Overview

Securing a business loan in Australia requires a comprehensive understanding of the diverse loan options available, a thorough assessment of your financial needs, and adherence to a structured application process. This process involves preparing essential documentation and presenting a robust business plan. By following this step-by-step approach, you can significantly enhance your chances of success.

Maintaining a good credit score is crucial in this journey. Furthermore, collaborating with financial experts can bolster your likelihood of approval. This article equips business owners with the necessary tools for successful financing, ensuring you are well-prepared to navigate the complexities of obtaining a loan.

Introduction

In the dynamic landscape of Australian business financing, understanding the array of loan options available is crucial for entrepreneurs aiming to fuel their growth and operational needs. Secured loans, which offer lower interest rates through collateral, and flexible lines of credit designed for cash flow management, each serve distinct purposes and risk profiles.

Furthermore, as the business financing landscape evolves—with trends indicating a surge in loan commitments and credit card usage—small business owners must navigate these options with a keen awareness of their unique requirements.

This article delves into the intricacies of business loans in Australia, providing insights into application processes, essential documentation, and strategies to enhance approval chances. By empowering business owners with this knowledge, we enable them to make informed financial decisions that align with their goals.

Understanding Business Loans in Australia

In Australia, understanding how to secure a business loan is a vital financial tool that empowers enterprises to sustain operations, foster growth, or execute specific projects. These loans can be categorized into several types, each tailored to distinct needs and risk profiles:

- Secured Loans: These loans necessitate collateral, such as property or equipment, which mitigates the lender's risk. Consequently, secured financing often features lower interest rates, making them an attractive option for numerous businesses.

- Unsecured Credit: In contrast to secured options, these do not require collateral. However, they generally come with higher interest rates due to the increased risk taken on by the lender.

- Term Loans: This type involves borrowing a lump sum for a set period, typically with fixed repayment terms. Term financing is ideal for enterprises seeking a straightforward funding solution.

- Lines of Credit: Offering flexibility, lines of credit allow organizations to borrow up to a specified limit, paying interest only on the amount utilized. This can be especially advantageous for managing cash flow fluctuations.

- Equipment Financing: Specifically designed for acquiring equipment, these funds use the equipment itself as collateral, facilitating access to essential tools without straining finances.

Grasping how to obtain a business loan in Australia and the various options available is crucial for making informed financial decisions. Finance Story specializes in crafting tailored and refined funding proposals that cater to the unique requirements of small business owners. We provide access to a comprehensive suite of lenders, including high street banks and our innovative private lending panels, ensuring you have the best options suited to your circumstances.

Recent trends reveal a significant shift in the loan landscape, with new loan commitments for property purchases soaring to $24.4 billion in the December quarter of 2023. Additionally, the surge in corporate credit card usage, which reached an unprecedented $8.64 billion in monthly transactions by June 2024, underscores a growing reliance on credit for transactions. This trend highlights the evolving financial management strategies among Australian enterprises.

As we approach 2025, the commercial financing landscape continues to transform, with a notable percentage of secured financing compared to unsecured options, emphasizing the importance of collateral in securing favorable terms. Successful loan applications often depend on a clear understanding of how to get a business loan in Australia, these loan types, and current market dynamics, along with the right support from experts like Finance Story. By remaining informed about the latest statistics and trends, small business owners can navigate the complexities of financing more effectively and position themselves for success.

Moreover, refinancing options are available to adapt your financing strategies as your needs evolve. As Shaun McGowan, Founder of Money.com.au, emphasizes, "He's determined to help individuals and companies pay as little as possible for monetary products, through education and developing world-class technology." This aligns with Finance Story's commitment to professionalism and a deep understanding of the finance sector, assisting clients in achieving their financial goals.

Furthermore, Anna Bligh has highlighted that small enterprises will play a critical role in steering Australia through the crisis and will employ millions as the economy rebuilds, making it essential for owners to stay informed and prepared.

