Overview

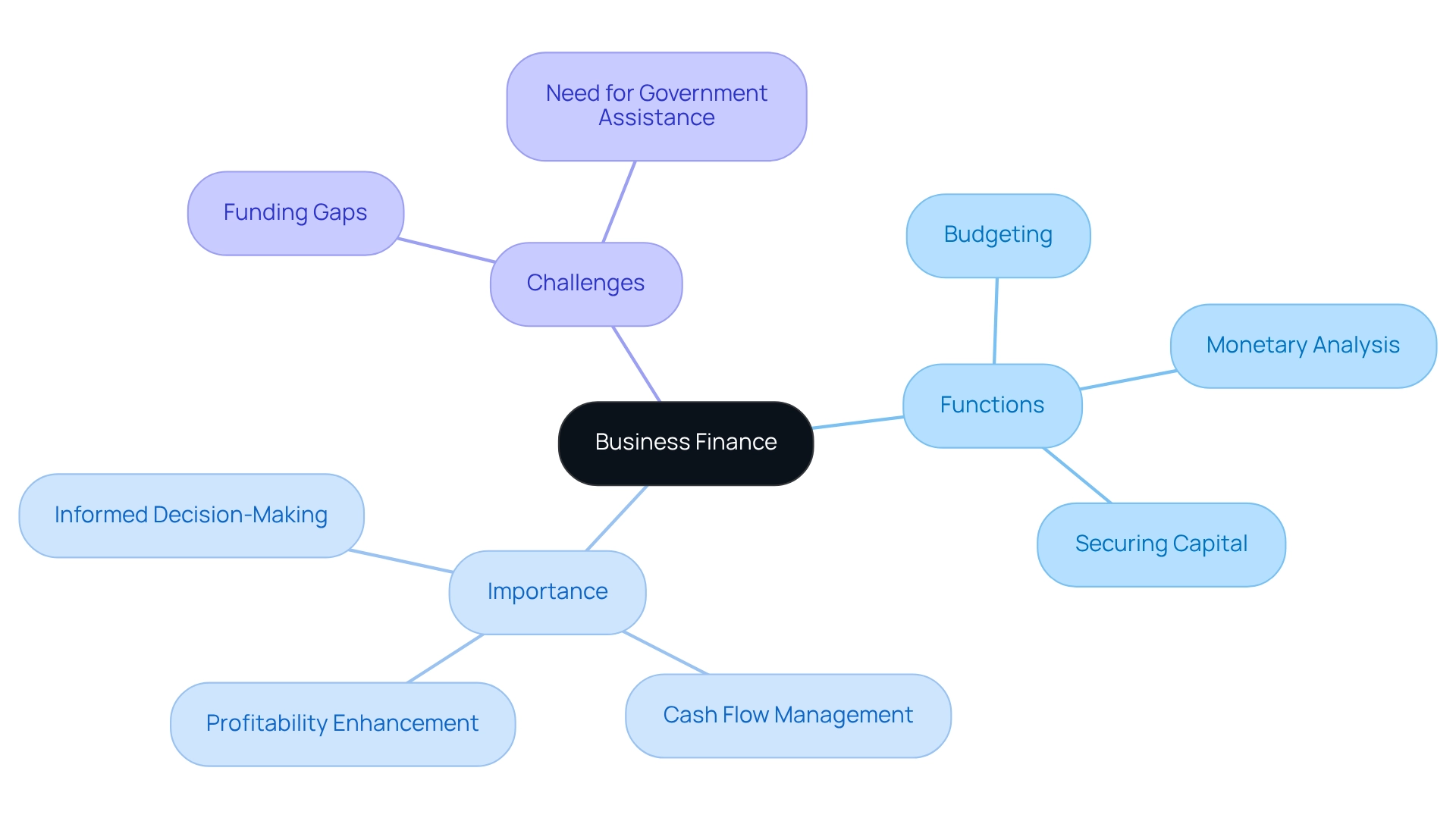

Business finance is fundamental in managing operations, securing funding, and ensuring long-term sustainability for organizations. Through essential functions such as budgeting, monetary analysis, and risk management, effective financial practices empower companies to allocate resources efficiently. This capability is crucial for navigating challenges in a competitive market landscape.

Furthermore, the article underscores that such practices enhance profitability and foster growth. By implementing sound financial strategies, organizations can position themselves to thrive even amid adversity. Are you leveraging your financial resources to their fullest potential?

In addition, understanding the intricacies of financial management can lead to informed decision-making, ultimately driving success. By prioritizing these practices, businesses not only improve their immediate operations but also lay the groundwork for sustainable growth.

