Overview

Currently, the best commercial mortgage rates hover around 7.15% for fixed loans ranging from $500,000 to $1,000,000. These rates are influenced by various factors, including:

- Borrower creditworthiness

- Loan-to-value ratios

- Prevailing economic conditions

It is crucial to understand how these rates can differ based on property type. Furthermore, being aware of additional costs and lender terms is essential for making informed financial decisions. By grasping these elements, you can secure favorable mortgage conditions that align with your financial goals.

Introduction

Navigating the world of commercial mortgage rates presents a significant challenge for business owners aiming to finance property investments. With interest rates shaped by a multitude of factors—from the borrower’s creditworthiness to broader economic conditions—grasping this landscape is vital for making informed decisions.

As we approach 2025, the average fixed-rate for business loans paints a complex picture, underscoring the distinct differences between commercial and residential mortgages.

This article explores the intricacies of commercial mortgage rates, examining the types available, the factors that influence them, and essential considerations for borrowers eager to secure favorable financing options in an ever-evolving market.

Defining Commercial Mortgage Rates

Business loan costs represent the interest applied on funds secured by business properties, including office structures, retail locations, and industrial units. These charges are influenced by several factors, such as the lender's policies, the borrower's creditworthiness, and current economic conditions. As of March 11, 2025, the average fixed-rate for new business borrowings between $500,000 and $1,000,000 is set at 7.15% per annum for a five-year term. This percentage reflects the higher risk associated with business property investments compared to residential loans, which typically carry lower rates due to their perceived stability.

In 2025, trends indicate that fixed-interest loans are available for terms ranging from five to fifteen years, while variable-interest loans fluctuate based on index-linked values and borrower characteristics. The differences between business and residential loan costs are significant; business costs are generally higher due to the complexities and risks involved in financing properties for business purposes.

For instance, business loan rates vary by property category:

- Office spaces may incur rates around 7.5%

- Retail locations could see rates closer to 8.0%

- Industrial facilities might range from 7.25% to 7.75%

For business owners seeking financing for property purchases or investments, understanding what are the best commercial mortgage rates is crucial.

At Finance Story, we specialize in developing polished and highly individualized business cases for lenders, ensuring our clients can navigate the complexities of securing the right financing. We provide access to a comprehensive array of lenders, including high street banks and innovative private lending panels, to cater to various types of business properties. Recent case studies highlight the importance of being aware of additional expenses related to business loans, such as arrangement fees, valuation fees, and legal fees. One case study reveals that these extra costs can accumulate to 3% of the loan amount, underscoring the necessity for borrowers to consider the total financial obligation involved in securing a business loan. Expert opinions stress the importance of brokers effectively navigating market shifts, ensuring clients receive tailored advice in this dynamic landscape. As Belinda Wright, head of partnerships and distribution at non-bank lender Thinktank, asserts, "We’re committed to supporting brokers in navigating market shifts effectively." Overall, staying informed about what are the best commercial mortgage rates and the fluctuations of current business loan terms is essential for making wise financial decisions in property funding.

