Overview

Commercial low doc loans are gaining traction among small business owners, thanks to their accessibility and reduced documentation requirements. These loans allow for alternative income verification methods, making them a practical solution for many. The benefits of these loans are noteworthy:

- They offer faster approval times

- They provide flexibility tailored to the unique financial situations of entrepreneurs

This makes them an attractive option for those who may encounter challenges with traditional financing methods.

Have you considered how these loans could fit into your financial strategy? With their streamlined processes, low doc loans can provide the necessary capital to help your business thrive. Furthermore, they cater to the diverse needs of entrepreneurs, ensuring that financing is within reach. As you explore your options, remember that these loans can serve as a viable alternative, especially if conventional methods have proven difficult.

In addition, the flexibility of low doc loans allows you to focus on growing your business rather than getting bogged down by extensive paperwork. By choosing this route, you can expedite your funding and respond swiftly to opportunities. It's time to take action and consider how commercial low doc loans could be the key to unlocking your business potential.

Introduction

In the rapidly changing landscape of business financing, low doc commercial loans have emerged as a pivotal solution for entrepreneurs and small business owners in search of accessible funding. These loans are specifically designed to ease the burdens associated with extensive documentation, providing a crucial lifeline for those with unconventional income streams or fluctuating financial situations.

As the market evolves to meet the demands of modern businesses, grasping the intricacies of low doc loans becomes essential for securing the capital necessary to thrive. With benefits such as expedited approval times and customized lending options, this article explores the following:

- Advantages of low doc loans

- Eligibility criteria

- Strategic insights for navigating the low doc loan landscape in 2025

This empowers borrowers to make informed financial decisions.

Understanding Low Doc Commercial Loans: An Overview

Commercial low doc loans are tailored for borrowers who may find it challenging to provide the extensive documentation typically required for conventional funding. These financial products allow for alternative income verification methods, making them particularly accessible for self-employed individuals and small entrepreneurs. In 2025, the low documentation financing market is experiencing notable trends, as more lenders recognize the necessity for flexible financing solutions that cater to the unique circumstances of entrepreneurs.

At Finance Story, we excel in delivering personalized commercial and residential financing solutions, driven by our expertise and commitment to building strong relationships with our clients. Our understanding of financing for enterprises enables us to craft highly customized funding proposals that address the specific requirements of small business owners. The current landscape reveals a growing acceptance of low documentation financing among major banks and non-major lenders alike, reflecting a competitive environment that ultimately benefits borrowers.

Recent statistics indicate that the typical borrowing amount for owner-occupier residences in the Australian Capital Territory is around $377,000, underscoring the considerable financial obligations that small business owners may seek to undertake. Moreover, the market share of broker-originated financing from major banks has risen to 40.1%, further emphasizing the competitive nature of the lending market.

Expert perspectives highlight the advantages of commercial low doc loans, particularly for individuals with varying incomes or those in the early stages of their ventures. Sean Callery, Editor of Money.com.au, notes that these financial products provide a viable pathway for entrepreneurs to secure funding without the burden of extensive paperwork, allowing them to concentrate on growing their businesses.

Real-world examples demonstrate the effectiveness of low doc options for self-employed individuals. For instance, a small business owner in the hospitality sector successfully obtained a low documentation financing option through Finance Story to expand their operations, showcasing how this funding alternative can foster growth even in the absence of conventional income documentation.

The benefits of low documentation financing for small business owners in 2025 are numerous. They not only streamline the borrowing process but also empower entrepreneurs to leverage their unique financial situations. As the market continues to evolve, commercial low doc loans are becoming an increasingly attractive financing option for those looking to navigate the complexities of financing with greater ease and flexibility.

Significantly, in the December quarter of 2024, owner-occupier financing commitments increased by 2.2% in number and 4.2% in value, indicating a shift in the lending landscape that favors low documentation options for small business owners. At Finance Story, we are dedicated to guiding you through this evolving landscape, ensuring you have access to the tailored financing solutions you need. Our extensive range of lenders, including both high street banks and innovative private lending panels, enables us to find the best options for your unique circumstances.

Don't just take our word for it; our clients consistently express satisfaction with our services, highlighting our commitment to their financial success.

