Overview

Self-Managed Super Funds (SMSFs) empower individuals to invest in a diverse array of assets, such as:

- Commercial properties

- Shares

- Cash

- Cryptocurrencies

- Collectibles

This investment versatility provides significant control and flexibility over retirement savings. Furthermore, the combination of compliance requirements and strategic planning allows SMSF members to customize their portfolios to align with personal financial objectives. By effectively navigating regulatory complexities, individuals can optimize their investment strategies and enhance their financial outcomes.

Introduction

In the realm of retirement planning, Self-Managed Super Funds (SMSFs) stand out as a formidable tool for individuals seeking greater control over their financial futures. Unlike traditional superannuation funds, SMSFs empower members to take the reins, enabling personalized investment choices that align with unique financial goals and risk appetites. This flexibility encompasses a diverse array of investment options, ranging from residential and commercial properties to shares and even cryptocurrencies.

However, navigating the complexities of SMSF regulations and compliance can be daunting. As the popularity of these funds continues to rise, understanding the benefits and risks associated with SMSF investments becomes increasingly essential. Are you ready to optimize your retirement savings? Savvy investors must grasp these dynamics to make informed decisions and secure their financial future.

Defining Self-Managed Super Funds (SMSFs)

A Self-Managed Superannuation Scheme (SMSF) serves as a private superannuation vehicle that individuals manage independently, granting them significant control over their retirement savings. Unlike traditional super funds, these self-managed funds are established by individuals or small groups of up to six members, who also take on the role of trustees. This dual responsibility means they make critical financial decisions and ensure compliance with superannuation regulations.

Notably, SMSFs offer exceptional flexibility in asset selection, which leads members to consider what they can buy with their SMSF, allowing them to allocate resources across a diverse array of options, including real estate, stocks, and cash. Importantly, SMSFs can invest in commercial real estate—such as office buildings, storage facilities, and retail spaces—highlighting what can I buy with my SMSF, as there are fewer restrictions compared to residential property investments. This structure empowers individuals to tailor their retirement strategies to align with their financial goals and risk tolerance.

The adaptability of self-managed superannuation structures sharply contrasts with conventional retirement savings accounts, which typically offer limited options for capital allocation and are managed by financial entities. For instance, while traditional funds may restrict allocations to a specified list of assets, members of self-managed schemes can pursue customized strategies that align more closely with their personal financial objectives. As Paul Rafton, National Leader at BDO Australia Ltd, notes, "Self-Managed Superannuation Funds provide unmatched control and personalization for individuals aiming to enhance their retirement savings."

With the ongoing evolution of the self-managed super fund landscape, including recent discussions on their advantages and the growing popularity of real estate within these funds, they remain an appealing option for individuals eager to take charge of their retirement planning. Finance Story is here to assist you in navigating compliance and identifying the right lender for your commercial property.

