Overview

This article presents a comparative analysis of SME loan banks, underscoring their critical role for small business owners in obtaining financial support for growth and operational needs. It highlights essential factors that businesses must consider when selecting a loan provider, including:

- Interest rates

- Repayment terms

- Lender reputation

By emphasizing the importance of informed decision-making, the article illustrates how such choices can profoundly influence a company's financial health and long-term success. Are you aware of how these factors can impact your business? Understanding them is key to navigating the financial landscape effectively.

Introduction

In the dynamic landscape of small and medium-sized enterprises (SMEs), securing the right financial support is paramount for growth and sustainability. SME loans serve as vital instruments, empowering businesses to expand their operations, invest in cutting-edge technologies, and maintain healthy cash flow. With the recent surge in business lending, particularly in Australia, the significance of these loans cannot be overstated. As companies navigate economic fluctuations, understanding the nuances of SME loans—from evaluating providers to comparing terms—becomes essential. This article delves into the importance of SME loans, the criteria for selecting the best providers, and a comparative analysis of leading banks, equipping small business owners with the insights needed to make informed financial decisions.

Understanding SME Loans and Their Importance for Business Growth

SME loan banks offer tailored financial solutions designed to meet the unique needs of small and medium-sized enterprises, playing a crucial role in their growth and sustainability. These financial aids empower enterprises to expand operations, invest in innovative technologies, and manage cash flow effectively. For example, acquiring new equipment through an SME financing option can significantly enhance productivity, leading to increased revenue streams.

In today's changing economic landscape, access to SME financing is essential for maintaining liquidity, enabling enterprises to address challenges and remain competitive. Notably, lending to enterprises in Australia saw a remarkable rise of nearly 9% by June 2023 compared to the previous year, underscoring the growing reliance on SME loan banks for small businesses aiming to thrive. The impact of SME loan banks extends beyond immediate financial support; they are vital for fostering long-term growth. Shane, the Founder and Funding Specialist Director at Finance Story, brings over thirty years of enhancement consulting experience, including specialized roles in automation and robotics. His BEng Hons in Manufacturing Engineering and Diploma in Finance & Mortgage Broking further enrich his insights into how strategically chosen financial solutions can bolster a company’s long-term profitability and cash flow. His expertise ensures that small business owners understand the benefits of securing adequate capital and the repayment requirements, both crucial for sustaining economic health.

A case study examining profitability disparities among small enterprises reveals that while median profitability aligns with that of larger companies, those with weaker economic stability are particularly vulnerable during downturns. This highlights the importance of obtaining sufficient funding through SME loan banks to enhance resilience and improve financial health. Expert opinions consistently affirm that SME loan banks are indispensable for promoting growth. They provide the necessary funding for enterprises to seize opportunities, adapt to market changes, and ultimately succeed. As Lendio notes, the financial pressures on small businesses can be substantial, with payroll expenses often reaching 6%. Thus, the ability to secure these funds can be the decisive factor between stagnation and vigorous growth, making them a fundamental component of any small business strategy.

Key Criteria for Comparing SME Loan Providers

When assessing SME loan banks, several essential criteria should be considered:

- Interest Rates: The cost of borrowing is paramount. Reduced interest rates can significantly lower the overall borrowing cost, making it crucial to compare rates among various lenders. In 2025, average interest rates for SME financing in Australia are expected to stay competitive, highlighting the significance of careful comparison. Notably, 59% of SBA loans are approved, underscoring the potential for securing financing.

- Repayment Terms: Flexibility in repayment schedules can ease monetary pressure on enterprises. Options that permit early repayment without penalties are especially advantageous, as they enable companies to manage cash flow more effectively. This is particularly important for women, minority, and veteran entrepreneurs, who often face additional challenges in accessing financing. Shane, the Founder and Funding Specialist Director at Finance Story, leverages his extensive experience in high-level consultancy roles and technical expertise to assist clients in grasping the nuances of repayment criteria, ensuring they select options that best suit their economic situations.

- Funding Amounts: Creditors differ in the sums they provide, so it’s essential to verify that the funding amounts correspond with the specific financial needs of the enterprise. This alignment can significantly impact the ability to fund growth or manage operational costs.

- Approval Process: The efficiency of the application process can greatly influence an organization's capacity to seize opportunities or navigate challenges swiftly. An efficient procedure, like the one provided by Finance Story, enables clients to obtain customized financing quotes swiftly, promoting quicker decision-making. Shane's expertise in creating persuasive proposals ensures that clients are well-prepared when presenting their needs to lenders.