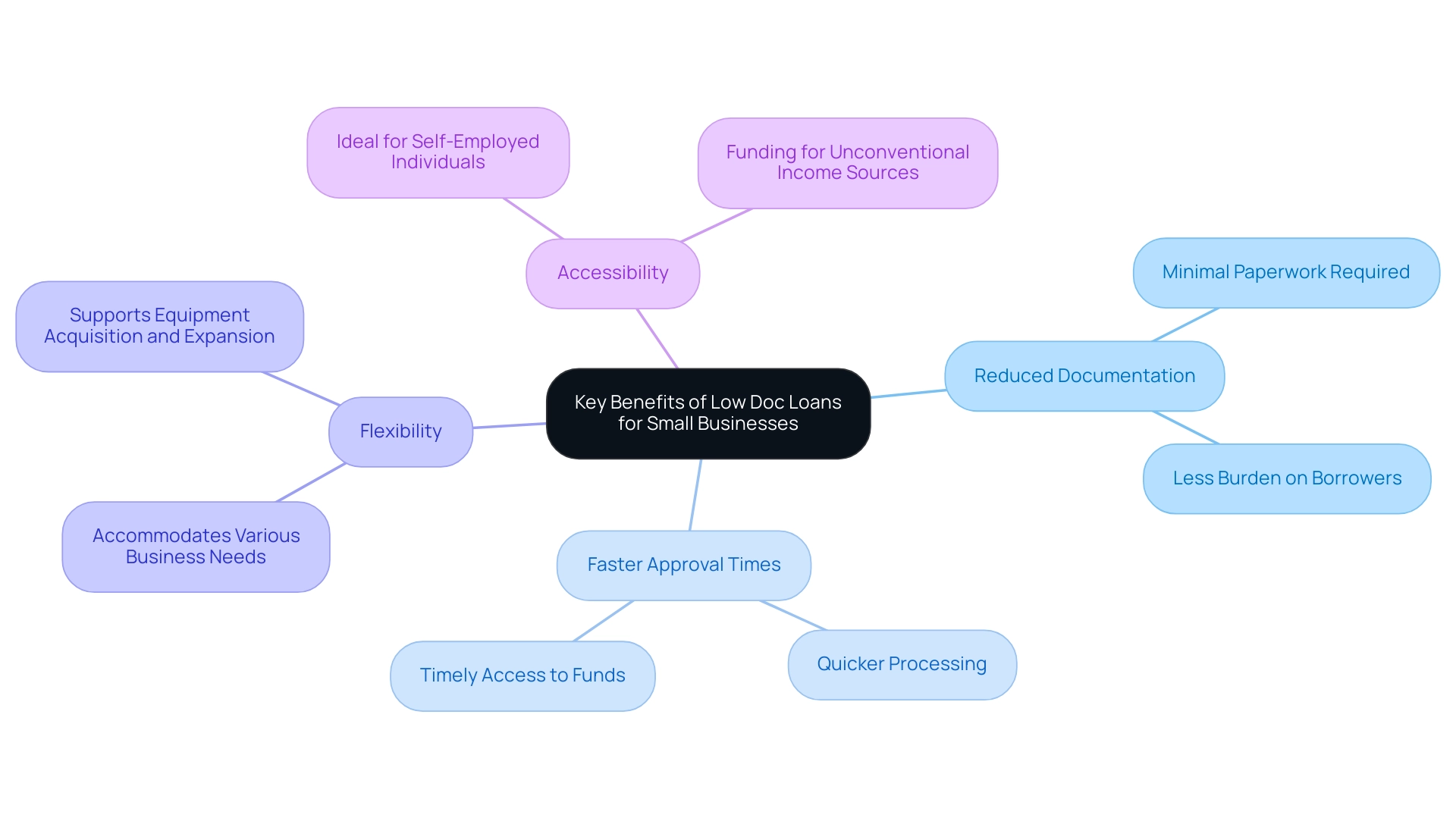

Key Benefits of Low Doc Loans for Small Businesses

Low doc loans offer significant advantages for small businesses, positioning them as an attractive financing option in 2025:

- Reduced Documentation: One of the most appealing features of low doc loans is the minimal paperwork required. This streamlined process alleviates the burden on borrowers, allowing them to focus on their work rather than getting bogged down in extensive documentation.

- Faster Approval Times: The reduction in required documents translates to quicker processing times. Lenders can expedite applications, enabling enterprises to access necessary funds promptly, which is crucial for maintaining cash flow and seizing growth opportunities.

- Flexibility: Low doc financing options are designed to accommodate a variety of business needs. Whether it's acquiring new equipment, covering operational costs, or financing expansion projects, these funds provide the flexibility that conventional financing often lacks.

