Overview

The article highlights essential financing options for entrepreneurs embarking on a business venture, including:

- Personal savings

- Loans

- Investments

- Grants

- Crowdfunding

Understanding these options is critical for developing a comprehensive funding strategy that secures necessary capital. Statistics reveal that many startups depend on personal savings, underscoring the significance of a well-organized financial plan. This plan is not just a necessity; it is crucial for attracting investors and ensuring long-term success. By recognizing the importance of these financial avenues, entrepreneurs can position themselves effectively in the competitive landscape.

Introduction

In the dynamic realm of entrepreneurship, securing the right financing can be the pivotal factor for startups striving to succeed. With over 150 million startups worldwide and a rapidly changing funding landscape, entrepreneurs encounter a multitude of options—from personal savings and loans to innovative crowdfunding and angel investments. Understanding these diverse financing methods is essential for making informed decisions that align with business objectives.

As trends shift towards inclusivity and alternative funding sources gain prominence, aspiring business owners must navigate this intricate terrain with a strategic mindset, ensuring they leverage the right capital to propel their growth.

This article explores the multifaceted world of startup financing, examining the various avenues available and providing insights to empower entrepreneurs on their financial journeys.

Understanding Startup Financing: An Overview

Startup financing encompasses a diverse array of methods and sources that entrepreneurs can leverage to launch and expand their businesses. This landscape includes options such as personal savings, loans, and investments from external entities, each playing a crucial role in the financial journey of a new business. In 2025, the entrepreneurial ecosystem is flourishing, with over 150 million ventures worldwide, and the U.S. alone hosting 82,038 of these businesses.

Remarkably, venture capital attained $66.5 billion in Q3 2024, with a substantial share allocated to AI enterprises, which drew almost $19 billion.

Comprehending the different financing options to consider when starting a business is essential for entrepreneurs seeking to make informed financial choices. The primary funding options include:

- Personal Savings: A significant percentage of startups rely on personal savings for initial funding, highlighting the importance of financial prudence and planning.

- Loans: Traditional bank loans and alternative lending options provide essential capital for new businesses, especially those with a solid business plan.

- Investments: Attracting investors can be a game-changer, with equity financing allowing entrepreneurs to secure funds in exchange for ownership stakes.

- Grants and Competitions: Different entities provide grants and contests that can offer non-dilutive financial support to creative new ventures.

The significance of a well-organized strategy cannot be overstated. A thorough plan not only delineates the company's vision and strategy but also acts as an essential instrument for obtaining financial support. Investors and lenders frequently demand comprehensive business plans to evaluate the feasibility and possible return on investment of a new venture.

Present trends in new venture financing suggest a rising interest in various financial sources, with a growing number of female entrepreneurs entering the arena—at this moment, 35.7% of founders are women, indicating a favorable change in the entrepreneurial environment. Additionally, the U.S. claims nearly 49% of all unicorn enterprises, underscoring its dominance in the global ecosystem of new ventures, driven by factors such as venture capital availability and a culture of risk-taking. This concentration of unicorns demonstrates the crucial role the U.S. plays in offering financial opportunities for new ventures.

As Josh Howarth points out, '75% of American new ventures fail within the initial 15 years,' emphasizing the harsh truth of the difficulties encountered by those starting their own companies. Effective financing options to consider when starting a business often incorporate a mix of these financial methods, customized to the specific requirements of the new venture. Entrepreneurs are encouraged to explore various avenues and remain adaptable in their approach to securing the necessary capital for growth.

As the financing environment for new businesses continues to evolve in 2025, staying informed about current statistics and trends will enable business founders to navigate their financial journeys effectively.

Exploring Traditional and Alternative Funding Sources

Conventional financial sources for startups typically encompass bank loans, credit unions, and government-backed loans. These options often necessitate a robust credit history and collateral, presenting hurdles for certain business owners. In contrast, alternative financial sources have gained significant traction, providing enhanced accessibility and flexibility.

Alternatives such as peer-to-peer lending, crowdfunding, and angel investors empower business founders to secure capital without the stringent criteria imposed by conventional lenders.

When considering financing options for starting a business, owners must evaluate the pros and cons of each source. Conventional loans may offer lower interest rates and structured repayment conditions; however, they can also limit the entrepreneur's control over their enterprise due to collateral requirements and rigid repayment schedules. Conversely, alternative financial sources frequently provide more adaptable terms and faster access to capital, though they might involve higher interest rates and less predictable funding amounts.

Statistics indicate that entrepreneurs who have previously launched successful enterprises experience a business success rate of approximately 30% when embarking on new projects. This underscores the vital importance of selecting the right financial source and exploring financing options when starting a business, as consistent startups often report lower self-assessed valuations and fewer paying users during the scaling phase compared to their inconsistent counterparts. Case studies reveal that later-stage startups that scale prematurely frequently encounter substantial challenges, including erratic growth and over-investment in early stages.

The Startup Genome Project emphasizes that recognizing the risks associated with premature scaling can aid entrepreneurs in managing their resources more effectively and enhancing their sustainability.

