Overview

Self-Managed Super Funds (SMSFs) offer a powerful opportunity for property investment through a Limited Recourse Borrowing Arrangement (LRBA). This arrangement not only facilitates borrowing but also safeguards the fund's other assets in the event of a default.

Understanding the steps and eligibility criteria for securing such loans is crucial. Compliance with regulations is paramount, as is the formulation of a well-defined investment strategy. These elements are essential for maximizing the benefits of SMSF property investments.

Are you ready to explore how SMSFs can enhance your investment portfolio?

Introduction

Navigating the world of Self-Managed Super Funds (SMSFs) can be both empowering and complex, particularly in the realm of property investment. As more Australians turn to SMSFs to take control of their retirement savings, understanding the intricacies of borrowing within this framework becomes essential.

With the ability to invest in a diverse range of assets, including commercial properties, SMSFs present unique opportunities that can significantly enhance retirement portfolios. However, this journey is not without its challenges.

- Compliance with legal and regulatory requirements

- Understanding permissible property types

- Fulfilling eligibility criteria

These are all crucial steps in leveraging SMSFs effectively. This article delves into the key aspects of SMSF borrowing potential, guiding individuals through the essential considerations for successful property investments.

Understand Self-Managed Super Funds and Their Borrowing Potential

A Self-Managed Super Fund (SMSF) represents a private superannuation fund that individuals manage independently, setting it apart from traditional industry or retail super funds. SMSFs empower individuals to take control of their retirement savings, allowing for investments across a range of assets, including real estate. A notable feature of SMSFs is that they can borrow money to buy property through a Limited Recourse Borrowing Arrangement (LRBA). This arrangement safeguards the other assets within the fund by limiting the lender's recourse solely to the acquired asset, thereby mitigating risk in the event of default.

As we approach 2025, the SMSF sector has exhibited strong performance, achieving a total return on assets of 10.1%. This statistic underscores the growing appeal of self-managed super funds for real estate, with an increasing number of Australians utilizing these funds for such purposes. Recent reports indicate that self-managed super funds are being recognized as effective tools for real estate financing, raising the question of whether a self-managed super fund can borrow money to buy property, which signals a shift in financial strategies among Australians. In fact, approximately [insert percentage] of Australians now leverage self-managed super funds for real estate, highlighting their rising popularity.

Expert insights emphasize the strategic advantages of self-managed super funds in real estate. Financial advisors stress the necessity of crafting tailored strategies that ensure liquidity and stability as individuals near retirement. Louise Laing, founder of Salus Private Wealth, articulates this approach: "For those in the lead into retirement, we design strategies so you have peace of mind that when you start to draw on your retirement savings, you have liquidity and stability to support that." This proactive strategy is essential for those aiming to effectively access their retirement savings.

In addition to their borrowing capacity, the question of whether a self-managed super fund can borrow money to buy property highlights unique characteristics that enhance their attractiveness for real estate ventures, particularly in commercial sectors like office buildings, storage facilities, and retail spaces. Finance Story provides expert guidance to navigate SMSF commercial real estate ventures, ensuring compliance and assisting clients in selecting suitable lenders. Understanding these fundamentals is vital for anyone considering SMSFs as a pathway to real estate, whether for commercial or residential objectives. Finance Story is committed to developing customized financing solutions that cater to both first-time buyers and seasoned investors, simplifying the process of expanding your investment portfolio.

BOOK A CHAT to explore your options today.

