Overview

This article provides essential insights into SME lending in Australia, focusing on the evolving landscape of financing options available to small and medium-sized enterprises. It highlights significant trends, including the rise of non-bank lenders, the necessity of tailored financing solutions, and the transformative impact of fintech innovations. These elements are crucial for SMEs to effectively navigate their funding needs.

Furthermore, as the financial environment shifts, understanding these trends becomes increasingly important. The emergence of non-bank lenders offers alternative avenues for financing, while tailored solutions ensure that SMEs can meet their unique challenges. In addition, fintech innovations are reshaping the way businesses access capital, making it imperative for SMEs to stay informed and adaptable.

In conclusion, the insights presented here are not just informative; they are actionable. By recognizing these trends and leveraging the available resources, SMEs can position themselves for success in a competitive market. Are you ready to explore the financing options that best suit your business needs?

Introduction

In the dynamic landscape of Australian finance, small and medium enterprises (SMEs) are increasingly seeking innovative solutions to navigate the complexities of securing funding. This growing recognition of the unique challenges faced by these businesses has led to the emergence of tailored financing options as a critical lifeline. From the rise of non-bank lending to the impact of fintech innovations, the landscape is evolving rapidly, offering SMEs a myriad of opportunities to access the capital they need.

As interest rates fluctuate and government support programs expand, understanding lender requirements and effective cash flow management becomes paramount. How can SMEs leverage these developments to enhance their growth potential? This article delves into the trends shaping SME financing in Australia, providing insights that can empower businesses to secure their financial future.

Finance Story: Tailored Financing Solutions for SMEs

Finance Story distinguishes itself in the Australian finance landscape by delivering tailored financing solutions specifically crafted for small and medium-sized businesses. Recognizing that every enterprise has distinct needs, Finance Story offers a comprehensive suite of services, including:

- Commercial property loans

- Corporate finance

- SMSF loans

- Residential home loans

- Expat mortgages

This personalized approach not only facilitates access to the most suitable funding options but also significantly enhances the likelihood of success for SMEs navigating a competitive market.

At Finance Story, we understand enterprises 100%. Our enduring relationships with clients ensure that we deliver optimal results for their strategies. With a broad panel of lenders, encompassing major banks, private financiers, and angel investors, we address every facet of funding. Personalized lending is essential for small businesses. Research shows that SMEs utilizing customized funding solutions experience higher success rates, as these options are specifically designed to align with their operational needs and growth objectives. Our diverse array of lenders allows us to identify the most appropriate and best-value home loan for your unique situation, making the home-buying process seamless and enjoyable.

Current statistics indicate that corporate banks are increasingly recognizing the revenue potential within the SME sector, particularly among middle-market clients. This shift underscores the growing demand for customized funding options that cater to the varied requirements of SME lending in Australia. By leveraging its extensive experience and understanding of the financial landscape, Finance Story is well-positioned to assist small and medium-sized enterprises in securing the funding they need to thrive.

Non-Bank Lending: A Rising Trend Among SMEs

SME lending in Australia has emerged as a vital trend among small and medium enterprises, with approximately 52% of companies now seeking these lenders for their financing needs. This represents a remarkable increase from just 15% in 2018, showcasing a growing recognition of the benefits that non-bank lenders provide, such as competitive rates and flexible terms. The shift is primarily fueled by the demand for quicker access to capital and more adaptable eligibility requirements, rendering non-bank alternatives particularly attractive for companies grappling with challenges in securing traditional bank financing.

Furthermore, the COVID-19 pandemic has accelerated this trend, with non-bank lenders experiencing a 35% surge in loan applications from small and medium enterprises. This increase underscores the evolving landscape of enterprise funding, where non-bank options are increasingly viewed as viable substitutes. As awareness of non-bank lending products grows—propelled by networking, technology, and broker activity—more SMEs are investigating these avenues to fulfill their financial requirements.

The impact of SME lending in Australia by non-bank lenders on small enterprise funding is substantial. They provide essential support for various enterprise activities, from acquiring new assets to expanding operations. Finance Story is dedicated to developing refined and uniquely tailored business cases to present to a diverse array of lenders, including mainstream banks and innovative private lending groups, ensuring that small and medium-sized enterprises can secure the appropriate funding for their commercial property investments and refinances. Jon Sutton, CEO of ScotPac, emphasizes this by stating, "Whether it is buying new assets, hiring more staff or helping to pay down a tax bill, ScotPac has the right product to help." As the lending landscape continues to evolve, the shift towards non-bank lending is expected to grow, providing innovative funding solutions for small and medium-sized enterprises through SME lending in Australia, tailored to their unique circumstances. Additionally, partnerships such as the one between ScotPac and Gallagher and APositive highlight collaborative efforts to stimulate growth in the industry, further enhancing the options available to small and medium-sized enterprises.

To effectively navigate this changing environment, small enterprise owners should consider exploring various lending alternatives and seek guidance from specialists like Finance Story to customize their funding strategies.