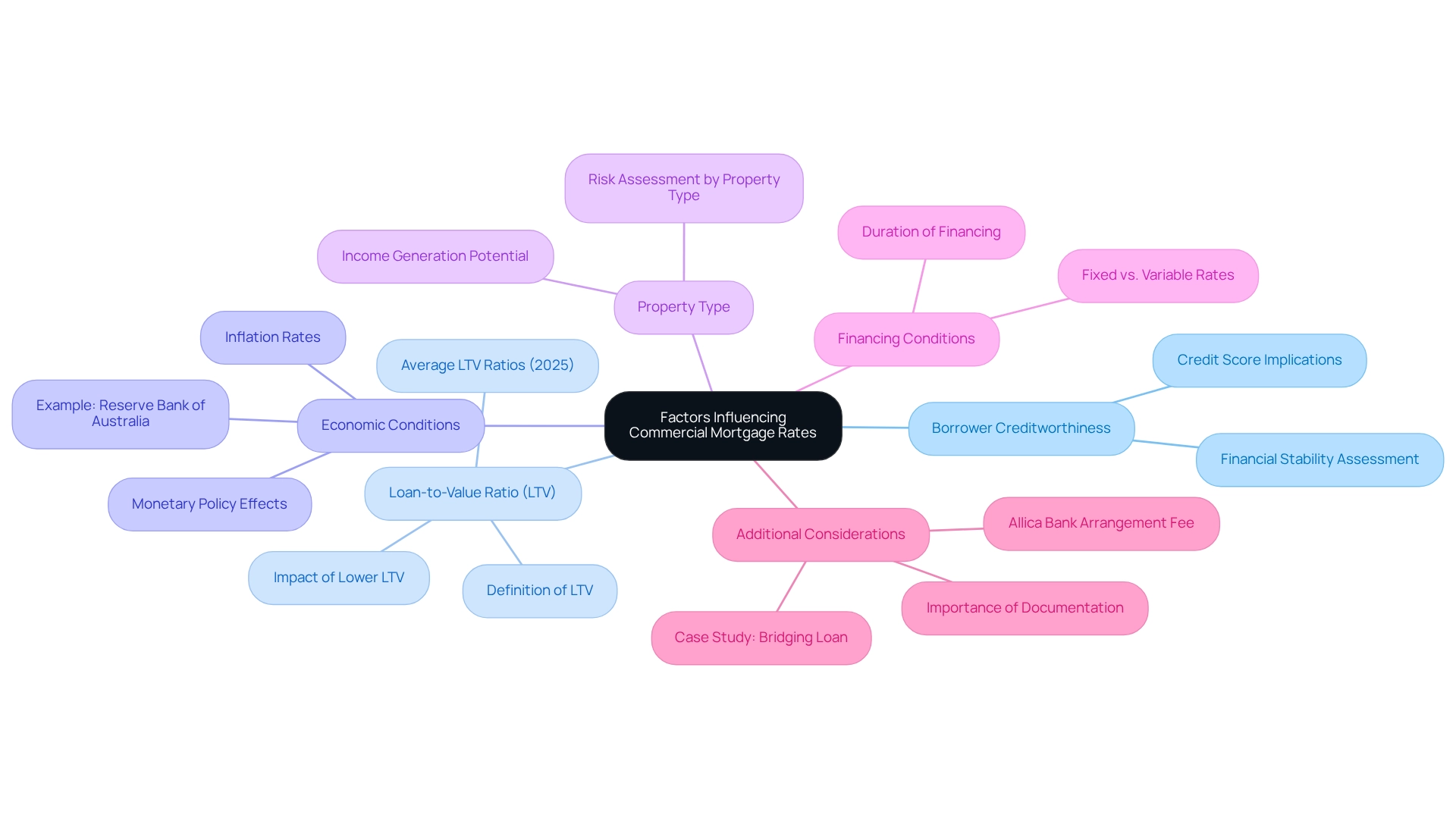

Factors Influencing Commercial Mortgage Rates

Several essential elements influence commercial mortgage prices, including:

-

Borrower Creditworthiness: Lenders assess the credit history and financial stability of the borrower. A higher credit score typically results in lower interest charges, reflecting a reduced risk of default. Recent statistics indicate that borrowers with excellent credit scores can secure significantly better terms than those with poor credit histories.

-

Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the appraised value of the property. A lower LTV often leads to more favorable terms, as it signifies reduced risk for the lender. For example, average LTV ratios for business loans in 2025 hover around 70%, with lower ratios generally yielding better conditions.

-

Economic Conditions: Broader economic factors, such as inflation rates and monetary policy set by central banks, can greatly impact interest charges. For instance, if the Reserve Bank of Australia raises its cash interest rate, mortgage expenses are likely to follow suit, affecting borrowing costs for businesses.

-

Property Type: Different kinds of commercial properties carry varying levels of risk. A strategically located office building may command lower prices compared to a retail space in a declining market, as lenders assess the potential for income generation based on property type.

-

Financing Conditions: The duration of the financing and whether it is fixed or variable can also influence costs. Fixed-rate mortgages provide stability but may start at a higher level compared to variable options, which can fluctuate over time. Understanding these terms is crucial for borrowers aiming to optimize their financing options.

Additionally, it's important to note that Allica Bank imposes an arrangement fee of 2% of the borrowed amount for properties under £3 million, which can affect overall borrowing costs.

In a recent case study, a client successfully secured £1.5 million in bridging finance to complete a self-build project under a tight deadline. This illustrates how timely access to funding can be critical in commercial property ventures. Such examples underscore the importance of understanding the elements that influence loan rates to determine what are the best commercial mortgage rates for making informed financial decisions. As Finance Story emphasizes, expertise in crafting polished and tailored business cases can significantly improve your chances of obtaining favorable loan terms. Furthermore, after receiving the final loan offer, additional documentation may be required to confirm that the applicant's circumstances haven't changed before legal work is finalized, highlighting the importance of being prepared throughout the loan process. Finance Story also provides a comprehensive range of lenders to accommodate various circumstances, including refinancing options tailored to different property types, ensuring that small business owners have access to optimal financing solutions.

