Overview

This article underscores the critical importance of understanding business loan conditions for small business owners, highlighting how these terms significantly impact their financial health and operational flexibility. It is essential for entrepreneurs to comprehend components such as:

- Loan amounts

- Interest rates

- Repayment schedules

- Collateral requirements

By doing so, they can make informed borrowing decisions and navigate the complexities of securing favorable financing. Are you aware of how these elements influence your business's financial landscape? Understanding these terms is not just beneficial; it is vital for your success.

Introduction

Navigating the intricate world of business loans can be a daunting task for small business owners, particularly as the lending landscape evolves. Understanding the specific terms and conditions set by lenders is crucial, as these factors significantly impact financial health and operational flexibility. From the intricacies of interest rates to the implications of collateral requirements, each component plays a vital role in shaping a business's borrowing strategy.

As economic conditions shift and consumer confidence fluctuates, the need for tailored financing solutions becomes increasingly apparent. This article delves into the essential components of business loan conditions, the factors influencing them, and the importance of being well-informed to secure favorable financing options that align with growth objectives.

Defining Business Loan Conditions

The criteria for business financing include the business loan conditions that comprise the specific terms and requirements established by lenders to govern funding operations. These business loan conditions typically include the borrowing amount, interest rate, repayment schedule, collateral requirements, and any associated fees. For small business owners, a comprehensive understanding of business loan conditions is crucial, as they have a significant impact on both financial health and operational flexibility.

For example, secured financing often necessitates that the company pledge assets, which mitigates risk for the lender but may limit the owner's ability to utilize those assets for alternative purposes. Conversely, unsecured credit, while not requiring collateral, generally carries higher interest rates due to the increased risk involved.

Recent statistics indicate that 9% of small enterprises seek funding for reasons beyond traditional needs, highlighting the diverse motivations behind credit requests. As we move into 2025, the lending landscape continues to evolve, with consumer confidence showing marked improvements, potentially enhancing loan conditions. As Anna Bligh, ABA CEO, noted, "This is a challenging time," underscoring the complexities faced by small business owners in securing financing.

At Finance Story, we specialize in crafting tailored case studies to present to banks, ensuring that proprietors can access the funding solutions that best meet their unique needs. We provide a comprehensive array of lenders, including high street banks and innovative private lending panels, to accommodate various scenarios, whether for purchasing a warehouse, retail space, factory, or hospitality venture. A recent case study titled "Optimism vs. 'Reality in Minor Enterprise Financing'" reveals that while many entrepreneurs express optimism about securing capital, significant hurdles persist, particularly for female, minority, and veteran founders. This underscores the importance of understanding the business loan conditions to foster growth in businesses.

In 2025, average interest rates for commercial financing in Australia are expected to reflect these shifting dynamics, making it essential for owners to stay informed about the latest trends and business loan conditions. By grasping the nuances of commercial financing conditions and leveraging the expertise of Finance Story, including our refinancing options, entrepreneurs can navigate the complexities of funding more effectively and make informed decisions that align with their growth objectives.

The Importance of Understanding Loan Conditions for Small Businesses

For small enterprise proprietors, understanding credit terms is crucial for efficient financial oversight. These business loan conditions can significantly impact borrowing costs and the overall financial strategy of a business. For instance, a credit agreement with an extended repayment term may offer lower monthly payments; however, it can lead to a higher total interest burden over the duration of the agreement. Conversely, a shorter-term loan might entail steeper monthly payments but result in reduced overall interest expenses. Comprehending these dynamics enables entrepreneurs to align their funding choices with operational requirements and growth objectives, promoting more sustainable financial practices.

At Finance Story, we focus on developing refined and highly personalized proposals to present to lenders. This ensures that enterprise owners can secure the appropriate financing for their commercial property investments and refinances. We collaborate with a full range of lenders, including high street banks and innovative private lending panels, to provide tailored financing solutions for various commercial properties such as warehouses, retail premises, factories, and hospitality ventures. Notably, statistics indicate that 83% of lenders in the consumer sector offer embedded services, in contrast to just 45% of medium and large-sized enterprise lenders. This disparity emphasizes the challenges small enterprises encounter in obtaining comprehensive assistance and comprehending business loan conditions, making it essential for them to be proactive in navigating the intricacies of funding.

Expert insights suggest that small firms with weak profitability are particularly vulnerable to economic downturns, complicating their understanding of business loan conditions. The general economic perspective remains cautious, with potential weaknesses impacting business loan conditions. For example, when evaluating your capacity to repay credit, lenders will consider the robustness of your enterprise's profits and require a plan along with cash flow forecasts for a minimum of the next 12 months. This context is vital, as the typical minor enterprise financing amount is approximately $663,000, underscoring the importance of understanding business loan conditions to secure advantageous funding.

