Overview

This article provides a comprehensive comparison of the features and offerings of various commercial loan banks, aimed at assisting businesses in making informed financing decisions. It highlights critical factors such as:

- Interest rates

- Loan types

- Fees

- Customer service ratings

across several leading banks. By doing so, it equips small business owners with the insights necessary to select the most suitable lender tailored to their specific financial needs. Are you aware of how these factors can impact your financing options? Understanding the nuances of each bank's offerings can significantly influence your decision-making process.

Introduction

Navigating the world of commercial loans can indeed be a daunting task for business owners, particularly given the myriad of options and terms available. These specialized financial products are meticulously designed to facilitate growth—whether through property acquisition, equipment purchases, or operational funding. Understanding key features such as loan types, interest rates, and repayment terms empowers businesses to make informed decisions that align with their financial strategies. Furthermore, as the landscape of commercial lending evolves, recognizing trends like the rise of private lending and the increasing importance of customer service becomes crucial.

This article delves into the essential components of commercial loans and offers insights on how to choose the right bank to meet unique business needs, ensuring that entrepreneurs are well-equipped to secure the financing necessary for their success.

Understanding Commercial Loans: Key Features and Types

Commercial credits represent specialized monetary products crafted to support enterprise operations, property acquisitions, or equipment purchases. Understanding their key features is essential for making informed financial decisions:

- Loan Types: The most prevalent types of commercial loans encompass term loans, lines of credit, and equipment financing. Each type addresses specific organizational needs, ranging from providing immediate cash flow to facilitating long-term investments. Notably, commercial real estate financing caters to enterprises seeking to acquire or refinance properties such as offices, warehouses, and retail spaces, offering long-term funding options and favorable conditions. Finance Story excels in developing polished and highly individualized business cases to present to lenders, ensuring that small business owners can secure the right financing tailored to their unique circumstances.

- Interest Charges: In 2025, average interest charges for business financing have shown variability, with both fixed and variable options available. Businesses must scrutinize these figures, as they significantly influence the total cost of borrowing and overall financial strategy. According to the ScotPac Review, commercial financing offerings achieved an impressive score of 82.2%, reflecting a robust market performance. Understanding these rates is vital for small enterprise owners aiming to optimize their financing options through the best commercial loan banks.

- Loan-to-Value (LTV) Ratio: This crucial ratio compares the borrowed amount to the property's value, playing a pivotal role in determining approval chances and financing terms. A lower LTV often results in better terms and conditions, which is essential for companies looking to refinance or secure new financing.

- Repayment Terms: Commercial financing offers a variety of repayment choices, ranging from short-term options (1-5 years) to long-term options (up to 30 years). The selection of repayment duration can significantly impact monthly payments and the overall financial strategy of an organization. As elevated interest rates lead to higher scheduled repayment amounts, comprehending repayment criteria becomes essential for small enterprises.

Current trends indicate that private financing has emerged as a viable option for enterprises that may not meet conventional funding requirements, providing flexibility in financial structure and approval standards. For instance, companies with unique circumstances can benefit from expedited approval processes and customized loan conditions, even with less-than-ideal credit histories. This adaptability is crucial for small enterprises navigating challenging economic landscapes.

As Mike Donaca, Vice President of SELCO Commercial & Business Banking, articulates, "Simply put, we’re all accessible and completely invested in the communities we live in and serve." This sentiment emphasizes the significance of community-focused lending solutions, which Finance Story embodies through its commitment to assisting clients in securing optimal financing options.

As the commercial lending landscape evolves, grasping these features and trends will empower small business owners to navigate their financing options effectively with the best commercial loan banks.