As we look to 2025, the evolution of alternative financial sources continues to reshape the landscape for entrepreneurs. With the average venture capital firm receiving over 1,000 proposals annually, competition for conventional financing remains fierce. Entrepreneurs are increasingly seeking innovative funding solutions that align with their unique models and growth trajectories, ensuring they possess the necessary resources to thrive in a competitive market.

The Role of Personal Investment and Self-Funding

Self-funding, commonly known as bootstrapping, presents a compelling financing option for entrepreneurs embarking on their business journey. This approach allows individuals to leverage personal savings or income to launch their startups, enabling them to retain complete control over their ventures and avoid the pitfalls associated with debt and equity dilution. However, it is crucial to acknowledge the inherent risks; personal finances can be significantly impacted, particularly if the business does not achieve immediate success.

In 2025, a notable trend emerges as many entrepreneurs increasingly turn to self-funding as a viable option. Statistics reveal that a substantial portion of new ventures relies on personal savings to initiate their operations. For instance, a significant case study within the construction industry indicates that 20% of new ventures fail within their first year, underscoring the necessity of financial caution and strategic planning when bootstrapping. Furthermore, it is essential to recognize that 82% of companies that failed did so due to cash flow issues, highlighting the financial dangers linked to this method.

Financial experts often caution that while bootstrapping can foster innovation and independence, it also carries risks. Entrepreneurs must meticulously evaluate their financial health, determining how much they can invest without jeopardizing their personal financial stability. As Josh Howarth notes, "75% of American startups fail within the first 15 years," serving as a stark reminder of the challenges faced by those launching their own ventures.

Numerous real-life instances abound, with successful entrepreneurs sharing stories of using their savings to fund their ventures, illustrating both the potential rewards and challenges inherent in this method.

As the landscape of self-funding evolves in 2025, understanding the risks associated with bootstrapping becomes increasingly critical. Entrepreneurs should recognize that while retaining control is advantageous, the financial burden can be considerable if the venture does not meet expectations. Therefore, a balanced approach that considers various financing options, alongside the benefits and risks of self-funding, is essential for aspiring business owners.

