Overview

This article delves into the critical concept of SMSF property loan LVR (Loan-to-Value Ratio) and its significant implications for borrowing and investment strategies. Understanding LVR is vital; a lower LVR not only enhances borrowing capacity but also provides more favorable financing conditions. Conversely, a higher LVR can lead to increased costs and risks. Therefore, it is essential for investors to strategically manage their LVR to optimize financial outcomes in real estate investments.

How effectively are you managing your LVR to align with your investment goals?

Introduction

In the realm of retirement planning, Self-Managed Super Fund (SMSF) property loans are emerging as a powerful tool for savvy investors. These specialized loans empower individuals to tap into their superannuation savings for property investment, enhancing wealth generation through real estate while offering significant tax advantages.

As more Australians take control of their retirement savings, understanding the intricacies of SMSF property loans becomes essential. This article delves into the fundamentals of SMSF property loans, explores the critical Loan-to-Value Ratio (LVR) and its implications on borrowing capacity, and outlines the necessary steps for applying for an SMSF property loan.

By equipping readers with this knowledge, we enable them to navigate this strategic investment avenue effectively.

Define SMSF Property Loans and Their Importance

Self-Directed Superannuation Fund (SMSF) financial arrangements are specialized monetary tools that empower individuals to utilize their retirement savings for acquiring investment real estate through an SMSF property loan LVR. This strategy is particularly beneficial, as it enables investors to leverage their retirement funds to generate wealth through real estate. By investing in real estate using an SMSF property loan LVR, individuals can capitalize on potential capital gains and rental income, alongside the tax advantages associated with superannuation. The importance of SMSF property loan LVR extends beyond mere investment; they play a crucial role in retirement planning.

As families increasingly assess their financial strategies, many are weighing the merits of overpaying their mortgages against contributing to their pensions. A balanced approach, where resources are allocated to both mortgage overpayments and investing in SMSF real estate, is often recommended to optimize financial outcomes.

Current statistics indicate that as of June 2019, there were over 1 million members of SMSFs in Australia, underscoring the rising trend of individuals taking charge of their retirement savings. Financial experts emphasize that professional guidance is essential when considering the long-term implications of using super for real estate investment. Such guidance ensures that investors make informed decisions that align with their retirement objectives.

Looking ahead to 2025, the landscape of SMSF financing continues to evolve. Experts like Brian Gidley highlight that mortgages can be structured in various ways to bolster financial stability and mitigate inflation risks for lenders. This adaptability is vital for investors aiming to secure their financial futures. Overall, financing through an SMSF property loan LVR represents a strategic pathway for diversifying investment portfolios and enhancing retirement savings.

