Overview

This article delves into effective strategies for managing SMSF (Self-Managed Super Fund) loan repayments. It highlights the significance of:

- Regular contributions

- Interest-only repayment options

- Robust cash flow management

By outlining these strategies, the article demonstrates how they contribute to maintaining financial health and ensuring compliance with ATO regulations. This compliance is crucial, as it enables SMSFs to meet their repayment obligations while also seizing investment opportunities.

Introduction

In the dynamic realm of investment strategies, Self-Managed Super Fund (SMSF) loans have emerged as a formidable tool for discerning investors seeking to acquire commercial properties. These specialized financial instruments not only offer access to substantial capital but also entail a distinct set of regulations and frameworks that can be intimidating for newcomers.

With features such as Limited Recourse Borrowing Arrangements (LRBAs) and specific Loan-to-Value Ratios (LVRs), grasping the intricacies of SMSF loans is essential for anyone aiming to navigate this complex financial landscape.

Furthermore, as the SMSF sector continues to flourish, with an estimated asset value of $887.4 billion in 2025, the demand for effective loan management strategies and professional guidance has never been more pressing.

This article explores the fundamentals of SMSF loans, effective repayment strategies, potential challenges, and the critical importance of expert advice in ensuring compliance and optimizing investment outcomes.

Understand SMSF Loans: Basics and Structure

Self-Managed Super Fund (SMSF) financing options represent specialized financial instruments that empower SMSFs to secure funds for acquiring assets, including commercial properties such as office buildings, warehouses, and retail locations. These loans, which include SMSF loan repayments, adhere to stringent guidelines set forth by the Australian Taxation Office (ATO) and encompass several critical components:

- Limited Recourse Borrowing Arrangements (LRBAs): This arrangement limits the lender's recourse solely to the asset financed by the loan, safeguarding other fund assets from potential claims.

- Loan-to-Value Ratio (LVR): Typically, lenders permit an LVR of up to 70% for residential properties and 60% for commercial properties, necessitating a minimum deposit of 30% from the fund.

- Repayment Sources: All SMSF loan repayments must originate from the fund's own resources, ensuring adherence to ATO regulations. This includes contributions from members and income generated by the rental property.

As we look toward 2025, the superannuation fund sector continues to demonstrate resilience, boasting an estimated asset value of $887.4 billion. The essentials of self-managed superannuation fund lending remain stable, with the structure of LRBAs being nearly identical across various transactions. Notably, commercial real estate investments via SMSFs face fewer restrictions compared to residential assets, making them an attractive option for investors. The ongoing demand for self-managed superannuation fund financing options, despite regulatory scrutiny, underscores a robust market for brokers and clients alike. Finance Story is poised to provide specialized advice tailored to your needs, ensuring you identify the right lender for your commercial asset.