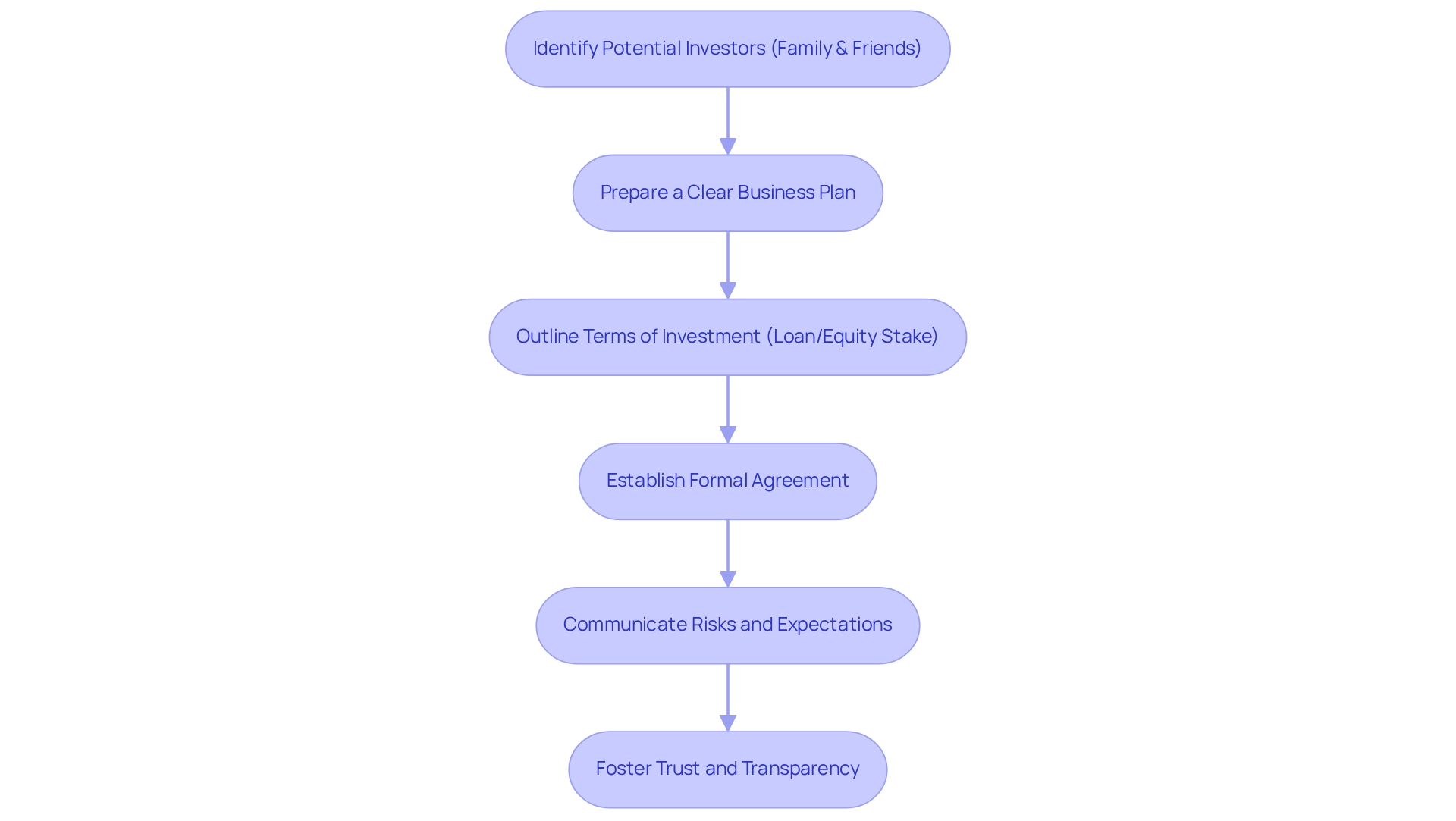

Leveraging Family and Friends for Initial Capital

Many business owners explore various financing options when starting a business, often seeking initial funding from family and friends. These individuals typically have a vested interest in the entrepreneur's success and may be more inclined to support their vision. However, approaching this financial resource requires a professional mindset. It is crucial for entrepreneurs to clearly outline the terms of the investment—whether it involves a loan or an equity stake—and ensure that all parties are aware of the associated risks.

Establishing a formal agreement is vital; it not only helps prevent misunderstandings but also safeguards personal relationships. As Graham Isador, a former Copywriter at North One, emphasizes, "Formal agreements in personal investments are essential to ensure clarity and protect relationships."

Statistics reveal that a notable portion of entrepreneurs—around 38%—depend on family and friends for initial financial support. This reliance underscores the importance of treating these investments with the same seriousness as conventional financial sources. A case study titled 'Impact of Personal and Professional Networks on Fundraising Success' demonstrates that both personal and professional networks can enhance financial opportunities, with professional networks proving particularly advantageous for older ventures.

Expert guidance indicates that when seeking support from family and friends for a new venture, business owners should prepare a clear business plan and explain how the funding will be utilized. This transparency fosters trust and demonstrates professionalism. Furthermore, emphasizing the importance of formal agreements in personal investments can help mitigate potential conflicts, ensuring that all parties have aligned expectations.

By taking these steps, entrepreneurs can effectively leverage their personal networks while maintaining the integrity of their relationships.

Harnessing the Power of Crowdfunding

Crowdfunding has rapidly emerged as a preferred avenue for startups aiming to raise capital through small contributions from a broad audience, primarily via online platforms. Entrepreneurs can choose between two main types of crowdfunding: rewards-based and equity crowdfunding. In rewards-based crowdfunding, supporters receive products or services in exchange for their financial support, making it an attractive option for companies looking to validate their concepts while building a customer base.

Conversely, equity crowdfunding allows investors to acquire shares in the company, appealing to those who wish to have a stake in the future success of the enterprise.

To execute a successful crowdfunding campaign in 2025, entrepreneurs must concentrate on several key strategies:

- A compelling pitch is crucial; it should articulate the business's vision and the project's impact clearly.

- Engaging marketing strategies, including social media outreach and targeted advertising, can significantly boost visibility and attract potential backers.

- Regular updates to supporters not only keep them informed but also foster a sense of community and investment in the project, which has been shown to improve success rates.

- Notably, campaigns that utilize personal videos and have dedicated teams behind them tend to raise significantly more funds, underscoring the importance of engagement in the crowdfunding process.

Statistics highlight the growing importance of crowdfunding in the startup ecosystem. For instance, GoFundMe has amassed over $9 billion from more than 120 million contributions worldwide, showcasing the potential of this financial approach. Moreover, while the lending market represented 70% of the crowdfunding industry in 2016, equity crowdfunding is now expanding at a rate more than three times that of its counterparts, signaling a shift in investor preferences.

Additionally, it is noteworthy that 15.17% of crowdfunding donations are made via mobile devices, emphasizing the necessity of mobile accessibility in crowdfunding campaigns.

Real-world examples illustrate the effectiveness of both crowdfunding types. Successful campaigns frequently incorporate personal videos and a dedicated team, which have been associated with higher funding outcomes. Campaigns that maintain consistent communication with their backers tend to raise significantly more funds, reinforcing the importance of engagement in the crowdfunding process.

According to a case study titled "Success Factors in Crowdfunding Campaigns," effective marketing strategies and engagement with potential backers are essential for success.

In summary, comprehending the distinctions between rewards-based and equity crowdfunding, alongside implementing effective strategies and evaluating financing options, can significantly enhance a new venture's chances of securing the necessary capital to launch and grow their business. Furthermore, as Asian intelligent city enterprises are projected to generate around 50% of global revenue in the industry by 2025, the potential for crowdfunding in emerging markets is substantial.

