Overview

This article provides a comparative analysis of SME lenders in Australia, shedding light on the evolving lending landscape. Small businesses must navigate several factors when selecting a lender.

Evaluating criteria such as:

- Interest rates

- Loan terms

- Approval speed

- Customer service

is essential. These elements are critical for SMEs aiming to secure the most suitable financing options tailored to their unique needs. By understanding these factors, businesses can effectively navigate economic challenges and make informed financial decisions.

Introduction

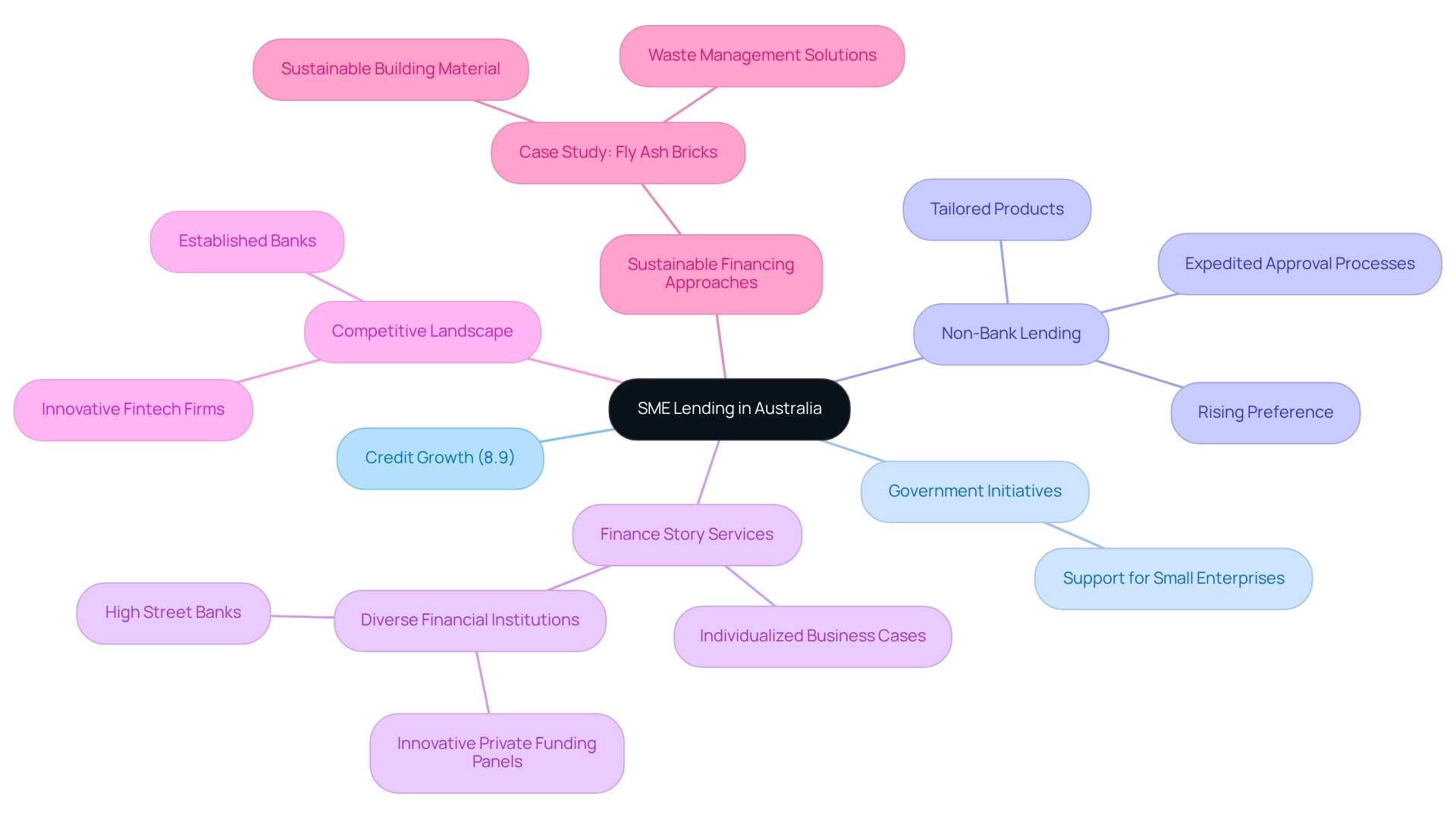

As Australia’s small and medium-sized enterprises (SMEs) navigate a rapidly evolving financial landscape in 2025, the dynamics of lending are shifting dramatically. With a remarkable business credit growth rate of 8.9%, fueled by supportive government initiatives and a rising trend towards non-bank lending, SMEs are now more than ever in search of flexible financing solutions.

