Overview

This article identifies the top commercial loan interest rates available to businesses in 2025, emphasizing the critical importance of understanding the factors that influence these rates. It highlights competitive options from various lenders, including NAB and Westpac. Business owners must conduct thorough research and comparisons to secure the best financing terms. Insights from industry experts and current economic trends support this necessity.

Are you ready to explore the best financing options for your business? Understanding these rates can significantly impact your financial success.

Introduction

In the intricate world of commercial financing, understanding interest rates is crucial for business owners aiming to navigate their financial options effectively. As these rates fluctuate based on a myriad of factors—ranging from credit scores to market conditions—staying informed is essential for making strategic decisions.

Furthermore, the landscape in Australia in 2025 reveals not only competitive rates but also a variety of loan types tailored to meet diverse business needs. With insights from financial experts and data-driven trends, this article delves into the key elements influencing commercial loan interest rates, the types of loans available, and practical tips for securing the best possible terms.

By leveraging this knowledge, businesses can enhance their financial profiles and position themselves for success in an ever-evolving economic environment.

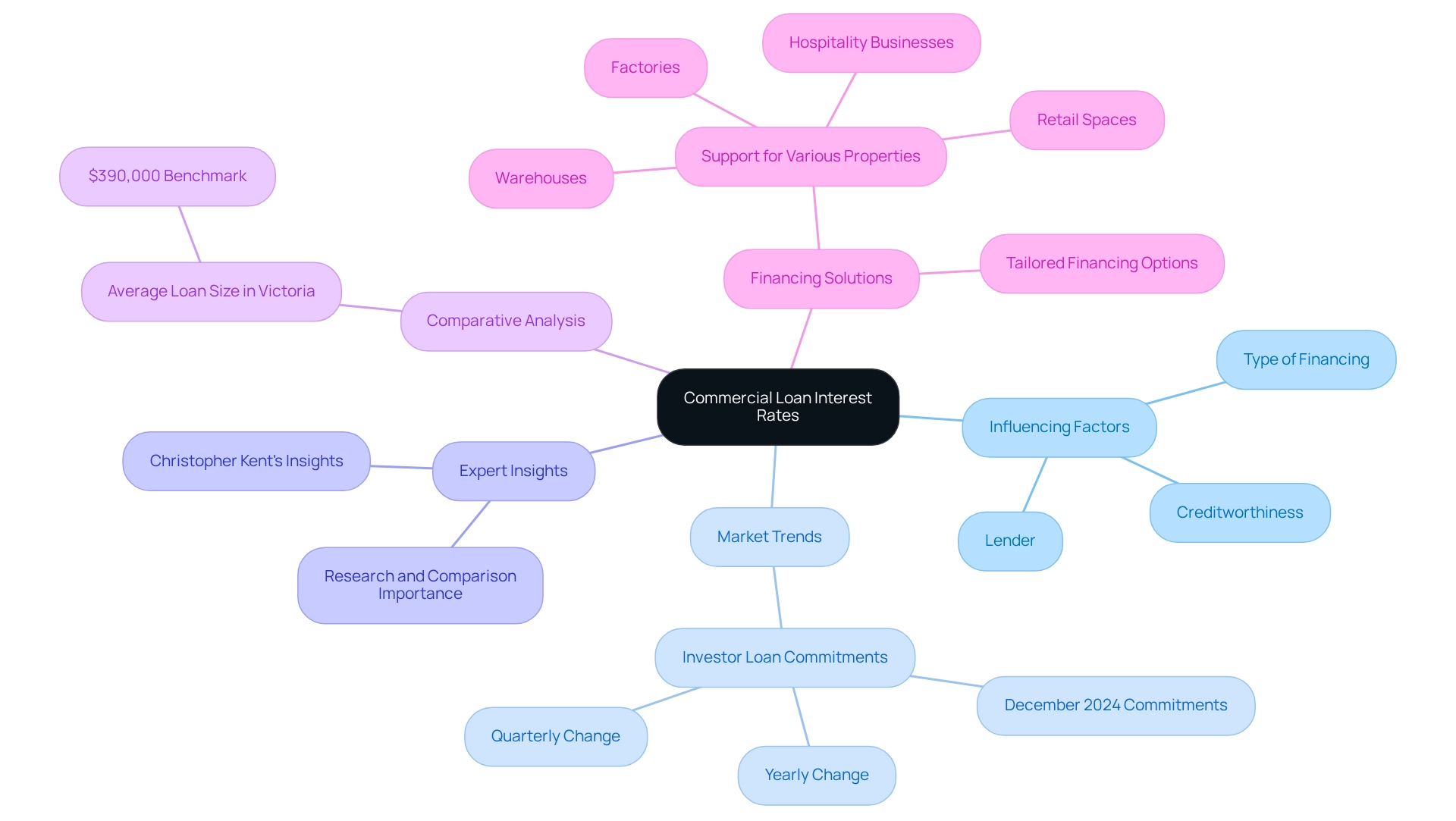

Understanding Commercial Loan Interest Rates

Commercial borrowing interest percentages reflect the costs associated with obtaining funds for business purposes, typically expressed as a fraction of the total borrowed amount. These figures can fluctuate significantly based on various factors, including the lender, the specific type of financing, and the borrower's creditworthiness. Generally, interest rates for commercial financing are higher than those for residential mortgages, underscoring the increased risk involved in lending to businesses.

As we look ahead to 2025, the landscape of interest rates for financing in Australia is shaped by several key trends. Recent data reveals that investor credit commitments reached 48,876 in the December quarter of 2024, marking a 4.5% decline from the previous quarter but a notable 13.2% increase compared to the same period last year. This shift indicates a vibrant market where entrepreneurs must stay informed about current rates and borrowing terms.

