Overview

This article presents an authoritative step-by-step guide for mastering the owner-occupied commercial loan process, emphasizing preparation, application, and common pitfalls to avoid. It highlights the critical importance of:

- Meticulous documentation

- A clear understanding of eligibility criteria

- The selection of the right lender

By focusing on these elements, businesses can significantly enhance their chances of securing favorable financing for purchasing or refinancing their operational premises.

Introduction

Navigating the world of owner-occupied commercial loans can be a daunting task for business owners eager to secure a space for their operations. These loans not only provide favorable terms compared to traditional investment property financing, but they also present a unique opportunity for businesses to lower costs and build equity. However, the path to approval is fraught with challenges, from understanding eligibility criteria to avoiding common pitfalls.

What essential steps must be taken to master the owner-occupied commercial loan process and ensure a successful application?

Understand Owner-Occupied Commercial Loans

Owner occupied commercial loans are designed for businesses looking to buy or refinance spaces intended for their own use. This type of financing, an owner occupied commercial loan, typically offers more favorable conditions than investment property financing, as lenders perceive it as lower risk. Key features include:

- Lower Interest Rates: Owner-occupied commercial loans generally have interest rates ranging from 2% to 6% per annum. These rates are influenced by factors such as credit history and financial health. This competitive framework can significantly reduce total borrowing costs for businesses.

- Higher Loan-to-Value Ratios (LVR): Many lenders allow for higher LVRs. Recent data shows that 32% of new loans had an LVR of 80% or more, enabling companies to secure a larger portion of the property's value and facilitating easier access to financing.

- Tax Advantages: Businesses can often deduct mortgage interest as an operational expense, leading to substantial tax savings over time.

These benefits make owner occupied commercial loans an attractive option for businesses aiming to establish or expand their operational premises. For example, a small business owner replacing rented space with a purchased property can enjoy lower monthly repayments and increased equity in their assets.

Finance Story specializes in creating refined and highly customized business cases to present to financiers, ensuring that small business owners navigate the complexities of obtaining funding effectively. We collaborate with a diverse range of lenders, including high street banks and innovative private lending panels, to offer tailored solutions that address your specific needs. Understanding these facets is crucial for making informed financing decisions.