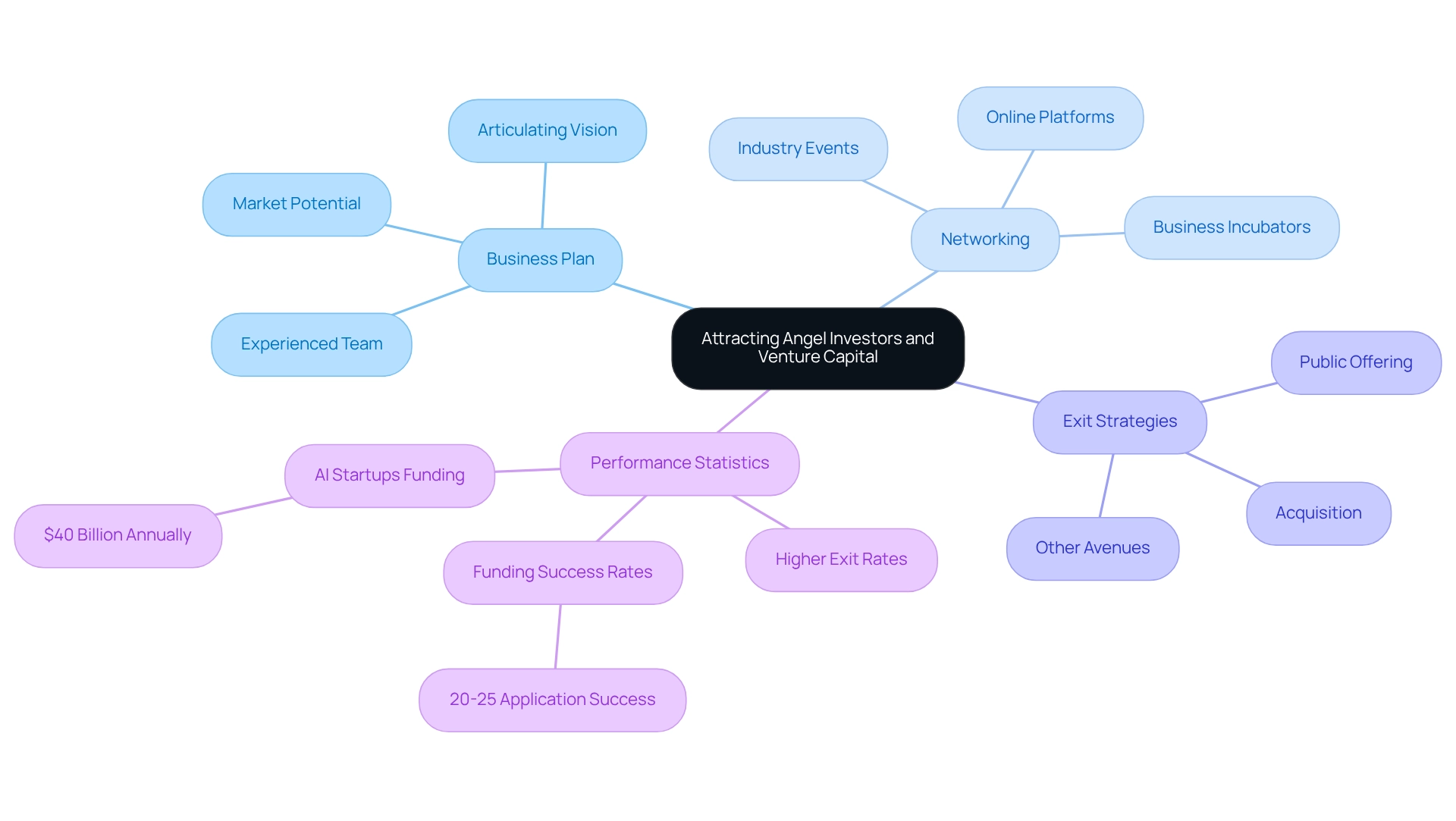

Attracting Angel Investors and Venture Capital

Angel investors and venture capitalists are pivotal in the entrepreneurial ecosystem, providing essential capital in exchange for equity. To attract these investors successfully, business owners must develop a compelling business plan that articulates their vision, showcases significant market potential, and emphasizes a capable and experienced team.

Networking is a critical element in this endeavor. Engaging in industry events, joining business incubators, and leveraging online platforms can significantly enhance an entrepreneur's ability to connect with prospective investors. In 2025, the importance of relationship-building cannot be overstated, as many successful financing rounds stem from personal connections and referrals.

Furthermore, presenting a well-defined exit strategy can greatly enhance the appeal of an investment opportunity. Investors are often eager to understand how they will realize a return on their investment, whether through acquisition, public offering, or other avenues.

Statistics indicate that companies backed by angel investors typically achieve superior performance, with higher exit rates compared to those relying on alternative financial resources. For example, new ventures supported by Sydney Angels have raised more rounds and attained greater exit rates than those backed by other investors, highlighting the effectiveness of angel investment. Additionally, the average financial support from venture capitalists has seen a significant increase, reflecting a growing confidence in the startup landscape.

As noted by Jo-Ann Suchard, Associate Professor in Banking and Finance, "The evidence on the financial success rates of start-ups seeking angel investments indicates a potentially sustainable Australian market over the longer term where application success rates in the 20-25% range have historically signified a sustainable market in the US."

In conclusion, individuals seeking financial support from angel investors and venture capitalists in 2025 should focus on crafting a robust strategy, actively networking within the industry, and clearly articulating their exit plans to enhance their chances of success. Furthermore, with AI companies attracting over $40 billion in investment annually, the current funding landscape presents substantial opportunities for innovative business founders.