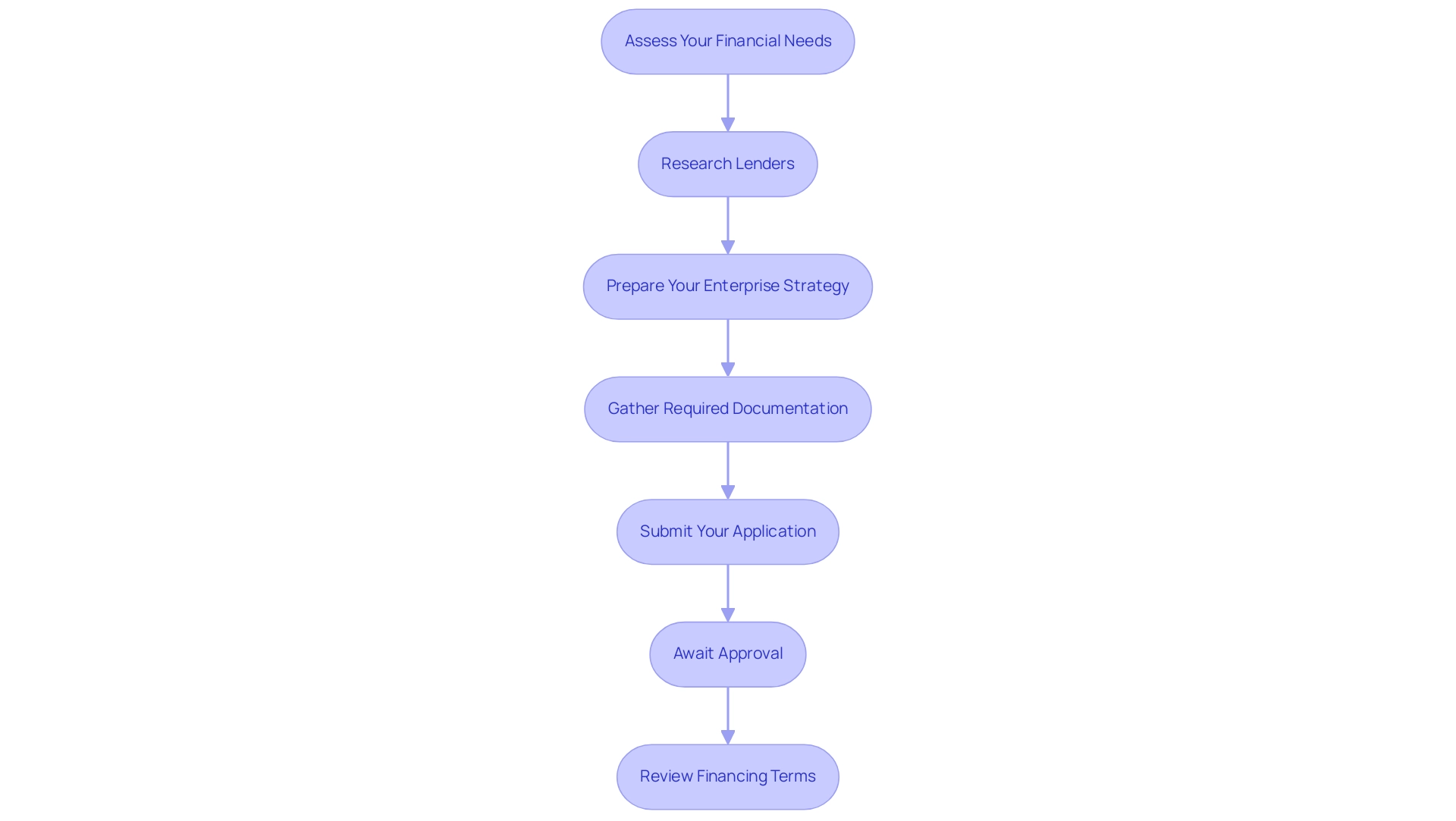

Step-by-Step Process for Applying for a Business Loan

To successfully apply for a business loan in Australia, follow this comprehensive step-by-step guide:

- Assess Your Financial Needs: Begin by determining the exact amount of funding required and the specific purposes for which it will be used. This clarity is essential, as it will direct your selection of financing options and providers.

- Research Lenders: Investigate various lenders that provide the type of financing you need. Compare interest rates, financing terms, and associated fees to find the most favorable options available. Significantly, Swoop has more than 95,000 enterprises subscribed to its newsletter, indicating a strong demand for financial assistance in Australia.

- Prepare Your Enterprise Strategy: A well-organized plan is crucial for financing applications. It should outline your operational model, market analysis, and a clear explanation of how you intend to utilize the loan funds. This document not only showcases your readiness but also assists financiers in comprehending your business's potential.

- Gather Required Documentation: Compile all necessary documents, which typically include financial statements, tax returns, and proof of income. Having these ready will streamline the application process and enhance your credibility.

- Submit Your Application: Complete the financial institution's application form with accurate and comprehensive information. Attention to detail is vital to avoid any delays in processing your application.

- Await Approval: After submission, the financial institution will review your application. The approval timeline can vary significantly, often taking anywhere from a few days to several weeks, depending on the lender's internal processes.

- Review Financing Terms: If your application is approved, take the time to carefully review the financing terms before signing. Ensure that the conditions align with your organizational needs and financial capabilities.

By following these steps, you can understand how to get a business loan in Australia more effectively. Finance Story's specialized expertise in creating polished and individualized proposals ensures you have the support needed to secure funding for your commercial property investments or refinancing needs, including warehouses, retail premises, factories, and hospitality ventures. We also offer refinancing options to help you adapt to the evolving needs of your business.