This article delves into the intricacies of SME lending, exploring:

- Essential criteria for evaluating lenders

- A comparative analysis of leading financial institutions

- Strategic steps for selecting the right lender to meet business needs

By understanding these elements, small business owners can empower themselves to secure the funding necessary for growth and sustainability in an increasingly competitive environment.

Overview of SME Lending in Australia

In 2025, SME lenders Australia are undergoing transformative changes in the lending environment, marked by a notable credit growth rate of 8.9%, as reported by the Reserve Bank of Australia. This surge is primarily driven by proactive government initiatives aimed at supporting small enterprises, alongside a rising preference for non-bank lending solutions. As economic uncertainties persist, SMEs are increasingly seeking flexible financing alternatives from SME lenders Australia, resulting in a shift toward alternative providers known for their expedited approval processes and tailored products.

Finance Story specializes in developing polished and highly individualized business cases to present to SME lenders Australia, ensuring small business owners secure the right funding for their specific goals. Whether addressing a temporary shortfall, funding a property development, or acquiring new equipment, we offer a comprehensive array of financial institutions, including high street banks and innovative private funding panels, to accommodate diverse situations—be it purchasing a warehouse, retail space, factory, or hospitality venture.

As highlighted by Private Mortgages Australia, 'This client-focused approach ensures small and medium-sized enterprises receive funding that aligns with their specific goals.' The competitive landscape features a wide range of SME lenders Australia, from established banks to innovative fintech firms, all striving to meet the varied requirements of small enterprises across different sectors. This evolution in lending practices not only enhances access to capital but also empowers small and medium-sized enterprises to pursue growth opportunities and effectively navigate challenges.

Moreover, the case study on Fly Ash Bricks illustrates creative approaches to financing and sustainability, appealing to small enterprise owners interested in sustainable practices. In this context, private business loans are increasingly viewed as a bridge to long-term stability for small and medium enterprises, particularly during growth or transition phases.