Real-world instances illustrate the repercussions of not fully grasping financing specifics. Small enterprises that misjudge their repayment capabilities may face financial strain, jeopardizing their operational sustainability. Therefore, understanding the subtleties of credit terms is not merely advantageous but essential for entrepreneurs seeking to secure favorable funding and ensure enduring success.

Key Components of Business Loan Conditions

Key Components of Business Loan Conditions

- Loan Amount: This refers to the total sum borrowed, tailored to meet the specific financial needs of the business. In 2025, average borrowing amounts for small enterprises in Australia are anticipated to reflect the increasing demand for customized financing solutions, with projections indicating an average borrowing amount of around AUD 100,000. Finance Story focuses on developing refined and highly personalized cases to present to lenders, ensuring that the business loan conditions align with the specific needs of each enterprise.

- Interest Rate: The cost of borrowing, expressed as a percentage, can be either fixed or variable. Trends suggest that reduced interest rates can substantially lower the total expense of borrowing. It is essential for business owners to compare options for the best rates. Understanding the nuances of interest rates is crucial for optimizing financing solutions.

- Repayment Schedule: This outlines the timeline for repayment, detailing the frequency of payments (monthly, quarterly, etc.) and the overall duration of the financing. A well-organized repayment plan can assist companies in managing cash flow efficiently. Finance Story highlights the significance of transparent business loan conditions in their funding proposals to address changing business requirements.

- Collateral Requirements: These are assets pledged by the borrower to secure the credit. The existence of collateral can influence both the terms and interest rates of the financing, often resulting in more favorable business loan conditions for the borrower. Tailored proposals can help clarify collateral expectations and enhance negotiation outcomes.

- Fees: Additional costs related to the credit, such as origination fees, late payment fees, and prepayment penalties, can influence the overall expense of borrowing. Understanding the business loan conditions is essential for making informed financial decisions. Finance Story offers perspectives on possible fees, ensuring that entrepreneurs are fully aware of the financial consequences of their financing.

The challenges encountered by small and medium enterprises (SMEs) in obtaining conventional financing often arise from stringent serviceability criteria and protracted approval procedures. As Robert Ewing, ABS head of business statistics, noted, "Operating profit results were varied at an industry level as many firms faced the challenge of higher input costs in 2022-23." This highlights the financial pressures SMEs encounter, reinforcing the growing demand for alternative lenders who can provide fast and tailored funding solutions. For example, enterprises in areas such as agriculture, forestry, and fishing support services, which possess a profit margin of 20.2%, may discover that comprehending these financing components is crucial for enhancing their financial strategies. Furthermore, tax debt financing is becoming increasingly significant, helping enterprises in handling their ATO responsibilities by supplying essential funds to settle overdue taxes such as GST and PAYG. By understanding these key elements, small enterprise owners can maneuver through the intricacies of financing and make strategic borrowing choices.