Implement Effective Repayment Strategies for SMSF Loans

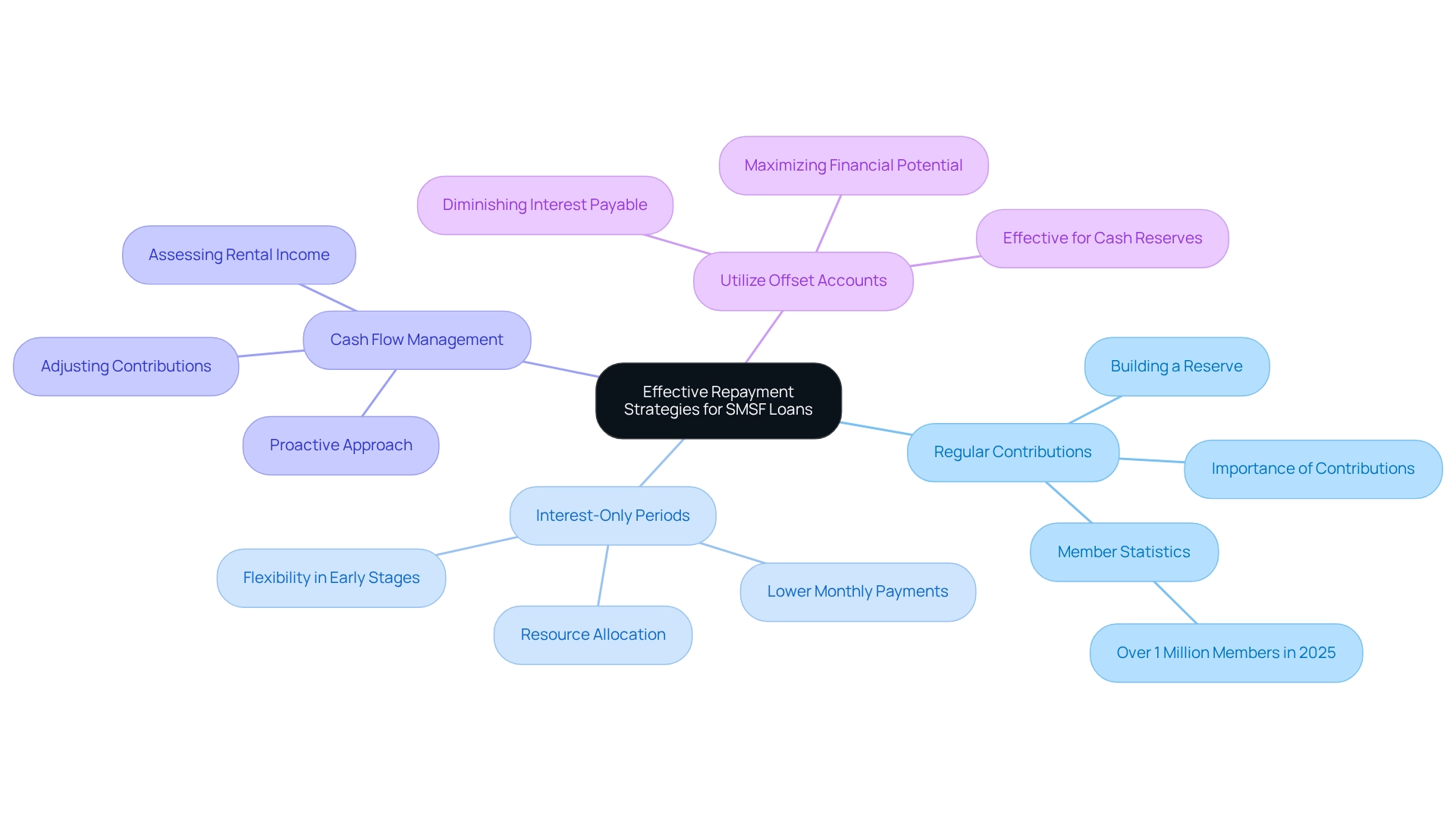

To manage SMSF loan repayments effectively, consider implementing the following strategies:

-

Regular Contributions: Consistent contributions from members are crucial for building a reserve to cover SMSF loan repayments and other expenses. In 2025, the total number of self-managed super fund members surpassed 1 million, underscoring the importance of regular contributions in maintaining financial health.

-

Interest-Only Periods: Opting for an interest-only repayment option at the outset can significantly lower monthly payments, providing flexibility during the early stages of property acquisition. This approach allows SMSFs to allocate resources toward other financial opportunities while adeptly managing cash flow.

-

Cash Flow Management: Regularly assessing rental income and adjusting contributions as needed is vital for sustaining robust cash flow. This proactive approach ensures that the self-managed super fund can meet its SMSF loan repayments without undue financial pressure, particularly in volatile market conditions.

-

Utilize Offset Accounts: Connecting an offset account to the self-managed super fund loan can diminish the interest payable, thereby reducing overall SMSF loan repayment costs. This strategy is particularly effective for self-managed super funds with substantial cash reserves, enabling them to maximize their financial potential while minimizing interest expenses through effective SMSF loan repayments.

Implementing these strategies not only enhances the fund's ability to meet its financial commitments but also positions it for sustained growth and stability. Case studies reveal that SMSFs employing these repayment strategies have successfully navigated the intricacies of real estate, capitalizing on tax advantages while ensuring compliance with legal requirements. As financial consultants emphasize, a well-structured repayment strategy is key to improving fund performance and achieving investment goals.

