Overview

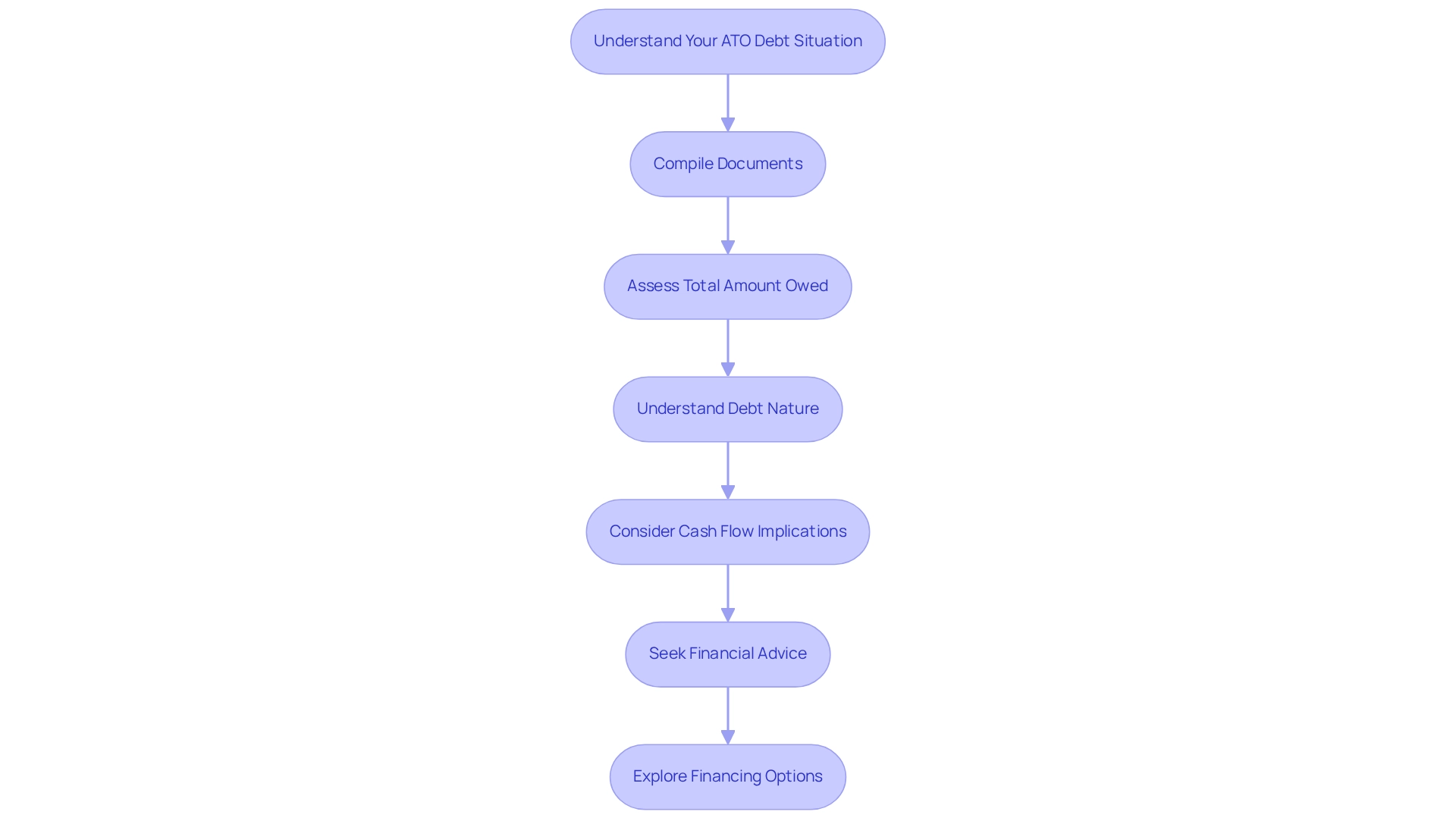

Securing a business loan with ATO debt requires:

- A firm grasp of your debt situation

- Meticulous preparation of financial documentation

- A well-crafted loan proposal

- The ability to navigate potential challenges

It is crucial to understand that thorough preparation and transparent communication about your financial health can significantly boost your chances of loan approval. Lenders seek detailed insights into your cash flow and repayment strategies to alleviate perceived risks associated with ATO debt.

