Overview

This article delves into the essential prerequisites for securing business loans, highlighting the critical need for small business owners to understand various loan types and the required documentation. Are you aware of what lenders look for? Key requirements such as:

- Credit scores

- Comprehensive business plans

- Accurate financial statements

play a pivotal role in enhancing your chances of approval. Furthermore, grasping these elements not only aids in navigating the lending landscape effectively but also empowers you to present your business in the best light possible. By focusing on these vital aspects, you can significantly improve your prospects in securing the financing you need.

Introduction

In the dynamic landscape of small business financing, grasping the intricacies of business loans is essential for success. With a multitude of options, ranging from traditional term loans to innovative invoice financing, entrepreneurs must navigate a complex web of requirements and strategies to secure the funding they need.

The significance of a well-structured business plan, a solid credit score, and meticulous preparation cannot be overstated; these elements profoundly influence loan eligibility and terms. As small business owners confront unique challenges—such as fluctuating market conditions and the need for operational resilience—understanding the nuances of the loan application process becomes critical.

This article explores the vital aspects of business loans, empowering entrepreneurs to make informed decisions and ultimately drive their ventures toward sustainable growth.

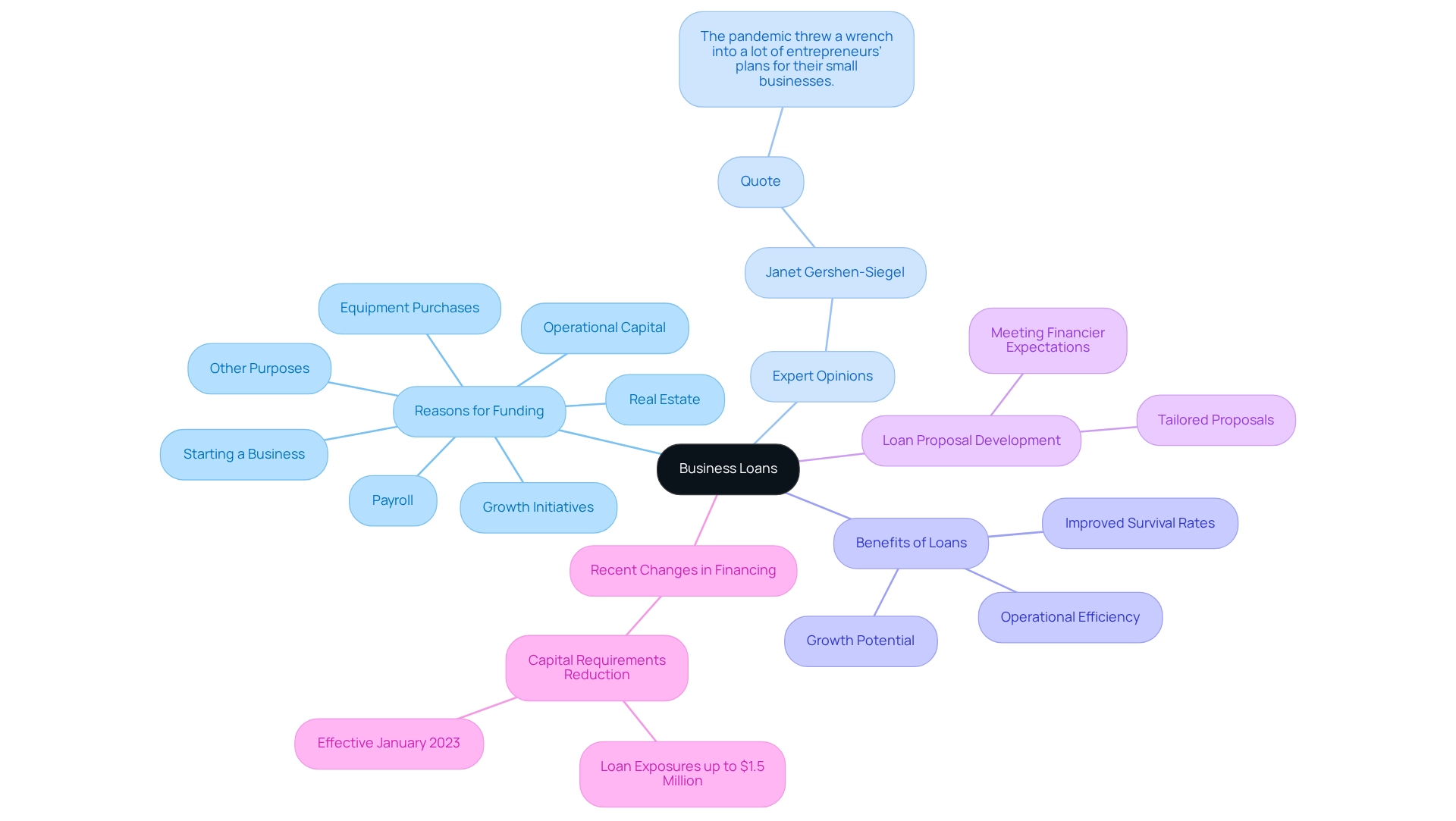

What is a Business Loan and Why Do You Need One?

A commercial credit serves as a vital financial resource, empowering entrepreneurs to secure capital for various operational needs, including equipment acquisition, cash flow management, and growth support. For both startups and established businesses, these funds are indispensable, providing the necessary capital to seize growth opportunities or navigate financial challenges.

The importance of financial assistance is underscored by recent data indicating that a significant percentage of small enterprises—33%—seek funding primarily for operational capital, followed by 19% for equipment purchases and 15% for growth initiatives. This information highlights the diverse reasons small business owners pursue funding, illustrating their need to adapt and thrive in a competitive landscape.

Experts emphasize the crucial role of financial support. Financial analysts assert that access to capital is particularly critical during the first three to five years of operation, a phase often fraught with challenges. Industry expert Janet Gershen-Siegel notes, "The pandemic disrupted many entrepreneurs’ plans for their small enterprises," reflecting the unpredictable nature of economic conditions and the necessity for financial resilience.

Moreover, securing financing can offer significant advantages for operational needs. It enables businesses to invest in essential resources, maintain cash flow during tough times, and ultimately enhance their growth potential. Numerous real-world examples exist, with many companies successfully leveraging loans to expand their operations.

For instance, small enterprises that secure funding often report improved survival rates, as access to capital can significantly influence their ability to overcome early-stage obstacles. Data reveals that between 65% and 70% of businesses that faced insolvency had fewer than five full-time employees, underscoring the challenges encountered by smaller enterprises.

Additionally, crafting a tailored loan proposal is critical for securing financing, especially concerning business loan requirements for commercial property investments. Finance Story specializes in developing refined and customized proposals that meet the heightened expectations of financiers. With access to a comprehensive range of lenders, including high street banks and innovative private lending panels, small business owners can identify the right financing solutions for their unique needs, whether acquiring a warehouse, retail space, factory, or hospitality venture.

Furthermore, Finance Story offers refinancing options to help businesses adapt to their changing financial needs, ensuring they can maintain operational efficiency and foster growth.

Recent changes to capital requirements for banks' SME financing, effective January 2023, allow exposures of up to $1.5 million to attract lower capital obligations. This development creates a more favorable lending environment for small enterprises seeking financial assistance.

