Overview

When embarking on the journey of starting a business, four financing options stand out:

- Personal investment

- Funding from family and friends

- Crowdfunding

- Business loans

Each of these avenues offers unique advantages and presents distinct challenges. It is crucial for entrepreneurs to understand these methods thoroughly, as aligning them with their financial goals and risk tolerance is essential for successful capital acquisition. By evaluating these options carefully, one can make informed decisions that pave the way for business success.

Introduction

In the dynamic world of entrepreneurship, securing the right financing is a critical step that can determine the success or failure of a business venture. As aspiring business owners navigate a landscape filled with diverse funding options—from traditional loans to innovative crowdfunding—understanding the nuances of each method becomes essential.

With the rise of alternative financing avenues and shifting economic conditions, entrepreneurs must equip themselves with the knowledge to make informed decisions that align with their financial goals.

This comprehensive overview explores the various financing strategies available in 2025, highlighting the advantages and challenges associated with each. Furthermore, it emphasizes the importance of a well-rounded approach to funding.

Understanding Business Financing: An Overview

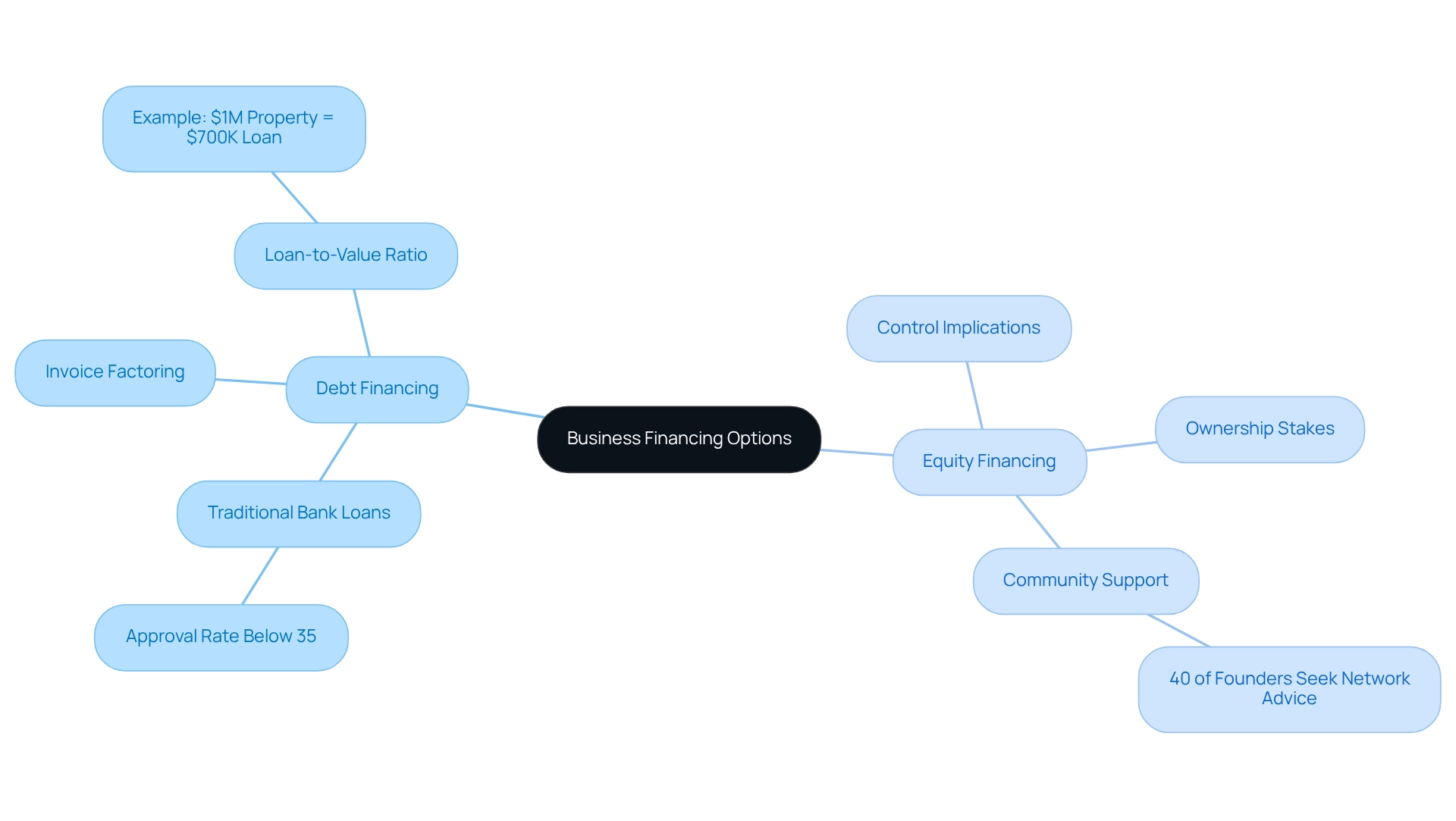

When embarking on a business journey, it is essential to consider four financing options that provide entrepreneurs with the necessary capital to initiate or expand their ventures. Understanding these options is crucial for new business owners, as it empowers them to make informed decisions aligned with their financial objectives. In 2025, funding can be broadly categorized into two primary types: debt and equity.

Debt financing involves borrowing money that must be repaid over time, typically with interest. This method can encompass traditional bank loans, which, despite their popularity, have become increasingly challenging to secure, with fewer than 35% of applications being fully approved. Consequently, many entrepreneurs are exploring alternative options, such as invoice factoring, which allows companies to access cash by selling their outstanding invoices.