Navigate Challenges and Risks in SMSF Loan Repayments

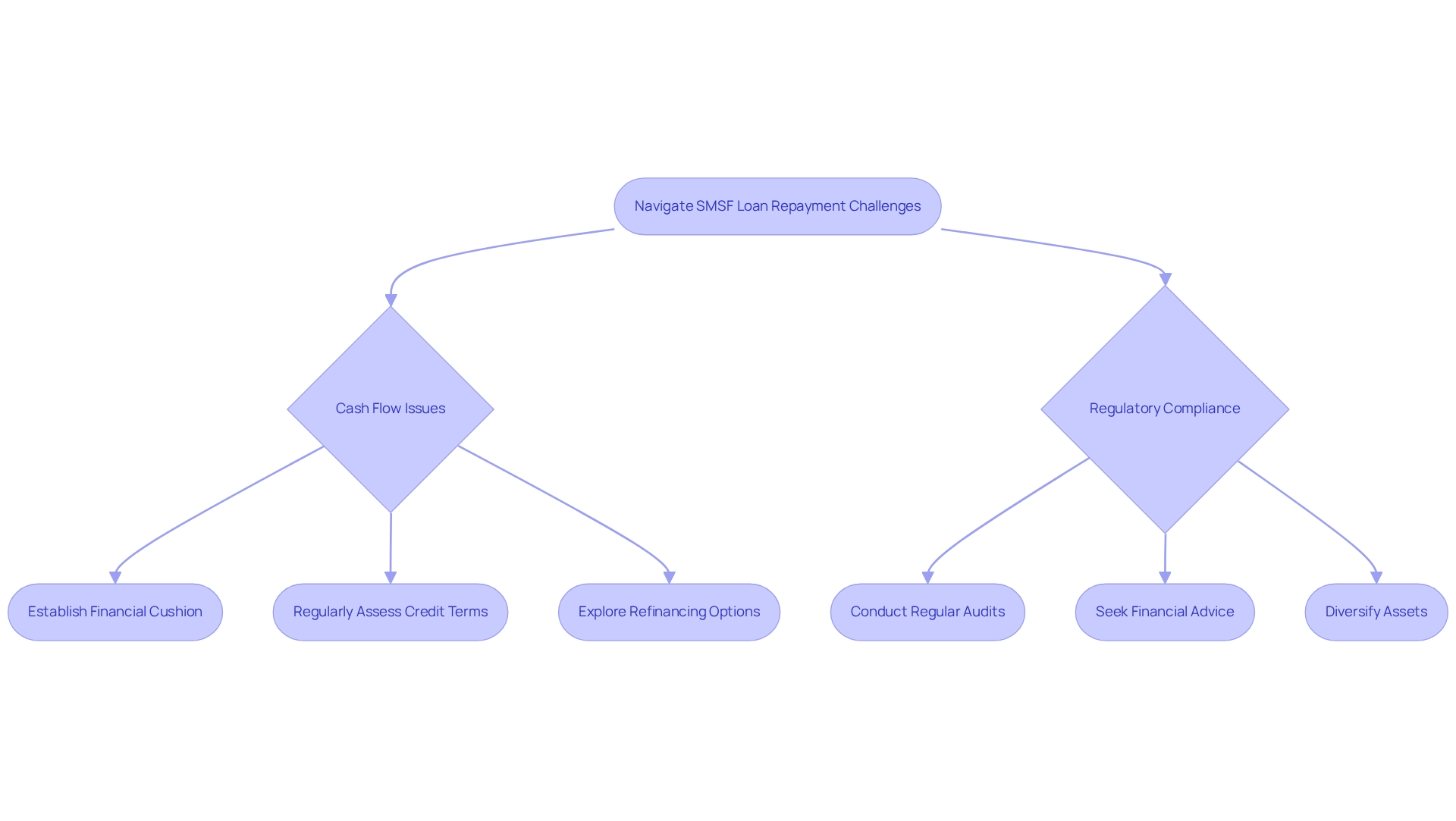

Navigating SMSF loan repayments presents several inherent challenges and risks that trustees must address:

-

Cash Flow Issues: Unexpected expenses or property vacancies can significantly disrupt cash flow, complicating the ability to meet SMSF loan repayments. Establishing a financial cushion is essential to address these potential shortfalls, ensuring that trustees can uphold their SMSF loan repayments even during challenging periods. Regularly assessing credit terms and exploring refinancing options can mitigate the effects of these fluctuations, enabling trustees to adapt to changing financial situations related to SMSF loan repayments. With access to a comprehensive range of lenders, including high street banks and innovative private lending panels, Finance Story is equipped to guide you through refinancing tailored to your evolving business needs.