- Accessibility: Especially advantageous for self-employed individuals or those with unconventional income sources, low documentation options offer a route to funding that might otherwise be unreachable. This inclusivity empowers entrepreneurs to pursue their objectives without the constraints of traditional lending criteria.

In 2025, financial specialists emphasize that the effect of decreased paperwork greatly improves approval rates, facilitating access to funding for small enterprises. For instance, companies operating within a lease or without a physical building can utilize cash savings or property equity to support their financing needs. A recent case study involving ODIN illustrates how their customized financial options, which emphasize fast approvals and flexible terms, have enabled small enterprises to quickly obtain the capital they need to thrive.

This approach not only supports operational needs but also fosters growth by allowing entrepreneurs to invest in their ventures without delay. Finance Story can likewise assist small enterprises in obtaining commercial low doc loans tailored to their needs, ensuring they have the appropriate financial solutions to thrive.

Furthermore, statistics suggest that enterprises utilizing low documentation financing experience enhanced cash flow and accelerated growth, reinforcing the idea that these financial solutions are not only convenient but also strategically beneficial. However, it is important to consider that interest-only financing may result in higher interest expenses over the life of the agreement, which is a crucial factor for small enterprise owners to evaluate. Finance Story addresses these concerns by providing comprehensive financing proposals that outline the implications of interest-only options, ensuring clients are well-informed.

As Denise Raward, a senior finance journalist, emphasizes, "Delivering financial information in everyday language helps Australians better understand how to manage their ongoing financial health." This viewpoint resonates with small enterprise owners seeking clarity in their financing options. As the terrain of financing evolves, commercial low doc loans stand out as a crucial resource for small enterprise owners seeking to navigate their financial journeys effectively.

Eligibility and Documentation: What You Need to Know

To qualify for commercial low doc loans in 2025, borrowers must navigate specific eligibility criteria designed to streamline the lending process while ensuring responsible borrowing. Key requirements typically include:

- Active ABN: An active Australian Business Number (ABN) is essential, confirming the legitimacy of the business seeking financing.

- Income Verification: Unlike conventional financing, low doc options do not necessitate extensive documentation. However, lenders may request alternative forms of income verification, such as Business Activity Statements (BAS) or a letter from an accountant, to assess the borrower's financial health.

- Credit History: A solid credit score is crucial, reflecting the borrower's financial responsibility and ability to repay the debt. Lenders often view a good credit history as a key indicator of reliability.

- Deposit Requirements: Borrowers should be prepared to provide a larger deposit for low documentation financing, typically around 20% of the property's value. This higher deposit requirement serves as a safeguard for lenders, mitigating risk in the lending process.

In 2025, the environment for low documentation financing continues to evolve, with financial experts emphasizing the importance of understanding these criteria. Recent statistics indicate that a significant portion of small enterprise owners are turning to commercial low doc loans, reflecting a growing trend in the market. For instance, the demand for alternative financing options has surged, with many companies seeking flexible solutions that accommodate their unique financial situations.

This trend aligns with Finance Story's commitment to innovation and adaptability in the lending process, allowing them to cater to the diverse needs of their clients.

Finance Story offers access to a complete array of lenders, including high street banks and innovative private lending panels, ensuring that small enterprise owners can discover the right financing solution for their circumstances. Furthermore, refinancing alternatives are accessible via Finance Story, enabling companies to modify their financing to accommodate changing requirements.

Real-world examples illustrate the documentation needed for low doc loans. For example, a small enterprise owner might provide their BAS to demonstrate income stability, while another may present a letter from their accountant confirming their financial status. These alternative verification methods not only simplify the borrowing process but also cater to the varied needs of enterprises today.

Overall, comprehending the eligibility requirements for commercial low doc loans is crucial for small enterprises seeking to obtain financing. As Matt Schulz, chief credit analyst at LendingTree, notes, "That’s such a long time to be stuck paying for a depreciating asset. It can have an enormous impact on a family’s finances."

By being aware of the requirements and preparing the necessary documentation, borrowers can enhance their chances of obtaining the funding they need to grow and succeed. With Finance Story's expertise in creating polished and highly individualized cases, small owners can confidently navigate the lending landscape and secure the right financing solutions for their commercial property investments.