Understanding the optimal commercial loan interest rates for financing is vital for business owners seeking to fund operations or expand their enterprises. These rates are influenced by factors such as the overall economic climate, the specific financial institution, and the nature of the business itself. For instance, average borrowing amounts for owner-occupier residences in Victoria hover around $390,000, which can serve as a benchmark for evaluating commercial financing options.

Expert insights on the best commercial loan interest rates in 2025 emphasize the importance of thorough research and comparison. Christopher Kent, Assistant Governor (Financial Markets), notes that operational changes in the financial sector will facilitate a transition to ample reserves, suggesting a shift that could affect lending practices. Analysts advise entrepreneurs to consider not only the stated interest rates but also the associated terms and conditions of each financing option to secure the most favorable commercial loan interest rates.

This comprehensive approach can lead to more advantageous funding outcomes.

At Finance Story, we specialize in crafting tailored and sophisticated cases to present to lenders, ensuring that small business owners can access optimal financing solutions tailored to their unique needs. Our extensive network of financiers, including traditional banks and private funding options, allows us to provide comprehensive support for refinancing and securing customized financing for various properties, such as warehouses, retail spaces, factories, and hospitality businesses.

In conclusion, navigating the complexities of financing interest rates requires a keen understanding of how these rates are determined and the myriad factors that influence them. By staying informed and leveraging expert insights from Finance Story, business owners can make strategic decisions that align with their financial objectives.

Factors Influencing Commercial Loan Interest Rates

Several key factors significantly influence commercial loan interest rates, shaping the financial landscape for borrowers.

- Credit Score: A higher credit score is crucial, as it typically leads to lower interest rates. Lenders consider borrowers with strong credit histories as lower risk, which results in the best commercial loan interest rates and more advantageous financing terms. For instance, a credit score exceeding 700 can frequently secure terms that are considerably lower than those offered to borrowers with scores under 600.

- Amount Borrowed: The magnitude of the borrowing plays a crucial role in determining interest charges. Larger borrowings may benefit from economies of scale, often resulting in reduced costs compared to smaller loans. This is because lenders may view larger amounts as more secure investments, particularly when supported by significant collateral.

