Overview

This article presents essential insights and options for comparing small business loan providers, focusing on the critical criteria entrepreneurs should consider when selecting a lender. Key factors such as:

- Interest rates

- Financing conditions

- Fees

- Customer service

- Creditor reputation

- Adaptability

are highlighted. These elements are vital for making informed decisions that align with both financial goals and operational needs. By understanding these aspects, business owners can navigate the lending landscape more effectively.

Introduction

Navigating the world of small business financing can be a daunting task for entrepreneurs, particularly in a rapidly evolving economic landscape. With a myriad of loan options available, understanding the key criteria for selecting the right loan provider is crucial for achieving financial success.

- Evaluating interest rates and loan terms

- Scrutinizing fees

- Assessing customer service

These are all significant factors that shape a business's financial future. As small business owners seek to secure funding in 2025, insights into leading loan providers and a comparative analysis of various loan products will empower them to make informed decisions.

This article delves into essential considerations for choosing a small business loan, ensuring that entrepreneurs are well-equipped to tailor their financing strategies to meet their unique needs.

Key Criteria for Choosing a Small Business Loan Provider

When selecting a small business loan provider, several key criteria warrant careful evaluation:

- Interest Rates: The cost of borrowing stands as a primary concern, as interest rates directly influence the total repayment amount. Current trends indicate that interest rates in Australia are expected to decrease starting in late 2024, potentially benefiting borrowers in the near future. By 2025, the average interest rates offered by small business loan providers for small enterprises are anticipated to be competitive, making it crucial for entrepreneurs to stay informed.

- Financing Conditions: Understanding the duration of financing and repayment schedules is vital. Flexible terms from small business loan providers can accommodate varying cash flow situations, enabling organizations to manage their finances more effectively. Lenders will assess the strength of your business's profits and its ability to handle repayments, so a clear understanding of your financials is essential.

- Fees and Charges: Hidden fees can significantly inflate the total cost of borrowing. It is essential to scrutinize all potential charges, including origination fees, late payment fees, and prepayment penalties, to avoid unexpected expenses.

- Customer Service: A responsive and knowledgeable customer service team can streamline the loan process and provide essential support when needed. According to Lendio, 84% of businesses started by a person of color relied on personal savings or funding from friends or family to finance their ventures, underscoring the importance of having reliable support during the financing process. Positive experiences with customer service can greatly enhance borrower satisfaction.

- Creditor Reputation: Investigating creditor reviews and ratings offers insights into their dependability and the experiences of other borrowers. A strong reputation among small business loan providers often correlates with superior service and support. Incorporating statistics or case studies related to financial institution performance can provide a more authoritative basis for this recommendation.

- Adaptability: Certain providers offer adjustable financial products tailored to specific organizational needs, which can be a considerable advantage for companies with distinct requirements. This adaptability can assist organizations in navigating financial challenges more effectively. Collaborating with a finance brokerage such as Finance Story can also improve your chances of obtaining suitable financing by presenting refined and personalized cases to financiers. Finance Story provides a comprehensive range of lenders, including high street banks and innovative private lending panels, to accommodate various circumstances, whether you are purchasing a warehouse, retail premise, factory, or hospitality venture.

In addition to these criteria, comprehending the tax implications of commercial financing is essential. For instance, the case study titled "Tax Implications of Financial Borrowing" analyzes how borrowing influences tax responsibilities, enabling enterprises to enhance their financial strategies and potentially resulting in substantial savings. By considering these factors, entrepreneurs can make informed decisions that align with their financial goals.

Overview of Leading Small Business Loan Providers

Several prominent small business loan providers in Australia are shaping the financing landscape for entrepreneurs in 2025:

- Commonwealth Bank: Recognized for its organized term financing and commercial overdrafts, Commonwealth Bank provides a wide array of funding solutions designed to address different corporate requirements. Their customer satisfaction ratings demonstrate a strong dedication to service, making them a favored option among small enterprise owners.