Are you ready to take the necessary steps to enhance your loan application? By focusing on these key areas, you can position yourself as a strong candidate for funding.

Introduction

In the intricate landscape of business finance, navigating the complexities of securing a loan while managing Australian Taxation Office (ATO) debt presents a formidable challenge. As businesses face increasing scrutiny and proactive enforcement from tax authorities, understanding one's debt situation becomes paramount.

How can businesses effectively address ATO debt? This article delves into essential strategies, including:

- Compiling comprehensive financial documentation

- Crafting compelling proposals for lenders

Furthermore, with insights on overcoming potential obstacles and leveraging expert assistance, readers will discover ways to enhance their chances of obtaining the necessary funding. This funding is crucial for stabilizing and growing operations in an ever-evolving economic environment.

Understand Your ATO Debt Situation

Begin by compiling all pertinent documents related to your ATO debt, including notices, payment plans, and correspondence with the Australian Taxation Office. Accurately assess the total amount owed, factoring in any accrued interest or penalties. Understanding the nature of your debt, particularly a business loan with ATO debt, whether it arises from unpaid taxes, late payments, or other issues, is crucial for effectively communicating your situation to potential lenders.

Consider the implications of this debt on your cash flow and overall financial health. A recent report indicates that the ATO issued over 30,000 director penalty notices between July 2022 and February 2023, highlighting a shift towards more proactive tax enforcement. This context underscores the importance of addressing ATO debt promptly, as enterprises grappling with these debts should seek advice on their options moving forward, including a business loan with ATO debt, according to an ATO spokeswoman.

In this scenario, collaborating with Finance Story can prove invaluable. Their expertise in crafting refined and highly personalized proposals can significantly enhance your financing request, making it more appealing to financiers. This evaluation will not only prepare you for discussions with financial institutions but also assist you in assessing the urgency and necessity of obtaining funding.

By fully comprehending your ATO debt and leveraging appropriate financing alternatives—such as a business loan with ATO debt, along with access to a broad spectrum of lenders and refinancing options—you can navigate the application process more effectively and improve your chances of securing the necessary funding to stabilize and expand your enterprise.

