Overview

Large business loan requirements encompass a robust credit score, a comprehensive business plan, recent financial statements, and potentially collateral. These elements are crucial for demonstrating the borrower's creditworthiness and financial health. Meeting these criteria significantly enhances the chances of securing funding.

In fact, businesses with well-structured plans are 30% more likely to obtain loans, as evidenced by compelling statistics. This highlights the importance of preparation and strategy in the loan application process.

Introduction

In the ever-evolving landscape of entrepreneurship, securing the right financial resources stands as a critical pillar for growth and sustainability. Business loans serve as a vital tool, empowering companies to expand, acquire essential equipment, and manage cash flow with precision.

As the lending environment transforms, it becomes increasingly crucial for business owners to grasp the various types of loans and their specific purposes, aligning financial strategies with overarching goals. With statistics indicating that a significant percentage of businesses leverage loans primarily for expansion, the stakes are higher than ever.

This article explores the essentials of business loans, detailing:

- Key requirements

- Necessary documentation

- The evaluation process

While emphasizing the importance of tailored financial solutions to meet diverse business needs.

Define Business Loans and Their Purpose

Commercial financing serves as a vital monetary resource for enterprises, aimed at various objectives such as growth, equipment acquisition, and cash flow management. These credit forms can be categorized as secured or unsecured, depending on the necessity of collateral. In 2025, the commercial financing landscape continues to evolve, with a notable percentage of enterprises primarily utilizing funding for expansion rather than equipment purchases. Understanding the specific aims of these loans is essential for aligning financial needs with large business loan requirements, thereby enhancing the prospects for growth and stability.

Current statistics reveal that a 66% approval rate represents the highest for institutional financiers in small enterprise financing, underscoring the market's competitive nature. This statistic suggests that while many enterprises may find financing opportunities, they must be prepared to meet large business loan requirements and present compelling cases to lenders for funding. Finance Story specializes in crafting refined, highly personalized cases, ensuring that small enterprise owners can effectively articulate their needs and secure suitable financing options. Moreover, the typical borrowing amount for purposes beyond equipment purchase is $112,047, highlighting the substantial financial commitments companies undertake to support their growth.

Expert insights emphasize the crucial role of commercial financing in driving expansion. Financial specialists assert that the right financing option can significantly accelerate enterprise growth, provided entrepreneurs have clearly defined their strategies, including anticipated returns on investment (ROI). Small enterprise owners should invest time in outlining their strategies and financial projections to leverage this advice effectively. Additionally, a recent report on the lending environment for small enterprises highlights the importance of understanding large business loan requirements and the various financing options available, particularly for underrepresented groups in the entrepreneurial community, who often face considerable challenges in securing capital due to systemic barriers.

Furthermore, a striking statistic indicates that 68% of entrepreneurs regard access to funding as the most critical factor in their growth. This underscores the essential role that commercial financing plays in facilitating growth and operational success. By partnering with specialists like Finance Story, who provide access to a diverse range of lenders, including high street banks and innovative private lending panels, business owners can navigate the complexities of refinancing their commercial financing to meet their evolving enterprise needs. This includes funding options for various types of commercial properties, such as warehouses, retail locations, factories, and hospitality projects.

In conclusion, commercial financing is pivotal for fostering growth, and a comprehensive understanding of its categories and functions can empower entrepreneurs to make informed economic decisions. By effectively leveraging these financial tools, organizations can adeptly navigate the complexities of the lending landscape and position themselves for success.

Identify Key Requirements for Business Loans

To qualify for a commercial financing option, applicants must typically meet several key criteria:

- Credit Score: A robust credit score is vital, reflecting the entity's creditworthiness. In 2025, the typical credit score needed for commercial loans is approximately 680, indicating lenders' growing focus on credit history.

- Plan: A comprehensive plan is essential, detailing how the loan will be utilized and the expected return on investment. Statistics reveal that companies with a well-structured plan are 30% more likely to secure funding, demonstrating the applicant's preparedness and understanding of their market. At Finance Story, we prioritize developing refined and highly personalized cases to present to banks, improving your chances of approval.

- Financial Statements: Lenders require recent financial statements, including profit and loss reports, balance sheets, and cash flow statements, to evaluate the company's financial health. These documents provide insights into the company's operational efficiency and profitability.