- Borrowing Period: The length of the borrowing also influences interest charges. Typically, shorter loan durations are associated with reduced costs, as the lender's risk decreases over a briefer repayment timeframe. Conversely, longer terms may lead to higher fees due to the greater uncertainty and risk linked to prolonged repayment periods, impacting the best commercial loan interest rates.

- Market Conditions: Broader economic factors, including inflation levels and the Reserve Bank of Australia's cash interest rate, significantly influence lending costs. For example, as inflation rises, lenders may increase charges to preserve their profit margins, reflecting the shifting economic landscape. Notably, the maximum impact on inflation is projected to require almost double the time compared to the maximum effect on GDP, suggesting that borrowers should remain vigilant regarding the best commercial loan interest rates as they evaluate financing alternatives.

- Property Type: The type of property being financed—commercial versus residential—can affect the interest cost. Commercial properties often carry higher risks due to market volatility, which can lead to higher rates compared to residential loans.

In 2025, these factors remain critical as corporate borrowing trends stabilize, with potential increases in debt issuance anticipated if macroeconomic uncertainties ease. As Kent C. mentioned in his speech to Bloomberg, understanding the 'Channels of Transmission' of these factors can empower borrowers to make informed choices when pursuing financing. This insight is particularly relevant for small enterprise owners navigating the current economic climate.

At Finance Story, we specialize in developing refined and highly tailored proposals to present to lenders, ensuring you obtain the best commercial loan interest rates for your investments and refinances.

Types of Commercial Loans to Consider

When exploring commercial loans, borrowers should familiarize themselves with several key types that cater to diverse financial needs:

- Term Loans: These traditional loans feature fixed repayment schedules, making them ideal for significant investments such as purchasing equipment or real estate. In 2025, term financing continues to be a favored option among small enterprises, with many utilizing them for vital capital investments. Notably, the value of new personal fixed-term loan commitments for 'Other' in Australia reached $3.48 billion in the December quarter of 2022, highlighting the ongoing demand for such financing options. Finance Story specializes in crafting refined and highly tailored cases to present to lenders, ensuring that borrowers can obtain the best terms available.

- Lines of Credit: Providing flexibility, lines of credit enable companies to access funds as required, which is especially advantageous for handling cash flow variations. This option enables small businesses to respond swiftly to unexpected expenses or opportunities without the burden of a fixed repayment schedule. Comprehending the repayment criteria for these credits is essential for effective financial management.

- Business Mortgages: Specifically intended for obtaining business properties, these funds are usually secured by the asset itself. As the commercial real estate market evolves, comprehending the nuances of commercial mortgages is vital for companies aiming to expand their physical presence. Finance Story provides access to a full suite of lenders, including high street banks and innovative private lending panels, to meet diverse financing needs, whether for warehouses, retail premises, factories, or hospitality ventures.

- SBA Financing: Supported by the government, SBA financing offers advantageous conditions for small enterprises, including reduced interest rates and prolonged repayment durations. These financial products are especially beneficial for startups and companies aiming to reduce economic risk while obtaining essential capital. Consulting with experts at Finance Story can help navigate these options effectively.

- Equipment Financing: Tailored for purchasing equipment, these loans use the equipment itself as collateral. This form of financing is becoming more favored among small enterprises, particularly in areas where technology and machinery are essential to operations. Finance Story's expertise in refinancing can aid companies in enhancing their equipment financing strategies.

In 2025, the commercial lending landscape is also witnessing a shift towards technology-driven solutions. The rise of digital and embedded lending options is expected to reshape the market, with API-first solutions projected to account for 40% of the lending landscape by 2026. This evolution not only simplifies the application process but also enhances integration with existing operational workflows, ultimately improving the overall lending experience.

As emphasized in the case study 'The Role of Technology in Small Enterprise Lending,' technology is transforming the lending environment, allowing quicker financing processing and improved integration with current organizational workflows.