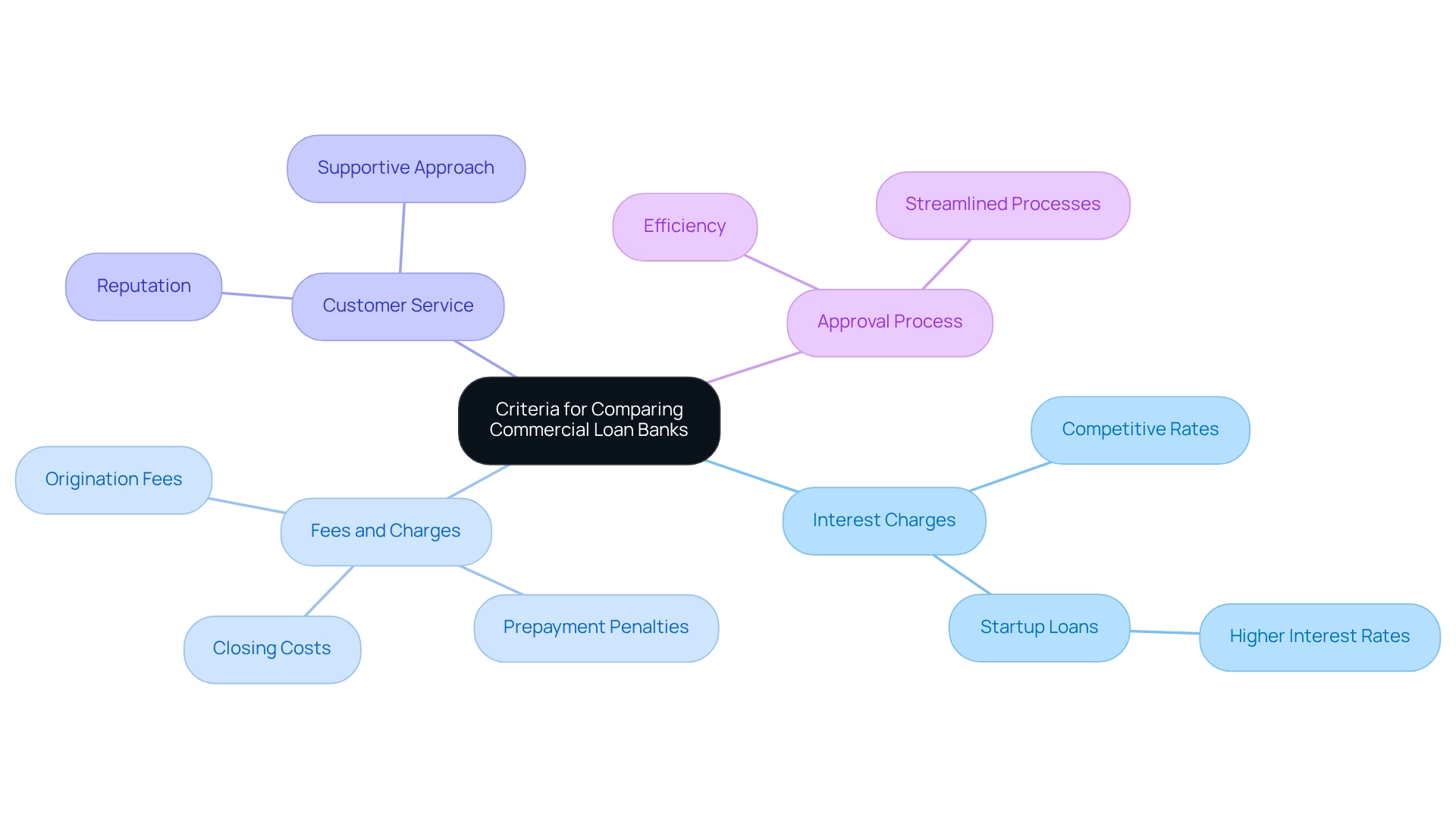

Criteria for Comparing Commercial Loan Banks

When assessing business financing institutions, several important factors should direct your decision-making process:

- Interest Charges: Seek competitive charges that align with your financial strategy. A slight change in interest levels can lead to significant discrepancies in overall repayment sums throughout the borrowing period. In 2025, average interest charges for business financing in Australia vary considerably among the top commercial loan banks, making meticulous evaluation essential. Notably, business loans for startups often carry higher interest rates due to the inherent risks associated with new ventures.

- Fees and Charges: Familiarize yourself with all associated costs, including origination fees, prepayment penalties, and closing costs. These charges can accumulate, impacting your overall monetary obligation. Finance Story aids clients in managing these expenses effectively, ensuring that all potential charges from the leading commercial loan banks are incorporated into your budgeting. When considering loan flexibility, evaluate the adaptability of repayment options offered by the top commercial loan banks. Features such as interest-only intervals or the ability to make extra payments without incurring penalties can provide considerable advantages, particularly in fluctuating economic conditions. Finance Story specializes in crafting customized financial solutions, ensuring that you can build robust cases that meet your unique lending needs.

- Customer Service: Investigate the bank's reputation for customer service. A lender known for its supportive approach can facilitate a smoother borrowing experience, which is crucial during the often-stressful application process. Finance Story's commitment to understanding organizational needs through comprehensive lending solutions illustrates how specific banks cater to unique client requirements, enhancing their customer service offerings.

