Overview

Self Managed Super Funds (SMSFs) empower small business owners to borrow for investment purposes, particularly through Limited Recourse Borrowing Arrangements (LRBAs). These arrangements enable the fund to acquire assets while limiting the lender's recourse to those specific assets. Understanding the borrowing rules and associated risks—such as market and regulatory risks—is crucial. This knowledge not only ensures compliance but also optimizes investment strategies effectively.

Are you aware of how these borrowing options could enhance your investment portfolio? By leveraging SMSFs and LRBAs, you can strategically position your assets for growth. However, it is essential to navigate the complexities of borrowing regulations and market dynamics. This approach will help you mitigate risks and maximize your investment potential.

In conclusion, taking the time to understand SMSFs and their borrowing capabilities can significantly impact your financial future. Equip yourself with the right knowledge to make informed decisions and take action towards a more prosperous investment strategy.

Introduction

In the realm of retirement planning, Self Managed Super Funds (SMSFs) have emerged as a powerful tool for Australians seeking greater control over their financial futures. These privately managed superannuation funds not only offer flexibility in investment choices—from property to shares—but also present unique borrowing capabilities through Limited Recourse Borrowing Arrangements (LRBAs). As SMSFs continue to capture a significant portion of the nation’s superannuation wealth, understanding the intricacies of their borrowing potential becomes crucial for maximizing retirement savings.

This article delves into the various aspects of SMSF borrowing, including:

- The rules and restrictions governing it

- The types of loans available

- The risks involved

By providing valuable insights, we aim to equip you with the knowledge necessary to navigate this complex financial landscape effectively.

