Overview

The average interest rate on commercial property loans is shaped by multiple factors, including economic conditions, loan-to-value ratios, borrower creditworthiness, and lender policies. Understanding these elements is crucial as they directly impact borrowing costs. A strong credit profile and lower loan-to-value ratios often lead to more favorable interest rates. This underscores the significance of strategic financial planning for potential borrowers. Are you ready to assess your financial standing and explore how these factors can work in your favor?

Introduction

Understanding the financial landscape of commercial property loans is essential for investors eager to capitalize on real estate opportunities. As interest in commercial investments grows, borrowers can unlock significant advantages by comprehending average interest rates and the factors that influence them. However, with economic conditions in flux and lending criteria evolving, how can one effectively navigate this complex terrain to secure the most favorable financing terms? Delving into these dynamics not only uncovers the intricacies of commercial property loans but also empowers investors with the knowledge needed to make informed decisions in a competitive market.

Define Commercial Property Loans

A commercial real estate financing option represents a specialized solution tailored for the acquisition, development, or refinancing of commercial assets. Unlike residential mortgages, which are secured by homes, these financial products are backed by assets such as office buildings, retail spaces, warehouses, and industrial facilities. Given the heightened risk associated with commercial real estate, these financial agreements often entail unique conditions, rates, including the average interest rate on commercial property loan, and repayment arrangements.

At Finance Story, we offer access to a comprehensive range of lenders, including high street banks and innovative private lending panels, ensuring you discover the right financing solution tailored to your needs. Refinancing your commercial financing can also serve as a strategic move to adapt to your evolving business requirements.

Recent trends reveal a growing interest in commercial property investments, with real estate consistently yielding the highest returns and lowest risks compared to other asset classes. Financial specialists emphasize the importance of a robust credit rating and a substantial deposit—typically 20-30% of the purchase price—to secure a favorable average interest rate on commercial property loan. For example, consider the case of Brisbane business owner Janet, who successfully acquired an office building to expand her consultancy. With expert guidance, she navigated the complexities of the financing process and secured advantageous terms, showcasing the potential for growth through strategic real estate investments.

As industry leaders assert, 'Every person who invests in well-selected real estate adopts the surest method of becoming independent.' This underscores the significance of understanding commercial financing for investors and entrepreneurs aiming to leverage real estate for sustainable growth and expansion.

