Overview

Small businesses can secure access to finance by understanding the financial landscape, preparing tailored loan proposals, and exploring various funding options such as:

- Traditional loans

- Government grants

- Crowdfunding

- Angel investments

Strategic planning is essential, as it enables businesses to navigate the complexities of funding. Furthermore, maintaining strong financial records and building relationships with lenders are crucial steps in overcoming challenges like strict lending criteria and economic uncertainty. By implementing these strategies, small businesses can significantly enhance their likelihood of obtaining the necessary funding for growth.

Introduction

Navigating the financial landscape is a formidable challenge for small business owners, particularly in today’s ever-evolving economic environment. Understanding the key components that influence financing options is essential for achieving success. From grasping the impact of economic conditions and regulatory changes to recognizing industry trends and tailoring loan proposals, each element plays a crucial role in securing the necessary funds.

As entrepreneurs explore diverse avenues such as:

- Bank loans

- Government grants

- Alternative financing options

they must also be prepared to confront challenges like:

- Strict lending criteria

- Fluctuating market conditions

This article delves into the intricacies of financing for small businesses, offering insights and strategies to empower owners to make informed decisions and ultimately thrive in their ventures.

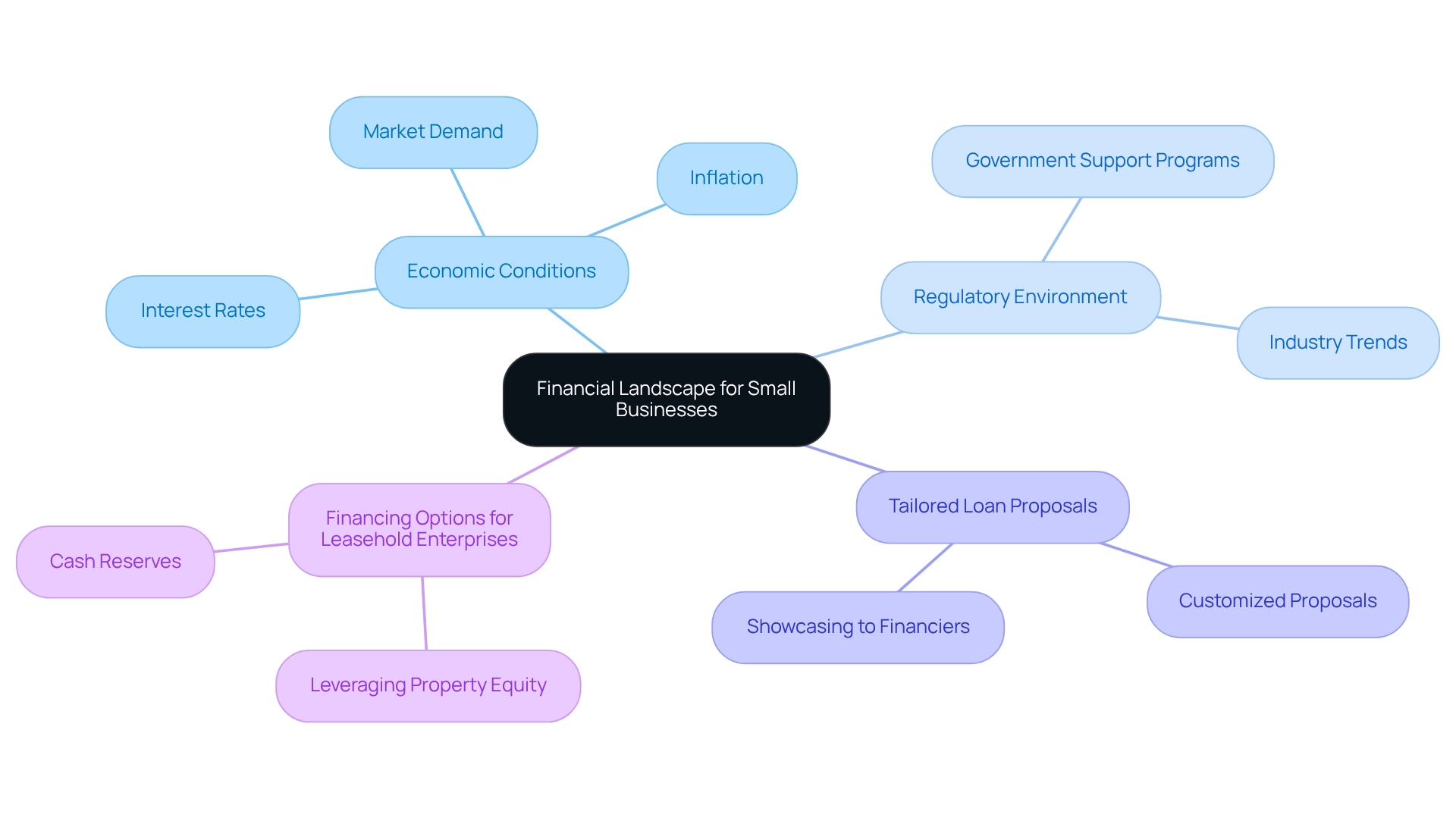

Understanding the Financial Landscape for Small Businesses

To successfully navigate the economic environment, small enterprise owners must first understand the essential elements impacting their access to finance. This includes:

- Economic Conditions: Stay informed about the current economic climate, including interest rates, inflation, and market demand. For instance, as of 2025, many economists predict a gradual recovery in the economy, which may affect lending conditions.

- Regulatory Environment: Familiarize yourself with any changes in regulations that could influence your financing. Understanding government support programs and grants available for small business access to finance is crucial. Additionally, analyze industry trends that may affect your financial needs and opportunities. For example, areas such as technology and renewable energy are anticipated to experience substantial growth, potentially influencing funding accessibility.

- Tailored Loan Proposals: Recognizing the significance of developing refined and customized proposals can greatly improve your odds of obtaining financing. Proficiency in showcasing your proposal to financiers is vital, particularly when pursuing capital for commercial real estate investments or restructuring current loans.

- Financing Options for Leasehold Enterprises: If your operation functions within a lease or lacks a physical structure, consider leveraging the equity in any property you possess or your cash reserves. For example, if you own a residence valued at $1.3M with $300k owed, you could access up to $740k in equity to assist with your company acquisition. At Finance Story, we provide a comprehensive selection of lenders to match your situation, whether you are purchasing a warehouse, retail space, factory, or hospitality project. We can also help with refinancing your commercial financing to accommodate the requirements of your developing enterprise.