Ultimately, the insights presented here serve as a call to action for organizations to evaluate their financial strategies and embrace best practices. The time to act is now—ensure your financial foundation is robust enough to support your ambitions.

Introduction

In a world where financial stability is paramount for business success, understanding the intricacies of business finance is more crucial than ever. This article delves into the essential components of business finance, exploring its significance in decision-making, resource allocation, and risk management. From the various types of financing available to the challenges small businesses face in securing funds, readers will gain insights into how effective financial strategies can empower organizations to thrive.

As the landscape evolves, staying informed about innovative financing solutions and best practices becomes vital for navigating the complexities of today's economy. Discover how businesses can not only survive but also position themselves for sustainable growth through sound financial management.

Define Business Finance and Its Importance

What does business finance do? It encompasses the funds and resources that organizations utilize to manage operations, invest in growth, and ensure long-term sustainability. This area includes a range of tasks such as budgeting, monetary analysis, and securing capital for various enterprise needs, highlighting what does business finance do. Understanding what does business finance do is paramount; it is vital for informed decision-making, efficient cash flow management, and ultimately, enhancing profitability. Alarmingly, almost one-third of small enterprises reported that they are unlikely to endure without additional government assistance until sales rebound, underscoring the difficulties they face in obtaining funding and sustaining financial stability.

Effective financial practices illustrate what does business finance do by empowering companies to allocate resources efficiently, mitigate risks, and seize opportunities for expansion and innovation. For instance, when considering the acquisition of a freehold property enterprise, understanding loan structures and utilizing property equity can be pivotal. A typical scenario might involve a commercial property valued at $1 million, where a lender permits borrowing against the property at a maximum loan-to-value ratio (LVR) of 70%. This indicates that an entrepreneur would need to supply a deposit and additional resources for the operational segment, emphasizing the significance of having a robust monetary strategy in place.

The 2017 Small Enterprise Credit Survey disclosed that while numerous small enterprises were profitable, a significant number encountered funding gaps, particularly among minority-owned and micro enterprises. This highlights what business finance does, emphasizing the necessity of strong economic strategies to navigate these challenges and foster growth. Collaborating with specialists in finance, such as those at Finance Story, can assist small enterprise owners in creating customized cases that meet their specific lending requirements, ensuring they are adequately equipped to obtain funding.

As we approach 2025, the significance of what business finance does continues to escalate, with statistics indicating that sustainable monetary practices are crucial for small enterprises striving to succeed in competitive markets. The World Bank collaborates with public stakeholders and private sector intermediaries to promote SME finance growth worldwide, emphasizing the joint effort to improve economic stability for small enterprises. By utilizing effective resource management, organizations can not only endure but also prepare themselves for future success. A specialist in the field observed that 'effective monetary strategies are the backbone of sustainable business development,' emphasizing what does business finance do in today's economy.