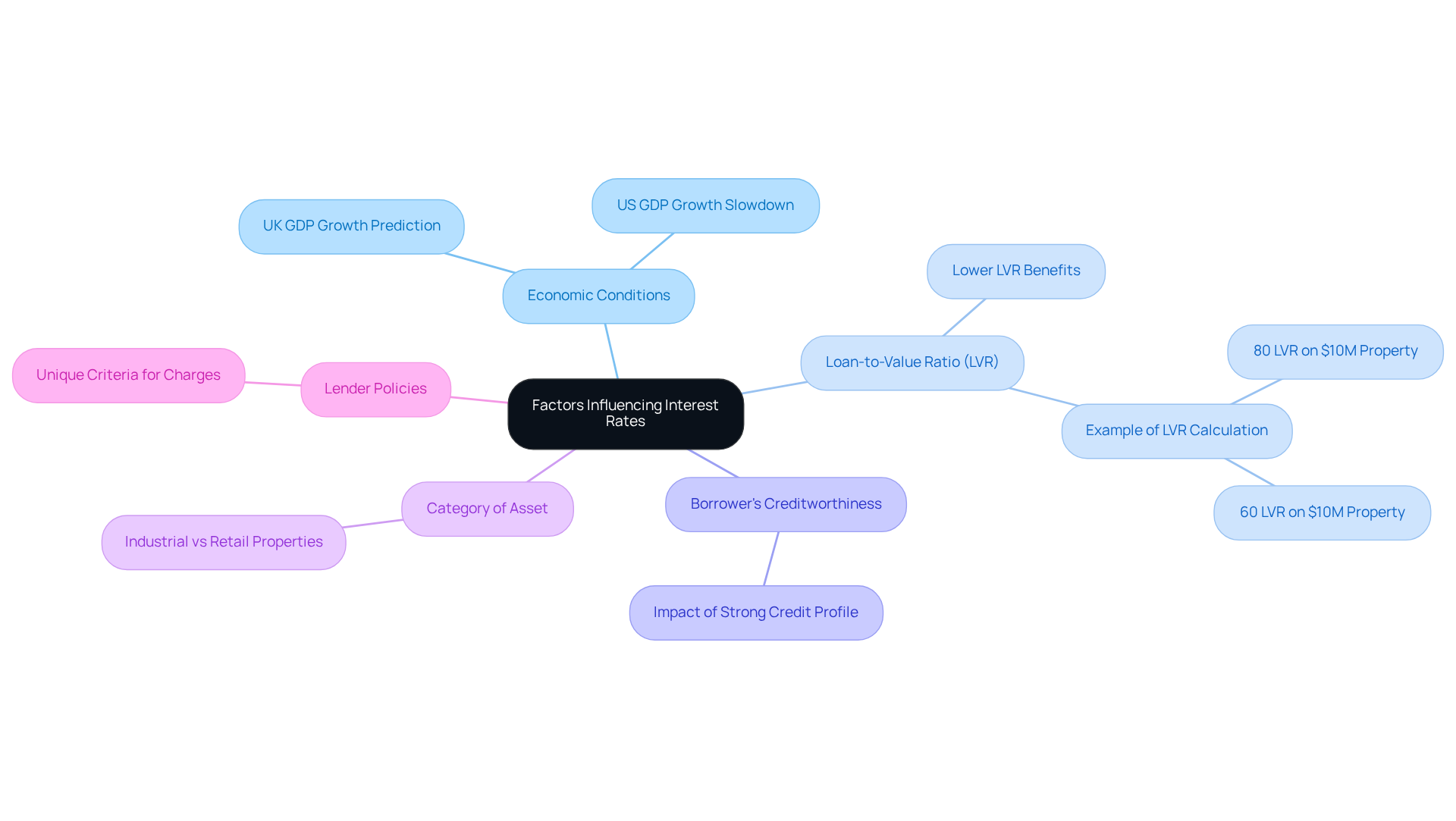

Explore Factors Influencing Interest Rates

Interest rates on commercial property loans are influenced by several key factors:

- Economic Conditions: The overall economic environment significantly influences borrowing costs. As economies rebound and GDP growth is expected to increase—like the predicted 1.2 percentage point rise in the UK in 2025—demand for borrowing generally surges, resulting in elevated charges. Conversely, when economic expansion decelerates, as anticipated in the US with a forecasted drop of 1.3 percentage points, borrowing costs may stabilize or reduce to encourage lending.

- Loan-to-Value Ratio (LVR): The LVR, which compares the borrowed amount to the asset's appraised value, is a significant factor influencing interest levels. A lower LVR indicates reduced risk for lenders, often leading to more advantageous terms. For instance, a property valued at $10 million with a $6 million loan results in a 60% LVR, which is considered lower risk compared to an $8 million loan (80% LVR) on the same property. This distinction can lead to reduced charges for borrowers with lower LVRs.

- Borrower's Creditworthiness: Lenders evaluate the credit history and financial stability of borrowers. A strong credit profile can secure more favorable terms, as lenders view these borrowers as lower risk.

- Category of Asset: Different commercial asset types attract varying interest levels depending on their perceived risk. For example, industrial real estate might be regarded more positively than retail locations, affecting the prices provided.

- Lender Policies: Each lender has unique criteria for determining charges, shaped by their risk appetite and prevailing market conditions. Understanding these policies can empower borrowers to negotiate better terms.

As the commercial real estate industry navigates elevated borrowing costs and economic uncertainties, insights from economists suggest that anticipated reductions in the average interest rate on commercial property loans could lead to lower financing expenses, improving asset valuations and boosting demand. This dynamic landscape underscores the importance of staying informed about economic trends and their effects on commercial borrowing interest rates.