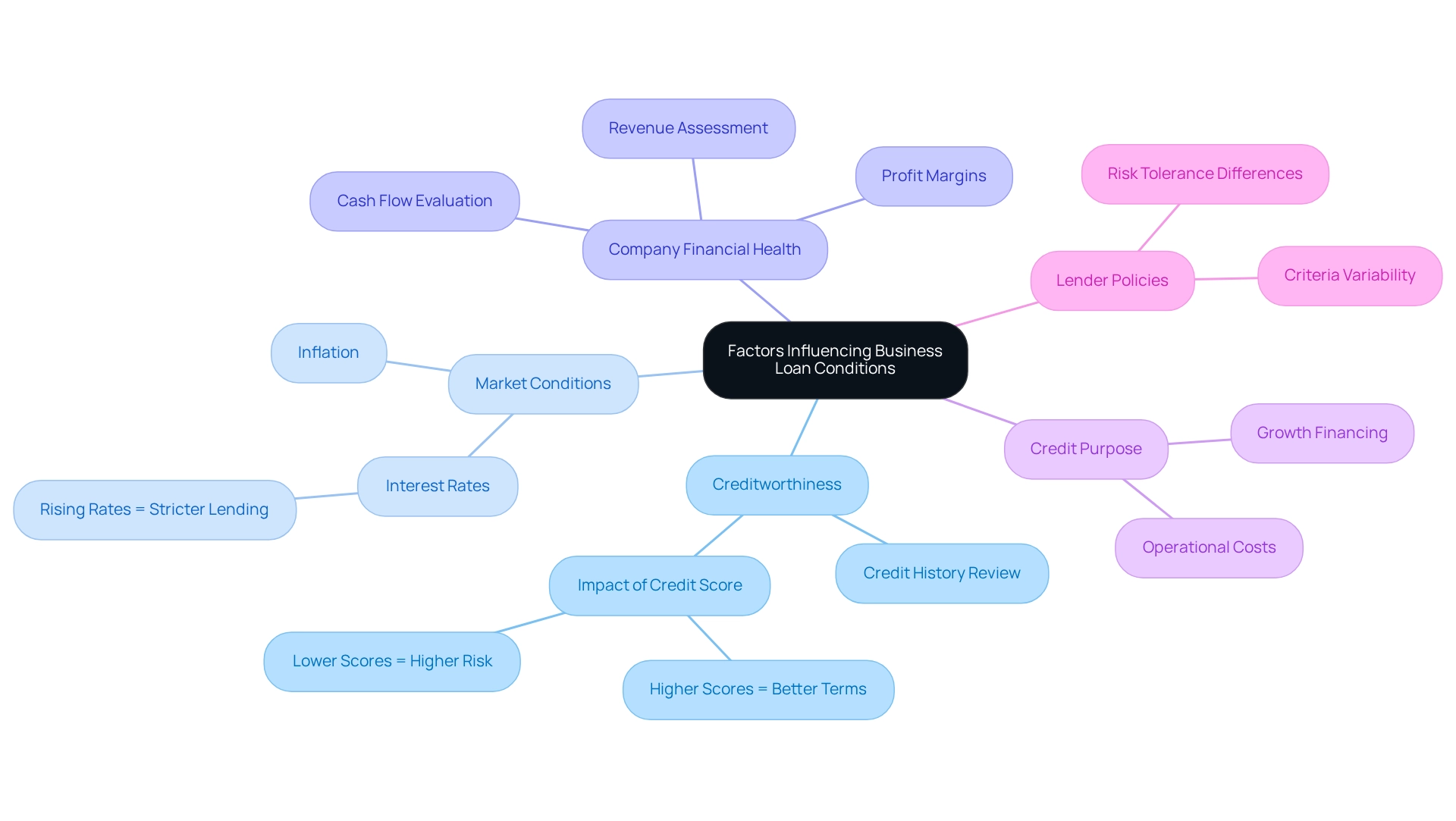

Factors Influencing Business Loan Conditions

Multiple essential elements greatly affect financing terms:

- Creditworthiness: Lenders carefully review a borrower's credit history and score to determine lending risk. A higher credit score typically results in more advantageous borrowing conditions, as it signifies a reduced chance of default.

- Market Conditions: Economic indicators, such as interest rates and inflation, play a vital role in influencing availability and terms of credit. For example, as interest rates increase, lenders might restrict their lending standards, making it more difficult for companies to obtain funding.

- Company Financial Health: Lenders assess financial documents, including revenue, profit margins, and cash flow, to evaluate an entity's ability to repay the credit. A strong financial profile can improve a company's chances of securing advantageous credit conditions.

- Credit Purpose: The intended use of the funding can also influence its terms. Financing aimed at growth usually has distinct terms in contrast to those meant for operational costs, highlighting the differing levels of risk linked to each objective.

- Lender Policies: Every financial establishment possesses its own criteria and risk tolerance, resulting in differences in borrowing terms. Comprehending these distinctions can assist companies in selecting the appropriate lender for their particular requirements.

As we progress into 2025, consumer confidence is anticipated to improve, which may affect lending practices and terms. This is especially significant considering that the failure rate of minor enterprises surpasses 50% after six years, emphasizing the necessity of comprehending financing terms to reduce risks. Furthermore, the changing environment of lending for minor enterprises, especially in reaction to economic shifts and the pandemic, highlights the necessity for companies to adjust their financing approaches. For instance, as interest rates increase, minor enterprises may redirect their attention from survival funding to seeking growth prospects, indicating a substantial transformation in their financing strategy. According to Janet Gershen-Siegel, only 24% of companies are currently seeking to refinance or reduce debt, indicating a shift in priorities. Understanding these factors is essential for small business owners looking to navigate the complexities of securing loans effectively, particularly when considering the business loan conditions while working with Finance Story to access a full suite of lenders and tailored refinancing options for various commercial properties, including warehouses, retail premises, factories, and hospitality ventures.

Conclusion

Navigating the landscape of business loans necessitates a comprehensive understanding of the specific conditions that govern lending. Key components—such as loan amount, interest rates, repayment schedules, collateral requirements, and associated fees—play a crucial role in shaping a business's financial strategy. A clear grasp of these elements empowers small business owners to make informed decisions that align with their growth objectives and operational needs.

Furthermore, recognizing the factors that influence loan conditions—such as creditworthiness, market conditions, and business financial health—can significantly enhance a business's ability to secure favorable financing. As the lending environment continues to evolve, particularly in response to economic shifts and changing consumer confidence, staying informed and proactive is essential. Small business owners are encouraged to leverage resources like Finance Story, which offers tailored financing solutions and expert guidance to navigate these complexities effectively.

In conclusion, understanding the intricacies of business loan conditions is not merely beneficial but vital for long-term success. By being well-informed and strategic about their financing options, small business owners can mitigate risks, optimize their borrowing strategies, and ultimately foster sustainable growth in an increasingly competitive landscape.