Overview

To successfully finance commercial investment property, it is essential to grasp various loan types, prepare the necessary documentation, and assess both financial health and property viability. This article delineates specific financing options, outlines required paperwork, and highlights common pitfalls. It emphasizes that thorough preparation and a solid understanding of market conditions are crucial for achieving successful investment outcomes and securing loan approval.

Introduction

Navigating the realm of commercial investment property financing can indeed feel overwhelming, particularly given the multitude of loan options and requirements investors encounter. Grasping the nuances of various financing products—from conventional loans to SBA financing—is vital for making informed decisions that can profoundly affect an investment's profitability.

However, with an abundance of choices and potential pitfalls, how can investors ensure they secure not only the best financing but also position themselves for sustained success? This guide explores the essential steps for financing commercial properties, equipping readers with the knowledge to confront challenges directly and make strategic investment choices.

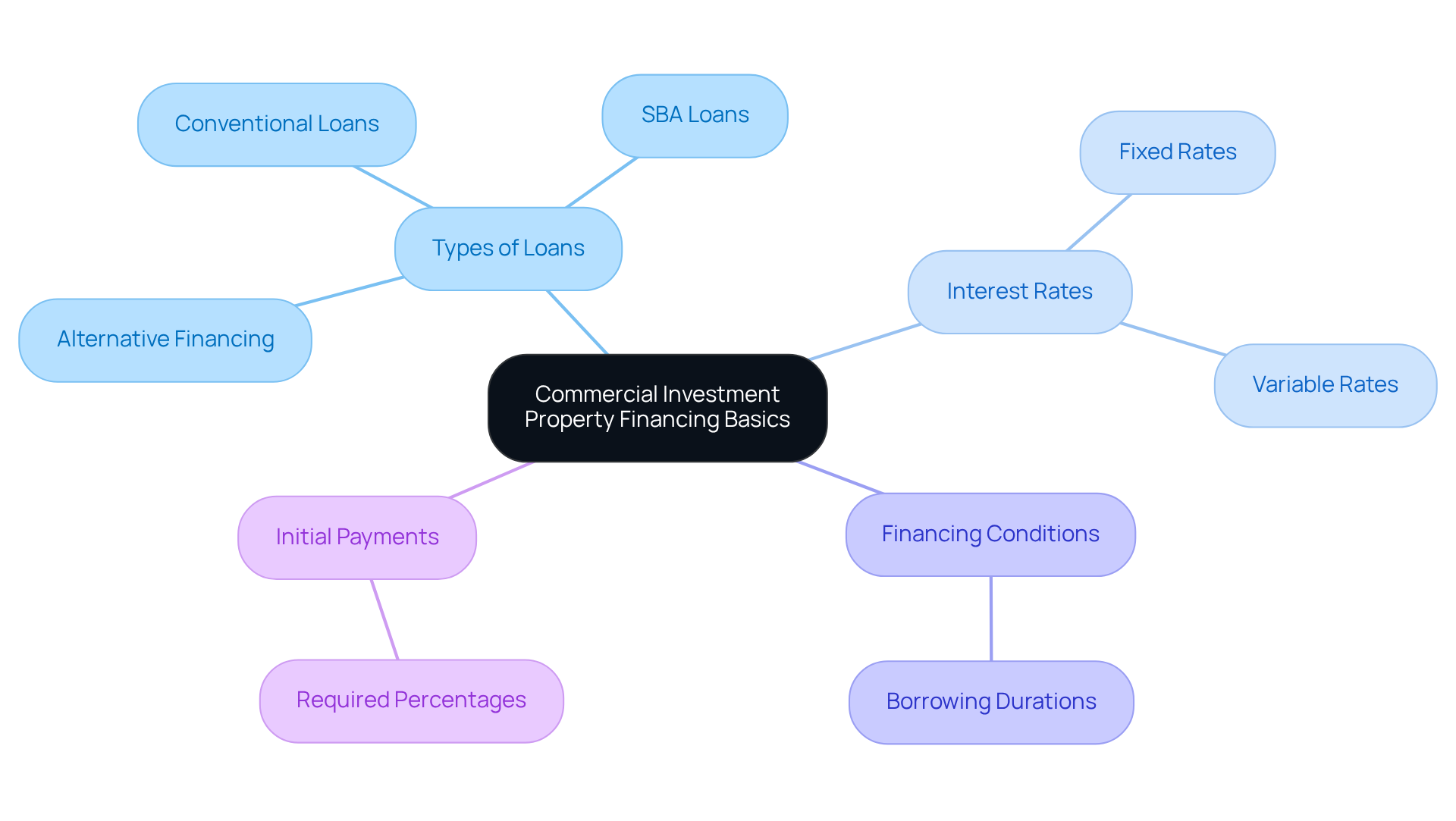

Understand Commercial Investment Property Financing Basics

To learn how to finance commercial investment property, one must explore a variety of specialized financial products tailored for acquiring or refinancing business-use properties. Understanding key concepts is crucial:

- Types of Loans: It is important to distinguish between conventional loans, SBA loans, and alternative financing options. For example, SBA 504 financing can provide up to $15 million with leverage of up to 90%, making it a viable choice for many investors.

- Interest Rates: Comprehending the difference between fixed and variable interest rates is essential, as these significantly influence your total borrowing cost. As of June 2025, commercial mortgage rates vary widely; conventional mortgages typically range from 4.5% to 5.5%, while SBA 7(a) financing rates range from 8.50% to 10.25%.

- Financing Conditions: Typical borrowing durations for commercial real estate can span from 5 to 30 years. Shorter terms may offer lower rates but could impact your cash flow more substantially than longer terms.

- Initial Payments: Unlike residential financing, most business financing requires a larger initial payment, often between 20% and 30% of the asset's value. This upfront funding is crucial for securing favorable credit conditions.

By mastering these fundamentals, you will be better equipped to navigate the complexities of financing commercial assets effectively.