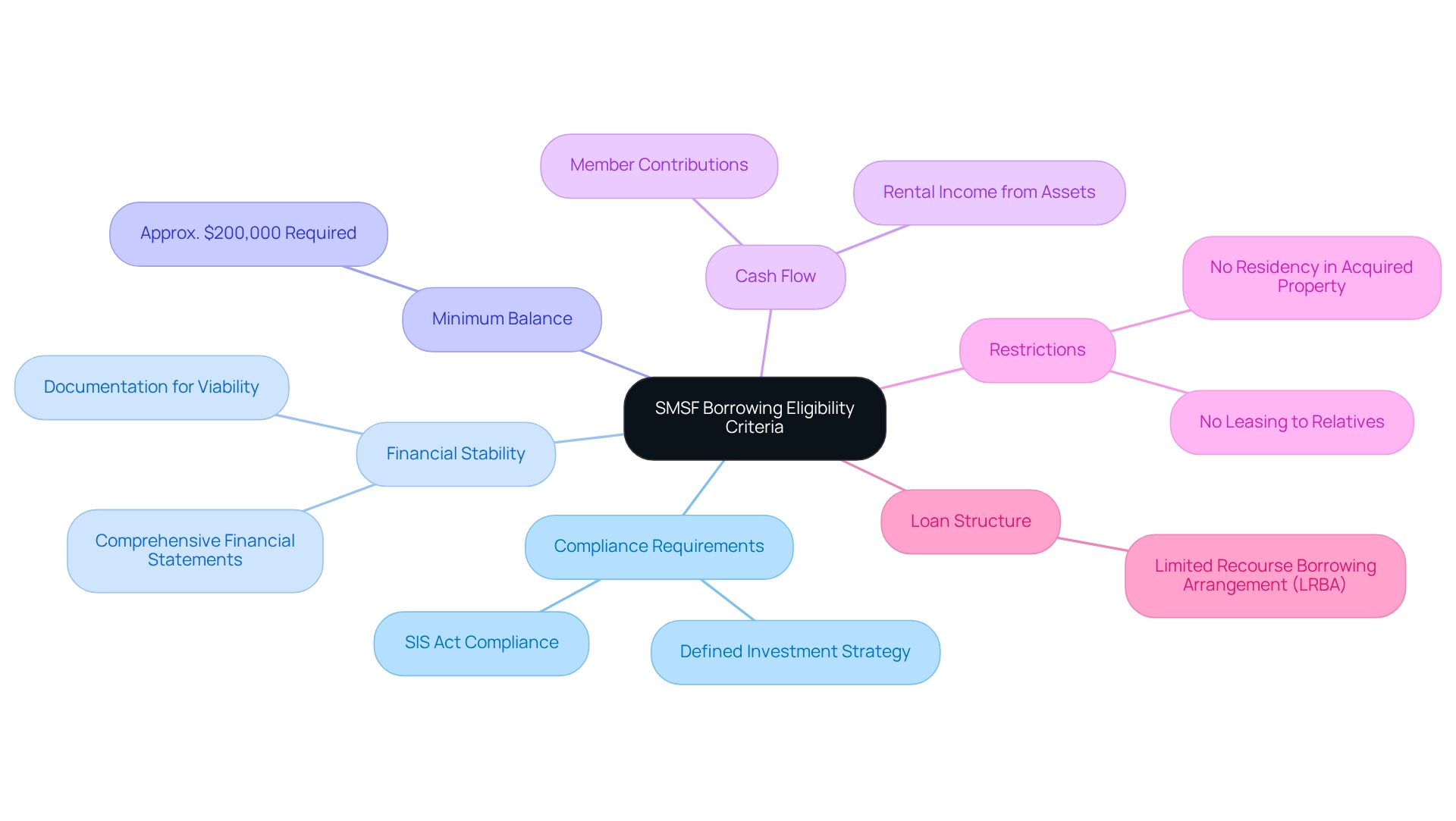

Identify Eligibility Criteria for SMSF Borrowing

To successfully obtain funds through a Self Managed Superannuation Fund (SMSF) for commercial property purchases, one must understand if a self managed super fund can borrow money to buy property, as specific eligibility criteria must be met. Compliance with the Superannuation Industry (Supervision) Act 1993 (SIS Act) is paramount, necessitating a well-defined investment strategy that aligns with the fund's objectives. Typically, an SMSF should maintain a minimum balance of approximately $200,000 to adequately cover loan repayments and associated costs.

Furthermore, the fund must demonstrate adequate cash flow to sustain the loan, which can involve member contributions and rental income from assets. It is essential to recognize that you cannot reside in or lease the residential asset acquired with an SMSF loan to relatives. This restriction is a significant limitation associated with SMSF borrowing. Financial stability is crucial, as lenders often require comprehensive financial statements and documentation to assess the fund's viability.