In conclusion, understanding the objectives and benefits of commercial financing enables business owners to comprehend the loan requirements necessary for making informed financial decisions that align with their enterprise goals. As the landscape evolves, staying informed about loan prerequisites and financing options is essential for small business leaders aiming for sustainable growth.

Exploring Different Types of Business Loans

In 2025, small enterprise proprietors can access a diverse array of financial options, each designed to meet specific monetary needs and objectives. Understanding the prerequisites for business loans is essential for making informed decisions. Here are the primary categories of financial assistance available:

- Term Financing: These traditional funds come with a fixed repayment schedule, making them ideal for long-term investments such as acquiring real estate or expanding operations. They typically offer lower interest rates compared to other funding options but require a robust credit history.

- Lines of Credit: This flexible borrowing option allows businesses to access funds as needed, up to a predetermined limit. It is particularly beneficial for managing cash flow fluctuations, providing quick access to funds without a lengthy application process each time.

- SBA Financing: Backed by the Small Business Administration, these financial products offer favorable terms and lower interest rates, making them an attractive choice for small enterprises. They are designed to cater to various commercial needs, from startup costs to operational expenses.

- Equipment Financing: Tailored specifically for purchasing equipment, this type of loan uses the equipment itself as collateral. This structure enables companies to acquire necessary tools without a significant upfront investment, facilitating better cash flow management.

- Invoice Financing: This innovative solution allows businesses to borrow against outstanding invoices, providing immediate cash flow. It is especially useful for companies experiencing delays in customer payments, enabling them to maintain operations without interruption.

At Finance Story, we specialize in crafting polished and highly personalized business cases for banks, ensuring that small business owners can secure the right financing for their commercial property investments. We offer a comprehensive range of lenders, including high street banks and innovative private lending panels, to accommodate various circumstances—whether you are purchasing a warehouse, retail premises, factory, or hospitality venture.

Recent trends indicate a growing preference for flexible loan servicing, which has been shown to increase repayment rates by an average of 30%. This adaptability helps companies navigate temporary setbacks more effectively. Moreover, the commercial lending market is projected to reach £496 billion in 2023, reflecting a 4% increase, as more small enterprises seek tailored financing solutions. This growth in the lending sector underscores the importance of understanding the various credit options available.

Additionally, commitments classified as 'Other' have seen a 3.9% rise from the previous quarter and a 25.9% increase year-over-year, indicating a dynamic lending environment that small enterprise proprietors should navigate with care. Case studies highlight the effectiveness of diverse credit types. For instance, API-first lending solutions are expected to revolutionize the lending process by seamlessly integrating into existing applications, enhancing efficiency and potentially representing 40% of the market by 2026. This innovation can significantly aid small enterprise operators in their funding decisions.

Financial consultants emphasize the importance of selecting the right type of enterprise financing based on business loan prerequisites and individual circumstances. They recommend evaluating the specific needs of the enterprise, the purpose of the funding, and repayment capabilities before making a decision. By understanding the advantages and disadvantages of each financing type, small enterprise owners can more effectively manage their funding options and select the most suitable solution for their growth and sustainability. Furthermore, refinancing options are available to help businesses adapt to their evolving needs, ensuring they can maintain financial stability as they expand.

Key Requirements for Securing a Business Loan

To successfully secure a business loan, lenders typically evaluate several critical requirements:

- Credit Score: A strong credit score, generally above 680, is vital for obtaining favorable loan terms. In 2025, maintaining a good credit score is more important than ever, as it directly influences the interest rates and repayment conditions offered by lenders. With personal loan debt continuing to rise, where 10.0% of borrowers secure personal loans for daily expenses, recognizing the significance of credit management becomes essential for small enterprise owners.

- Business Loan Prerequisites: A comprehensive enterprise plan is essential to meet business loan prerequisites. This document should clearly outline the commercial model, market analysis, and financial projections. Studies show that companies with well-organized strategies experience considerably greater approval rates, as financiers utilize these strategies to assess the feasibility and possible profitability of the venture. The innovative nature of financial products, as emphasized by Jess Rise, underscores the need for modern solutions in developing effective plans. At Finance Story, we focus on developing refined and highly personalized cases to present to banks, ensuring that your proposal meets the increased expectations of financiers.

- Financial Statements: As part of the business loan prerequisites, lenders require recent financial statements, including income statements, balance sheets, and cash flow statements. These documents provide insight into the business's financial condition and operational effectiveness, enabling financiers to evaluate risk precisely.

- Collateral: Providing collateral—assets that can be pledged to secure the business loan prerequisites—can significantly lower the risk for the financial institution. This could encompass property, machinery, or stock, which assures financiers of their investment's safety. By working with Finance Story, you gain access to a full suite of lenders, including high street banks and innovative private lending panels, which can help you secure the right financing solutions tailored to your needs.

- Business Loan Prerequisites: Having a solid operational history and management experience is crucial. Lenders favor enterprises with a proven track record, as this demonstrates stability and the capability to manage challenges effectively.

Meeting these requirements is essential for a successful credit request. For example, companies that have successfully handled their credit ratings and showcased strong plans have experienced higher approval rates, indicating the significance of these factors in the lending process. The case study titled 'Growth of Personal Loan Debt' illustrates how personal loans are utilized, paralleling the discussion on commercial loans and the importance of managing financial obligations.

Additionally, the recent shift of lending indicators from a monthly to a quarterly release emphasizes the changing environment of lending, which small enterprise operators must navigate in 2025. Furthermore, Finance Story can aid with refinancing choices for different commercial properties, such as warehouses, retail locations, factories, and hospitality projects, ensuring that your financing requirements are met as your enterprise develops.