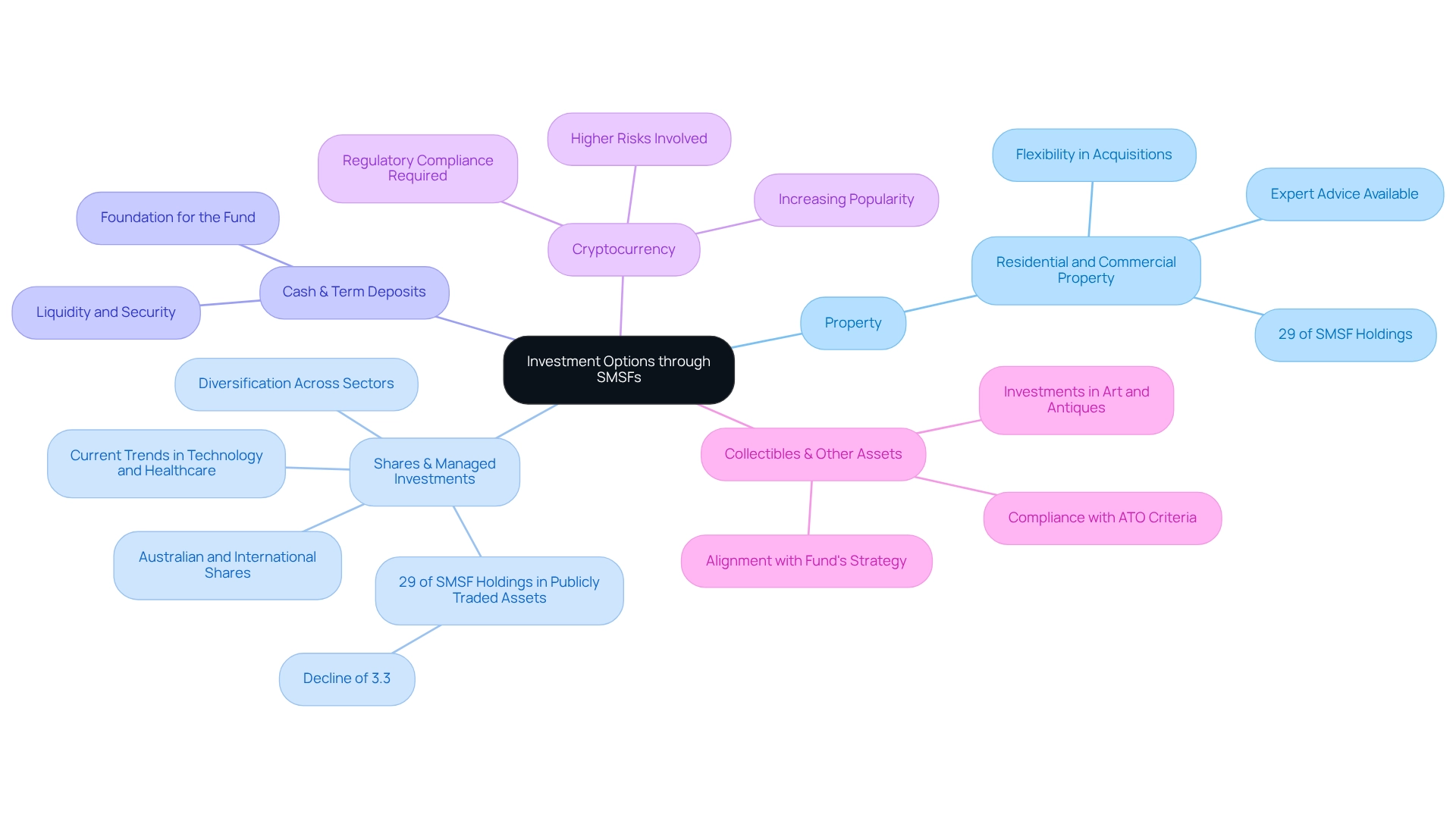

Investment Options Available Through SMSFs

SMSFs offer a wide array of investment options, enabling members to tailor their portfolios according to their financial goals:

- Residential and Commercial Property: SMSFs can acquire real estate, including commercial properties such as office buildings, warehouses, and retail premises. This financial opportunity has fewer restrictions compared to residential properties, allowing for greater flexibility. Finance Story offers expert advice to assist you in building a robust case and ensuring adherence to regulations, aiding in the choice of the appropriate lender for your commercial real estate. As of 2025, approximately 29% of total SMSF holdings are in property investments, reflecting a growing interest in this asset class. BOOK A CHAT to learn more.

- Shares and Managed Investments: Members have the flexibility to consider what can I buy with my SMSF, including both Australian and international shares, as well as managed investments, facilitating diversification across various sectors and markets. For example, numerous self-managed superannuation funds are progressively directing resources towards technology and healthcare industries, which have demonstrated resilience in recent market conditions.

- Cash and Term Deposits: Self-managed super funds can maintain cash in bank accounts or invest in term deposits, providing liquidity and a secure foundation for the fund.

- Cryptocurrency: The increasing popularity of digital currencies prompts consideration of what can I buy with my SMSF, as self-managed superannuation funds can invest in cryptocurrencies, although this option carries higher risks and requires careful regulatory compliance.

- Collectibles and Other Assets: When exploring what can I buy with my SMSF, it's important to know that SMSFs can invest in collectibles such as art and antiques, provided they meet specific criteria established by the Australian Taxation Office (ATO). Every allocation must correspond with the fund's allocation strategy and adhere to superannuation laws.

As of 2025, roughly 29% of total self-managed superannuation fund holdings are in publicly traded assets, indicating a decrease of 3.3%. This trend highlights the significance of strategic planning in managing market volatility and enhancing performance. Financial specialists stress that "strategic planning is identifying how an investor will achieve their goals and objectives," underscoring its essential role in self-managed super fund choices. With the June quarter anticipated to be pivotal for SMSF performance, particularly following recent interest rate cuts and the Albanese government securing a majority, investors are encouraged to reassess their strategies. The case study from Wybenga Financial on strategic planning illustrates how clients can define their financial goals and adapt their investment strategies to changing market conditions.

