Overview

This article serves as a comprehensive guide for mastering commercial loans in Perth. It details various types of loans, necessary documentation, and the application process, ensuring that readers are well-informed. Understanding loan types is crucial; thorough preparation of applications can significantly improve the chances of securing favorable financing terms. Additionally, it addresses common challenges that borrowers face. Supported by expert insights and practical strategies, this guide aims to equip readers with the knowledge they need to navigate the lending landscape confidently.

Introduction

In the dynamic world of business financing, understanding commercial loans is crucial for entrepreneurs aiming to fuel growth and navigate financial challenges. With a variety of loans available—from commercial property loans to equipment financing—business owners must grasp the intricacies of each option to make informed decisions. As trends evolve, particularly in Australia, the landscape of commercial loans reflects a shift towards more flexible financing solutions that cater to the unique needs of small businesses.

This article delves into the essential aspects of commercial loans, guiding readers through the types available, the documentation required, the application process, and strategies to overcome common hurdles in securing funding. By equipping themselves with this knowledge, business owners can enhance their chances of obtaining the financial support necessary to thrive in a competitive market.

Understand Commercial Loans and Their Types

Commercial financing is a crucial financial offering designed to assist with diverse enterprise activities, such as property acquisition, equipment purchases, and cash flow management. In 2025, the landscape of commercial loans in Australia reflects significant trends and statistics that small business owners must consider:

- Commercial Property Loans: Specifically designed for purchasing or refinancing commercial real estate, these loans typically use the property itself as collateral. Recent data indicates that approximately 40% of enterprises utilize property financing to grow operations or invest in real estate. Key characteristics often include flexible repayment conditions and the capability to fund up to 80% of the property's worth. Finance Story specializes in crafting polished and highly tailored cases to present to banks, thereby enhancing the likelihood of securing favorable terms.

- Commercial Financing: These general-purpose funds address a wide array of operational expenses, from daily costs to expansion initiatives. Such funds are essential for companies aiming to grow without the constraints of specific usage conditions. It's important to note that interest rates on commercial financing are typically higher than those on residential mortgages, which can impact overall funding expenses.

- Equipment Financing: Designed for the purchase of equipment, these loans often feature terms that align with the equipment's useful life, making them a practical choice for enterprises needing to upgrade or expand operational capabilities.

- Lines of Credit: Offering flexibility, lines of credit allow companies to access funds as necessary, making them ideal for managing cash flow variations. This form of financing is increasingly popular among small enterprises, providing a safety net for unforeseen costs.

- SBA Financing: These government-supported funds present advantageous conditions for small enterprises, often requiring less collateral than conventional financing. They are particularly beneficial for startups and companies looking to establish a solid financial foundation.

Understanding these types of commercial loans in Perth is essential for making informed decisions that align with your objectives and financial circumstances. Recent trends reveal that companies are increasingly seeking financiers who do not mandate annual evaluations, as highlighted in the case study 'Choosing Financiers Without Annual Reviews.' This study connects clients with smaller, specialized providers that offer more adaptable financing options. By submitting a robust loan application that emphasizes critical details, organizations can enhance their chances of obtaining favorable terms.

As industry expert Alston Soff points out, "All any creditor wants to do is ensure they provide funds to the appropriate individual who will repay their obligation, as that’s how they earn their profit." This insight underscores the necessity of demonstrating reliability and a clear repayment strategy, fostering a mutually beneficial relationship. Furthermore, Finance Story provides access to a diverse array of lenders, ensuring that companies can discover financing solutions tailored to their specific requirements.

