Overview

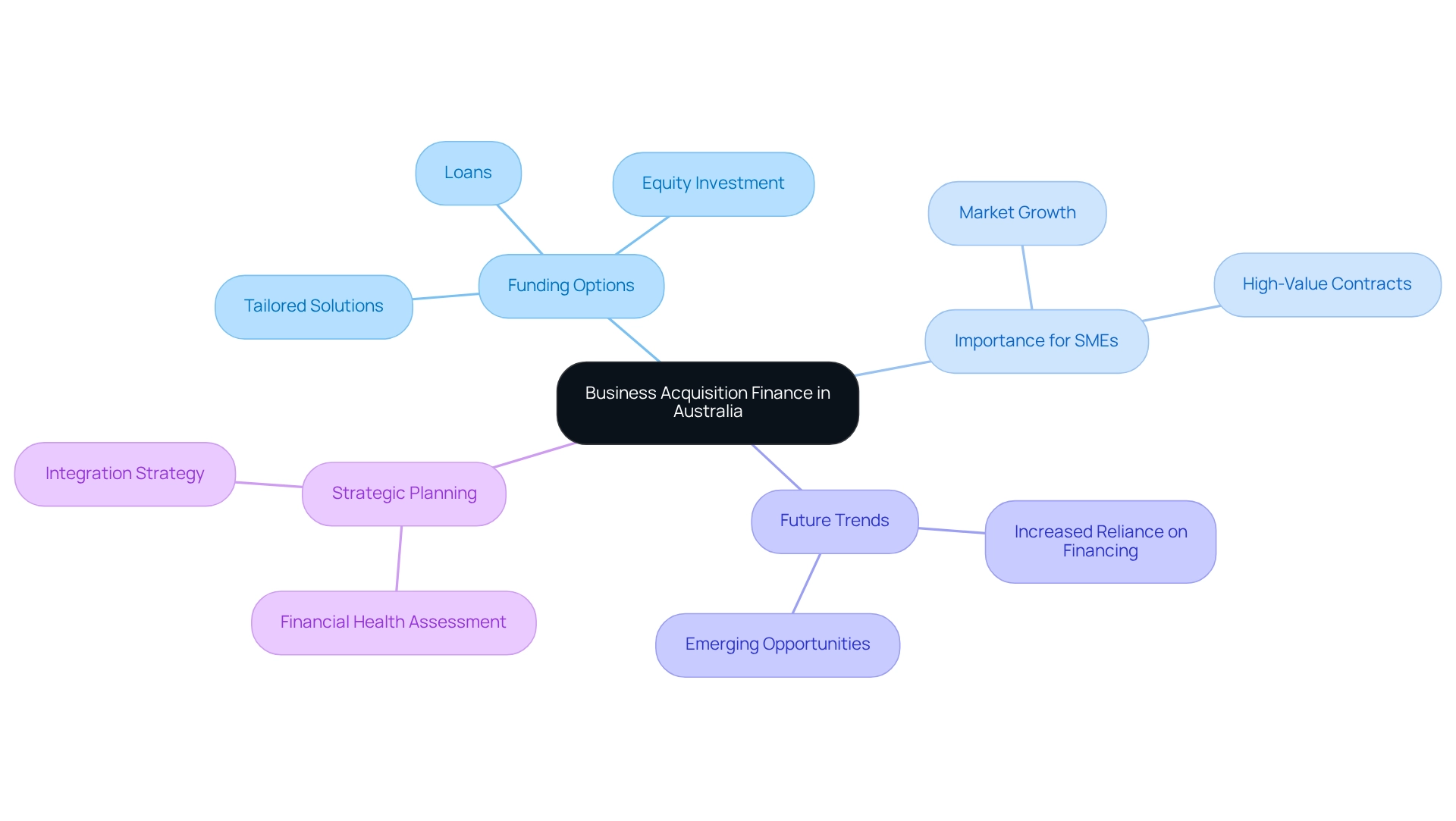

Business acquisition finance in Australia plays a pivotal role for entrepreneurs aiming to expand their operations through company acquisitions. This area encompasses a variety of funding options, including:

- Loans

- Equity investments

- Vendor financing

Understanding these financial avenues is essential. Moreover, conducting thorough due diligence is vital for successful acquisitions, as it enables businesses to capitalize on strategic opportunities while effectively navigating potential risks and regulatory challenges.

Have you considered how these financial strategies could enhance your business growth? By exploring the available funding options, entrepreneurs can make informed decisions that align with their growth objectives. In addition, recognizing the importance of due diligence allows businesses to mitigate risks and ensure compliance with regulations, ultimately leading to more successful acquisitions.

In summary, grasping the intricacies of business acquisition finance is not just beneficial but necessary for entrepreneurs seeking to thrive in a competitive landscape. Take the time to evaluate your financial strategies and consider how they can support your growth ambitions.

Introduction

In the dynamic landscape of Australian business, acquisition finance has emerged as a vital tool for entrepreneurs seeking to expand operations and seize new opportunities. As companies increasingly turn to financing options to facilitate acquisitions, understanding the intricacies of this financial avenue becomes essential.

From traditional bank loans to innovative equity financing, the available options cater to a diverse range of needs, enabling businesses to navigate the complexities of purchasing another entity. Furthermore, recent statistics reveal a significant uptick in small and medium enterprises engaging in acquisition finance, underscoring the importance of strategic financial planning.

This article delves into various financing options, eligibility criteria, and best practices for securing business acquisition finance, equipping entrepreneurs with the knowledge to make informed decisions in their pursuit of growth.

What is Business Acquisition Finance?