Arrange your complimentary personalized consultation with Shane Duffy, Head of Funding Solutions at Finance Story, to discuss your needs and objectives, and allow us to assist you in developing a customized monetary strategy for your next chapter. As one satisfied client remarked, "I will definitely be recommending your services to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." This emphasizes the exceptional service and dedication that Finance Story offers, particularly in complex monetary scenarios.

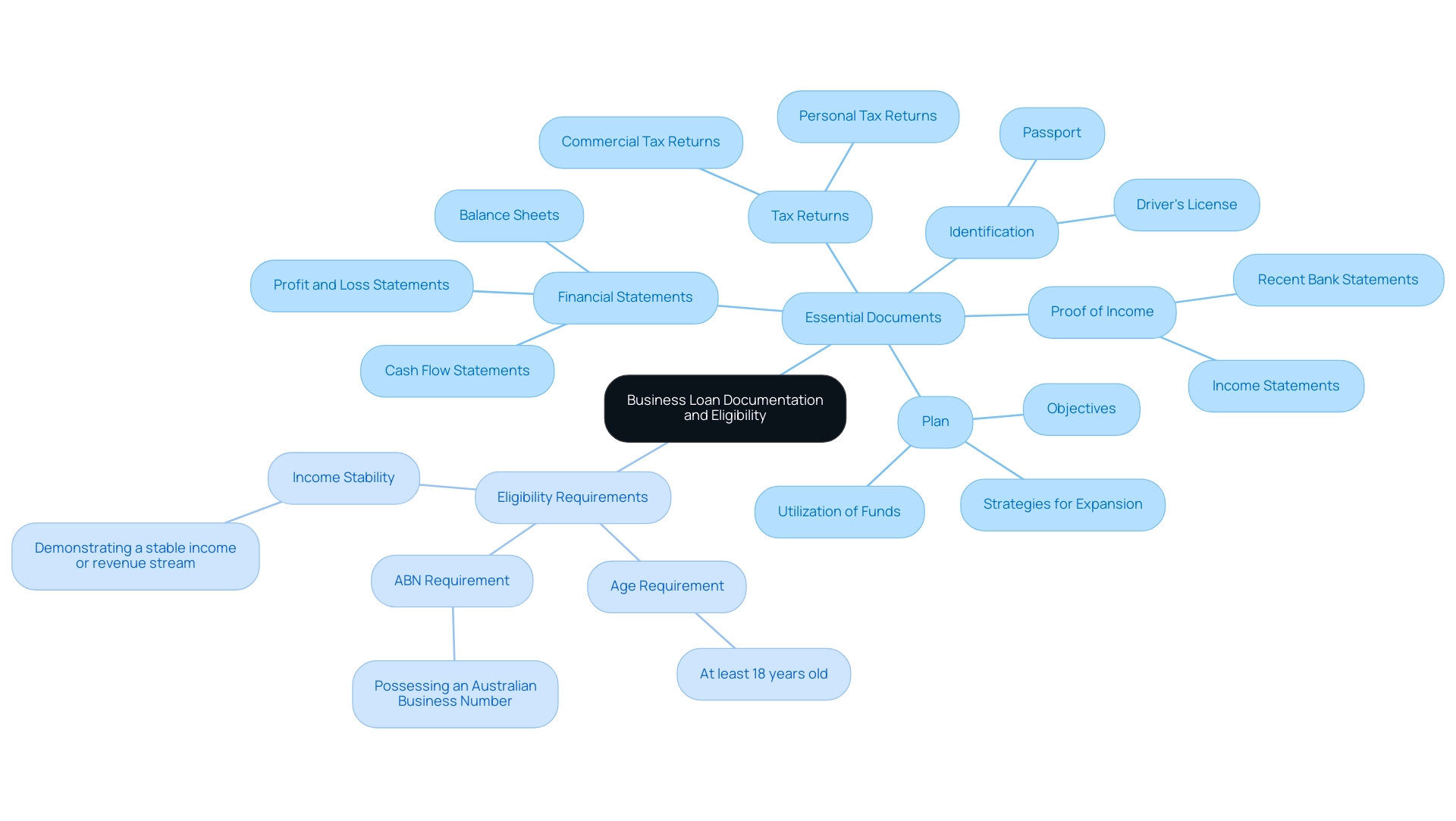

Essential Documentation and Eligibility Requirements

When learning how to secure a business loan in Australia, it is essential to prepare a comprehensive collection of documents and understand the eligibility standards that lenders typically require. Shane, the Founder and Funding Specialist Director at Finance Story, emphasizes the significance of a well-structured loan proposal. Customized financial solutions can greatly enhance your chances of approval. Finance Story specializes in crafting polished and highly individualized cases to present to banks, ensuring you have the best opportunity to secure funding for your development projects.