Exploring Different Types of Low Doc Commercial Loans

In 2025, small business owners have access to a variety of low doc commercial loans, each designed to meet specific financial needs:

- Low Doc Term Loans: These loans provide a fixed sum of funding that is repaid over a predetermined term, making them ideal for long-term investments. They equip companies with the capital necessary to undertake significant projects or acquisitions without the burden of extensive documentation. Finance Story specializes in crafting polished and highly individualized cases to present to lenders, ensuring that clients secure the right funding for their needs.

- Commercial Low Doc Loans: Recognized for their flexibility, these financial products allow businesses to withdraw funds as necessary, making them especially advantageous for managing cash flow. This option enables companies to react swiftly to unforeseen costs or opportunities without the delays associated with conventional funding applications. Understanding the repayment criteria for these credits is crucial for effective financial management.

- Equipment Financing: Designed for the acquisition of equipment, these loans often come with favorable terms that facilitate asset purchases. This type of financing is essential for organizations looking to upgrade or expand their operational capabilities without straining their cash reserves. Finance Story's expertise in refinancing ensures that companies can adapt their financing strategies as their needs evolve.

- Growth Financing: These loans are specifically crafted for enterprises aiming to grow, providing funds that can support new projects or expansions while reducing the paperwork typically required. This makes them an appealing choice for entrepreneurs eager to seize growth opportunities without the lengthy approval processes of traditional financing. By leveraging property equity and cash savings, small enterprise owners can enhance their acquisition strategies.

The market for commercial low doc loans is evolving, with a notable increase in investor commitments, which reached 48,876 in recent reports. This trend underscores the growing confidence in commercial low doc loans, which, when conducted responsibly, contribute to market stability and investor trust. Financial experts emphasize that understanding the nuances of these loan types is essential for small enterprises looking to navigate the complexities of financing in today's dynamic economic landscape.

Dr. Nalini Prasad, a Senior Lecturer at UNSW Business School, notes that sectors with a large fraction of cash buyers are likely to outperform the overall market, highlighting the importance of understanding market dynamics.

Furthermore, insights from the case study titled "Finance Insights" reveal lending patterns and financial needs that can guide small enterprise owners in their financing decisions. By leveraging these options, businesses can secure the funding they need to thrive and adapt in an ever-changing market. Finance Story's commitment to innovation and adaptability in the lending process further distinguishes it from competitors, ensuring that clients receive tailored solutions that meet their unique circumstances.