Interest Rate Hikes: Implications for SME Financing

The recent trend of interest rate hikes presents significant challenges for SMEs seeking financing. As borrowing costs rise, many businesses encounter increased difficulty in managing cash flow and meeting repayment obligations. Current average interest rates for SME lending in Australia hover in the mid to high 20 percent range, which can strain financial resources. This environment often leads to stricter lending criteria, compelling SMEs to reassess their financial strategies.

To navigate these challenges, owners should consider securing fixed rates where possible, as this can offer stability against future increases. Furthermore, exploring alternative funding options, such as private lenders or specialized loan products, can help mitigate the impact of rising costs. Finance Story focuses on developing refined and highly personalized cases to present to banks, ensuring that small and medium enterprises can obtain the appropriate funding for their requirements.

Expert opinions suggest that SMEs must prioritize cash flow management during these turbulent times. Financial analysts emphasize the importance of maintaining a robust cash reserve and closely monitoring expenses to ensure sustainability. As Lauren, a small enterprise owner, remarked, 'Absolutely brilliant, will never go back.' For small enterprise owners, time and simplicity regarding accounting software are essential. This highlights the need for efficient financial management during challenging periods.

Furthermore, case studies indicate that lenders are increasingly relying on accountants to confirm clients' repayment capabilities, which raises ethical concerns and underscores the need for transparency in financial dealings. This shift places additional pressure on SMEs, as they must ensure their financial documentation is in order to meet lender requirements. Working with Finance Story provides access to a full suite of lenders, including high street banks and innovative private lending panels, which can be crucial for navigating these complexities. As interest rates continue to rise, the effect on SME lending in Australia is anticipated to be significant, with many enterprises needing to adjust swiftly to endure. Policymakers may only authorize a rate reduction if the economy undergoes a sharp downturn, which small enterprise owners do not wish for. By executing strategic financial planning, utilizing available resources, and exploring alternatives such as fixed-rate financing, small and medium enterprises can enhance their ability to endure the challenges of increasing borrowing expenses.

Fintech Innovations: Transforming SME Lending Practices

Fintech innovations are transforming SME lending in Australia, with AI-driven credit assessments and online lending platforms leading the way. These advancements facilitate quicker loan approvals and tailor financing options to meet the unique needs of small enterprises. For example, AI algorithms analyze vast amounts of data to assess creditworthiness more accurately, significantly improving approval rates for small and medium-sized enterprises. This evolution not only streamlines the borrowing process but also minimizes the extensive documentation typically required to secure loans.

As the fintech sector continues to evolve, staying informed about these developments is crucial for entrepreneurs. The Australian fintech market, comprising over 400 fintech companies and startups, is projected to experience substantial growth from 2025 to 2033, fueled by the rising adoption of digital solutions in financial services. Companies like Zeller are spearheading this transformation, having launched a new transaction account and debit card specifically designed for small enterprises, directly challenging the traditional banking sector.

Moreover, data indicates that AI-driven credit evaluations can enhance approval rates by up to 30%, showcasing the potential of these technologies to assist SMEs in their funding endeavors. Additionally, partnering with specialists such as Finance Story can provide small business owners with tailored funding proposals that align with the evolving demands of lenders, ensuring they secure the most favorable funding options for their commercial property investments and refinances. Finance Story offers a comprehensive range of lenders, including high street banks and innovative private lending panels, to accommodate various scenarios, whether acquiring a warehouse, retail space, factory, or hospitality venture. As fintech leaders emphasize the importance of innovation in shaping the future of SME lending in Australia, it becomes clear that leveraging these tools will be vital for small enterprises navigating the complexities of securing capital in an increasingly competitive market.