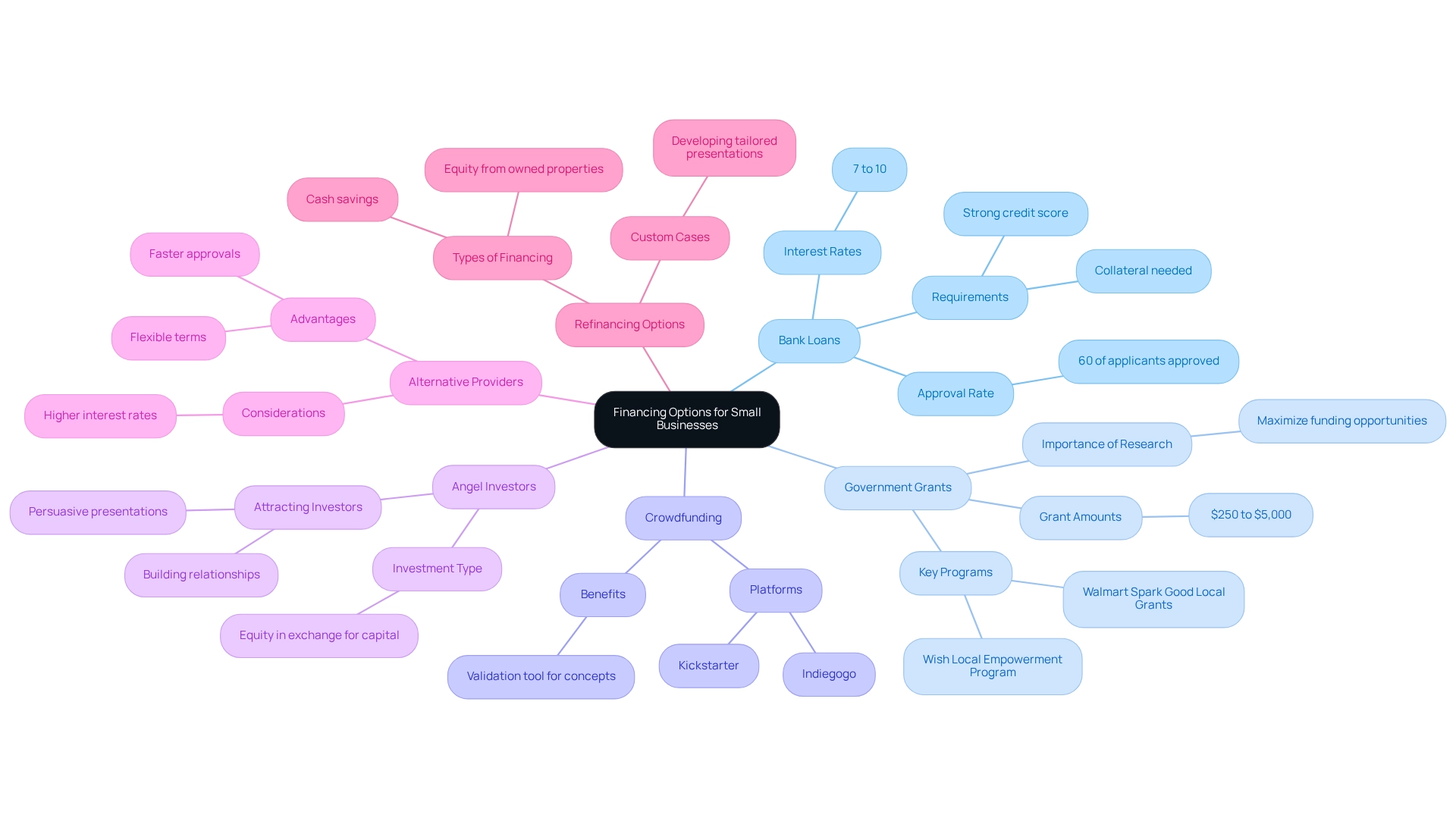

Exploring Financing Options: Loans, Grants, and More

Today, small business access to finance encompasses a diverse array of options, each presenting unique advantages and challenges. Understanding these options is essential for entrepreneurs aiming to secure funding for growth and sustainability. Here are some key financing avenues:

- Bank Loans: Traditional bank loans remain a popular choice for small businesses, offering both fixed and variable interest rates. While they can provide significant funding, obtaining a bank credit often necessitates a strong credit score and collateral, which can be a hurdle for some entrepreneurs. In 2025, the approval rates for small business access to finance from banks demonstrated a slight rise, with roughly 60% of applicants obtaining funds, indicating a more favorable lending atmosphere. The average interest rates for small enterprise loans in 2025 range from 7% to 10%, making it essential for entrepreneurs to assess their options carefully.

- Government Grants: In 2025, various government programs are available to support small enterprises, particularly in innovation and technology sectors. Grants can vary significantly, with programs like the Walmart Spark Good Local Grants offering amounts from $250 to $5,000 to address local community needs. As Rebecca Iwanuscha observes, "Comprehending the grant landscape is essential for companies to optimize funding opportunities in line with their growth strategies." Entrepreneurs should actively research available grants through government websites to maximize small business access to finance that aligns with their growth strategies. A notable example is the Wish Local Empowerment Program, which supports local organizations addressing community needs through grants, showcasing how such funding can make a tangible impact.

- Crowdfunding: Platforms like Kickstarter and Indiegogo have transformed how companies can gather funds. Crowdfunding not only offers crucial funds but also acts as a validation tool for entrepreneurial concepts, enabling innovators to assess public interest prior to launching their products or services.