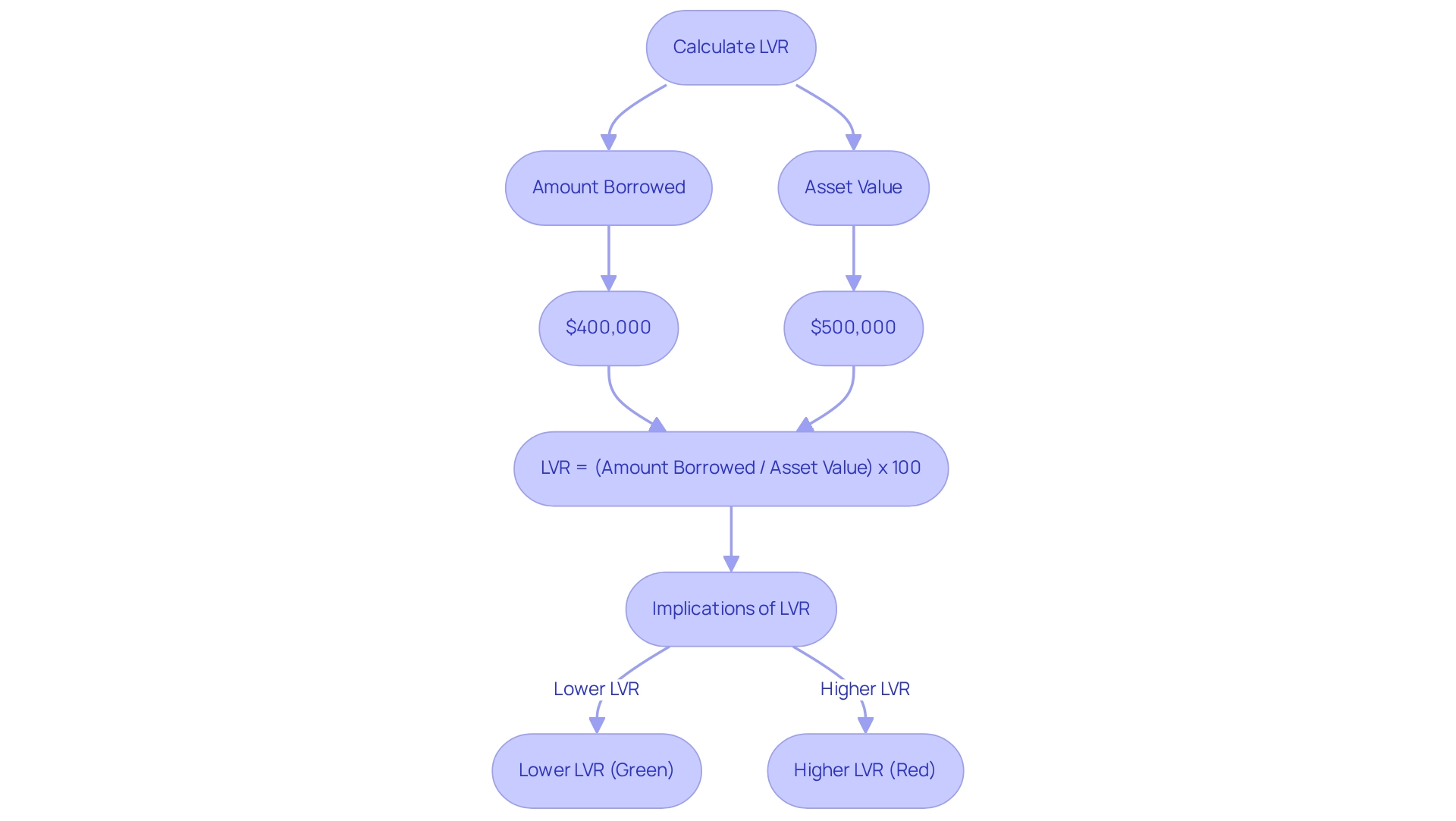

Explain Loan-to-Value Ratio (LVR) and Its Calculation

The Loan-to-Value Ratio (LVR) serves as a crucial financial metric, illustrating the relationship between a mortgage and the value of the asset being acquired. It is calculated by dividing the borrowed amount by the asset's appraised value and multiplying by 100 to express it as a percentage. For example, if you plan to borrow $400,000 for a property valued at $500,000, your LVR would be 80% (calculated as $400,000 / $500,000 x 100).

Lenders regard LVR as a significant factor in evaluating risk. A lower LVR signifies reduced risk for the lender, often resulting in more favorable credit terms. Conversely, a higher LVR—typically 90% or above—can complicate financing approval, potentially necessitating Lenders Mortgage Insurance (LMI) and leading to increased interest rates. As industry experts note, "Generally speaking, the higher your LVR, the more LMI will cost," underscoring the financial ramifications of elevated LVRs.

Understanding the SMSF property loan LVR is vital for making informed borrowing decisions, especially in the realm of SMSF real estate financing. For instance, a case study on LVR assessment demonstrates how prospective homebuyers can navigate the mortgage process more effectively by accurately calculating their LVR. Currently, the average LVR for real estate financing in Australia hovers around 80%, though this figure may vary based on individual circumstances and lender criteria.

