Overview

Mastering commercial investment loans requires a thorough understanding of their distinctive features, eligibility criteria, and strategic planning to secure advantageous financing for income-generating properties. It is essential to emphasize that comprehensive financial documentation, awareness of market trends, and expert guidance from mortgage brokers, such as Finance Story, can significantly enhance the chances of approval and lead to successful investment outcomes.

Introduction

In the dynamic realm of commercial real estate, grasping the intricacies of investment loans is vital for businesses eager to expand their portfolios and secure their financial futures. These specialized financing options not only facilitate the acquisition and development of income-generating properties but also come with unique terms and conditions that significantly differ from residential loans. As the market evolves, an increasing number of businesses are turning to commercial investment loans to capitalize on real estate opportunities. Recent statistics indicate a substantial rise in loan commitments, underscoring this trend.

This article explores the various types of commercial investment loans available, the key eligibility criteria for securing financing, and the strategic planning necessary to navigate this complex landscape effectively. With expert guidance from specialized brokers, businesses can enhance their chances of success and unlock the potential of commercial property investments.

Understanding Commercial Investment Loans: An Overview

Commercial investment loan options represent specialized resources tailored for the acquisition, development, or refinancing of income-generating properties, encompassing retail spaces, office buildings, warehouses, factories, and industrial facilities. In contrast to residential financing, a commercial investment loan typically necessitates larger amounts and distinct evaluation standards, making it imperative for enterprises aiming to expand operations or invest in property.

By 2025, approximately 40% of enterprises in Australia are projected to utilize investment financing, highlighting a growing trend in leveraging real estate for revenue generation. This shift is supported by the increasing demand across various property categories, as businesses recognize the potential of a commercial investment loan to enhance their real estate portfolios.

Key features of a commercial investment loan include flexible repayment options, competitive interest rates, and the ability to finance up to 80% of the property's value, contingent upon the lender and the specific circumstances of the borrower. These financial products are designed to cater to diverse business needs, whether for acquiring new properties or restructuring existing ones to unlock capital for further investments.

Finance Story is dedicated to crafting refined and highly customized business cases for presentation to banks, ensuring that clients secure the most suitable financing options for their property investments. We provide a comprehensive array of lenders, ranging from high street banks to innovative private lending panels, accommodating any situation. Recent case studies illustrate the successful acquisition of business properties through these financial arrangements.

For instance, a startup based in Melbourne secured a business financing option to purchase an office building, which has since generated a steady rental income, significantly boosting the company's cash flow. This case exemplifies the potential of a commercial investment loan to foster growth and stability for enterprises.

Expert insights underscore the importance of understanding the current market landscape when assessing business investment financing. Insights from industry leaders, such as Victor Calanog, Global Head of Research and Strategy at Manulife Investment Management, reveal that suburban office markets are exhibiting signs of cap rate flatness or declines. This awareness emphasizes the necessity for enterprises to stay attuned to evolving trends in the property market.

In conclusion, securing a commercial investment loan is vital for organizations seeking to capitalize on real estate opportunities. As the market continues to evolve in 2025, remaining informed about current statistics and trends will empower business owners to make informed decisions that align with their financial objectives. Schedule your free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy, to explore tailored financial strategies that address your unique needs.

