Overview

Small businesses typically source their finance from a diverse blend of:

- Traditional funding options

- Alternative methods

- Government support

- Private equity

- Venture capital

Each of these avenues presents unique advantages and challenges. Notably, there is a discernible shift towards alternative financing sources; in fact, 45% of small enterprises are now opting for these methods, drawn by their accessibility and flexibility. Meanwhile, traditional financing options continue to hold steady, albeit often accompanied by stringent requirements that can pose barriers for many.

Introduction

Navigating the financial landscape is a formidable challenge for small business owners, particularly when it comes to securing appropriate funding. With a multitude of financing sources available—from traditional bank loans to innovative crowdfunding platforms—each option presents distinct advantages and challenges. Understanding these diverse avenues is essential for entrepreneurs aiming to fuel their growth and sustain operations in an ever-evolving market.

As the economic environment shifts, so too do strategies for obtaining capital, making it imperative for small businesses to remain informed about the latest trends and opportunities.

This article explores the various financing sources available to small businesses, offering insights that empower owners to make informed decisions tailored to their unique needs and aspirations.

Overview of Financing Sources for Small Businesses

Small enterprises today have access to a diverse array of funding options. Where are small businesses most likely to source their finance? Each option presents unique characteristics, benefits, and challenges. These sources can be categorized into:

- Traditional funding options

- Alternative methods

- Government support

- Private equity

- Venture capital

Understanding these classifications is crucial for entrepreneurs as they explore their financing avenues.

Traditional financing sources, such as banks and credit unions, are recognized for their stability and reliability. However, they often come with stringent requirements that can pose challenges for many small enterprises. For instance, when considering a leasehold property or business, owners may discover that they cannot borrow against the commercial property component, limiting their options to cash savings or equity from other owned properties.

In this scenario, the highest loan-to-value ratio (LVR) is typically 80%. This means if an owner has a property valued at $1.3M with $300k owed, they could access up to $740k in equity to facilitate their acquisition.

On the other hand, alternative financing methods, including crowdfunding and peer-to-peer lending, offer greater flexibility and quicker access to funds, making them appealing for enterprises that require immediate capital.

Government grants and funding represent another vital avenue, particularly beneficial for startups and enterprises in specific sectors. These programs can provide substantial financial support without the burden of repayment, allowing entrepreneurs to concentrate on growth. Meanwhile, private equity and venture capital are essential for companies aiming for rapid expansion, as they offer not only funding but also strategic guidance and networking opportunities.

For individuals seeking to fund a freehold property venture, understanding financing structures is essential. For example, if a commercial property is valued at $1M, a lender may permit borrowing against it at a maximum loan-to-value ratio (LVR) of 70%, equating to a $700k loan. This means owners must also consider additional funds for the purchase, which may necessitate utilizing equity from other properties or cash savings.

Recent statistics indicate that as of 2025, approximately 30% of small enterprises are utilizing traditional funding methods, while 45% are pursuing alternative sources. This shift reflects a growing trend among entrepreneurs regarding where small businesses are most likely to source their finance, as they seek more accessible and less restrictive funding options. Furthermore, expert insights emphasize that "the primary reason independent enterprises steer clear of credit is due to elevated fees and interest rates," as noted by Tom Sullivan, a fintech author.

This underscores the importance of understanding the cost implications of each funding source.

Each funding alternative plays a crucial role in the financial ecosystem for emerging enterprises, especially in understanding where small businesses are most likely to source their finance, influencing their growth trajectories and operational capabilities. Moreover, ongoing labor shortages are impacting productivity and growth, adding another layer of complexity to the funding landscape. As this environment continues to evolve, staying informed on current trends and effective funding strategies will empower entrepreneurs to make educated choices that align with their unique needs and objectives.

The prevalence of legal disputes, with a significant proportion of small enterprises facing lawsuits each year, further highlights the importance of understanding funding alternatives in relation to potential risks. Consequently, effective financial planning is essential for mitigating these challenges.