In addition, the loan is structured as a Limited Recourse Borrowing Arrangement (LRBA), which limits the lender's recourse to the asset purchased. Understanding these criteria is essential for navigating how a self managed super fund can borrow money to buy property effectively. Finance Story is here to assist you in building a solid case and ensuring adherence to the regulations, guiding you in locating the appropriate lender for your commercial real estate needs.

Brokers are also encouraged to learn about SMSF regulations and involve clients in discussions regarding their retirement and investment strategies. This ensures that small business owners are well-informed as they contemplate SMSF loans.

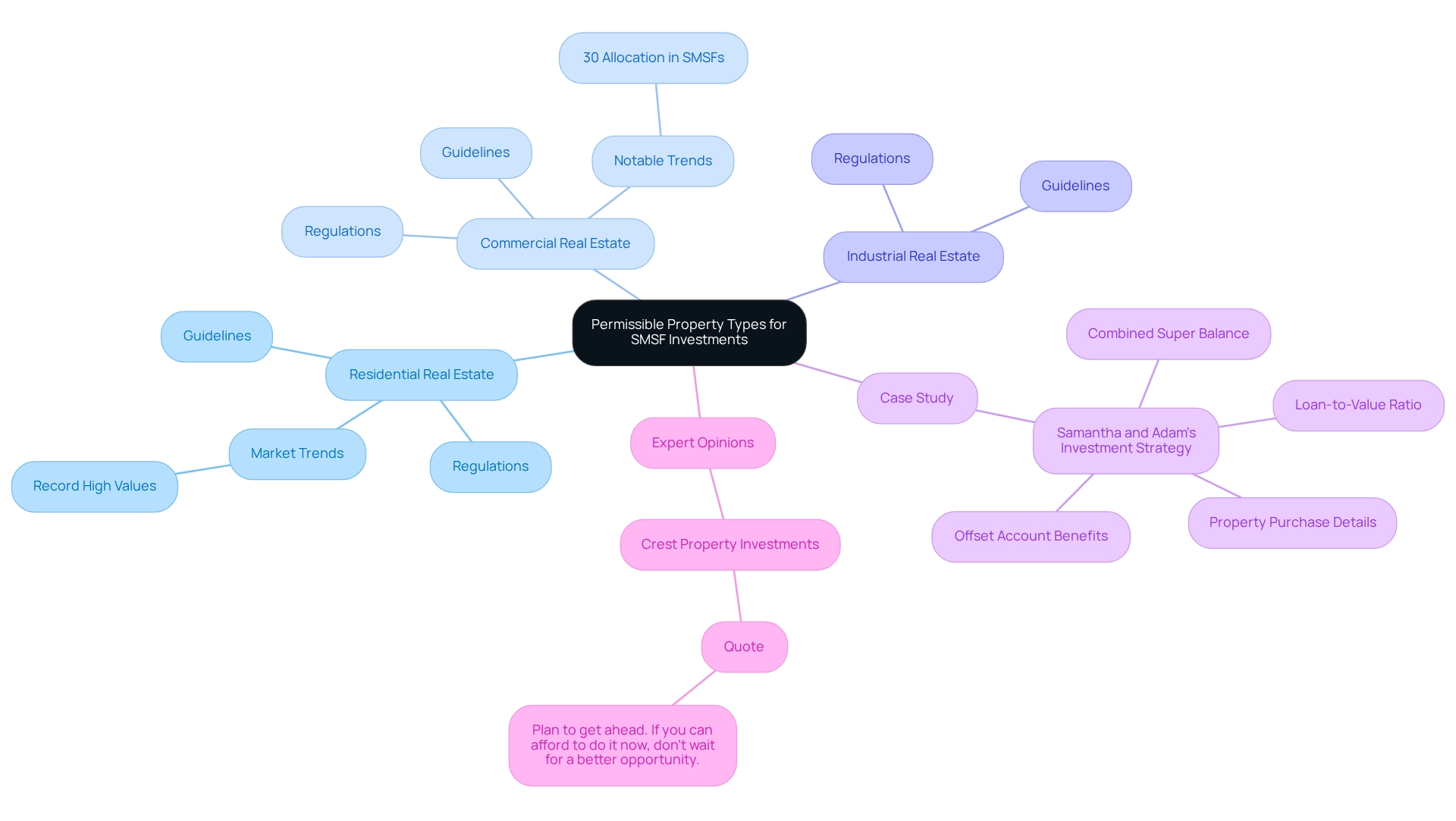

Explore Permissible Property Types for SMSF Investments

Investing through a Self-Managed Super Fund (SMSF) necessitates a clear understanding of the allowable asset types. SMSFs can typically invest in residential, commercial, and industrial real estate, leading to the inquiry of how can a self-managed super fund borrow money to buy property, as each investment type is governed by specific guidelines. Crucially, assets must not be utilized for personal reasons by any fund member or their relatives, ensuring compliance with Australian Taxation Office (ATO) regulations. Furthermore, assets must be acquired at market value and cannot be purchased from affiliated parties unless specific conditions are satisfied.

A notable trend in self-managed superannuation fund allocations reveals that approximately 30% of these funds are currently channeling resources into commercial real estate, encompassing office structures, storage facilities, and retail locations. This shift underscores a strategic change among fund participants, often motivated by the potential for greater returns and the effective utilization of real estate. Investors in self-managed super funds enjoy increased flexibility in their