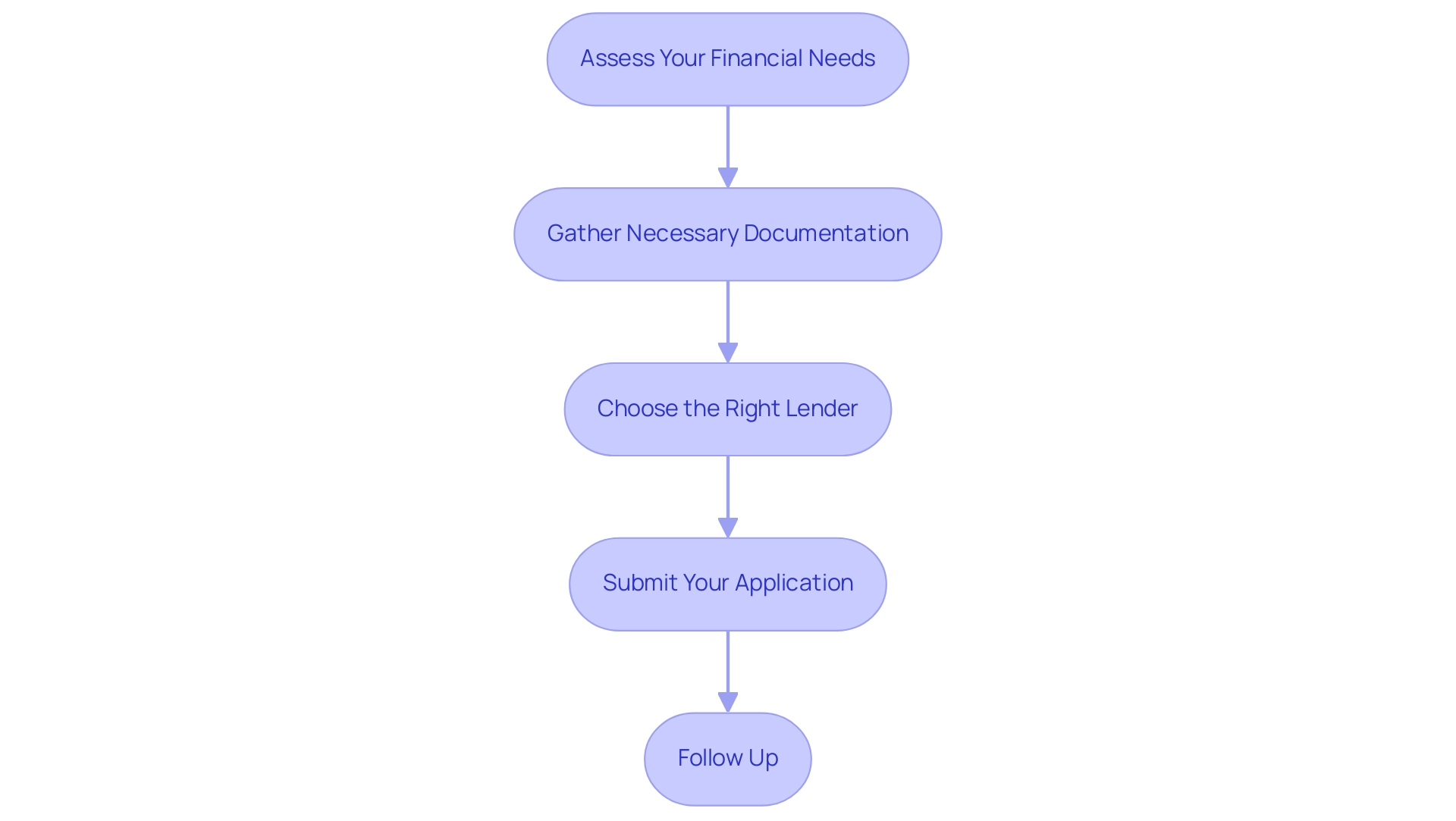

Navigating the Application Process for Low Doc Loans

Navigating the application process for low doc loans necessitates a strategic approach, encompassing several essential steps:

- Assess Your Financial Needs: Start by clearly defining the amount of funding you require and the specific purpose for which it will be utilized. This clarity will guide your application and facilitate effective communication with potential lenders.

- Gather Necessary Documentation: Unlike traditional financing, low doc options allow for alternative documentation. Collect crucial documents such as Business Activity Statements (BAS), recent bank statements, and a signed income declaration. These documents will help illustrate your financial situation without the burden of extensive paperwork.

- Choose the Right Lender: Research is vital in this step. Identify lenders who specialize in commercial low doc loans and compare their offerings, including interest rates and terms. Non-bank lenders have emerged as significant players in the Australian mortgage market. As Toni Mladenova noted, "Non-bank lenders have disrupted the Australian mortgage market. Here’s what you need to know." This underscores the importance of considering these lenders for more flexible options. At Finance Story, we excel in crafting polished and highly individualized business cases to present to banks, ensuring you secure the best financing solutions tailored to your needs. We also provide access to a comprehensive range of lenders, including high street banks and innovative private lending panels, to suit your specific circumstances.

- Submit Your Application: Complete the application form meticulously, ensuring all required documentation is included. A well-prepared application can significantly enhance your chances of approval. With Finance Story's expertise, you can streamline this process and increase your likelihood of success.

- Follow Up: After submission, maintain open lines of communication with your lender. Regular follow-ups can help address any questions they may have and expedite the processing of your application.

In 2025, the average time taken to process low doc applications has been reported to be around 14 days, reflecting a more streamlined approach in the lending process. Additionally, understanding the specific eligibility criteria for commercial low doc loans can further enhance your application strategy. For instance, recent statistics indicate a 25.9% increase in new commitments for personal 'Other' categories, highlighting a growing acceptance of alternative lending solutions.

Real-world examples, such as successful applications for rural home financing, illustrate how borrowers have effectively navigated the low doc funding landscape. These cases frequently involve properties classified as hobby farms, which meet specific criteria regarding income generation and land size, showcasing the flexibility and potential of commercial low doc loans for various financial needs. Furthermore, refinancing your commercial financing with Finance Story can help meet the evolving needs of your business, allowing you to leverage our personalized support and access to top products confidently as you approach your next home financing or commercial investment.

Understanding the Risks: Drawbacks of Low Doc Loans

While low doc financing presents several advantages, it also carries inherent risks that borrowers should carefully consider:

- Higher Interest Rates: Due to the perceived risk associated with lending without extensive documentation, interest rates for low doc financing are typically higher than those for traditional options. This can significantly affect the overall expense of borrowing, making it crucial for borrowers to assess their financial capacity before proceeding.