- Angel Investors: Angel investors are individuals who provide capital to startups in exchange for equity. Attracting these investors necessitates a persuasive presentation that clearly describes the model and potential for growth. Building relationships within the investment community can significantly enhance the chances of securing funding from angel investors.

- Alternative Providers: Non-bank entities have emerged as a feasible choice for enhancing small business access to finance, pursuing faster approvals and more adaptable terms. While these lenders may offer quicker access to funds, they often come with higher interest rates, making it crucial for entrepreneurs to carefully evaluate the total cost of borrowing.

- Refinancing Options: For enterprises operating within a lease or without a physical structure, financing choices may be restricted to cash savings or equity from owned properties. Understanding how to utilize property equity can be essential for obtaining a venture or refinancing current loans. Finance Story focuses on developing customized cases to present to financiers, ensuring that entrepreneurs can obtain the appropriate funding for their requirements. We have a full range of lenders to suit any circumstances, whether it be a large warehouse, retail premise, factory, hospitality venture, or office.

As the economic environment in 2025 offers both challenges and opportunities for Australian small enterprises, strategic planning and adaptability are crucial. By comprehending the existing trends in funding alternatives, including the average interest rates for small enterprise credits, entrepreneurs can make knowledgeable choices that correspond with their monetary objectives. Furthermore, successful case studies emphasize the significance of utilizing a blend of these funding options to develop a strong monetary strategy.

Grasping repayment standards is also vital for guaranteeing that enterprises can handle their monetary obligations efficiently.