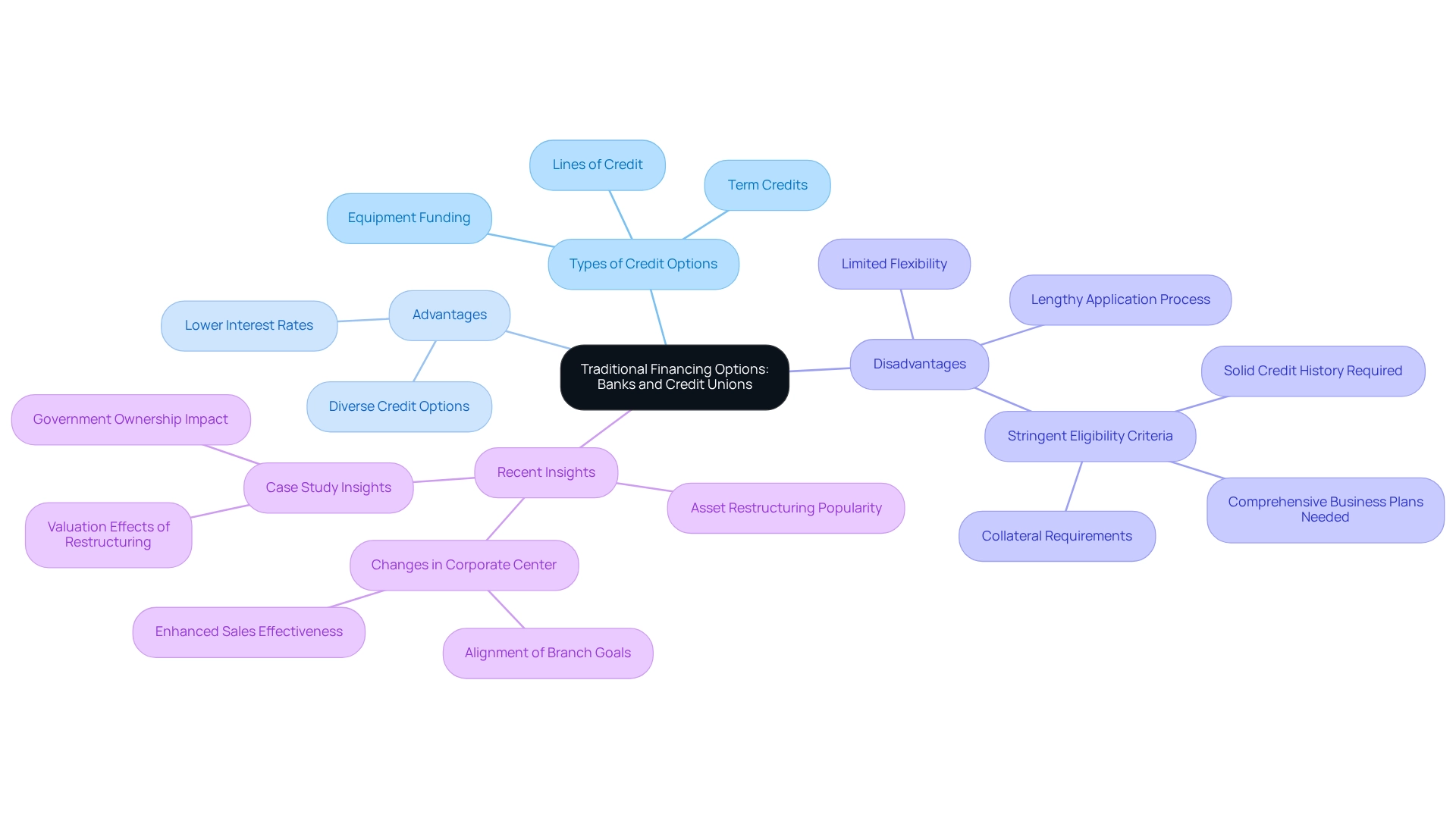

Traditional Financing Options: Banks and Credit Unions

Conventional funding alternatives, primarily offered by banks and credit unions, serve as a vital resource for small enterprises. These institutions provide a diverse array of credit options, including term credits, lines of credit, and equipment funding, effectively addressing various financial needs. A significant advantage of conventional financing is their generally lower interest rates compared to alternative funding options, making them an attractive choice for many entrepreneurs.

However, securing these funds often requires meeting stringent eligibility criteria. Small enterprises typically must demonstrate a solid credit history, present comprehensive business plans, and provide collateral, which can pose challenges for startups or those with less established credit profiles. Additionally, the application process can be lengthy, potentially delaying access to funds for businesses in urgent need of financial support.

Moreover, banks may exhibit limited flexibility regarding repayment plans and loan amounts, which can be particularly challenging for businesses operating in volatile markets. For example, a recent analysis revealed that asset restructuring is the most prevalent strategy among distressed firms, suggesting that conventional funding may not always meet the dynamic needs of smaller enterprises. This notion is further emphasized by findings from a case study on the valuation effects of restructuring announcements in Chinese companies, illustrating how conventional funding impacts distressed firms and their recovery strategies.

