Overview

Unsecured SME loans offer businesses flexible financing options without the need for collateral, allowing for swift access to funds for purposes such as working capital and expansion. These loans provide significant advantages, including rapid approval and the absence of asset risk.

However, it is crucial to recognize that they also come with higher interest rates and shorter repayment terms. Therefore, careful consideration of the associated risks is necessary.

Are you ready to explore how these financing solutions can propel your business forward?

Introduction

In a rapidly evolving financial landscape, unsecured SME loans have emerged as a vital resource for small and medium enterprises aiming to fuel their growth without the burden of collateral. These loans offer businesses the flexibility to secure funding based on their creditworthiness and financial performance, rather than tying up valuable assets. As more SMEs turn to these financing options to navigate economic uncertainties, understanding the benefits, eligibility criteria, and potential risks associated with unsecured loans becomes essential. With the right strategies in place, businesses can leverage these financial tools to seize opportunities, enhance cash flow, and ultimately drive success in a competitive market.

What Are Unsecured SME Loans?

Unsecured SME loans present tailored financing solutions for small and medium enterprises (SMEs) that do not necessitate collateral, allowing businesses to secure funding without risking their physical assets. Instead of relying on tangible security, lenders assess the borrower's creditworthiness through their financial history and operational performance. This evaluation process grants SMEs greater flexibility in accessing funds, making these financial aids suitable for a variety of purposes, including working capital, business expansion, and operational expenses.

The appeal of non-secured financing lies in their accessibility; they provide a crucial lifeline for SMEs aiming to grow without the burden of collateral. Recent statistics indicate that a significant proportion of SMEs utilize non-secured financing to fuel their growth, reflecting a broader trend within the market. For instance, the unprotected business financing sector benefits from government-backed lending initiatives that offer fixed interest rates, further enhancing the attractiveness of these financial options. Notably, Trimont manages USD 236 billion in credit, underscoring the significance of non-secured financing in the broader financial landscape.

Real-world examples highlight the efficacy of unsecured credit. Bizcap, for example, offers small enterprise funding ranging from $5,000 to $5,000,000, with approval times as quick as three hours. This rapid response is vital for businesses that require immediate financing to seize growth opportunities. Additionally, the non-secured business financing market in Germany is anticipated to experience substantial growth, driven by a robust SME sector and advanced banking systems. This trend underscores the increasing availability of risk-free financing, which is equally relevant to the Australian market.

Key characteristics of unsecured SME loans encompass expedited approval processes, less stringent documentation requirements, and the capacity to secure funding without encumbering assets. As Prime Minister Anthony Albanese remarked, "Small enterprises are the backbone of our economy. We must ensure they have access to fair and sustainable financing options." With over 25 years of expertise in business improvement and technology implementation, Shane, the Founder and Funding Specialist Director at Finance Story, is exceptionally qualified to guide SMEs through the complexities of securing appropriate financing solutions. His credentials, including a BEng Hons in Manufacturing Engineering and a Diploma in Finance & Mortgage Broking, further bolster his capacity to provide customized financial solutions. As the market evolves, these financial products are gaining traction among SMEs, reinforcing their role as a cornerstone of economic growth. By employing the right financial strategies, small enterprises can leverage non-secured funding to navigate challenges and capitalize on opportunities in today's dynamic market.