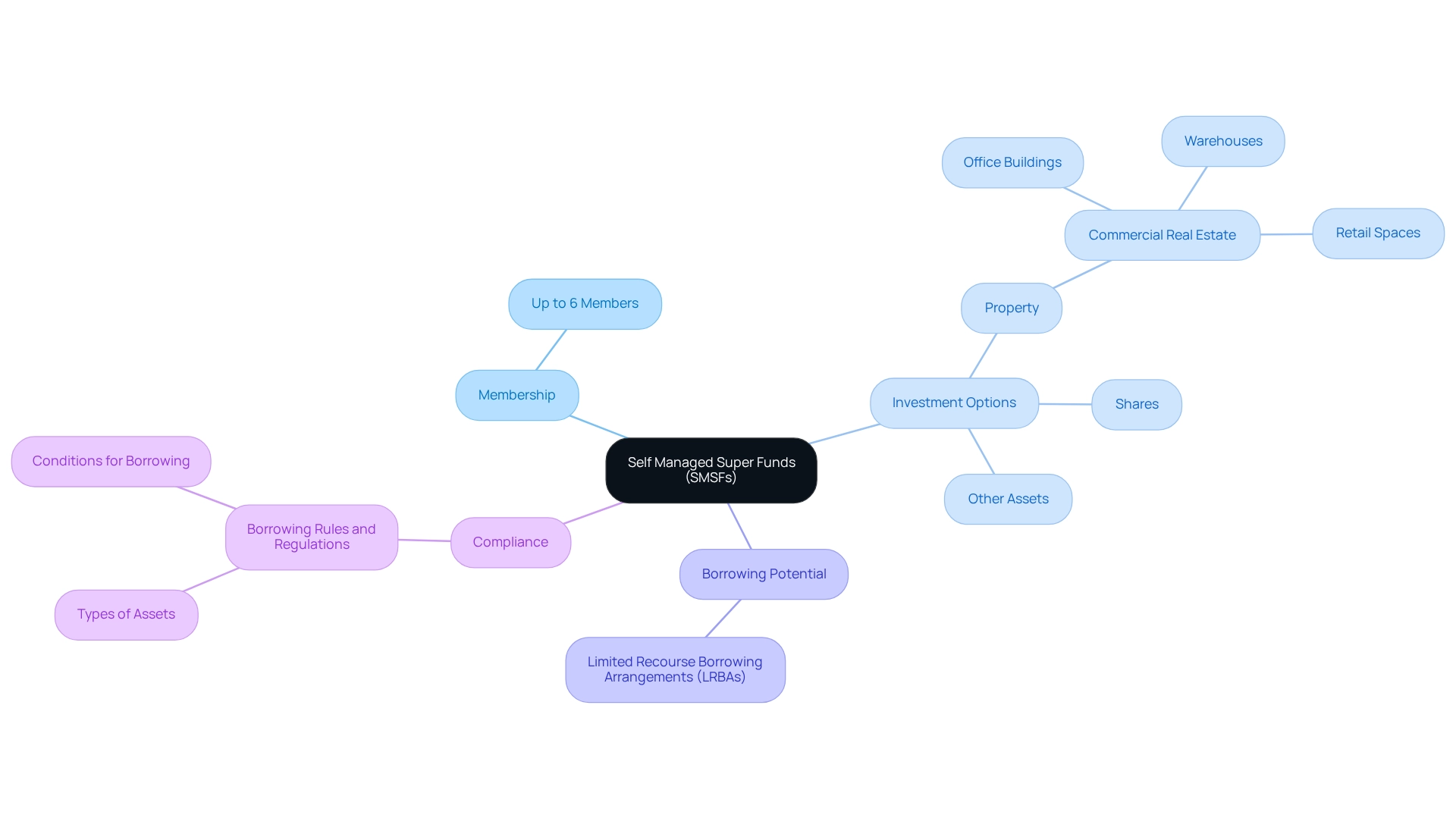

Define Self Managed Super Funds and Their Borrowing Potential

A Self Managed Super Fund (SMSF) is a private superannuation fund that individuals manage themselves, granting them significant control over their retirement savings. With the capacity to include up to six members, SMSFs provide remarkable flexibility in investment options, encompassing property, shares, and other assets. Furthermore, SMSFs can utilize borrowing options under the self managed super fund borrowing rules via Limited Recourse Borrowing Arrangements (LRBAs), enabling them to invest in assets that may otherwise be financially unattainable. This borrowing capacity greatly enhances the growth opportunities of the fund and aids in accumulating more considerable retirement savings.

As of mid-2023, SMSFs represented roughly one quarter of the $3.6 trillion in superannuation wealth owned by Australians, highlighting their significance in the financial landscape. SMSFs can be especially beneficial for allocating resources in commercial real estate, such as office buildings, warehouses, and retail spaces, due to fewer limitations compared to residential real estate. Finance Story is here to assist you in compliance and securing the right lender for your commercial real estate needs. The ability to borrow not only enhances portfolio diversification but also aligns with the increasing trend of SMSFs pursuing creative methods to maximize returns. However, it is crucial for SMSF trustees to fully understand the self managed super fund borrowing rules to ensure compliance and avoid potential penalties. This includes adhering to the self managed super fund borrowing rules that outline the types of assets that can be purchased and the conditions under which borrowing is permitted. By ensuring that the fund remains within the legal framework, trustees can optimize their investment strategy effectively.