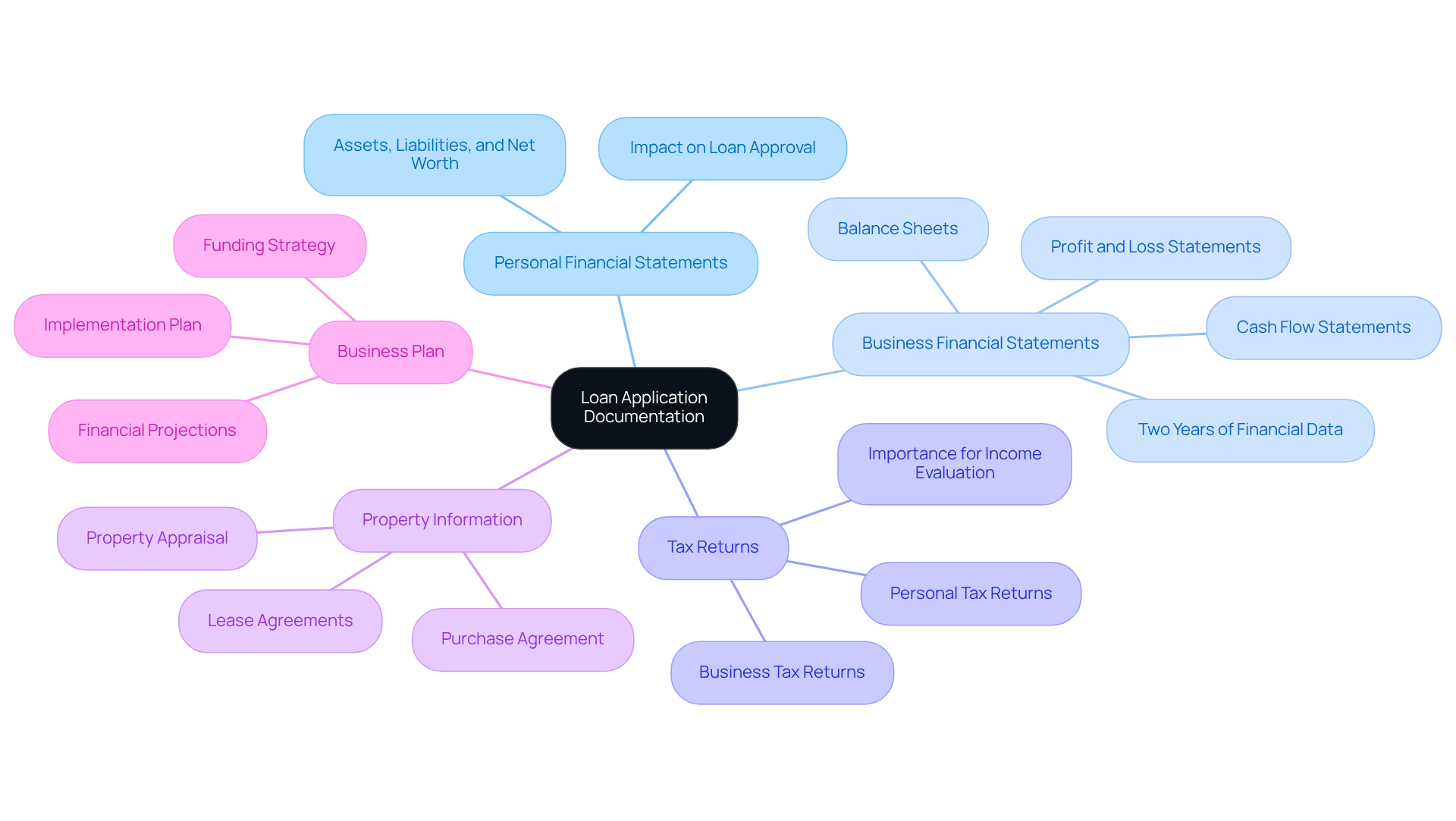

Gather Required Documentation for Loan Application

When seeking a commercial investment financing option, collecting various important documents is crucial to simplify the process and demonstrate your financial preparedness to lenders. Here’s a comprehensive list of what you’ll need:

- Personal Financial Statements: These should detail your assets, liabilities, and net worth, providing a clear picture of your financial health. A well-prepared personal financial statement can significantly impact your loan approval chances, especially when working with specialized lenders like Finance Story who appreciate tailored proposals.

- Business Financial Statements: Include profit and loss statements, balance sheets, and cash flow statements for the past two years. This information is crucial, as lenders typically require at least two years of financial data to assess your business's stability and repayment capacity.

- Tax Returns: Submit both personal and business tax returns for the last two years. This documentation helps lenders evaluate your income and tax obligations, which are critical in understanding your overall financial profile.

- Property Information: Provide comprehensive details about the property you intend to purchase, including the purchase agreement, property appraisal, and any lease agreements if applicable. This information is essential for lenders to comprehend the asset's potential and how it corresponds with your funding strategy.

- Business Plan: A well-structured business plan outlining your funding strategy and financial projections can significantly strengthen your application. It demonstrates to lenders that you have a clear vision and a plan for achieving your financial goals, which is essential when presenting your case to banks or private lenders.

Furthermore, Finance Story provides access to a complete range of lenders, including high street banks and creative private lending panels, which can improve your funding options. Having these documents ready not only makes the application process easier but also shows your readiness and dedication to understanding how to finance commercial investment property. It's worth mentioning that 39% of banks can approve a small and straightforward credit within one business day, while 76% can do so within five business days. Understanding these timelines can help you prepare your documentation promptly. Lastly, consider that gathering these documents may take an average of several weeks, so starting early is advisable.