For those considering freehold property ventures, understanding the loan-to-value ratio (LVR) is vital. For instance, if a commercial property is valued at $1 million, a lender might permit borrowing up to 70% of that value, resulting in a $700,000 loan. This scenario necessitates a $300,000 down payment, along with additional funds for operational costs.

Conversely, equity funding involves raising capital by selling ownership stakes in the company. This approach can be particularly attractive for startups, as it does not require repayment like debt financing. However, it does entail relinquishing a portion of ownership and control over the business.

Recent trends reveal that 40% of founders are turning to their professional networks for monetary guidance, signaling a shift towards community-driven support within the startup ecosystem. This collaborative environment fosters knowledge sharing and resource exchange, which can be invaluable for entrepreneurs exploring their funding options. As Tony Hsieh, CEO of Zappos, wisely stated, "Chase the vision, not the money; the money will end up following you," highlighting the importance of focusing on long-term goals rather than immediate financial concerns.

Understanding the nuances of debt versus equity funding is essential for new entrepreneurs. Each option presents distinct advantages and disadvantages, and the right choice will depend on the specific needs and circumstances of the business. For example, while debt funding can provide immediate capital without diluting ownership, it also imposes repayment obligations that can strain cash flow.

On the flip side, equity funding can offer a more flexible financial structure but may lead to a loss of control.

In summary, the capital acquisition landscape in 2025 presents four financing options for entrepreneurs, each with its own implications. By comprehending these funding methods, new business owners can better position themselves to achieve their financial goals and drive their ventures toward success. Finance Story, renowned for its professionalism and deep understanding of the finance sector, is well-equipped to assist clients in navigating these options and realizing their financial aspirations.

To explore tailored financial strategies, schedule your free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy, and let us help you create your next chapter.