- Limited Amounts: Lenders often impose caps on the amount available for financing through commercial low doc loan options. This limitation can restrict financing options, particularly for businesses seeking substantial capital for growth or investment.

- Potential for Higher Fees: Some lenders may charge additional fees specifically for low documentation financing, which can further elevate the total cost of borrowing. It is crucial for borrowers to scrutinize the fee structure outlined in the Product Disclosure Statement to avoid unexpected expenses. Before obtaining any financial product, it is recommended to read the relevant Product Disclosure Statement and other offer documents.

- Risk of Over-Borrowing: The simplified application process for low documentation financing may entice some borrowers to take on more debt than they can realistically manage. This over-borrowing can jeopardize financial stability, leading to potential repayment difficulties down the line.

- Expert Insights on Risks: Financial experts, including those at Finance Story, caution that while commercial low doc loans can be a viable choice for many borrowers, they come with risks that require careful consideration. The lack of comprehensive documentation can lead to misunderstandings regarding repayment terms and conditions, which may not be apparent at the outset. Ben, a Mortgage Broker and Finance Professional at Finance Story, emphasizes his commitment to helping clients become debt-free and build their wealth through investment, focusing on educating them about finance.

- Case Studies on Risks: A notable case study highlights the diversity of non-bank lenders in Australia, where registered financial corporations (RFCs) account for a significant portion of non-bank lending. These lenders often focus on residential and auto financing, but their approach to commercial low doc loans can vary widely, underscoring the importance of thorough research and understanding of lender practices.

- Average Interest Rates: In 2025, the average interest rates for low documentation options are notably higher compared to traditional financing, reflecting the increased risk perceived by lenders. Borrowers should be prepared for these elevated rates when considering their financing options. Instances have emerged where borrowers faced interest rates significantly above the market average due to the low documentation nature of their financing. Such examples serve as a reminder of the potential financial implications of choosing this type of financing.

- Documentation Requirements: Borrowers seeking commercial low doc loans must provide proof of income through various documents, including Business Activity Statements (BAS) and personal tax returns. This requirement highlights the importance of being prepared with the necessary documentation when considering low doc loans.

- Current Lending Landscape: As of 2025, the lending landscape is evolving, with the first quarterly Lending indicators release transitioning from a monthly release after the September 2024 reference period. This change aims to improve usability and interpretability, providing borrowers with better insights into the lending environment. Collaborating with Finance Story guarantees access to a complete range of lenders, including high street banks and innovative private lending panels, customized to address the unique needs of small enterprises. Furthermore, Finance Story focuses on developing refined project cases for financing proposals and provides refinancing alternatives for different commercial properties, such as warehouses, retail spaces, and factories. Small business owners are encouraged to consult with Finance Story for personalized assistance in navigating commercial low doc loans.

Choosing the Right Lender for Your Low Doc Loan Needs

When selecting a lender for your low doc loan, it is crucial to evaluate several key factors to ensure you make an informed decision:

- Reputation: Investigate the lender's history and customer feedback. A strong track record and positive reviews are indicators of a trustworthy lender, which is essential for a successful financing experience. As Denise Raward from National Australia Bank notes, "Customer service is paramount in the lending industry, and lenders must adapt to meet the evolving needs of borrowers." Companies like Finance Story exemplify this commitment, having established a solid reputation in the market by successfully navigating the complexities of low doc financing.

- Loan Terms: Scrutinize the interest rates, fees, and repayment conditions offered by various lenders. Finding the most favorable terms can significantly impact your business's financial health. Notably, statistics indicate that investor new credit commitments reached $25.41 billion in December 2014, underscoring the significance of market stability and lender reputation.

- Specialization: Opt for lenders who focus on commercial low doc loans. Their expertise in this niche will provide you with tailored solutions that address the specific challenges associated with low documentation financing. Finance Story, for example, specializes in creating refined and highly personalized cases to present to banks, ensuring that clients receive the best possible financing options. They also have access to a full range of lenders, including high street banks and innovative private lending panels, to suit various circumstances.

- Customer Service: Assess the lender's approach to customer service. A responsive and supportive team can greatly enhance your experience, especially during the often complex application process. Testimonials from pleased clients of Finance Story emphasize their commitment to grasping unique financial journeys, with one client stating, "I will definitely be recommending your services to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." This level of commitment can be a deciding factor for many small business owners.