Navigating Business Loans: Options and Considerations

For startups seeking capital, loans represent a critical financing option worth considering. Entrepreneurs can explore an array of funding avenues, including traditional bank loans, government-backed loans, and alternative lenders. Each financing option presents its own set of advantages and considerations.

Current interest rates for commercial loans in 2025 are competitive, averaging between 6.5% and 8%, influenced by the lender and the borrower’s creditworthiness.

When evaluating loan options, entrepreneurs must consider several key factors:

- Interest Rates: Understanding the cost of borrowing is essential. Lower rates can significantly alleviate the overall financial burden, underscoring the necessity of exploring various financing options. Startups should assess financing alternatives that align with their cash flow projections. Familiarizing oneself with these requirements can streamline the application process. This involves presenting a comprehensive plan that outlines the startup's vision, market analysis, and financial projections. Such preparation not only enhances the chances of approval but also demonstrates the entrepreneur's commitment and understanding of their business, as well as the implications of taking on debt. Startups must ensure they can manage repayments without jeopardizing their operational stability. Lenders will evaluate the company's profitability and cash flow management, seeking indicators such as steady revenue streams and sufficient cash reserves to cover repayments during slower sales periods.

With consumer confidence on the rise and an anticipated increase in unsecured credit lending, the lending environment is becoming increasingly favorable for new businesses. In fact, the value of new loan commitments for property purchases reached $24.4 billion in the December quarter of 2023, highlighting the robust financing landscape available for startups.

Finance Story, led by Shane Duffy, a seasoned expert in business growth and customized financial solutions, is well-equipped to assist new enterprises in navigating these financing options effectively. Shane's extensive experience in manufacturing and supply chain, coupled with his deep understanding of the financial landscape, positions Finance Story as a valuable partner for entrepreneurs in need of guidance.

Successful instances abound, with numerous new businesses securing both traditional and alternative loans to fuel their growth. As Josh Howarth noted, Asian smart city enterprises are projected to generate approximately 50% of worldwide revenue in the sector by 2025, emphasizing the opportunities available in the current environment. As the lending landscape continues to evolve, a thorough understanding of loans will empower entrepreneurs to identify financing options that align with their financial objectives.