Despite these hurdles, traditional funding remains a reliable source of capital. In 2025, average interest rates for small business loans from banks and credit unions are projected to remain competitive, further solidifying their role in the funding landscape. As small enterprises evaluate their funding options, it is crucial to understand where they are most likely to secure financing, alongside the advantages and disadvantages of conventional funding, to make informed financial decisions.

Furthermore, armed with insights from Finance Story in developing tailored and refined cases, entrepreneurs can enhance their chances of obtaining suitable funding options tailored to their specific needs. Recent changes in the Corporate Center of banks, aimed at aligning branch objectives with corporate strategy, reflect an evolving approach to better support small enterprises in their funding requirements. As noted by Gulnur Muradoglu, the unique aspects of the restructuring process can provide valuable insights into how businesses can adapt and thrive in challenging financial climates.

Alternative Financing Methods: Exploring New Avenues

Alternative funding approaches have increasingly become crucial for enterprises seeking to determine where small businesses are most likely to source their finance beyond conventional banking avenues. These innovative solutions—peer-to-peer lending, crowdfunding, invoice financing, and revenue-based financing—each offer unique advantages tailored to the needs of entrepreneurs.

Peer-to-peer lending platforms facilitate direct connections between borrowers and individual investors, often resulting in expedited approvals and more flexible repayment terms. This approach has gained popularity, especially as minor enterprises face urgent capital needs. In fact, the expansion of peer-to-peer lending for minor enterprises is anticipated to increase significantly in 2025, reflecting a broader shift towards non-bank lending solutions. As Sutton observes, 'When you combine increasing demand for non-bank lending with the time constraints encountered by medium-sized and independent owners, it highlights where small businesses are most likely to source their finance, making the role of the broker more significant than ever.'

Crowdfunding offers another dynamic option for financing, enabling enterprises to collect minor contributions from a vast number of individuals. This approach not only raises capital but also fosters community engagement, as backers often receive early access to products or equity stakes in the company. Successful crowdfunding initiatives have demonstrated the potential for enterprises to utilize their networks effectively, transforming concepts into viable ventures.

Invoice funding provides a practical answer for companies requiring prompt cash flow. By borrowing against outstanding invoices, companies can access funds without waiting for customer payments, thus maintaining operational liquidity. This approach is especially advantageous for minor enterprises facing seasonal variations in revenue.

While these alternative financing options—often where small businesses are most likely to source their finance—provide quicker access to funds and have less stringent eligibility requirements, they may also entail higher interest rates and fees. Conventional bank lenders and SBA loans have faced criticism for their sluggish processing and disbursement, which can be especially challenging for enterprises with urgent working capital requirements. Consequently, owners of minor enterprises must thoroughly assess where small businesses are most likely to source their finance, considering the trade-offs between the speed and adaptability of these methods versus the possible expenses involved.

As the terrain of minor enterprise funding changes, comprehending these options will be vital for entrepreneurs seeking to obtain the resources essential for expansion and durability. Furthermore, recent information indicates that despite increasing interest rates and economic difficulties, 60% of SMEs intend to invest in their enterprises within the next six months, emphasizing the continuous demand for accessible funding alternatives.

Government Support: Grants and Loans for Small Enterprises

Government assistance is vital in the funding landscape for minor enterprises, addressing the critical question of where small businesses are most likely to source their finance. It provides a variety of grants and financing initiatives designed to promote economic development and innovation. These initiatives offer essential financing that often does not require repayment, making them particularly appealing for startups and early-stage ventures. Grants may be allocated for specific objectives, such as research and development, technology adoption, or export activities, enabling enterprises to invest in key sectors without the financial burden of conventional financing.

On the other hand, government-supported financing typically offers favorable conditions, including reduced interest rates and extended repayment periods, which can significantly ease the financial strain on local entrepreneurs. However, competition for these funds can be fierce, as many programs have stringent eligibility criteria and demand detailed application processes. In 2025, success rates for minor enterprises seeking government funding remain promising, but applicants must be well-prepared to navigate the complexities involved.

Importantly, projects must be completed within 12 months of initiation, underscoring the urgency and planning required for organizations pursuing funding.

To enhance their chances of securing financing, proprietors should proactively explore where small businesses are most likely to source their finance, including existing government grants and loan programs available. For example, the case of 10Tickles Animation & Design exemplifies the potential of government support; the company successfully obtained an expansion grant by leveraging augmented reality technology to develop an immersive app based on historical crime. This instance illustrates how targeted funding can foster growth and innovation, highlighting the tangible benefits of government assistance.