Corporate purchase funding represents a vital aspect of business acquisition finance in Australia, specifically designed for the capital required to acquire another company. This funding is essential for entrepreneurs seeking to expand operations, explore new markets, or secure strategic assets. In Australia, business acquisition finance encompasses various forms of corporate purchase funding, including loans, equity investment, and tailored financial solutions that cater to the unique needs of the acquiring entity.

As we look ahead to 2025, emerging trends indicate a growing reliance on financing for acquisitions among Australian firms. Approximately 25.1 percent of contracts awarded to small and medium enterprises (SMEs) by value are under $1 billion, totaling $18.7 billion. This marks a significant increase from previous years, underscoring the expanding availability of funding options for SMEs eager to engage in acquisitions.

Experts emphasize the importance of understanding business acquisition finance in Australia as a critical step for any entrepreneur considering a company takeover. Erin Cartledge, Special Counsel, notes, "The capacity to obtain suitable business acquisition finance in Australia can greatly affect the success of a purchase, allowing companies to capitalize on opportunities that align with their strategic objectives." This underscores the fundamental role of financial planning in the acquisition process.

Current data reveals that a substantial number of Australian enterprises are utilizing business acquisition finance for purchases, reflecting a robust market for these financial solutions. This trend is further supported by the Commonwealth's recent allocation of $99.6 billion to suppliers, highlighting the increasing importance of high-value contracts and the evolving landscape of commercial funding. The implications of these contracts for SMEs are profound, indicating a shift toward more significant procurement opportunities that can drive growth and expansion.

Key components of enterprise purchase funding for entrepreneurs include:

- Assessing the financial health of the target company

- Understanding the various financing options available

- Developing a clear integration strategy post-acquisition

Partnering with specialists like Finance Story can provide customized loan proposals tailored to your enterprise's specific needs, ensuring access to a comprehensive range of lenders, from high street banks to innovative private lending panels.

For example, when contemplating the acquisition of a commercial property valued at $1 million, a lender might permit a maximum loan-to-value ratio (LVR) of 70%. This allows for borrowing up to $700,000, necessitating a deposit of $300,000. If the commercial aspect of the purchase is appraised at $400,000, additional capital of $700,000 would need to be sourced, potentially from equity in existing properties or cash reserves.

Case studies, such as the analysis of AEMO Services, illustrate the impact of strategic acquisitions on company growth and operational efficiency, providing valuable insights into effective funding strategies.

In conclusion, business acquisition finance in Australia is not merely a transactional tool; it is a crucial element of strategic planning for entrepreneurs. As the market continues to evolve, staying informed about funding options and trends will be essential for those looking to navigate the complexities of business acquisitions successfully.

Types of Business Acquisition Financing Options

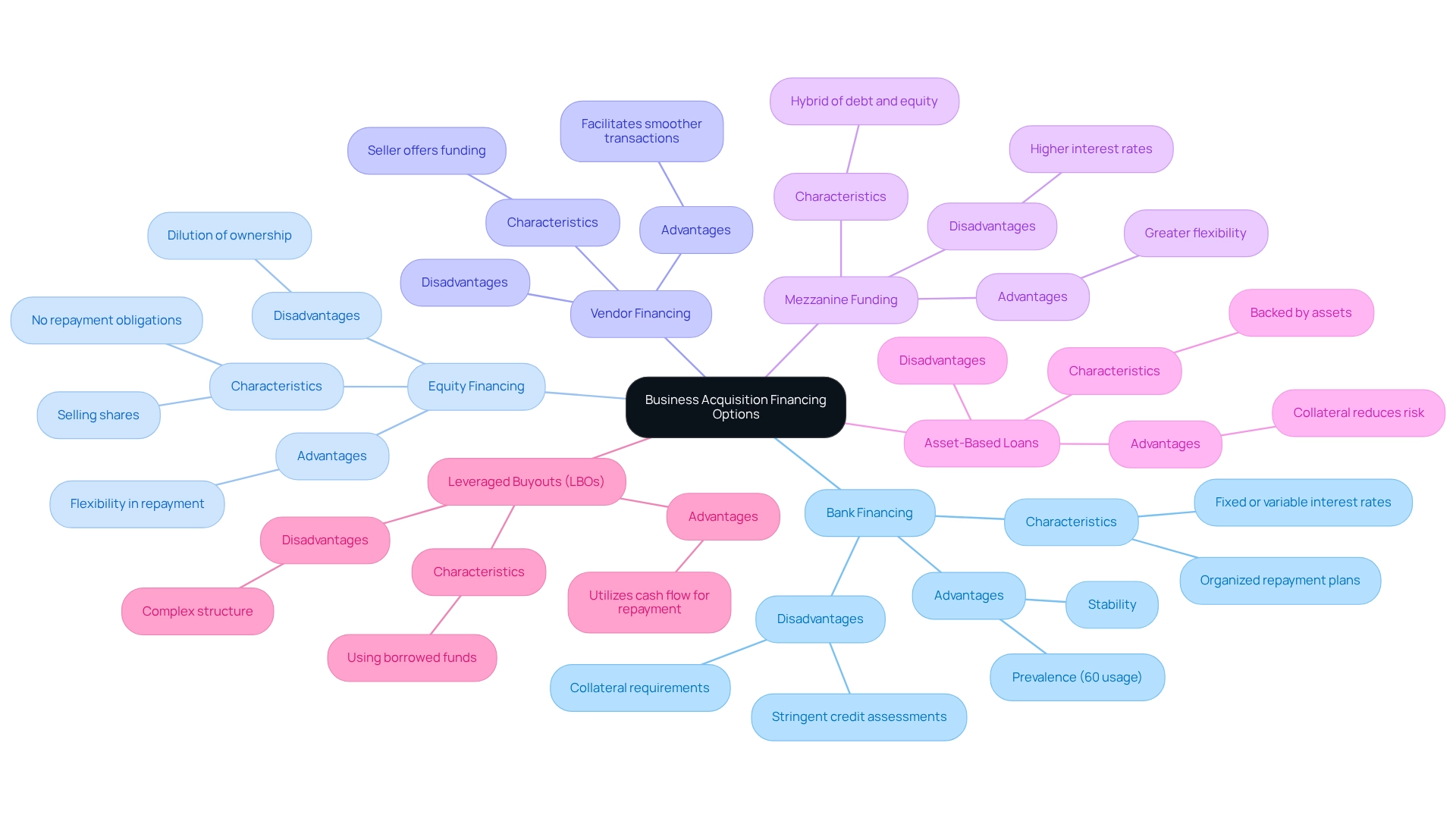

In Australia, a variety of financing options are available for business acquisitions, each catering to different needs and circumstances:

-

Bank Financing: Conventional bank financing remains a popular option for many purchasers, providing organized repayment plans with either fixed or variable interest rates. Recent statistics suggest that roughly 60% of companies seeking acquisitions employ bank financing, highlighting its prevalence in the market. Notably, Ingham recently transformed its A$545 million debt facilities into a sustainability-linked financial arrangement, reflecting a growing trend towards sustainable financing options. For freehold property enterprises, lenders generally permit borrowing against the commercial property, frequently with a maximum loan-to-value ratio (LVR) of 70%. This indicates that for a commercial property appraised at $1 million, a purchaser could obtain financing of $700,000, necessitating a down payment of $300,000, along with extra funds for the operational segment of the acquisition.

-

Equity Financing: This approach entails gathering funds by selling shares in the enterprise. While it can dilute ownership, it does not impose repayment obligations like traditional loans, making it an attractive option for some buyers. For those looking to finance leasehold businesses, utilizing equity from existing properties can be crucial, especially when cash savings are limited.

-

Vendor Financing: In this arrangement, the seller offers funding to the buyer, facilitating a smoother transaction process. This can be particularly beneficial in negotiations, as it aligns the interests of both parties.

-

Mezzanine Funding: A hybrid of debt and equity, mezzanine funding is often employed to bridge the gap between senior debt and equity. It allows for greater flexibility but typically comes with higher interest rates due to the increased risk for lenders.

-

Asset-Based Loans: These loans are backed by the assets of the entity being acquired, providing lenders with collateral to reduce risk. This option is particularly useful for buyers looking to leverage existing assets to secure financing, especially in the context of freehold properties where substantial assets can be used as collateral.

-

Leveraged Buyouts (LBOs): This strategy involves using borrowed funds to acquire a business, with the cash flow generated by the acquired company used to repay the debt. LBOs can be complex but are a common strategy in larger acquisitions.

Each funding choice offers its own set of advantages and disadvantages. For instance, while bank loans offer stability, they may require stringent credit assessments and collateral. Conversely, equity funding can dilute ownership but offers flexibility in repayment.

The selection of funding will ultimately rely on the purchaser's financial circumstances, the details of the purchase, and the conditions agreed upon with lenders.

Current trends indicate a growing discourse around the regulatory framework for private credit, particularly in the realm of business acquisition finance in Australia, with anticipated changes focusing on higher disclosure standards and stricter liquidity requirements. This changing environment is essential for purchasers to take into account as they explore their funding options. Additionally, the introduction of the Personal Property Securities Act 2009 has established a uniform concept of security interests, requiring registration on the Personal Property Securities Register to ensure priority.

This act significantly impacts funding choices in takeovers, as it enhances the credibility of funding alternatives by ensuring that security interests are properly registered and prioritized.

Moreover, as emphasized by John Schembri in the Australian section of the Chambers Global Practice Guide for Finance (2023), comprehending the legal and practical factors in finance related to purchases is crucial for buyers to maneuver through these complexities efficiently. The case study titled "Certain Funds Requirements in Takeover Offers" illustrates that while there is no strict legal requirement for 'certain funds' financing in takeover offers, practical considerations often lead financiers to provide commitments on this basis, thereby enhancing the credibility of takeover offers and protecting the interests of shareholders.

Eligibility Criteria for Business Acquisition Loans

To qualify for business acquisition loans in Australia, borrowers must navigate several key eligibility criteria that lenders typically assess:

- Creditworthiness: A strong credit history and score are essential, as lenders assess the borrower's ability to repay the debt. Recent statistics indicate that a significant portion of credit requests is influenced by credit scores, with many lenders requiring a minimum score of 650 for favorable terms. Notably, the value of new personal fixed-term loan commitments for 'Other' in Australia reached $3.8 billion in the December quarter of 2023, highlighting the active lending landscape.

- Business Financials: Comprehensive financial statements are essential. This encompasses profit and loss statements, balance sheets, and cash flow projections, which together demonstrate the organization's financial health and operational viability.

- Business Plan: A meticulously crafted business plan is crucial. It should detail the acquisition strategy, anticipated synergies, and financial forecasts, effectively demonstrating to lenders the potential for success post-acquisition.

- Collateral: Many lenders mandate collateral to secure the loan. This could include commercial assets or personal guarantees, offering lenders a safety net in case of default. For leasehold enterprises, where there may not be physical property to leverage, utilizing equity from other owned properties or cash savings becomes essential. This highlights the importance of understanding how to leverage existing assets effectively.

- Experience: Lenders frequently prefer borrowers with pertinent industry experience or a demonstrated history in overseeing similar enterprises. This experience can significantly enhance the credibility of the financial request.

Understanding these criteria is vital for potential borrowers as they prepare their applications for business acquisition finance in Australia. For example, case studies show that companies that carefully align their financial documentation and plans with lender expectations have a higher success rate in obtaining financing. Furthermore, the case study titled "Deposit Requirements for Commercial Financing" indicates that the deposit required for a commercial credit in Australia typically ranges from 10% to 30% of the amount, varying by lender and financing type.