Cash Flow Management: Key to Securing SME Loans

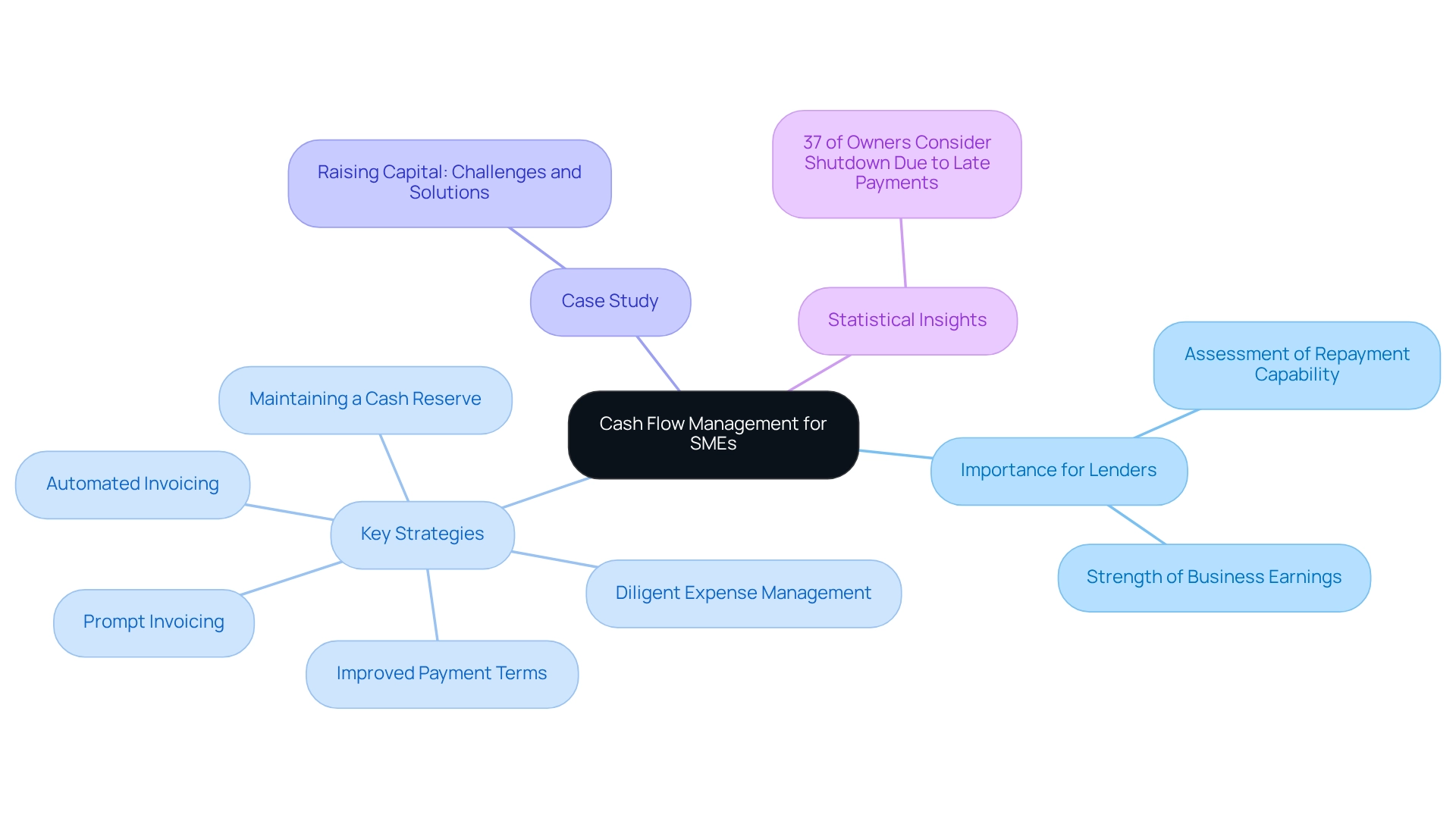

Efficient cash flow management is paramount for SMEs seeking SME lending in Australia, as lenders meticulously assess a company's cash flow to gauge its repayment capability. In evaluating your ability to repay a debt, lenders scrutinize the strength of your business's earnings, ensuring it can effortlessly meet all repayment obligations. This encompasses not only loans for new commercial properties but also any existing debts, such as those secured against your home.

By implementing robust cash flow forecasting and monitoring practices, small to medium-sized enterprises can effectively demonstrate their financial health to prospective lenders involved in SME lending in Australia. Key strategies include:

- Prompt invoicing

- Diligent expense management

- Maintaining a cash reserve

Each significantly enhances an enterprise's attractiveness to lenders involved in SME lending in Australia. A case study titled 'Raising Capital: Challenges and Solutions' underscores the hurdles entrepreneurs face in securing funds for growth, accentuating the need for innovative financing solutions.

Furthermore, data reveals that 37% of small enterprise owners have contemplated shutting down their operations due to late payment issues, emphasizing the critical need for effective cash flow management, particularly in the realm of SME lending in Australia. Professional insights from financial advisors consistently highlight the significance of cash flow forecasting for small enterprises, as it not only aids in securing financing but also fosters long-term financial stability.

As Shane Duffy, founder of Finance Story, asserts, lenders seek assurance that you comprehend your venture and possess growth strategies, which can be illustrated through a comprehensive plan and cash flow projections. By prioritizing cash flow management, small enterprises can bolster their creditworthiness and navigate the complexities of SME lending in Australia with enhanced confidence.

To further refine cash flow management practices, small businesses should consider adopting specific strategies, such as:

- Negotiating improved payment terms with suppliers

- Leveraging technology for automated invoicing

These actionable steps can lead to improved cash flow and increased borrowing eligibility.

Government Support Programs: Boosting SME Financing Opportunities

Government support programs play a crucial role in enhancing SME lending in Australia for SMEs. Initiatives such as grants, tax incentives, and loan guarantee schemes are specifically designed to assist small enterprises in accessing the capital necessary for growth and sustainability. For instance, the Collaboration Readiness Level Tool enables businesses to assess their preparedness for engaging with publicly-funded research organizations, ensuring they maximize the benefits of such partnerships.