Moreover, enterprises are encouraged to engage with resources like Mentoring for Growth (M4G) mentors, who can provide guidance on applying for and pitching government grants. These mentors can assist owners of modest enterprises in understanding the application process, ensuring they submit their applications at least an hour before the deadline to meet requirements. By aligning their funding strategies with available government support, small enterprises can significantly improve their financing prospects and gain a better understanding of where small businesses are most likely to source their finance, driving their growth in 2025.

Private Equity and Venture Capital: Funding for Growth

Private equity and venture capital play a pivotal role in financing emerging enterprises, illustrating the primary avenues through which small businesses can secure funding, especially those poised for significant growth. Venture capital firms typically focus on startups and early-stage companies, providing not only capital but also mentorship and access to invaluable industry networks. This support is essential for businesses aiming to scale rapidly, innovate, or enter new markets.

However, competition for venture capital is intense; investors often favor companies with groundbreaking ideas and strong management teams. For instance, Pax8 recently secured over $50 million, demonstrating the substantial funding potential available through venture capital and the competitive landscape for such investments. In 2025, the average equity stake taken by venture capitalists in small enterprises is projected to be around 25%, reflecting their dedication to fostering growth while anticipating significant returns.

On the other hand, private equity investments are generally directed toward more established companies, with a focus on restructuring or expanding operations. These investments can offer considerable financial resources, yet they come with high expectations for accelerated growth and profitability. A recent case study titled 'Choosing the Right Finance for Your Company' emphasizes where small businesses are most likely to source their finance by highlighting the importance of aligning financial strategies with the specific needs and goals of an organization.

It underscores various funding alternatives, such as venture capital and private equity, stressing that well-informed financial decisions can profoundly influence a company's trajectory.

As the landscape of small enterprise financing evolves, understanding the primary sources of finance from trends in private equity and venture capital becomes crucial. In 2025, these funding sources are expected to continue shaping enterprise growth, with venture capitalists increasingly focusing on sectors driven by e-commerce and technology. As noted by the Blackstone Group, "Logistics remains among our highest conviction global investment themes, and we continue to see strong momentum driven by e-commerce trends."

Expert opinions indicate that strategically aligning funding sources with organizational objectives is vital for mitigating risks and ensuring sustainable growth. Furthermore, platforms like DealRoom assist companies in their fundraising efforts, highlighting the support systems available for emerging enterprises seeking venture capital or private equity. Overall, while both private equity and venture capital offer significant opportunities, startups must carefully evaluate their readiness to meet the expectations that accompany these investments.