Personal Investment: The Foundation of Your Business

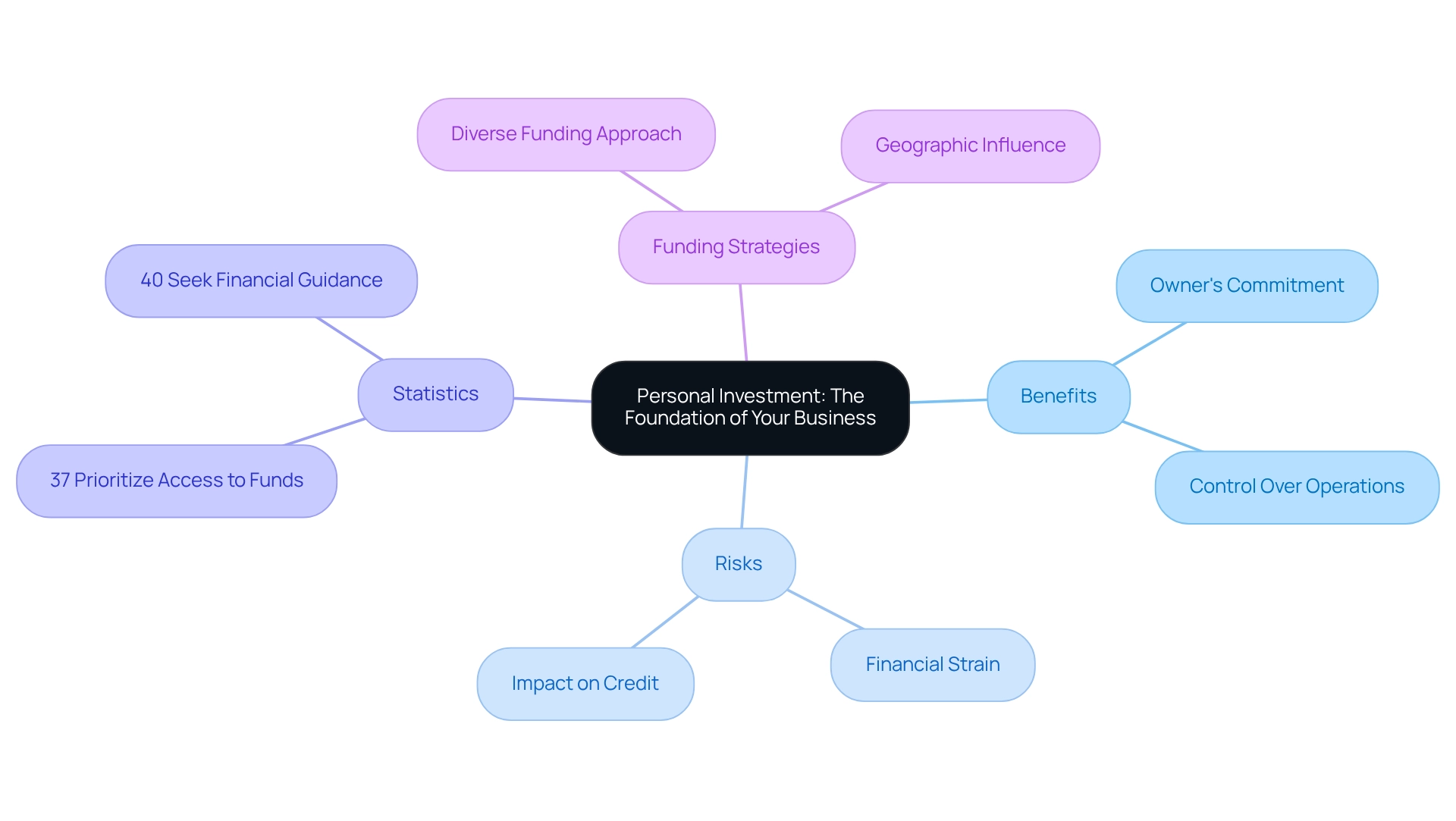

Personal investment is a crucial element of funding for many individuals, representing the resources they contribute from their own savings or assets to initiate their ventures. This initial capital often serves as a strong indicator of the owner's commitment and confidence in their enterprise. By utilizing personal funds, business owners can maintain greater control over their operations and circumvent the complexities associated with external financing options.

However, relying exclusively on personal savings carries inherent risks. It places the business owner's personal finances in jeopardy, potentially leading to significant stress if the venture does not perform as anticipated. Investment specialists caution that while personal investment can act as a powerful motivator, it is essential for business owners to carefully assess their economic situation.

They should evaluate how much they can afford to invest without jeopardizing their personal economic stability.

Statistics reveal that 37% of business owners prioritize the ability to access funds, underscoring the significance of having a diverse funding strategy. Furthermore, 40% of founders seek monetary guidance from their professional networks, highlighting the importance of a supportive entrepreneurial ecosystem in Australia. This collaborative approach can provide insights into the typical levels of personal investment, which vary significantly but often reflect the founder's confidence in their business model.

As emphasized by Forbes, successful startups offer solutions that meet demand, recognize challenges, scale effectively, and recover from setbacks. This perspective reinforces the importance of personal investment as a foundational funding source. Case studies indicate that successful business founders frequently utilize personal savings, yet they also acknowledge the risks involved, such as potential financial strain and the impact on personal credit.

Moreover, the geographic influence on startup financing suggests that location can significantly affect access to capital, with startups in larger cities often enjoying advantages.

As the landscape of startup funding evolves in 2025, understanding these dynamics becomes increasingly vital for aspiring entrepreneurs. The COVID-19 pandemic has led to a more equitable distribution of funding, with secondary cities experiencing increased investment, potentially creating new opportunities for business owners. By balancing personal investment with the four financing options to consider when starting a business, individuals can navigate the challenges of launching and expanding their ventures more effectively.