In 2025, various government support programs continue to evolve, providing critical resources for SMEs. These programs not only alleviate financial burdens but also improve the chances of securing SME lending in Australia from both traditional and non-traditional lenders. Statistics indicate that enterprises engaged in SME lending in Australia while leveraging government grants experience a significant increase in their financing capabilities, with many reporting enhanced operational efficiency and growth potential. For example, a local café in Melbourne successfully utilized a government grant to expand its operations, resulting in a 30% increase in revenue within a year.

Furthermore, small enterprises that effectively utilize grants and tax incentives often find themselves in a stronger position to innovate and grow. As Stephen, Treasurer of South Australia, stated, "Government support programs are essential for nurturing a dynamic small enterprise ecosystem, enabling entrepreneurs to prosper in a competitive market." Entrepreneurs are therefore encouraged to actively seek out and engage with available government resources to fully capitalize on their funding potential.

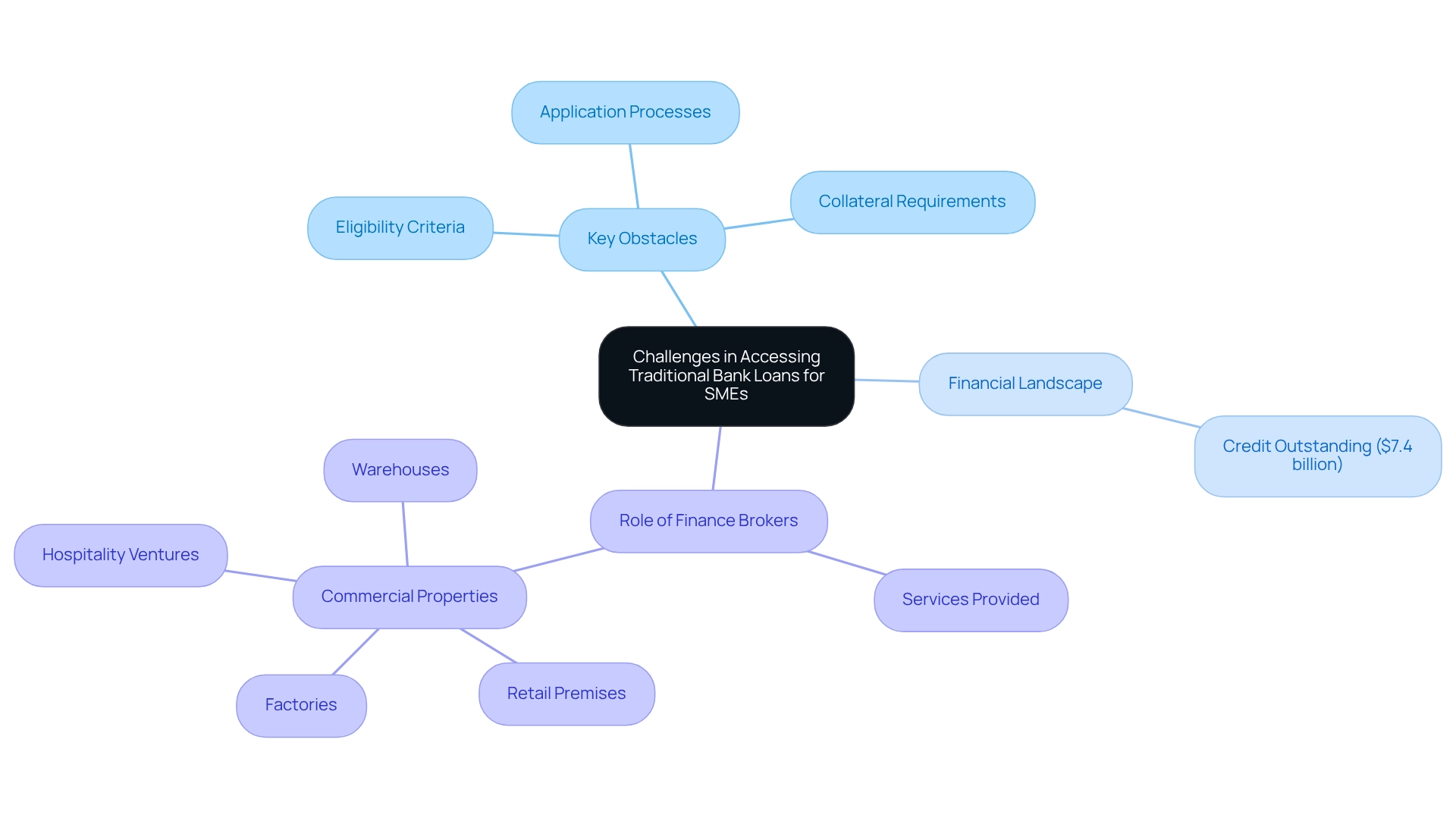

Challenges in Accessing Traditional Bank Loans for SMEs

Obtaining SME lending in Australia poses significant challenges for many small and medium-sized enterprises (SMEs). Key obstacles include:

- Stringent eligibility criteria

- Lengthy application processes

- Necessity for substantial collateral

In 2025, numerous SMEs reported feeling overwhelmed by the extensive documentation demands and the perceived risks associated with their operational models. Statistics indicate that approval rates for SME lending in Australia remain low, with many enterprises struggling to meet traditional banking standards. Notably, the amount of credit outstanding under the SME Loan Guarantee Schemes is $7.4 billion, underscoring the financial landscape for SMEs.