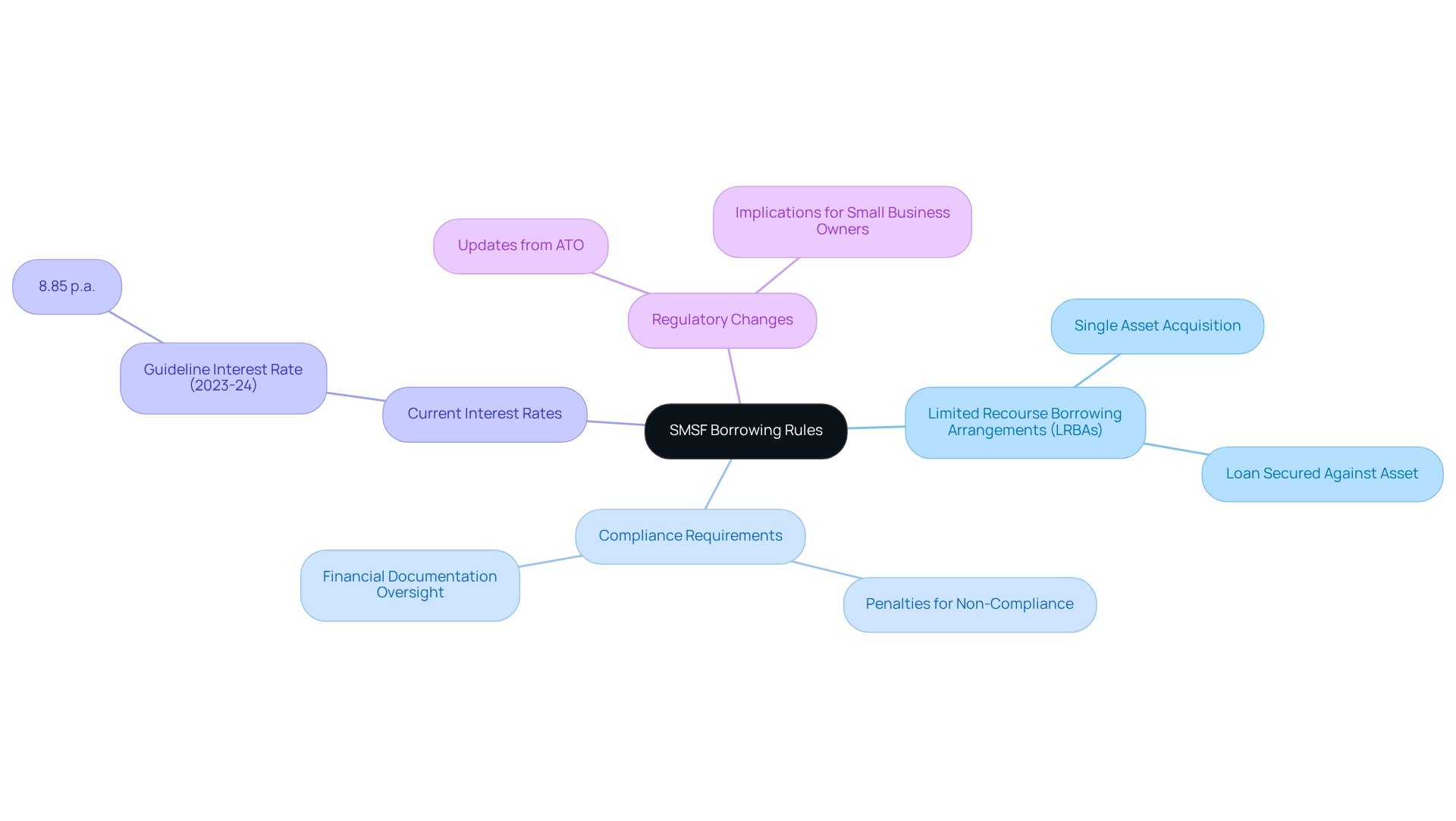

Explore SMSF Borrowing Rules and Restrictions

Self-managed super fund borrowing rules are governed by stringent regulations established by the Australian Taxation Office (ATO) to safeguard retirement savings and mitigate excessive leverage. Here are the key self-managed super fund borrowing rules:

- Limited Recourse Borrowing Arrangements (LRBAs) allow self-managed superannuation funds to borrow funds to acquire a single asset, such as real estate, with the loan secured solely against that asset.

- This arrangement protects other self-managed superannuation fund assets in the event of a loan default, aligning with the self-managed super fund borrowing rules that stipulate borrowing limits, short-term borrowing provisions, and in-house asset restrictions.

- In 2023-24, the guideline interest rate for property LRBAs was approximately 8.85% p.a., reflecting the current borrowing landscape.

- It is vital for trustees to stay informed about modifications in tax regulations to maximize benefits and ensure compliance.

- For instance, a case study on self-managed super fund borrowing rules illustrates that while these funds can borrow under specific conditions, non-compliance can lead to significant penalties.

- A specialist perspective indicates that managing a self-managed super fund with real estate resembles operating a small enterprise, necessitating meticulous oversight of financial documentation and adherence to regulations.

- As the ATO continues to revise its regulations in 2025, understanding the self-managed super fund borrowing rules will be imperative for small business owners looking to leverage self-managed super funds for real estate and business acquisitions.

Finance Story is here to support you in forming a robust compliance strategy and identifying the right lender for your SMSF commercial real estate endeavors. BOOK A CHAT.