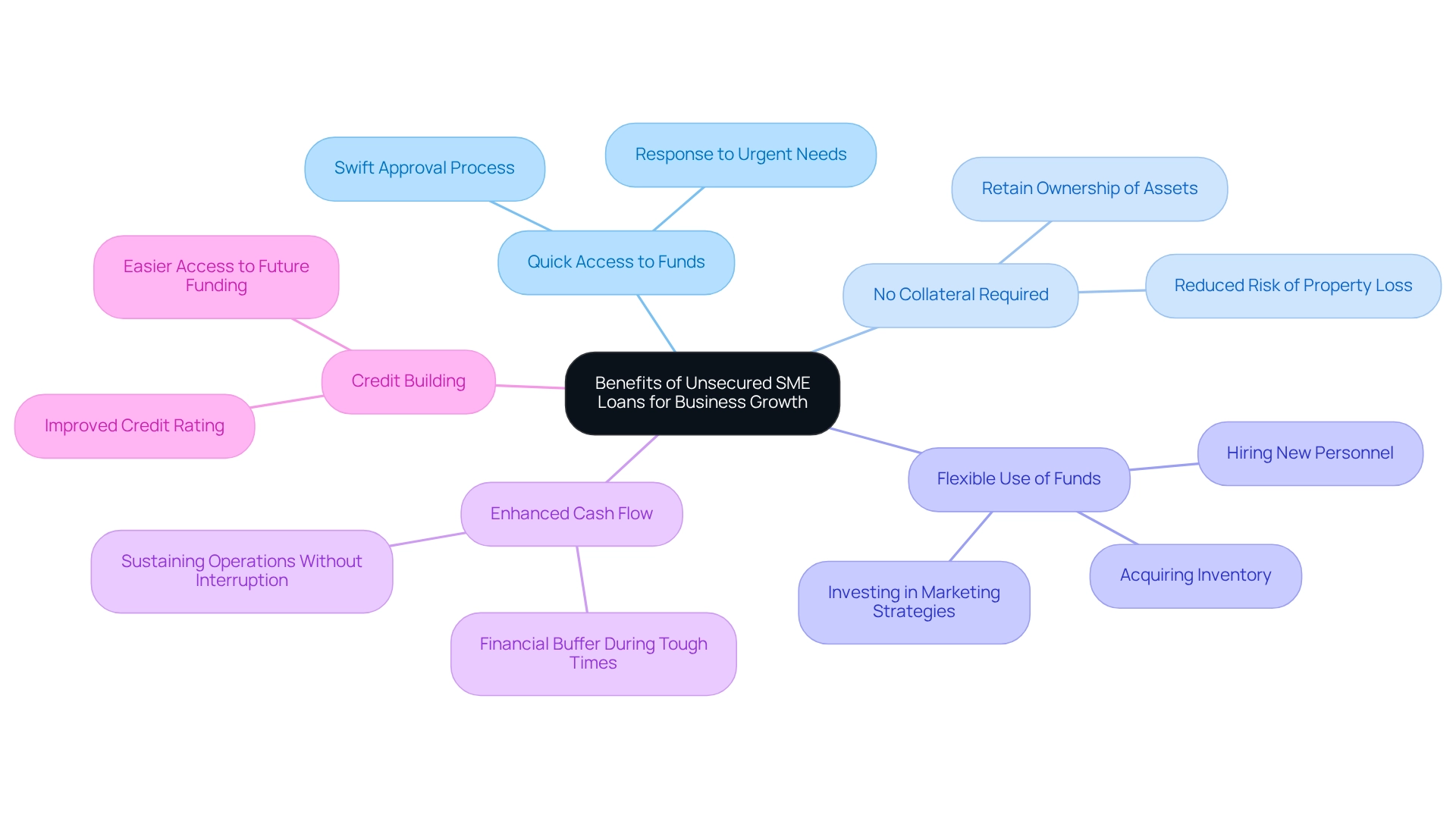

Benefits of Unsecured SME Loans for Business Growth

Unsecured SME financing presents several key advantages that can significantly facilitate business growth, particularly in challenging economic conditions.

- Quick Access to Funds: One of the standout features of unsecured financing is its swift approval process. Businesses can often secure funding within days, enabling them to respond quickly to urgent financial needs or opportunities.

- No Collateral Required: Unlike secured financing, non-collateralized options do not necessitate collateral, allowing companies to retain ownership of their assets. This significantly reduces the risk of losing valuable property in the event of repayment difficulties.

- Flexible Use of Funds: The adaptability of unsecured financing is a major advantage. Resources can be allocated for various objectives, such as acquiring inventory, hiring new personnel, or investing in marketing strategies, providing organizations the flexibility to adjust to their specific requirements.

- Enhanced Cash Flow: These financial aids can serve as a crucial tool for managing cash flow fluctuations. By offering a financial buffer during tough times, non-collateral funding assists companies in sustaining operations without interruption.

- Credit Building: Successfully repaying a non-secured debt can enhance a company's credit rating. This improvement can ease access to future funding opportunities, simplifying the process for companies to obtain additional capital when needed.

However, it is essential to note that non-collateralized credit typically carries higher interest rates compared to secured financing, which can influence overall borrowing costs. In 2025, the benefits of unsecured SME loans are particularly pronounced, as these loans empower enterprises to navigate economic uncertainties with greater confidence. Financial analysts emphasize that quick access to unsecured SME loans is vital for SMEs, enabling them to capture growth opportunities and address operational challenges effectively.