As small enterprises explore their funding choices, understanding the specific features and advantages of each credit type, especially the best commercial loan interest rates, is crucial. For example, numerous companies are utilizing term loans for equipment purchases, demonstrating the practical application of these financial products in real-world scenarios. By carefully evaluating their needs and consulting with financial advisors at Finance Story, borrowers can make informed decisions that align with their long-term goals.

Moreover, refinancing choices are accessible to assist enterprises in adjusting to evolving financial situations, guaranteeing they can persist in flourishing. As Janet Gershen-Siegel observed, "The pandemic disrupted many entrepreneurs’ strategies for their small ventures," highlighting the significance of having adaptable and reachable funding alternatives.

How to Compare Commercial Loan Interest Rates

To effectively compare commercial loan interest rates in 2025, follow these essential steps:

- Gather Multiple Quotes: Reach out to a variety of lenders to obtain quotes for the same loan amount and term. Research indicates that borrowers typically secure an average of three to five quotes, which can significantly influence the terms they receive. At Finance Story, we specialize in creating polished and highly individualized business cases to present to banks, ensuring you have the best chance of securing favorable terms.

- Look Beyond the Interest Charge: While the interest charge is a crucial factor, it’s important to consider additional elements such as fees, repayment terms, and the overall flexibility of the loan. A reduced interest level might be accompanied by elevated fees that could cancel out the savings. Our expertise in refinancing can help you navigate these complexities.

- Use Comparison Tools: Utilize online comparison tools that enable you to visualize differences in prices and terms across various lenders. These tools can simplify the process and help you identify the most favorable options quickly.

- Negotiate Terms: Don’t shy away from negotiating with lenders. Present competing offers to leverage better rates or terms. Many lenders are willing to adjust their offers to secure your business, especially if you demonstrate that you have other options. With access to a full suite of lenders, including high street banks and innovative private lending panels, Finance Story can assist you in this process.

- Understand the Total Cost: Calculate the total expense of the borrowing over its lifetime, including both interest and fees. This comprehensive perspective will allow you to make a more informed choice, ensuring that you select a financial option that aligns with your financial goals.

In the competitive environment of financial funding, enterprises that effectively negotiate improved credit conditions frequently employ a shared approach: they emphasize comprehensive research and proactive communication with financiers. For example, a recent case study emphasized how a small business was able to decrease its interest percentage by 1.5% merely by presenting multiple proposals during negotiations, leading to significant savings over the duration of the financing.

Specialist guidance emphasizes the significance of efficiently evaluating the best commercial loan interest rates for financing options. As Vikram, an experienced leader in the financial services sector, observes, "Grasping the subtleties of credit proposals is essential for making wise financial choices." By adhering to these steps and utilizing the knowledge of Finance Story, which provides a complete array of lenders for different business properties including warehouses, retail spaces, factories, and hospitality projects, you can traverse the intricacies of financing for businesses and obtain the most favorable conditions for your enterprise.

Key Terms to Know About Commercial Loans

Grasping important terminology associated with business financing is crucial for borrowers to navigate the financial landscape successfully. Here are some essential terms:

- APR (Annual Percentage Ratio): This represents the total cost of borrowing expressed as a yearly interest percentage, encompassing not only the interest charged but also any associated fees. In 2025, the average APR for business financing in Australia is anticipated to reflect the existing economic environment, with lenders adjusting rates according to market conditions and borrower profiles. Finance Story highlights the significance of comprehending APR, as it directly affects the total expense of funding for business property investments.

- LTV (Loan-to-Value Ratio): This ratio assesses the financing amount concerning the property's worth, serving a vital function in risk evaluation. A lower LTV indicates less risk for lenders, often resulting in more favorable financing terms. As of 2025, lenders are increasingly cautious, particularly for land banks and pre-development sites, where lower LTV levels are common due to the heightened risks involved in commercial real estate (CRE) lending. Finance Story's expertise in refinancing can assist borrowers in navigating these challenges efficiently.

- Amortization: This term denotes the process of gradually paying off a debt through regular payments that cover both principal and interest. Understanding the amortization schedule is essential for borrowers to manage their cash flow effectively throughout the duration of the debt. Finance Story aids clients in organizing their financing to enhance amortization conditions that align with their business requirements.