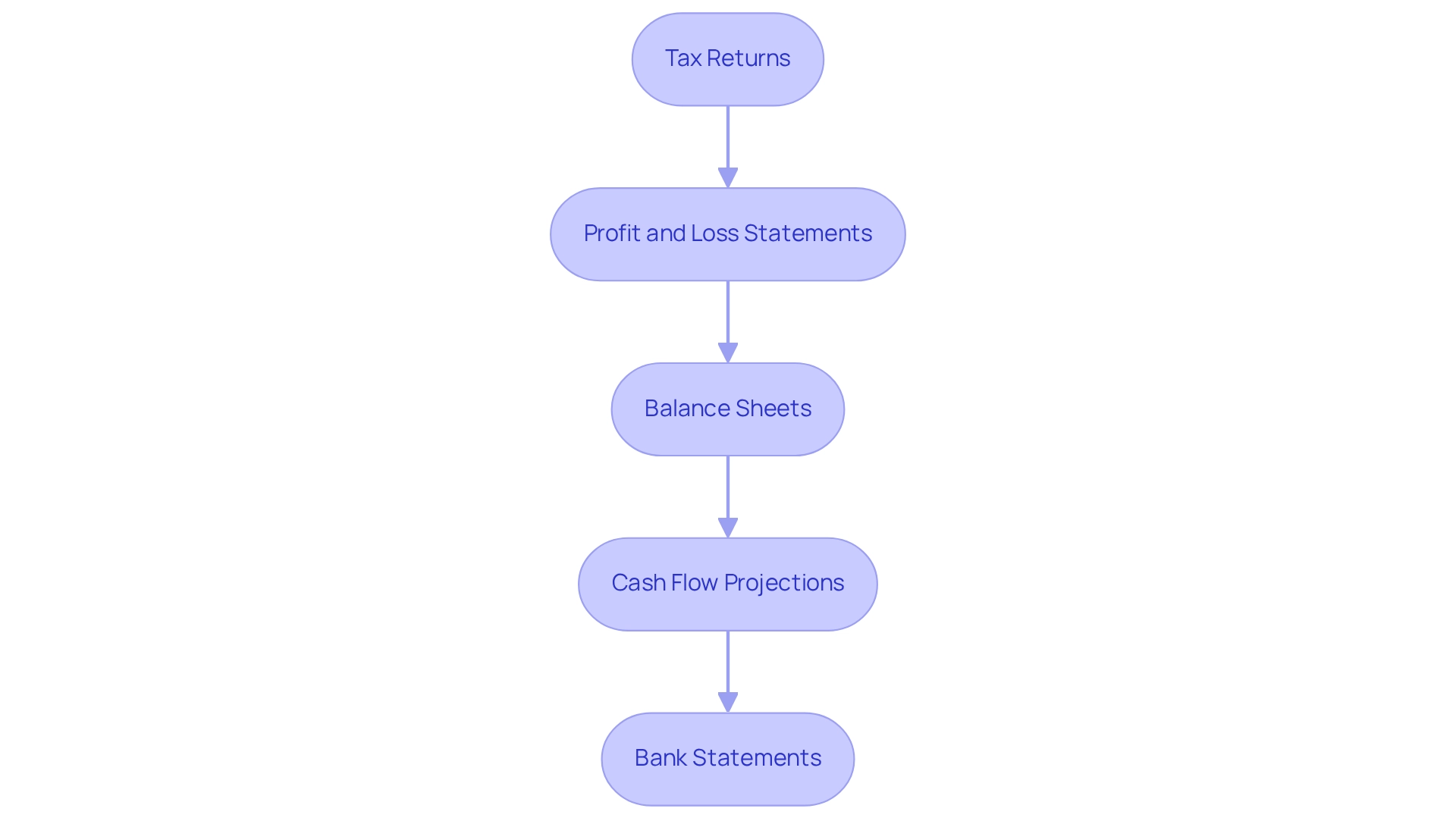

Preparing Your Financial Documents for Loan Applications

When preparing for a loan application, business owners must meticulously gather and organize the following essential financial documents:

- Tax Returns: Personal and business tax returns for the past two to three years are crucial. Lenders utilize these documents to evaluate the financial health and tax compliance of the enterprise.

- Profit and Loss Statements: Monthly or quarterly profit and loss statements offer a clear perspective on revenue and expenses, assisting financiers in assessing the organization's profitability and operational efficiency.

- Balance Sheets: A balance sheet provides a snapshot of the company's assets, liabilities, and equity, enabling lenders to assess the overall financial position and stability of the organization.

- Cash Flow Projections: Detailed forecasts that illustrate the capability to repay the borrowing are vital. These projections should reflect realistic expectations based on historical data and market conditions.

- Bank Statements: Recent bank statements are necessary to verify cash flow and financial stability, showcasing the business's liquidity and ability to manage funds effectively.

Arranging these documents not only simplifies the application process but also ensures that all business loan prerequisites are met, significantly improving the likelihood of approval. According to recent data, the average amounts for owner-occupier properties differ by state, with the highest average noted at $811,000. This statistic emphasizes the financial environment that small enterprise operators must recognize when seeking loans.

Furthermore, insights from Finance Story indicate that companies with organized financial records experienced a smoother application process, even in challenging market conditions. By prioritizing the preparation of these documents, entrepreneurs position themselves for success in their financing efforts. As Anja Pannek, CEO of the Mortgage & Finance Association of Australia, states, "It’s essential for the long-term sustainability and relevance of our industry that we nurture an environment that is welcoming to people from all walks of life."

This underscores the importance of thorough preparation in creating a positive experience for diverse applicants, especially when seeking tailored financing solutions for commercial property investments. In addition, Finance Story focuses on developing refined and tailored cases to present to lenders, guaranteeing that small entrepreneurs have access to a complete array of financing alternatives, including refinancing possibilities to address their changing enterprise requirements.