Expert insights indicate that enhancing creditworthiness through prompt payments and decreasing current debt can significantly boost the likelihood of loan approval for business acquisition finance in Australia. Moreover, considering the present financial situation, as mentioned by Dr. Jim Chalmers, Treasurer of Australia, the recent surplus reported may impact borrowers' choices concerning company purchases. By addressing these factors, borrowers can improve their chances of securing the necessary business acquisition finance in Australia to enable successful company purchases in 2025.

Finance Story, with its professionalism and profound knowledge of the finance sector, is well-prepared to help clients navigate these criteria and secure the best funding options available, including customized loans for commercial property investments, refinancing solutions, and access to a complete range of lenders to suit various situations.

How to Apply for Business Acquisition Finance

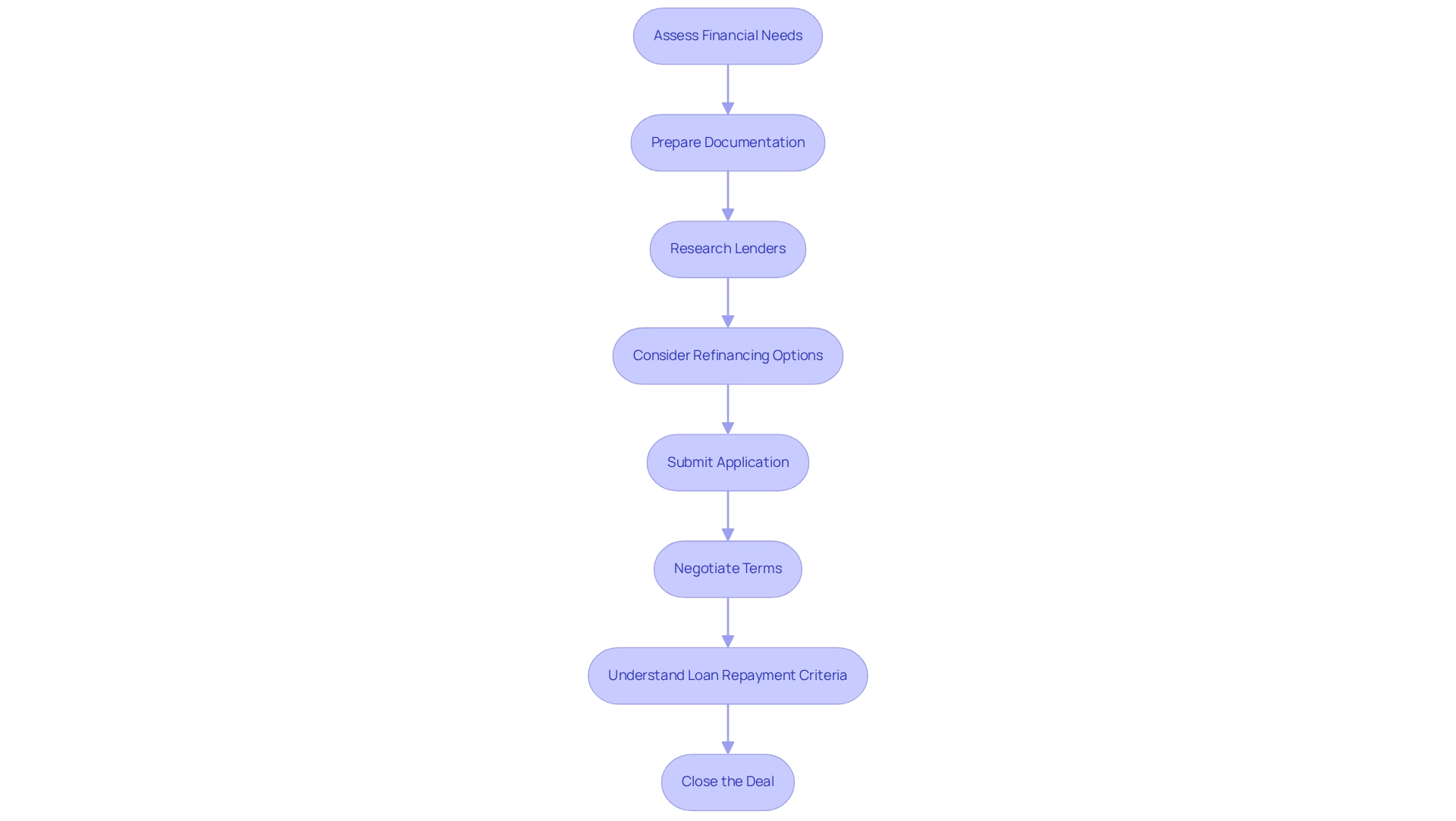

Applying for business acquisition finance in Australia involves several critical steps that can significantly impact the success of your application:

-

Assess Financial Needs: Begin by determining the total funding required for the acquisition. This includes not only the purchase price but also transaction costs and necessary working capital to ensure a smooth transition. Statistics indicate that the average small enterprise loan amount requested is approximately $94,845, highlighting the importance of having a clear financial strategy in place. At Finance Story, we specialize in creating refined and highly personalized case studies to present to lenders, ensuring you secure the right business acquisition finance in Australia for your needs.

-

Prepare Documentation: Compile essential documents such as financial statements, tax returns, a detailed operational plan, and any legal documents relevant to the purchase. A thoroughly developed proposal is essential, as it outlines the strategic reasoning behind the purchase and shows your readiness to creditors. As Phil noted, "the right loan facility can be a very powerful tool to accelerate growth," making it essential to have your plans clearly mapped out, including expected ROI.