Explore Key Functions and Components of Business Finance

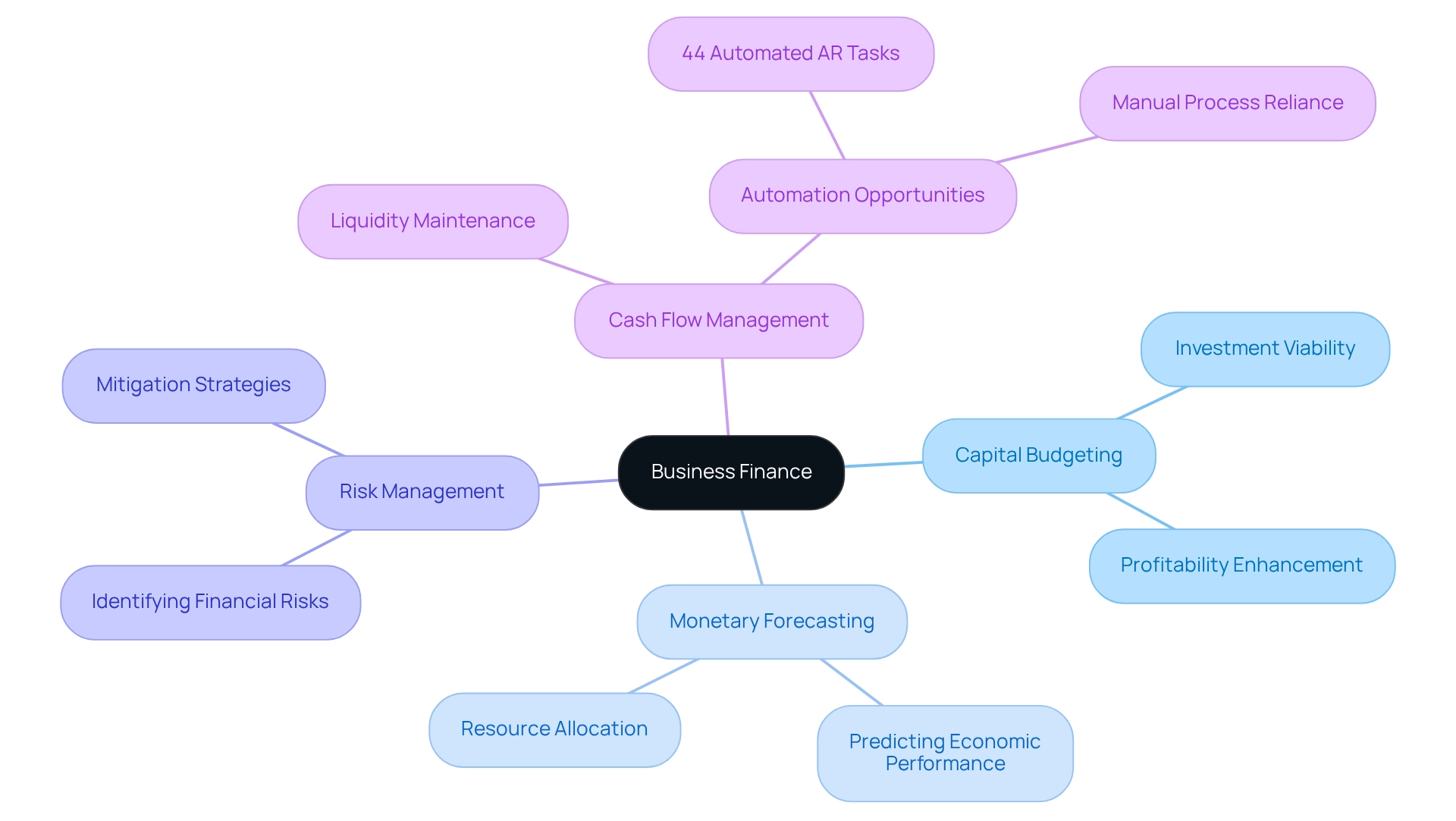

Business finance is pivotal to the success of any organization, highlighting what business finance does to ensure economic stability and growth. One of the most critical aspects is capital budgeting, which assesses potential investments to determine their viability and expected returns. This process is essential; effective capital budgeting can significantly enhance profitability and drive long-term success.

Monetary forecasting represents another vital function, predicting future economic performance based on historical data and market trends. This practice empowers businesses to make informed decisions, allocate resources efficiently, and prepare for potential challenges. For instance, companies that adopt robust economic forecasting often observe enhanced performance metrics, as they can proactively address issues before they escalate.

Risk management is equally important, concentrating on identifying and mitigating financial risks that could impact the organization. By recognizing potential threats, organizations can devise strategies to protect their assets and ensure continuity.

Furthermore, cash flow management is crucial for maintaining liquidity, enabling companies to meet their obligations and invest in expansion opportunities. A recent study revealed that 44% of companies have automated only a few accounts receivable tasks, indicating a significant opportunity for improvement in cash flow processes. This underscores the importance of efficient cash flow management, ensuring that enterprises can operate seamlessly and seize growth opportunities.

Together, these components form the backbone of effective enterprise finance, allowing organizations to navigate challenges and capitalize on growth opportunities. For example, a case study on a small enterprise that effectively applied capital budgeting strategies demonstrated a significant rise in investment returns, highlighting the tangible benefits of prudent economic practices. As Warren Buffett wisely noted, "Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks." This statement emphasizes the importance of making informed financial decisions, particularly in capital budgeting and forecasting, to achieve better outcomes. Thus, understanding what business finance does and leveraging these key functions is essential for any business aiming to thrive in today's competitive landscape.

Identify Types of Business Finance Available

What does business finance do encompasses a range of choices, primarily categorized into debt and equity options. Debt funding involves borrowing money that must be repaid with interest, including bank loans, lines of credit, and bonds. This method is often favored for its tax advantages and the preservation of ownership control, making it an appealing choice for many enterprises. On the other hand, equity funding raises capital by selling shares of the company, which can dilute ownership but does not require repayment, thus allowing for greater flexibility in cash flow management.

Furthermore, companies can explore alternative funding options such as venture capital, angel investing, and crowdfunding. Venture capital is particularly significant for startups in the tech industry, where investors provide funds in exchange for ownership interests, aiming to accelerate growth for potential public offerings or acquisitions. A case study illustrates that venture capital has proven successful for numerous small enterprises, highlighting the potential for substantial returns when paired with the right development strategies.

