Overview

This article evaluates SMSF loan providers by scrutinizing their terms, including interest rates, fees, and lending criteria, to identify which options present the most favorable conditions for borrowers. Notably, banks dominate the market with competitive rates, albeit accompanied by stricter criteria. On the other hand, mortgage brokers deliver personalized solutions, while private lenders offer enhanced flexibility. Ultimately, the best choice hinges on individual financial circumstances and needs.

How do your current financial situations align with these options?

Introduction

In the realm of personal finance, Self-Managed Super Fund (SMSF) loans have emerged as a powerful tool for individuals aiming to invest in property while retaining control over their retirement savings. These unique financial arrangements enable investors to leverage their SMSF for both residential and commercial property acquisitions, often through limited recourse borrowing arrangements (LRBAs) that safeguard the fund’s other assets in the event of default. As the SMSF sector continues to expand, with assets approaching $990 billion and average returns surging, grasping the intricacies of SMSF loans becomes essential for astute investors. This article explores the various facets of SMSF loans, including:

- Types of lenders

- Application processes

- Benefits and risks involved

Equipping readers with the knowledge necessary to navigate this complex financial landscape effectively.

Understanding SMSF Loans: A Comprehensive Overview

Self-Managed Super Funds (SMSFs) represent a distinct financial option, empowering individuals to leverage their superannuation for property investment through SMSF loan providers. These financial arrangements, often facilitated by SMSF loan providers, are primarily structured as limited recourse borrowing arrangements (LRBAs). This means that in the event of a default, the lender's claim is restricted solely to the asset obtained through the funding. Such protective measures ensure that the other assets within the self-managed super fund remain secure, making the choice of SMSF loan providers appealing for investors.

The versatility of self-managed super fund loans from SMSF loan providers extends to both residential and commercial properties, allowing investors to diversify their portfolios effectively. Finance Story specializes in creating tailored financing solutions for both first-time buyers and seasoned investors, ensuring that each client receives the best funding options suited to their circumstances, including a full range of mainstream and private options. As of June 30, 2024, the self-managed superannuation fund sector has demonstrated remarkable growth, with over 625,000 such funds managing approximately $990 billion in assets.

This growth reflects a robust financial landscape, with average self-managed superannuation fund assets increasing by 21% over the past five years. Notably, the estimated return for SMSFs surged to 10.1% for the 2022-23 period, a significant rise from just 0.6% in the previous year, highlighting the potential for lucrative investments.

Current trends reveal that self-managed super fund members are predominantly older, with 85% aged 45 years or older, and the median age of members is 63 years. Interestingly, while female members have contributed more on average than their male counterparts, males still lead in employer contributions. This demographic insight underscores the importance of customized financial strategies to address the varied needs of members.

The substantial rise in average member balances for both genders further emphasizes the flourishing nature of the self-managed superannuation fund sector.

Understanding the workings of self-managed superannuation fund financing is essential for prospective borrowers considering options from SMSF loan providers. These financial aids not only enable asset acquisition but also act as a strategic instrument for wealth growth within the superannuation structure, especially when accessed through SMSF loan providers. Finance Story is dedicated to assisting clients with the intricacies of self-managed superannuation fund commercial property investments, ensuring compliance and aiding in the selection of the appropriate lender for their needs.

As Shaun Backhaus, Director of DBA Lawyers, notes, "Financial product advice can only be obtained from a licensed financial adviser under the Corporations Act 2001 (Cth)." As the self-managed super fund sector continues to prosper, it offers an attractive opportunity for small business proprietors and investors to consider financing through SMSF loan providers as a practical choice for enhancing their financial portfolios.

Types of SMSF Loan Providers: Banks, Brokers, and Private Lenders

SMSF loan providers are classified into three primary categories: banks, mortgage brokers, and private lenders. Each category offers distinct advantages and challenges that borrowers must consider when seeking financing through SMSF loan providers for their self-managed super funds (SMSFs).

Banks often emerge as the first choice for many borrowers, thanks to their competitive interest rates and established reputations. However, they typically enforce stricter lending criteria, which can complicate the approval process for some applicants. According to the latest quarterly statistical report on self-managed superannuation funds, banks represented approximately 60% of all financial arrangements involving SMSF loan providers in Australia, underscoring their dominance in the market despite the stringent requirements.

Mortgage brokers, such as Finance Story, play a vital role in the funding landscape by offering access to a broader array of lenders, including SMSF loan providers. They can customize solutions to meet individual client needs, often streamlining the application process. This personalized approach is particularly advantageous for clients navigating unique financial situations.