Prepare Your Financial Documentation

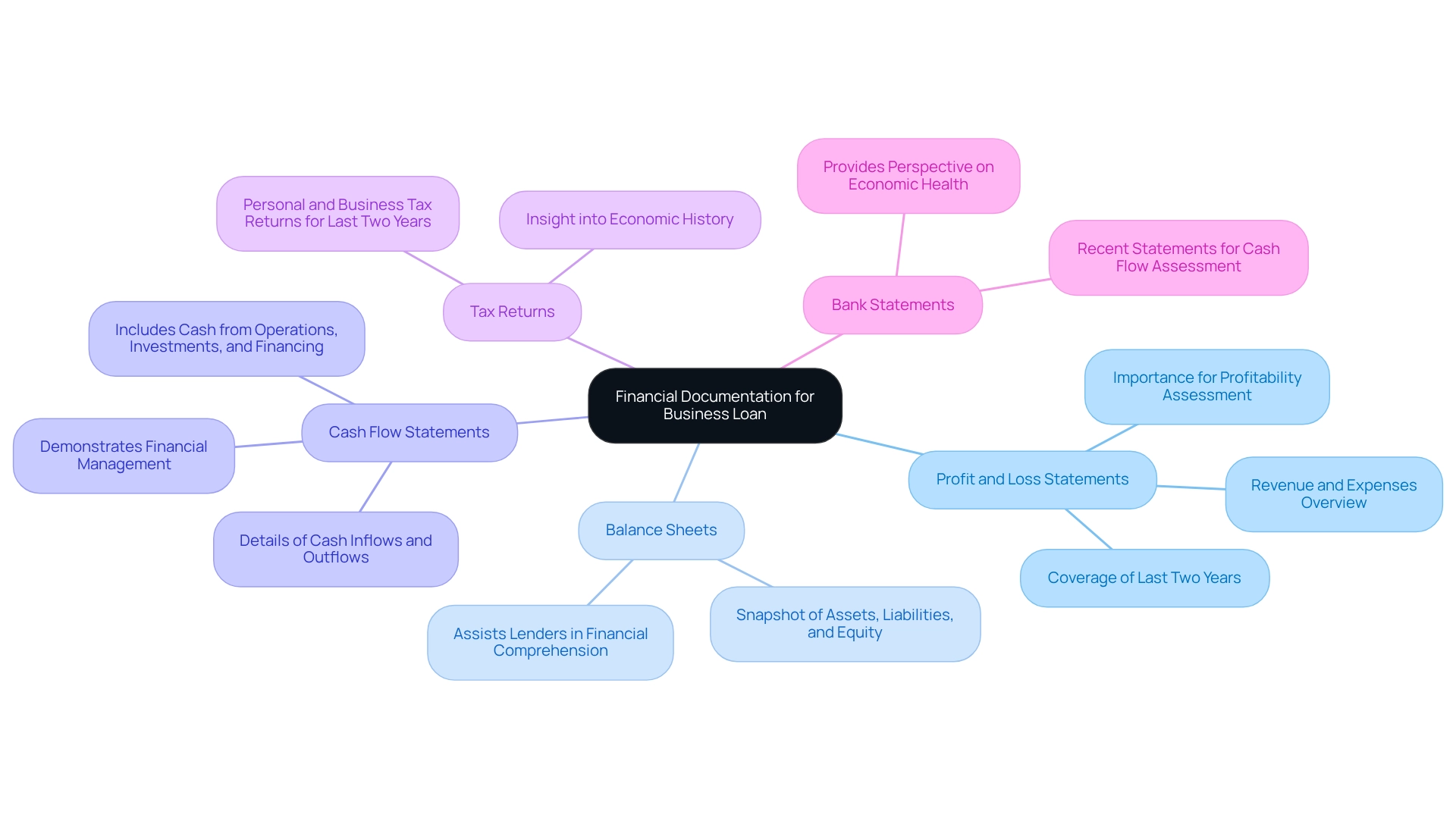

To secure a business loan with ATO debt, it is essential to gather a comprehensive set of financial documents. Key documents include:

- Profit and Loss Statements: These should cover at least the last two years, clearly outlining your business's revenue and expenses. This information is crucial, as financial institutions often emphasize profitability when evaluating credit requests.

- Balance Sheets: A current balance sheet provides a snapshot of your company's assets, liabilities, and equity, assisting lenders in quickly comprehending your financial position.

- Cash Flow Statements: These statements should detail your cash inflows and outflows, demonstrating your ability to manage finances effectively. Lenders will closely examine your cash flow to gauge your capacity to repay the business loan with ATO debt. Cash flow statements typically show cash from operations, investments, and financing.

- Tax Returns: Include both personal and business tax returns for the past two years. These documents give lenders insight into your economic history and adherence to tax obligations.

- Bank Statements: Recent bank statements are essential for assessing your cash flow and spending habits, providing an up-to-date perspective on your economic health and liquidity.

Ensure that all documents are current and accurately represent your economic situation. This careful preparation not only simplifies the financing application process but also instills confidence in potential investors. Insights from Finance Story reveal that offering detailed economic information significantly enhances the chances of approval, as it enables creditors to confirm income and evaluate overall monetary health. As one expert noted, "A financial institution will assess your cash flow situation when you request a loan." By showcasing a well-structured financial profile, you present your enterprise positively to financiers, thereby improving your likelihood of obtaining essential funding. Additionally, Finance Story specializes in creating polished and individualized business cases, further strengthening your application. With access to a diverse range of financial institutions, including high street banks and innovative private lending panels, you can find tailored financing solutions that meet your specific needs. A case study on the significance of supplementary financial information emphasizes that offering thorough documentation enhances the chances of approval, enabling financiers to confirm income and evaluate overall financial well-being.

Approach Lenders with a Solid Proposal

When approaching lenders, your proposal must encompass several critical elements to effectively address ATO debt:

- Executive Summary: Start with a concise overview of your business, detailing the purpose of the loan and how it will assist in managing your ATO debt. This sets the stage for your proposal and captures the lender's interest.