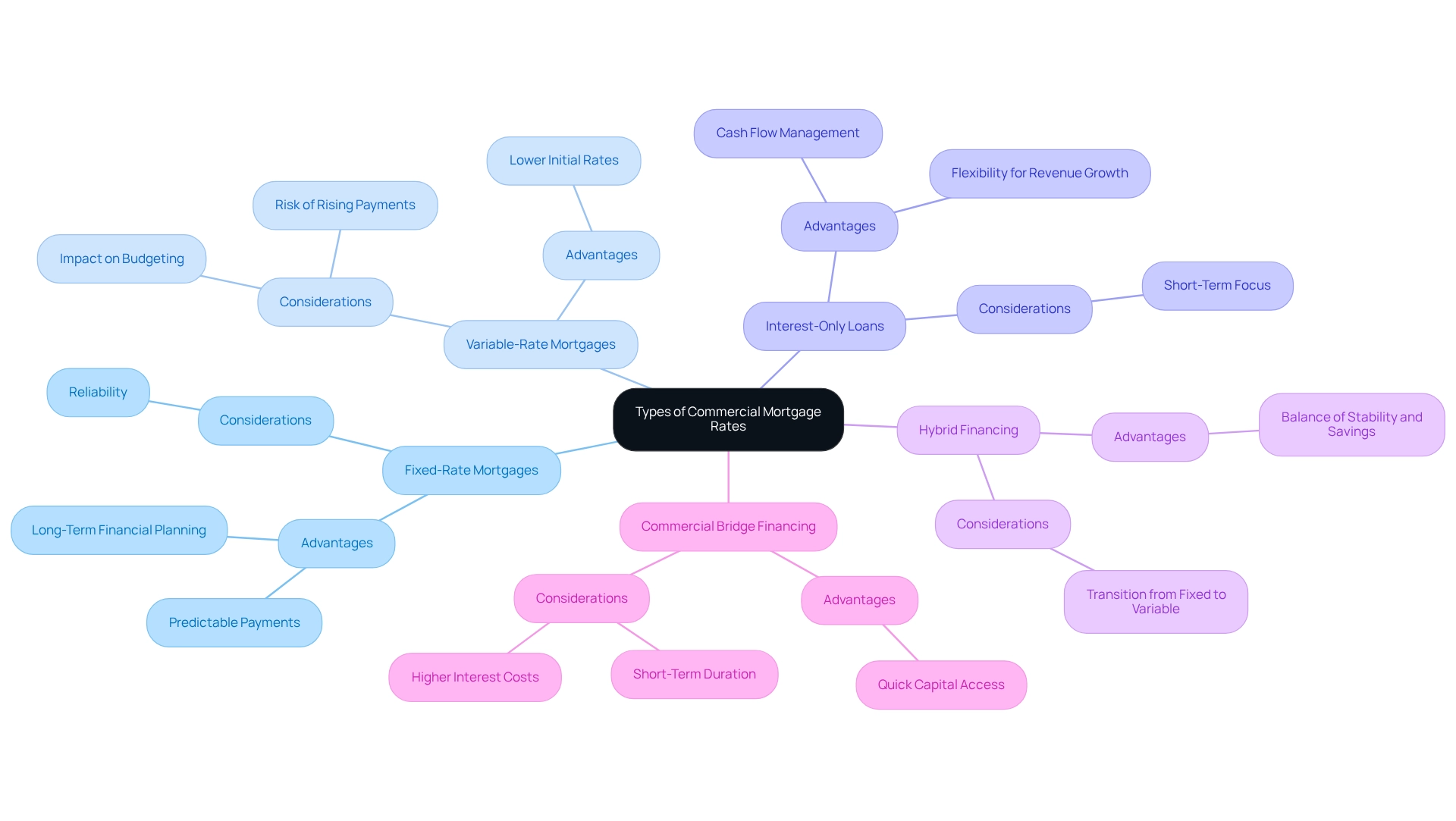

Types and Variations of Commercial Mortgage Rates

Commercial mortgage rates can be categorized into several distinct types, each offering unique advantages and considerations:

-

Fixed-Rate Mortgages: These loans maintain a stable interest percentage throughout the entire term, ensuring predictability in monthly payments. This stability is particularly beneficial for borrowers focused on long-term financial planning, helping them evade the unpredictability of changing costs. Current statistics indicate that fixed-rate loans are favored by many businesses in 2025 due to their reliability.