Finance Story's commitment to understanding business needs is evident in their ongoing relationships with clients, ensuring they achieve optimal results for their plans. As Natasha B. from VIC remarked, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." This testimonial underscores the bespoke service and support that Finance Story delivers throughout the process, reinforcing the firm's reputation for professionalism and a profound understanding of the finance sector.

Private lenders, including SMSF loan providers, are recognized for their flexibility and expedited approval times. They can serve as an excellent option for borrowers who may not satisfy the stringent criteria imposed by banks. While private lenders may charge higher interest rates, their willingness to accommodate unique financial circumstances can render them an appealing alternative for certain borrowers.

In 2025, grasping the distinctions among these categories of financial providers, such as SMSF loan providers, is essential for making informed decisions. Each option possesses its advantages, and borrowers should assess their specific needs and financial situations to pinpoint the most suitable provider for their loan requirements. With Finance Story's tailored support, clients can construct robust business cases for various lending needs, ensuring compliance and optimal lender selection for their commercial real estate pursuits.

Furthermore, Finance Story's expertise in navigating self-managed superannuation fund commercial property investments further solidifies their position as a trusted partner in achieving financial objectives.

Key Factors Influencing SMSF Loan Terms

The conditions surrounding self-managed superannuation fund financing are shaped by several essential elements, including interest rates, fees, and value-to-loan ratios (LVR). In 2025, interest rates for self-managed superannuation fund financing typically range from approximately 6.74% to higher figures, influenced by the lender's policies and the borrower's financial circumstances. This variability highlights the necessity of comparing offers from various SMSF loan providers to secure the most advantageous terms.

As Harry O'Sullivan noted, monetary policy decisions are likely to significantly impact these rates.

Fees associated with self-managed super funds can substantially affect the overall cost of borrowing. Common fees include establishment fees, ongoing fees, and exit fees, which borrowers must carefully evaluate when considering financing options. For example, establishment fees can vary from $500 to $2,000, while ongoing fees may be charged monthly or annually. A thorough understanding of these fees is crucial for making informed financial decisions.

The loan-to-value ratio is another critical factor in the self-managed superannuation fund loan landscape. Most lenders permit an LVR of up to 80% for residential properties and 70% for commercial assets. This means that borrowers can finance a significant portion of their real estate purchases through their self-managed super funds, yet they must also be aware of the consequences of higher loan-to-value ratios, which may lead to increased interest rates and fees.

Recent trends indicate that the average annual capital gains in the Australian real estate market fluctuate between 5% and 10%, rendering real estate investments through self-managed super funds an attractive option for many investors. However, it is vital to ensure that these investments comply with the sole purpose test, which stipulates that the assets must benefit fund members in retirement and cannot be occupied or acquired from related parties. Additionally, safe harbor provisions outline recommended interest rates and borrowing terms for related party financing to ensure compliance with ATO guidelines.

In navigating the complexities of self-managed super funds, Finance Story's specialized expertise in leveraging these funds for commercial real estate ventures has proven invaluable. The brokerage's capability to assist clients in securing customized lending solutions, even in challenging financial scenarios, has solidified its reputation as a trusted ally in the finance sector. By grasping the key factors influencing self-managed superannuation fund loan terms, borrowers can more effectively assess the competitiveness of various offers from SMSF loan providers and make informed decisions that align with their financial objectives.

It's important to note that there are fewer restrictions on commercial real estate acquisitions compared to residential properties, and SMSFs can invest in a variety of commercial assets, including office buildings, warehouses, and retail spaces. For tailored assistance, BOOK A CHAT with Finance Story today.

Pros and Cons of SMSF Borrowing: Weighing the Benefits and Risks

Borrowing through a Self-Managed Super Fund (SMSF) presents a range of benefits that can significantly enhance financial strategies, particularly in commercial real estate ventures. One of the primary advantages is the ability to leverage superannuation funds for real estate acquisition, which can lead to substantial growth in retirement savings. Moreover, SMSFs may provide potential tax benefits, enabling investors to optimize their financial outcomes.

This control over financial decisions empowers individuals to customize their portfolios based on personal goals and risk tolerance.

Finance Story specializes in guiding small business owners through the complexities of self-managed superannuation fund commercial real estate ventures, particularly with the assistance of SMSF loan providers. With fewer restrictions on commercial real estate investments compared to residential properties, Finance Story helps clients build a robust case for compliance with regulatory requirements, ensuring they are well-equipped to identify suitable SMSF loan providers for their commercial investments.

However, it is essential to acknowledge the inherent risks. SMSF loans frequently incur higher costs, which can impact overall returns. The intricacies of compliance with regulatory requirements add another layer of challenge, necessitating a comprehensive understanding of the legal landscape.