In 2025, customer satisfaction ratings for providers of commercial low doc loans have become increasingly important, with many borrowers prioritizing lenders who demonstrate a commitment to understanding their unique needs. Statistics suggest that factors affecting lender selection involve not only the conditions of the financing but also the quality of service provided. For instance, lenders that excel in customer support often see higher satisfaction ratings, which can be a deciding factor for many small business owners.

Furthermore, reputable lenders for commercial low doc loans in 2025 are those that have built a strong reputation in the market. Companies like Finance Story exemplify how a commitment to innovation and adaptability can enhance service offerings. By accessing a diverse portfolio of private lenders and mainstream financial institutions, they can present clients with a variety of tailored options for different types of commercial properties, including warehouses, retail premises, factories, and hospitality ventures, ensuring that even the most challenging financial situations are addressed effectively.

This innovative lending process not only showcases their expertise but also reinforces their dedication to client success.

Financial experts emphasize the importance of these considerations, advising borrowers to prioritize lenders who not only offer competitive rates but also demonstrate a genuine understanding of their financial journey. This holistic approach to selecting a lender can lead to more favorable outcomes and a smoother borrowing experience.

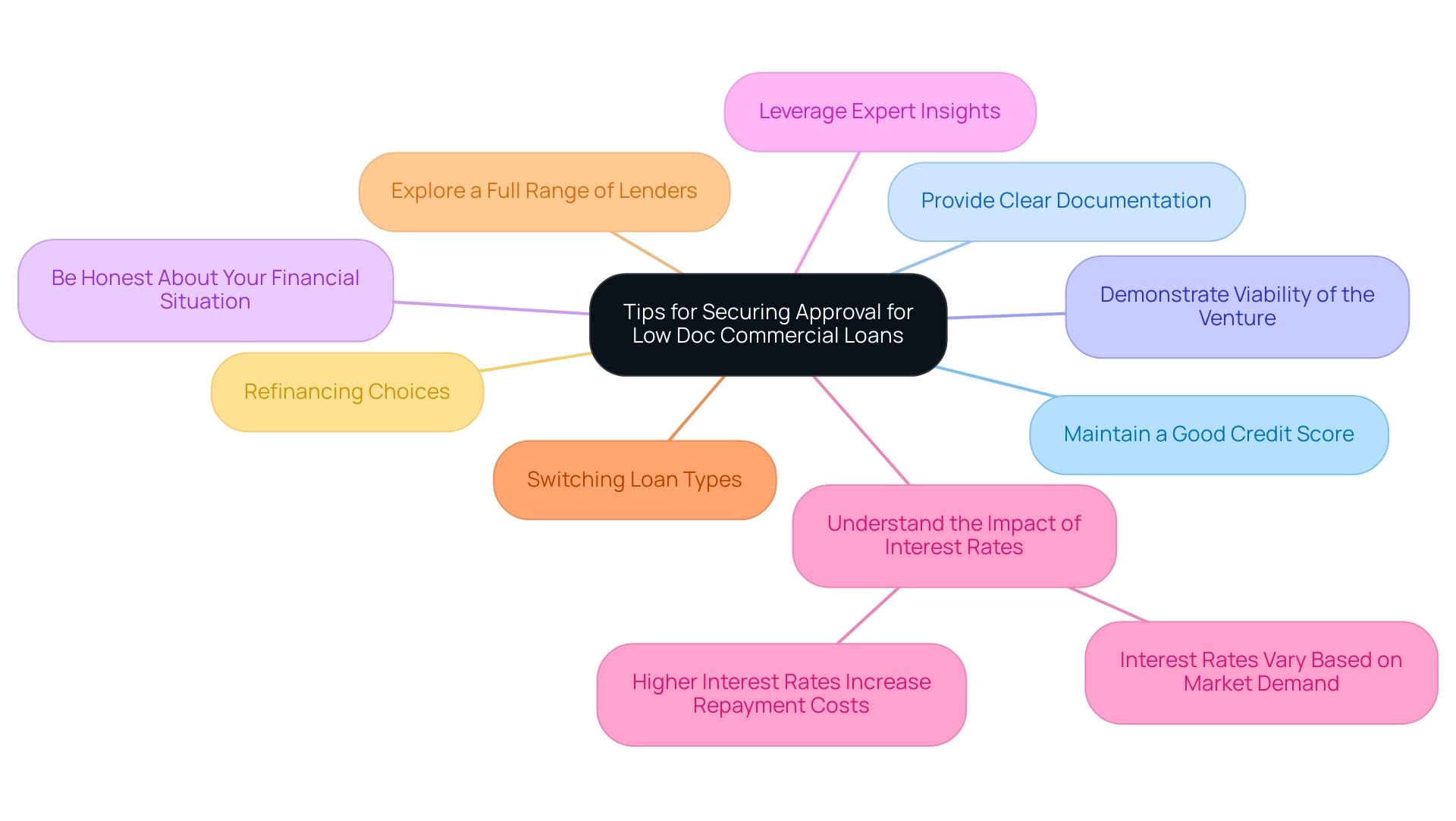

Tips for Securing Approval for Low Doc Commercial Loans

To enhance your chances of securing approval for a low doc commercial loan in 2025, consider the following strategies:

- Maintain a Good Credit Score: A clean credit history is paramount, as it significantly influences loan approval rates. In fact, a higher credit score can lead to more favorable financing terms and lower interest rates, which are crucial for maintaining profitability.

- Provide Clear Documentation: While commercial low doc loans require less paperwork, the documentation you submit should be accurate and well-organized. This clarity can expedite the approval process and demonstrate your professionalism to lenders.

- Demonstrate Viability of the Venture: Presenting a robust plan is essential. Outline your financial forecasts and clearly express how the funding will promote growth or stability in your enterprise. This not only showcases your preparedness but also reassures lenders of your commitment to success.

- Be Honest About Your Financial Situation: Transparency regarding your income and financial obligations fosters trust with lenders. Being upfront about your financial landscape can significantly improve your chances of approval, as it allows lenders to assess your situation more accurately.

- Leverage Expert Insights: Financial experts recommend that borrowers stay informed about current market trends and lender policies related to commercial low doc loans, as these can affect approval rates. Engaging with a knowledgeable mortgage broker, like those at Finance Story, can provide tailored advice and strategies specific to your circumstances, ensuring you present a polished and individualized business case to lenders.