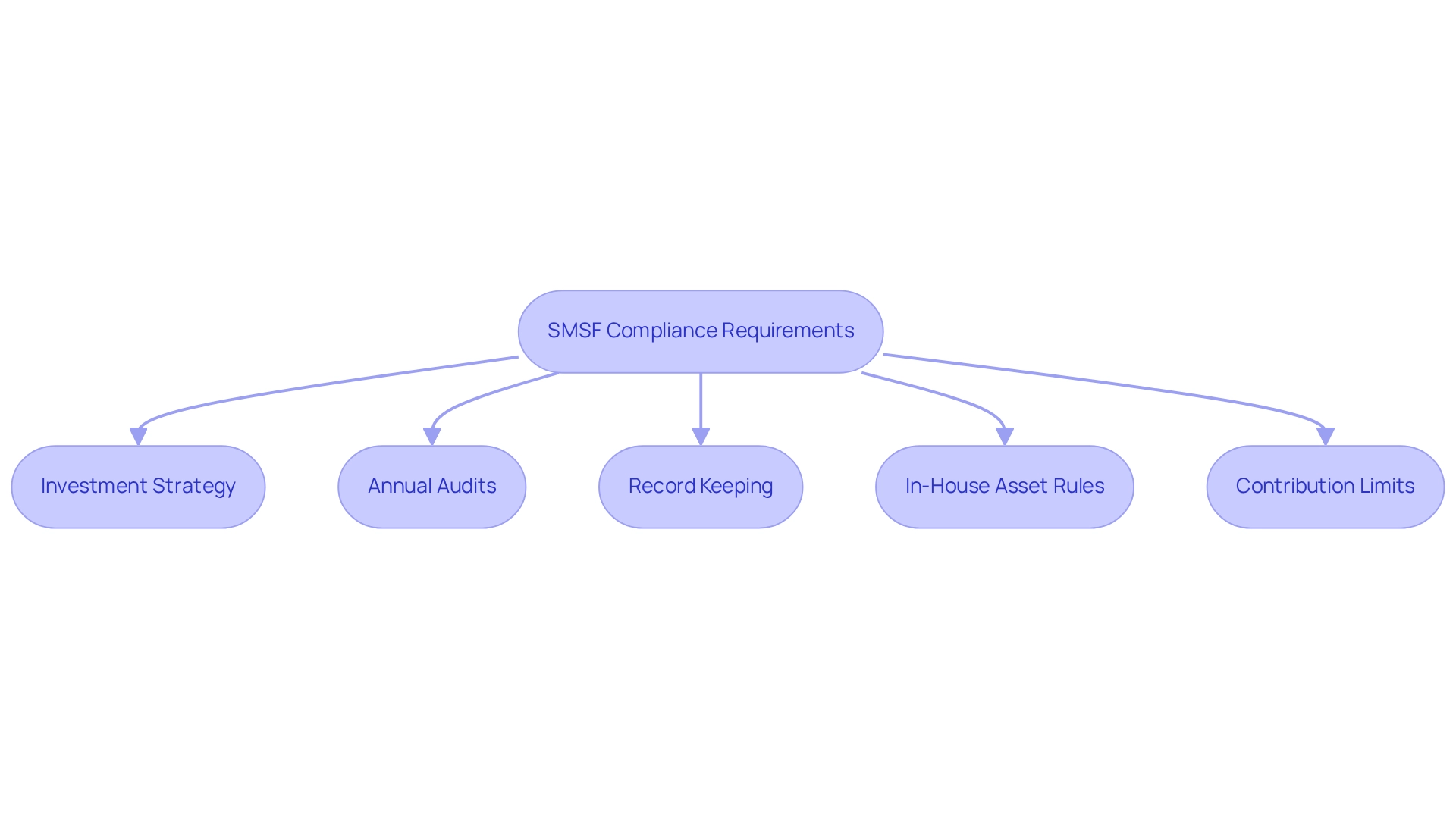

Understanding SMSF Regulations and Compliance

Self-managed superannuation accounts operate under stringent regulations established by the Australian Taxation Office and the Superannuation Industry (Supervision) Act 1993. Adhering to these compliance requirements is essential for trustees to maintain the integrity of their investments and avoid penalties. Key compliance elements include:

- Investment Strategy: SMSFs must maintain a documented investment strategy that clearly outlines how the fund will achieve its investment objectives, considering factors such as risk, liquidity, and diversification.

- Annual Audits: Each SMSF is mandated to undergo an annual audit conducted by an approved auditor, ensuring adherence to superannuation laws and regulations.

- Record Keeping: Trustees are required to keep accurate records of all transactions, including investment decisions and financial statements, for a minimum of five years.

- In-House Asset Rules: Self-managed superannuation funds face restrictions on holding in-house assets (assets owned by related parties), which must not exceed 5% of the total market value of the fund's assets.