To effectively navigate these hurdles, SMEs are increasingly turning to finance brokers like Finance Story, which specializes in crafting polished and highly customized proposals specifically for SME lending in Australia to present to banks. With access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, Finance Story is well-equipped to assist clients in achieving their financial goals. They provide support for various commercial properties, including:

- Warehouses

- Retail premises

- Factories

- Hospitality ventures

These experts offer essential advice and facilitate access to a broader range of lending options, helping businesses secure the resources they need to thrive. Are you ready to tackle your financial challenges? Reach out to Finance Story today to discover how they can assist you in overcoming these obstacles.

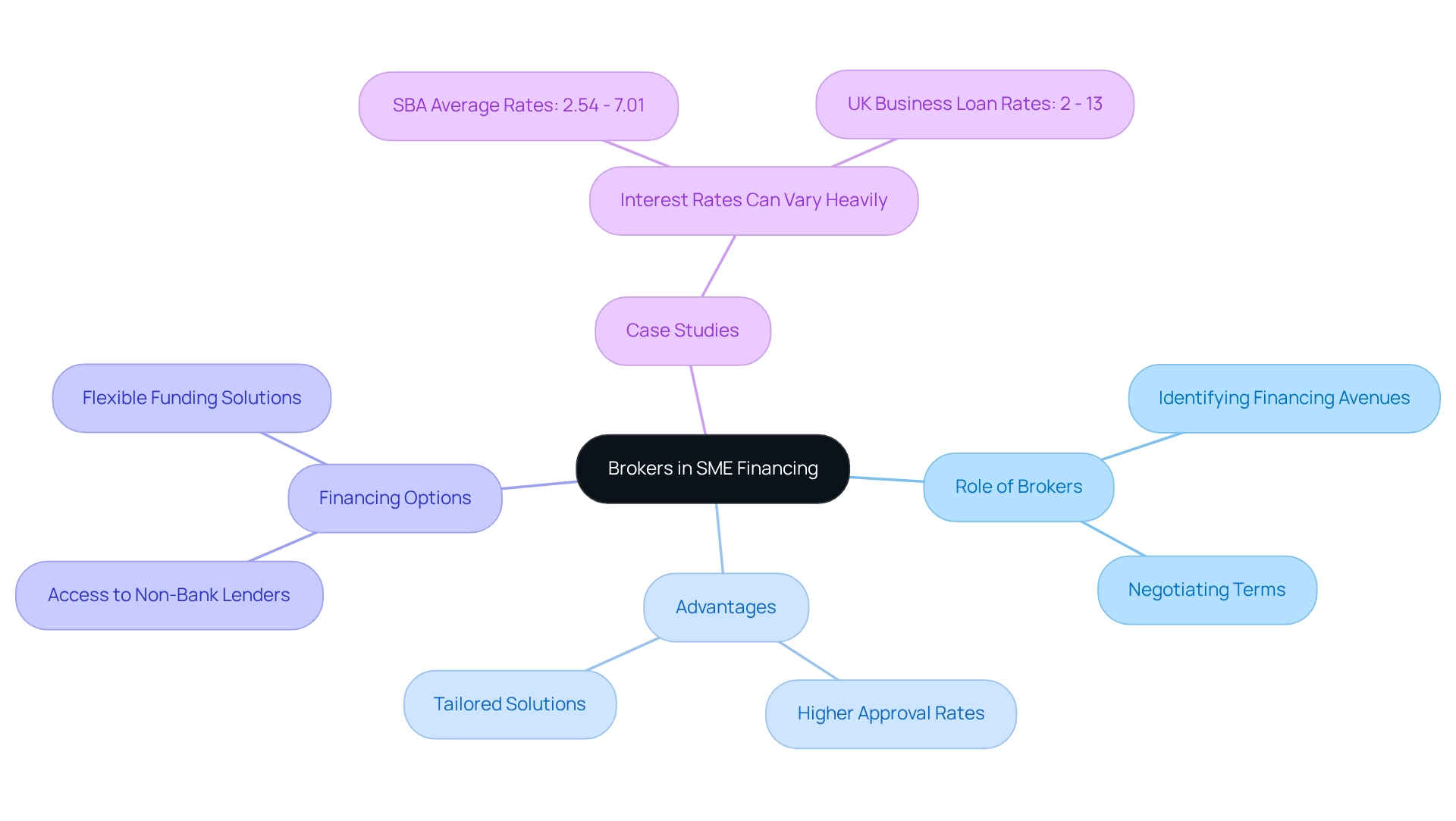

Brokers: Essential Partners in SME Financing

Brokers have emerged as indispensable allies for small and medium-sized enterprises (SMEs) navigating the intricate landscape of funding options. Their expertise plays a pivotal role in helping businesses identify suitable financing avenues and negotiate favorable terms. With access to a wide array of lenders, including non-bank institutions, brokers can offer flexible funding solutions tailored to the unique needs of SMEs. This partnership not only simplifies the funding application process but also significantly enhances the likelihood of securing essential financing.