Here are the essential documents you will need:

- Financial Statements: Lenders will require profit and loss statements, balance sheets, and cash flow statements for the past two years. These documents provide a clear overview of your company's economic status and performance.

- Tax Returns: Both personal and commercial tax returns are crucial for assisting lenders in assessing your historical records and tax compliance.

- Proof of Income: This may include recent bank statements and income statements, demonstrating your ability to repay the amount based on your current financial situation.

- Plan: A well-structured plan is vital. It should outline your objectives, strategies for expansion, and a detailed explanation of how the funds will be utilized to achieve these aims. Shane's insights into leveraging technology and automation can also be beneficial, showcasing how these elements can impact long-term profitability and cash flow.

- Identification: Personal identification, such as a driver's license or passport, is necessary to verify your identity.

Eligibility requirements for business loans can vary significantly among lenders, but common criteria include:

- Being at least 18 years old.

- Possessing an Australian Business Number (ABN).

- Demonstrating a stable income or revenue stream.

In 2025, lenders may also consider additional factors such as your credit history and the overall economic climate when evaluating your application. For instance, companies that can demonstrate a solid economic track record and a clear repayment plan are often viewed more favorably.

A case study illustrating the importance of documentation is that of Swoop, a funding platform that utilizes Open Banking technology to streamline the funding application process. By securely accessing financial information, Swoop minimizes manual data entry and errors, expediting applications and providing creditors with a reliable summary of an organization's financial health. This innovative strategy not only saves time for entrepreneurs but also connects them with suitable funding options from over 1,000 sources, including banks and alternative financiers.

As Philana Kwan, Marketing Coordinator at Drive, states, "Our extensive network of over 30 lenders empowers you to make informed comparisons, helping you discover the solution that aligns perfectly with your needs."

Furthermore, Finance Story's dedicated lending associate in the UK for expat financing enhances its service offerings, especially for small business owners with international connections.

Understanding these crucial documents and eligibility criteria, along with Shane's expertise in creating persuasive proposals, will enable you to learn how to secure a business loan in Australia more effectively, increasing your likelihood of obtaining the capital needed to grow your enterprise. It is important to note that the information contained in this article is accurate as of July 2022, ensuring you have the most relevant and timely insights as you prepare your application.

Exploring Different Types of Business Loans

Business financing options in Australia are diverse, each designed to meet specific financial needs and circumstances. Understanding how to secure a business loan in Australia is essential for small enterprises aiming to obtain funding effectively. With Finance Story’s expertise, navigating these choices becomes streamlined and tailored to individual requirements.

- Secured Financing: These options require collateral, reducing the risk for lenders. As a result, secured financing often offers lower interest rates, making it an appealing choice for companies looking to minimize borrowing costs. Understanding the repayment conditions associated with secured credit can help entrepreneurs manage their finances more effectively.

- Unsecured Credit: Unlike secured credit, these options do not necessitate collateral. However, they typically come with higher interest rates due to the increased risk for lenders. This category of credit is suitable for enterprises that may lack assets to offer but still require access to funds. Grasping how to get a business loan in Australia and the repayment criteria for unsecured financing is crucial for maintaining financial health.

- Short-Term Financing: Designed for quick access to funds, short-term financing typically features shorter repayment periods and higher interest rates. They are ideal for enterprises needing immediate cash flow solutions, but understanding the repayment schedule is vital to avoid potential pitfalls.

- Long-Term Loans: These loans are better suited for larger investments, offering longer repayment terms and lower monthly payments. They enable organizations to distribute the cost of substantial expenses over time, making them manageable. Accurately evaluating repayment responsibilities can ensure sustainable development.

- Credit Cards for Enterprises: Providing a revolving line of credit, credit cards for enterprises are advantageous for ongoing expenses. While they often carry elevated interest rates, they offer flexibility in repayment, enabling companies to manage cash flow more effectively.

In 2025, the average interest rates for secured financing are generally lower than those for unsecured financing, reflecting the reduced risk associated with collateralized borrowing. For instance, secured credit options may have rates ranging from 5% to 8%, whereas unsecured credit can fluctuate from 10% to 15%. Statistics indicate that the typical amount requested by small enterprises when learning how to get a business loan in Australia is approximately $94,845, with many pursuing funding for growth projects despite careful economic circumstances.

This trend underscores the importance of adequate planning and understanding how to obtain a business loan in Australia to ensure anticipated returns on investment (ROI) when utilizing loans for expansion.