-

Research Lenders: Identify lenders that focus on financing for company purchases. Compare their terms, interest rates, and eligibility requirements to find the best fit for your needs. This step is crucial, as the right lender can provide customized solutions that align with your objectives. At Finance Story, we provide access to a full suite of lenders, including high street banks and innovative private lending panels, to meet your unique circumstances.

-

Consider Refinancing Options: If you already own property, restructuring your current debts can provide additional capital for your acquisition. This can be especially advantageous if your property has increased in value, enabling you to utilize that equity for your purchase.

-

Submit Application: Complete the financial application meticulously, ensuring all information is accurate and comprehensive. A compelling business plan should accompany your application, highlighting the potential return on investment (ROI) and growth opportunities that the acquisition presents.

-

Negotiate Terms: Upon receiving approval, engage in discussions regarding the financing conditions. This encompasses interest rates, repayment plans, and any covenants that may be associated with the financing. Effective negotiation can result in more advantageous terms that support your organization's financial health.

-

Understand Loan Repayment Criteria: Familiarize yourself with the repayment criteria set by lenders, including the loan-to-value ratio (LVR) and other financial metrics that may affect your eligibility. This understanding is crucial for planning your cash flow and ensuring timely repayments.

-

Close the Deal: After finalizing the loan agreement, proceed with the purchase while ensuring that all legal and financial obligations are met. Security can be granted over real property through registered mortgages, which is an important aspect to consider during this step. This marks the culmination of your efforts and sets the stage for future growth.

Expert advice emphasizes that having a clear financial strategy is crucial, especially in light of the growing trend of SMEs borrowing to fund growth despite challenging economic conditions. By adhering to these steps and arranging a complimentary personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy, you can simplify the application process and improve your chances of obtaining the required financing for your venture.

The Importance of Due Diligence in Business Acquisitions

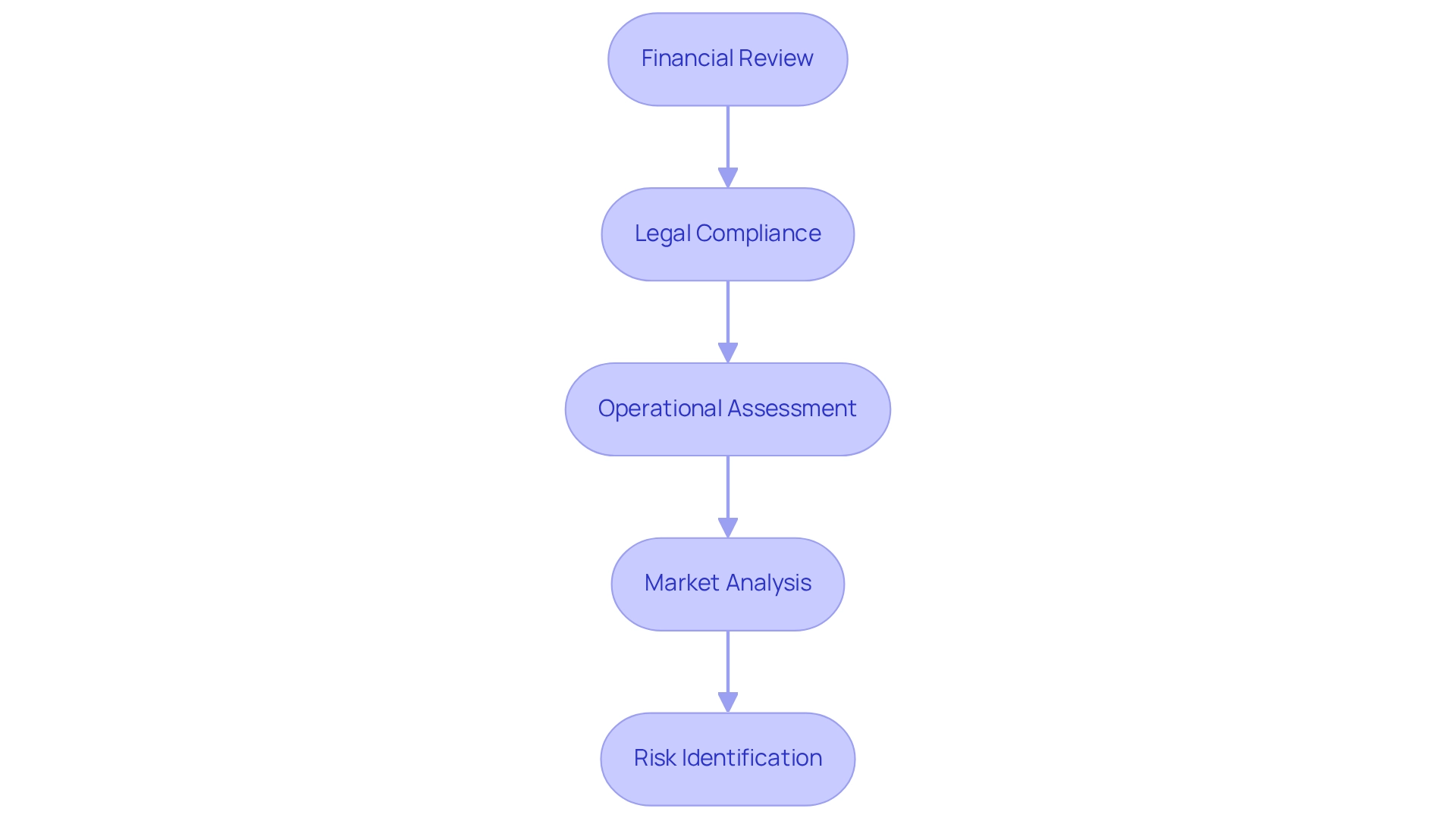

Due diligence is an essential procedure in company purchases, involving a comprehensive examination of the target firm to uncover potential risks and liabilities that could impact the success of the acquisition. As we approach 2025, the importance of due diligence is underscored by the fact that a significant proportion of companies in Australia are now conducting financial assessments related to business acquisition finance. This trend reflects a growing awareness of its critical role in safeguarding investments.