To compute LVR for real estate financing, simply utilize the formula:

- LVR = (Amount Borrowed / Asset Value) x 100.

This straightforward calculation is equally essential for understanding SMSF property loan LVR, ensuring that borrowers grasp their financial standing and can manage risks effectively. By recognizing the significance of LVR, clients can strategically position themselves within the competitive landscape of real estate financing.

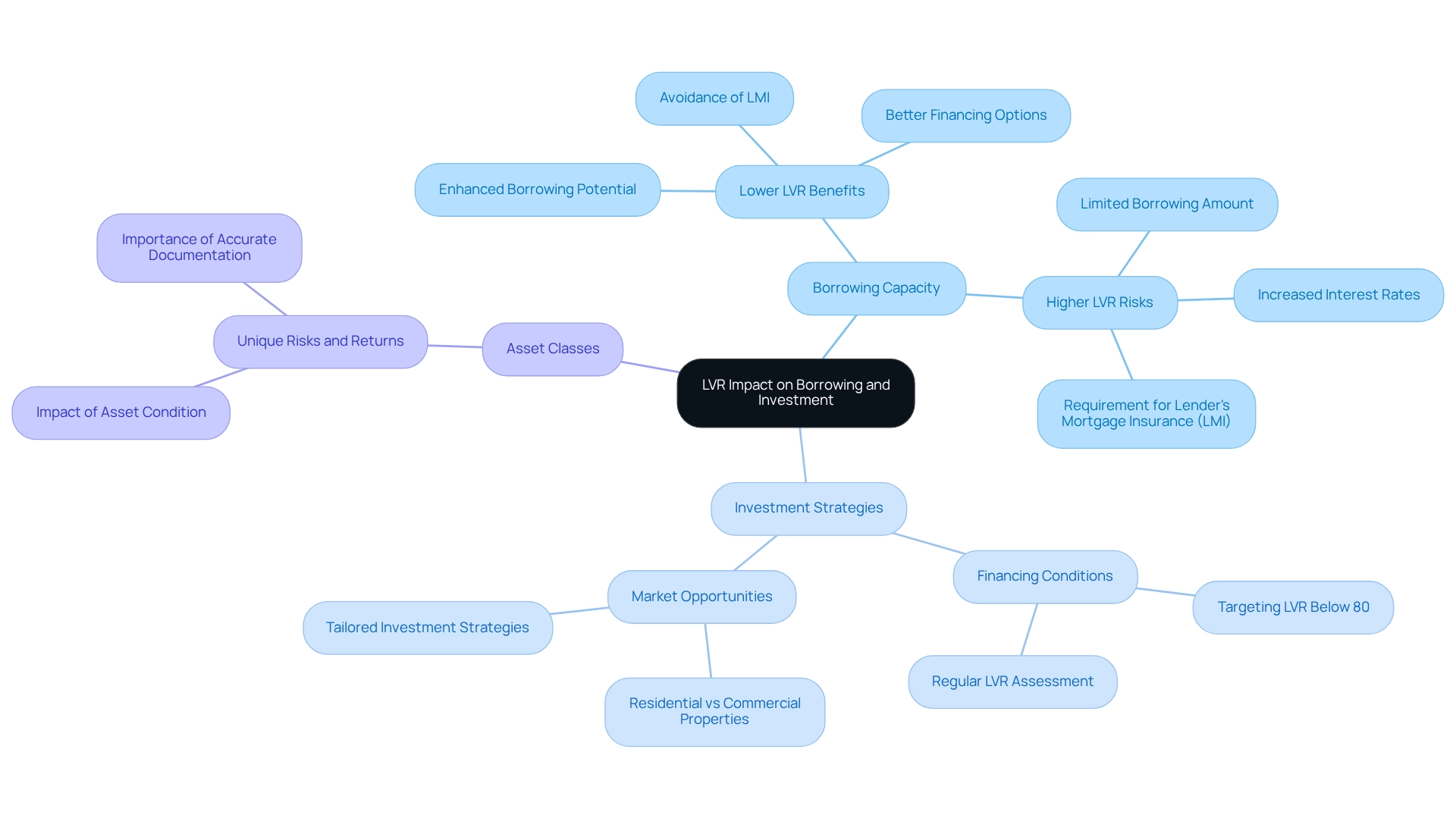

Discuss Implications of LVR on Borrowing Capacity and Investment Strategies

The smsf property loan lvr is crucial in shaping both your borrowing capacity and investment strategies. A lower smsf property loan lvr typically enhances your borrowing potential, as lenders perceive it as a sign of reduced risk. Conversely, a higher smsf property loan lvr can limit the amount you are able to borrow and may result in increased interest rates or the requirement for lender's mortgage insurance (LMI).

To secure favorable financing conditions and minimize costs, it is advisable for investors to target an SMSF property loan LVR below 80%. This benchmark is essential, as it not only helps avoid LMI but also opens the door to better financing options; understanding the smsf property loan lvr is vital for guiding your investment strategies, particularly when deciding between residential and commercial properties.

Each asset class presents unique risks and potential returns, which can be more effectively evaluated through a comprehensive analysis of the smsf property loan lvr. For example, maintaining a strong asset condition and ensuring accurate documentation can significantly impact valuations, thereby affecting LVR and, ultimately, loan terms.

Regularly assessing your smsf property loan lvr is also critical for those considering refinancing or expanding their real estate portfolio, as it directly influences your borrowing capacity and investment decisions in 2025 and beyond.

Investment strategies should be tailored based on SMSF property loan LVR analysis, emphasizing the importance of lower SMSF property loan LVRs to maximize borrowing potential. As investment strategists note, a knowledgeable approach to LVR empowers borrowers to make informed decisions in their real estate investment journey, aligning their financial objectives with market opportunities.