Family and Friends: Tapping into Your Network

For many entrepreneurs embarking on their business journeys, funding from family and friends represents one of the four financing options to consider when starting a business. This financing method can take various forms, including loans, equity investments, or even gifts, making it a potentially accessible source of capital. However, it is vital to approach these financing options with caution.

Clear communication regarding the terms of the investment and the associated risks is essential to preserving personal relationships. Statistics reveal that nearly 14% of founders who receive support from family also engage three to four senior advisors with equity, highlighting the blend of personal and professional support that can enhance a startup's chances of success. This statistic underscores the significance of not only seeking monetary support but also leveraging the knowledge of personal connections. Moreover, a significant percentage of startups rely on funding from family and friends, emphasizing the importance of these networks in the entrepreneurial landscape.

When seeking financial support from loved ones, business owners should consider formalizing agreements as part of the four financing options to prevent misunderstandings down the line. This method clarifies expectations and emphasizes the seriousness of the venture. For instance, businessman Greenough faced a crucial moment when his company encountered difficulties. By reaching out to his father for guidance, he not only secured a bridge investment but also benefited from his father's extensive experience, demonstrating the dual value of financial and experiential support.

As one entrepreneur noted, "I’ve decided to build a company and am learning how much there is to do – just to get off the ground. I need help with the basics." This sentiment resonates with many small enterprise owners navigating the complexities of starting an enterprise.

The typical sum collected from relatives and acquaintances for new ventures can fluctuate, but it often provides essential support during the initial phases. While the advantages of this funding method include accessibility and the potential for favorable terms, entrepreneurs must explore the four financing options, as challenges such as the risk of straining personal relationships must be carefully navigated. Ultimately, by leveraging personal networks thoughtfully, business owners can secure the necessary funds while cultivating a supportive community around their venture.

Finance Story stands ready to assist clients in navigating these financing options, ensuring they have the guidance needed to make informed decisions in today's evolving financial landscape.