Additionally, construction finance options are available up to $5 million, which can be particularly beneficial for entities aiming to invest in property development or renovations. These options often encompass terms such as prepaid or capitalized interest and acceptance of owner builders, making them accessible for various commercial needs. Finance Story’s expertise ensures that clients are well-informed about these options and can tailor their proposals to reflect their unique circumstances.

Finance Story collaborates with a diverse range of lenders, including high street banks and innovative private lending panels, ensuring that clients have access to the most suitable financing options.

Expert opinions emphasize that selecting the appropriate financing option can significantly influence a company's growth trajectory. Financial advisors recommend that entrepreneurs clearly outline their plans and anticipated ROI before committing to a financial agreement, ensuring that the selected funding aligns with their strategic objectives. By thoroughly understanding the various categories of financing options available, including their benefits and potential downsides, entrepreneurs can make informed choices that enhance their financial strategies and long-term success.

Finance Story, recognized for its professionalism and extensive knowledge of the finance industry, is well-equipped to assist clients in exploring these options and securing the most appropriate funding solutions, including commercial property financing and enterprise capital.

Navigating Challenges in Securing Business Financing

Securing financing in Australia presents a myriad of challenges, particularly in 2025, as economic conditions continue to evolve. Understanding how to get a business loan in Australia can be daunting for small enterprise owners. Below are key challenges they may face, along with insights on how to navigate them effectively with the right expertise:

- Poor Credit History: A low credit score is a significant barrier to financing approval. At Finance Story, we encourage owners to proactively enhance their credit scores by addressing outstanding debts and ensuring timely payments. This effort can significantly improve their chances of securing favorable financing terms, as noted by industry experts like Jonathan Hambur.

- Insufficient Documentation: Incomplete or inaccurate documentation can lead to frustrating delays or outright denials of financing applications. It is crucial for owners to prepare comprehensive and precise paperwork, including financial statements, tax returns, and business plans. Our customized mortgage services at Finance Story are designed to simplify this approval process for our clients.

- Lack of Company History: New enterprises often struggle to secure funding due to their limited trading history. In such cases, exploring alternative financing options, such as microloans or peer-to-peer lending, can be beneficial. Additionally, seeking smaller loan amounts initially may increase the likelihood of approval. Finance Story specializes in creating highly individualized cases that cater to various circumstances.

- Economic Conditions: The current economic landscape, influenced by recent legislative changes and potential uncertainties under a possible second Trump administration, has made lenders more cautious. Profit margins for most small enterprises hover around their pre-pandemic averages, indicating a need for tailored policies and proactive measures to navigate financing challenges. Entrepreneurs should be prepared to demonstrate resilience and adaptability in the face of economic fluctuations, showcasing a solid model and a clear plan for sustainability.

Addressing these challenges directly can significantly enhance the likelihood of understanding how to get a business loan in Australia. For instance, a recent case study highlighted how a startup overcame its poor credit history by implementing a robust financial management strategy, ultimately leading to successful loan approval. By understanding and navigating these hurdles with the expertise of Finance Story, small enterprise owners can position themselves more favorably in the competitive financing landscape.

Furthermore, our extensive network includes a variety of lenders, from high street banks to private investors, ensuring that we can find the best financing solutions tailored to your needs. As one pleased client, Natasha B. from VIC, remarked, 'I will certainly be recommending your service to anyone.' We are finished with the constant worry. Once again, thank you so much for being a part of our journey.

Understanding Loan Terms and Conditions

When assessing a commercial credit, it is essential to consider the following terms and conditions:

- Interest Rate: Is the interest rate fixed or variable? A fixed rate offers stability in repayments, while a variable rate may fluctuate, impacting your overall costs. In 2025, average interest rates for commercial financing in Australia are anticipated to showcase a competitive environment. Evaluating how these rates will affect your monetary obligations is crucial.

- Repayment Schedule: Familiarize yourself with the repayment timetable, including due dates and frequency (monthly, quarterly, etc.). Understanding this aspect is vital for effective cash flow planning, ensuring your business can meet its obligations without strain. At Finance Story, we emphasize the importance of aligning your repayment strategy with your cash flow needs.

- Fees and Charges: Be vigilant about additional fees that may apply, such as application fees, late payment penalties, or early repayment charges. These expenses can significantly influence the total amount you repay over the borrowing period, making it essential to include them in your budgeting. Our team can assist you in navigating these complexities to guarantee clarity in your financial obligations.

- Credit Term: The duration of the credit can substantially impact your cash flow. Generally, longer borrowing terms result in lower monthly payments, but they also lead to higher total interest costs over time. In the current market context, understanding the effects of various financing terms is essential for aligning your funding with your enterprise strategy.