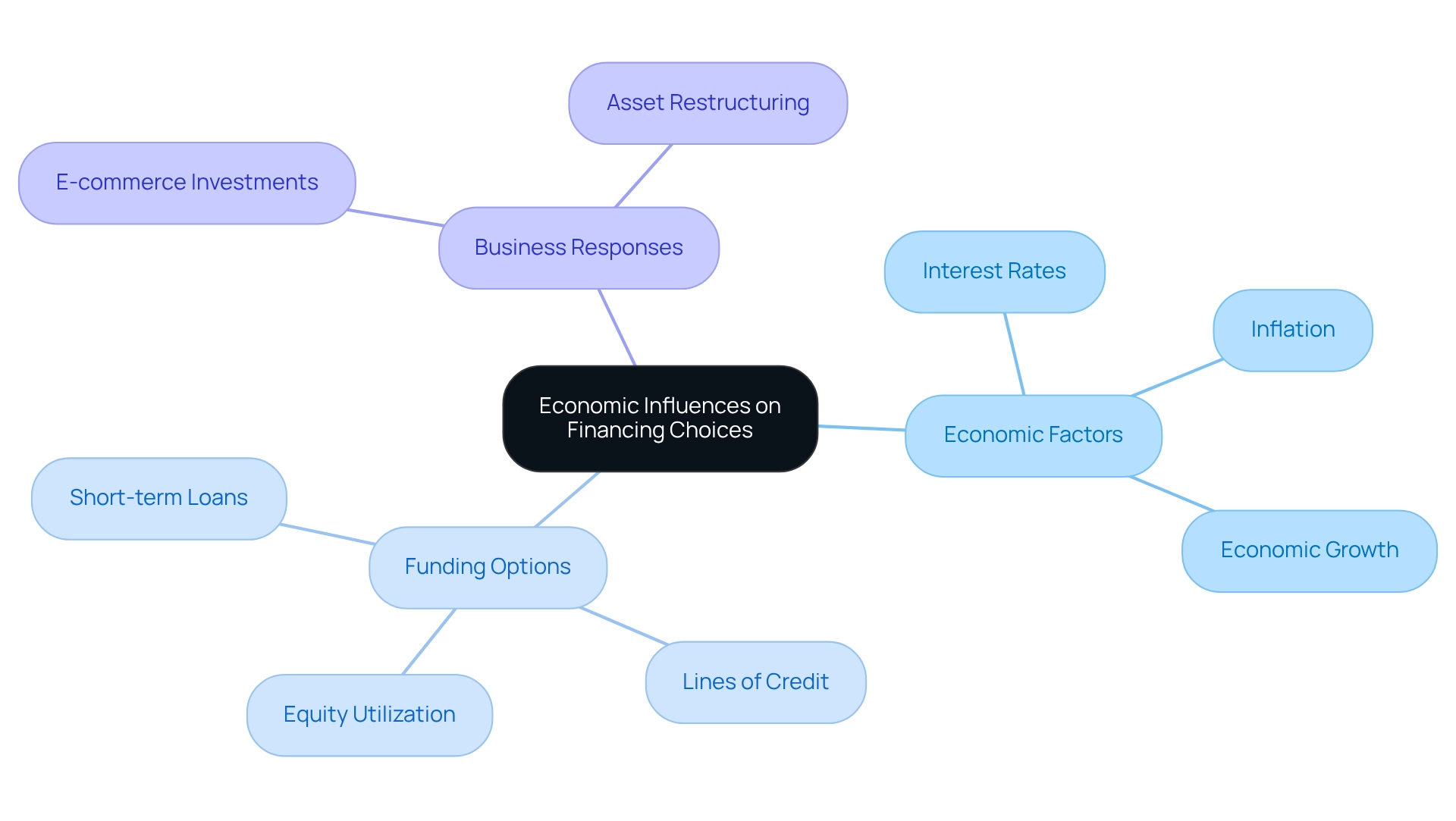

Economic Influences: How Market Trends Affect Financing Choices

Economic conditions significantly influence where small businesses are most likely to source their finance. Key factors such as interest rates, inflation, and overall economic growth directly affect both the availability of credit and lenders' readiness to provide funding. For instance, during periods of economic growth, banks typically exhibit a greater willingness to extend credit, whereas elevated interest rates can considerably deter borrowing actions.

Furthermore, variations in consumer behavior and market demand compel companies to explore diverse funding options. A notable example is the recent surge in e-commerce, which has prompted many retailers to invest in technology and inventory enhancements. This shift often drives them to consider alternative funding avenues that offer quicker access to capital, such as short-term loans or lines of credit.

For leasehold enterprises, financing options may be limited, as they cannot leverage commercial property for borrowing. In such scenarios, independent proprietors can utilize cash savings or the equity in any owned property. For example, if an entrepreneur possesses a residence valued at $1.3 million with $300,000 owed, they could potentially access up to $740,000 in equity to support acquisitions, supplemented by any cash savings.

As we navigate through 2025, small business owners must remain vigilant about these economic trends. Understanding where small businesses are most likely to source their finance is essential for comprehending how interest rates and inflation influence borrowing costs, enabling informed funding choices. Current interest rates, which have fluctuated due to economic policies, can either facilitate or hinder access to necessary funds.

Moreover, the ongoing impact of inflation on operational expenses further complicates the funding environment, as it can erode purchasing power and affect repayment capabilities.

Expert insights suggest that small enterprises should adopt a proactive approach to funding, exploring where small businesses are most likely to source their finance by leveraging market trends to align their financial strategies with growth objectives. By staying informed about economic conditions and their implications for funding options, entrepreneurs can better position themselves to secure the resources needed to thrive in a competitive landscape.

To illustrate the complexities of funding choices in challenging economic environments, consider the case study of distressed companies in China. The restructuring process often involves asset transfers without payment and reflects the influence of government and social policies. Notably, asset restructuring is the most favored strategy among distressed companies, underscoring how enterprises adapt to economic pressures.

As Gulnur Muradoglu observes, 'Asset sales are not viewed favorably by the market for either competitive or state-owned firms,' highlighting the market's perception of funding strategies. This insight underscores the importance of understanding external factors that can influence funding decisions in various contexts.