Key Comparison Criteria for SME Lenders

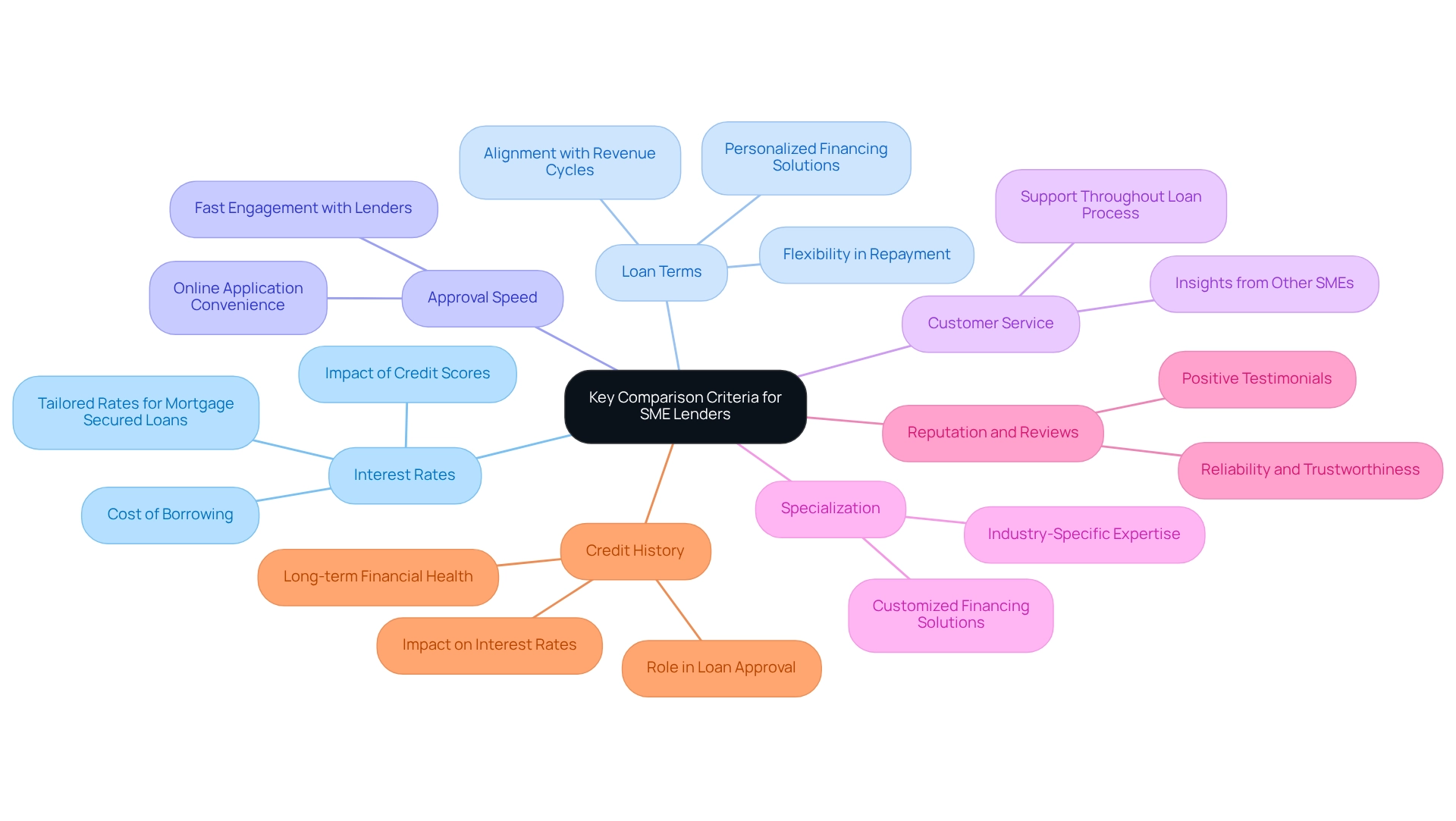

When evaluating SME lenders, it is crucial to consider several essential criteria:

-

Interest Rates: The cost of borrowing is a primary concern for SMEs, as interest rates can vary significantly among lenders. In 2025, average interest rates set by SME lenders in Australia are expected to reflect this variability, directly impacting overall loan affordability and financial health. Notably, interest rates for Mortgage Secured Commercial Loans are tailored to meet organizational needs, allowing for personalization based on specific requirements. As highlighted by industry specialists, focusing on enhancing credit scores can lead to improved rates over time, making it essential for companies to prioritize their financial well-being.

-

Loan Terms: Flexibility in repayment terms, including duration and payment frequency, is vital for managing cash flow. Lenders, such as SME lenders Australia, that offer flexible financing terms can assist SMEs in navigating financial challenges more effectively, ensuring that repayments align with their revenue cycles. Finance Story specializes in creating polished and highly personalized cases, which can enhance the chances of securing favorable terms.

-

Approval Speed: In today's fast-paced corporate environment, the speed at which loans are approved can be a decisive factor. Numerous financiers now guarantee engagement with interested candidates within two days, enabling companies to swiftly evaluate options and make informed decisions. For instance, HSBC business banking customers can apply online, enhancing convenience in the application process.

-

Customer Service: The level of support and guidance offered by financial institutions significantly influences the borrowing experience. Exceptional customer service from SME lenders Australia can simplify the complexities of the loan process, ensuring that small and medium enterprises feel supported throughout their financial journey. Insights from other SMEs provide valuable perspectives on the reliability and trustworthiness of financial institutions. Positive testimonials can indicate a financial institution's commitment to customer satisfaction and their ability to deliver on promises.

-

Specialization: Some financial institutions focus on particular industries or types of financing, which can be advantageous for niche businesses. Understanding the expertise of SME lenders Australia can assist small and medium-sized enterprises in discovering customized solutions that cater to their distinct requirements. Finance Story's access to a comprehensive portfolio of private, boutique commercial investors, in addition to standard financing providers, means they can offer a wide range of options to discuss with clients.

-

Reputation and Reviews: Input from other SMEs offers valuable insights into the reliability and trustworthiness of financial institutions. Positive testimonials can indicate a financial institution's commitment to customer satisfaction and their ability to deliver on promises.

-

Credit History: A company's credit history plays a significant role in borrowing approval and interest rates. Lenders evaluate both personal and commercial credit scores during the application process. Enhancing credit scores can improve a business's likelihood of obtaining financing with more favorable conditions, as emphasized in the case study titled 'Impact of Credit History on Approval.' As Brad, a Senior Money Writer, states, "Work on credit and financial health (longer-term). While it takes time, improving your credit score and overall financial health can lead to better rates down the line."

By thoughtfully evaluating these criteria, SMEs can make informed decisions that align with their financial objectives and improve their chances of securing favorable funding conditions.

Comparative Analysis of Leading SME Lenders

This comparative analysis highlights three prominent SME lenders in Australia.