At Finance Story, we specialize in crafting refined and highly personalized cases to present to banks, which is crucial for obtaining the appropriate financing for your commercial property investments. Grasping these terms is not merely about compliance; it’s about strategically managing your financing to ensure it supports your business objectives. For instance, recent data reveals a rising trend in refinancing among both owner-occupiers and investors, with statistics demonstrating a significant increase in refinance commitments for the December quarter 2024.

This underscores the importance of being proactive in evaluating your financial conditions. Furthermore, with an anticipated total of 132,082 new loan commitments for residences in December 2024, remaining aware of interest rate trends and the overall lending environment can empower you to make informed decisions that enhance your business's economic well-being. Our access to a full range of lenders, including high street banks and innovative private lending panels, ensures you have the best options available.

At Finance Story, we are committed to building strong, long-term relationships with our clients, ensuring you feel understood and supported as you navigate these important financial decisions.

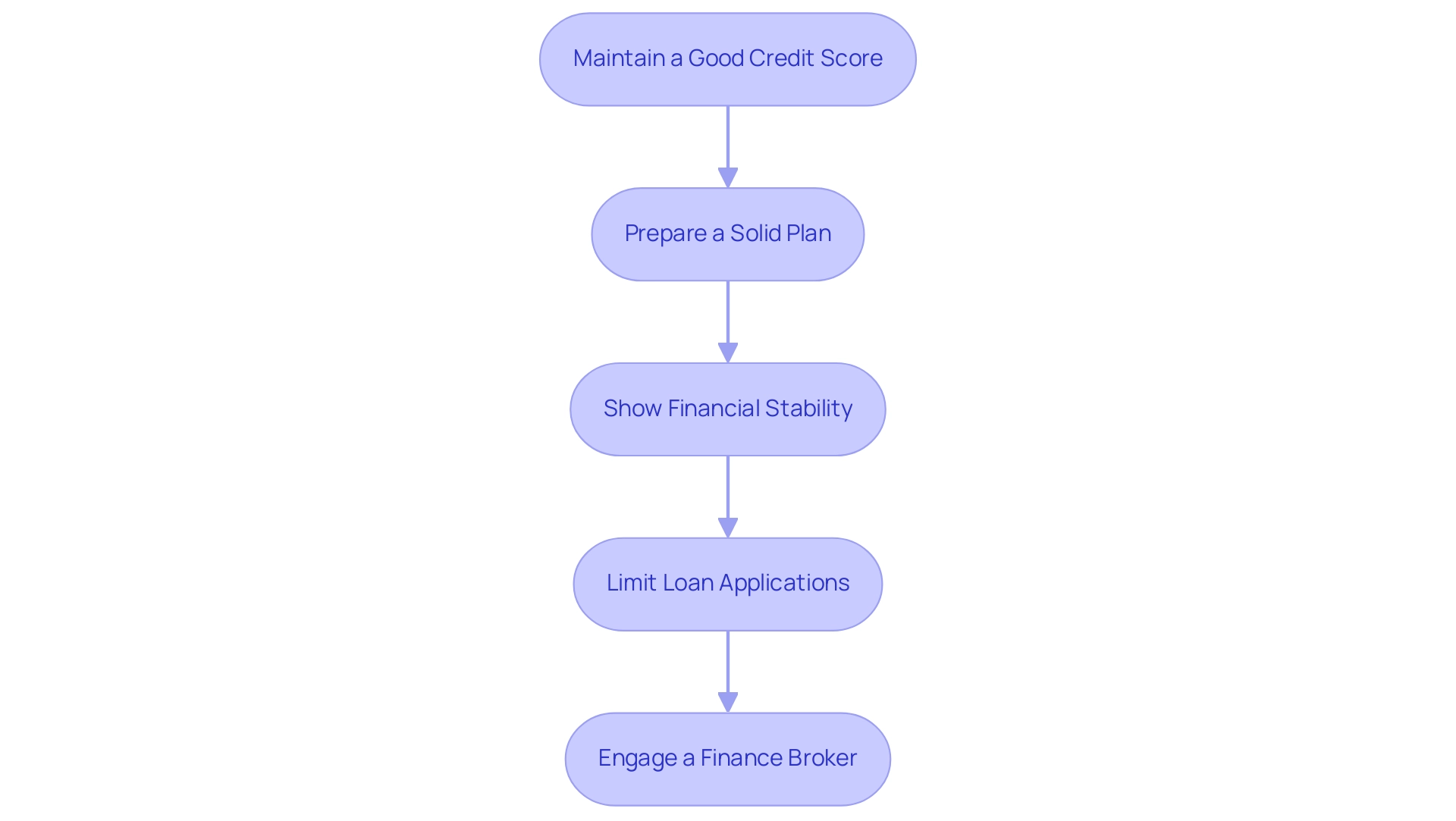

Tips for Increasing Your Chances of Loan Approval

To enhance your chances of securing a business loan, consider the following strategies:

- Maintain a Good Credit Score: Regularly review your credit report for inaccuracies and take steps to rectify any issues. A strong credit score is essential for understanding how to get a business loan in Australia, as it directly affects your approval chances for financing in 2025. In fact, the demand for personal credit in Western Australia increased by 10% year-on-year in 2023, highlighting the competitive lending landscape.