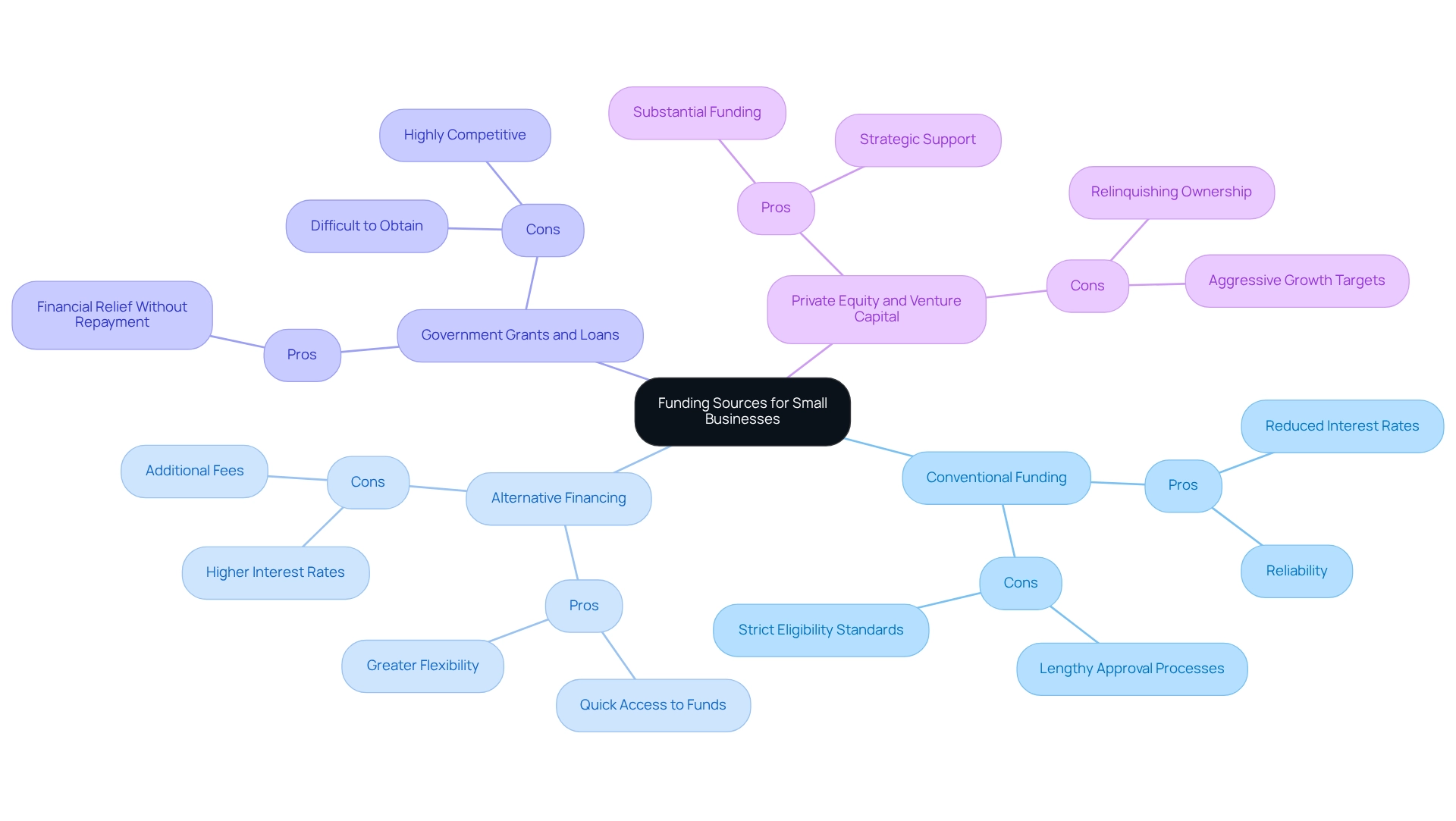

Comparative Analysis: Pros and Cons of Financing Sources

When evaluating funding sources, small business owners must consider where they are most likely to source their finance and carefully weigh the advantages and disadvantages of each option. Conventional funding, such as bank credits, is frequently preferred for its reduced interest rates and reliability; however, it often entails protracted approval procedures and strict eligibility standards that can be intimidating for many entrepreneurs. In contrast, alternative financing methods, including online lenders and peer-to-peer platforms, offer quicker access to funds and greater flexibility, albeit at the cost of higher interest rates and fees.

Government grants and loans present another avenue, providing financial relief without the burden of repayment. Yet, these options can be highly competitive and difficult to obtain, requiring thorough preparation and a persuasive case. On the other hand, private equity and venture capital can deliver substantial funding along with strategic support, but they often necessitate relinquishing a portion of ownership and adhering to aggressive growth targets.

Grasping these trade-offs is essential for small business owners as they explore where they are most likely to source their finance. For instance, a recent study showed that over half of new sole traders do not last beyond three years since 2019/20, highlighting the significance of choosing the appropriate funding strategy to guarantee sustainability and growth. By assessing the specific requirements of their enterprises against the attributes of each funding source, entrepreneurs can discover where they are most likely to source their finance, enabling them to make informed choices that align with their long-term objectives.