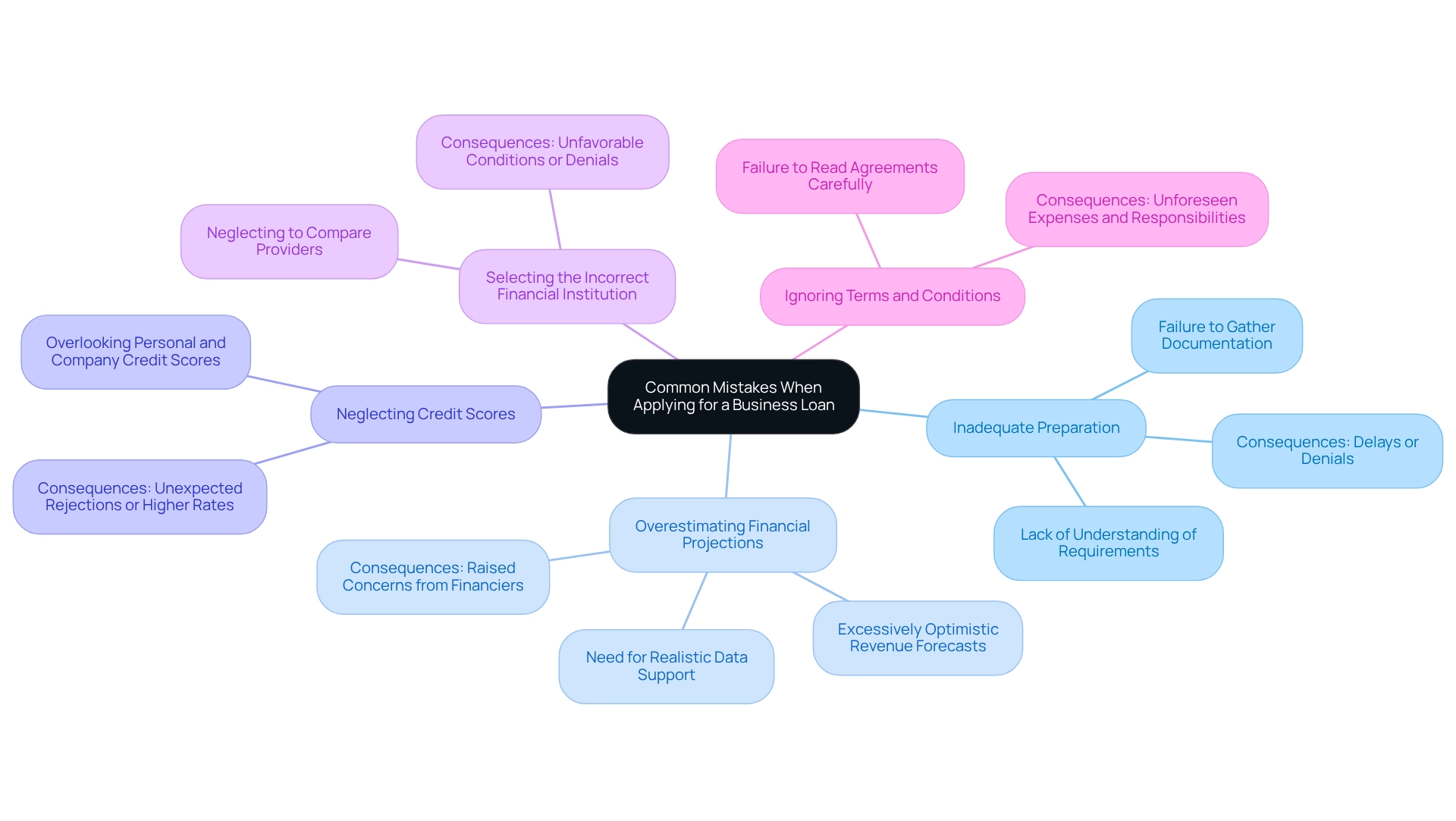

Common Mistakes to Avoid When Applying for a Business Loan

When seeking financial assistance for a business, small business owners must navigate several common pitfalls that can jeopardize their chances of approval. Key mistakes to avoid include:

- Inadequate Preparation: Many applicants fail to gather the necessary documentation or fully understand the specific requirements of the loan. This lack of preparation can lead to delays or outright denials. Finance Story emphasizes the importance of thorough preparation, offering bespoke mortgage services that guide clients through the financing journey.

- Overestimating Financial Projections: Presenting excessively optimistic revenue forecasts can raise concerns for financiers. Financial specialists recommend that forecasts must be realistic and supported by reliable data to instill confidence in prospective financiers.

- Neglecting Credit Scores: A significant number of entrepreneurs overlook the importance of checking both personal and company credit scores prior to applying. Unfavorable credit scores can lead to unexpected rejections or higher interest rates.

- Selecting the Incorrect Financial Institution: Neglecting to investigate and contrast providers can lead to unfavorable conditions or even denial. Each financial provider has different business loan prerequisites and offerings, making it essential to identify one that aligns with the business's needs. Finance Story provides access to a comprehensive portfolio of lenders, including private and boutique commercial investors, ensuring clients have the best options available to meet their unique financing needs.

- Ignoring Terms and Conditions: Many applicants overlook the need to carefully read and comprehend the agreement, which can result in unforeseen expenses and responsibilities later.

Statistics show that a significant portion of small enterprise operators face these problems, with insufficient preparation being a primary reason for application failures. For example, entering incorrect information in automated online credit applications can result in automatic rejections, emphasizing the significance of precision and attention to detail. Furthermore, the typical borrowing amount for owner-occupier residences in Victoria is around $390,000, which offers insight into the financial anticipations small enterprise owners ought to contemplate when pursuing funding through Finance Story.

Real-world examples illustrate the consequences of these mistakes. Businesses that failed to prepare sufficiently for credit applications often discovered they could not obtain essential funding, hindering their growth and operational capabilities. In contrast, those who took the time to understand the application process and prepare thoroughly significantly improved their approval rates.

Industry leaders emphasize the importance of avoiding these pitfalls. As mentioned by our group at Finance Story, "we strive to support as many small enterprises as we can, offering flexible funding options to our clients." Seeking advice from financial experts prior to making enterprise decisions is strongly recommended, as their knowledge can assist individuals in navigating the intricacies of the funding application process.

By being aware of these common errors and taking proactive measures to address them, entrepreneurs can improve their chances of meeting the business loan prerequisites to obtain the funding they require to succeed.

Furthermore, Finance Story's commitment to innovation and adaptability in the lending process allows them to present clients with a variety of tailored options, enhancing their service offerings and reputation for professionalism in the finance sector. This competitive edge can greatly assist small enterprise owners in their credit applications.

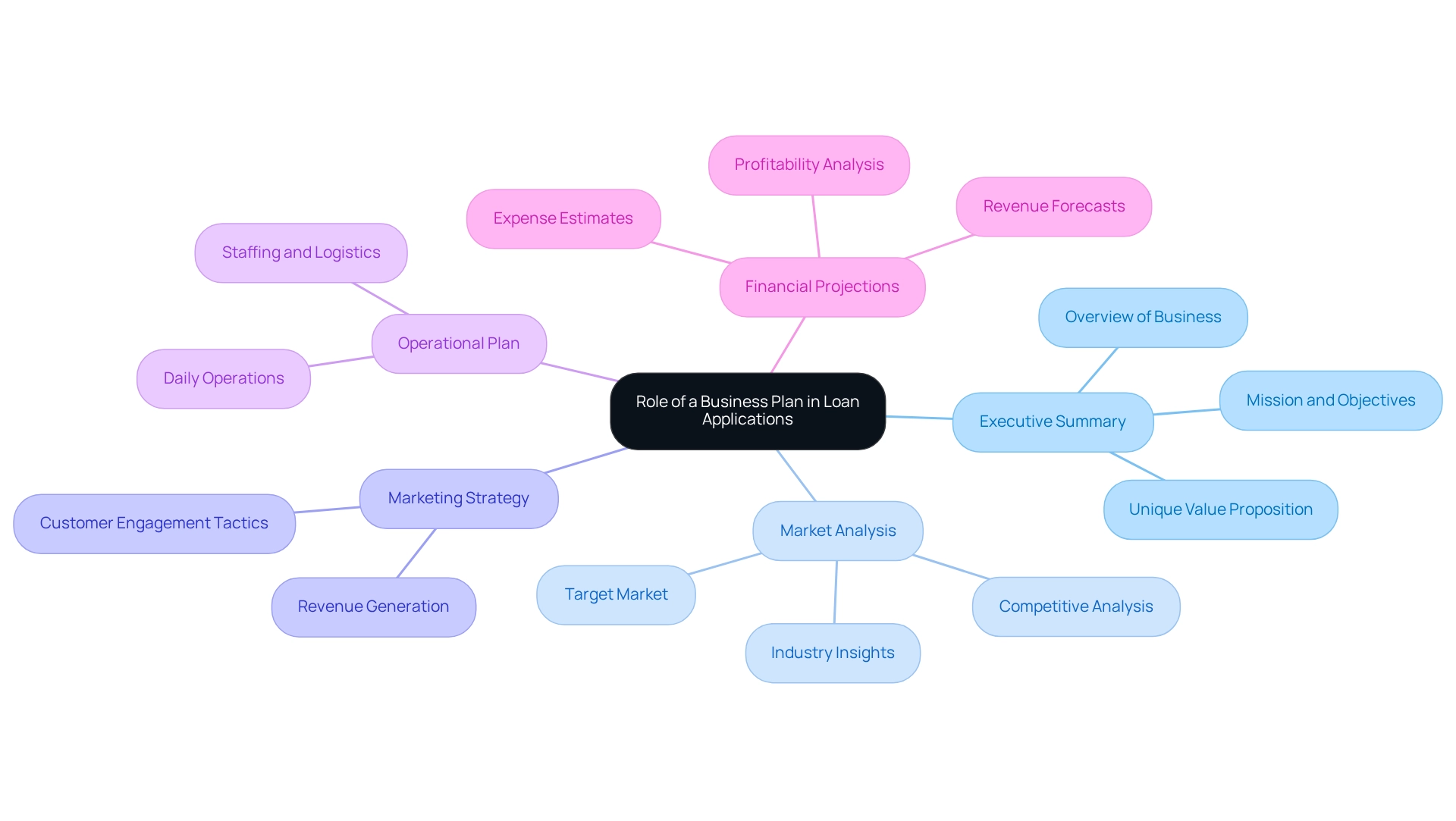

The Role of a Business Plan in Loan Applications

A well-organized enterprise plan is essential for any small venture aiming to grasp the business loan prerequisites. It serves as a strategic roadmap that outlines the organization's vision and operational framework. Key components of an effective business plan include:

- Executive Summary: This section provides a concise overview of the business, highlighting its mission, objectives, and the unique value proposition it offers.