Gather Required Documentation and Eligibility Criteria

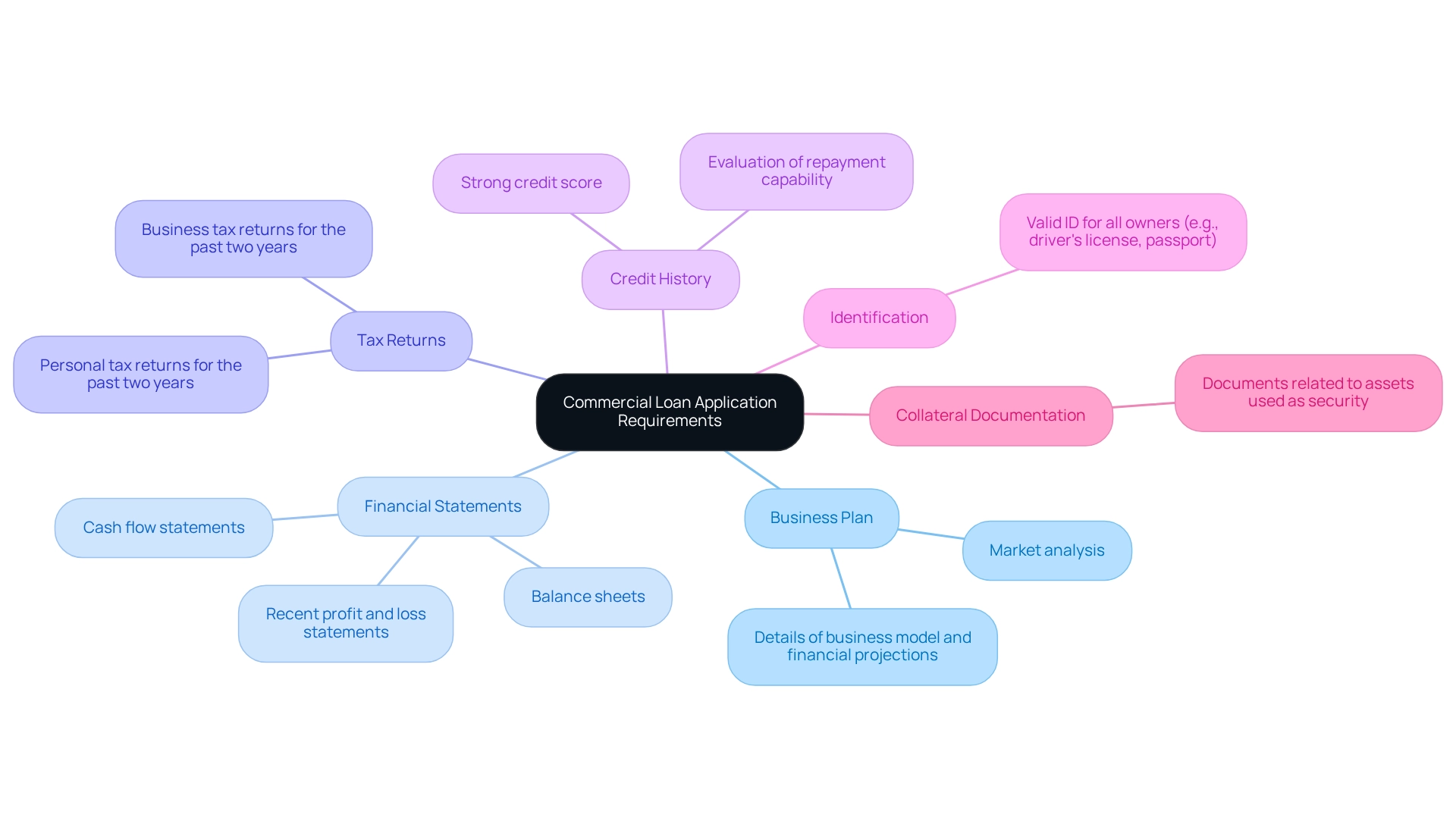

To successfully apply for commercial loans in Perth, compiling specific documentation and meeting defined eligibility criteria is essential. Here’s a comprehensive list of what you typically need:

- Business Plan: A thorough document detailing your business model, market analysis, and financial projections is crucial for demonstrating your strategic vision. Studies indicate that enterprises with comprehensive plans have a higher success rate in securing funding.

- Financial Statements: Recent profit and loss statements, balance sheets, and cash flow statements are necessary to showcase your company's financial health and operational performance.

- Tax Returns: Personal and business tax returns for the past two years are required to verify income and establish financial stability.

- Credit History: A strong credit score is vital; lenders will scrutinize your credit history to evaluate risk and repayment capability. Understanding your credit profile can greatly influence your financing terms and rates.

- Identification: Valid identification for all owners, such as a driver’s license or passport, is needed to confirm identity.

- Collateral Documentation: If relevant, include documents associated with the assets you plan to use as security for the financing.

It is crucial to verify that all documents are up to date and accurately represent your organization's status. This attention to detail can significantly improve your chances of approval. Financial consultants suggest that applicants concentrate on providing clear and organized documentation to simplify the evaluation procedure and enhance their qualifications for commercial loans in Perth.