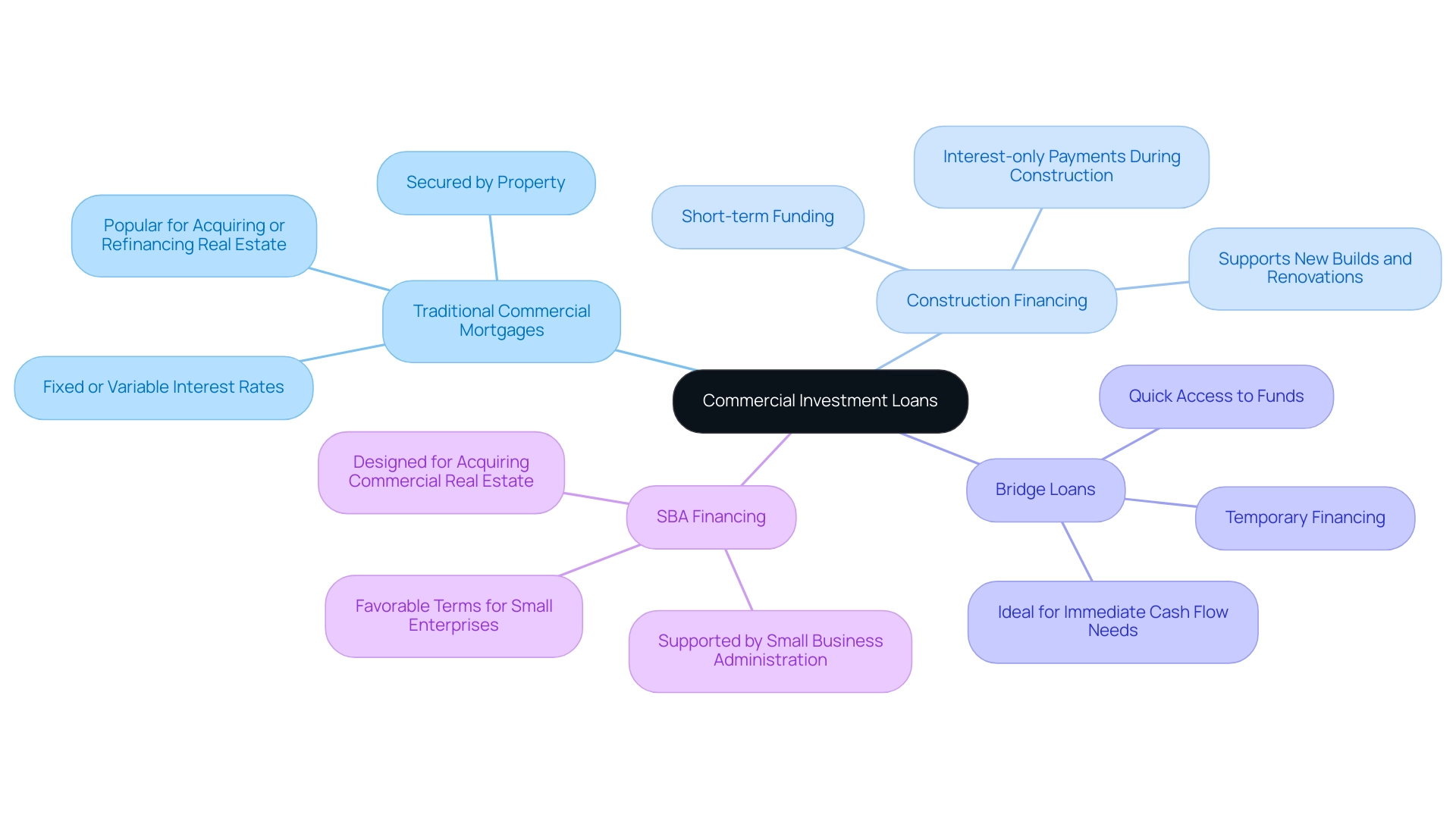

Exploring Different Types of Commercial Investment Loans

When evaluating financing options for a commercial investment loan, understanding the various types available is essential, as each is designed for specific needs and situations. Here are the primary categories:

-

Traditional Commercial Mortgages: These long-term loans are secured by the property itself and typically feature fixed or variable interest rates. They are a popular option for investors seeking to acquire or refinance real estate, holding a significant market share in Australia, reflecting their reliability and stability in the lending landscape.

-

Construction Financing: Designed for those looking to build new properties or renovate existing ones, construction financing provides short-term funding. Borrowers often benefit from interest-only payments during the construction phase, facilitating easier cash flow management while the project is underway.

-

Bridge Loans: These temporary financing options are ideal for covering immediate cash flow needs, particularly when waiting for permanent financing or property sales. They serve as a crucial tool for investors needing quick access to funds to seize opportunities in a competitive market.

-

SBA Financing: Supported by the Small Business Administration, these funds are specifically designed to assist small enterprises in acquiring commercial real estate. They provide favorable terms and conditions, making them an appealing choice for qualified applicants.