selections because, with fewer restrictions on commercial real estate investments compared to residential properties, can a self-managed super fund borrow money to buy property? Finance Story is positioned to assist you in constructing a robust case and ensuring regulatory compliance, guiding you in finding the appropriate lender for your commercial real estate endeavors. BOOK A CHAT.

Moreover, Australia’s residential real estate values reached a new record peak in April, raising the question of whether a self-managed super fund can borrow money to buy property, which presents a favorable opportunity for investors to explore their options in commercial real estate.

An illustrative case study features Samantha and Adam, a couple from Melbourne who pooled their superannuation into a self-managed fund to see if a self-managed super fund can borrow money to buy property. With a combined super balance of $456,000, they successfully acquired a residential investment asset valued at $482,000, securing a 60% loan-to-value ratio (LVR) loan. This strategic decision not only allowed them to retain over $235,000 of their original balance but also enabled them to utilize a 100% offset account, significantly reducing their interest payments and facilitating additional contributions to their SMSF.

Expert opinions emphasize the importance of understanding the limitations on asset use for SMSFs. As the market evolves, staying informed about permissible property types and the latest regulations is crucial for maximizing investment potential while ensuring compliance. As noted by Crest Property Investments, "Plan to get ahead. If you can afford to do it now, don’t wait for a better opportunity." This sentiment underscores the urgency for self-managed super fund investors to take action in the current market landscape.

Please note that the information provided is for general purposes and should not be construed as legal or financial advice.