Prepare Your Documentation and Meet Eligibility Criteria

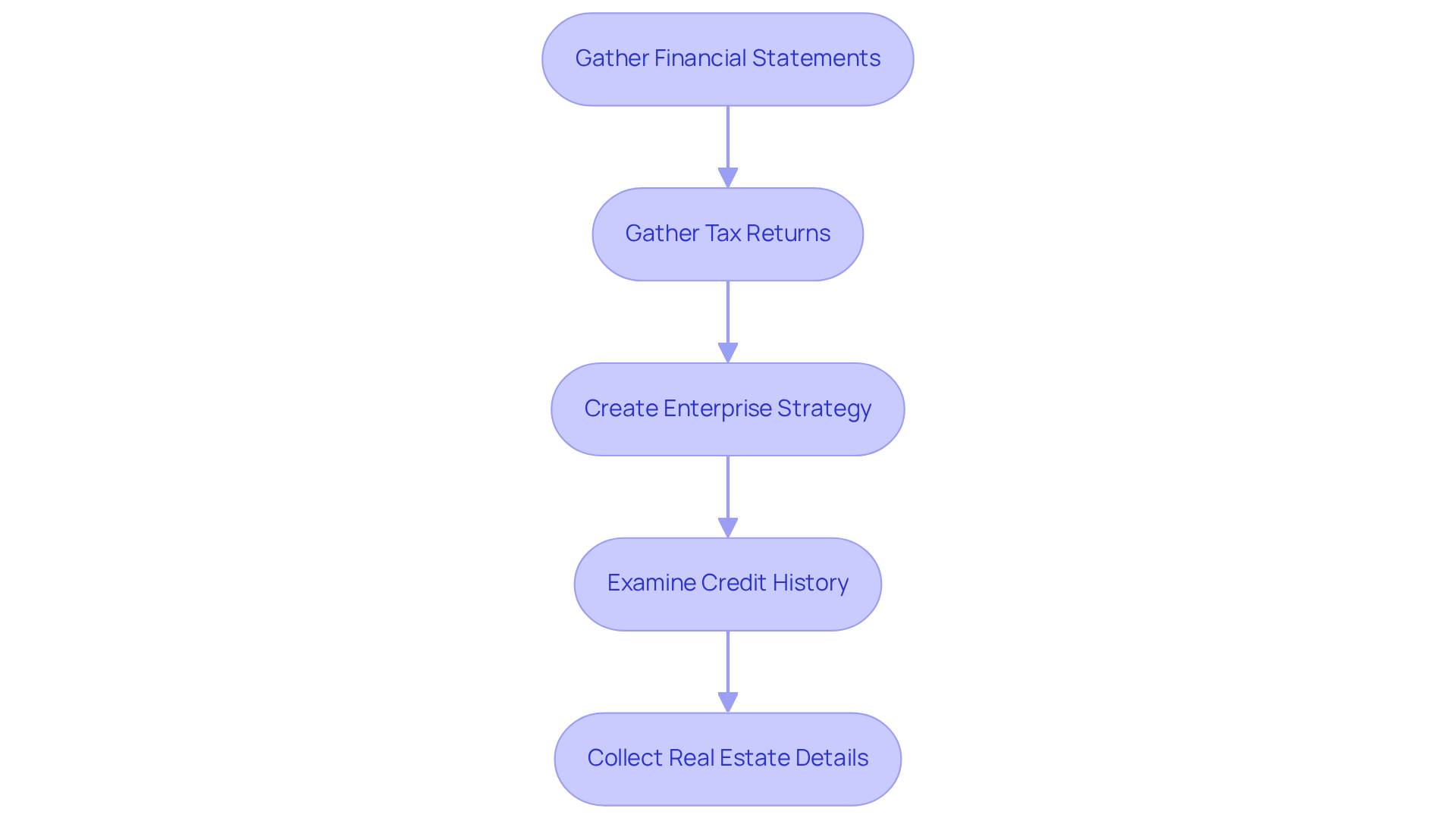

Meticulous preparation of documentation and adherence to specific eligibility criteria are essential for successfully applying for an owner occupied commercial loan. This step-by-step guide will enhance your chances of approval:

- Gather Financial Statements: Compile your organization's financial statements for the past two years, including profit and loss statements and balance sheets. This demonstrates your financial health and operational performance.

- Tax Returns: Gather personal and company tax returns for the last two years. Lenders use this information to assess your income stability and tax compliance.

- Enterprise Strategy: Create a detailed enterprise strategy that describes your commercial model, market assessment, and financial forecasts. A well-structured plan can significantly bolster your application, showcasing your strategic vision and operational viability. Effective business strategies frequently incorporate thorough market analysis and precise financial projections that meet creditor expectations, which Finance Story excels in developing to improve your likelihood of approval.

- Credit History: Examine your credit report for any inconsistencies and confirm your credit score satisfies borrowing criteria, usually above 600. A strong credit history reflects financial responsibility, making you a more attractive borrower.

- Real Estate Details: Collect comprehensive information regarding the asset you intend to acquire, including its location, dimensions, and intended purpose. This information is essential for financiers to assess the asset's potential worth and appropriateness for your enterprise.

Furthermore, consider the refinancing options available through Finance Story, which can help you adapt your financing to meet the evolving needs of your business. By meeting these criteria and utilizing the expertise of Finance Story in developing customized financing proposals, you position yourself advantageously in the eyes of financial institutions, thereby enhancing your chances of obtaining the necessary funds for your owner occupied commercial loan.