-

Regulatory Compliance: SMSFs must adhere to stringent ATO regulations concerning borrowing. Non-compliance can lead to severe penalties, including the loss of valuable tax concessions. Conducting regular audits and seeking advice from financial consultants can help maintain compliance with these regulations, safeguarding the fund's status. Engaging with specialists from Finance Story can provide the essential guidance needed to navigate these regulations effectively, particularly regarding the implications of market volatility on SMSF loan repayments. Diversifying assets within the self-managed super fund can help distribute risk and provide a buffer against market fluctuations. Finance Story's expertise in refinancing can assist in adjusting your investment strategy to mitigate these risks, including the impact of SMSF loan repayments. By proactively addressing these challenges, trustees can protect their investments and secure long-term financial stability. The importance of professional advice cannot be overstated; many trustees benefit from the insights of mortgage brokers, legal experts, and accountants to effectively navigate the complexities of self-managed superannuation fund lending. This collaborative approach not only ensures compliance but also enhances the overall effectiveness of the repayment process.

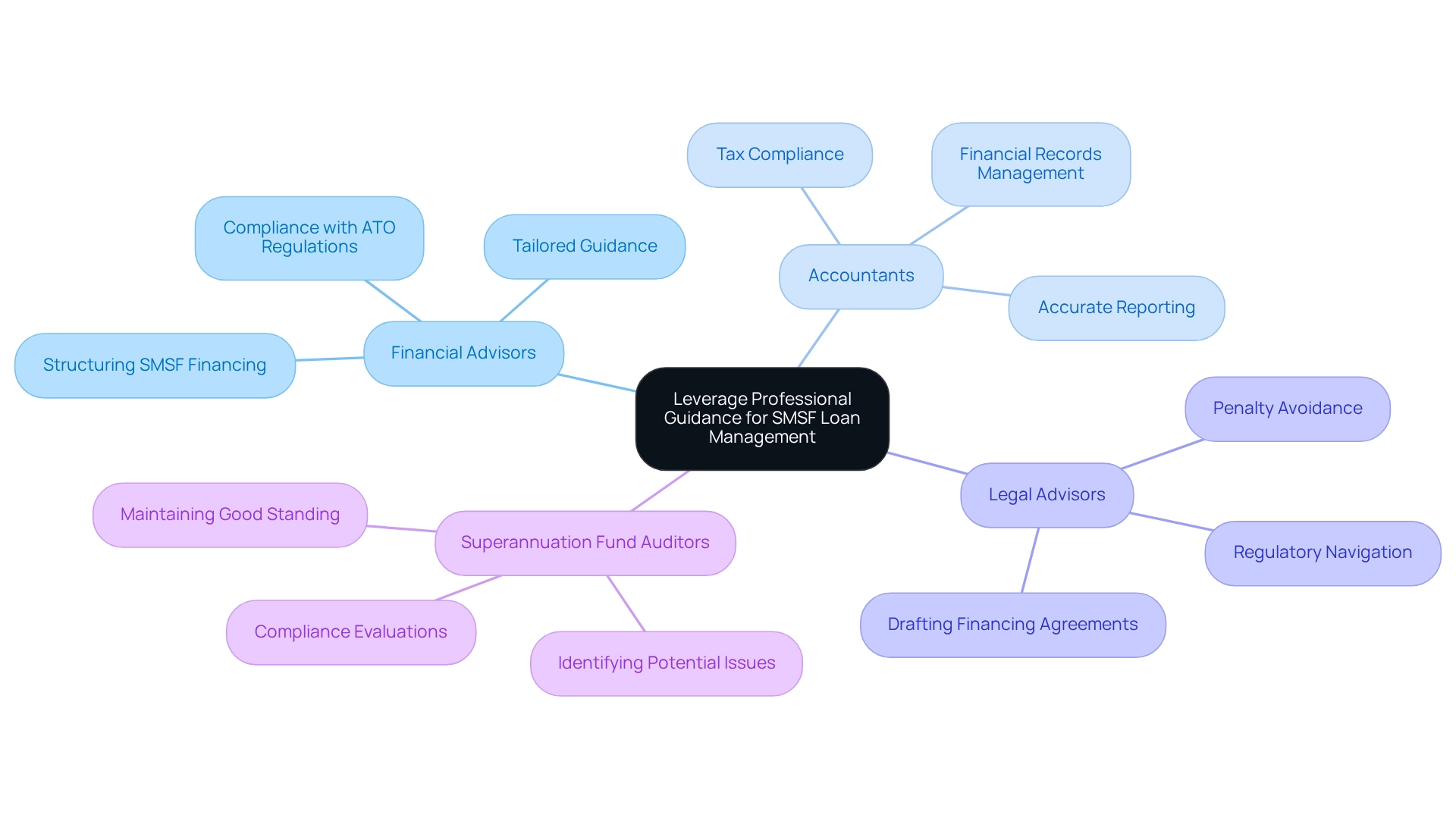

Leverage Professional Guidance for SMSF Loan Management

Engaging experts who specialize in self-managed superannuation fund administration can significantly enhance the efficiency of financing strategies. This is particularly relevant given the fewer restrictions on commercial property investments compared to residential property. The key experts include:

- Financial Advisors: They offer tailored guidance on structuring self-managed superannuation fund financing, enhancing smsf loan repayments strategies, and ensuring compliance with ATO regulations. Their expertise is vital, especially considering that approximately 85,000 self-managed super funds have yet to submit their annual returns for the 2023 income year, highlighting the need for diligent oversight.

- Accountants: A financial professional with self-managed super fund expertise manages the fund's financial records, ensuring accurate reporting and compliance with tax obligations. Their role is critical in preventing compliance issues, as evidenced by the 54,000 pending returns from 2022.