- Prepayment Penalty: Some agreements include a fee for settling the debt early, which can significantly affect refinancing possibilities. Borrowers should be aware of these penalties when considering their long-term financial strategies. Finance Story recommends clients to take these elements into account when formulating their financing strategies.

- Collateral: This is an asset pledged as security for the credit, which can influence the interest rate provided. The type and value of collateral can affect a lender's willingness to provide financing and the terms of that financing. Understanding how collateral impacts borrowing conditions is essential for individuals seeking to secure the best rates.

By becoming acquainted with these important terms, individuals can make informed choices regarding the best commercial loan interest rates that align with their financial objectives. Additionally, industry leaders emphasize the importance of understanding these concepts to capitalize on market opportunities effectively. For instance, Belinda Wright, leader of partnerships and distribution at a non-bank lender, observes that brokers and clients can utilize expanded options for purchases, refinancing, and equity release to navigate the current market environment successfully.

Real-world instances demonstrate how APR influences commercial financing choices, as borrowers must consider the total cost of funding against their investment strategies. For context, the average amount borrowed for owner-occupier dwellings in the Australian Capital Territory is $377,000, serving as a benchmark for potential borrowers. Understanding these terms not only empowers borrowers but also enhances their capacity to negotiate better financing conditions tailored to their unique circumstances.

Furthermore, Finance Story's commitment to client service is exemplified through its comprehensive complaints resolution process, ensuring that clients are supported throughout their financing journey. Additionally, Finance Story provides a complete array of lenders, including high street banks and innovative private lending panels, to assist clients in acquiring various business properties such as warehouses, retail spaces, factories, and hospitality ventures. This all-encompassing strategy guarantees that clients can restructure their business financing efficiently to meet the evolving demands of their enterprises.

Tips for Securing the Best Commercial Loan Rates

To secure the most favorable commercial financing terms, consider implementing the following strategies:

- Enhance Your Credit Score: Regularly review your credit report for inaccuracies and take corrective action as necessary. A robust credit score not only enhances your creditworthiness but also positions you favorably for the best commercial loan interest rates. In 2025, prioritizing credit score improvement is essential, as lenders increasingly depend on these metrics to evaluate risk. Additionally, establishing an emergency fund signals to lenders that you are a reliable credit risk, further bolstering your profile.

- Prepare a Solid Enterprise Plan: A comprehensive enterprise plan is vital in demonstrating your venture's potential to financiers. It should clearly outline your goals, strategies, and financial projections, illustrating how you intend to achieve success. Research indicates that a well-prepared strategy significantly increases your chances of securing the most competitive commercial loan interest rates. At Finance Story, we specialize in crafting refined and tailored business cases to present to banks, ensuring you maximize your chances of success.

- Offer Collateral: Providing collateral can mitigate the lender's risk, potentially leading to more favorable loan terms. This may include real estate, equipment, or other valuable assets that reassure lenders of your commitment to repayment.

- Shop Around: Avoid settling for the first offer you receive. Take the time to compare terms and conditions from various lenders. This not only aids in identifying the best commercial loan interest rates but also empowers you in negotiations. With access to a diverse range of lenders, including high street banks and innovative private lending panels, Finance Story can effectively guide you through this process.

- Negotiate Terms: Leverage your research and the offers you have gathered to negotiate improved terms. Many lenders are open to discussion, and you may be able to secure reduced fees or more favorable repayment conditions by clearly articulating your needs.

- Utilize Professional Advice: Financial advisors emphasize the importance of enhancing your credit score as a strategy for achieving better borrowing conditions. Engaging with experts, such as those at Finance Story, can provide personalized insights relevant to your situation, thereby increasing your chances of obtaining the best available commercial loan interest rates. As Isaac Garson, Senior Business Development Manager, notes, companies can save 60-70% of the funding by negotiating more favorable terms.