Understand Types of SMSF Loans and Application Processes

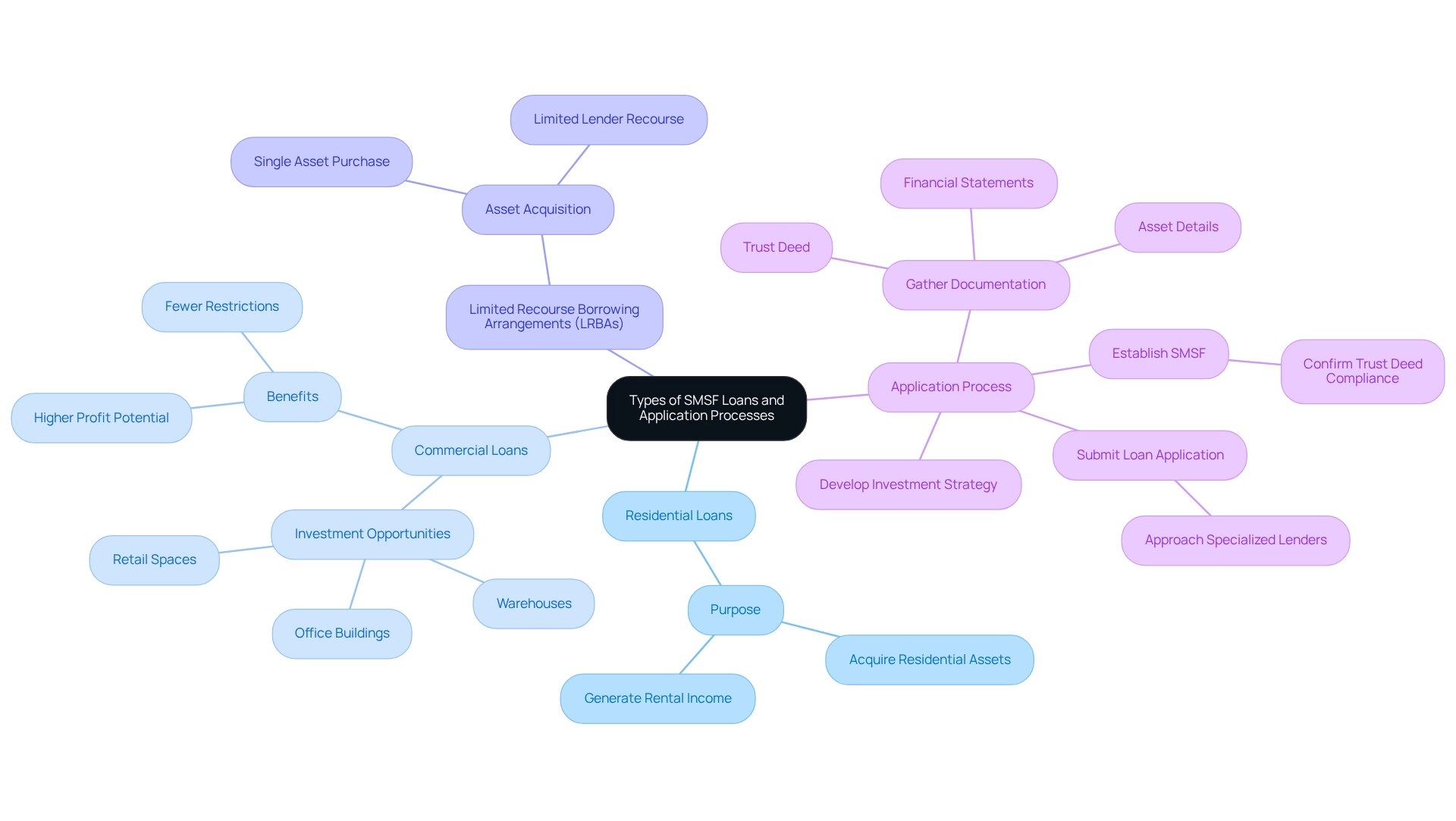

Self Managed Superannuation Funds offer a range of loan options for small business proprietors, in accordance with self managed super fund borrowing rules. The primary classifications include:

- Residential Loans: These loans enable self-managed super funds to acquire residential assets for financial gain, providing a reliable income source through rental returns.

- Commercial Loans: Investing in commercial assets can yield higher profits, making this an attractive choice for self-managed super funds aiming to diversify their portfolios. These funds can utilize their resources to invest in commercial real estate such as office buildings, warehouses, and retail spaces, benefiting from fewer restrictions compared to residential real estate ventures due to self managed super fund borrowing rules. Finance Story can assist in building a robust case for compliance and in finding the right lender for your commercial investment property.

