Overview

This article presents a comprehensive comparative analysis of small business loan companies for 2025, focusing on their offerings, interest rates, and distinctive features. It aims to assist entrepreneurs in making informed financing decisions. By highlighting the diverse financing options available, the article underscores the critical importance of understanding each lender's terms. Furthermore, it illustrates how tailored loan proposals can significantly influence approval rates and repayment success. This analysis emphasizes the vital role these companies play in fostering small business growth.

Introduction

Navigating the world of small business financing can be a daunting task, particularly in the rapidly evolving landscape of 2025. Small business loans have emerged as essential tools for entrepreneurs seeking to fuel growth, manage cash flow, or invest in new opportunities.

With a variety of loan types available—from traditional term loans to flexible lines of credit—business owners must carefully evaluate their options to find the best fit for their unique needs. As interest rates fluctuate and economic conditions shift, understanding the intricacies of loan selection becomes crucial.

This article delves into the significance of small business loans, the diverse types available, key criteria for choosing a lender, and a comparative analysis of leading loan companies. By equipping entrepreneurs with the knowledge they need, we empower them to make informed financial decisions.

Understanding Small Business Loans: Definition and Importance

Minor enterprise financing options offered by small business loan companies represent tailored financial solutions designed to meet the specific funding needs of medium-sized and smaller enterprises (SMEs). These credits can be utilized for various purposes, including acquiring inventory, expanding operations, or managing cash flow. The significance of small business loan companies is profound; they serve as a crucial lifeline for numerous companies, enabling them to seize growth opportunities, navigate economic challenges, and maintain operational stability.

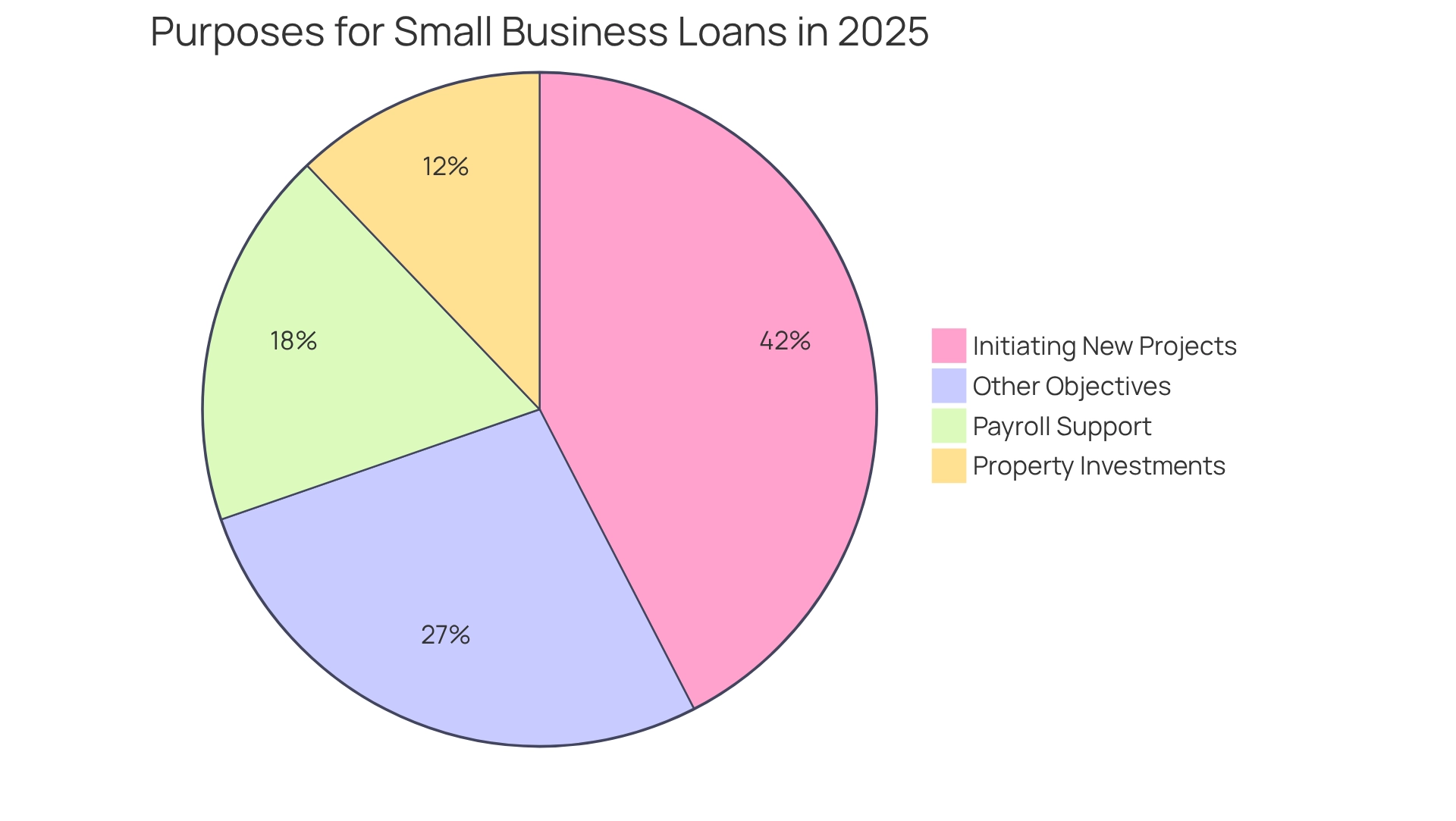

As we advance through 2025, the financing landscape for small enterprises is undergoing substantial transformations. With rising interest rates, entrepreneurs are increasingly seeking financing from small business loan companies, not merely for survival but to thrive in a competitive market. Data indicate that:

- 14% of minor enterprises pursue financing to initiate new projects

- 6% seek support for payroll

- 4% for property investments

- 9% of small enterprises seek funding for a variety of other objectives, which may include marketing initiatives, equipment acquisitions, or technology enhancements

This underscores the diverse reasons for pursuing credit.

At Finance Story, we understand the complexities of these requirements and offer customized financing solutions that promote growth at every stage. Our expertise in crafting refined and highly tailored funding proposals ensures that enterprises can secure the appropriate financing for their projects, whether they are acquiring commercial properties or refinancing existing debts.

We provide access to a comprehensive portfolio of lenders, offering a range of financing options including term lending, debtor finance, and asset finance. The impact of small business loan companies on economic expansion is substantial, as they enable SMEs to innovate and grow, contributing to job creation and overall economic stability. Financial specialists emphasize that access to small business loan companies is vital for fostering a robust entrepreneurial environment.

Indeed, case studies reveal that enterprises utilizing funding for growth initiatives have achieved notable success, illustrating the transformative power of financial assistance in the SME sector. As the market continues to evolve, understanding the importance of minor enterprise financing remains essential for entrepreneurs navigating the complexities of today's economy.

Types of Small Business Loans: Exploring Your Options

In 2025, small enterprises will have access to a diverse array of financing options offered by small business loan companies, tailored to meet their unique financial needs. The most popular types include:

- Term Financing: These traditional credits come with fixed repayment plans, making them ideal for businesses seeking a lump sum to invest in expansion efforts.

- Lines of Credit: Offering flexibility, lines of credit allow companies to withdraw funds as needed, proving especially beneficial for managing cash flow fluctuations.

- Equipment Financing: Specifically designed for acquiring equipment, these financial products use the equipment itself as collateral, making them a practical choice for businesses looking to invest in essential tools.

- Invoice Financing: This method enables companies to borrow against outstanding invoices, providing immediate cash flow to cover operational expenses.

- SBA Financing: Backed by the government, these loans often feature lower interest rates and extended repayment periods, making them an attractive option for small enterprises.

- Unsecured Financing: These financing options do not require collateral, although they typically carry higher interest rates, making them suitable for businesses without significant assets.

Statistics reveal that the average amount borrowed for purposes beyond immediate operational needs is approximately $112,047, highlighting the substantial financial support available to entrepreneurs. Furthermore, case studies illustrate the effectiveness of adaptable loan servicing provided by small business loan companies, which allows lenders to adjust terms in response to borrowers' temporary challenges, resulting in an average 30% increase in loan repayment rates for clients utilizing such platforms. As businesses evaluate their financing options, financial consultants emphasize the importance of understanding the specific needs and circumstances of each entity when selecting a loan type. Finance Story is dedicated to crafting refined, highly tailored cases to present to banks, ensuring that entrepreneurs secure the appropriate funding for their commercial property investments. We provide access to a comprehensive range of lenders, including high street banks and innovative private lending panels, to address diverse financing needs.

Dr. Pratiti Chatterjee notes that the hospitality sector is facing declining profit margins, coupled with tight household budget constraints, which limit discretionary spending. This context is crucial for small business owners to consider when evaluating their funding options. Additionally, sectors such as professional, scientific, and technical services boast a profit margin of 23.9%, while agriculture, forestry, and fishing support services have a profit margin of 20.2%. These figures underscore the varying financial landscapes across sectors, which may influence borrowing decisions. This tailored approach ensures that entrepreneurs can make informed choices that align with their growth objectives and financial capabilities.

Key Criteria for Choosing a Small Business Loan Company

When selecting small business loan companies, it is crucial to evaluate several key factors to ensure an informed decision:

-

Interest Rates: Compare rates across various lenders, as even slight differences can lead to significant variations in total repayment amounts. In 2025, average interest rates for small enterprise financing are expected to fluctuate, making it essential to stay updated on current trends. Moreover, customers utilizing flexible servicing observe repayment rates increase by 30% on average, underscoring the benefits of exploring flexible options.

-

Loan Terms: Assess the repayment terms, including duration and flexibility. Aligning these terms with your company's cash flow is vital for maintaining financial stability. Finance Story specializes in crafting refined and highly personalized cases, ensuring that your loan terms are tailored to meet your specific needs, including refinancing options to adapt to your evolving requirements.