- Contribution Limits: There are yearly caps on contributions to self-managed superannuation funds, which trustees must diligently monitor to prevent excess contributions that could lead to penalties.

As of March 2025, the SMSF sector has demonstrated strong growth, with 646,168 self-managed super funds overseeing a total estimated asset value of $1.01 trillion. This growth underscores the importance of compliance, as the potential assets per adviser have risen to $62.29 million, reflecting an increasing complexity in managing these funds. Recent reports indicate that while the increase in compliance breaches is minor, it still poses significant risks for trustees, highlighting the need for vigilance in adhering to ATO regulations.

For small business owners, exploring what can I buy with my SMSF for commercial property ventures offers a unique opportunity. Finance Story can assist in creating a strong case for compliance and help navigate the lending landscape to find the right lender for purchasing commercial properties. A recent case study involving a small business owner illustrated how proactive compliance measures facilitated successful navigation of ATO regulations, leading to enhanced financial opportunities. Furthermore, compliance specialist Darin stresses, "Grasping the intricacies of self-managed superannuation fund regulations is crucial for trustees to evade traps and enhance their financial potential." Such insights demonstrate that although the regulatory environment can be difficult, effective strategies and expert advice from Finance Story can result in positive outcomes for trustees, ensuring compliance while maximizing financial opportunities. BOOK A CHAT