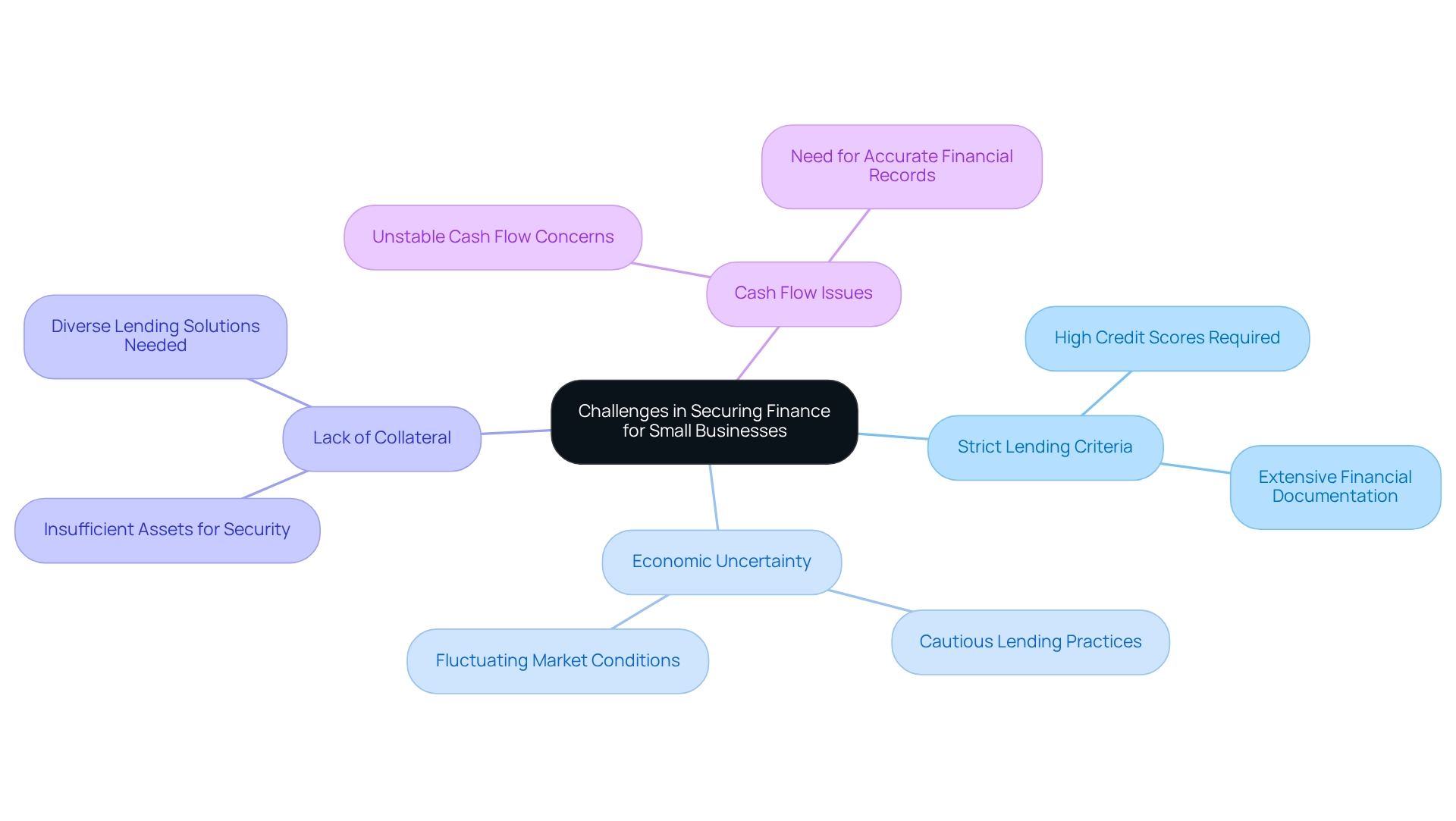

Identifying Challenges in Securing Finance for Small Businesses

Securing funding can be particularly challenging for small enterprises due to several critical factors:

- Strict Lending Criteria: Many lenders impose stringent standards, such as high credit scores and extensive financial documentation, which can be difficult for new ventures to meet. At Finance Story, we specialize in crafting refined, tailored cases that help you navigate these strict criteria and present compelling proposals to banks.

- Economic Uncertainty: Fluctuating economic conditions often lead to cautious lending practices, making it more difficult for small businesses to access finance. Our expertise allows us to understand these dynamics and customize financing options that align with current market conditions.