-

Variable-Rate Mortgages: Also known as adjustable-rate mortgages, these loans feature interest charges that can fluctuate depending on market conditions. While they often begin with lower prices compared to fixed-rate alternatives, they carry the risk of rising payments over time, potentially impacting budgeting and cash flow. As market conditions evolve, borrowers should remain vigilant about the potential for increasing rates.

-

Interest-Only Loans: This structure allows borrowers to pay only the interest for a specified period, after which they begin repaying the principal. This option can be particularly advantageous for businesses aiming to manage cash flow in the short term, especially during anticipated revenue growth. For instance, if a business expects rent hikes throughout the duration of the financing, an interest-only option may provide the necessary flexibility in budgeting. As stated by Multifamily Loans, "if you require flexibility in your budget or anticipate rent hikes during the duration of the financing, an interest-only option could be more reasonable."

-

Hybrid Financing: Merging characteristics of both fixed and variable interest, hybrid financing offers a fixed interest for an initial duration before transitioning to a variable interest. This structure can strike a balance between the stability of fixed prices and the potential cost savings associated with variable pricing.

-

Commercial Bridge Financing: These short-term funds are designed to provide quick capital until a more permanent solution is secured. Due to their brief duration and higher risk profile, bridge financing typically involves higher interest costs.

Understanding what are the best commercial mortgage rates is essential for businesses looking to enhance their financing strategies. Finance Story specializes in crafting refined and tailored business cases to present to lenders, ensuring clients can navigate the complexities of repayment criteria effectively. We provide a comprehensive selection of lenders, including high street banks and innovative private lending panels, to accommodate various property types such as warehouses, retail locations, factories, and hospitality enterprises. Additionally, refinancing options are available to meet the evolving needs of your business. It is crucial to consider factors such as customer service, credit duration, repayment terms, and penalties when selecting a lender. As emphasized in the case study 'Risks Associated with Investment Mortgages,' investing in business properties carries various risks, including market volatility and economic conditions that can affect occupancy and property prices. Consequently, borrowers should regularly evaluate their loan terms and attributes to ensure they are securing the most favorable arrangements.