-

Approval Process: Seek financial institutions that offer a streamlined application process and quick approval times. Statistics indicate that businesses benefit from faster funding, especially in urgent situations, as nearly half of small and medium-sized enterprises continue to rely on small business loan companies instead of traditional methods for financial management. This highlights the importance of modern financing solutions, such as those provided by small business loan companies like Finance Story, which grants access to a comprehensive suite of lenders.

-

Customer Service: Evaluate the quality of customer support. A flexible financial institution can significantly ease the loan process, ensuring you receive assistance when needed. Finance Story prides itself on its commitment to client satisfaction, providing expert guidance throughout the financing journey.

-

Reputation: Research financial institution reviews and ratings to assess their reliability and trustworthiness. A financial institution's reputation often reflects its service quality and dedication to clients. Finance Story's track record in helping clients secure funding for various commercial properties, including warehouses, retail premises, factories, and hospitality ventures, attests to its reliability.

-

Specialization: Certain providers focus on specific sectors or loan categories, which can be advantageous if your company has distinct funding requirements. For instance, companies in niche markets may discover customized solutions that better meet their needs. Finance Story offers a comprehensive selection of lenders to address any situation, whether you are purchasing a warehouse, retail space, factory, or hospitality project.

In 2025, the landscape of financing for enterprises is evolving, with 32% of organizations seeking funding from online lenders last year, reflecting a trend toward more accessible options compared to conventional lenders. This trend emphasizes the importance of thoughtfully assessing interest rates and financing terms, along with understanding the approval process data to make the optimal decision for your enterprise.

Comparative Analysis of Leading Small Business Loan Companies

In 2025, the modest enterprise credit market features a variety of notable small business loan companies, each offering unique benefits tailored to entrepreneurs' needs. Below is a comparative analysis of leading companies:

- Commonwealth Bank:

Interest Rates: 6.29% - 15%

Loan Amounts: Up to $5 million

Approval Time: 1-3 days

Special Features: Structured term loans, business overdrafts - ANZ:

Interest Rates: 5% - 20%

Loan Amounts: Up to $1 million

Approval Time: 2-5 days

Special Features: Flexible repayments, secured finance - Westpac:

Interest Rates: 6% - 18%

Loan Amounts: Up to $500,000

Approval Time: Equipment finance, tailored solutions - Bizcap:

Interest Rates: 12.5% - 20%

Loan Amounts: $5K - $5M

Approval Time: 24 hours

Special Features: Fast and flexible loans without upfront credit checks - OnDeck:

Interest Rates: 10% - 30%

Loan Amounts: $10K - $250K

Approval Time: 1-2 days

Special Features: Quick access to funds, transparent fees

This analysis highlights the diverse interest rates, loan amounts, and unique features of each lender, enabling businesses to make informed decisions based on their specific requirements.

Current trends indicate that minor enterprises often secure only about 50% of the funding they initially seek. This underscores the importance of understanding each lender's offerings, particularly from small business loan companies, and crafting tailored proposals for banks. For instance, a recent case study revealed that a small enterprise aiming for $100,000 was approved for just $50,000, showcasing the hurdles many entrepreneurs encounter in obtaining sufficient funding. Notably, the approval rate for financing through small business loan companies stands at 59%, reflecting a competitive landscape where flexibility is crucial. For example, Commonwealth Bank's structured term financing and commercial overdrafts have proven advantageous for businesses striving for stability, as demonstrated in a case study where a local retailer effectively utilized these options to manage cash flow during seasonal fluctuations. Meanwhile, ANZ's flexible repayment options cater to those facing temporary financial difficulties. Case studies indicate that adaptable loan servicing can improve repayment rates by an average of 30%, benefiting both lenders and borrowers. As the market evolves, financial analysts emphasize the necessity for entrepreneurs to remain informed about current interest rates from small business loan companies, which range from 5% to 30% among various providers in 2025. This spectrum reflects broader market conditions rather than being exclusive to the companies listed. Such knowledge is vital for navigating the complexities of securing funding from small business loan companies in a landscape where challenges persist, particularly for women, minority, and veteran entrepreneurs. By leveraging these insights, small business owners can better position themselves to secure the capital essential for growth from small business loan companies.

Conclusion

Navigating the complexities of small business financing in 2025 is essential for entrepreneurs aiming to thrive in a competitive marketplace. Small business loans serve as a vital resource for addressing various funding needs, from purchasing inventory to managing cash flow. Understanding the diverse types of loans available—including term loans, lines of credit, and SBA loans—empowers business owners to select the most suitable options tailored to their unique circumstances.

When choosing a loan company, key criteria such as interest rates, loan terms, and customer service should be carefully evaluated. Furthermore, the comparative analysis of leading lenders highlights the importance of finding a provider that aligns with specific business needs while ensuring a streamlined approval process. As the financial landscape evolves, staying informed about market trends and lender offerings is crucial for securing the necessary capital.

Ultimately, small business loans are more than just financial instruments; they represent opportunities for growth, innovation, and stability. By leveraging the right financing options, entrepreneurs can navigate economic challenges and capitalize on growth initiatives, contributing to a robust and dynamic entrepreneurial ecosystem. As businesses continue to adapt in 2025, understanding the intricacies of small business loans will remain a cornerstone for success and sustainability.