- Lack of Collateral: Insufficient assets for security can hinder small businesses' access to finance, impacting their ability to secure funding. We work with a diverse range of lenders, including mainstream banks and innovative private lending groups, to find solutions that suit your unique situation, whether you are looking to fund a warehouse, retail location, factory, or hospitality project.

- Cash Flow Issues: Unstable cash flow can raise concerns for lenders, significantly affecting small businesses' access to finance. Business owners should maintain accurate financial records to demonstrate stability. Our understanding of repayment standards can assist you in organizing your financial documents effectively, enhancing your chances of obtaining the necessary capital for your ventures. Additionally, we offer refinancing options to help you adjust your current debts to meet the evolving needs of your enterprise.

Preparing for Your Loan Application: Essential Steps

To prepare for a successful loan application, consider these essential steps:

- Assess Your Financial Needs: Clearly define the amount of funding required and its intended use. This understanding will assist you in choosing the most suitable financing option for your enterprise.

- Gather Documentation: Compile all necessary documents, including:

- A detailed business plan

- Financial statements, such as profit and loss statements and cash flow projections

- Recent tax returns

- Personal financial statements

- Check Your Credit Score: Review your credit report for any inaccuracies and take proactive measures to enhance your score if needed. A strong credit score can significantly improve your chances of loan approval.

- Create a Solid Commercial Plan: Develop a comprehensive commercial strategy that articulates your model, includes a thorough market analysis, and presents realistic financial projections. A well-organized strategy can significantly impress potential financiers and showcase your readiness. As mentioned by CBL Financial Inc., "we focus on assisting small enterprises by creating a thorough proposal that improves small business access to finance with financiers."

- Practice Your Pitch: Be prepared to clearly and confidently articulate your business and funding requirements during meetings with financial institutions. Effective communication can make a substantial difference in how your proposal is received.

Alongside these measures, comprehending the significance of responsible financial management is essential. Once a loan is secured, borrowers must handle it efficiently by following the terms, making timely payments, and maintaining open communication with creditors, especially if their financial situation changes. As emphasized in the case study named 'Responsible Loan Management,' this approach not only fosters a positive relationship with lenders but also ensures the sustainability of your enterprise through responsible financial practices.

Furthermore, with approximately 450,000 mortgages on low fixed rates scheduled to reset in 2024, small business access to finance should be a key consideration for enterprise owners as they contemplate how this may affect their financial strategies. As you navigate the loan application process, remember that a well-prepared application can significantly enhance your chances of securing the necessary funding to expand your enterprise. Additionally, understanding the services provided by commercial and investment banks can be beneficial, as they play a crucial role in the lending landscape.

To further enhance your chances of success, consider booking a free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. This meeting will enable you to discuss your specific needs and goals, ensuring that you receive customized strategies that align with your objectives. Finance Story provides a comprehensive selection of financial institutions to meet diverse situations, whether you are seeking to fund a warehouse, retail location, factory, or hospitality enterprise.

Demonstrating Financial Stability: Key Strategies for Small Businesses

To effectively demonstrate financial stability, small businesses should adopt the following strategies:

- Maintain Accurate Financial Records: Regularly updating financial statements is crucial. Ensure these documents accurately represent your current economic situation, as they serve as the foundation for informed decision-making and transparency with potential lenders. Last year, more than 400 senior accounting experts participated in Accountants Daily’s flagship forum, underscoring the significance of expert insights in record-keeping.

- Manage Cash Flow Effectively: Implementing robust cash flow management practices is essential for fulfilling monetary obligations. Utilizing cash flow forecasting tools can help anticipate future cash needs and identify potential shortfalls before they arise. The emergence of autonomous intelligence systems is set to play a central role in business decision-making, making adaptive technologies invaluable for small businesses in managing their finances.

- Reduce Debt: Minimizing existing debts enhances creditworthiness. Concentrate on settling high-interest obligations first, which can greatly enhance your monetary profile and make you more attractive to creditors.

- Build a Reserve Fund: Establishing an emergency fund is a prudent strategy to cover unexpected expenses. This not only showcases financial caution but also assures creditors that you are ready for unexpected challenges.

- Show Consistent Revenue Growth: Highlighting trends in revenue growth over time can indicate a healthy commercial model. Consistent growth signals to lenders that your enterprise is thriving and capable of generating profits. Case studies reveal that businesses leveraging technology for monetary forecasting and budgeting can significantly enhance their economic stability.