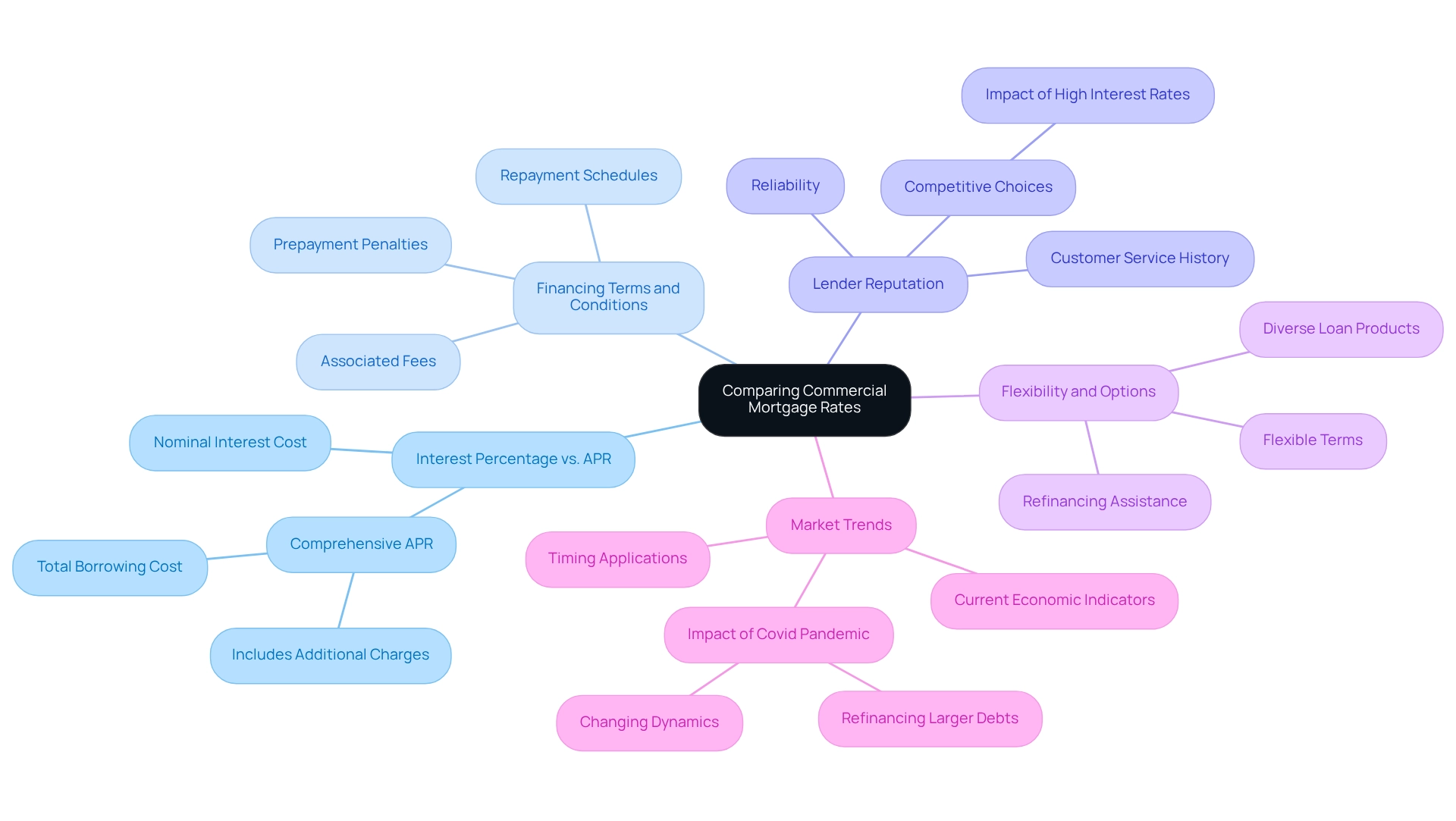

Comparing Commercial Mortgage Rates: What Borrowers Should Know

When comparing commercial mortgage rates, borrowers must consider several key factors:

- Interest Percentage vs. APR: It is crucial to differentiate between the nominal interest and the annual percentage rate (APR). While the interest percentage reflects the cost of borrowing, the APR encompasses additional charges and expenses, providing a more comprehensive view of the total borrowing cost.

- Financing Terms and Conditions: Thoroughly review the financing terms, including repayment schedules, prepayment penalties, and associated fees. These elements can significantly influence the overall borrowing cost and should align with the borrower’s financial strategy. At Finance Story, we specialize in crafting polished and highly individualized business cases that empower you to navigate these terms effectively.

- Lender Reputation: Investigate the lender's reputation and customer service history. A lender known for reliability and strong support can enhance your borrowing experience and may offer more favorable terms. As finance journalist Bernadette Lunas observes, "High interest levels put an end to the multitude of cashback offers available, but there are still several lenders providing competitive choices."

- Flexibility and Options: Seek lenders that provide flexible terms and additional services, such as refinancing assistance or access to a diverse range of loan products. Finance Story offers access to a full suite of lenders, including high street banks and innovative private lending panels, ensuring you find the right fit for your evolving business needs.

- Market Trends: Staying informed about current market trends and economic indicators is vital. Understanding how these factors affect interest levels can assist borrowers in timing their applications efficiently, potentially securing more advantageous terms. Prospective buyers should remain informed, assess their financial situation, and plan accordingly.

In 2025, what are the best commercial mortgage rates is likely to be influenced by the average APR for commercial mortgages, which is expected to reflect ongoing economic shifts, with lenders adjusting their offerings based on market conditions. For instance, a recent retail refinance request of $3,600,000 underscores the importance of evaluating both interest rates and APR in the current environment, as borrowers navigate these complexities. This figure illustrates the significant financial commitments involved and the necessity for a thorough understanding of loan terms and lender reputations. Furthermore, during the Covid pandemic, many borrowers refinanced larger debts, reflecting changing dynamics in the mortgage market. As borrowers make decisions, they should prioritize understanding these nuances to make informed choices.

Conclusion

Navigating the complexities of commercial mortgage rates is essential for business owners seeking financing for property investments. Key factors such as borrower creditworthiness, loan-to-value ratios, and economic conditions significantly influence these rates. By understanding the distinctions between fixed-rate, variable-rate, and other types of loans, borrowers can make informed decisions aligned with their financial goals.

As the landscape of commercial mortgages evolves, thorough research becomes increasingly important. Borrowers must consider not only interest rates but also the annual percentage rate (APR), loan terms, and lender reputations to select the most suitable financing options. Furthermore, being aware of market trends and their potential impact on mortgage rates can provide a strategic advantage in securing favorable terms.

In conclusion, obtaining a commercial mortgage requires careful consideration and an informed approach. By understanding the intricacies of the market and leveraging expert resources, business owners can effectively navigate this challenging terrain. Ultimately, staying informed and prepared empowers borrowers to make sound financial decisions that support their investment objectives in an ever-changing economic environment.