As Anna Bligh, CEO of the Australian Banking Association, stated, "We will deliver high customer service and standards," highlighting the significance of clear communication with financial partners. Furthermore, collaborating with specialists such as Finance Story can offer customized funding proposals that address the changing requirements of your business, guaranteeing you obtain the most advantageous financing choices accessible. Finance Story provides access to a comprehensive selection of financial institutions, including high street banks and creative private funding groups, to support various business properties such as warehouses, retail spaces, factories, and hospitality enterprises.

Navigate the Application Process for Commercial Loans

Navigating the application process for business financing can be intricate; however, following these steps can significantly simplify your experience:

- Research Financial Institutions: Start by identifying organizations that offer commercial financing tailored to your needs. Compare interest rates, terms, and associated fees to find the best fit. Remember, with 10 partners able to use limited data for content selection, thorough research is crucial for making informed decisions.

- Prepare Your Application: Accurately complete the loan application form, ensuring that all information aligns with your supporting documentation.

- Submit Documentation: Alongside your application, submit all necessary documentation. Organize and label everything clearly to facilitate the review process.

- Interview with Financier: Be prepared for a conversation with the financier, either in person or via phone, where they may inquire about your business operations and financial status. Loan Approval Process: Once submitted, the financial institution will evaluate your application and documentation. This review period can range from a few days to several weeks, depending on the lender's processes.

- Finalizing the Financing: Upon approval, you will receive a financing agreement. Take the time to review the terms thoroughly before signing, ensuring you fully understand your repayment obligations.

To enhance your chances of securing the financing you need, consider scheduling a free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy. He can offer customized financial strategies and insights into repayment criteria, ensuring you are well-prepared for the application process. By adhering to these steps and creating a list of crucial and preferred characteristics for your business financing, you can navigate the application process more efficiently.