- Leverage Expert Opinions: Engaging with financial advisors or industry experts can provide valuable insights into demonstrating financial stability. Their viewpoints can assist in improving your approaches and boosting your trustworthiness with financial institutions. As Rebecca Warren, Executive General Manager of Small Enterprise Banking, stated, "Our partnership with AGSM UNSW highlights CommBank’s commitment to supporting small enterprises and complements a range of products, services, and tools to help Australian small enterprises thrive."

By implementing these strategies, small enterprises can effectively demonstrate their economic stability, enhancing access to finance and increasing their chances of obtaining necessary funding. Furthermore, as the management of small enterprises evolves in 2025, with an increase in remote work and freelancing, investing in employee well-being and adopting automation will further bolster financial resilience.

The Role of Credit Scores in Securing Business Finance

Credit scores play a vital role in ensuring small businesses have access to finance within the current financing environment. Here’s how they impact your capital access:

- Effect on Loan Approval: Lenders significantly rely on credit scores to assess the risk associated with lending to an enterprise. A high credit score greatly enhances the likelihood of approval, signaling to lenders that the enterprise presents a lower risk. Notably, statistics reveal that 59% of SBA financing options receive approval; maintaining a strong credit score can increase your chances of being among those accepted.

- Impact on Interest Rates: Companies with high credit scores often receive lower interest rates. This reduction can lead to substantial savings over the life of a loan, making borrowing more economical.

- Types of Credit Scores: It is crucial to differentiate between personal and commercial credit scores. Both can influence your ability to secure financing, as lenders may consider each when evaluating your application.

- Improving Your Score: To enhance your credit score, regularly review your credit report for inaccuracies, ensure timely payment of bills, and focus on reducing outstanding debts. These measures can lead to gradual improvements in your score, making you a more attractive candidate for financing.

Understanding the nuances of credit scores is essential for improving small business access to finance. For instance, a case study highlights that women-owned enterprises received only 32.6% of approvals for SBA financing, underscoring the necessity of maintaining a robust credit score to navigate potential biases in the lending process. Additionally, managing a commercial bank account effectively can indirectly enhance your credit over time, showcasing responsible financial behavior.

In 2025, the average credit score for small enterprise funding applicants is anticipated to be a critical factor in obtaining favorable financing terms. By concentrating on improving your credit score, you can enhance small business access to finance and increase your chances of securing the necessary funding to grow your enterprise. Furthermore, recognizing that small business access to finance is influenced by annual revenues and exposure limits established by the Australian Prudential Regulation Authority can help you identify the right funding options for your needs.

At Finance Story, we specialize in crafting refined and highly personalized business cases to present to financial institutions, ensuring that your credit rating and financial background are effectively communicated. We collaborate with a wide range of lenders, including high street banks and innovative private lending panels, to provide you with optimal financing solutions. Our expertise in tailored financing proposals can significantly enhance your chances of securing the right funding for your commercial property investments and refinances.

As noted by McKinsey, embedded lending is already linked to higher profit margins, further highlighting the importance of credit scores and effective lending practices.

Alternative Financing: Exploring Crowdfunding and Angel Investment

In addition to traditional loans, small businesses can explore a variety of alternative financing options tailored to their unique needs:

- Crowdfunding: Platforms such as Kickstarter and GoFundMe empower businesses to raise funds from a broad audience. Successful campaigns typically hinge on a compelling narrative and strategic marketing efforts. For instance, the recent campaign for 'Good Puppers Too' has garnered significant attention, achieving 84% of its funding goal, while another campaign, 'Paper Walls,' is currently 128% funded with 6 days left. This showcases the potential of well-crafted crowdfunding initiatives. As Alexandros Tziranis, a serial entrepreneur and business coach, states, "Crowdfunding isn’t just about money—it’s about building proof, community, and credibility." This statement underscores the broader benefits of crowdfunding beyond mere financial gain.

- Angel Investors: These investors provide capital in exchange for equity, often offering not just funds but also invaluable mentorship and networking opportunities. Building robust relationships with potential angel investors can significantly enhance a startup's growth trajectory. In 2025, statistics indicate a growing trend in angel investment, with many startups successfully securing funding through strategic outreach and relationship-building.

- Peer-to-Peer Lending: This innovative method connects borrowers directly with individual lenders, frequently resulting in lower interest rates and more flexible repayment terms. As this market continues to develop, it presents an appealing choice for small enterprises seeking accessible funding.

- Microloans: Organizations like Kiva specialize in providing small loans to entrepreneurs, particularly those in underserved communities. This approach not only facilitates access to funding but also fosters community engagement and support.