Key aspects of due diligence include:

- Financial Review: A meticulous analysis of financial statements, tax returns, and cash flow projections is crucial for evaluating the target's financial health. Recent statistics reveal that many purchases are now preceded by thorough financial assessments, which enhance buyer confidence.

- Legal Compliance: It is vital to ensure that the target company adheres to all relevant laws and regulations. This involves reviewing contracts, licenses, and permits to prevent future legal complications.

- Operational Assessment: Evaluating the target's operational processes, management team, and employee relations helps identify potential integration challenges that may arise post-acquisition.

- Market Analysis: Understanding the target's market position, competitive landscape, and growth potential is essential for assessing the strategic alignment of the purchase. This analysis aids in determining whether the acquisition aligns with the buyer's long-term objectives.

- Risk Identification: Recognizing existing liabilities, such as pending lawsuits or regulatory issues, is essential for mitigating risks that could emerge following the purchase.

Conducting thorough due diligence not only minimizes risks but also strengthens the buyer's negotiating position, leading to a more favorable purchase outcome. As noted by Mark Trewhella, a corporate tax practitioner, "Conducting thorough tax due diligence not only protects the buyer but also enhances confidence among stakeholders of the buyer." Efficient due diligence practices foster stakeholder trust and protect the buyer's interests, making it an indispensable component of the acquisition process.

For instance, various remediation options for tax risks identified during due diligence—such as adjusting the purchase price or utilizing escrow accounts—provide buyers with strategies to navigate potential pitfalls, ensuring that tax risks do not derail the transaction. This comprehensive approach to due diligence in business acquisition finance is increasingly recognized as a best practice in the Australian commercial landscape. Furthermore, the ABS plans to transition to a comprehensive monthly CPI by the end of 2025, which may influence economic conditions affecting corporate purchases.

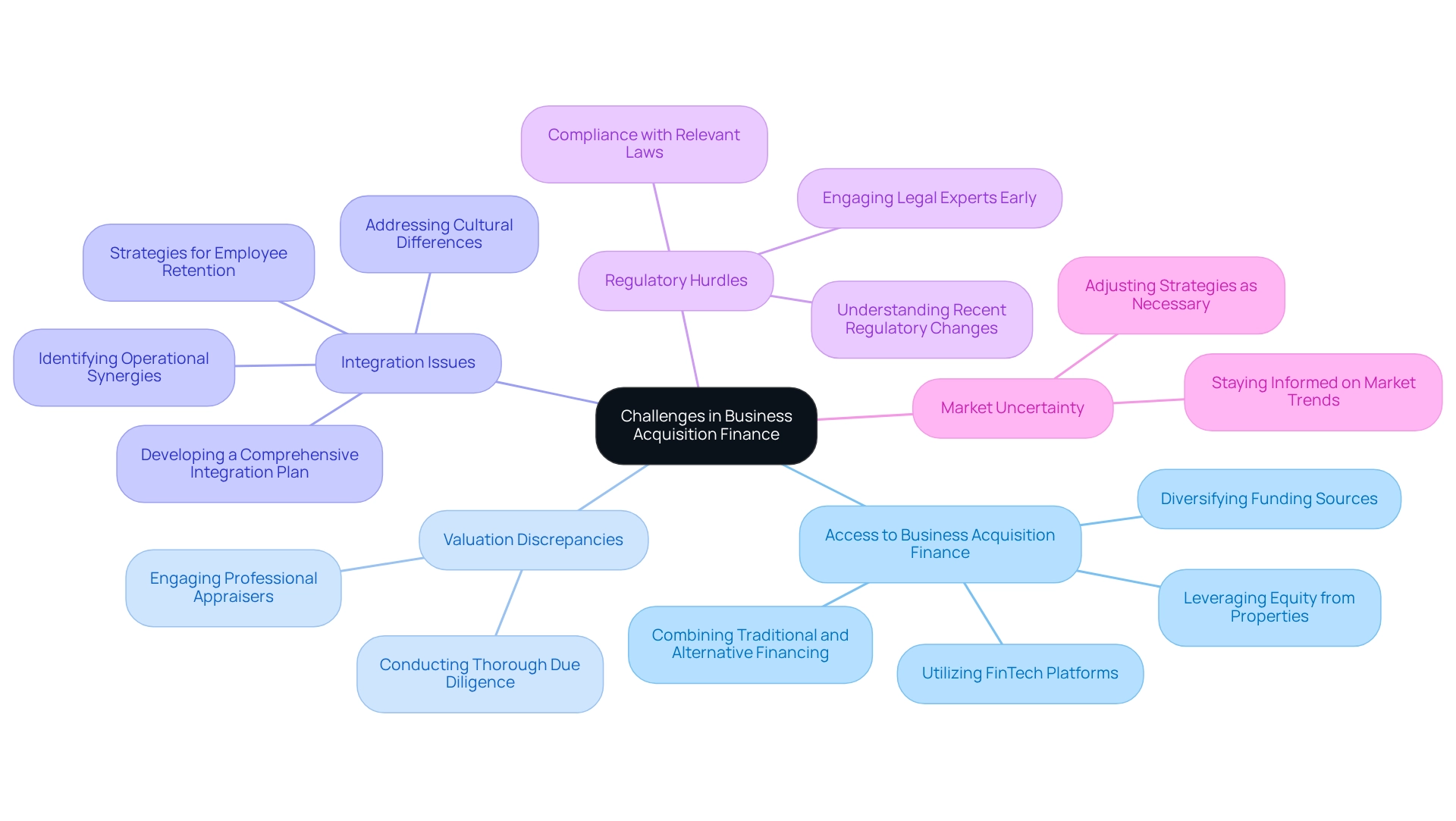

Challenges in Business Acquisition Finance and How to Overcome Them

Corporate purchase finance, particularly in the context of business acquisition finance in Australia, presents several significant challenges for small enterprises navigating this complex landscape. Understanding these obstacles and implementing effective strategies can greatly enhance the prospects of a successful business acquisition. Key challenges include:

-

Access to Business Acquisition Finance: Securing adequate funding remains a substantial hurdle for many small enterprises in Australia. To address this, diversifying funding sources is essential. For instance, when assessing a freehold property purchase, small business owners can leverage equity from existing properties.