Expert insights underscore the importance of brokers in this arena. Malcolm Roberts, a prominent Productivity Commissioner, notes that while locating the right product can be daunting, the potential rewards are considerable. Additionally, statistics indicate that SMEs utilizing brokers for loan applications enjoy higher approval rates compared to those who apply directly, showcasing brokers' adeptness in navigating the complexities of the lending landscape.

Finance Story exemplifies this expertise by providing customized mortgage brokerage solutions that address both commercial and residential financing requirements, even under challenging circumstances. Their ability to craft refined and highly tailored cases for banks increases the chances of obtaining financing for a range of projects, from small startups to large-scale developments. Case studies demonstrate the favorable outcomes for SMEs that have collaborated with finance brokers. For instance, companies that engage actively with brokers often secure financing with more advantageous interest rates, which can vary significantly, as evidenced by the SBA's report showing average rates between 2.54% and 7.01%. Understanding these rates is crucial for companies to manage their repayments effectively and avoid prolonged debt. As we look toward 2025, the role of brokers in SME lending in Australia continues to adapt, responding to the evolving financial landscape and the specific challenges faced by small businesses. Maintaining a strong credit profile remains essential for accessing favorable financing conditions, further emphasizing the critical role of brokers like Finance Story in guiding small and medium-sized enterprises through this process.