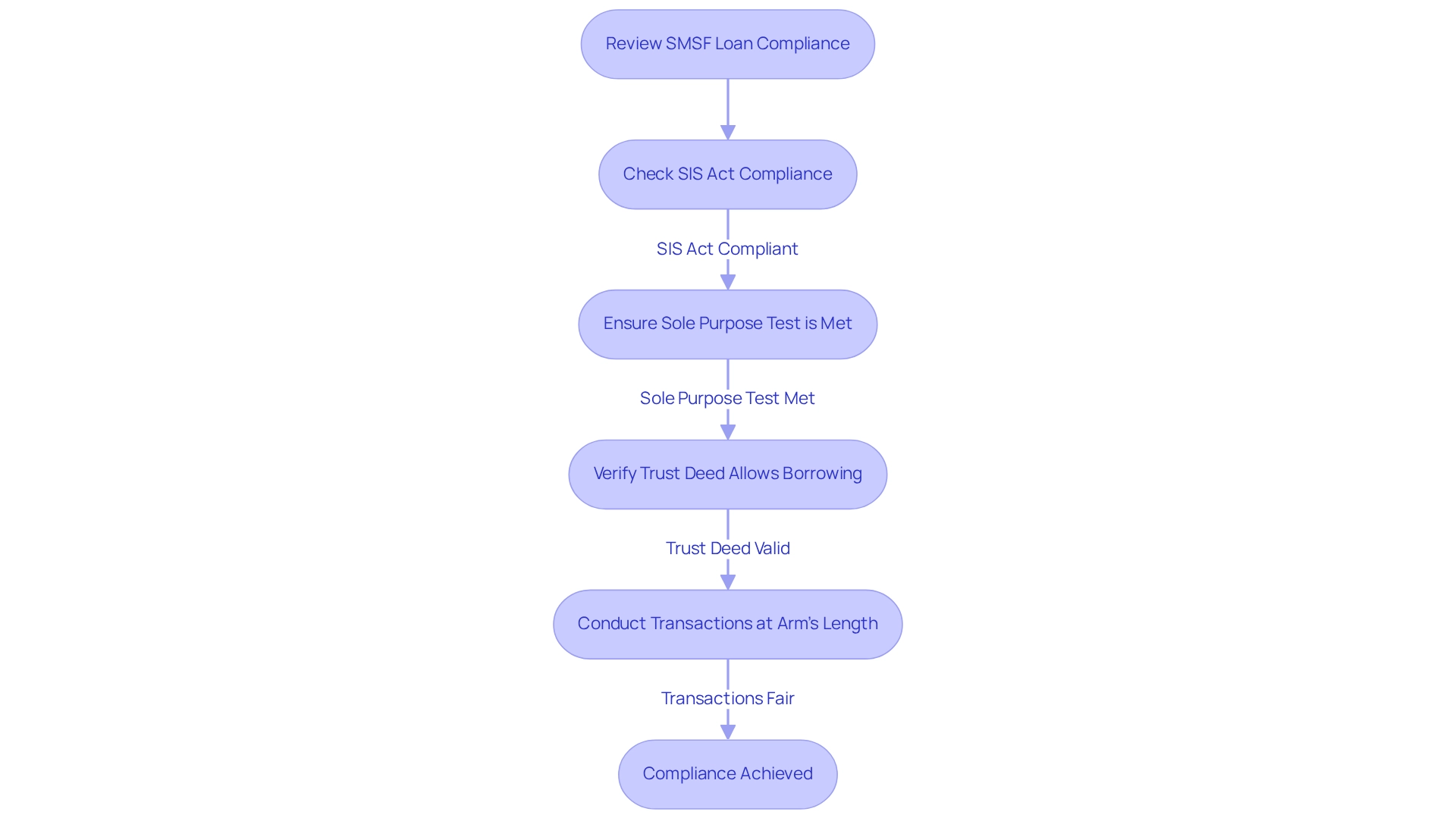

Review Legal and Regulatory Requirements for SMSF Loans

Before proceeding with a loan, it is imperative to fully understand if a self-managed super fund can borrow money to buy property and the legal and regulatory obligations involved. The SMSF must comply with the Superannuation Industry (Supervision) Act 1993 (SIS Act), which delineates the operational framework for superannuation funds in Australia. A vital aspect of compliance is the 'sole purpose test,' which ensures that when considering whether a self-managed super fund can borrow money to buy property, the loan is used exclusively for investment purposes that benefit the fund members' retirement. This stipulation means that any property acquired through the loan must solely aim to provide retirement benefits, which raises the question of whether a self-managed super fund can borrow money to buy property. Notably, failing to complete an education course after breaching superannuation regulations can result in additional penalties, underscoring the importance of strict adherence.

Furthermore, to determine if a self-managed super fund can borrow money to buy property, the SMSF must have a trust deed that explicitly allows borrowing, and all transactions must be conducted on an arm's length basis to ensure fairness and transparency. Significantly, self-managed super funds can borrow money to buy property, as they face fewer restrictions when investing in commercial properties—such as office buildings, warehouses, and retail spaces—compared to residential properties. This flexibility makes commercial investments an appealing option for many trustees. Recent updates reveal that a significant percentage of SMSFs are compliant with SIS Act regulations, raising the question of whether a self-managed super fund can borrow money to buy property, reflecting an increasing awareness among trustees regarding the necessity of adhering to these legal frameworks.