- Collateral: Depending on the nature of the credit, collateral may be necessary to secure financing. This could include assets like real estate, equipment, or inventory, which can mitigate the lender's risk.

- Company Age: Many lenders favor enterprises that have been operating for a minimum of two years, as this duration generally signifies stability and experience in the market.

Case studies indicate that new entrepreneurs often find it challenging to manage operational expenses solely with personal savings, making financing a vital option. Understanding the lending landscape and having a solid action plan is crucial for securing financing. Furthermore, recent statistics emphasize that women, minority, and veteran entrepreneurs face significant challenges in obtaining loans, with only 20% of minority-owned enterprises securing the funding they pursue, underscoring the necessity for customized financial solutions.

Expert opinions underscore that maintaining a favorable credit score is not just advantageous but essential for loan applications. As noted by industry leaders, a significant portion of small enterprise loans—approximately 70%—is provided by banks with less than $250 billion in assets. This reality makes it imperative for applicants to present a compelling case that includes a strong credit profile and a strategic plan. Additionally, the typical amount for SBA financing can reach up to $5 million, illustrating the potential extent of funding available to small enterprises.

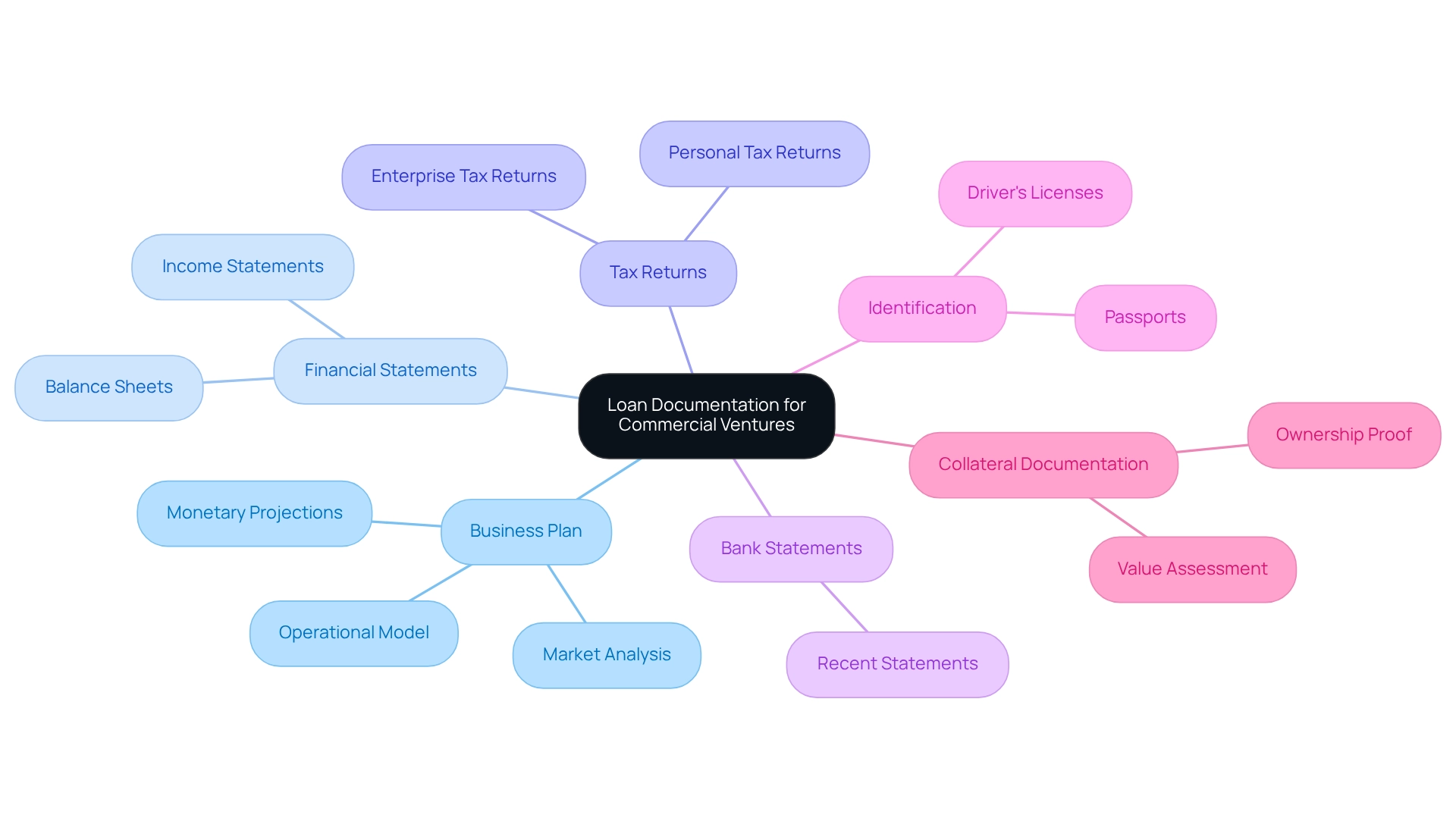

Prepare Necessary Documentation for Loan Applications

When seeking a loan for a commercial venture, it is essential to prepare the following documentation to ensure your proposal meets the elevated expectations of financiers:

- Business Plan: A detailed plan outlining the operational model, market analysis, and monetary projections tailored to your specific investment goals. This emphasizes the importance of creating a polished case.

- Financial Statements: Include at least two years of fiscal statements, such as balance sheets and income statements, to demonstrate your enterprise's economic health.

- Tax Returns: Personal and enterprise tax returns for the last two years provide a comprehensive view of your fiscal history.

- Bank Statements: Recent bank statements are vital to demonstrate cash flow and economic stability, which are critical for securing favorable loan terms.

- Identification: Personal identification documents for all owners, such as driver's licenses or passports, are necessary to verify ownership and authority.

- Collateral Documentation: If applicable, documents proving ownership and value of collateral assets can strengthen your loan application.

Furthermore, consider the types of commercial properties that can be financed, including warehouses, retail premises, factories, and hospitality ventures. By preparing these documents, you can create a refined and highly personalized case that meets the needs of financiers. For additional help, think about arranging your complimentary personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy, to discuss customized strategies that align with your objectives.