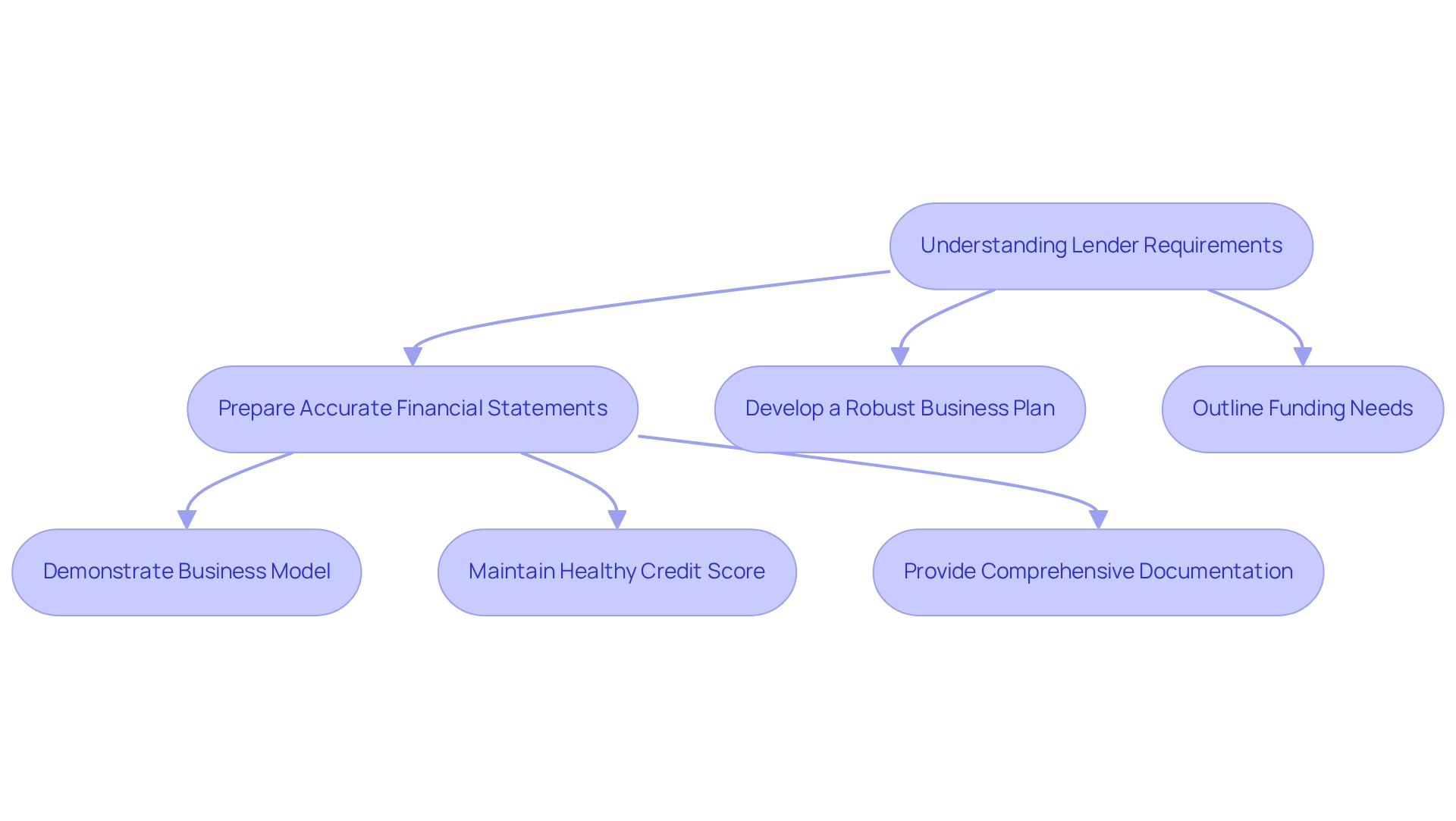

Understanding Lender Requirements: A Must for SMEs

Understanding lender requirements is crucial for small and medium-sized enterprises (SMEs) looking to secure financing. Lenders assess various factors, including credit history, company performance, and cash flow stability, when evaluating loan applications. To boost their chances of approval, SMEs must prepare accurate financial statements, a robust business plan, and a clear outline of their funding needs.

At Finance Story, we excel in crafting polished and highly tailored business cases that meet the elevated expectations of lenders. This expertise can significantly enhance your application, especially when seeking funding for commercial property investments or restructuring existing debts. We provide access to a comprehensive range of lenders, from high street banks to innovative private lending panels, catering to your specific circumstances.

Statistics reveal that customers utilizing flexible financing services experience a 30% increase in repayment rates on average, underscoring the importance of presenting a well-structured application. As Rajeev Chalisgaonkar, Head of Banking Services, notes, "Incorporating digital tools into our banking offerings has enabled us to enhance processes and deliver a more seamless experience for our SME clients." This highlights the necessity of adopting innovative solutions within the lending process.

Moreover, grasping what lenders prioritize can substantially influence application success rates. Key lender criteria for SME lending in Australia in 2025 include:

- Demonstrating a robust business model

- Maintaining a healthy credit score

- Providing comprehensive documentation

Types of commercial properties eligible for financing encompass warehouses, retail premises, factories, and hospitality ventures. The landscape of small business financing is evolving, with new technologies and solutions emerging to streamline the process. SMEs that prepare thoroughly and align their applications with these criteria are more likely to secure the funding they require.

Expert advice emphasizes the significance of clarity and organization in loan applications. Financial experts suggest that small and medium-sized enterprises should focus on transparently showcasing their financial health and effectively communicating their growth potential. By doing so, owners can craft a compelling case that resonates with lenders, paving the way for successful financing outcomes. A practical recommendation for SMEs is to consider leveraging digital platforms like Canopy to enhance their application process, ensuring they meet lender expectations and improve their chances of approval. Furthermore, engaging with Finance Story can provide you with customized loan proposals tailored to your organizational needs.