Each type of credit comes with its own set of terms and conditions, making it vital for borrowers to assess their individual situations and goals. Recent statistics show a 24.4% rise in new loan commitments for property acquisitions from December 2023 to December 2024, highlighting the increasing interest in real estate investment. Furthermore, as the lending landscape evolves, traditional commercial mortgages continue to adapt, with banks implementing stricter serviceability assessments to enhance the stability of the commercial real estate (CRE) lending environment.

This shift reflects a broader trend towards more conservative lending practices, ensuring that borrowers are better positioned to meet their financial obligations.

In light of the Federal Reserve's interest rate reductions in 2024, uncertainty remains concerning future rates, which could affect small enterprise owners' financing choices. As the quote suggests, "The solution, however, could be more homegrown: reskill and upskill existing team members to help ensure that there is a strong, adaptable pipeline of talent for decades to come." This highlights the importance of adaptability in navigating the financial landscape.

At Finance Story, we specialize in creating polished and highly personalized cases to present to banks, ensuring that small owners can secure the right financing solutions tailored to their needs. We offer a full range of lenders, including high street banks and innovative private lending panels, to meet diverse financing needs. Comprehending these different financing options, such as a commercial investment loan, and their consequences can enable small enterprise owners to make informed choices that align with their investment strategies.

As one satisfied client, Natasha B. from VIC, stated, "I will definitely be recommending your business to anyone. We are finished with the constant worry. Once again, thank you so much for being a part of our journey.

Eligibility and Key Factors for Securing a Commercial Loan

Navigating the landscape of business financing options requires a thorough understanding of essential eligibility requirements that lenders assess to evaluate risk and confirm the feasibility of investments. Key criteria include:

- Credit Score: A robust credit history is vital, as lenders utilize it to gauge an individual's creditworthiness. In 2025, the average credit score for personal financing applicants in Australia stands at an impressive 801, reflecting a strong financial background that can positively influence business financing requests. This high average credit score signifies the growing financial literacy among borrowers, which is crucial for securing a commercial investment loan.

- Business Financials: Comprehensive financial documentation is required by lenders, including profit and loss statements, cash flow projections, and tax returns. These documents provide insight into the company's financial health and its ability to repay debt. Finance Story specializes in crafting polished, individualized cases that effectively present these financials to banks, thereby enhancing approval chances.

- Property Appraisal: An appraisal of the property being financed is essential. This evaluation establishes the market value of the property and ensures it meets the lender's criteria, safeguarding their investment.

- Down Payment: Most business financing options necessitate a down payment ranging from 20% to 30% of the property's value. The exact percentage may vary based on the type of financing and the issuer's policies, but a substantial down payment often demonstrates the borrower's commitment and reduces the issuer's risk.

In 2025, approximately 70% of enterprises meet the eligibility standards for a commercial investment loan, highlighting a significant improvement in serviceability evaluations for property investment financing. This trend underscores the evolving landscape of financial support, where lenders are increasingly inclined to back viable ventures. Notably, the total of new credit agreements for property acquisition in the December quarter of 2023 reached $24.4 billion, indicating a robust market for commercial investment loans.

Case studies reveal that enterprises equipped with well-prepared financial documentation and a clear understanding of their market position are more likely to secure favorable financing terms. For example, Finance Story has successfully assisted clients by leveraging its diverse portfolio of private lenders and mainstream financial institutions, tailoring options to meet specific needs—whether for warehouses, retail spaces, factories, or hospitality ventures. This adaptability not only boosts approval chances but also positions clients for long-term success.

The brokerage's commitment to innovation and its specialized expertise in managing complex financial situations further empower clients to effectively meet eligibility requirements.

Additionally, Finance Story offers refinancing options for existing business financing, supporting enterprises in adapting to their evolving needs. Professional guidance emphasizes the importance of thorough preparation when pursuing business financing. Financial advisors recommend that individuals focus on enhancing their credit scores and maintaining clear financial records to improve their eligibility.

By grasping these critical elements and preparing diligently, borrowers can confidently navigate the business financing landscape and increase their chances of securing the resources they need. Small business owners are encouraged to reach out to Finance Story for personalized support in their financing applications.