Market fluctuations can also influence property values, posing a risk to the stability of retirement savings. Should a financial venture underperform, it could jeopardize the financial security that SMSFs are intended to provide.

Recent statistics underscore the growth of the self-managed super fund sector, with the average balance in such funds rising by over 20% in recent years. Notably, the average member balance for females surged by 26%, while for males, it increased by 22% over the five years leading to 2022-23. This growth reflects the rising popularity of SMSFs as a vehicle for investment.

Furthermore, more than 65 percent of SMSFs have been established for over 10 years, highlighting their stability and longevity.

Financial advisors emphasize the importance of understanding the risks associated with self-managed superannuation fund borrowing, especially considering the complexities faced by SMSF loan providers and potential market volatility. Denise Raward, an expert in the field, poses the question, "Is it a good idea to invest in crypto through your self-managed super fund?" This inquiry underscores the necessity for careful deliberation in financial decisions.

Case studies illustrate the benefits of self-managed super fund borrowing via SMSF loan providers, demonstrating how strategic investments can result in significant asset growth. For instance, the self-managed superannuation fund sector has experienced a 45% increase in contributions, reaching $24.4 billion, with the average assets per fund now at $1.55 million. Additionally, statistics reveal that 74% of self-managed superannuation fund assets are allocated to Australian listed shares, cash and term deposits, unlisted trusts, non-residential real property, and LRBA assets.

This trend highlights the potential for SMSFs to serve as a powerful tool for wealth accumulation when managed prudently. Ultimately, individuals considering self-managed super fund borrowing should conduct thorough research and seek expert guidance from Finance Story to effectively navigate the complexities of this financial strategy.