- Detailed Financial Plan: Present financial projections that demonstrate how the funding will improve your cash flow and enable you to fulfill your ATO obligations. Clear, realistic forecasts can showcase your business's potential for recovery and growth.

- Repayment Strategy: Clearly articulate your plan for repaying the debt, including specific timelines and anticipated sources of revenue. A well-defined repayment plan reassures creditors of your commitment and ability to meet the loan conditions.

- Supporting Documents: Attach comprehensive documentation that substantiates your business's viability. This may include balance sheets, income statements, and tax returns, offering creditors a complete view of your financial health.

Customize your proposal for each financial institution by addressing their unique requirements and concerns. With Finance Story's extensive access to boutique lenders, private investors, and mainstream banks, you can create robust cases that emphasize your proactive approach to securing a business loan with ATO debt. This fosters trust and significantly enhances your chances of securing approval. Furthermore, consider refinancing options to adapt to your changing operational needs. Given that average loan approval rates for enterprises applying for a business loan with ATO debt fluctuate, a strong proposal can greatly impact your ability to navigate the complexities of financing in 2025.

In the current economic landscape, where opportunities and volatility coexist, it is crucial to act decisively. Notably, private credit can yield around 10% per year, presenting an appealing alternative for enterprises seeking financing options. According to advisor Arraj, "Australian investors could significantly benefit from incorporating higher-yielding private debt into their portfolios to achieve a high risk-adjusted return on capital." Additionally, recognizing that tax debt information can persist on a company's credit file for up to seven years underscores the importance of prompt debt management and planning to prevent future financial challenges.