- Prepare a Solid Plan: A well-structured plan is essential. Clearly articulate your organizational objectives, strategies, and how to get a business loan in Australia for your intended use of the loan. This not only demonstrates your preparedness but also reassures lenders of your commitment to success. At Finance Story, we specialize in crafting polished and highly individualized cases that can significantly strengthen your proposal.

- Show Financial Stability: Present evidence of consistent revenue streams and healthy cash flow. Lenders are more likely to approve financing for businesses that understand how to get a business loan in Australia by demonstrating financial resilience and stability. Our team can assist you in presenting this information effectively in your application.

- Limit Loan Applications: Be strategic with your loan applications. Submitting multiple applications can negatively affect your credit score, making it harder to secure funding. Concentrate on those that correspond with your enterprise requirements. We offer access to a full suite of lenders, ensuring you find the right fit for your circumstances.

- Engage a Finance Broker: Collaborating with a finance broker can streamline the lending process. Brokers possess in-depth knowledge of the lending landscape and can connect you with suitable options tailored to your specific circumstances. Finance Story, with its expertise in the finance sector, is a dependable partner for enterprises exploring alternative funding options.

Implementing these strategies can significantly bolster your application for how to get a business loan in Australia. For example, companies using tools like Thriday have experienced enhanced credit approval rates by showcasing themselves as well-organized and financially stable entities. Thriday provides insights into commercial credit scores and automated financial monitoring, improving the likelihood of qualifying for financing.

By concentrating on these essential aspects and utilizing the knowledge of Finance Story, which assists various commercial properties such as warehouses, retail locations, factories, and hospitality projects, you can manage the intricacies of the application process more efficiently and enhance your likelihood of securing the required funding. Furthermore, if you are exploring refinancing choices, we can help you assess your existing debts to better align with the changing requirements of your enterprise. As one satisfied client remarked, "I will definitely be recommending your services to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey.