Crowdfunding: Harnessing the Power of the Crowd

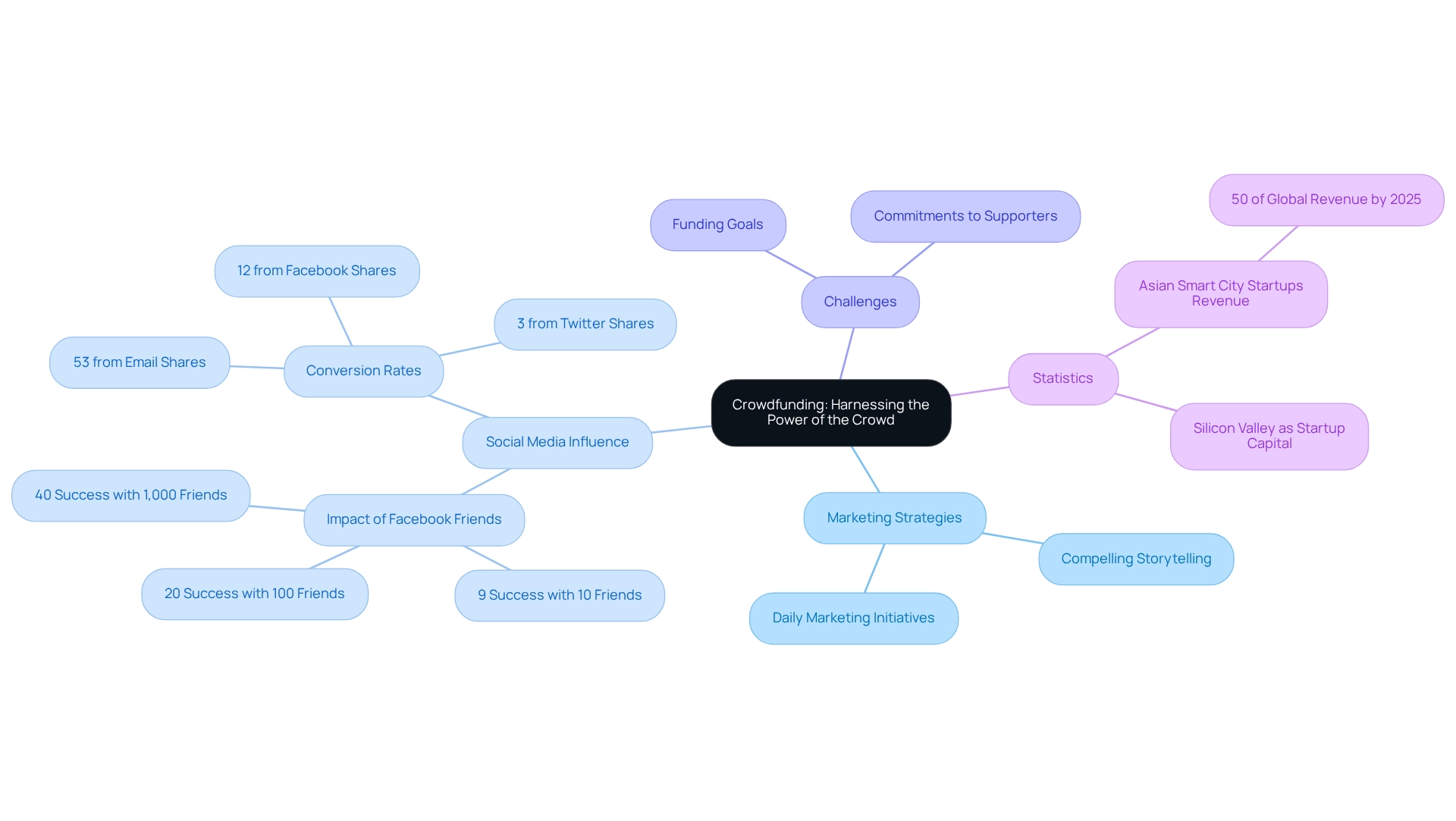

Crowdfunding stands as an innovative method for raising capital, gathering small contributions from a vast number of individuals primarily through online platforms. This approach not only secures essential funding but also serves as a powerful marketing instrument, enabling business owners to gauge market interest in their product or service before its official launch. Platforms like Kickstarter and Indiegogo have transformed how startups engage with potential backers, simplifying the process of reaching a broad audience.

Successful crowdfunding campaigns are often marked by compelling storytelling paired with strategic marketing efforts. Engaging narratives that resonate with potential supporters can significantly elevate a campaign's visibility and appeal. In fact, campaigns that implement daily marketing initiatives can raise up to three times more than those that do not, as highlighted in the case study "Marketing's Role in Crowdfunding Success." This underscores the critical importance of a proactive approach to outreach.

Current statistics reveal that social media plays an essential role in crowdfunding success. For instance, the likelihood of a campaign succeeding increases dramatically with the number of Facebook friends a backer possesses, rising from 9% with 10 friends to an impressive 40% with 1,000 friends. This highlights the necessity of leveraging social networks to amplify campaign reach.

Furthermore, as Asian smart city startups are projected to generate around 50% of global revenue in the industry by 2025, the significance of crowdfunding in this expanding landscape cannot be overstated.

However, business owners must navigate specific challenges, such as meeting funding goals and fulfilling commitments to supporters. The pressure to deliver on promises can be substantial, and failure to do so may adversely affect future fundraising efforts. Despite these hurdles, crowdfunding remains one of the four financing options to consider when starting a business, as it continues to be a potent tool for startups to finance their ventures while simultaneously cultivating a community of early adopters invested in their success.

By mastering the operation of a successful crowdfunding campaign and employing effective strategies, business owners can significantly enhance their chances of achieving their funding objectives. As noted by CrunchBase, Stanford University has graduated more startup founders than any other university in the US, further emphasizing the vibrant startup ecosystem that crowdfunding supports.

Business Loans: Navigating Traditional Financing

Entrepreneurs seeking to support their operations or grow their ventures should explore the four financing options available when starting a business, with business loans being a crucial funding avenue. These loans can be categorized into secured and unsecured options. Secured loans require collateral, which mitigates the lender's risk, whereas unsecured loans do not necessitate collateral but may carry higher interest rates due to the increased risk for lenders.

The application process for commercial loans is comprehensive, typically requiring a detailed plan, financial statements, and personal credit history. Entrepreneurs must be prepared to demonstrate their repayment capability and clearly articulate how the funds will be utilized to generate revenue. At Finance Story, we specialize in creating refined and highly personalized case studies to present to banks, enhancing your chances of securing the right funding for your commercial property investments.

In 2022, male-operated enterprises secured 71.6% of loan approval amounts, highlighting a notable gap for female-operated ventures despite their considerable presence in the market. While commercial loans can provide significant funding, they also entail the responsibility of repayment, which can pressure cash flow if not managed efficiently. Therefore, it is essential for business owners to thoroughly evaluate their financial health and develop a robust repayment strategy before incurring debt.