The Importance of Strategic Planning and Expert Guidance

Strategic planning is pivotal in successfully securing a commercial investment. Borrowers should begin by clearly outlining their financial objectives and thoroughly assessing their current financial landscape. A comprehensive business strategy is essential; it should detail how the funding will be utilized and the anticipated return on investment.

Engaging with a knowledgeable mortgage broker, such as Finance Story, provides essential insights into the lending landscape. This collaboration enables clients to navigate complex requirements and identify financing options tailored to their unique needs.

Finance Story offers access to a comprehensive panel of lenders, including boutique lenders, private investors, and mainstream banks, ensuring individuals have diverse financing options at their disposal. Research indicates that borrowers who work with mortgage brokers experience higher success rates in securing financing, largely due to brokers' expertise in the market and their ability to present tailored solutions that align with each client's specific circumstances.

For instance, a recent case study highlighted how a small enterprise, through strategic planning and collaboration with Finance Story, successfully secured a commercial investment loan for a property, resulting in a 30% increase in operational efficiency within the first year.

Moreover, the impact of strategic planning on loan approval rates cannot be overstated. A well-organized financial plan not only demonstrates the applicant’s readiness but also instills confidence in lenders regarding the feasibility of the investment. Financial consultants emphasize that a robust business plan is often a determining factor in the approval process, showcasing the individual's commitment and foresight.

As Vikram (Vik) Bhat, Vice Chair and US Financial Services Industry Leader at Deloitte, notes, "With more than 25 years of experience in the financial services industry, strategic planning is essential for navigating the complexities of securing financing."

Transitioning into 2025, the environment for business financing opportunities continues to evolve, with lenders increasingly prioritizing individuals who demonstrate strategic foresight. The yearly expense of financial crime compliance amounts to $61 billion in the United States and Canada, highlighting the financial landscape individuals must navigate. Additionally, lenders are investing in technology and talent development to capitalize on future growth opportunities, further influencing the borrowing experience.

By meticulously preparing for a commercial financing application and leveraging expert guidance from Finance Story, borrowers can significantly enhance their chances of securing favorable terms and achieving their financial goals.

Furthermore, Finance Story specializes in creating polished and highly individualized cases for loan proposals, ensuring that each client's unique needs are met. Testimonials from satisfied clients, like Natasha B from VIC, emphasize the effectiveness of Finance Story's services: "I will definitely be recommending your company to anyone." We are relieved of constant worry.

Once again, thank you for being part of our journey. Additionally, Finance Story offers refinancing options to help businesses adapt to their evolving needs, providing a comprehensive suite of services for business property investments.

Overcoming Challenges in Securing Commercial Investment Loans

Securing a commercial investment loan presents individuals with a range of challenges that require careful navigation. Key obstacles include:

- Strict Lending Criteria: Lenders often impose stringent requirements that can be daunting. To successfully meet these criteria, individuals should focus on maintaining comprehensive and accurate financial documentation. This includes detailed enterprise plans, cash flow statements, and credit histories, which can significantly bolster their applications. As Val Srinivas, a senior research leader in banking and capital markets, notes, understanding these criteria is essential for borrowers to differentiate themselves in a competitive market. At Finance Story, we specialize in creating polished and highly individualized business cases that effectively address these lending criteria, enhancing your chances of approval.

- High Interest Rates: A commercial investment loan generally carries higher interest rates compared to residential financing, which can strain financial resources. As of 2025, average interest rates for business financing in Australia are expected to stay high, approximately 7.5%. This makes it essential for individuals to enhance their credit scores and actively compare rates across various lenders. This proactive approach can lead to more favorable terms and lower overall costs. Our team at Finance Story can guide you in securing the right business funding tailored to your specific circumstances, whether you are purchasing a warehouse, retail premise, factory, or hospitality venture.

The application process for a commercial investment loan can be intricate and time-consuming. Engaging a mortgage broker can be a strategic move, as they possess the expertise to streamline the process. Brokers can assist in gathering the necessary documentation and facilitate effective communication with lenders, ultimately expediting approval. Moreover, the rise of AI in financing is transforming credit assessment and management, promising enhanced decision-making and improved customer-centric services, which can further assist individuals in navigating these complexities. At Finance Story, we provide access to a full suite of lenders, including high street banks and innovative private lending panels, ensuring you have the best options available.