Troubleshoot Common Challenges in Securing Loans

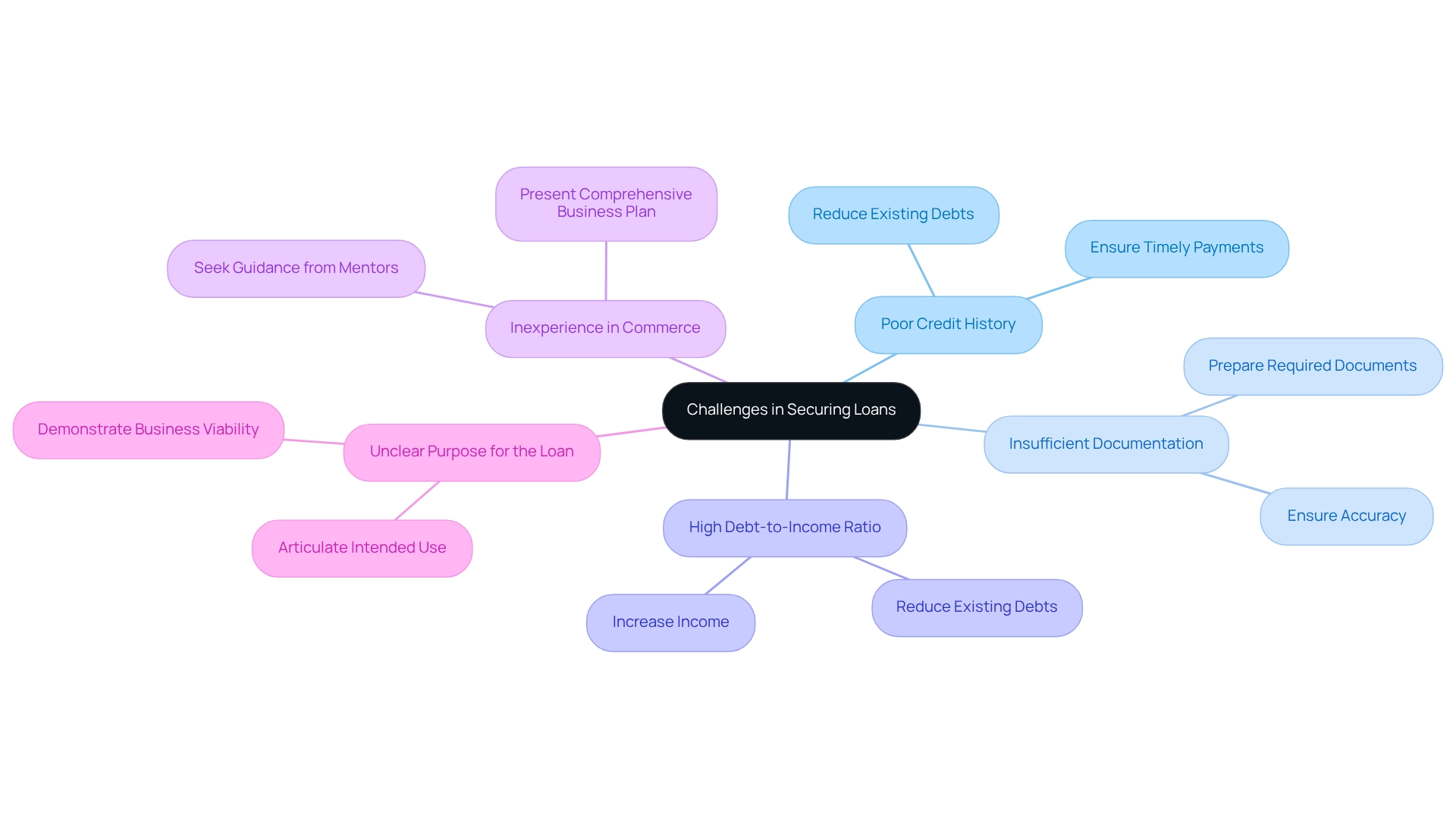

Navigating the landscape of commercial loans in Perth can indeed pose several challenges. Understanding these common issues and employing effective strategies to address them is essential for success.

- Poor Credit History: A low credit score can significantly impede your loan application. To enhance your credit standing, concentrate on reducing existing debts and ensuring timely payment of all bills. Research indicates that consistent punctual payments can elevate your credit score by as much as 100 points over time, thereby considerably increasing your chances of approval.

- Insufficient Documentation: Incomplete or inaccurate documentation often leads to delays in the application process. It is crucial to ensure that all required documents are meticulously prepared and accurately filled out. Such attention to detail can facilitate a smoother approval process.

- High Debt-to-Income Ratio: Lenders typically favor applicants with a lower debt-to-income ratio. If yours is on the higher side, consider strategies to reduce your existing debts or explore avenues to increase your income before applying. A lower ratio can significantly enhance your approval prospects. As of 2025, a debt-to-income ratio exceeding 40% may considerably diminish your chances of securing a loan.

- Inexperience in Commerce: New entrepreneurs may be perceived as a higher risk by creditors. To fortify your application, present a comprehensive business plan and seek guidance from seasoned mentors. Demonstrating a clear understanding of your market can bolster the confidence of financial institutions in your venture.

- Unclear Purpose for the Loan: Clearly articulating your intended use of the loan funds is paramount. A well-defined purpose can enhance your business's perceived viability and persuade financiers of your commitment to success.

As financial analyst Harrison Astbury aptly notes, "High interest rates put the kibosh on the litany of cashback offers out there, but there are still a number of institutions offering competitive rates." By proactively addressing these challenges and preparing thoroughly, you can significantly improve your chances of obtaining commercial loans in Perth.

Moreover, Finance Story specializes in developing refined and highly personalized business cases for banks, ensuring that your funding proposal aligns with the elevated standards of financial institutions. They provide a diverse array of lenders suited to various circumstances, whether you are acquiring a warehouse, retail premise, factory, or hospitality venture. Additionally, Finance Story offers financial hardship arrangements for clients temporarily unable to meet their repayment obligations, including options such as deferring payments or adjusting loan terms to assist clients in regaining financial stability.

Conclusion

Understanding commercial loans is vital for entrepreneurs aiming to drive growth and tackle financial challenges in today’s competitive landscape. This article explores the various types of commercial loans available, including:

- Commercial property loans

- Business loans

- Equipment financing

- Lines of credit

- SBA loans

Each is tailored to meet the diverse needs of small businesses. By grasping the unique features and benefits of these financing options, business owners can make informed choices that align with their goals.

Furthermore, the importance of thorough documentation and meeting eligibility criteria cannot be overstated. A well-prepared business plan, accurate financial statements, and a solid credit history are essential for enhancing the likelihood of loan approval. Navigating the application process may seem daunting; however, by following a structured approach and leveraging expert guidance, such as that offered by Finance Story, entrepreneurs can streamline their efforts and improve their chances of securing the necessary funding.

Finally, addressing common challenges—such as poor credit history, insufficient documentation, and unclear loan purposes—can significantly impact the success of securing a commercial loan. By proactively tackling these issues and presenting a compelling case to lenders, businesses can foster stronger relationships with financial institutions. Ultimately, the insights shared in this article empower business owners to approach commercial loans with confidence, ensuring they have the financial support needed to thrive and succeed in their respective markets.