- Real-World Examples: Consider the case of a client who sought distinct funds for land acquisition and construction. The team at Finance Story effectively managed both financial agreements, demonstrating their capability in navigating complex scenarios. This case illustrates the importance of having a supportive brokerage that understands the intricacies of commercial financing. As Riya P. noted, "Special thanks to Pranav this time for making our experience truly exceptional for our construction financing."

- Understand the Impact of Interest Rates: Be aware that higher interest rates can increase repayment costs, potentially reducing your rental yield and overall return on investment. Interest rates for investment property financing can vary based on market demand and lender policies, so staying informed about market conditions can help you make strategic decisions regarding your options.

- Switching Loan Types: If you initially secure a low doc investment financing option, remember that you can transition to a full doc option once you can present lodged tax returns or payslips. This flexibility can be advantageous as your financial situation evolves.

- Explore a Full Range of Lenders: At Finance Story, we offer access to a comprehensive suite of lenders, including high street banks and innovative private lending panels, ensuring you have the best options available for your financing needs.

- Refinancing Choices: If your enterprise develops, think about refinancing your commercial financing to better satisfy your present requirements. Our team at Finance Story can assist you in navigating this process effectively.

By implementing these strategies, you can significantly improve your chances of obtaining a low doc commercial loan, positioning your business for future growth and success.

Conclusion

Low doc commercial loans have emerged as a vital resource for small business owners navigating the complexities of funding in 2025. The advantages of these loans—reduced documentation and faster approval times—empower entrepreneurs to secure financing without the burdens of traditional lending processes. By understanding the eligibility criteria and strategically preparing their applications, borrowers can significantly enhance their chances of approval.

As the market for low doc loans continues to evolve, it is crucial for business owners to carefully consider the risks associated with these financing options. Higher interest rates and potential fees are important factors that should not be overlooked. However, with the right knowledge and support, such as that provided by specialized lenders like Finance Story, entrepreneurs can access tailored solutions that suit their unique financial situations.

Ultimately, low doc loans represent an opportunity for small businesses to thrive in a competitive landscape. By leveraging these flexible financing options, entrepreneurs can focus on growth and innovation, ensuring their ventures not only survive but flourish. The key lies in making informed decisions, understanding the lending landscape, and utilizing the resources available to navigate this dynamic financial environment effectively.