Identify Types of Commercial Property Loans

Commercial property loans come in various forms, each tailored to meet specific financing needs:

- Standard Commercial Mortgages: These conventional funds are essential for acquiring commercial real estate, usually necessitating a down payment. They provide either fixed or variable financial charges, with the average interest rate on commercial property loan fluctuating according to market conditions.

- Construction Financing: Designed for funding the construction of new commercial structures or major renovations, these financial products typically carry elevated interest rates. Funds are disbursed in stages, aligning with construction progress, making them particularly suitable for developers.

- Bridge Financing: These short-term funds offer prompt capital until permanent financing is secured. They prove particularly useful in scenarios requiring quick access to capital, such as when a property is acquired before securing long-term financing.

- SBA Financing: Supported by the Small Business Administration, these financial products are intended to assist small enterprises in obtaining funding with advantageous conditions, frequently offering reduced down payments and extended repayment durations.

- Hard Money Loans: Typically offered by private lenders, these short-term loans are secured by real estate. They are frequently pursued when conventional funding alternatives are inaccessible due to credit issues or the state of the asset.

- Mezzanine Financing: This hybrid financing option combines debt and equity, often used to bridge the gap between senior debt and equity in larger commercial real estate transactions. It enables investors to utilize their capital while retaining an interest in the asset.

Understanding these financing types is crucial for navigating the commercial real estate landscape, especially as the average interest rate on commercial property loan is anticipated to fluctuate in 2025, reflecting ongoing market trends. Financial advisors emphasize the importance of selecting the appropriate financing option based on individual business requirements and current market conditions.

Apply Strategies to Secure Competitive Rates

To secure competitive interest rates on commercial property loans, consider these effective strategies:

- Enhance Your Credit Score: A higher credit score can significantly reduce interest costs. Regularly review your credit report for errors and take proactive steps to improve your score by paying down debts and ensuring timely payments. Studies indicate that even minor improvements in credit scores can lead to better loan terms.

- Explore Options: Different lenders offer various terms and conditions. By comparing multiple lenders, you can identify the best deal. Don’t hesitate to negotiate for more favorable terms; research shows that borrowers who compare options can save considerably on the average interest rate on commercial property loans.

- Provide a Strong Business Plan: A well-crafted business plan showcases your ability to repay the funds, making you a more appealing borrower. This can be particularly beneficial in securing improved terms from lenders.

- Consider a Larger Down Payment: A larger down payment reduces the amount borrowed and enhances your loan-to-value ratio (LVR), potentially resulting in better interest terms. Most lenders typically require a deposit of 20-30% for commercial property financing, which is often influenced by the average interest rate on commercial property loans.

- Leverage Existing Relationships: If you have a positive history with a bank or lender, use that relationship to negotiate better terms. Providers are often more inclined to offer attractive terms to long-standing clients.

- Stay Updated on Market Trends: Understanding current market conditions and interest trends can help you time your loan application effectively. Monitoring economic indicators can provide leverage in negotiations, ensuring you secure the best possible rates.

Conclusion

Understanding the average interest rate on commercial property loans is essential for investors eager to harness the potential of real estate. By grasping the nuances of these financial products—such as the various types of loans available and the factors influencing interest rates—borrowers can position themselves to make informed decisions that align with their investment goals.

Several key factors affect the average interest rate on commercial property loans, including:

- Economic conditions

- Loan-to-value ratios

- Borrower creditworthiness

- Lender policies

Each element significantly influences the terms and costs associated with financing commercial real estate. Strategies like enhancing credit scores, exploring multiple lending options, and providing a robust business plan can empower borrowers to secure more favorable rates.

Navigating the commercial property loan landscape demands a proactive approach and a keen understanding of market dynamics. As interest rates are anticipated to fluctuate in the coming years, staying informed about trends and employing effective strategies can lead to substantial savings and enhanced investment opportunities. Investors are encouraged to leverage this knowledge to make strategic decisions that will foster growth and success in their commercial real estate ventures.