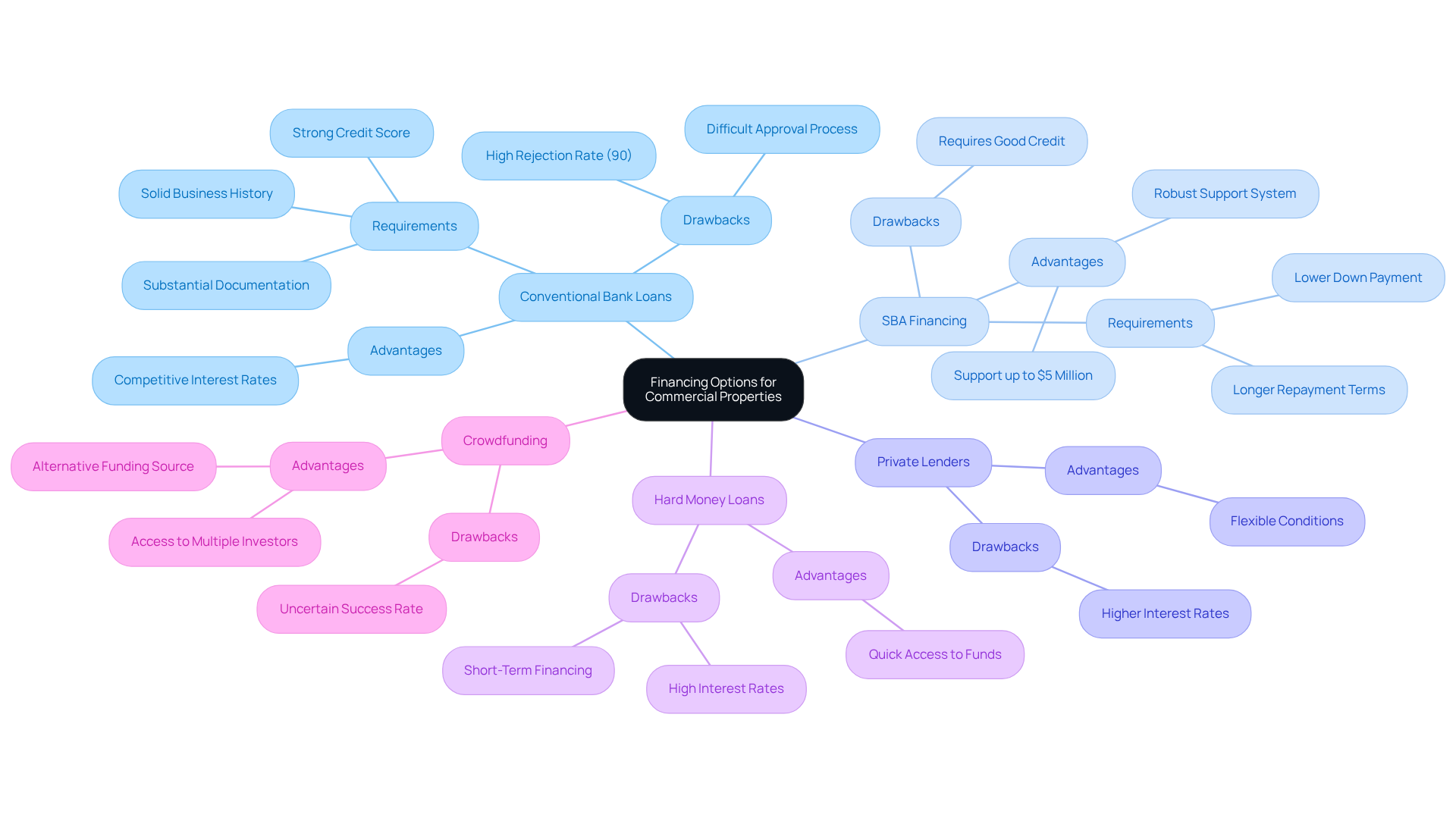

Explore Financing Options for Commercial Properties

When financing a commercial property, several options are available, each with distinct advantages and considerations:

-

Conventional Bank Loans: These traditional loans are typically offered by banks and require a strong credit score, substantial documentation, and a solid business history. They often come with competitive interest rates, making them a favorable choice for established businesses. However, obtaining approval can be difficult, as nearly 90% of SBA funding requests are rejected due to discrepancies among lenders.

-

SBA Financing: Supported by the Small Business Administration, this funding is especially appealing for small business proprietors in 2025. They often feature lower down payment requirements and longer repayment terms, which can ease the financial burden. In fiscal year 2024, the SBA provided $37.8 billion in funding, indicating a robust support system for small businesses. The typical interest rate for SBA funding is approximately 7.75%, and they can provide support of up to $5 million, rendering them a practical choice for substantial investments.

-

Private Lenders: These lenders may offer more adaptable conditions compared to conventional banks, addressing unique funding requirements. However, they often charge higher interest rates, which can impact overall profitability. It's essential to weigh the flexibility against the cost when considering this option.

-

Hard Money Loans: These are short-term loans backed by real estate, usually utilized for urgent funding requirements. Although they can be advantageous for urgent circumstances, they carry elevated interest rates and charges, rendering them less appropriate for long-term funding strategies.

-

Crowdfunding: An emerging funding method where multiple investors combine resources to support a property. This choice can be especially attractive for those unable to obtain conventional funding. Successful crowdfunding initiatives have shown the ability to generate substantial funds for commercial real estate ventures, offering an alternative route for financing.