Professional advice is invaluable in navigating the complexities of SMSF loans, especially when determining if a self-managed super fund can borrow money to buy property, given the stringent compliance requirements. Finance Story can assist you in constructing a robust case for compliance and help you identify the appropriate lender for your commercial real estate needs. For instance, a case study titled "Strategy Compliance for SMSFs" emphasizes the necessity for trustees to develop and regularly review a strategy aligned with their property development activities. This practice ensures that their investment efforts remain consistent with the fund's objectives, thereby maintaining compliance and avoiding regulatory scrutiny.

As we approach 2025, it becomes essential for trustees of self-managed super funds to understand if and how a self-managed super fund can borrow money to buy property in the evolving legal landscape. Engaging with compliance specialists can provide insights into the latest developments and aid in optimizing financial objectives while ensuring adherence to the SIS Act. As Kirsten Taylor-Martin aptly states, "Ideally, you want 5-10 years to plan for retirement. The longer you allow yourself, the easier it will be to reach your goal." Ultimately, comprehending these legal obligations is crucial for safeguarding your assets and achieving long-term financial success.

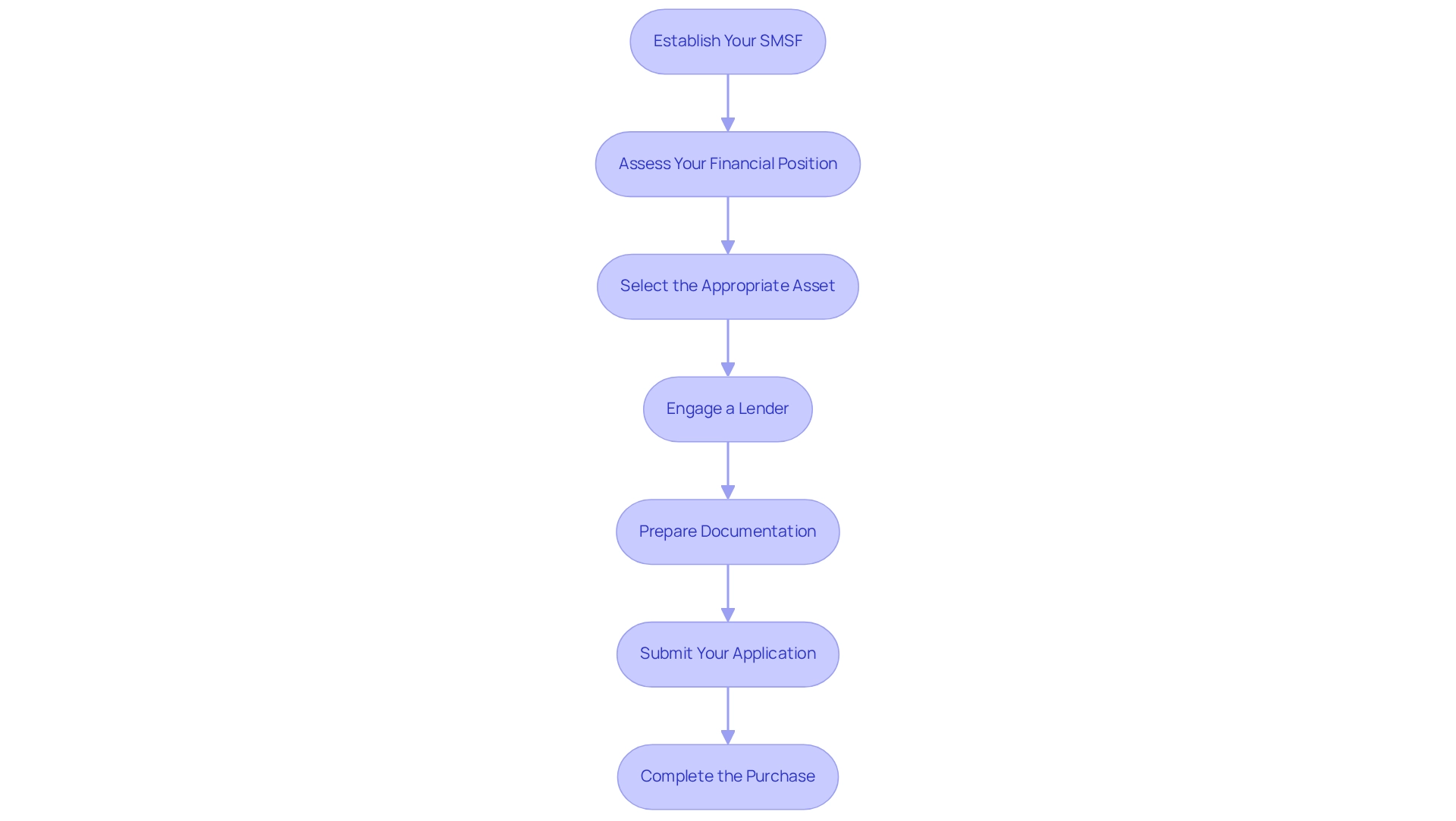

Follow Steps to Secure SMSF Financing for Property Purchase

To understand how one can a self managed super fund borrow money to buy property, follow these essential steps:

-

Establish Your Self-Managed Superannuation Fund: Ensure your Self-Managed Superannuation Fund is properly set up with a compliant trust deed and a clear financial strategy that aligns with regulatory requirements.

-

Assess Your Financial Position: Review your self-managed super fund's financial statements to confirm it meets the minimum balance and cash flow requirements necessary for borrowing.

-

Select the Appropriate Asset: Identify a real estate asset that adheres to superannuation fund regulations, ensuring it fulfills the ‘sole purpose test’—that is, it must solely provide retirement benefits for the fund’s members. This compliance is crucial to avoid any penalties. Consider commercial real estate options such as office buildings, warehouses, and retail spaces, as these typically have fewer limitations compared to residential properties.

-

Engage a Lender: Approach lenders who specialize in self-managed superannuation fund loans to discuss your financing options. Finance Story can assist you in building a strong case and ensuring adherence to regulations, helping you locate the right lender for your commercial investment asset. With over 65% of self-managed super funds operating for more than ten years, lenders are increasingly familiar with the requirements of fund holders, which can ease the loan process.