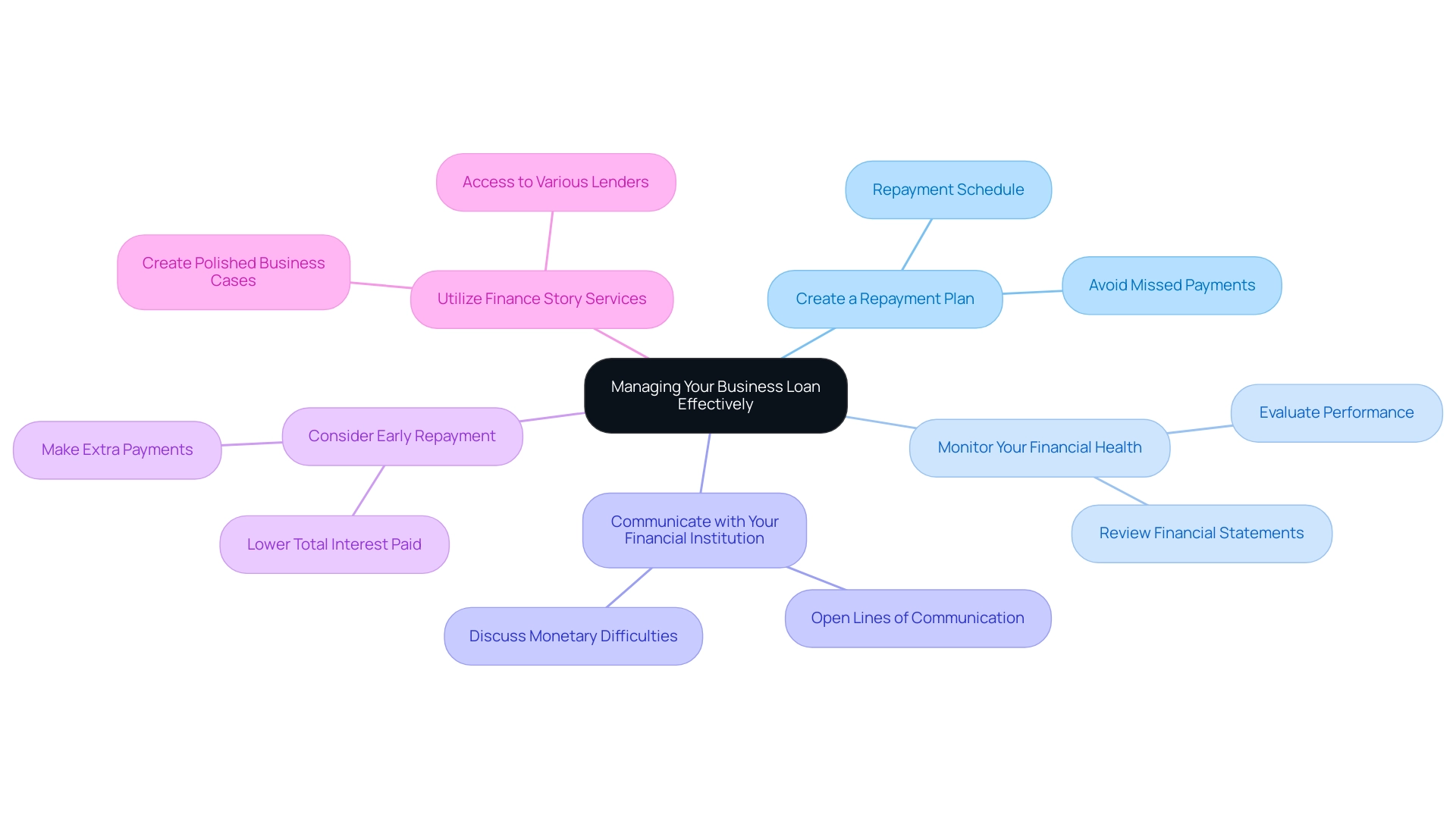

Managing Your Business Loan Effectively

Once you obtain a loan through Finance Story, effective management is essential to ensure it contributes positively to your growth and economic stability. Here are key strategies to consider:

- Create a Repayment Plan: Develop a detailed repayment plan that aligns with your cash flow. This plan should outline the repayment schedule, including amounts and due dates, to help you stay organized and avoid missed payments.

- Monitor Your Financial Health: Regularly review your financial statements, including profit and loss reports and cash flow statements. This practice will help you monitor your progress against your repayment plan and evaluate your overall performance. Lenders assess multiple factors when determining approval, including your business credit score, which typically ranges from 500 to 680. Improving these factors can enhance your likelihood of securing favorable loan terms.

- Communicate with Your Financial Institution: Maintain open lines of communication with your financial institution. If you face monetary difficulties, proactively discuss your situation with them. Many lenders, particularly those in the network of Finance Story, are willing to explore options to assist you before you miss any payments, which can help you avoid penalties and maintain a good relationship.

- Consider Early Repayment: If your financial situation permits, think about making extra payments towards your principal. Early repayment can significantly lower the total interest paid throughout the duration of the credit, ultimately saving you money. As mentioned by Finance Story, 'Interest rates fluctuate based on your circumstances, as not all enterprises are alike.' There are no hidden costs and fees; all details will be listed out clearly before there is any commitment.

In 2025, statistics suggest that enterprises that proactively oversee their debts are more likely to attain early repayment, with many reporting enhanced cash flow as a consequence. For instance, a case study revealed that enterprises that concentrated on improving their credit scores and financial well-being experienced a significant rise in approval rates and advantageous terms. By applying these best practices and utilizing the knowledge of Finance Story, you can effectively manage the intricacies of financial assistance in Australia and learn how to get a business loan in Australia, ensuring that your funding supports your long-term goals.

Additionally, Finance Story offers a full range of lenders, from high street banks to innovative private lending panels, catering to various commercial properties such as warehouses, retail premises, factories, and hospitality ventures. Creating polished business cases with our assistance can further enhance your chances of securing the right loan for your needs.

Conclusion

Understanding the diverse landscape of business loans in Australia is crucial for entrepreneurs seeking to enhance their financial standing and operational capabilities. This article has explored various loan types—secured, unsecured, term loans, and lines of credit—each serving distinct purposes and risk profiles. Furthermore, it has outlined the essential steps for applying for a loan, the documentation required, and strategies to improve approval chances.

Navigating the complexities of business financing requires a comprehensive understanding of both the options available and the current market dynamics. With trends indicating a shift towards secured loans and increased reliance on credit, it is imperative for business owners to stay informed and prepared. Engaging with experts, such as Finance Story, can provide valuable insights and tailored support, ensuring that business proposals align with lender expectations and increase the likelihood of securing funding.

Ultimately, the ability to make informed financial decisions can significantly impact the growth trajectory of a business. By leveraging the right resources and understanding the intricacies of loan terms and conditions, business owners can position themselves for success in an evolving financial landscape. As the Australian economy continues to recover, the proactive management of financing options will play a pivotal role in driving sustainable growth and operational resilience.