If a commercial property is valued at $1 million, a lender may permit borrowing up to 70% of that value, equating to $700,000 towards the purchase. This indicates a required deposit of $300,000, along with an additional $400,000 for the business segment, totaling $700,000 needed for the acquisition. It is crucial to recognize that this total does not encompass other expenses, such as valuation, legal, and stamp duty fees.

Combining traditional bank loans with alternative options, such as equity funding or vendor support, can fortify business acquisition finance in Australia, establishing a more resilient financial foundation. Furthermore, FinTech platforms are emerging as alternatives to traditional banking, offering peer-to-peer lending solutions, albeit with higher credit risks despite potential cost savings.

-

Valuation Discrepancies: Disputes over the target company's valuation can hinder negotiations. To alleviate this concern, conducting thorough due diligence is imperative. Engaging professional appraisers can assist in determining a fair market value, facilitating smoother discussions between buyers and sellers.

-

Integration Issues: Post-acquisition integration frequently presents challenges that may disrupt operations. Developing a comprehensive integration plan is vital. This plan should address potential cultural differences, pinpoint operational synergies, and incorporate strategies for employee retention to ensure a seamless transition.

-

Regulatory Hurdles: The purchasing process can be complicated by various regulatory requirements. Engaging legal experts early in the process can help ensure compliance with all relevant laws and regulations, minimizing the risk of costly delays or penalties. Recent changes in the Australian thin-capitalization regime, effective from July 2023, limit income tax deductions for interest expenditure on highly geared groups, highlighting the importance of understanding business acquisition finance in Australia when planning acquisitions.

-

Market Uncertainty: Economic fluctuations can significantly impact funding options and the overall feasibility of a purchase. Staying informed about current market trends and being prepared to adjust strategies as necessary is crucial for managing these uncertainties.

In the Australian section of the Chambers Global Practice Guide for Purchase Finance (2023), Special Counsel Erin Cartledge emphasizes the importance of understanding key legal and practical factors in purchase finance, which can further aid small business owners in their purchasing strategies.

Moreover, a case study analyzing the limitations under the Corporations Act on obtaining substantial voting power illustrates the real-world implications of these challenges. Although stringent restrictions exist, approaches such as off-market takeover offers and schemes of arrangement present pathways for gaining control.

By proactively addressing these obstacles, owners can enhance their likelihood of securing the necessary funding and achieving a successful acquisition. Insights from financial advisors underscore the significance of strategic planning and adaptability in overcoming access to capital challenges, particularly within the realm of business acquisition finance in Australia, especially in the current economic climate. Furthermore, it is essential for small business owners to consider the potential risks associated with alternative funding options to ensure a comprehensive approach to their procurement strategies.