Moreover, seeking expert guidance from professionals like Finance Story can significantly enhance the decision-making process. Finance Story is known for its tailored mortgage brokerage solutions, adeptly assisting clients in both commercial and residential financing, especially in challenging circumstances. As Natasha B. from VIC mentioned, "I will certainly be recommending your services to anyone."

We are finished with the constant worry. Once again, thank you so much for being a part of our journey. Shane, the Founder and Funding Specialist Director, brings extensive experience in company growth and a deep understanding of loan repayment criteria, ensuring that clients receive personalized financial solutions.

His unique insights into cleverly selected property, automation, and technology solutions can significantly influence an organization's long-term profit and cash flow. As Gusto highlights, employees are 40% less likely to leave a job that provides retirement benefits, illustrating the broader context of financial stability and its impact on retention. Furthermore, creative lending solutions, like those provided by Canopy, can improve the lending experience, making it more adaptable and responsive to the requirements of entrepreneurs.

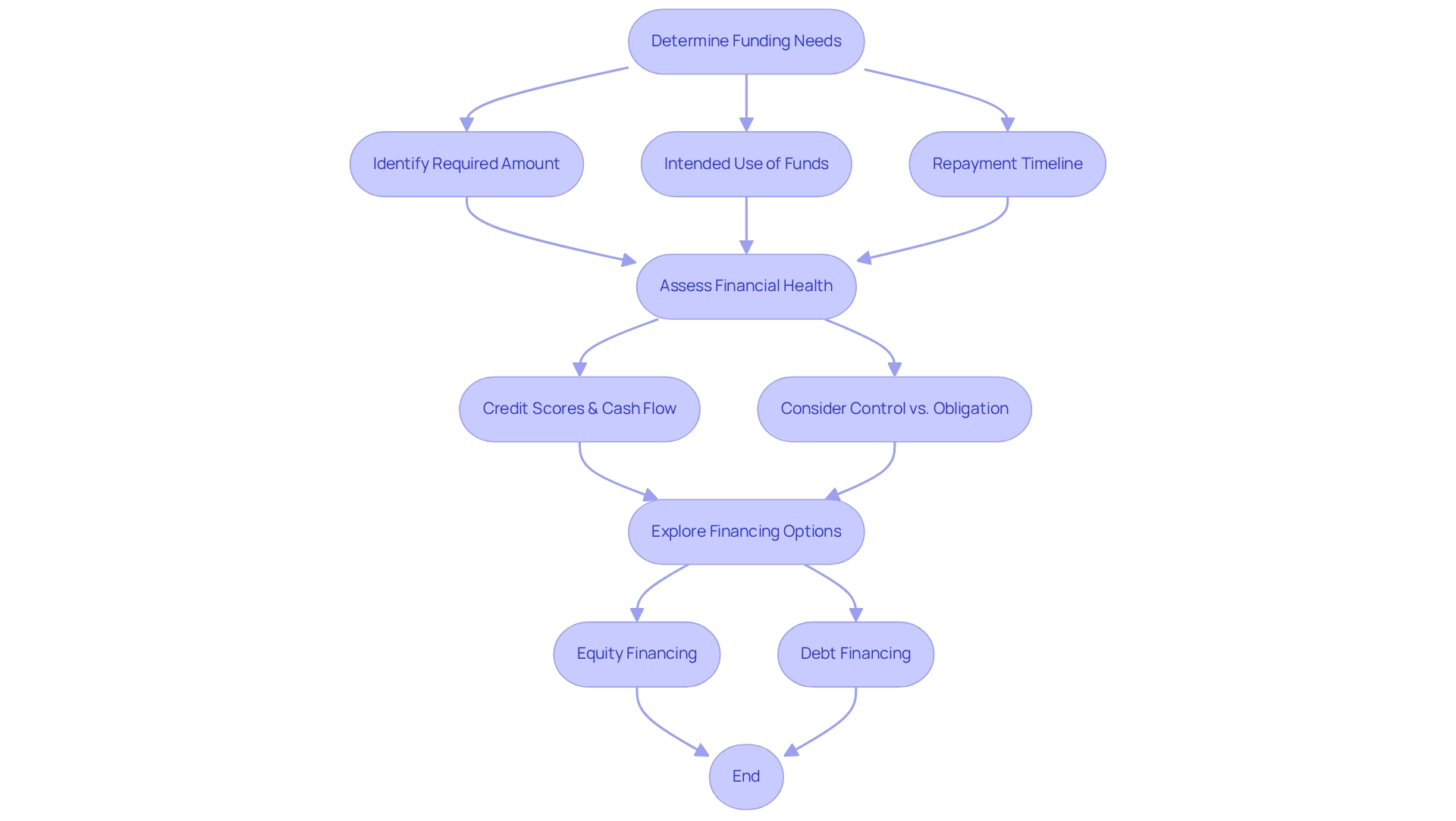

Choosing the Right Financing Source: Practical Guidance for Small Business Owners