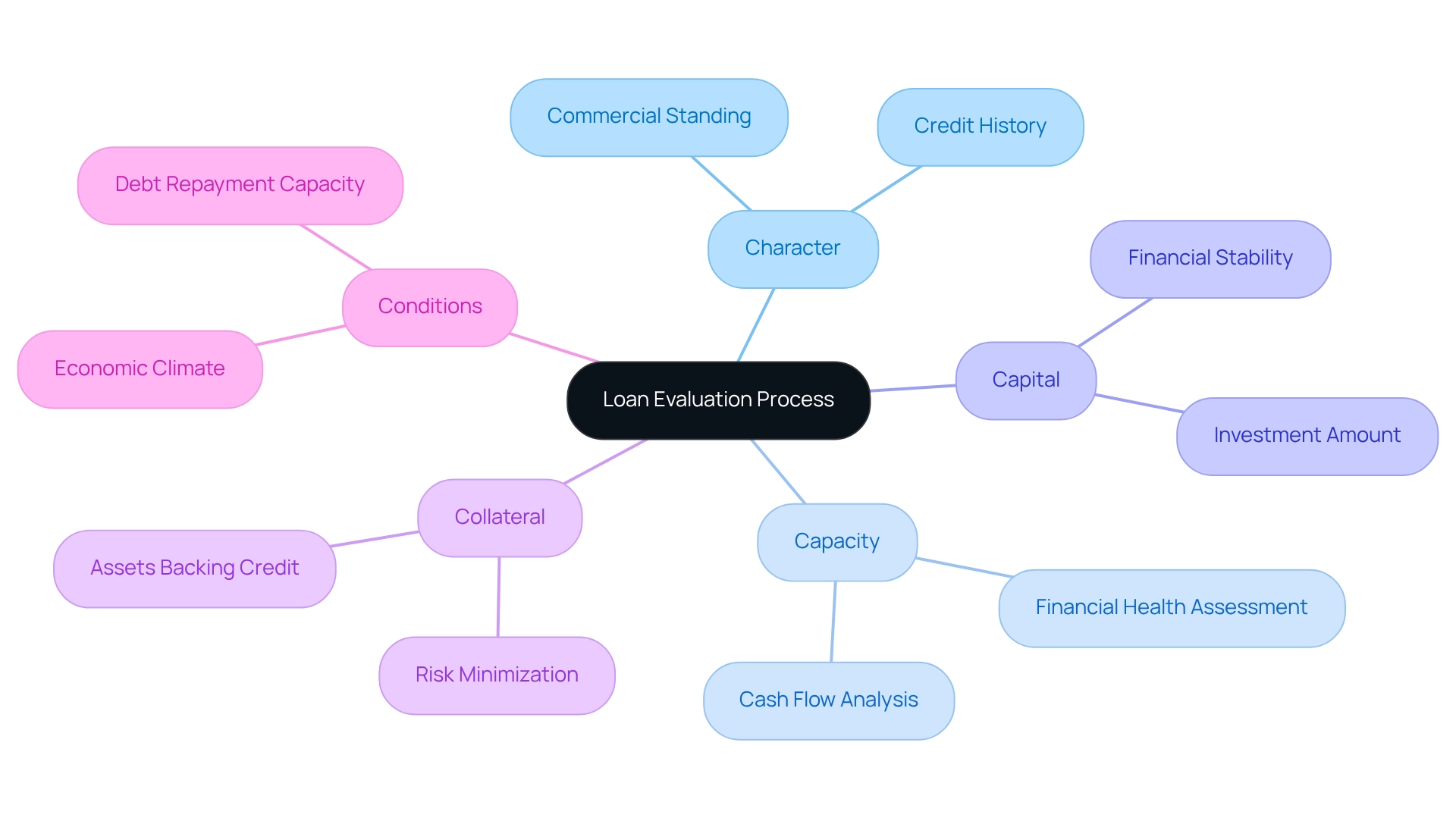

Understand the Loan Evaluation Process and Criteria

The financing assessment procedure encompasses several essential factors that financiers evaluate:

- Character: This refers to the borrower's credit history and standing within the commercial community, significantly influencing financier trust.

- Capacity: It pertains to the enterprise's ability to repay the financing, often analyzed through cash flow examination. Understanding this is crucial for creditors to assess the financial health of the enterprise.

- Capital: This indicates the amount of money the enterprise has invested in itself, showcasing commitment and financial stability. A robust capital foundation can enhance the likelihood of securing advantageous credit conditions.

- Collateral: These are the assets that can be utilized to back the credit, thereby minimizing risk for the financier. Significant collateral can elevate a company's appeal to creditors.

- Conditions: This involves the overall economic climate and its potential impact on the entity's capacity to repay the debt. Understanding these conditions can help companies tailor their applications to meet large business loan requirements.

At Finance Story, we prioritize crafting refined and highly personalized cases that address large business loan requirements, ensuring your loan proposal meets the elevated expectations of lenders. By collaborating with us, small business owners can effectively navigate the complexities of securing financing for commercial property investments and refinances.

Conclusion

Understanding the landscape of business loans is crucial for entrepreneurs aiming to fuel their growth and navigate financial challenges. Business loans serve a variety of purposes, from expansion to equipment acquisition. Recognizing the specific requirements and documentation needed for these loans can significantly enhance a business's chances of securing the necessary funding. Key factors such as credit scores, comprehensive business plans, and financial statements play a pivotal role in the loan evaluation process, underscoring the importance of being well-prepared and informed.

Furthermore, the evaluation criteria that lenders use—character, capacity, capital, collateral, and conditions—highlight the multifaceted nature of loan applications. By addressing these aspects, business owners can present compelling cases that resonate with lenders, ultimately facilitating access to the financial resources needed for success. Statistics indicate that a significant percentage of businesses rely on loans for expansion, further emphasizing the critical role that financing plays in driving operational success and achieving long-term goals.

In conclusion, as the lending environment continues to evolve, it is imperative for business owners to stay informed and proactive in their financial strategies. By leveraging tailored financial solutions and expert guidance, entrepreneurs can navigate the complexities of securing business loans and position themselves for sustained growth and stability in an increasingly competitive market. The right approach to financing not only supports business objectives but also empowers entrepreneurs to realize their visions with confidence.