As we approach 2025, understanding the advantages and disadvantages of these financing methods becomes crucial for organizational growth. For small business owners considering the acquisition of freehold or leasehold properties, comprehending the available loan structures is essential. For instance, when purchasing a freehold property, a lender may permit borrowing against the commercial property, typically up to a maximum loan-to-value ratio (LVR) of 70%. This means that for a commercial property appraised at $1M, an owner could secure a loan of $700k, necessitating a deposit of $300k and additional funds for the operational aspect of the acquisition, totaling $400k, resulting in a total asking price of $1.4M.

In contrast, financing options for leasehold enterprises are more limited, as there is no commercial property to leverage. In such cases, owners may need to rely on cash savings or equity from other properties they own. For example, if a residence is valued at $1.3M with $300k owed, the available equity could be utilized to assist in acquiring a venture, underscoring the importance of understanding one's financial situation and available resources. Additionally, it is vital to account for other costs associated with purchasing a business, such as valuation, legal, and stamp duty fees.

Statistics reveal that nearly one-third of firms express concerns about their survival without additional government aid, while the 2024 Report on Employer Firms indicates that revenue and employment growth has remained steady but lags behind prepandemic levels. This context emphasizes what does business finance do in relation to strategic monetary planning. Experts suggest that to improve funding strategies and support long-term goals, it's important to understand what business finance does by considering both debt and equity funding. Wayne Vance, CFO, states, "If you would like support in identifying the optimal combination of debt and equity funding for your company, preparing a forecast and presentation to approach investors and lenders, or creating and assessing a financial plan, Preferred CFO will be glad to assist." By evaluating the distinct requirements and growth objectives of their enterprises, owners can make informed decisions regarding the most suitable funding alternatives available.

Address Challenges in Securing Business Finance and Tailored Solutions

Securing financing in 2025 presents numerous challenges, including stringent lending criteria, fluctuating interest rates, and the necessity for collateral. Many small enterprises, particularly startups, frequently encounter difficulties in showcasing creditworthiness or offering sufficient guarantees, which hinders access to conventional funding alternatives. Statistics indicate that slightly less than 23% of enterprises pursued funding to replace capital assets or conduct repairs, while 13.5% intended to refinance or reduce debt, underscoring the urgent requirement for accessible resources. Furthermore, almost one-third of companies indicate they’re unlikely to endure without additional governmental support until sales rebound, emphasizing the necessity for small enterprises to secure funding in the current economic environment.

For organizations operating under a lease or those lacking a physical structure, conventional collateral options may be limited. In such scenarios, leveraging cash savings or the equity in owned properties becomes crucial. For instance, if an entrepreneur possesses a residence valued at $1.3M with $300k owed, they could access up to $740k in equity to support acquisitions, supplemented by any cash savings.

To navigate these hurdles, enterprises can consider alternative financing solutions such as peer-to-peer lending, microloans, and government-backed loans tailored for startups. Notably, some alternative lenders can review and respond to loan requests within 24 hours, significantly expediting the funding process. The typical response duration for non-SBA short-term small enterprise loans is under 10 days, with quick approvals enabling companies to access necessary funds promptly. This swift response can be vital for companies requiring immediate financial assistance.

Improving financial literacy and maintaining precise financial records can also enhance an organization's appeal to lenders. Furthermore, as approximately 61 percent of small enterprise owners are investing in social media marketing, understanding how to adapt to market conditions can influence their financing needs. By comprehending the current environment and utilizing available resources, small enterprises can effectively manage the complexities of obtaining the funding crucial for growth and sustainability.

To further assist in this journey, we invite you to arrange your complimentary personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your needs and goals, and let us help you create your next chapter in business finance.

Conclusion

Understanding the nuances of business finance is essential for organizations aiming to thrive in today's competitive landscape. Effective financial strategies not only facilitate informed decision-making but also empower businesses to manage their resources efficiently, mitigate risks, and capitalize on growth opportunities. In light of the challenges faced by small businesses in securing funding, particularly in a fluctuating economic environment, a robust financial strategy is more critical than ever.

Key functions such as capital budgeting, financial forecasting, and cash flow management play a vital role in ensuring financial stability and fostering growth. By recognizing the various financing options available, including debt and equity financing, business owners can tailor their approach to meet their unique needs. The significance of understanding one's financial position and available resources cannot be overstated, especially when navigating the complexities of property acquisitions or seeking alternative financing solutions.

As the landscape of business finance continues to evolve, the ability to address challenges effectively is crucial. Enhancing financial literacy, maintaining accurate records, and exploring innovative funding avenues can significantly improve a business's chances of securing the necessary capital to thrive. Ultimately, the path to financial stability and sustainable growth lies in a commitment to sound financial management practices, which serve as the backbone of any successful organization. Embracing these principles will not only help businesses survive but also position them for long-term success in an ever-changing economy.