-

Commonwealth Bank: Renowned for its extensive branch network and diverse service offerings, Commonwealth Bank presents competitive interest rates and flexible loan terms. They also assist enterprises in managing risks linked to foreign exchange, interest rate variations, and commodity pricing through hedging and risk management tools. However, the approval procedure of SME lenders in Australia can be more sluggish than that of non-bank financial institutions, which may pose challenges for small and medium-sized enterprises requiring rapid access to funds. Additionally, it is important to note the bank's past scandal, which has raised questions about its reputation and trustworthiness among potential borrowers.

-

Prospa: As a prominent non-bank lender, Prospa focuses on quick, unsecured loans for enterprises with swift approval periods. While their interest rates are generally elevated, they are well-suited for small and medium enterprises that require prompt funding without the burden of extensive documentation, making them a popular choice for organizations in urgent need of capital. Prospa's strategy aligns with the recent appeal for focused financial assistance for small and medium enterprises, as emphasized by Banjo Loans CEO Guy Callaghan, highlighting the urgency of meeting the financial requirements of companies in the current economic situation, which is being addressed by SME lenders in Australia.

-

Judo Bank: Judo Bank is positioned as a challenger bank that focuses exclusively on small and medium-sized enterprises, offering tailored lending solutions as one of the SME lenders in Australia, with a strong emphasis on customer service. Their competitive rates and tailored assistance during the loan process make SME lenders in Australia an appealing choice for companies looking for a more personalized method of financing.

Each lender offers unique benefits, highlighting the significance for small and medium enterprises to assess their particular requirements against these options. As Matt Comyn, CEO of Commonwealth Bank, has observed, comprehending the environment of SME lending is essential for small enterprise owners. Recent calls for targeted financial support for SMEs highlight the urgency of addressing their financial needs, particularly in light of ongoing economic challenges. As the landscape changes, grasping the subtleties of each provider's offerings will enable small enterprise owners to make knowledgeable choices regarding their financing alternatives.