-

Prepare Documentation: Collect all essential documents, including the trust deed, financial statements, and information regarding the asset you wish to acquire.

-

Submit Your Application: Complete the loan application process with your chosen lender, ensuring that all documentation is accurate and comprehensive. Recent trends indicate that the average time taken to obtain self-managed superannuation fund loans has improved, reflecting a more streamlined process.

-

Complete the Purchase: Once your loan is approved, finalize the transaction and proceed with the property acquisition, ensuring all actions comply with regulatory guidelines. By diligently following these steps, you can effectively navigate the process of securing financing through your self-managed superannuation fund, particularly in understanding how a self-managed super fund can borrow money to buy property. This approach aligns with the growing trend of SMSFs remaining active into retirement, as evidenced by a 30% year-on-year decline in fund closures, indicating increased stability and confidence among SMSF holders. For tailored guidance and to ensure compliance, don’t hesitate to BOOK A CHAT with Finance Story.

Conclusion

Navigating the complexities of Self-Managed Super Funds (SMSFs) and their borrowing potential is essential for anyone aiming to enhance retirement savings through property investment. SMSFs present unique advantages, such as the ability to borrow via Limited Recourse Borrowing Arrangements (LRBAs), which can mitigate risks while maximizing investment opportunities. It is crucial to understand eligibility criteria, permissible property types, and legal requirements to make informed decisions and ensure compliance with regulations.

The strategic shift towards commercial property investments reflects a growing trend among SMSF holders, driven by the potential for higher returns and increased flexibility. However, adhering to the legal frameworks established by the Superannuation Industry (Supervision) Act 1993, particularly the 'sole purpose test,' is vital to safeguard the integrity of the fund. By following a structured approach to securing SMSF financing, individuals can effectively position themselves to capitalize on the benefits of property investment.

Ultimately, the journey toward successful SMSF property investment necessitates careful planning, a thorough understanding of the regulatory landscape, and the support of knowledgeable professionals. As the SMSF sector continues to evolve, staying informed and proactive will empower individuals to fully leverage their retirement savings, paving the way for a more secure financial future.