- Market Analysis: A thorough examination of the industry landscape, including insights into the target market, customer demographics, and competitive analysis, is crucial for demonstrating market viability.

- Marketing Strategy: This outlines the tactics for attracting and retaining customers, showcasing how the company intends to generate revenue and grow its customer base.

- Operational Plan: Information on daily operations, including staffing, production processes, and logistics, assists financers in comprehending how the enterprise will operate efficiently.

- Financial Projections: Providing detailed forecasts of revenue, expenses, and profitability is vital. These projections not only demonstrate the organization's potential for growth but also reassure lenders of its financial viability.

Statistics suggest that companies with a strategic plan are considerably more likely to secure funding; in fact, 70% of firms endure beyond the first five years when they operate with a well-defined operational plan. Furthermore, expert insights indicate that integrating a solid company plan can lead to a 30% boost in growth for enterprises, underscoring its significance in fulfilling business loan prerequisites during the loan application process. Seeking professional guidance, such as that provided by Finance Story, or utilizing planning software can also enhance this growth potential.

Case studies reveal that effective planning clarifies roles and responsibilities, facilitating better delegation and communication among team members. For instance, the case study titled "Improving Delegation and Communication" illustrates how this clarity enhances productivity and fosters stronger teams, contributing to long-term growth. In 2025, the role of a financial plan in obtaining funding remains essential, as lenders increasingly seek thorough documentation that showcases an enterprise's readiness and potential for success.

In summary, a solid strategy is not merely a resource for obtaining financing; it is a fundamental component that directs the enterprise's growth and development. It is essential for small business owners to be aware of the business loan prerequisites while navigating the funding application landscape. Finance Story's reputation for professionalism and profound knowledge of the finance sector further emphasizes the significance of having a well-crafted business plan when pursuing funding.

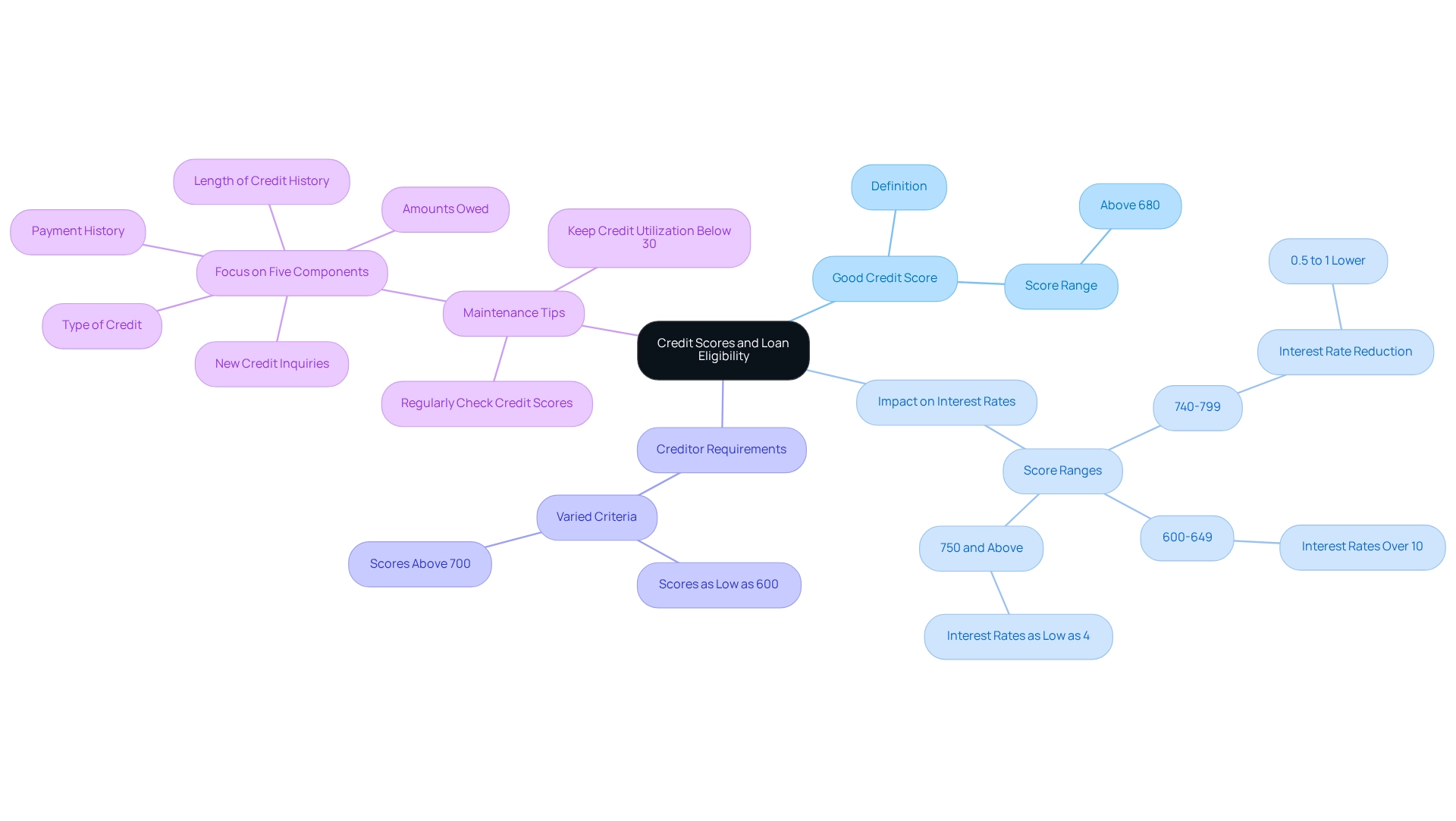

Understanding Credit Scores and Their Impact on Loan Eligibility

Credit scores are an essential element in the application process, typically ranging from 300 to 850. A higher score suggests a reduced risk to creditors, which can significantly affect borrowing eligibility and conditions. Consider the following key points:

- Good Credit Score: A score above 680 is generally regarded as good, often leading to more favorable borrowing terms and conditions.

- Impact on Interest Rates: Higher credit scores are associated with lower interest rates, which can substantially decrease the overall cost of borrowing. For example, companies with scores in the 740-799 range may qualify for interest rates that are 0.5% to 1% lower than those with scores below 680.

- Creditor Requirements: Each creditor has its own credit score criteria, making it essential for borrowers to research and understand these requirements before applying. Some lenders may accept scores as low as 600, while others may require scores above 700.