- Limited Recourse Borrowing Arrangements (LRBAs): This popular borrowing method, in accordance with self managed super fund borrowing rules, allows self-managed super funds to acquire a single asset while limiting the lender's recourse solely to that asset, thereby protecting the fund's other assets.

As we approach 2025, the landscape of self-managed super fund loans is evolving. Over 80,000 members are expected to have balances exceeding $3 million by mid-2024, indicating a growing interest in utilizing self-managed super funds for property investments. This trend underscores the importance of understanding the various types of self managed super fund borrowing rules and their associated application procedures.

To successfully apply for a self-managed superannuation fund loan, consider the following steps:

- Establish your self-managed super fund by confirming that it is appropriately set up with a trust deed that complies with self managed super fund borrowing rules.

- Develop an Investment Strategy: Clearly articulate how the loan aligns with your overall investment objectives.

- Gather Required Documentation: Assemble essential documents, including the self-managed superannuation fund trust deed, financial statements, and asset details.

- Submit Loan Application: Approach lenders specializing in self-managed super fund loans and submit your application along with the necessary documentation.

Staying informed about the average interest rates for self-managed super fund loans in Australia, which are projected to fluctuate in 2025, is vital for making informed financial decisions. Moreover, seeking professional guidance is advisable to ensure compliance with the self managed super fund borrowing rules, especially given the complexities associated with real estate strategies. Case studies on self-managed superannuation fund residential real estate loans and examples of successful self-managed superannuation fund commercial real estate ventures can offer valuable insights into effective borrowing practices.