Shane Duffy, Founder and Funding Specialist Director at Finance Story, underscores the importance of understanding repayment criteria when evaluating financing options. He notes that lenders will assess a company's profit strength, its ability to manage repayments without incurring economic strain, and the necessity of a comprehensive plan along with cash flow forecasts. Examining repayment conditions is crucial to ensure they align with an organization's cash flow and to comprehend penalties for early or missed payments. For instance, companies that have successfully leveraged non-collateral funding often report substantial growth, highlighting their value in the resource arsenal of small enterprises. Shane's extensive experience in organizational enhancement and financial solutions further emphasizes the importance of these insights.

Eligibility Requirements for Unsecured SME Loans

To qualify for unsecured SME loans, enterprises typically need to meet several key criteria:

- Credit Score: A robust credit score is crucial, with most lenders necessitating a minimum score of 650 for both personal and corporate credit. Notably, a strong credit score for enterprises can occasionally offset a lower personal score, providing extra flexibility in the application process. This means that companies with a strong credit profile may still qualify even if their personal credit score is not ideal.

- Company History: Lenders generally favor enterprises that have been active for a minimum of two years, as this indicates stability and experience in handling financial obligations.

- Revenue Requirements: Steady revenue is essential; many lenders establish a minimum annual revenue benchmark to ensure that the company can manage loan repayments. This requirement helps reduce risk for lenders while supplying enterprises with the necessary capital. Lenders will evaluate the strength of the company's profits and its capability to make all necessary repayments, including those for current loans.

- Debt-to-Income (DTI) Ratio: Lenders typically seek a DTI ratio under 40%, although this can differ by lender and type of credit. A lower DTI ratio indicates that an enterprise is not over-leveraged and can manage additional debt responsibly.

- Proposal: A well-organized proposal is often needed, detailing how the loan will be utilized and the expected advantages for the enterprise. This plan acts as a guide for lenders, highlighting the applicant's vision and economic strategy. Furthermore, lenders will seek to view cash flow forecasts for at least the upcoming 12 months to confirm that the company can maintain its operations and fulfill repayment responsibilities, particularly during slower times.

- Financial Reports: Recent fiscal statements, including profit and loss reports, are typically requested to evaluate the organization's economic health. These documents provide insight into cash flow and overall performance, which are essential for assessing eligibility for financing. Creditors aim to ensure that the enterprise can sustain itself and manage repayments without imposing excessive economic pressure on the owner.

Understanding these standards is crucial for SMEs pursuing unsecured SME loans, especially in an environment where lenders are progressively concentrating on risk evaluation. For example, companies encountering temporary cash flow shortages can benefit from unsecured SME loans, which provide rapid access to working capital without requiring collateral. This flexibility enables them to address urgent monetary needs, such as operational costs or marketing efforts, thus promoting growth and continuity.

As the lending environment evolves, remaining knowledgeable about eligibility criteria and maintaining a robust credit profile can significantly enhance an enterprise's chances of securing the necessary funding. At Finance Story, we specialize in crafting customized loan proposals and can assist you in navigating the array of lenders available to find the perfect match for your requirements. Ready to take the first step towards financial success? Contact our experts today for personalized assistance in navigating your business finance journey.

Risks Involved with Unsecured SME Loans

Unsecured SME loans present several risks that small and medium enterprises (SMEs) must carefully consider before proceeding.

- Higher Interest Rates: Unsecured credit typically carries higher interest rates compared to secured credit, reflecting the increased risk lenders encounter. In 2025, the average interest rates for unsecured SME loans in Australia are anticipated to be approximately 12% to 15%. This can significantly influence a firm's financial well-being, particularly as many SMEs navigate a challenging economic environment. Finance Story focuses on developing customized financing proposals that assist SMEs in obtaining more advantageous terms by presenting refined and personalized cases to lenders.

- Shorter Repayment Terms: These financial products often come with shorter repayment periods, resulting in higher monthly payments. This can strain cash flow, especially for companies that experience seasonal variations in revenue. Understanding the repayment requirements is essential; lenders will evaluate the entity's capacity to generate adequate profits to meet all financial obligations, including any outstanding debts. A robust strategy and cash flow forecasts are vital to demonstrate to lenders that the venture can uphold its monetary obligations.