Maintaining a good credit score is crucial for securing advantageous financing options. Frequently reviewing credit scores can assist individuals and companies in comprehending their credit status and taking proactive measures to enhance it. For instance, focusing on the five components that determine credit scores—payment history, amounts owed, length of credit history, type of credit, and new credit inquiries—can empower borrowers to manage their credit more effectively.

Sustaining a favorable payment record and ensuring credit usage remains under 30% are effective methods that can enhance credit scores, resulting in improved borrowing conditions.

It's essential to recognize that adverse information, such as defaults or bankruptcies, remains on credit reports for as long as 5 years, which can have a lasting effect on borrowing eligibility. In 2025, the average interest rates for commercial loans vary significantly based on credit score ranges. Businesses with excellent credit scores (750 and above) may see rates as low as 4%, while those with fair scores (600-649) could face rates exceeding 10%.

Comprehending these dynamics is crucial for small enterprise owners striving to understand the business loan prerequisites in order to obtain the best financing options accessible. At Finance Story, we focus on developing refined and highly customized proposals to present to financial institutions, ensuring you have access to a comprehensive array of funding options suited to your requirements, including a wide variety of creditors appropriate for different commercial properties such as warehouses, retail spaces, factories, and hospitality projects.

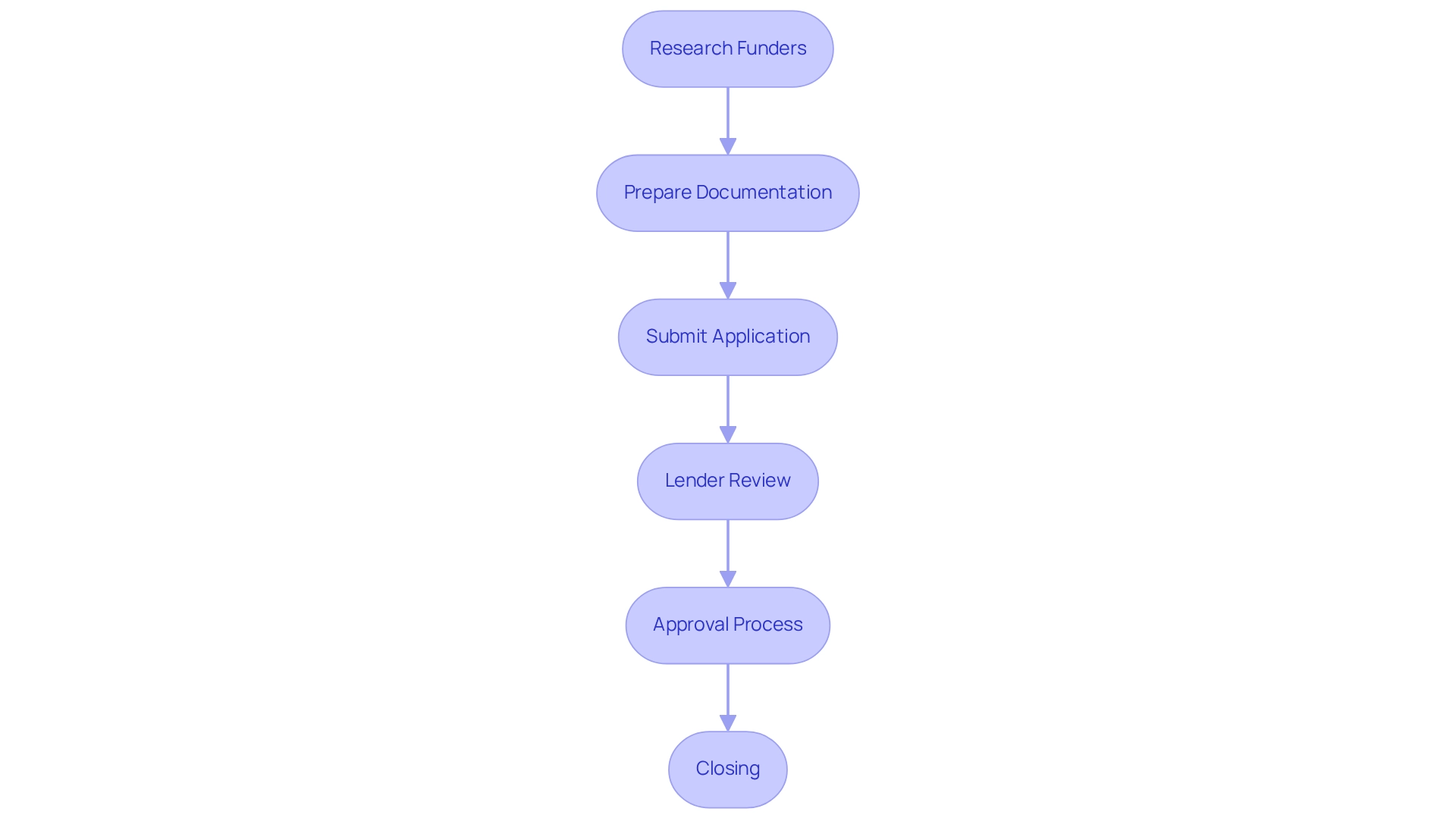

Navigating the Business Loan Application Process

Navigating the business loan prerequisites involves several essential steps that can significantly impact your chances of securing funding. Here’s a detailed breakdown of each stage:

-

Research Funders: Start by identifying potential financiers that align with your business requirements. Explore various options, including traditional banks, credit unions, and alternative sources such as peer-to-peer platforms, which have recently experienced a 15% growth, providing viable alternatives to conventional loans. At Finance Story, we offer access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, ensuring you find the right fit for your circumstances.

-

Prepare Documentation: Gather all essential financial documents, including tax returns, profit and loss statements, and a detailed operational plan. This preparation is crucial, as the speed of loan processing often hinges on how quickly you can compile the necessary documentation. The efficiency of this stage can significantly affect your overall application timeline. Our expertise in creating refined and personalized cases can assist you in presenting a compelling proposal to lenders.

-

Submit Application: Complete the application form meticulously, ensuring that all required documents are attached. A well-prepared application can expedite the review process.

-

Lender Review: Once submitted, your application will undergo a thorough review by the lender. This stage typically includes a credit check and a detailed financial analysis to evaluate your company's viability. Statistics indicate that 70% of small businesses carry some form of debt, totaling approximately $18 trillion by the end of 2022, underscoring the importance of understanding business loan prerequisites to demonstrate financial stability.

-

Approval Process: If your application meets the criteria of the financial institution, you will receive a funding proposal detailing the terms and conditions. The average time for this approval process can range from 30 to 90 days, depending on the lender and the complexity of your application. As noted by Kellye Guinan, Editor at Bankrate, SBA financing can take anywhere from 30 to 90 days from the application being submitted, highlighting the variability in approval timelines.

-

Closing: Upon accepting the financial agreement, the finalization process begins, leading to the disbursement of funds. This step is vital for ensuring that you can swiftly obtain the funds required for your ventures.

Being well-prepared for each of the business loan prerequisites not only simplifies the application process but also increases your chances of approval. For instance, our case studies demonstrate how specialized lenders can support entrepreneurs, especially those with low credit scores, by providing financing up to $10 million with flexible terms. Their streamlined application process benefits applicants by facilitating quicker approvals, enabling them to navigate the complexities of acquisitions effectively.