Navigate Challenges in Securing Your Loan

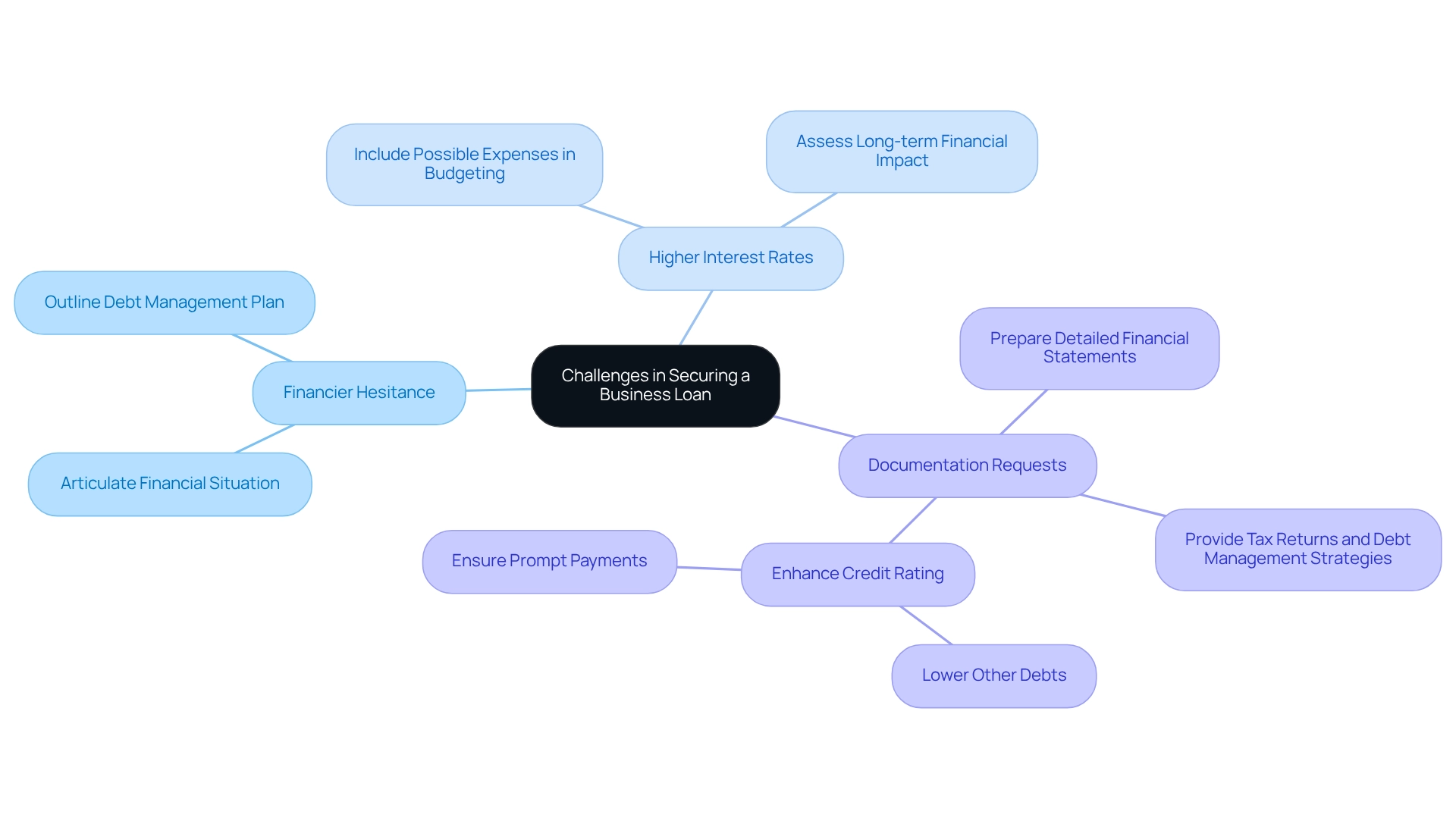

Navigating the complexities of obtaining a business loan with ATO debt while managing finances can be daunting. Here are some key challenges to anticipate:

- Financier Hesitance: Many financial institutions exhibit caution when considering applications for a business loan with ATO debt. It is crucial to clearly articulate your financial situation and outline a robust plan for managing and repaying the debt. This transparency can help alleviate concerns of financial institutions. At Finance Story, we focus on developing refined and highly tailored cases to present to banks, enhancing your likelihood of approval for a business loan with ATO debt.

- Higher Interest Rates: Due to the perceived risk linked with a business loan with ATO debt, financial institutions frequently impose higher interest rates on loans. It is crucial to include these possible expenses in your budgeting to ensure that your business stays sustainable.

- Documentation Requests: Anticipate that creditors will ask for extensive documentation to evaluate your economic health. This may include detailed financial statements, tax returns, and explanations of your debt management strategies. Prompt and thorough responses can enhance your credibility and improve your chances of approval. Collaborating with Finance Story provides you with access to a comprehensive range of lenders, ensuring you are well-prepared for these requests, especially if you are considering a business loan with ATO debt, since ATO debt can adversely influence your credit score, which is a crucial element in approval processes. To alleviate this, concentrate on enhancing your credit rating by lowering other debts and ensuring prompt payments on current commitments.

Grasping these obstacles is crucial for small enterprises pursuing financing in 2025. By preparing for these challenges and developing strategic responses, you can navigate the loan application process more effectively, ultimately increasing your chances of securing the funding necessary for your business's growth and stability.

Conclusion

Successfully navigating the complexities of securing a loan while managing ATO debt demands a strategic and informed approach. By thoroughly understanding the specifics of ATO debt, businesses can compile essential financial documentation that accurately reflects their financial health. This preparation is crucial in building a credible and compelling case for lenders, significantly enhancing the prospects of loan approval.

Crafting a solid proposal that includes an executive summary, detailed financial plans, and a clear repayment strategy is vital. Tailoring each proposal to meet the unique requirements of different lenders fosters trust and increases the likelihood of securing necessary funding. Furthermore, being upfront about challenges—such as lender hesitance and potential higher interest rates—while demonstrating proactive management strategies can further bolster a business’s position.

Ultimately, addressing ATO debt effectively not only stabilizes a business's financial standing but also opens avenues for growth. By leveraging expert assistance and presenting a well-organized financial profile, businesses can navigate the hurdles of the loan application process with confidence, setting the stage for a more secure financial future. In the evolving economic landscape of 2025, timely action and strategic planning are essential for overcoming obstacles and achieving long-term success.