- Customer Support: Exceptional customer service can enhance the borrowing experience, especially for first-time borrowers who may require additional guidance. A provider that emphasizes customer assistance can help navigate the intricacies of financing contracts and repayment choices. Shane's commitment to client education and support is a cornerstone of Finance Story's approach, backed by his qualifications in Finance and Mortgage Broking.

- Lender Reputation: Investigating lender reviews and ratings provides valuable insights into their reliability and service quality. A lender with a strong reputation, like SME loan banks, is more likely to provide a positive borrowing experience and support throughout the financing term. By considering these criteria, small business owners can make informed decisions that align with their financial goals and operational needs. As Lendio points out, comprehending the different purposes for which financing can be utilized, including the 9% designated for other uses, can further assist borrowers in their decision-making process.

Comparative Analysis of Leading SME Loan Banks

In this comparative analysis, we delve into three leading SME loan banks that can significantly impact your financing options:

- Commonwealth Bank: Renowned for its extensive range of commercial loans, Commonwealth Bank offers competitive interest rates, including a recent reduction of up to 0.10% per annum on its Online Saver product for enterprises. Their streamlined online application process enhances accessibility for small business owners, making it easier to secure financing. Mike Vacy-Lyle, Group Executive for Business Banking, emphasizes, "We also acknowledge the importance of balancing the needs of borrowers and depositors, and we will continue to evaluate our pricing and make further adjustments as necessary."

- ANZ: ANZ distinguishes itself with tailored financing solutions and exceptional customer service. The bank provides a variety of credit products, including both secured and unsecured options, specifically designed to meet diverse corporate needs. However, it's important to note that applicants must fulfill specific eligibility criteria to apply for the ANZ GoBiz funding through SME loan banks, ensuring that the offerings align with the appropriate enterprises.

- Westpac: Westpac stands out by offering robust support services, delivering financial guidance and planning resources alongside its credit products. Their financing options cater to both short-term and long-term objectives, providing a comprehensive approach to funding.

In addition to these banks, collaborating with a specialized firm like Finance Story can significantly enhance your chances of securing the right financing. They excel in crafting refined and personalized cases tailored to meet lenders' requirements, ensuring your proposal stands out. Each of these SME loan banks has unique strengths, and the optimal choice will depend on your specific needs, including the desired loan amount and repayment flexibility. A recent survey highlights that despite current challenges, SMEs remain optimistic about future growth, underscoring the importance of selecting the right funding partner to navigate these opportunities. For instance, Commonwealth Bank's competitive rates and ANZ's customized solutions could play a pivotal role in fostering this optimism among small business owners.