- Impact on Credit Score: Timely repayment is crucial; failure to meet obligations can adversely affect a borrower's credit score. For instance, unpaid telco bills can negatively impact credit reports if overdue for 60 days or more and amount to $150 or more. A negative credit report can hinder future borrowing opportunities, making it essential for SMEs to manage their repayments diligently. Finance Story highlights the significance of possessing a robust plan and cash flow forecasts to show to lenders that the enterprise can uphold its financial obligations.

- Restricted Borrowing Amounts: Unsecured financing generally provides smaller sums compared to their secured equivalents. This limitation can restrict financing options for larger projects, such as unsecured SME loans, potentially stifling growth opportunities. By collaborating with Finance Story, SMEs can explore a full range of lenders, including high street banks and innovative private lending panels, to find the right financing solutions for their needs, whether they are purchasing a warehouse, retail premise, factory, or hospitality venture.

- Potential for Debt Cycle: Without careful management, organizations may fall into a debt cycle, relying on new loans to settle existing debts. This scenario can lead to financial instability and increased vulnerability to market fluctuations. Finance Story advises SMEs to ensure that their business can support itself financially, particularly during quieter months, to avoid such pitfalls.

A case study involving a mid-sized construction firm illustrates these risks. The firm obtained unsecured credit to invest in advanced construction management software, aiming to enhance operational efficiency. While the investment improved project tracking and client satisfaction, the firm encountered difficulties due to the elevated interest rates linked to the financing, which strained their cash flow. This situation underscores the importance of having a robust financial strategy and collaborating with experts like Finance Story to navigate these challenges effectively.

Considering these risks, it is essential for SMEs to evaluate the advantages of unsecured SME loans against their possible disadvantages. As Labor Senator Katy Gallagher emphasizes, "We need to move beyond short-term fixes and establish frameworks that protect small businesses from exploitative lending." Grasping the consequences of elevated interest rates and the dangers linked to non-secured borrowing can empower SMEs to make informed financial choices.