Assessing these choices according to your financial situation and funding approach will assist you in understanding how to finance commercial investment property optimally.

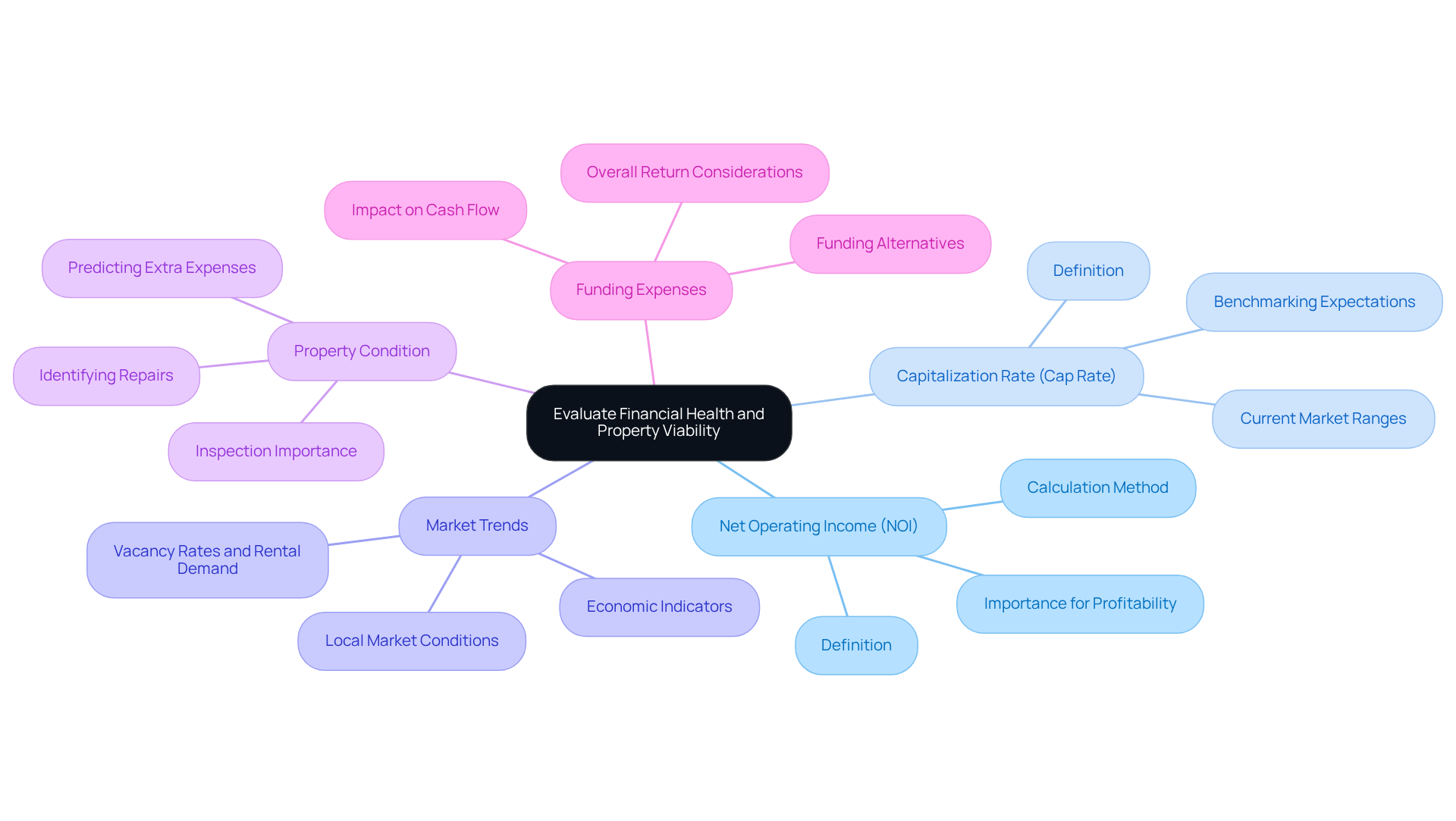

Evaluate Financial Health and Property Viability

Before embarking on a commercial property investment, it is essential to conduct a thorough evaluation of several key factors:

- Net Operating Income (NOI): This metric represents the income generated by the property after deducting operating expenses. Precisely calculating NOI is essential, as it acts as a basis for evaluating the asset's profitability and potential cash flow.

