This preparation is vital, as lenders often scrutinize applications thoroughly, particularly for enterprises with less established credit.

In cases where collateral is lacking, business finance brokers can suggest alternative funding options, such as unsecured loans or innovative sources like crowdfunding platforms. These alternatives can provide the necessary funding without the requirement for traditional collateral, allowing companies to pursue growth opportunities without jeopardizing their assets.

A case study exemplifying the success of a small enterprise illustrates the effectiveness of business finance brokers in overcoming financing challenges. In 2024, a startup struggled to secure funding due to its limited credit history and fluctuating cash flow. By partnering with business finance brokers like Shane, the company improved its credit score through strategic financial practices and ultimately secured an unsecured loan that facilitated its expansion into e-commerce—a trend that has surged in recent years.

This aligns with the key trends for 2024, where the growth of e-commerce is a significant factor for expansion. Moreover, it is noteworthy that over 90% of entrepreneurs do not regret starting their ventures, underlining the positive outlook of entrepreneurship. Expert advice from financial advisors underscores the necessity of having a clear financial strategy.

As lending expert Phil Collard states, 'The right loan facility can be a very powerful tool to accelerate growth, so be sure to have your plans clearly mapped out, including expected ROI.' This insight emphasizes the importance for entrepreneurs to work closely with business finance brokers who can adeptly guide them through the funding landscape.

In summary, business finance brokers are essential partners for entrepreneurs facing funding challenges. By providing specialized advice on credit enhancement, loan readiness, and alternative funding solutions, they empower enterprises to secure the capital needed to thrive in a competitive environment. Additionally, with 77% of small enterprise owners reporting successful marketing efforts in the past year, adapting to evolving digital marketing strategies is also crucial for their success.