- ANZ: With an emphasis on flexibility, ANZ offers versatile repayment choices and secured financing, attracting enterprises in search of tailored funding solutions. Success stories from ANZ clients showcase the effectiveness of their offerings in fostering growth. Significantly, adaptable financing servicing can enhance repayment rates by 30% on average, rendering ANZ's offerings especially appealing.

- Westpac: Westpac highlights outstanding customer support and provides a range of commercial financing options, including equipment funding and lines of credit. Their method has received favorable responses from clients who value the personalized assistance throughout the financing process.

- Bizcap: Recognized for its innovative financing method, Bizcap offers quick access to adaptable funding, serving enterprises with less-than-perfect credit histories. This open-minded strategy has proven beneficial for many entrepreneurs looking to secure funding quickly.

- OnDeck: Focusing on rapid funding solutions, OnDeck simplifies the application process for small enterprise financing, making it a perfect choice for firms in urgent need of capital. Their efficiency in loan processing is a significant advantage for time-sensitive entrepreneurs.

For leasehold enterprises or those without a physical asset to leverage, financing options may include utilizing cash savings or tapping into the equity of any owned properties. For example, if an entrepreneur has a residence valued at $1.3M with $300k owed, they could potentially access $740k in equity to support acquisitions. This strategic approach to financing is crucial for entrepreneurs navigating the complexities of leasehold operations, as they often face unique challenges in securing funding.

As the modest lending market develops, small business loan providers like Commonwealth Bank and ANZ are anticipated to uphold significant market shares, with Commonwealth Bank's structured offerings and ANZ's adaptable solutions taking the lead. The integration of API-first lending solutions is expected to represent 40% of the lending market for enterprises by 2026, further improving access to capital for entrepreneurs. This trend highlights the significance of innovative lending initiatives in fostering the development of local enterprises throughout Australia. As Anna Bligh, CEO of the ABA, stated, "These modest enterprises will propel Australia through the crisis, and after it has passed, employ millions of Australians as the economy reconstructs." This emphasizes the vital role that minor enterprises play in the economic environment.

Comparative Analysis of Loan Products: Pros and Cons

A comparative analysis of typical small enterprise funding options reveals distinct advantages and disadvantages for entrepreneurs seeking financing:

-

Term Loans:

- Pros: These loans offer fixed interest rates and predictable payments, making them suitable for long-term investments.

- Cons: Approval times can be lengthy, and collateral may be required, presenting a barrier for some businesses.

-

Line of Credit:

- Pros: A line of credit provides flexible access to funds, allowing businesses to draw only what they need and pay interest solely on that amount.

- Cons: Interest rates can be variable, and there is a risk of overspending if not managed carefully.

-

Equipment Financing:

- Pros: This option is tailored for purchasing equipment and is often secured by the equipment itself, which can facilitate approval.

- Cons: It is limited to equipment purchases and may require a down payment, potentially straining cash flow.

-

Invoice Financing:

- Pros: This method allows for quick access to cash based on outstanding invoices, with no collateral needed, providing immediate liquidity.

- Cons: It can become expensive if invoices are not paid promptly, and reliance on this method may affect customer relationships.

-

- Pros: These loans do not require collateral, leading to a faster approval process, which is beneficial for urgent funding needs.

- Cons: They generally come with higher interest rates and lower borrowing limits, which can restrict growth potential.

Understanding these options is crucial, especially as many businesses face operational sustainability challenges that impact their ability to secure loans. For instance, when evaluating funding for a freehold property venture, it is essential to comprehend the financing structures available, such as the maximum loan-to-value ratio (LVR) that financial institutions typically permit. If a commercial property is valued at $1M, a lender may allow borrowing up to 70% of that value, equating to a $700k loan. This indicates that independent enterprise owners frequently need to utilize property equity and cash savings to cover the total funds necessary for acquisitions, which can encompass additional expenses such as valuation and legal fees.