- Capitalization Rate (Cap Rate): To determine the cap rate, divide the NOI by the asset's purchase price. This figure is crucial for assessing the potential return on capital. Current cap rates for prime commercial assets typically range from 4.5% to 6.5%, while residential assets often see cap rates between 3.0% and 6.5%. Understanding these rates can help investors benchmark their expectations against market standards.

- Market Trends: Investigate local market conditions, including vacancy rates, rental demand, and economic indicators. These factors can significantly affect real estate performance and financial viability.

- Property Condition: Conduct a comprehensive inspection to identify any necessary repairs or renovations. Comprehending the property's state can assist you in predicting extra expenses that might affect your total financial commitment.

- Funding Expenses: Examine different funding alternatives to understand how to finance commercial investment property and how they will influence your cash flow and overall return. Understanding how to finance commercial investment property is critical as different financing structures can lead to varying impacts on profitability.

By meticulously evaluating these aspects, you can make a more informed decision regarding your commercial property investment, positioning yourself for long-term success.

Navigate the Loan Application Process

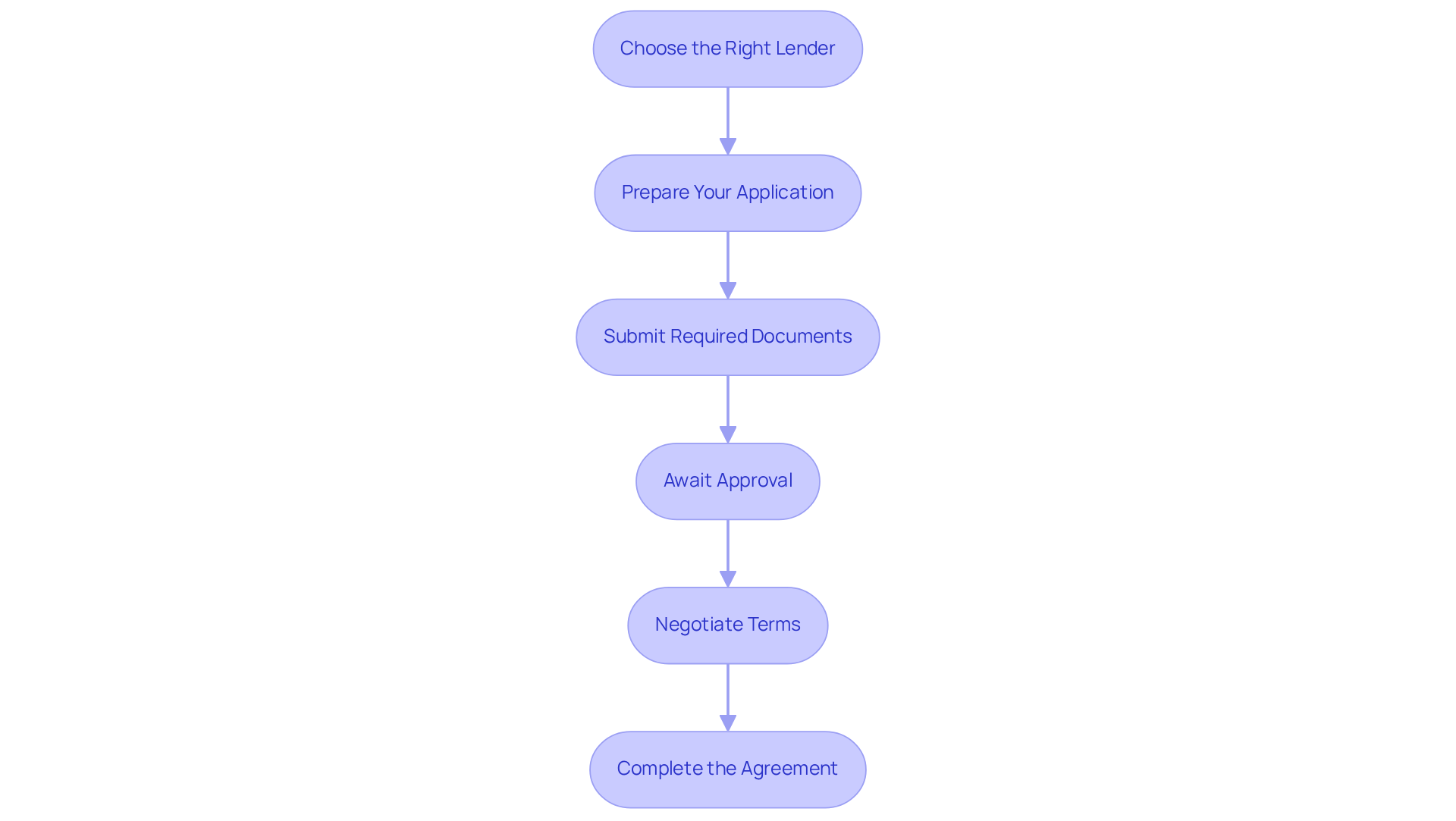

To navigate the loan application process effectively with the support of Finance Story, follow this three-step guide:

-

Choose the Right Lender: Research and compare lenders based on their terms, interest rates, and customer reviews. With Finance Story, you gain access to a wide range of the best value products on the market, ensuring you make an informed choice.

-

Prepare Your Application: Complete the application form accurately, ensuring all information is consistent with your documentation. Our expert team is here to guide you through this process, making it effortless.

-

Submit Required Documents: Provide all necessary documentation as outlined in the previous section to support your application. Finance Story can assist you in gathering and organizing these documents efficiently.

-

Await Approval: After submission, the lender will review your application and may request additional information or clarification. Our team will keep you informed throughout this stage.

-

Negotiate Terms: Once approved, review the financing terms carefully. Don’t hesitate to negotiate for better rates or conditions. With Finance Story's expertise, you can feel confident in securing the best possible terms.

-

Complete the Agreement: After accepting the conditions, you will sign the documents and finalize the funding. We can help ensure that this final step is smooth and straightforward.

By following these steps and leveraging the personalized support from Finance Story, you can streamline the application process and increase your chances of securing the necessary funding.