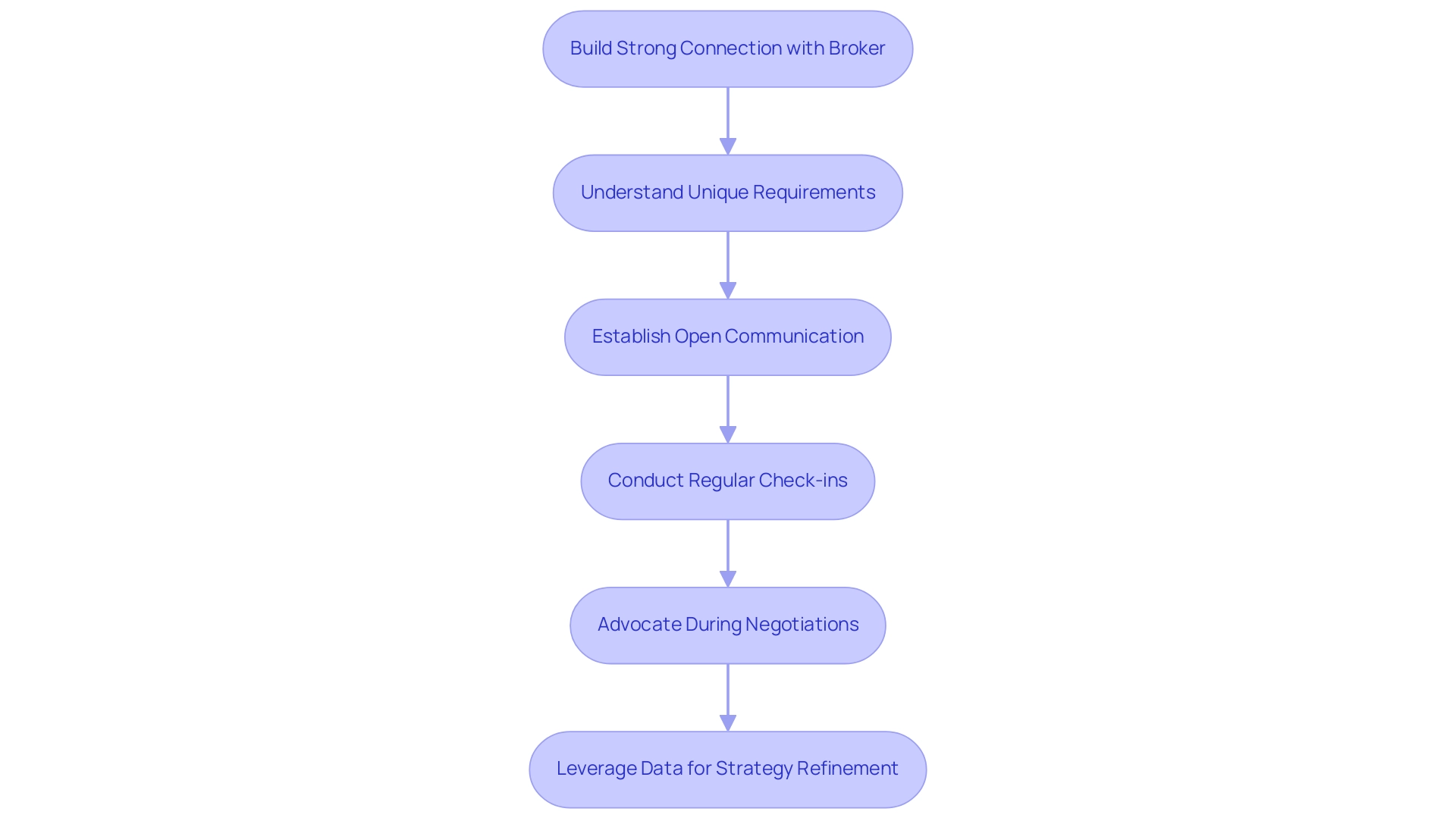

The Importance of Building Relationships with Your Broker

Building a strong connection with your financial advisor and business finance brokers is essential for achieving optimal funding results, especially in challenging economic conditions. A skilled intermediary, such as those at Finance Story, dedicates time to understanding your organization's unique requirements, objectives, and obstacles, establishing a solid foundation for a successful partnership. This relationship fosters open communication, enabling a tailored approach to identifying suitable financing options.

Regular check-ins and updates are crucial; they keep agents informed about your company's evolving circumstances, allowing them to provide timely advice and support. Moreover, business finance brokers who possess a comprehensive understanding of your organization can advocate more effectively on your behalf during negotiations with lenders. This advocacy is particularly vital in today's competitive environment, where business finance brokers can significantly influence loan approval rates by grasping the nuances of your operations.

Statistics reveal that intermediaries maintaining strong relationships with their clients enhance communication on digital platforms, a trend that has tripled since 2018, thereby streamlining the financing process and positively impacting loan approval rates.

Expert commentary emphasizes the importance of these relationships, with business finance brokers noting that understanding a client's long-term goals and challenges is essential for navigating access to capital. This insight not only maximizes opportunities but also prepares enterprises for future financial landscapes. Case studies demonstrate that mortgage professionals leveraging data to enhance their strategies can identify growth opportunities and align their services with evolving borrower preferences.

For instance, brokers employing data-driven approaches can refine their services, strengthen client relationships, and position themselves as trusted advisors.

At Finance Story, our specialized expertise in navigating challenging financial situations enables us to provide tailored solutions that meet the unique needs of small enterprise owners. As Natasha B from VIC states, 'I will definitely be recommending your services to anyone.' We are finished with the constant worry.

Once again, thank you so much for being a part of our journey.' We invite you to schedule your free personalized consultation with our Head of Funding Solutions, Shane Duffy. Discuss your needs and objectives, whether they pertain to commerce or personal funding, and let us begin collaborating with you to craft your next chapter.

With access to a comprehensive portfolio of private, boutique commercial investors, establishing a strong relationship with your business finance brokers is not merely advantageous; it is a strategic necessity that can significantly influence your enterprise's financial success.