Investigating these alternative funding paths can significantly enhance small business access to finance, enabling owners to obtain the essential capital necessary to drive their growth and innovation. Furthermore, when evaluating crowdfunding, it is crucial to select a platform that aligns with your requirements, as this can greatly influence the success of your campaign. Crowdfunding also offers nonprofits a substantial opportunity to broaden funding avenues and connect with communities, demonstrating its potential advantages for small enterprises as well.

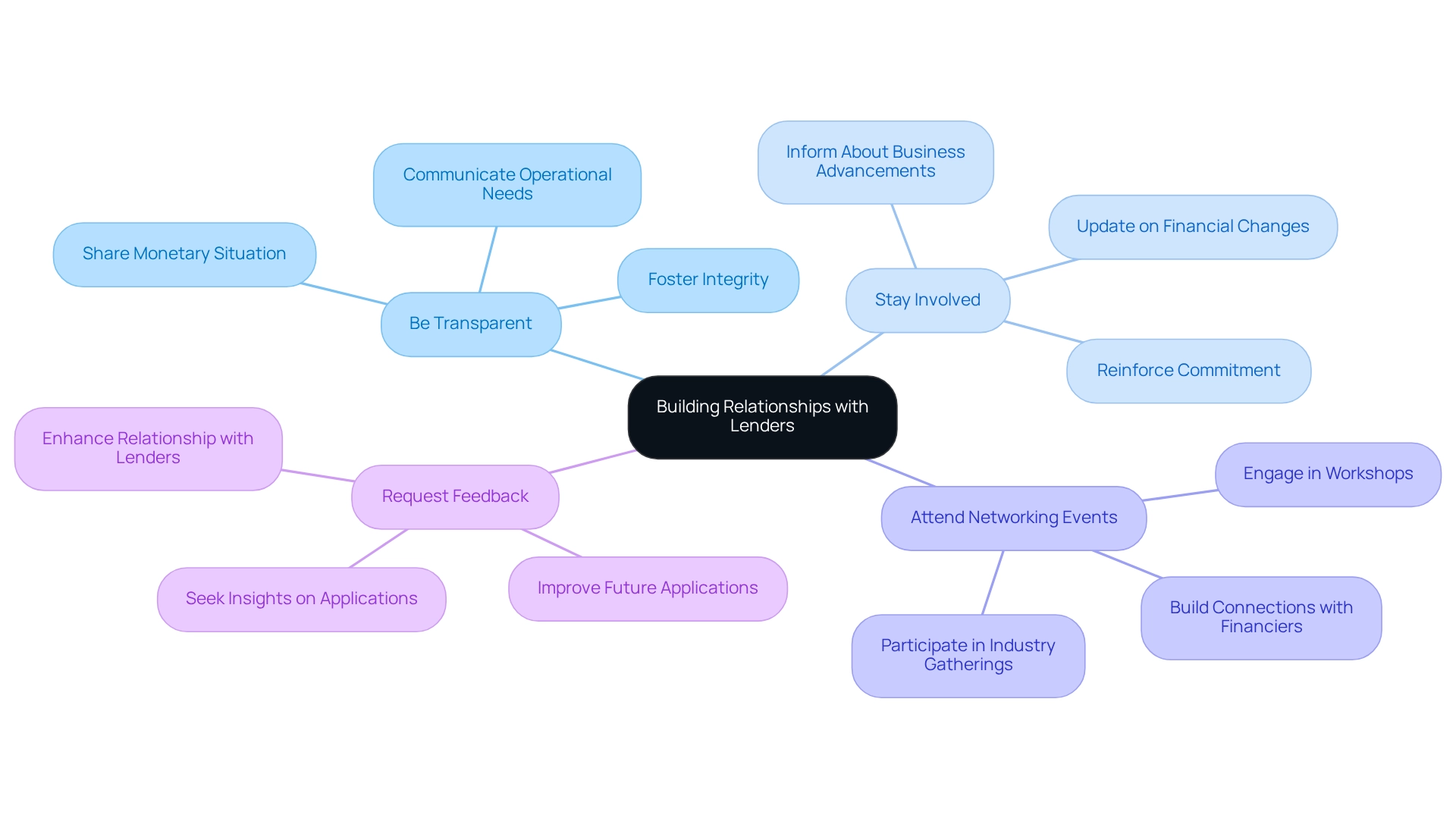

Building Relationships with Lenders: A Key to Successful Financing

To establish productive connections with creditors, consider the following strategies:

- Be Transparent: Clearly communicate your operational needs and monetary situation to creditors. Integrity fosters confidence, which is essential for a thriving collaboration.