Additionally, refinancing options are available for various commercial properties, including warehouses, retail premises, factories, and hospitality ventures. Understanding these choices can offer considerable benefits for your developing enterprise needs.

In conclusion, grasping and preparing for the financing application process is vital for small business leaders aiming to secure funding in 2025. Financial advisors often suggest that entrepreneurs maintain clear communication with lenders and be ready to provide additional documentation if requested, as this can further facilitate a smoother approval process.

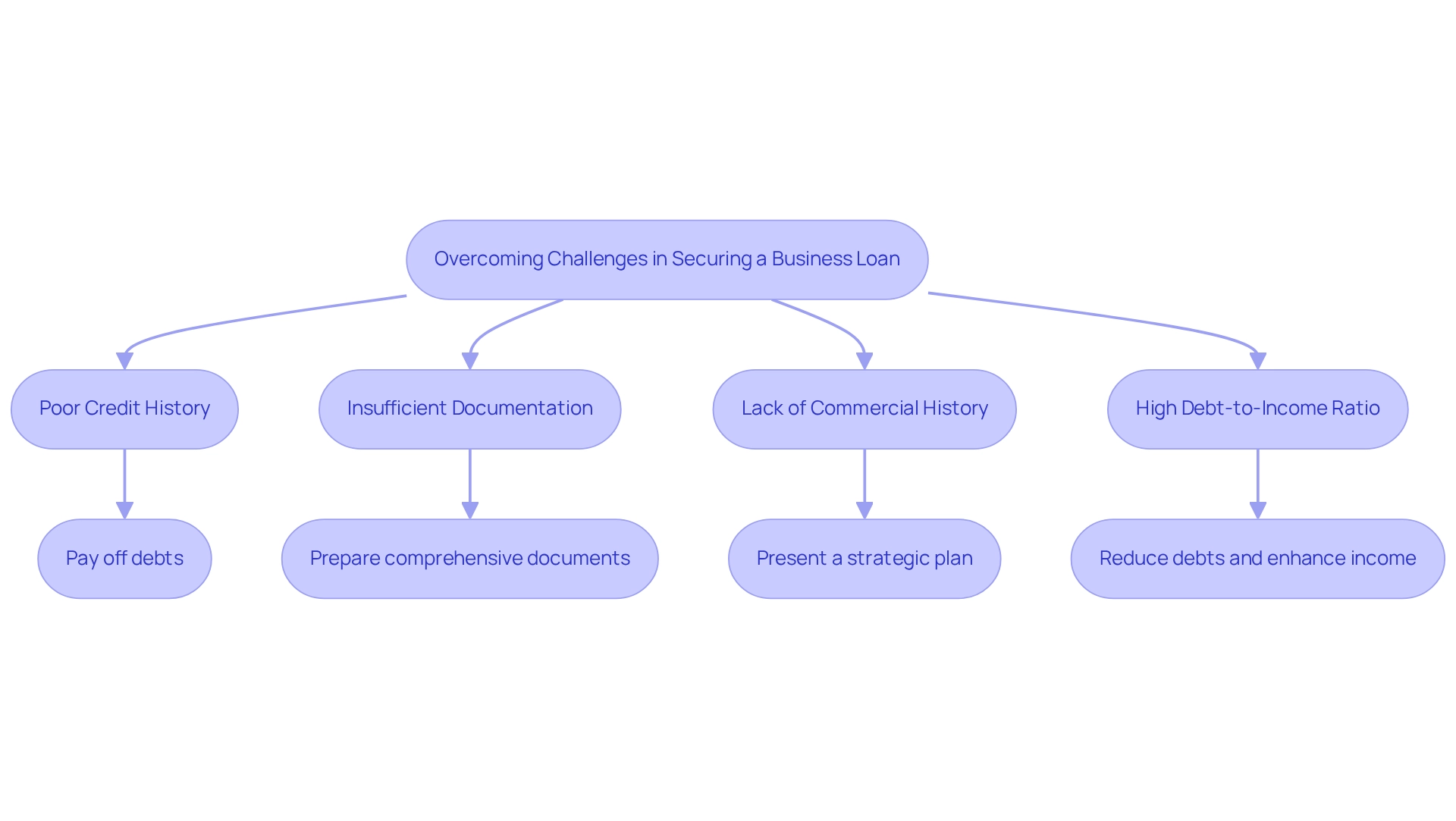

Overcoming Challenges in Securing a Business Loan

Obtaining financing, particularly meeting the business loan prerequisites, can present significant challenges for small enterprise owners, especially in today's economic climate. As Anna Bligh, CEO of the Australian Banking Association, remarked, "This Budget provides extra support to Australians in the short-term whilst at the same time helping to address some of our longer-term challenges." Below are key obstacles and strategies to overcome them:

-

Poor Credit History: A low credit score can severely hinder loan approval. To enhance your credit history, prioritize paying off outstanding debts and ensuring timely payments on existing obligations. This proactive approach can significantly improve your creditworthiness before applying.

-

Insufficient Documentation: Comprehensive documentation is essential for business loan prerequisites, as lenders require it to assess your application. Ensure that all necessary documents, such as tax returns, financial statements, and project plans, are complete and accurate. This preparation can prevent delays and showcase your professionalism to potential lenders.

-

Lack of Commercial History: New enterprises often struggle to meet the business loan prerequisites that demonstrate their viability. To address this, present a strong strategic plan that outlines your vision, market analysis, and financial projections. This can help instill confidence in financiers regarding your venture's potential for success.

-

High Debt-to-Income Ratio: A high debt-to-income ratio can deter lenders from meeting your business loan prerequisites. Focus on reducing existing debts and enhancing your income streams to create a more favorable financial profile. This adjustment can significantly bolster your chances of securing funding.

Recent research indicates that 45% of enterprises are contemplating borrowing to mitigate the impacts of high inflation, underscoring the urgency for many to secure funding. Furthermore, over half of new sole traders do not survive beyond three years, highlighting the critical importance of financial stability and access to capital. Notably, 84% of enterprises initiated by individuals of color relied on personal savings or support from friends or family, emphasizing the financial hurdles faced by minority entrepreneurs.

By proactively addressing these challenges, small enterprise owners can markedly enhance their prospects of meeting the business loan prerequisites. Finance Story specializes in developing refined and distinctly tailored cases for creditors, ensuring that your application stands out. The case study titled "Challenges Faced by SMEs in Australia" reveals that many SMEs remain resilient and optimistic despite the pressures of rising interest rates and inflation.

Expert insights suggest that maintaining open communication with lenders and seeking advice from financial advisors can provide valuable guidance throughout the financing application process. With access to a comprehensive portfolio of private and boutique commercial investors, Finance Story is well-positioned to assist you in overcoming these obstacles and securing the financing you require. Testimonials from satisfied clients, such as Natasha B from VIC, underscore the effectiveness of Finance Story in alleviating the persistent concerns associated with securing funding.

Moreover, Finance Story can support refinancing options to help manage your evolving enterprise needs, whether you are acquiring a warehouse, retail location, factory, or hospitality project.