- Legal Advisors: Legal professionals navigate the complexities of self-managed superannuation fund regulations and assist in drafting financing agreements that protect the trustees' interests. Their guidance is essential to avoid penalties, which can reach $19,800 per violation.

- Superannuation Fund Auditors: Regular evaluations by certified superannuation fund auditors can identify potential compliance issues before they escalate, ensuring the fund remains in good standing with the ATO.

By leveraging expert advice, superannuation fund trustees can deepen their understanding of the financial landscape, make informed decisions, and ultimately achieve their financial objectives more effectively. This collaborative approach not only bolsters compliance but also empowers trustees to navigate the complexities of managing SMSF loan repayments with confidence. For additional support, consider contacting Finance Story to build a robust case and ensure adherence to regulations, positioning yourself to find the right lender for your commercial investment property. BOOK A CHAT.

Conclusion

The landscape of Self-Managed Super Fund (SMSF) loans presents a compelling opportunity for investors eager to acquire commercial properties. Understanding the fundamental components—such as Limited Recourse Borrowing Arrangements (LRBAs) and Loan-to-Value Ratios (LVRs)—is crucial for navigating the complexities of these financial products. By leveraging effective repayment strategies, including regular contributions, interest-only periods, and proactive cash flow management, trustees can position their SMSFs for long-term success while mitigating potential risks.

However, challenges such as cash flow disruptions, interest rate fluctuations, and regulatory compliance must be addressed thoughtfully. Establishing a financial buffer and engaging in regular reviews can help navigate these hurdles. Furthermore, the importance of professional guidance cannot be overstated; financial advisors, accountants, legal experts, and auditors play an essential role in ensuring adherence to regulations and optimizing loan management strategies.

In summary, SMSF loans offer a powerful tool for investment, but their successful management requires a comprehensive understanding of the associated risks and a commitment to strategic planning. By partnering with industry professionals, SMSF trustees can enhance their investment outcomes, ensuring compliance while confidently navigating the complexities of the SMSF lending landscape. As the sector continues to grow, the potential for substantial returns remains, provided that investors approach these opportunities with diligence and informed expertise.