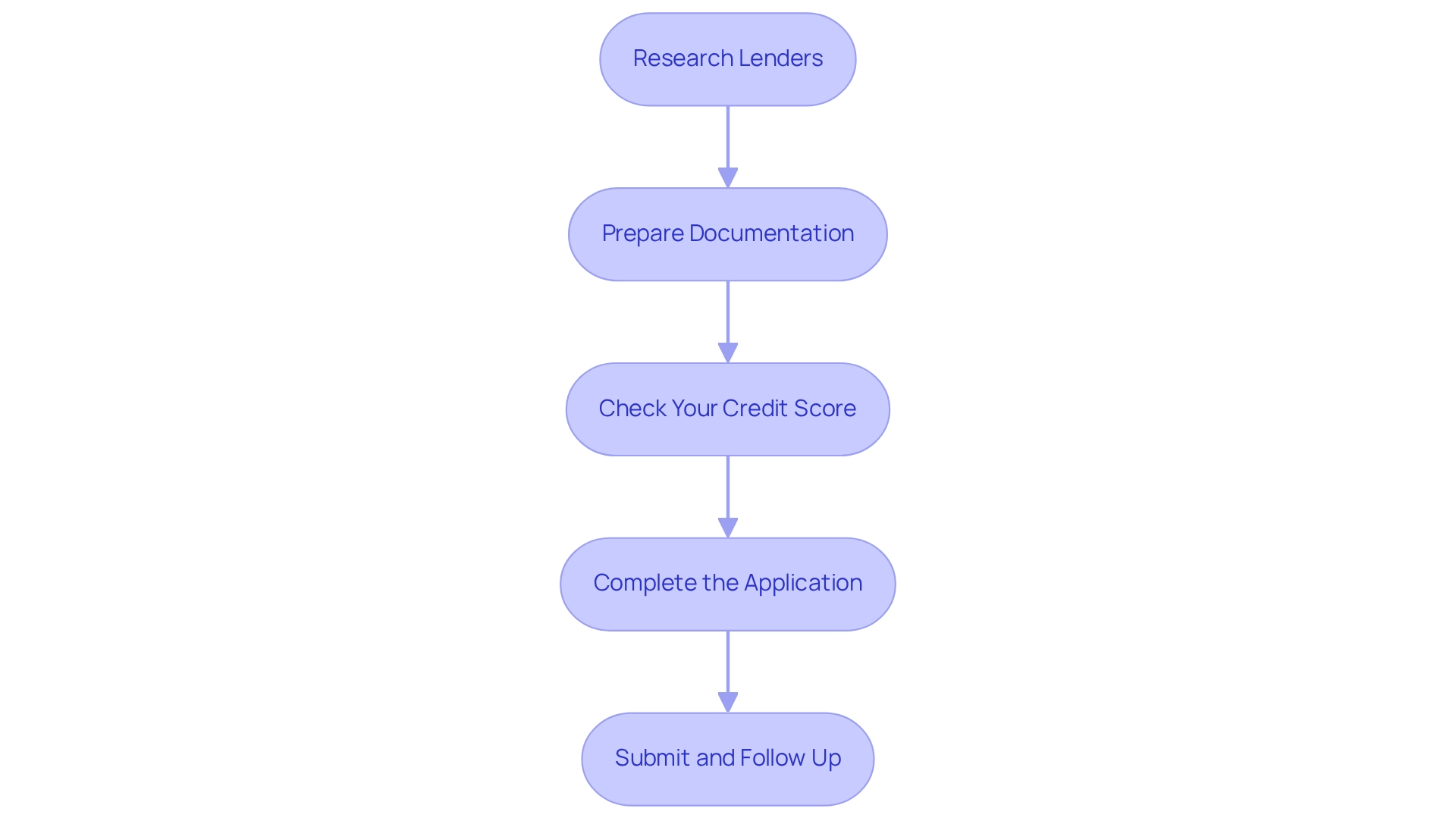

How to Apply for Unsecured SME Loans

- Research lenders specializing in unsecured SME loans by exploring various financing options. Seek those that offer competitive terms and flexible repayment options. In the current landscape, digital banks are gaining traction for their quicker processing times, which can significantly enhance your application. As noted by Finance Story, their expertise in developing refined and tailored cases can assist you in securing the appropriate funding for your commercial property investments, including warehouses, retail spaces, factories, and hospitality projects. This increase in average processing time is largely due to the influx of new digital banks that streamline loan application processes.

- Prepare Documentation: Gather essential documents such as accounting statements, tax returns, and a detailed operational plan. These papers not only showcase your financial health but also enable lenders to assess your business's viability. Finance Story underscores the importance of a well-prepared proposal to meet the elevated expectations of lenders.

- Check Your Credit Score: Before applying, review your credit report for any inaccuracies and to evaluate your creditworthiness. A strong credit score can enhance your chances of approval and may lead to more favorable financing conditions.

- Complete the Application: Fill out the financial application accurately, ensuring all required information is included. Attention to detail is paramount, as incomplete applications can delay processing. Collaborating with Finance Story can provide insights into the repayment criteria that lenders typically evaluate.

- Submit and Follow Up: After submitting your application, proactively follow up with the lender to check its status. Be prepared to address any additional inquiries they may have, as this demonstrates your commitment and can expedite the process.

Current trends indicate that the typical processing duration for unsecured SME loans has increased, primarily due to the rise of digital banks that simplify application procedures. As of 2025, the updated definition of retail SMEs includes credit exposures of up to $1.5 million, expanding the financing opportunities available for small enterprises. By adhering to these steps and staying informed about market trends and lender options, businesses can effectively navigate the application process for unsecured SME loans. Remember, proactive engagement in the loan application process is crucial to securing the best financing options available.

Conclusion

Unsecured SME loans are a vital financial resource for small and medium enterprises seeking to expand without the burden of collateral. By providing swift access to funds, flexibility in usage, and the capacity to enhance cash flow, these loans empower businesses to navigate economic uncertainties and capitalize on growth opportunities. The increasing trend of SMEs utilizing unsecured loans highlights their significance in today's financial landscape, bolstered by government-backed initiatives that improve access to financing.

However, it is crucial for businesses to comprehend the eligibility criteria and associated risks. A strong credit score, a proven business history, and a meticulously crafted business plan are essential for securing these loans. While the advantages are substantial, the potential for elevated interest rates and shorter repayment terms demands careful consideration and strategic planning. Businesses must diligently manage their repayments to prevent adverse effects on their credit scores and overall financial stability.

In conclusion, unsecured SME loans can be a potent instrument for business growth, provided that enterprises approach them with a comprehensive understanding of both the opportunities and challenges involved. By leveraging the insights and expertise of financial specialists, such as those at Finance Story, SMEs can successfully navigate the complexities of the lending landscape and make informed decisions that promote sustainable growth and success in a competitive market.