BOOK A CHAT

Navigating the SMSF Loan Application Process: Requirements and Documentation

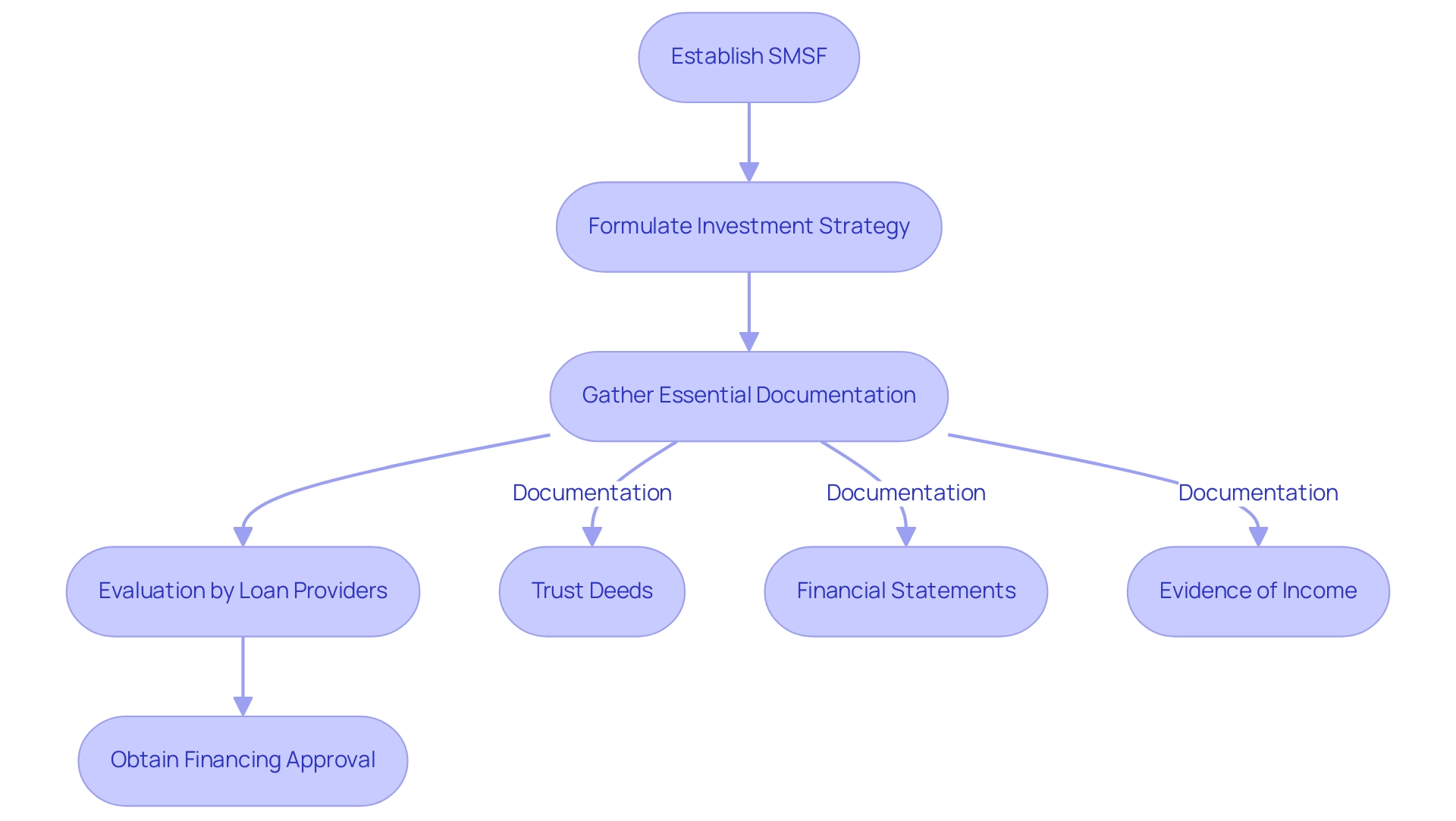

The application process for SMSF loan providers is multifaceted, requiring careful attention to several key steps and documentation. Initially, borrowers must establish their Self-Managed Superannuation Fund and formulate an investment strategy that aligns with their long-term financial objectives. Essential documentation generally consists of:

- Trust deeds

- Detailed financial statements

- Evidence of income for all fund members

Before granting approval for financing, SMSF loan providers will perform a comprehensive evaluation of the fund's adherence to regulatory standards and its overall financial condition. This examination is especially important considering that 74% of self-managed superannuation fund assets are concentrated in Australian listed shares, cash, term deposits, unlisted trusts, non-residential real estate, and LRBA assets, indicating a need for strategic asset management.

In 2025, understanding these documentation requirements is essential for borrowers aiming to simplify their application process and improve their chances of obtaining financing. For instance, successful self-managed superannuation fund loan applications often showcase well-organized documentation that clearly demonstrates the fund's compliance and financial viability to SMSF loan providers. Finance Story, with its professionalism and deep understanding of the finance sector, is well-positioned to guide clients through this complex process, ensuring they are equipped with the necessary documentation and strategies tailored to their unique business needs.

SMSFs can invest in various types of commercial properties, including office buildings, warehouses, and retail premises, which have fewer restrictions compared to residential properties.

Recent statistics reveal that the average return on assets (ROA) for SMSFs was reported at a mere 0.6% for the 2021-22 period, with 62% of funds recording zero or negative ROA. This decline highlights the significance of a strong financial strategy and the need for SMSF members—85% of whom are aged 45 or older—to reassess their financial approaches. By leveraging Finance Story's expertise, clients can develop more effective financial strategies in light of these statistics.

Ensuring that all necessary documentation is in order and understanding the application process can significantly improve borrowers' prospects of obtaining favorable financing conditions from SMSF loan providers, particularly when investing in commercial properties where fewer restrictions apply. BOOK A CHAT with Finance Story to explore tailored lending solutions and comprehensive support for your self-managed super fund investment journey.

Comparing SMSF Loan Offers: Finding the Best Terms for Your Needs

When assessing funding offers, borrowers must consider a range of essential factors, including interest rates, fees, terms, and the lender's reputation. Present market trends indicate that SMSF loan providers typically have elevated interest rates for self-managed super fund financing, starting at approximately 6.99%, and are subject to loan-to-value ratio (LVR) limitations of up to 90%. As noted by Theo Chambers, "It's important to highlight that self-managed super fund financing, provided by SMSF loan providers, has LVR restrictions (up to 90%) and generally has higher interest rates (starting from 6.99%) compared to conventional home financing." This makes it crucial for borrowers to conduct a comprehensive comparison of available options.

Utilizing comparison tools and resources can significantly aid in identifying the most competitive offers. Furthermore, engaging with a mortgage broker can provide tailored insights and access to a wider array of lenders, enhancing the chances of securing favorable terms. Brokers can also assist in navigating the complexities of SMSF financing, particularly with the help of SMSF loan providers, especially regarding the requirement to maintain a liquidity buffer of 5% to 10% within the SMSF after the funding is settled. This liquidity buffer is essential as it affects approval processes and borrower strategies.