Choosing the right funding source is a critical decision for small business owners. They must evaluate where small businesses are most likely to source their finance and assess various key elements. First and foremost, it is crucial to determine funding needs by identifying the required amount, the intended use of the funds, and the repayment timeline. A comprehensive understanding of the company's financial health, particularly credit scores and cash flow, significantly influences eligibility for various financing options.

For example, a strong credit score can unlock more favorable loan terms, while a weaker score may restrict options.

Moreover, business owners must consider the level of control they wish to retain. Equity funding provides necessary capital but can dilute ownership stakes. In contrast, debt options allow for greater control but come with the obligation of regular repayments. Understanding repayment conditions is vital, especially when funding freehold property ventures, where lenders typically permit borrowing against commercial real estate rather than the business itself.

Consider this: if a commercial property is valued at $1 million, a lender may allow a maximum loan-to-value ratio (LVR) of 70%, resulting in a potential loan of $700,000. This means a deposit of $300,000 is necessary, along with an additional $400,000 for the business portion of the purchase, bringing the total funds required to $700,000. Importantly, this total does not include other costs such as valuation, legal, and stamp duty fees.

Staying informed about market trends and economic conditions is equally crucial when exploring where small businesses are most likely to source their finance, as these factors can greatly impact the funding landscape. Recent regulatory changes have aimed to lower barriers for small and medium-sized enterprises (SMEs) in obtaining finance, addressing the question of where small businesses are most likely to source their finance and fostering competition within the banking sector. This evolving environment presents both challenges and opportunities for entrepreneurs.

Significantly, the projected annual funding shortfall for intangible asset-supported growth credits ranges from £68 million to £354 million, underscoring the substantial hurdles small enterprises face in securing adequate capital.

A practical example of effective funding strategies is demonstrated by Boomer Biz Loans, which illustrates where small businesses are most likely to source their finance for business acquisitions, particularly for baby boomers. Their streamlined three-step application process and flexible loan terms specifically address the unique challenges faced by this demographic, enabling them to secure loans of up to $10 million at competitive rates. This approach not only assists first-time purchasers but also supports experienced business owners in their financial endeavors, emphasizing the importance of strategic funding decisions.

As Sid Roche aptly noted, 'Thanks to Sid Roche for his considerable assistance in the preparation of these remarks, and to Angelina Bruno and Jonathan Hambur for acting as invaluable sounding boards.' By adopting a strategic approach to funding, small business owners can navigate the complexities of financial options and secure the necessary resources, particularly considering where small businesses are most likely to source their finance to achieve their growth objectives. Engaging with expert guidance, such as arranging a complimentary personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy, can further enhance decision-making, ensuring that the chosen funding source aligns with the organization's long-term goals.

Additionally, it is essential to recognize that a significant portion of small businesses are not highly profitable or may incur losses, rendering them vulnerable to economic downturns. This reality underscores the importance of careful financing decisions.

Conclusion

Understanding the diverse financing sources available to small businesses is essential for navigating the complex financial landscape. Traditional bank loans offer stability but often come with stringent requirements. In contrast, alternative methods like crowdfunding and peer-to-peer lending provide flexibility and quick access to funds, each presenting its unique set of advantages and challenges. Government grants and loans enrich the funding landscape further, allowing startups and specific sectors to access capital without the burden of repayment. Meanwhile, private equity and venture capital present significant opportunities for growth alongside strategic mentorship.

As economic conditions evolve, financing choices for small businesses must also adapt. Entrepreneurs should remain vigilant about market trends, interest rates, and inflation, as these factors can significantly impact their ability to secure funding. Understanding the comparative pros and cons of each financing source is crucial for making informed decisions that align with long-term business goals.

Ultimately, the key to successful financing lies in thorough preparation and strategic alignment. Small business owners are encouraged to assess their specific needs, explore available funding options, and engage with experts to navigate the complexities of financing. By doing so, they can effectively position themselves to secure the necessary capital to fuel growth and ensure sustainability in an ever-changing economic landscape.