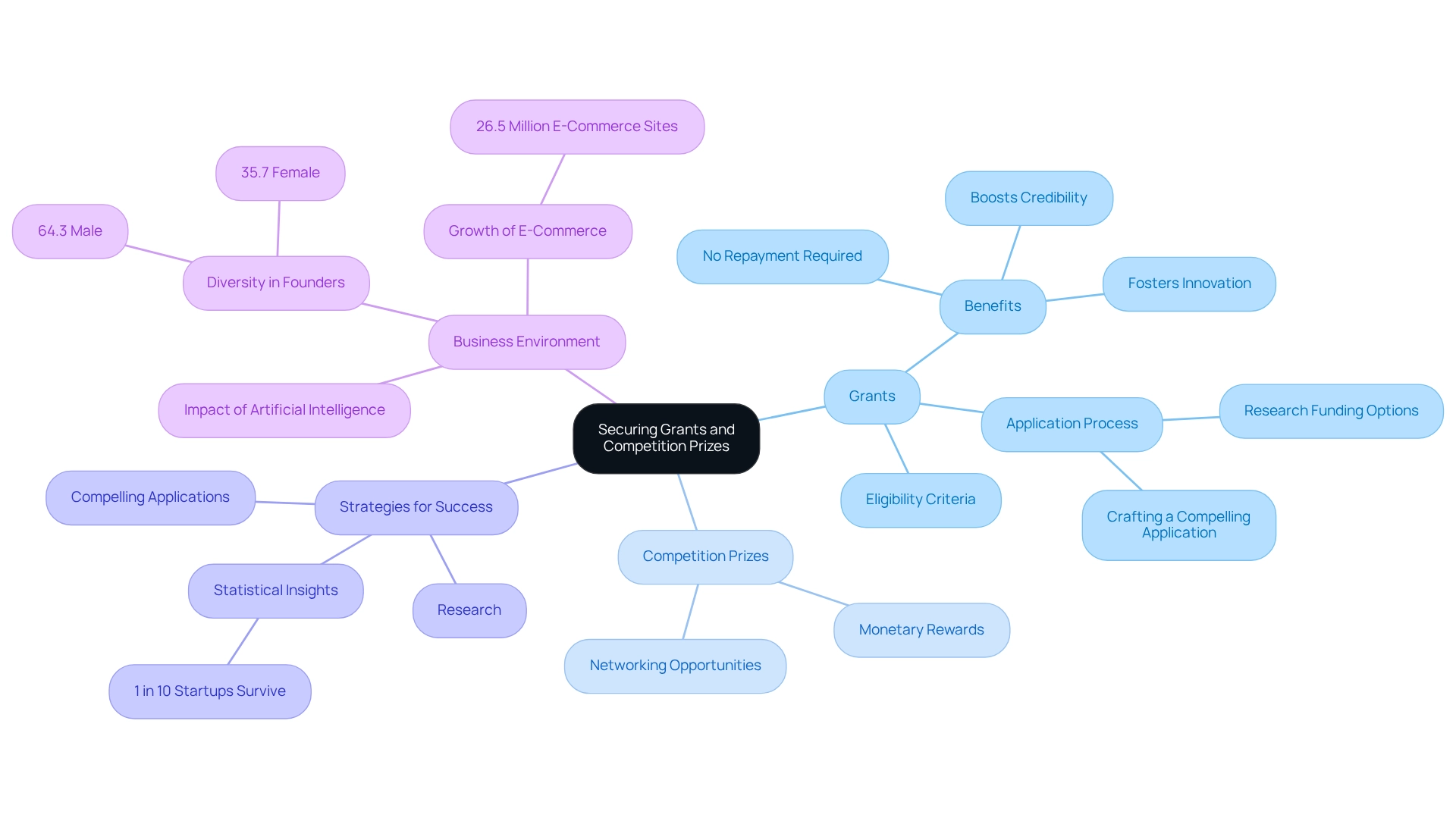

Securing Grants and Competition Prizes

Grants represent a vital funding source for new businesses, provided by governments, foundations, or organizations, and they come with the significant advantage of not requiring repayment. These funds are specifically designed to foster innovation, research, and development, making them an attractive option for new businesses looking to establish themselves in competitive markets.

In addition to grants, entering competitions can yield substantial benefits. Not only do these competitions frequently offer monetary rewards, but they also provide invaluable exposure and networking opportunities that can accelerate a new business's growth.

Consider the new business environment in 2025, which is anticipated to witness a rise in competition rewards, with numerous organizations acknowledging the significance of aiding new business founders. Significantly, as of 2025, the business ecosystem is becoming increasingly diverse, with 64.3% of founders being male and 35.7% female, reflecting a positive trend towards inclusivity in business ventures.

To maximize the chances of securing grants and competition prizes, business owners should conduct thorough research on financing options, including understanding the eligibility criteria for each grant. Crafting a compelling application is essential; it should clearly express the company's vision, innovation, and potential impact. Statistics indicate that only one in ten new companies in the United States achieve long-term growth, which underscores the importance of exploring financing options when starting a business.

Successful examples abound, with numerous entrepreneurs having won grants for their innovative ideas. These grants not only offer financial assistance but also affirm the business's concept, boosting its credibility in the eyes of investors and customers alike. As of 2025, there are numerous grants available for new businesses, each with varying eligibility criteria, making it essential for founders to stay informed about the landscape.

The success rates of new ventures applying for grants can differ, but those who approach the process with diligence and creativity often find themselves at an advantage. By leveraging both grants and competition prizes, new ventures can explore financing options that significantly enhance their chances of survival and growth in an increasingly competitive environment. Additionally, sectors like e-commerce are flourishing, with over 26.5 million e-commerce sites globally, suggesting strong growth potential for new businesses.

Furthermore, the incorporation of artificial intelligence is anticipated to improve efficiency and assist the swift growth of new ventures across multiple sectors, further highlighting the necessity for creative financing solutions.