Moreover, it is crucial to assess not only the financial aspects of the credit but also the quality of service and support offered by the lender. A lender's responsiveness and willingness to assist can greatly influence the overall borrowing experience. For example, some financial institutions evaluate the earnings and contributions of beneficiaries when reviewing credit applications, highlighting the significance of sustaining stable income and contribution levels to enable approval. This practice is emphasized in the case study titled 'Assessment of Beneficiaries in Financing Applications,' which stresses the necessity for beneficiaries to maintain stable income and contribution levels to support approval processes.

In 2025, effective strategies for identifying the best financing terms involve a thorough comparison of offers, considering average fees and interest rates, along with expert insights into the lending landscape. Additionally, SMSF loan providers include limited-recourse borrowing arrangements, which do not affect serviceability for traditional borrowing outside the super, allowing investors to grow their asset base without impacting personal financial goals. By concentrating on these factors, borrowers can make informed choices that align with their financial objectives and enhance their potential for returns.

Finance Story is here to provide expert guidance and support throughout this process, ensuring compliance and helping you find the right lender for your commercial property investment.

The Value of Expert Guidance in Choosing SMSF Loan Providers

Collaborating with a business finance consultant or mortgage broker offers significant advantages when selecting SMSF loan providers for self-managed super fund financing. Experts like Finance Story provide tailored advice that aligns with individual financial circumstances, enabling borrowers to fully comprehend their options and the potential implications of their decisions. With self-managed super fund loans typically starting at interest rates of 6.99%, which may be higher than other financing options, understanding the nuances of these loans is crucial for making informed choices.

Finance Story's mortgage brokers play a critical role in negotiating better terms and guiding clients through the often-complex application process. They ensure adherence to strict regulatory requirements such as the sole purpose test, which mandates that properties purchased through a self-managed superannuation fund benefit fund members solely in retirement. This expert guidance not only streamlines the borrowing experience but also significantly enhances the likelihood of achieving favorable financial outcomes for self-managed superannuation fund investors.

As Natasha B. from VIC states, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey." This testimonial underscores the essential role that brokers at Finance Story play as SMSF loan providers in the financing landscape, delivering bespoke solutions that cater to the unique needs of their clients.

Finance Story offers access to a comprehensive range of lenders, including innovative and entrepreneurial private lending panels, establishing them as one of the leading SMSF loan providers. This ensures clients have a variety of options to choose from. Recent trends indicate that brokers have adapted to technological advancements, conducting three times more communication through digital platforms compared to 2018. This shift has expanded their reach and improved service delivery, underscoring the importance of technology in the evolving mortgage broking landscape.

By utilizing these advancements, brokers can offer prompt and pertinent insights, further assisting clients in their self-managed super fund financing selection process with SMSF loan providers.

Seeking assistance from a mortgage advisor for self-managed superannuation fund financing can yield favorable results, as demonstrated by various case studies emphasizing the advantages of professional advice. Clients frequently report increased satisfaction and better financing conditions, reinforcing the importance of expert assistance from SMSF loan providers in managing the intricacies of self-managed superannuation fund financing. As the landscape continues to evolve, the role of mortgage brokers remains integral in helping clients secure the most advantageous options from SMSF loan providers, particularly with reputable firms like Finance Story, known for their professionalism and deep understanding of the finance sector.

Conclusion

The exploration of Self-Managed Super Fund (SMSF) loans unveils a dynamic opportunity for property investment, empowering individuals to strategically leverage their retirement savings. With the advent of limited recourse borrowing arrangements (LRBAs), investors can confidently pursue both residential and commercial properties while safeguarding their fund's other assets. This financial tool is particularly compelling in light of the SMSF sector's impressive growth, which is approaching $990 billion in assets, alongside a notable surge in average returns.

Understanding the diverse types of SMSF loan providers—banks, brokers, and private lenders—equips borrowers with the necessary knowledge to make informed decisions. Each option presents unique advantages and challenges, highlighting the importance of comparing offers to secure favorable loan terms. Factors such as interest rates, fees, and loan-to-value ratios (LVR) are crucial in shaping the borrowing landscape, necessitating careful navigation of these complexities.

While SMSF loans offer substantial benefits, including potential tax advantages and tailored investment strategies, they also come with inherent risks. Higher costs and market fluctuations can impact returns, underscoring the need for thorough research and expert guidance. Engaging with professionals like Finance Story can streamline the application process and enhance the likelihood of achieving optimal financial outcomes.

In conclusion, the potential of SMSF loans as a vehicle for wealth accumulation is significant, provided that investors approach them with a clear understanding of the associated risks and rewards. By leveraging expert advice and making informed choices, individuals can effectively navigate the complexities of SMSF borrowing, ultimately enhancing their financial portfolios and securing a more prosperous retirement.