Assess Risks and Considerations in SMSF Borrowing

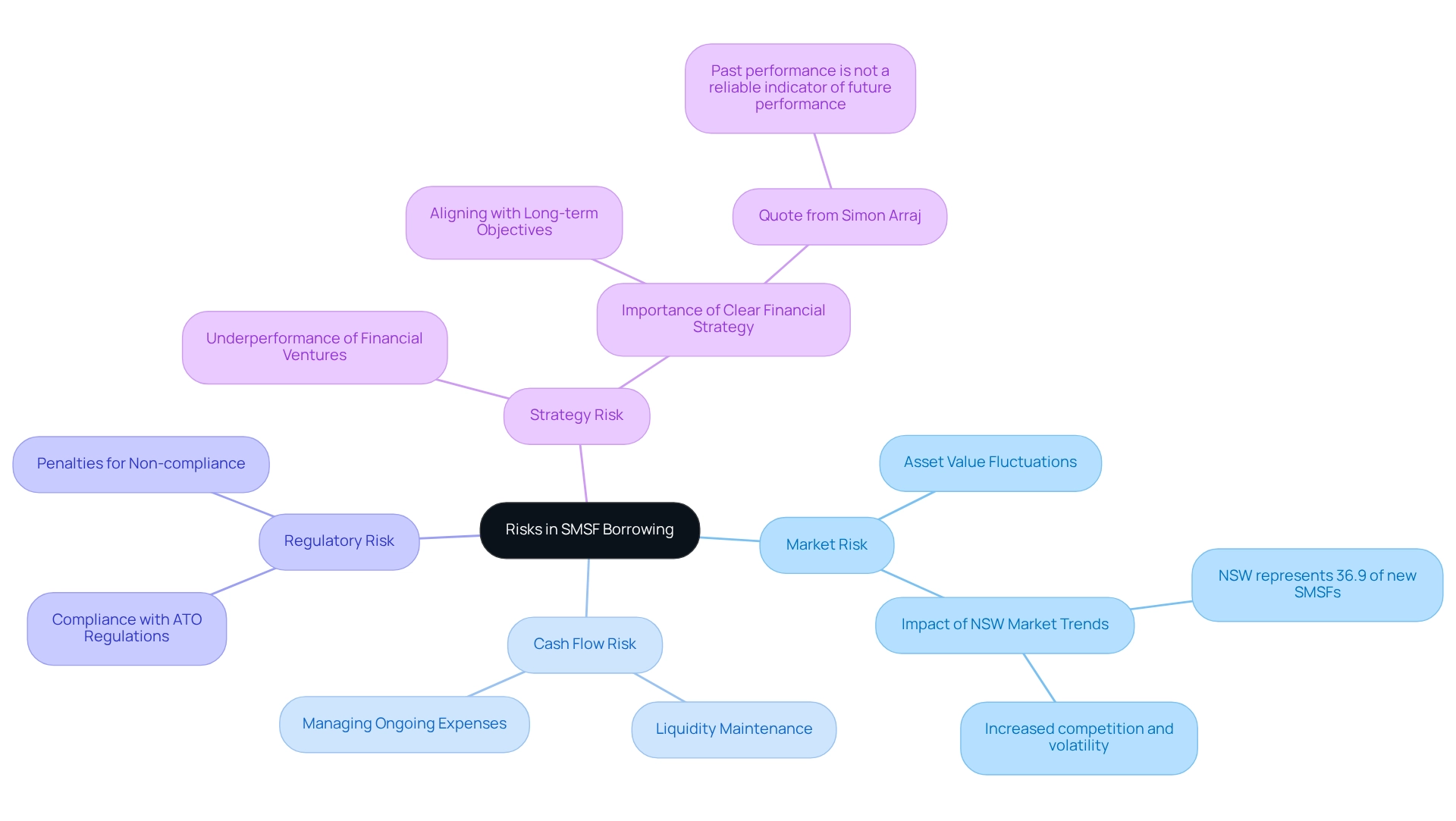

While SMSF borrowing can unlock substantial investment opportunities, it is essential to recognize the inherent risks involved:

- Market Risk: The value of the asset acquired may decline, adversely affecting the overall performance of the SMSF. Recent trends indicate that fluctuations in the property market can significantly impact asset values, necessitating careful market analysis. Notably, New South Wales (NSW) now represents 36.9% of new self-managed super funds, highlighting a significant change in state-wise allocation. This trend may affect market risk for self-managed superannuation fund investments, as increased activity in one region could lead to heightened competition and volatility.

- Cash Flow Risk: SMSFs must maintain adequate liquidity to meet loan repayments and other financial obligations. Insufficient cash flow can lead to difficulties in managing ongoing expenses, which is critical for sustaining the fund's health.

- Regulatory Risk: Adherence to ATO regulations is paramount; non-compliance can result in severe penalties, including the potential loss of tax concessions. Staying informed about regulatory changes is essential for superannuation fund trustees.

- Strategy Risk: If a financial venture underperforms, it could jeopardize the retirement savings of fund members. A clearly outlined financial strategy that aligns with the fund's long-term objectives is essential to reduce this risk. As Simon Arraj, Founder and Responsible Manager, aptly states, "Past performance is not a reliable indicator of future performance," emphasizing the importance of careful financial planning.

Given these risks, performing comprehensive due diligence and obtaining expert guidance is essential before participating in the self managed super fund borrowing rules. Understanding these factors can help small business owners navigate the complexities of SMSF investments effectively. Finance Story's reputation for professionalism and its access to a comprehensive portfolio of private and boutique commercial investors position it as a valuable partner in this journey, ensuring tailored lending solutions that meet the unique needs of each client.

Conclusion

Understanding the intricacies of Self Managed Super Funds (SMSFs) and their borrowing potential is vital for anyone looking to optimize their retirement savings. SMSFs provide a remarkable degree of control over investment choices, allowing members to diversify their portfolios through various asset classes, including property and shares. Furthermore, the ability to utilize Limited Recourse Borrowing Arrangements (LRBAs) enhances the appeal of SMSFs, enabling members to invest in high-value assets while protecting the fund's other investments.

However, navigating SMSF borrowing comes with its own set of rules and restrictions that must be adhered to. From the limits on borrowing amounts to the specific conditions under which loans can be obtained, understanding these regulations is essential for compliance and to avoid penalties. Additionally, the types of loans available—ranging from residential to commercial property loans—offer different benefits and risks that require careful consideration.

While the potential for significant returns exists, it is crucial to assess the associated risks, including market fluctuations, cash flow management, and regulatory compliance. A well-defined investment strategy aligned with long-term goals can mitigate these risks, emphasizing the importance of thorough planning and professional guidance.

As SMSFs continue to grow in popularity, the landscape of borrowing is evolving. Staying informed about changes in regulations and market conditions will empower trustees to make sound financial decisions. By leveraging the opportunities and navigating the challenges of SMSF borrowing wisely, individuals can enhance their financial futures and work towards a more secure retirement.