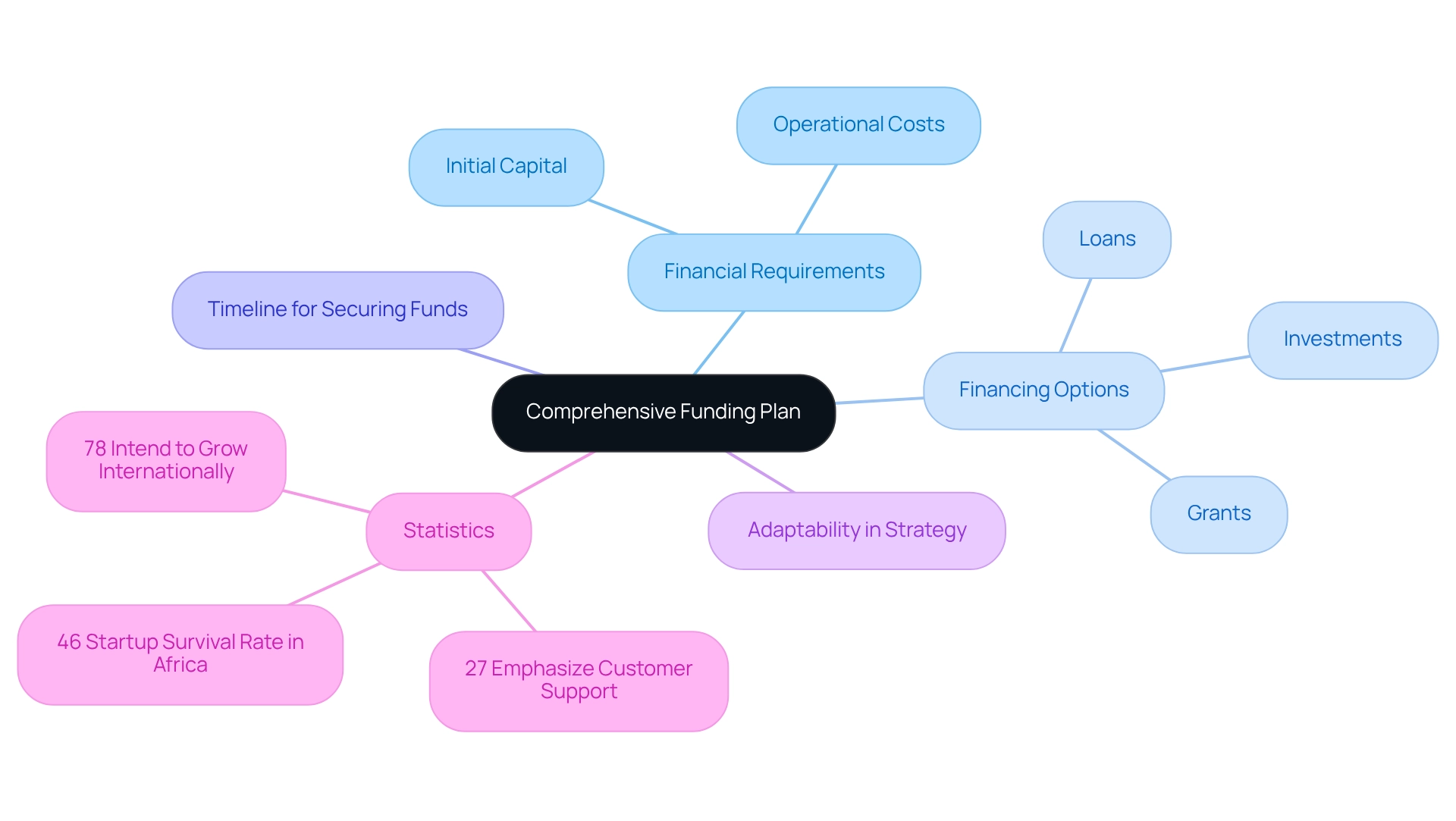

Creating a Comprehensive Funding Plan

A thorough financial strategy is vital for any startup, as it clearly delineates the monetary needs essential for success. This includes initial capital, operational costs, and projected revenue streams. Entrepreneurs should begin by thoroughly evaluating their financial requirements, including the financing options to consider when starting a business, such as loans, investments, or grants.

Based on recent data, 27% of entrepreneurs emphasize the importance of having a dedicated customer support team, which can be essential in managing financial options effectively. As Isabelle Comber notes, "Flexible banking solutions enable founders to manage cash flow more effectively, access various financial tools as needed, and scale their operations without being constrained by rigid services."

In formulating this plan, it is essential to create a timeline for securing financial resources while also developing a solid strategy for managing cash flow. This method not only assists in obtaining the required funds but also guarantees that the company can function seamlessly during its initial phases. Consistently examining and revising the financial strategy is essential, as it enables entrepreneurs to remain in sync with their monetary objectives and adjust to any shifting conditions in the market.

For example, a case study on global expansion ambitions shows that 78% of founders intend to grow their businesses internationally within the coming year, emphasizing the necessity for an adaptable financial strategy that supports growth beyond local markets. This flexibility is crucial, particularly in an environment where residential real estate ventures utilizing artificial intelligence are drawing considerable investments, signifying a shift towards creative financial strategies.

By developing a thorough financial strategy and identifying financing options to consider when starting a business, new ventures can position themselves to capitalize on opportunities and manage challenges efficiently, ensuring long-term viability and achievement. Furthermore, comprehending the differing startup survival rates in areas such as Africa, where around 46% of startups endure initially, can offer meaningful insights into the financial challenges and success rates that business owners may encounter worldwide. Additionally, working with experts like Finance Story can enhance your funding strategy, as they specialize in crafting tailored loan proposals for various commercial properties, including warehouses, retail premises, factories, and hospitality ventures.

They also provide guidance on refinancing commercial loans, ensuring you secure the right financing for your commercial property investments and refinances.