- Learn from Successful Case Studies: Numerous organizations have successfully improved their credit scores and secured better financing conditions by implementing strategic adjustments. For instance, companies that faced challenges due to low credit ratings found success by utilizing alternative lenders that do not impose stringent credit criteria, allowing them to obtain funding quickly and efficiently. This is particularly relevant as 93% of small enterprise owners anticipate moderate to substantial growth over the next 12 months, underscoring the importance of securing advantageous financing terms.

By following these recommendations and leveraging the expertise of Finance Story, you can enhance your financial profile and increase your likelihood of securing the most favorable funding conditions in 2025.

Top Commercial Loan Interest Rates to Consider

As of April 2025, the environment for commercial borrowing interest levels in Australia presents several competitive options for enterprises seeking the best commercial loan interest rates. Here are some top rates to consider:

- NAB: Starting rates from 6.29% p.a. for secured loans, making it an attractive choice for businesses looking to leverage their assets.

- Westpac: Provides a variety of competitive offers with adaptable choices for both fixed and variable terms, addressing diverse financing requirements.

- ING: Currently offers terms at 7.15% p.a. for commercial adjustable financing, appealing to companies that favor the flexibility of variable interest.

- Suncorp: Offers terms starting at 6.99% p.a. for minor enterprise financing, aiding the expansion of smaller establishments.

- BOQ: Provides financing for commercial properties with terms beginning at 6.6% p.a., offering a strong choice for property investments.

These terms are subject to modification, so it is advisable for businesses to consult directly with lenders to find the best commercial loan interest rates and the most up-to-date offers.

The recent positive sentiment in the economy, as indicated by the Roy Morgan Business Confidence index measuring above 100 for three consecutive months, suggests a favorable environment for securing loans. This optimism is additionally backed by the expected influence of reduced interest levels on the property market, which is predicted to encourage demand for new purchases. According to a case study titled "Impact of Reduced Interest Levels on Business Property Market," the potential for decreased interest levels is anticipated to significantly affect the business property market by enhancing the desire for new purchases.

Investors are likely to re-enter the market or expand their portfolios as financing costs decline, enhancing investment activity in the commercial sector.

Considering these developments, businesses have successfully obtained competitive terms from NAB and Westpac, showcasing the possibility for advantageous financing conditions. As Luci Ellis, the economic spokesperson at Westpac, noted, "That would follow a similar pattern to what we’ve seen from international peers including the Federal Reserve and RBNZ and mark an acceleration from our previous forecast of one cut per quarter." This insight highlights the changing economic environment and its effects on interest levels.

As the market evolves, staying informed about the best commercial loan interest rates and lender offerings will be crucial for making strategic financial decisions. With over 25 years of experience in business improvement and technology implementation, Finance Story is well-equipped to assist small business owners in navigating these changes and securing the best financing options available. We offer a full range of lenders, including high street banks and innovative private lending panels, to suit your unique circumstances.

Whether you are looking to purchase a warehouse, retail premise, factory, or hospitality venture, Finance Story can help you create tailored loan proposals that meet your specific needs.

Conclusion

Understanding commercial loan interest rates is crucial for business owners aiming to make informed financial decisions. This article highlights the dynamic landscape of these rates in Australia as of 2025, emphasizing the significance of factors such as credit scores, loan amounts, and market conditions in determining borrowing costs. Furthermore, it outlines various types of loans available, from traditional term loans to flexible lines of credit, each designed to meet different business needs.

To secure the best possible loan terms, businesses should:

- Conduct thorough research

- Compare multiple quotes

- Negotiate with lenders

By leveraging expert insights and grasping key financial terms, borrowers can enhance their financial profiles and navigate the complexities of commercial financing more effectively.

Ultimately, staying informed and proactive in the search for competitive rates positions businesses for immediate financial success and fosters long-term growth in an ever-evolving economic environment. By utilizing the resources and expertise available, such as those offered by Finance Story, business owners can strategically align their financing options with their broader business goals, ensuring they are well-equipped to thrive in the marketplace.