A lower credit score can restrict the number of financing options accessible, making it crucial for independent enterprise owners to be aware of their credit standing. Furthermore, a recent survey indicated that 56% of small-business owners reported cybersecurity threats affecting their operations, prompting a cautious approach to financing and digital transformation. In this competitive environment, small business loan providers, especially community banks, play a crucial role in lending to local enterprises, as emphasized by FDIC Chairman Martin J. Gruenberg, who pointed out that the community banking model continues to be highly competitive and is vital for our communities. Additionally, the Small Business Administration (SBA) typically provides higher approval rates and quicker financing processing times compared to conventional banks, making it a feasible choice for many entrepreneurs.

Making the Right Choice: Tailoring Your Loan Selection

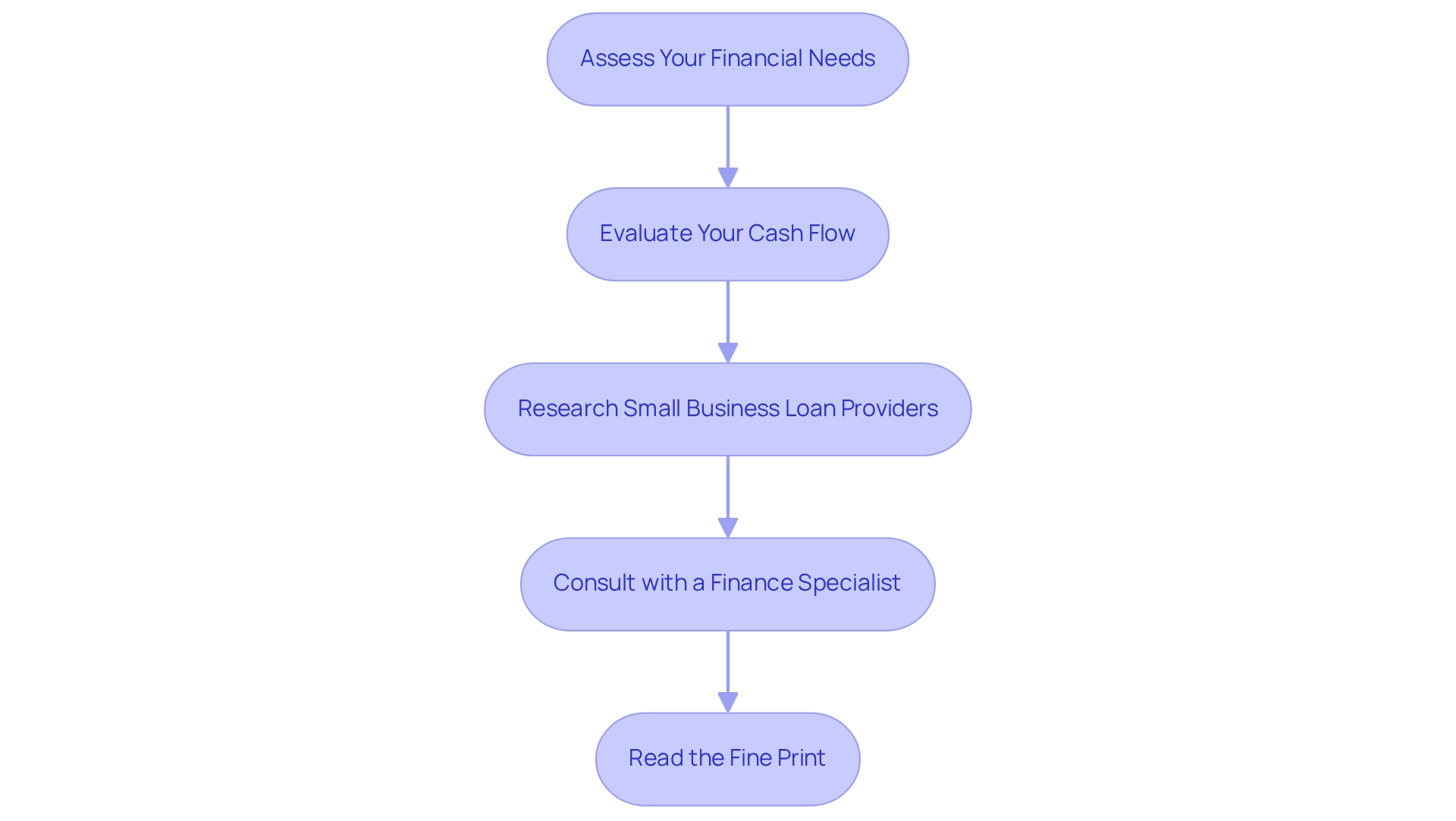

To select the right small business loan, follow these essential steps:

- Assess Your Financial Needs: Clearly define the amount of funding required and its intended purpose. This clarity will help you identify the most suitable loan type.

- Evaluate Your Cash Flow: A comprehensive grasp of your enterprise's cash flow is essential. Statistics show that approximately 60% of small enterprises in Australia encounter cash flow difficulties, rendering efficient cash flow management essential. This assessment will enable you to choose a loan with repayment terms that are manageable within your financial framework. Consider how seasonal changes may affect your capacity to make repayments, ensuring that your venture can sustain itself during slower months.

- Small business loan providers offer various financing options. Research small business loan providers: Carry out a comparative evaluation of different small business loan providers, concentrating on those that satisfy your particular operational needs. Search for financial institutions that provide flexibility and competitive rates, as the average loan amount for other purposes is approximately $112,047. Be aware that creditors will assess your company's profitability and repayment capability, so ensure your financials demonstrate a strong ability to meet obligations. Moreover, lenders will evaluate your personal finances and demand a plan along with cash flow forecasts for a minimum of the next 12 months.

- Consult with a Finance Specialist: Involving a finance consultant can offer customized insights and help in maneuvering through the intricacies of funding options. As Shaun McGowan, founder of Money.com.au, emphasizes, "He's determined to help people and businesses pay as little as possible for financial products, through education and building world-class technology." Their expertise can be invaluable in evaluating your financial needs and ensuring you make informed decisions. At Finance Story, we offer personalized consultations to help you understand your options better.

- Read the Fine Print: Before concluding any credit agreement, meticulously review all terms and conditions, including fees and repayment schedules. Understanding these details is essential to avoid unexpected costs and ensure the loan aligns with your financial strategy.

By following these steps, minor enterprise owners can make informed choices that align with their financial objectives and operational requirements when considering options from small business loan providers. Moreover, taking into account the anticipated job expansion in areas such as individual and family services, which is predicted to create over one million positions from 2019 to 2029, highlights the significance of obtaining financial assistance for enterprises in expanding sectors. Furthermore, with small enterprise funding needs in Australia expected to increase in 2025, being proactive in loan selection is more critical than ever. If you need funding to purchase a business, reach out to Finance Story to discuss your story and what you want to achieve next.

Conclusion

Navigating the landscape of small business financing demands careful consideration of various factors that can significantly impact an entrepreneur's success. Key criteria such as interest rates, loan terms, fees, customer service, lender reputation, and flexibility must be meticulously evaluated to ensure that the selected loan aligns with the unique needs of the business. Understanding these elements not only aids in making informed decisions but also empowers entrepreneurs to secure funding that fosters growth and sustainability.

As the market evolves, leading loan providers such as Commonwealth Bank, ANZ, Westpac, Bizcap, and OnDeck are reshaping the financing landscape in Australia. Each provider offers distinct advantages, catering to diverse business requirements. Entrepreneurs must be proactive in researching these options and weighing the pros and cons of different loan products, including:

- Term loans

- Lines of credit

- Equipment financing

- Invoice financing

- Unsecured loans

This comparative analysis is essential for aligning financing strategies with long-term business goals.

Ultimately, the journey to securing the right small business loan requires diligence and foresight. By assessing financial needs, evaluating cash flow, researching lenders, consulting with finance experts, and meticulously reviewing loan agreements, small business owners can position themselves for success. With the anticipated rise in funding needs in 2025, taking these steps now will not only prepare businesses for future challenges but also ensure they remain competitive in an ever-changing economic landscape.