Making the Right Choice: Selecting the Best SME Loan Bank for Your Business

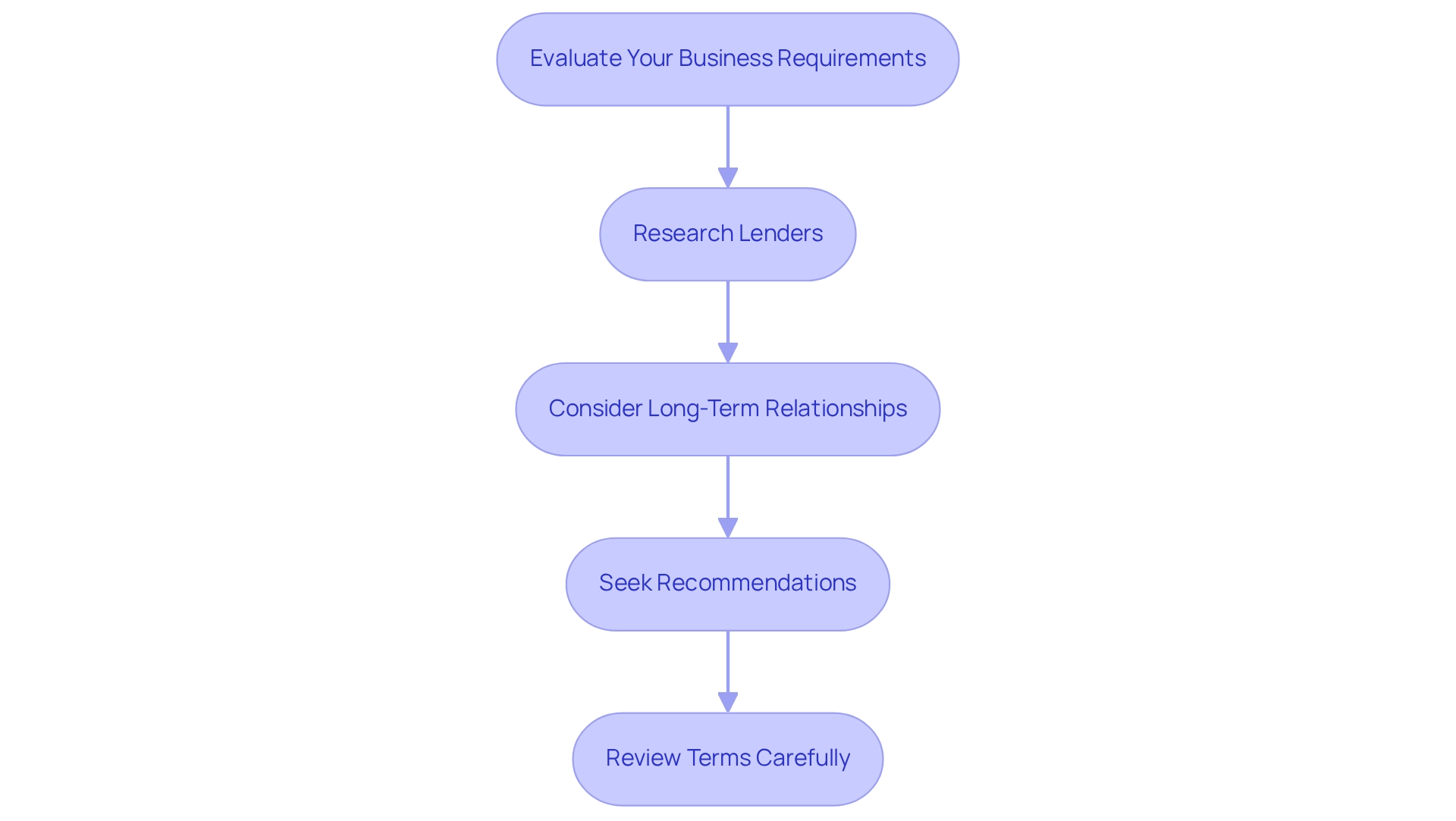

Selecting the appropriate SME banking institution necessitates a methodical strategy that can significantly influence your enterprise's economic wellbeing. Here are essential steps to guide you:

- Evaluate Your Business Requirements: Clearly outline the objective of the financing and the capital required. Understanding your financial needs is crucial, as statistics reveal that 57% of small enterprise funding applicants seek $100,000 or less, while the average small enterprise bank funding amount stands at $633,000. This underscores the importance of precise assessment.

- Research Lenders: Utilize comparison tools to evaluate various banks based on their offerings, interest rates, and customer service. For instance, Finance Story specializes in crafting refined and highly personalized cases to present to banks, ensuring you secure the appropriate funding for your commercial property investments. This research phase is vital for identifying lenders that align with your specific requirements.

- Consider Long-Term Relationships: Choose banks that provide ongoing support and resources beyond the initial loan. Building a long-term connection can be advantageous for future funding needs, guaranteeing you have a reliable ally as your enterprise expands. Seek Recommendations: Engage with fellow entrepreneurs or advisors to gain insights into their experiences with various lenders. Personal recommendations can offer valuable perspectives on the reliability and service quality of potential banks.

- Review Terms Carefully: Before finalizing your decision, meticulously examine the financial terms, including any associated fees or penalties for early repayment. Understanding these details will help you avoid unexpected costs and ensure the loan aligns with your financial strategy.

By following these steps, small business owners can make informed decisions that not only meet their immediate financial needs but also support their long-term operational goals. This strategic approach is essential in navigating the complexities of financing through SME loan banks in Australia, especially when considering the tailored solutions offered by experts like Finance Story.

Conclusion

Securing the right SME loan is a crucial step in fostering growth and ensuring the sustainability of small and medium-sized enterprises. These loans not only provide essential capital for expansion and innovation but also play a pivotal role in maintaining liquidity during challenging economic times. The recent increase in business lending in Australia underscores the growing reliance on these financial instruments, highlighting their significance in helping businesses navigate fluctuating market conditions.

When selecting an SME loan provider, it is essential to consider various criteria, including:

- interest rates

- repayment terms

- customer support

By evaluating these factors, business owners can make informed choices that align with their financial goals and operational needs. A comparative analysis of leading banks such as Commonwealth Bank, ANZ, and Westpac illustrates the diverse options available, each with unique strengths tailored to different business requirements.

Ultimately, the process of choosing the right SME loan involves careful assessment and strategic planning. By understanding their specific financial needs and researching potential lenders, business owners can forge long-term relationships that provide ongoing support and resources. This proactive approach not only aids in securing the necessary funding but also positions businesses for sustained growth and success in a competitive landscape. Emphasizing the importance of informed financial decisions will empower SMEs to thrive and adapt in an ever-evolving economic environment.