According to data from 2020, 11.8% of enterprises sought financing for reasons classified as 'other,' indicating a diverse range of funding needs among entrepreneurs.

Navigating the loan landscape in 2025 requires an understanding of current trends and statistics. For instance, Goldman Sachs reports that 70% of small enterprise loans are issued by banks with less than $250 billion in assets, underscoring the critical role small banks play in the economy. Furthermore, a recent report titled 'Impact of Economic Conditions on SME Lending' indicates that despite rising interest rates and inflation, outstanding debt among SMEs has increased, suggesting that companies are borrowing more to manage economic pressures.

This report emphasizes the importance of understanding the evolving lending environment.

As Michael McCareins, a Content Marketing Associate, observes, 'Creating distinctive, educational content assists audiences in comprehending concepts and subjects like invoice factoring and A/R funding,' which is essential for business owners exploring their funding alternatives.

In summary, individuals must approach loans with a clear understanding of their options, particularly the four financing options available when starting a business, the implications of secured versus unsecured loans, and the current lending landscape to enhance their chances of successful loan applications. With Finance Story's expertise in customized loan proposals, you can secure the appropriate funding to meet your changing enterprise requirements.

Choosing the Right Financing Option: Key Takeaways

Choosing the right funding alternative is crucial among the four financing options available when starting a business. Understanding these options—personal investment, assistance from family and friends, crowdfunding, and conventional loans—is essential, as each presents unique advantages and challenges. Before making a decision, individuals embarking on their entrepreneurial journey must evaluate their financial situations, commercial goals, and risk tolerance in relation to these four financing options.

Recent statistics indicate that many entrepreneurs utilize diverse funding sources to bolster their capital. This strategy not only mitigates risk but also enhances the potential for securing essential funds. For instance, a study on initial funding sources for start-up firms in Japan found that growth-oriented and innovative start-ups often prefer subsidies and private equity, while those with significant physical assets tend to favor bank borrowing.

This underscores the importance of aligning funding strategies with specific business characteristics and objectives. Moreover, the advantages of combining various funding sources cannot be overstated. A diversified funding approach enables entrepreneurs to access different capital pools, thereby increasing their likelihood of success.

Financial experts assert that leveraging the four financing options when starting a business can significantly influence startup success rates, providing a buffer against market fluctuations and unforeseen challenges. Bonini et al. (2018) further highlight the importance of distinguishing between managerial and entrepreneurial experience, which can impact the choice of funding alternatives.

As we approach 2025, the landscape of funding options continues to evolve, particularly with the emergence of new models in crowdfunding. A 2023 OECD survey reveals that both public and private financial institutions are increasingly integrating climate considerations into their operations, potentially affecting the types of funding available. Entrepreneurs are encouraged to explore these innovative avenues while also considering the traditional methods that have proven effective over time.

By comprehending the intricacies of the four financing options and strategically aligning them with their business objectives, entrepreneurs can effectively secure the capital needed to launch and grow their ventures. To assist you in navigating these financing options, we invite you to schedule a free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. Book your 30-minute meeting to discuss your needs and goals, and let us help you create your next chapter. During this consultation, you will gain tailored insights and strategies that can significantly enhance your funding approach.

Please select a time that suits you from our live calendar.

Conclusion

Navigating the complex landscape of business financing in 2025 is crucial for entrepreneurs aiming to secure the necessary capital for their ventures. This article highlights various financing methods, including:

- Debt financing

- Equity financing

- Personal investments

- Support from family and friends

- Crowdfunding

- Traditional business loans

Each option presents unique advantages and challenges, making it imperative for business owners to thoroughly assess their financial circumstances and strategic goals before making informed decisions.

A diversified funding strategy is emphasized as key to enhancing the chances of success. By combining multiple financing sources, entrepreneurs can mitigate risks while maximizing their access to capital. The importance of aligning funding strategies with specific business characteristics and objectives cannot be overstated, particularly as the economic landscape continues to evolve with emerging trends like climate-conscious financing.

Ultimately, understanding the nuances of each financing option equips entrepreneurs with the tools to navigate their funding journey effectively. As the entrepreneurial ecosystem grows increasingly collaborative, leveraging personal networks and seeking professional advice can provide invaluable support. By embracing a well-rounded approach to financing, aspiring business owners can position themselves for long-term success, ensuring they have the resources needed to bring their visions to life.