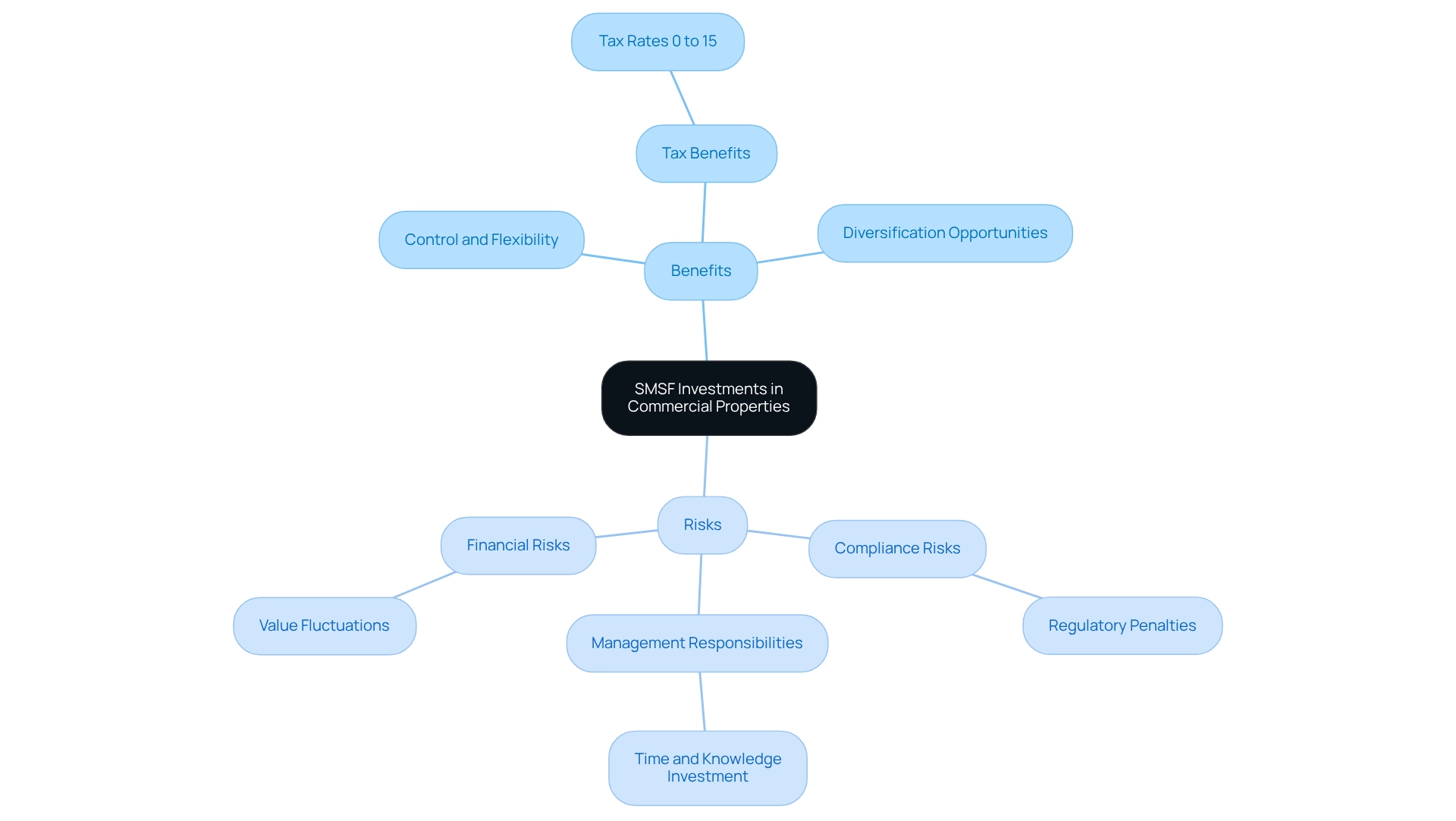

Evaluating the Benefits and Risks of SMSF Investments

Investing through a Self-Managed Super Fund (SMSF) in commercial properties offers numerous advantages that can significantly enhance your financial strategy:

- Control and Flexibility: SMSF members have complete autonomy over their investment decisions, allowing them to tailor their portfolios to meet specific financial objectives, especially in commercial real estate.

- Tax Benefits: Self-managed super funds can take advantage of concessional tax rates on earnings and capital gains, which can notably improve overall returns. High-income earners may benefit from tax rates as low as 0% to 15% on superannuation funds, making SMSFs an appealing choice for tax-efficient investing in commercial properties.

- Diversification Opportunities: The ability to invest in a wide range of assets, including commercial real estate, facilitates improved diversification, which can help mitigate risk.

However, potential investors must also consider the associated risks:

- Compliance Risks: Non-compliance with regulatory requirements can result in severe penalties, including the forfeiture of tax concessions. This underscores the importance of adhering to self-managed superannuation fund regulations, particularly when investing in commercial properties. Finance Story can assist you in establishing a robust compliance framework, ensuring you navigate these regulations effectively.

- Management Responsibilities: Operating a self-managed superannuation fund demands a significant investment of time, knowledge, and effort, which may not be feasible for everyone. Trustees must be prepared to actively manage their fund, particularly when handling the complexities of commercial real estate. Seeking guidance from Finance Story can help streamline this process.

- Financial Risks: Similar to any asset, the value of self-managed superannuation fund resources can fluctuate. Poor investment decisions in commercial properties can lead to financial losses, making it crucial for trustees to conduct thorough research and seek professional advice from experts like Finance Story when necessary.

The self-managed superannuation fund sector has demonstrated resilience, particularly during challenging times such as the COVID-19 pandemic, when membership and assets continued to grow. This adaptability highlights the SMSF's role as a vital financial tool for retirement savings, especially in commercial property investments.

As intergenerational self-managed superannuation structures become more popular, the increasing number of members may contribute to a decline in fund closures, suggesting a shift in investment strategies among Australians. Shelley Banton, head of education for ASF Audits, observes, "As intergenerational SMSFs gain traction, the growth in the proportion of funds by the number of members could also contribute to the decline in wind-ups." Nonetheless, investors must remain vigilant regarding the risks, including potential elder abuse within self-managed superannuation fund structures, as emphasized by industry leaders. Furthermore, ongoing education and training for professionals in the self-managed superannuation fund sector are essential to ensure knowledgeable management and compliance.

By weighing these benefits and risks, small business owners can make informed decisions about what can I buy with my SMSF for their investment strategies, particularly in commercial properties.

To discover how Finance Story can support you in your SMSF journey—covering compliance and identifying the right lender—BOOK A CHAT today.

Conclusion

The advantages of Self-Managed Super Funds (SMSFs) are substantial, offering individuals a unique opportunity to take control of their retirement savings through personalized investment strategies. With the ability to invest in a wide range of assets—including residential and commercial properties, shares, cryptocurrencies, and even collectibles—SMSFs provide flexibility that traditional superannuation funds cannot match. This customization allows members to align their investments with their financial goals and risk appetites, enhancing their potential for growth.

However, with great power comes great responsibility. The complexities of SMSF regulations and compliance highlight the importance of diligence and strategic planning. Adhering to the stringent requirements set forth by the Australian Taxation Office is essential to avoid penalties and ensure the integrity of the fund. The risks associated with non-compliance, management responsibilities, and fluctuating asset values necessitate a proactive approach to fund management. Seeking expert guidance can significantly mitigate these risks and help navigate the regulatory landscape.

Ultimately, SMSFs represent a powerful tool for retirement planning, particularly for those willing to invest the time and effort required for effective fund management. By weighing the benefits against the risks and embracing a well-informed strategy, individuals can optimize their retirement savings and secure a more prosperous financial future. Engaging with experienced professionals can further enhance the potential of SMSFs, ensuring compliance while maximizing investment opportunities.