Choosing the Right SME Lender for Your Business Needs

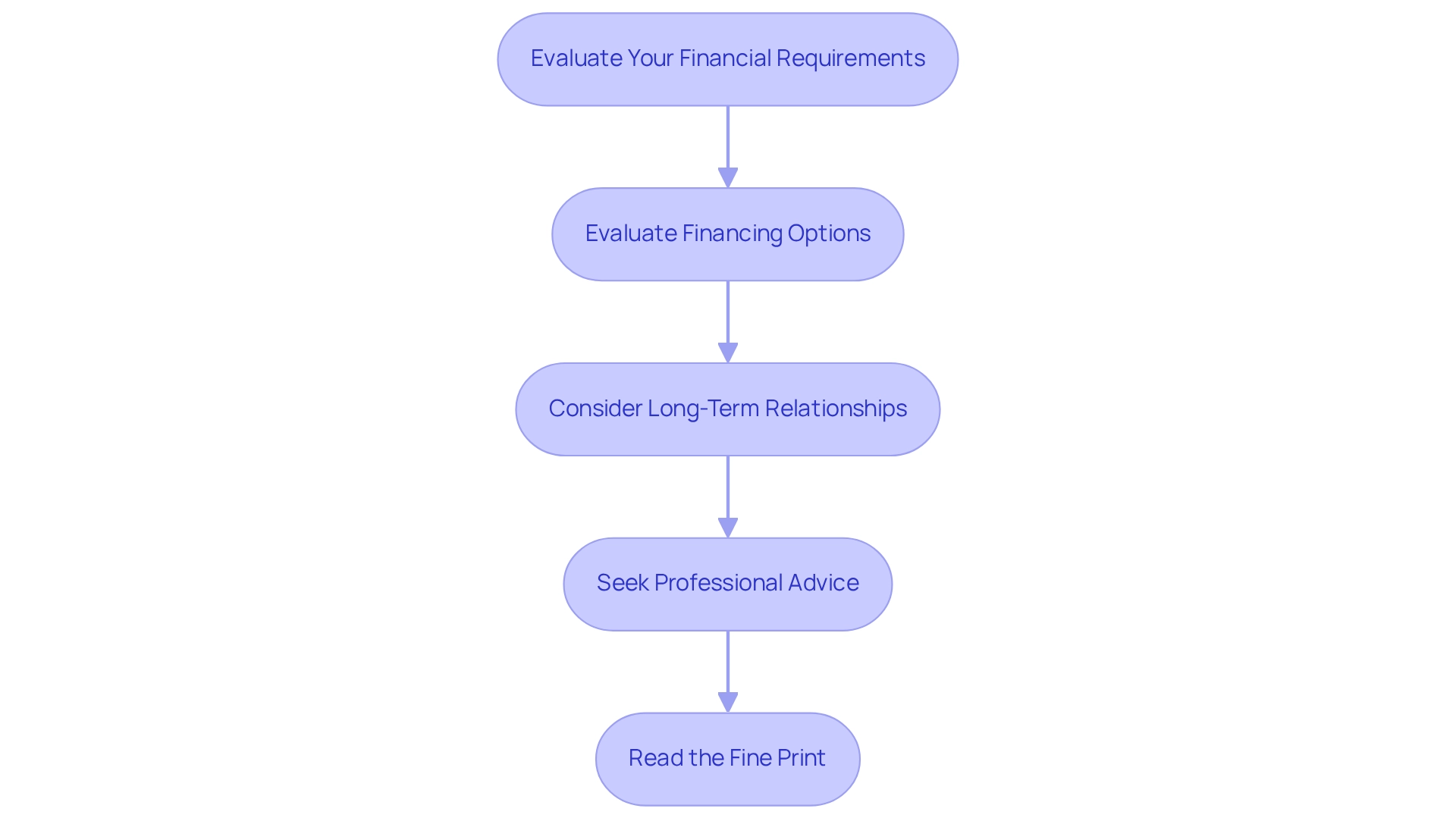

Selecting the right SME lender is a crucial process that involves several key steps:

-

Evaluate Your Financial Requirements: Begin by determining the exact funding amount required and the intended purpose of the loan—whether it’s for growth, acquiring equipment, or managing cash flow.

-

Evaluate Financing Options: Utilize established comparison criteria to create a shortlist of potential institutions that align with your financial needs. Given that capital cities in Australia accommodate three times the number of enterprises compared to regional areas, it is essential to understand the local lending environment, particularly with SME lenders in Australia.

-

Consider Long-Term Relationships: Prioritize financial institutions that provide ongoing support and additional services. Establishing a long-term relationship can significantly benefit future financing needs. As Bruce Billson, the Australian Small Enterprise and Family Enterprise Ombudsman, states, 'The operating environment for small and family enterprises can and needs to be improved if we are to halt the decline of this vital ‘engine room of the economy.’ This highlights the importance of choosing SME lenders in Australia who are committed to supporting your venture in the long run.

-

Seek Professional Advice: Engaging with a business finance expert, such as Finance Story, can provide valuable insights and assist in navigating the complexities of various lending options. Our expertise in crafting customized funding proposals ensures that you secure the right financing solutions for your commercial property investments and refinances. We offer access to a comprehensive range of lenders, including high street banks and innovative private lending panels, tailored to meet your unique circumstances.

-

Read the Fine Print: Thoroughly review loan agreements, paying close attention to terms, fees, and conditions to avoid unexpected surprises later on.

By following these steps, SMEs can make informed choices that align with their objectives, ultimately enhancing their chances of securing the right financing to thrive in a dynamic market. Recent statistics reveal that in the last financial year, approximately 436,018 new firms entered the market while 362,893 exited. This highlights the significance of strategic financial planning and exit strategies in the small business landscape, further emphasizing the necessity for careful consideration when selecting a lender. To further assist you, consider scheduling a free personalized consultation with Finance Story's Head of Funding Solutions, Shane Duffy, to discuss your specific needs and goals.

Conclusion

Navigating the evolving landscape of SME lending in Australia is crucial for small and medium-sized enterprises aiming for growth and sustainability. With a remarkable business credit growth rate of 8.9%, SMEs are presented with a plethora of financing options, including traditional banks and innovative non-bank lenders. Understanding the essential criteria for evaluating lenders—such as interest rates, loan terms, approval speed, and customer service—enables business owners to make informed decisions that align with their unique financial needs.

The comparative analysis of leading SME lenders, including Commonwealth Bank, Prospa, and Judo Bank, highlights the distinct advantages each offers, emphasizing the importance of matching lender capabilities with specific business requirements. As economic uncertainties continue, the urgency for SMEs to secure flexible financing solutions becomes increasingly apparent.

Ultimately, the process of selecting the right SME lender is not just about immediate funding; it’s about fostering long-term relationships and building a solid financial foundation. By following strategic steps and seeking professional advice, small business owners can empower themselves to navigate the complexities of lending and ensure they are well-equipped to seize growth opportunities. In an environment where adaptability and financial acumen are paramount, making informed choices in financing will be key to thriving in the competitive market of 2025 and beyond.