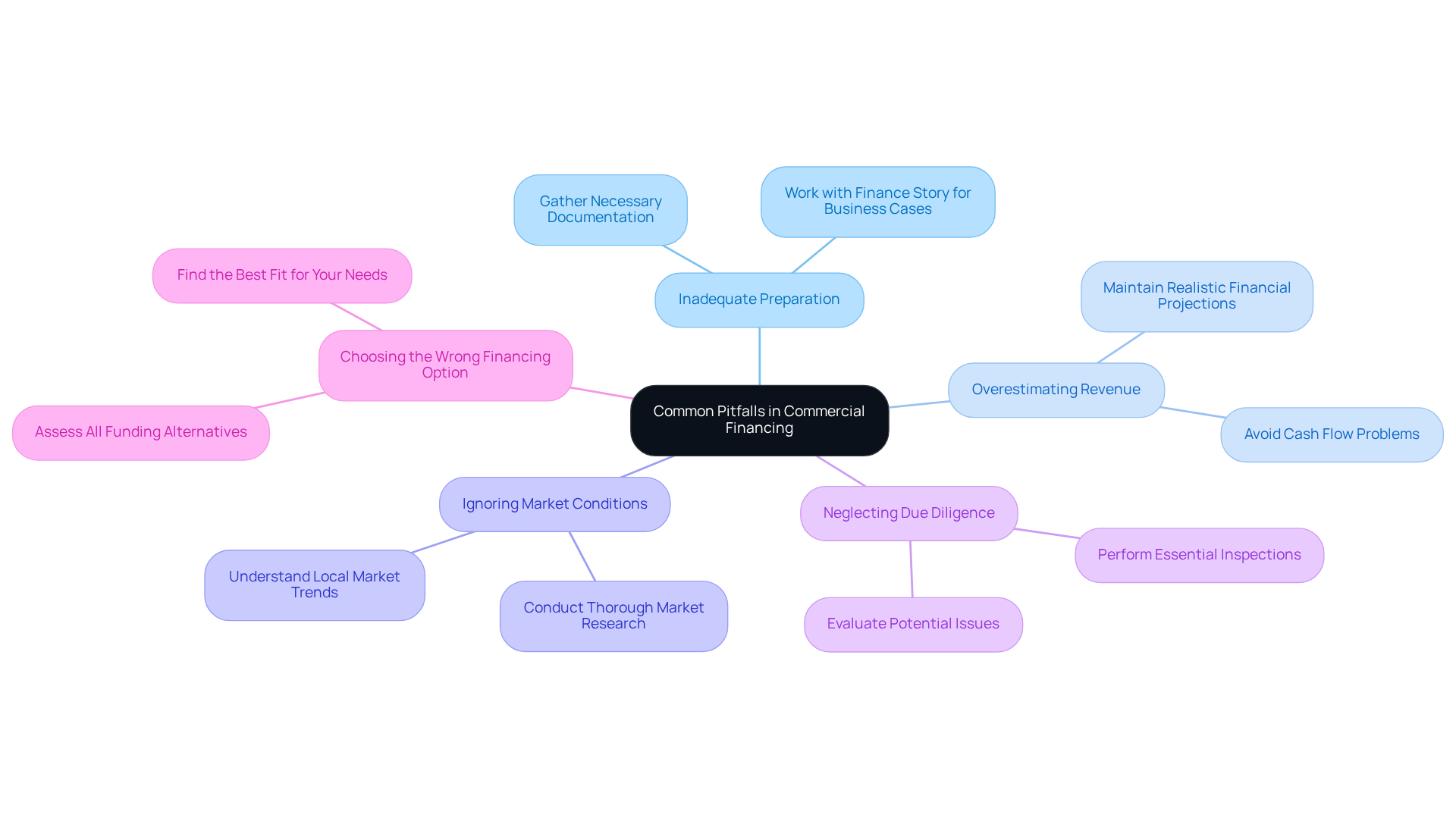

Identify Common Pitfalls in Commercial Financing

When financing commercial properties, recognizing common pitfalls that can hinder your success is crucial:

- Inadequate Preparation: Failing to gather all necessary documentation can lead to significant delays or outright rejections of your loan application. Ensure that you have all required paperwork organized and ready before applying. Working with Finance Story, you can create polished and highly individualized business cases that meet the heightened expectations of lenders, ensuring you are well-prepared.

- Overestimating Revenue: It is essential to maintain realistic financial projections. Excessively hopeful revenue projections can lead to cash flow problems that may endanger your capital.

- Ignoring Market Conditions: Neglecting to consider local market trends can result in poor investment decisions. Conduct thorough market research to understand the dynamics affecting your potential real estate.

- Neglecting Due Diligence: Skipping essential inspections or evaluations of real estate can lead to unexpected costs and complications. Always perform due diligence to uncover any potential issues before finalizing a purchase. A case study from Finance Story illustrates how inadequate property evaluations led to unforeseen expenses for a client, ultimately affecting their investment.

- Choosing the Wrong Financing Option: Selecting a loan that does not align with your financial situation can create long-term challenges. Assess all funding alternatives carefully to find the best fit for your needs. Finance Story can help you obtain the appropriate funding option customized to your situation, whether you are buying a warehouse, retail space, factory, or hospitality business.

By being aware of these pitfalls and preparing adequately, you can significantly enhance your chances of understanding how to finance commercial investment property for a successful acquisition. As Warren Buffett wisely noted, "Risk comes from not knowing what you’re doing," underscoring the importance of thorough preparation in the investment process.

Conclusion

Financing commercial investment property is a multifaceted process that demands careful consideration of various financial products, documentation, and evaluation strategies. By mastering the essential steps outlined in this guide, investors can position themselves for success in the competitive realm of commercial real estate.

Key points discussed underscore the importance of familiarizing oneself with different types of loans, including conventional and SBA financing, as well as the necessity of gathering comprehensive documentation to support loan applications. Furthermore, evaluating financial health through metrics like Net Operating Income and Capitalization Rate is crucial, along with being aware of common pitfalls that could derail investment efforts. Each of these elements plays a vital role in ensuring that investors make informed decisions and secure favorable financing terms.

Ultimately, the journey to financing commercial investment property transcends merely securing funds; it involves laying a solid foundation for future success. Investors are encouraged to take proactive steps in understanding their financing options and preparing thoroughly to avoid common mistakes. By doing so, they can navigate the complexities of commercial property financing with confidence and clarity, setting the stage for profitable investments that contribute to long-term financial growth.