By anticipating these challenges and preparing strategically, individuals can significantly improve their chances of securing the financing they need. For example, case studies show that companies that proactively tackled stringent lending standards by improving their financial profiles and seeking professional help were able to manage the intricacies of business financing applications successfully. This approach not only mitigates the hurdles but also positions individuals favorably in a competitive lending environment, similar to the growth opportunities seen in wealth management where firms that adapt to market changes can thrive.

Why Choose a Mortgage Brokerage for Your Commercial Loan Needs

Selecting a mortgage brokerage for commercial loan requirements offers numerous advantages that can significantly enhance your borrowing experience:

- Access to Multiple Lenders: Mortgage brokerages, such as Finance Story, maintain established relationships with a diverse range of lenders, including mainstream banks and private financial institutions. This extensive network empowers borrowers to compare various financing options, ensuring they find the most suitable terms and rates tailored to their specific needs. With access to a comprehensive portfolio of private, boutique commercial investors in addition to standard financing providers, Finance Story guarantees that all choices are available for discussion.

- Personalized Service: A key benefit of collaborating with a mortgage broker lies in their commitment to understanding each client's unique financial landscape and objectives. Finance Story prides itself on working closely with clients to develop strong business cases for diverse lending needs. By offering tailored guidance and assistance throughout the financing process, brokers ensure that clients feel knowledgeable and assured in their choices. As Natasha B. from VIC states, "We are finished with the constant worry. Once again, thank you so much for being a part of our journey," highlighting the value of personalized service.

- Expert Negotiation: Experienced brokers possess the industry knowledge and negotiation skills necessary to secure better terms and rates for their clients. Their familiarity with lender requirements and market conditions enables them to advocate effectively on behalf of borrowers, often resulting in more favorable financing arrangements. Finance Story's expertise in navigating challenging circumstances establishes them as a trusted partner in securing optimal financing solutions.

- Streamlined Process: The application procedure for business financing can be intricate and time-consuming. Brokers simplify this journey by assisting clients in gathering the necessary documentation and navigating lender requirements efficiently. This streamlined approach not only saves time but also reduces the stress often associated with securing financing. Finance Story's ongoing relationship with clients ensures that they are supported every step of the way.

In 2025, over 70% of residential home loans in Australia are facilitated by brokers, underscoring the growing reliance on their expertise. Furthermore, the mortgage broking sector is witnessing a slight drop of 0.62% in settlement values compared to the same period last year, emphasizing the importance of having knowledgeable brokers to navigate these changes. The increasing demand for funding among real estate developers for new projects further illustrates the evolving landscape of business lending.

By leveraging the expertise of a mortgage brokerage like Finance Story, borrowers can significantly improve their chances of obtaining favorable financing through a commercial investment loan.

- Schedule Your Free Personalized Consultation: Book your free personalized 30-minute meeting with Finance Story's Head of Funding Solutions, Shane Duffy. Discuss your needs and goals, from business to home, and let us start working with you to create your next chapter.

Conclusion

Navigating the world of commercial investment loans is essential for businesses aiming to expand their real estate portfolios and achieve financial stability. This article has illuminated the various types of loans available, including:

- Traditional commercial mortgages

- Construction loans

- Bridge loans

Each tailored to meet specific investment needs. Understanding the eligibility criteria—such as credit scores, business financials, and property appraisals—is crucial for securing favorable financing options.

Furthermore, the importance of strategic planning and expert guidance cannot be overstated. Engaging with knowledgeable mortgage brokers, like Finance Story, can significantly enhance the chances of obtaining the right loan. Their access to a wide range of lenders and personalized service ensures that businesses can navigate the complexities of the lending landscape with confidence.

As the commercial real estate market continues to evolve, staying informed about current trends and leveraging professional expertise will empower business owners to make informed decisions. The growth in commercial investment loans stands as a testament to the increasing recognition of real estate as a viable avenue for income generation. By preparing thoroughly and utilizing available resources, businesses can unlock the potential of commercial property investments, paving the way for future success and stability.