- Stay Involved: Consistently inform your financiers about your business advancements and any alterations in your financial situation. This keeps them updated and engaged, reinforcing your commitment to a long-term partnership.

- Attend Networking Events: Participate in industry gatherings and workshops to meet prospective financiers and build connections. These interactions can yield meaningful insights and opportunities.

- Request Feedback: After applying for financing, seek feedback on your application. This can provide valuable insights into improving future applications and enhancing your relationship with lenders.

At Finance Story, we recognize the significance of these relationships. Our extensive panel of lenders, including mainstream banks, private lenders, and angel investors, ensures we can meet your distinct requirements. We offer a variety of funding options, including small business access to finance, equipment funding, and lines of credit, all designed to support your expansion.

To advance in your financing journey, schedule your complimentary personalized 30-minute consultation with Shane Duffy, our Head of Funding Solutions. Let us collaborate to develop tailored strategies that align with your goals. Please select a convenient time from our live calendar.

Key Takeaways: Securing Finance for Your Small Business

Securing finance for your small business necessitates a strategic approach that encompasses several key steps:

- Understand the Financial Landscape: Familiarize yourself with the various financing options available in 2025, including traditional loans, alternative financing, and government grants. This knowledge is crucial for making informed decisions. As Shahrokh Fardoust observed, budget assistance could serve a crucial function in aiding low-income and vulnerable nations, emphasizing the significance of economic stability in obtaining resources.

- Identify and Overcome Challenges: Recognize common obstacles in the financing process, such as stringent lending criteria and fluctuating market conditions. The "Global Financial Stability Report: Bridge to Recovery" illustrates the vulnerabilities faced by small and medium-sized enterprises, emphasizing the need for proactive strategies to address these challenges.

- Prepare Thoroughly for Loan Applications: Gather all necessary documentation, including statements of account, plans for the enterprise, and tax returns. A well-prepared application demonstrates professionalism and readiness to lenders. Resources are accessible for understanding ratios and enhancing cash flow, which are essential for small enterprise owners getting ready for funding requests.

- Demonstrate Financial Stability: Maintain a strong credit score and showcase your organization's financial health. Lenders often look for evidence of stability and the ability to repay loans, making this a critical factor in the approval process.

- Explore Alternative Financing Options: Consider non-traditional funding sources such as peer-to-peer lending, crowdfunding, or angel investors. These avenues can provide additional flexibility and access to capital.

- Schedule Your Free Personalized Consultation: Book your free personalized 30-minute meeting with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your needs and objectives, from personal to home, and let us begin collaborating with you to create your next chapter. This customized method can assist you in navigating the complexities of financing options, including utilizing property equity and cash savings for acquisitions.

- Understand Freehold Property Financing: If you're contemplating a freehold property venture, it's important to know how to leverage property equity. For instance, if you're looking at a commercial property valued at $1M, you may be able to borrow up to 70% of that value, which would be $700k. This indicates you would have to supply a deposit of $300k and an extra $400 for the operational segment. Understanding these details can significantly impact your financing strategy.

- Build Strong Relationships with Lenders: Establishing rapport with potential lenders can lead to better financing terms and opportunities. Consistent communication and openness regarding your organization's needs and objectives can promote trust and teamwork.

By following these steps and leveraging insights from successful case studies, small business owners can significantly enhance their access to the finance necessary for growth and sustainability. Understanding the financial landscape and being proactive in addressing challenges are essential components of this journey.

Conclusion

Navigating the financial landscape is essential for small business owners aiming to secure the funding necessary for growth and sustainability. By understanding the key components that influence financing options—including economic conditions, regulatory environments, and industry trends—entrepreneurs can make informed decisions. Exploring various avenues such as bank loans, government grants, crowdfunding, and angel investments allows business owners to diversify their funding sources and tailor their strategies to meet specific needs.

However, challenges such as strict lending criteria, economic uncertainty, and cash flow issues remain prevalent. To overcome these hurdles, thorough preparation for loan applications is crucial. Maintaining accurate financial records and demonstrating financial stability through effective cash flow management and a strong credit score are essential steps. Furthermore, building and nurturing relationships with lenders can significantly enhance opportunities for securing favorable financing terms.

Ultimately, small business owners are encouraged to adopt a strategic approach that encompasses thorough preparation and a proactive mindset. By leveraging available resources and exploring alternative financing options, entrepreneurs can navigate the complexities of the financial landscape, ensuring their businesses not only survive but thrive in an ever-evolving economic environment.