Navigate the Application Process for Your Loan

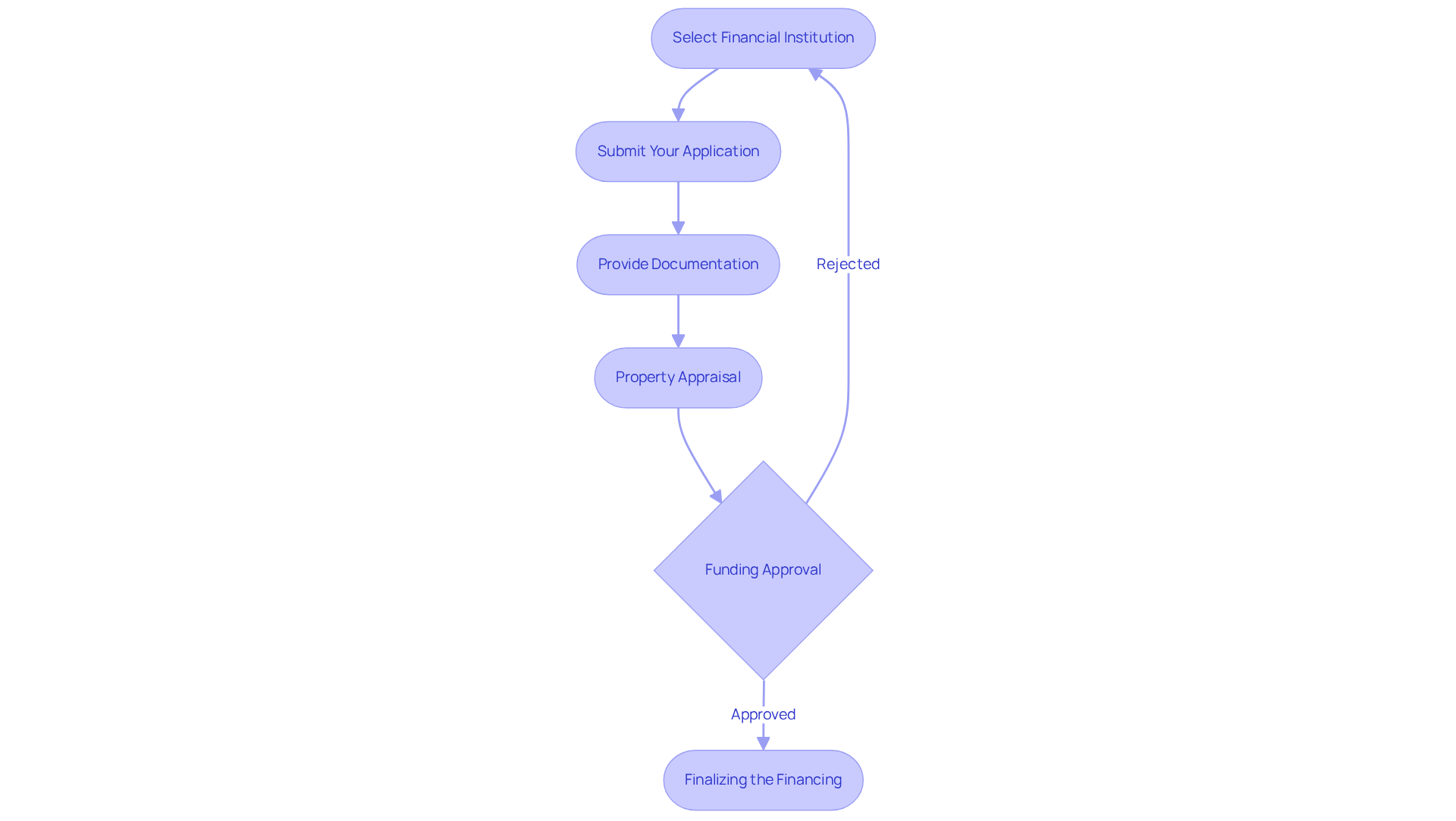

Navigating the application process for an owner occupied commercial loan involves several essential steps that can significantly impact your financial future.

-

Select the appropriate financial institution by performing extensive research to evaluate institutions that offer advantageous conditions for an owner occupied commercial loan. Consider crucial factors such as interest rates, loan-to-value ratios (LVR), and the lender's experience with commercial properties.

-

Submit Your Application: Complete the loan application form meticulously. Ensure that all information is accurate and comprehensive; a well-prepared application can greatly enhance your chances of approval.

-

Provide Documentation: Gather and submit the required documentation, including financial statements, tax returns, and a comprehensive plan for your enterprise. Lenders typically require this information to assess your financial health and the viability of your business.

-

Property Appraisal: Be prepared for the financial institution to conduct an appraisal of the property to determine its market value. This step is crucial, as it directly affects the amount of credit you may qualify for.

-

Funding Approval: After examining your application, the lender will either authorize or reject your request. If approved, you will receive a financial offer that outlines the terms, including interest rates and repayment schedules.

-

Finalizing the Financing: Upon accepting the financing offer, you will proceed to the closing stage. Here, you will sign the necessary documents and complete the agreement, legally committing you to the financing terms.

By following these steps, you can streamline the application process and significantly increase your chances of securing the financing needed for your owner occupied commercial loan.

Identify Challenges and Avoid Common Mistakes

Navigating the challenges and potential pitfalls of the application process for an owner-occupied commercial loan can be quite difficult. To enhance your chances of success, it is crucial to identify and avoid common mistakes:

- Inadequate Preparation: Insufficient documentation can significantly delay your application. To streamline the process, gather all necessary documents, including tax returns, bank statements, and profit & loss statements, before applying.

- Ignoring Credit Scores: Failing to check your credit score may lead to unexpected issues during the application. Consistently review your credit report and rectify any errors, as most financial institutions require a personal credit score above 650-680 for approval.

- Underestimating Costs: Many applicants overlook additional expenses such as appraisal fees, legal fees, and closing costs. By budgeting for these, you can prevent financial strain and ensure you are fully prepared for the total cost of borrowing.

- Selecting the Incorrect Financial Institution: Not all lenders offer the same terms and conditions. Conduct thorough research and compare options to find a lender that aligns with your financial needs and offers favorable rates.

- Neglecting Professional Advice: Many business owners attempt to navigate the financing process independently. Seeking guidance from a finance expert can provide valuable insights and help you avoid common pitfalls, ultimately enhancing your chances of approval.

By recognizing these challenges and taking proactive measures, you can significantly enhance your chances of successfully securing an owner-occupied commercial loan.

Conclusion

Mastering the owner-occupied commercial loan process is essential for business owners seeking to secure a space that meets their operational needs. This financing option presents significant advantages, including lower interest rates, higher loan-to-value ratios, and potential tax benefits, making it a compelling choice for those looking to invest in their own premises.

Key steps have been outlined to navigate this complex process effectively:

- Understanding the unique features of owner-occupied commercial loans

- Meticulously preparing documentation

- Avoiding common pitfalls

Each stage plays a critical role in ensuring a successful application. Engaging with financial experts and conducting thorough research on lenders can further enhance the likelihood of securing favorable terms.

Ultimately, obtaining an owner-occupied commercial loan transcends mere financing; it lays the groundwork for the future of a business. By taking proactive steps and leveraging available resources, business owners can position themselves for success, transforming their vision into reality while building equity and reducing operational costs. Embracing this process with diligence and strategic planning can lead to lasting benefits and a solid foundation for growth.