- Approval Process: Consider the efficiency of the application and approval process. If you require funds promptly, the leading commercial loan banks should be top of mind, as they have streamlined processes that can be invaluable, reducing the time between application and funding. As financial experts note, understanding the significance of interest levels in business financing is crucial for making well-informed decisions.

Comparative Analysis of Leading Commercial Loan Banks

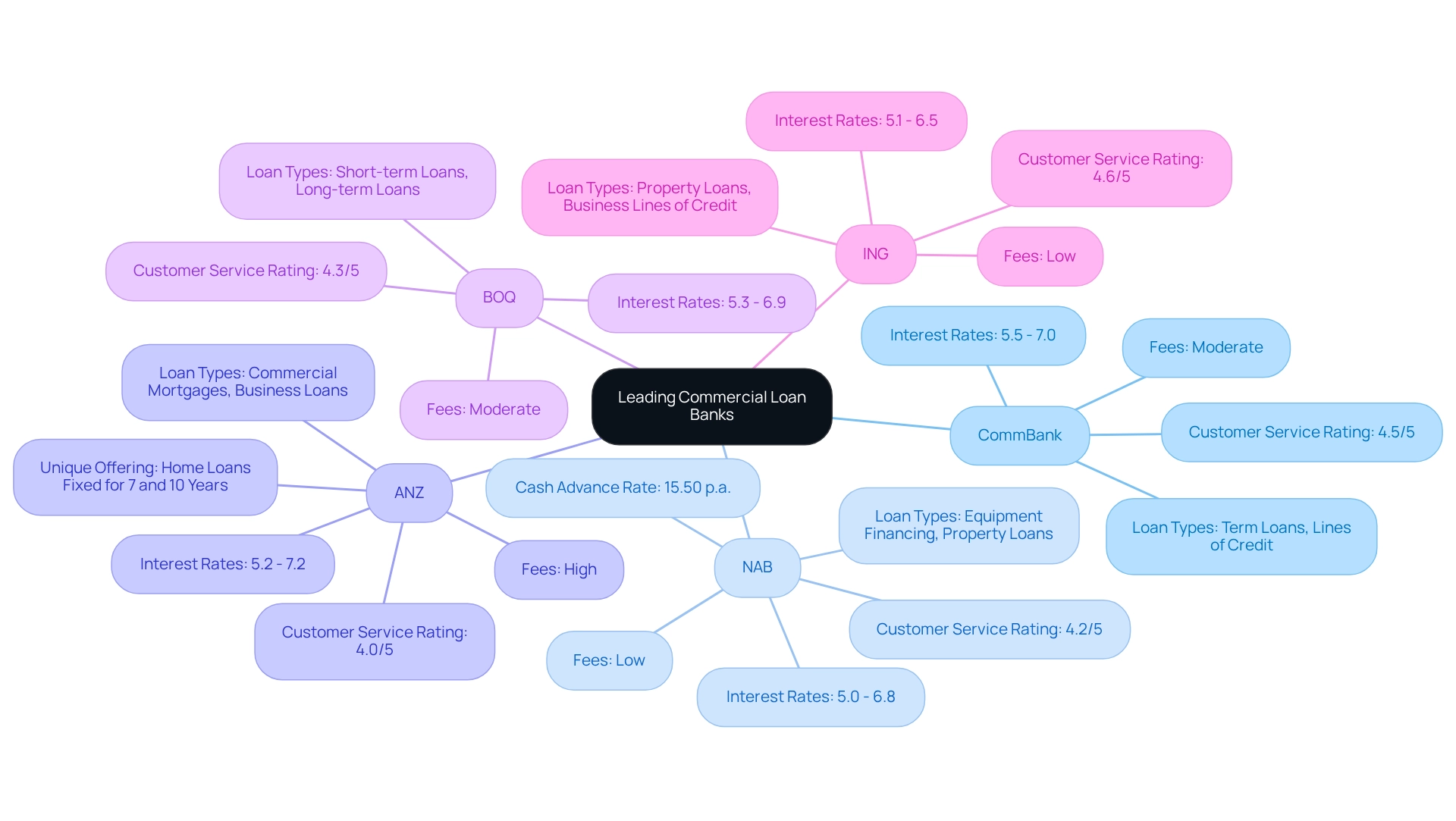

This comparative analysis highlights several leading commercial loan banks, focusing on their interest rates, loan types, and customer service ratings:

- Bank Name: CommBank

Interest Rates: 5.5% - 7.0%

Loan Types Offered: Term Loans, Lines of Credit

Fees: Moderate

Customer Service Rating: 4.5/5 - Bank Name: NAB

Interest Rates: 5.0% - 6.8%

Loan Types Offered: Equipment Financing, Property Loans

Fees: Low

Customer Service Rating: 4.2/5 - Bank Name: ANZ

Interest Rates: 5.2% - 7.2%

Loan Types Offered: Commercial Mortgages, Business Loans

Fees: High

Customer Service Rating: 4.0/5 - Bank Name: BOQ

Interest Rates: 5.3% - 6.9%

Loan Types Offered: Short-term Loans, Long-term Loans

Fees: Moderate

Customer Service Rating: 4.3/5 - Bank Name: ING

Interest Rates: 5.1% - 6.5%

Loan Types Offered: Property Loans, Business Lines of Credit

Fees: Low

Customer Service Rating: 4.6/5

This summary enables businesses to quickly identify the lender that best aligns with their financing needs. Notably, ANZ stands out for its unique offering of home loans fixed for 7 and 10 years, providing clients with stability in their repayments. Furthermore, NAB's competitive cash advance rate of 15.50% p.a. on its Payments Card reflects its commitment to supporting financing for enterprises.

For small enterprise owners, seeking expert assistance from Finance Story can significantly enhance the decision-making process. With our expertise in crafting refined and personalized financing proposals, we guarantee that you explore these options efficiently, obtaining the most appropriate funding solutions tailored to your changing enterprise needs. It is advisable to verify the sources of interest rates and customer service ratings to ensure accuracy and reliability.

Choosing the Right Commercial Loan Bank for Your Business Needs

Selecting the right commercial financing institution, such as the leading commercial loan banks, is vital for your company's financial health. Here’s a structured approach to guide you through the process:

- Assess Your Needs: Begin by clearly defining the purpose of the financial assistance, the amount required, and your repayment capacity. Understanding these factors is essential, especially as small enterprises in Australia increasingly seek funding, with the average amount requested being approximately $94,845. Compare the offerings of the best commercial loan banks based on criteria most relevant to your business, such as loan types, terms, and customer service. Finance Story provides access to a comprehensive range of lenders, including high street banks and innovative private lending panels, tailored to your specific circumstances.

- Consult with Experts: Engage with financial consultants or brokers, like those at Finance Story, who can offer tailored insights and assist you in navigating the complexities of commercial lending. Their expertise in crafting refined and tailored proposals can be invaluable in identifying the best options for your specific situation, whether you aim to purchase a warehouse, retail space, factory, or hospitality venture. Evaluate Terms: Look beyond interest rates; consider the overall loan structure, including any associated fees and the flexibility of repayment options. This thorough evaluation can help you avoid unexpected costs in the future.

- Read Reviews: Investigate customer feedback and ratings to gauge the reliability and service quality of potential banks. Positive testimonials can reflect a bank's commitment to effectively supporting its clients.

- Make a Choice: Select the best commercial loan banks that align with your economic strategy and objectives. Ensure you feel comfortable with the lender, as a strong relationship can facilitate smoother transactions in the future.

Current trends indicate that small and medium enterprises (SMEs) significantly contribute to Australia’s workforce, accounting for about two-thirds of it. This underscores the importance of making informed financial decisions. By following these steps, you can position your enterprise for growth and success in an evolving economic landscape. For personalized guidance, consider scheduling a free consultation with Finance Story's Head of Funding Solutions to discuss tailored financial strategies that meet your needs, including refinancing options to adapt to your evolving business requirements.

Conclusion

Navigating the commercial loan landscape is essential for business owners seeking to fuel their growth and operational success. Understanding the various types of loans, interest rates, loan-to-value ratios, and repayment terms equips entrepreneurs with the knowledge needed to make informed financial decisions. Furthermore, with the emergence of private lending as a flexible alternative, businesses can explore options that best suit their unique circumstances, especially in challenging financial environments.

When choosing a commercial loan bank, it is crucial to evaluate key criteria such as:

- Interest rates

- Fees

- Loan flexibility

- Customer service

- Efficiency of the approval process

This thorough evaluation not only helps in identifying the best financial partner but also ensures that the selected bank aligns with the specific needs and goals of the business. By leveraging expert insights and conducting diligent research, business owners can navigate the complexities of commercial lending effectively.

Ultimately, making informed choices about commercial loans is not just about securing financing; it’s about fostering a relationship with a lender who understands the nuances of your business. As the commercial lending landscape continues to evolve, staying abreast of trends and best practices will empower businesses to thrive in an increasingly competitive market. By prioritizing informed decision-making, entrepreneurs can position their businesses for sustainable growth and success.