Choosing the Right Financing Options for Your Business

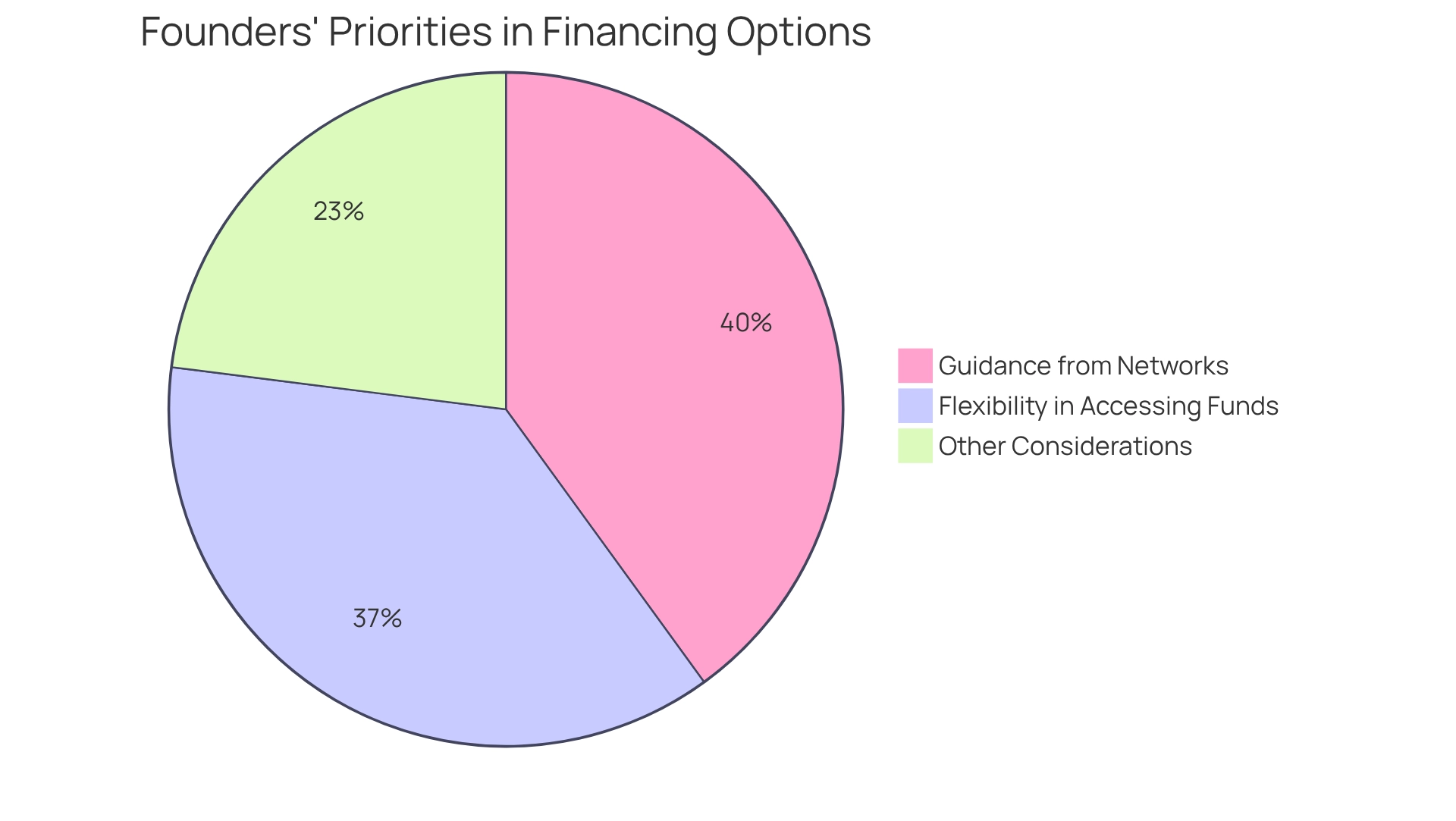

Entrepreneurs must thoroughly evaluate their financing options when starting a business. This process necessitates a comprehensive assessment of the venture's unique requirements, its developmental stage, and the entrepreneur's risk tolerance. Key considerations include the cost of capital, the desired level of control over the enterprise, and the potential impact of financing choices on growth trajectories. Notably, recent statistics reveal that 37% of founders prioritize flexibility in accessing funds to effectively manage cash flow and scale operations.

This flexibility is crucial in a dynamic market where adaptability can significantly influence success. Consulting with financial advisors or mentors, such as Shane, the Founder and Funding Specialist Director at Finance Story, can provide invaluable insights. With extensive experience in crafting refined and personalized cases for securing loans, Shane understands the intricacies of funding choices and the importance of customized financial solutions. His expertise allows founders to manage cash flow more efficiently and utilize various financial resources as needed, facilitating the expansion of operations without being constrained by inflexible services.

Furthermore, case studies indicate that 40% of founders are increasingly seeking guidance from their professional networks for financial advice, reflecting a shift towards community-based support within the entrepreneurial ecosystem. This collaborative environment fosters knowledge sharing and resource exchange, enhancing organizational growth. Indeed, as Asian smart city startups are projected to generate approximately 50% of global revenue in the sector by 2025, the importance of strategic financing becomes increasingly evident.

Ultimately, a balanced strategy that integrates diverse financing options—such as equity financing, loans, and grants—may provide the strongest foundation for success. Successful entrepreneurs exemplify the necessity of carefully evaluating funding sources, ensuring that their choices align with their long-term business goals and risk tolerance.

Conclusion

Navigating the complex landscape of startup financing is essential for entrepreneurs aiming to secure the capital needed to launch and grow their businesses. This article has explored the various methods of funding available, ranging from personal savings and traditional loans to innovative crowdfunding and angel investments. Each funding source presents unique advantages and challenges, underscoring the importance of a tailored approach that aligns with specific business needs and goals.

Understanding the nuances of financing options is critical, especially as trends evolve towards inclusivity and alternative funding mechanisms. Entrepreneurs must remain vigilant about the shifting dynamics of the funding environment, leveraging insights and statistics to make informed decisions. Whether choosing to bootstrap, seek support from family and friends, or attract venture capital, a well-structured funding plan serves as a roadmap for achieving long-term success.

Ultimately, the ability to effectively navigate the funding landscape can significantly impact a startup's trajectory. By evaluating various financing options and employing a strategic mindset, entrepreneurs can enhance their chances of survival and growth in an increasingly competitive market. As the startup ecosystem continues to thrive, informed financial decision-making will remain a pivotal component of entrepreneurial success.