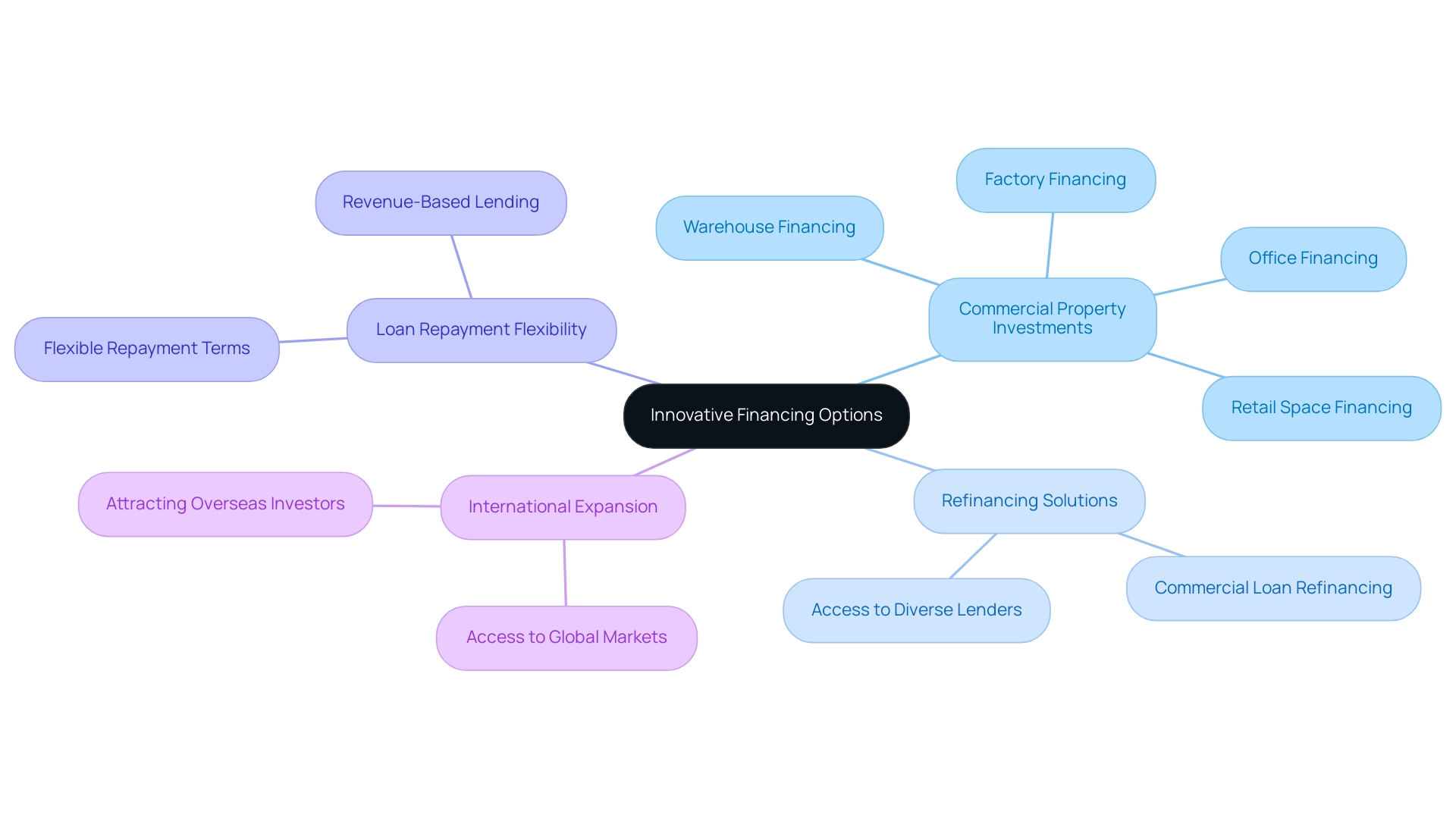

Innovative Financing Options: What Brokers Can Offer You

In the ever-evolving financial landscape of 2025, business finance brokers are essential in offering innovative funding solutions to small enterprises, particularly in commercial property investments and refinances. At Finance Story, we specialize in crafting polished and tailored loan proposals that meet the increasingly high expectations of banks. This ensures that entrepreneurs secure the right loans for acquiring or refinancing properties such as warehouses, retail spaces, factories, and offices.

We provide access to a comprehensive range of lenders, including high street banks and entrepreneurial private lending panels, designed to suit your unique circumstances.

Understanding loan repayment criteria is crucial for effective funding. Our specialized expertise enables us to guide entrepreneurs through various funding options, including revenue-based lending, which allows for loan repayments based on income, thereby offering flexibility during fluctuating sales periods. As Isabelle Comber noted, 'Flexibility was another prevalent theme throughout our research,' underscoring the importance of adaptable funding solutions.

Statistics reveal that a significant 78% of founders are likely to expand their businesses internationally within the next 12 months, acknowledging the limitations of the Australian market. This trend towards international growth emphasizes the necessity for startups to access broader customer bases and attract capital from overseas investors. By leveraging the diverse financing options available through business finance brokers like Finance Story, small enterprises can position themselves for substantial growth and success in an increasingly competitive environment.

Our expertise in facilitating the refinancing of commercial loans through business finance brokers ensures that businesses can adapt to their evolving needs while maintaining access to innovative funding options. This makes our role indispensable in navigating financial journeys.

Conclusion

The pivotal role of finance brokers in the landscape of small business financing cannot be overstated. As intermediaries, they not only simplify the often complex financing process but also provide tailored solutions that address the unique challenges faced by entrepreneurs. By leveraging their extensive networks and expertise, brokers help small business owners navigate the diverse lending options available, ensuring they secure the capital needed for growth and innovation.

In 2025, as businesses face a myriad of financial challenges, the value of establishing strong relationships with finance brokers becomes increasingly apparent. These professionals advocate on behalf of their clients, offering personalized guidance that enhances the likelihood of favorable financing outcomes. Their ability to understand individual business needs and market conditions positions them as trusted allies in the pursuit of financial success.

Furthermore, the innovative financing options brokers provide, including revenue-based financing and flexible loan structures, empower small businesses to adapt to changing market dynamics. As businesses seek to expand and explore new growth opportunities, the strategic insights and tailored solutions offered by finance brokers will be essential in navigating the evolving financial landscape.

Ultimately, partnering with a knowledgeable finance broker is a strategic necessity for small business owners aiming to thrive in a competitive environment. By fostering these relationships and utilizing the expertise of brokers, entrepreneurs can confidently pursue their financial goals and drive their businesses toward a successful future.