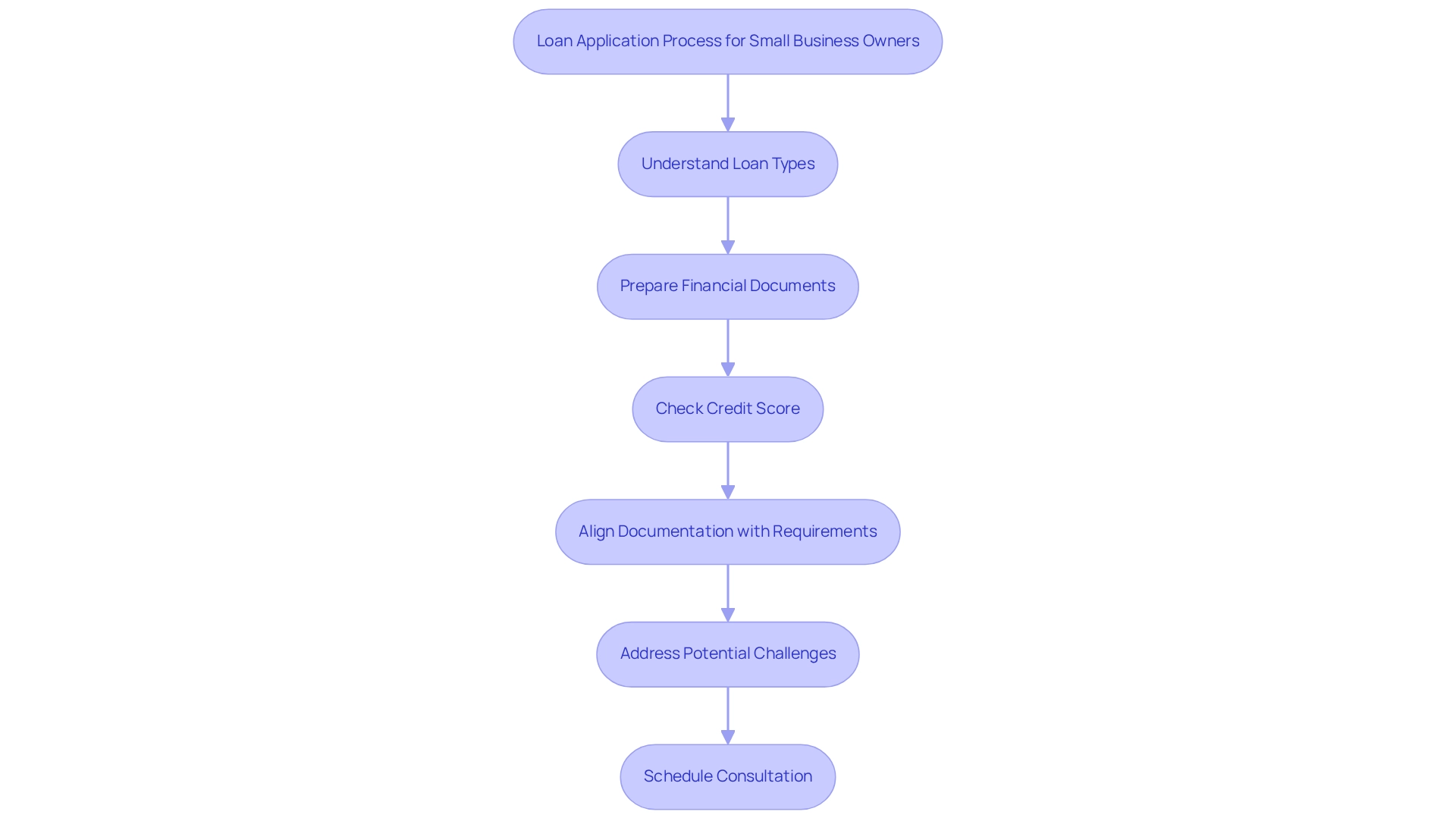

Key Takeaways for Small Business Owners Seeking Loans

Small enterprise owners must familiarize themselves with the various types of loans available, including the prerequisites and specific requirements associated with business loans. This understanding is crucial for selecting the most suitable funding option, taking into account the necessary business loan prerequisites.

-

Preparing comprehensive financial documents and a robust project plan is paramount. These documents not only demonstrate the viability of the venture but also instill confidence in lenders regarding the applicant's commitment and foresight. At Finance Story, we specialize in crafting refined and highly customized cases to present to banks, ensuring you maximize your chances of securing the necessary funds.

-

Understanding credit scores is essential, as they significantly influence borrowing eligibility. Entrepreneurs should regularly check their credit reports and take proactive steps to enhance their scores if needed, as a higher score can lead to more favorable loan conditions.

Navigating the application process demands diligence and careful preparation to meet the business loan prerequisites. Small enterprise owners must ensure that all necessary documentation aligns with these prerequisites to prevent delays or rejections. Partnering with Finance Story provides access to a comprehensive suite of lenders, encompassing high street banks and innovative private lending panels, tailored to your specific circumstances.

-

Proactively addressing potential challenges can bolster the likelihood of securing financing. This includes being prepared to clarify any past credit issues or financial difficulties and demonstrating how the enterprise has advanced since then.

-

Notably, 33% of small enterprises seek financing for working capital, highlighting a prevalent funding need among entrepreneurs. Additionally, small enterprises have created 17.3 million net positions over the past 26 years, with 63% of new roles originating from this sector, underscoring their substantial impact on the economy.

-

It is imperative to recognize the barriers faced by minority entrepreneurs in securing financing, as evidenced by a case study revealing that nearly half of black entrepreneurs experience credit denial. This underscores the urgent need for improved access to funding and support for these entrepreneurs.

-

In the December quarter of 2023, the value of new credit commitments for property acquisitions reached $24.4 billion, providing a relevant context for the financing market. Furthermore, refinancing data from the December quarter of 2024 indicate a trend in commitments that small enterprise leaders should understand when assessing their financing options.

-

To further assist you, we invite you to schedule a complimentary personalized 30-minute consultation with Shane Duffy, our Head of Funding Solutions. Discuss your needs and goals, and let us help you create your next chapter in business.

By adhering to these guidelines and leveraging the expertise of Finance Story, small business owners can approach the loan application process with enhanced confidence and clarity, ultimately increasing their chances of obtaining the necessary funding to support their ventures.

Conclusion

Understanding the complexities of business loans is vital for small business owners seeking essential funding. Recognizing the various types of loans available—such as term loans, lines of credit, and SBA loans—is crucial, as each is designed to meet specific financial needs. A well-structured business plan and a strong credit score are indispensable, significantly influencing loan eligibility and terms.

Preparation is key in the loan application process. By organizing essential financial documents and tailoring loan proposals, entrepreneurs can markedly enhance their chances of approval. Common pitfalls, including inadequate preparation and overestimating financial projections, jeopardize applications, making it imperative for business owners to approach the process with diligence and realism.

Navigating the business loan landscape ultimately requires a proactive mindset and a comprehensive understanding of available options. With the right preparation and support, small business owners can secure funding and position their ventures for sustainable growth. As the lending environment evolves, staying informed and adaptable will empower entrepreneurs to thrive in an increasingly competitive marketplace.