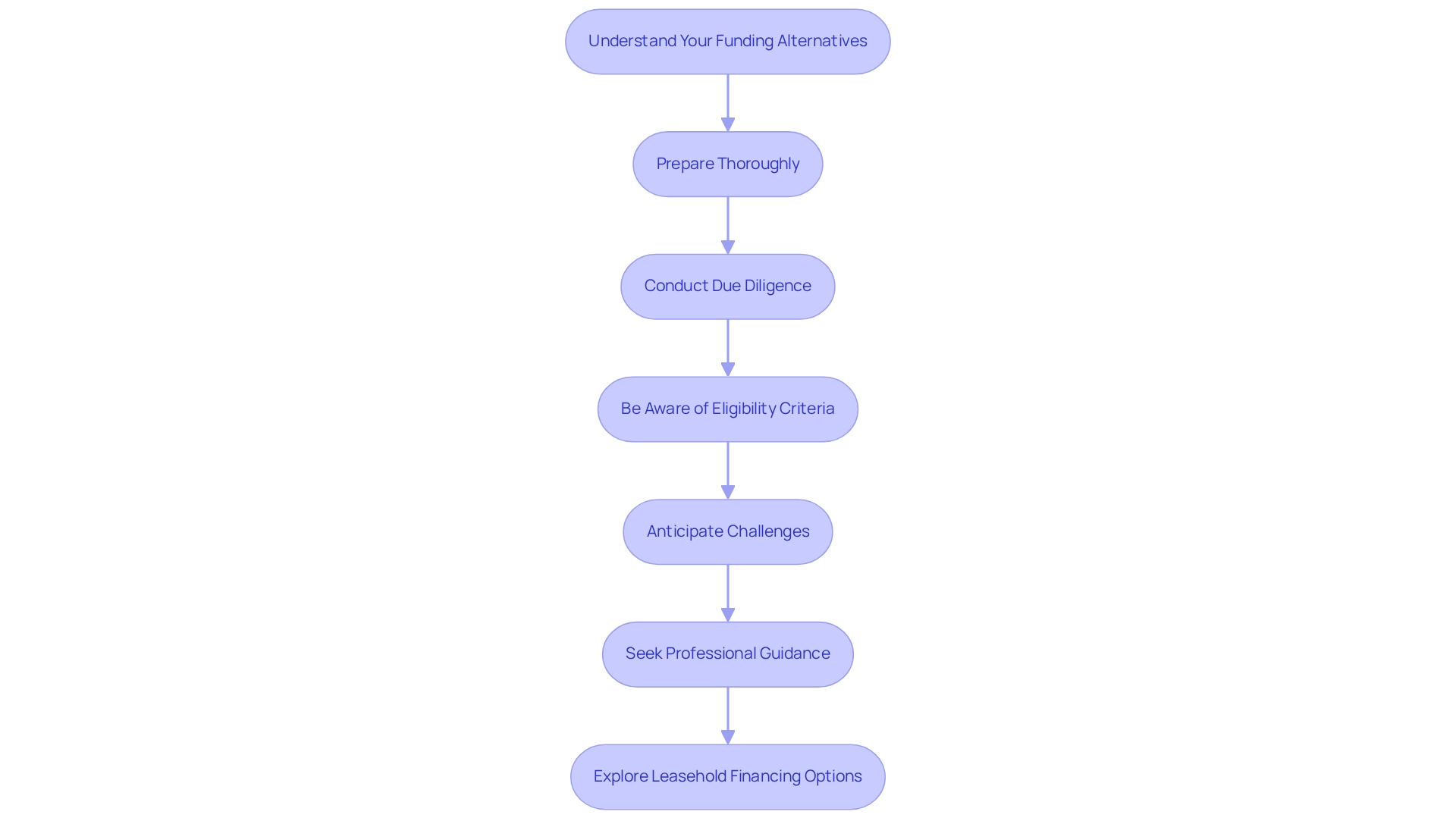

Key Takeaways for Successful Business Acquisition Financing

To successfully navigate the process of acquiring funds for a company, consider the following key takeaways:

-

Understand Your Funding Alternatives: Familiarize yourself with the various types of funding available, such as commercial loans and private equity, and choose the one that best aligns with your objectives. With corporate credit card expenditures in Australia hitting a record $8.64 billion in June 2024, comprehending your choices is more vital than ever. Finance Story provides customized mortgage brokerage solutions that can assist you in exploring a comprehensive portfolio of funding options, including access to private and boutique commercial investors.

-

Prepare Thoroughly: Ensure you have all necessary documentation, including detailed financial statements and a strong operational plan, to support your loan application. This preparation is essential, as companies that provide thorough documentation are more likely to obtain favorable funding conditions. At Finance Story, we specialize in creating polished and highly individualized business cases to present to lenders, enhancing your chances of approval.

-

Conduct Due Diligence: Perform comprehensive due diligence on the target company to identify potential risks and ensure a sound investment. This process not only protects your interests but also demonstrates to lenders that you are a responsible borrower. Comprehending the eligibility requirements for obtaining funding is crucial, as these may differ by lender.

-

Be Aware of Eligibility Criteria: Understand the eligibility requirements for securing financing, which may vary by lender. Preparing accordingly can significantly enhance your chances of approval. Finance Story's expertise in tailored loan proposals ensures that you meet the heightened expectations around securing business acquisition finance in Australia.

-

Anticipate Challenges: Be proactive in identifying potential challenges, such as market fluctuations or operational hurdles, and develop strategies to overcome them. This foresight can lead to a smoother procurement process and better outcomes. Our group at Finance Story is skilled at addressing these challenges, offering insights that can assist you in adjusting your model effectively.

-

Seek Professional Guidance: Consider collaborating with financial advisors, legal specialists, and seasoned consultants who can offer valuable insights and assist in navigating the complexities of finance related to company purchases effectively. As noted by Erin Cartledge, Special Counsel, in the Australian chapter of the Chambers Global Practice Guide for business acquisition finance Australia (2023), understanding the key legal and practical considerations is essential for success. Their expertise can be instrumental in avoiding common pitfalls and ensuring compliance with legal requirements.

-

Explore Leasehold Financing Options: If your enterprise operates within a lease or lacks a physical building, consider utilizing cash savings or the equity in any property you own. For example, if your residence is appraised at $1.3M with $300k owed, you could access $740k in equity to assist your venture purchase.

By adhering to these insights, entrepreneurs can improve their odds of obtaining the required funding and achieving successful purchases. In fact, recent statistics show that enterprises that involve professional advisors during the acquisition process experience a higher success rate in obtaining financing, highlighting the significance of expert guidance in today's competitive environment. A pertinent example is the case study of 'Bouncing Back – I Love Butter,' where country caterers Jess and Ben encountered substantial challenges but successfully adjusted their model with the assistance of their bank, showcasing resilience and innovation during difficult times.

Additionally, testimonials from satisfied clients like Natasha B from VIC highlight the positive impact of Finance Story's services, stating, 'I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey.

Conclusion

In the evolving landscape of Australian business, acquisition finance emerges as a pivotal element for entrepreneurs seeking to expand and innovate. By understanding various financing options—from traditional bank loans to vendor financing—business owners are equipped with essential tools to navigate this complex terrain. A strategic approach to financing, grounded in thorough due diligence and a robust understanding of eligibility criteria, significantly enhances the likelihood of successful acquisitions.

The increasing engagement of small and medium enterprises in acquisition finance signals a market shift, underscoring the necessity for astute financial planning. By leveraging available resources and grasping the intricacies of each financing option, businesses position themselves to capitalize on growth opportunities. The emphasis on preparation—ensuring comprehensive documentation and a solid business plan—cannot be overstated, as these factors directly influence lender confidence and the overall success of the acquisition process.

Ultimately, securing business acquisition finance requires careful consideration of challenges and proactive strategies. By seeking professional guidance and remaining adaptable in the face of market fluctuations, entrepreneurs can effectively navigate the complexities of acquisition finance. As the Australian business environment continues to evolve, staying informed and prepared will be essential for those looking to harness the power of acquisition finance to drive their growth ambitions.