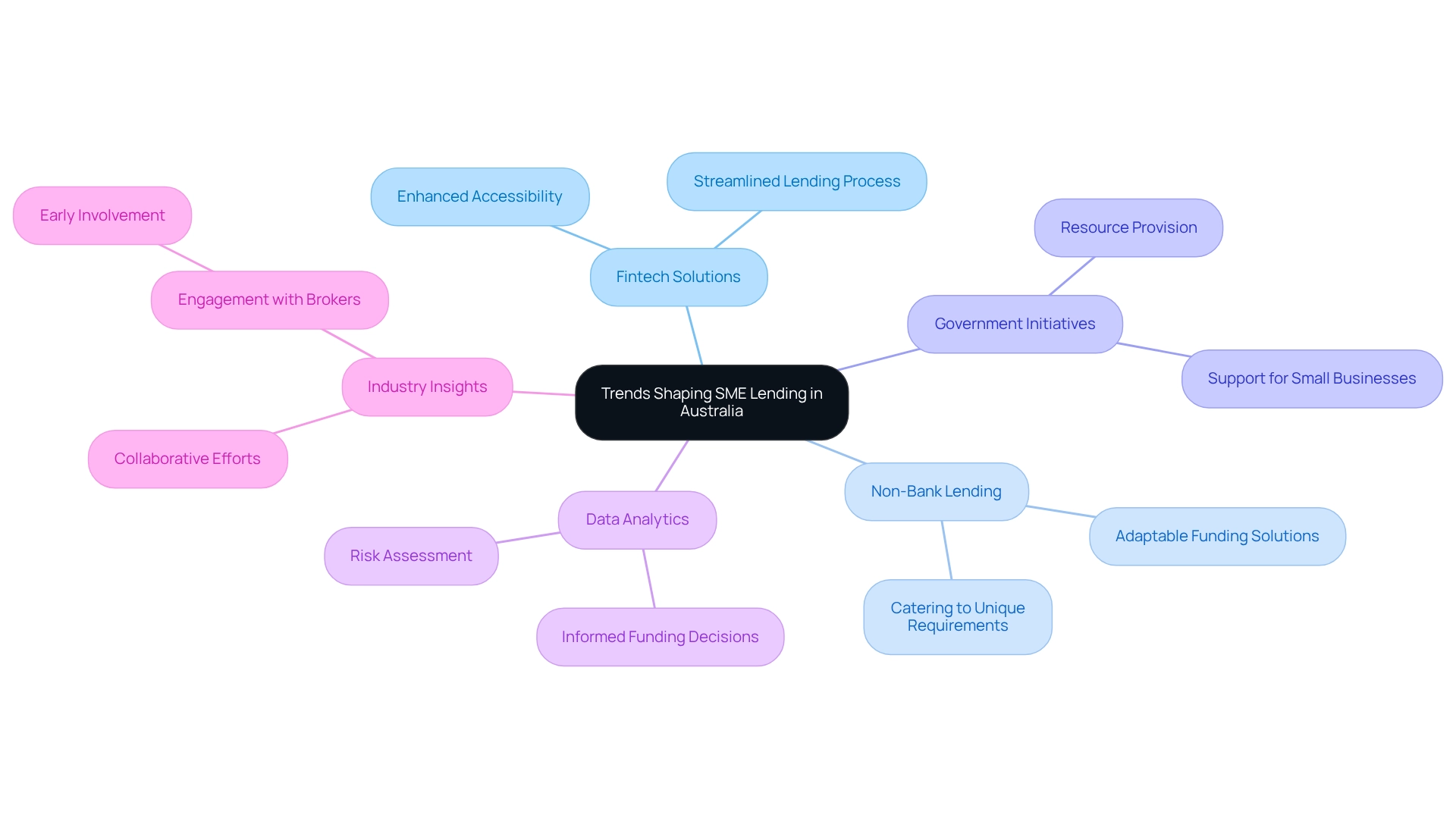

Future Outlook: Trends Shaping SME Lending in Australia

Several pivotal trends are significantly shaping the future of SME lending in Australia. As technology continues to evolve, the adoption of fintech solutions is expected to rise, streamlining the lending process and enhancing accessibility for small and medium enterprises. This shift is further supported by an increasing inclination towards non-bank lending alternatives, which cater to the need for more adaptable funding solutions tailored to the unique requirements of small and medium-sized enterprises, especially in terms of SME lending in Australia.

Statistics indicate that approximately 75 percent of established small enterprises with employees were still operational four years later, underscoring the resilience of small firms and the critical need for accessible financing options. Government initiatives aimed at bolstering small businesses will also play an essential role in shaping SME lending in Australia. These programs are designed to equip SMEs with vital resources, enabling them to navigate a competitive environment effectively. Moreover, insights from industry leaders, such as John Shillington, NAB’s Head of Commercial Broker and Equipment Finance - VIC/TAS, underscore the importance of engaging commercial brokers early in the funding process to mitigate common challenges and enhance the overall experience for borrowers.

As we approach 2025, the integration of data analytics in funding decisions will become increasingly crucial. Lenders are anticipated to leverage a variety of data points, including financial performance and market trends, to assess risk and tailor lending solutions more effectively. A case study titled "Increased Reliance On Data for Funding Decisions" emphasizes the role of technology in facilitating data collection, which is vital for lenders and investors in evaluating risk and making informed funding choices for SMBs. This data-driven approach will not only refine the precision of lending decisions but also cultivate a more responsive lending environment for SMEs.

Furthermore, the expertise of companies such as Finance Story in developing refined and customized funding proposals is essential for small enterprise owners seeking capital for commercial property investments or restructuring existing debts. Understanding loan repayment requirements and leveraging property equity can significantly enhance the likelihood of successful funding. The Small Business Finance Advisory Panel, which includes diverse entrepreneurs from various industries across Australia, emphasizes the collaborative efforts in shaping SME lending in Australia. The Reserve Bank's liaison with lenders indicates that the availability of housing collateral significantly influences the cost and availability of debt finance for small business borrowers, providing further context on external factors impacting SME lending.

In summary, the convergence of technology, the growth of non-bank lending, and supportive government policies is poised to redefine SME lending in Australia, paving the way for more innovative and accessible financing options.

Conclusion

The financing landscape for small and medium enterprises (SMEs) in Australia is experiencing a significant transformation, driven by tailored solutions that address the unique challenges these businesses face. With the rise of non-bank lending and innovations from fintech, SMEs now have access to a diverse range of options that enhance their ability to secure the necessary capital for growth. The increasing preference for non-bank lenders illustrates that the demand for flexibility and speed in financing is reshaping traditional norms.

Furthermore, understanding lender requirements and effective cash flow management are essential for SMEs aiming to navigate this evolving environment successfully. By prioritizing these aspects, businesses can position themselves favorably to meet the stringent criteria set by lenders. The role of brokers, such as Finance Story, is also vital in this context, as they provide the expertise and resources needed to create compelling loan proposals that resonate with potential financiers.

As interest rates rise and government support programs continue to evolve, the focus on strategic financial planning becomes paramount. SMEs that leverage available resources, adopt innovative technologies, and engage with knowledgeable partners will be better equipped to thrive amidst the challenges of securing funding. The future of SME lending in Australia looks promising, with a convergence of technology, non-bank options, and supportive policies paving the way for more accessible and tailored financing solutions.

In conclusion, by embracing these trends and prioritizing effective financial management, SMEs can enhance their growth potential and secure a prosperous future in an increasingly competitive landscape.