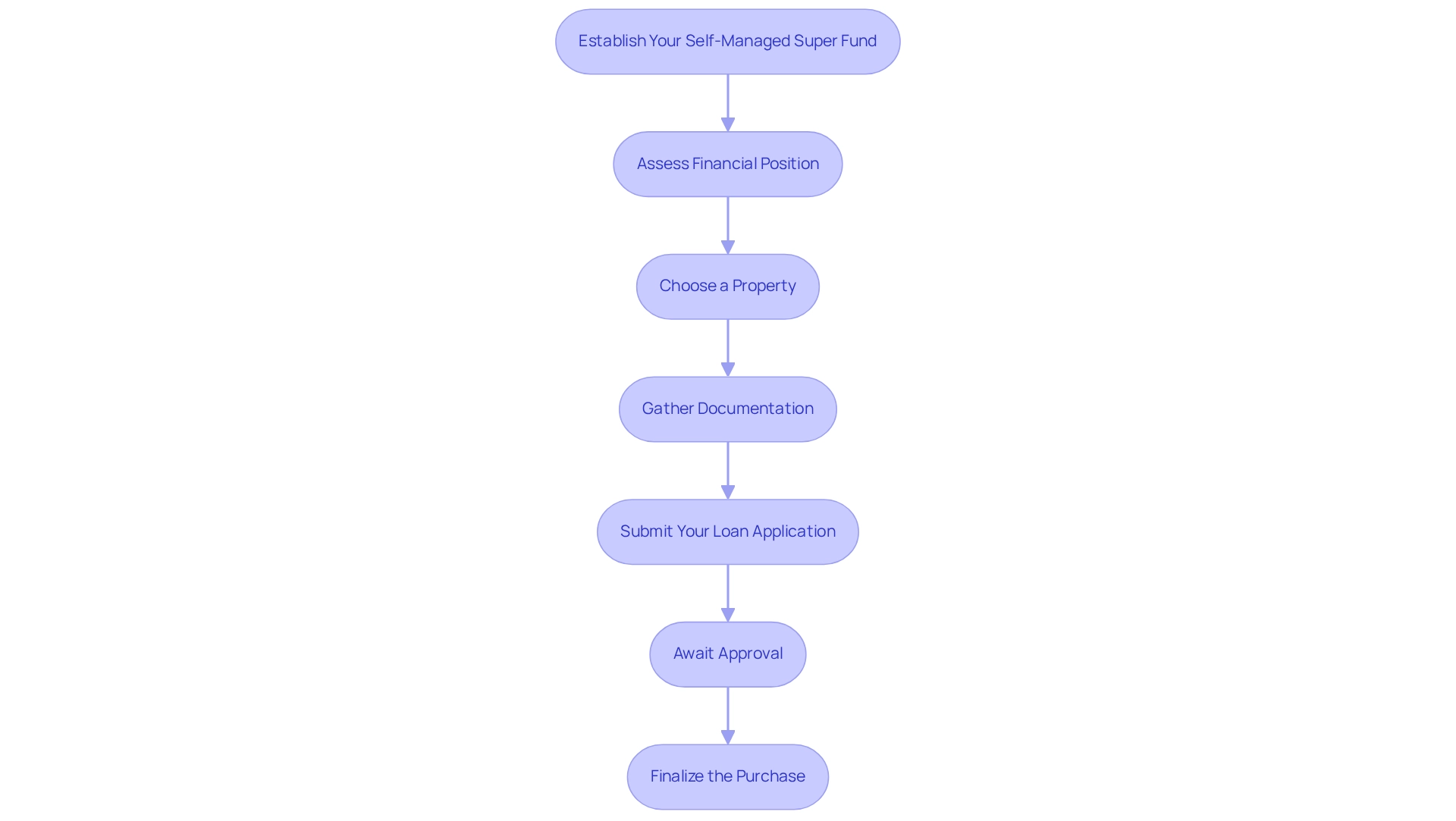

Outline Steps to Apply for an SMSF Property Loan

Applying for a self-managed super fund property loan involves several key steps:

- Establish Your Self-Managed Super Fund: Ensure your self-managed super fund is set up correctly, including the necessary trust deeds and compliance with regulatory requirements.

- Assess the financial position of your self-managed superannuation fund, focusing on cash flow and existing assets, to determine your smsf property loan lvr.

- Choose a Property: Identify the property you wish to purchase, ensuring it meets the investment criteria set by your SMSF.

- Gather Documentation: Prepare necessary documents, including SMSF trust deeds, financial statements, and proof of income for all members.

- Submit your loan application by approaching lenders with your documentation and details about the property, ensuring you consider the smsf property loan lvr.

- Await Approval: Once submitted, lenders will assess your application, which may take several weeks. Be prepared to provide additional information if requested.

- Finalize the Purchase: Upon approval, complete the purchase process, ensuring all legal and financial obligations are met.

Conclusion

Understanding SMSF property loans is increasingly vital for individuals aiming to enhance their retirement savings through strategic real estate investments. These specialized loans not only enable investors to leverage their superannuation funds but also come with significant tax benefits. By utilizing SMSF property loans, investors can reap the rewards of both capital gains and rental income, making this a compelling option for wealth generation.

The concept of Loan-to-Value Ratio (LVR) is central to navigating the complexities of SMSF property loans. A thorough understanding of LVR empowers investors to assess their borrowing capacity and make informed decisions that align with their financial goals. Maintaining an optimal LVR can lead to more favorable loan terms and minimize additional costs, such as lender's mortgage insurance.

To successfully apply for an SMSF property loan, a clear roadmap is essential. By following the outlined steps—from establishing the SMSF to finalizing the property purchase—investors can effectively manage their financial strategies and maximize their investment potential.

As more Australians take charge of their retirement planning, the insights shared in this article underscore the importance of SMSF property loans as a strategic investment avenue. With the right knowledge and approach, individuals can navigate this landscape confidently, paving the way for a secure and prosperous retirement.